Alternative investment strategies are financial approaches that go beyond traditional stocks and bonds, offering investors a broader range of opportunities for growth and diversification. These strategies involve a variety of asset classes—such as real estate, private equity, hedge funds, commodities, and venture capital—that generally behave differently from mainstream markets. For many beginners, the appeal lies in the potential for strong returns, lower correlation with public equities, and unique risk profiles that can help balance a portfolio. On the other hand, seasoned investors often leverage these alternative investment management strategies to refine asset allocation, boost diversification, and seek out higher returns with controlled risk. However, it is crucial to understand the benefits, risks, and operational aspects of these investments before diving in. In this guide, we will explore what alternative investment strategies are, discuss common types, highlight key benefits and potential downsides, and offer insights tailored to both beginners and experienced investors.

Understanding Alternative Investment Strategies

Alternative investment strategies describe methods of investing in asset classes other than the typical combination of stocks, bonds, and cash. These assets often have unique risk-return profiles and may not be publicly traded, requiring specialized knowledge, management techniques, and sometimes higher minimum capital.

- Diverse Asset Classes: While traditional portfolios are generally concentrated in stocks and bonds, alternative investments can include real estate, hedge funds, private equity, structured products, and more.

- Lower Correlation: Because these investments may not move in tandem with the stock market, they can provide a stabilizing influence on a portfolio.

- Complex Risk Profiles: Although they have the potential for higher returns, alternative investments typically come with complexities such as illiquidity, higher fees, and less transparency compared to traditional assets.

According to BlackRock’s “Alternative Investments 101” guide, these assets often show a lower correlation with public-equity markets, helping to smooth overall portfolio volatility.

Why Investors Turn to Alternatives

- Diversification: Adding uncorrelated assets can reduce overall portfolio volatility.

- Potential Higher Returns: Some alternative investment strategies aim to capture opportunities not accessible through typical public markets.

- Tactical Opportunities: Investors may use alternative investments to capitalize on emerging sectors or specialized niches (e.g., technology startups in venture capital).

Despite these potential benefits, it is essential to note that alternative investment management strategies can be complex. Investors need robust research capabilities, an understanding of the market environment, and careful risk assessment to maximize their success.

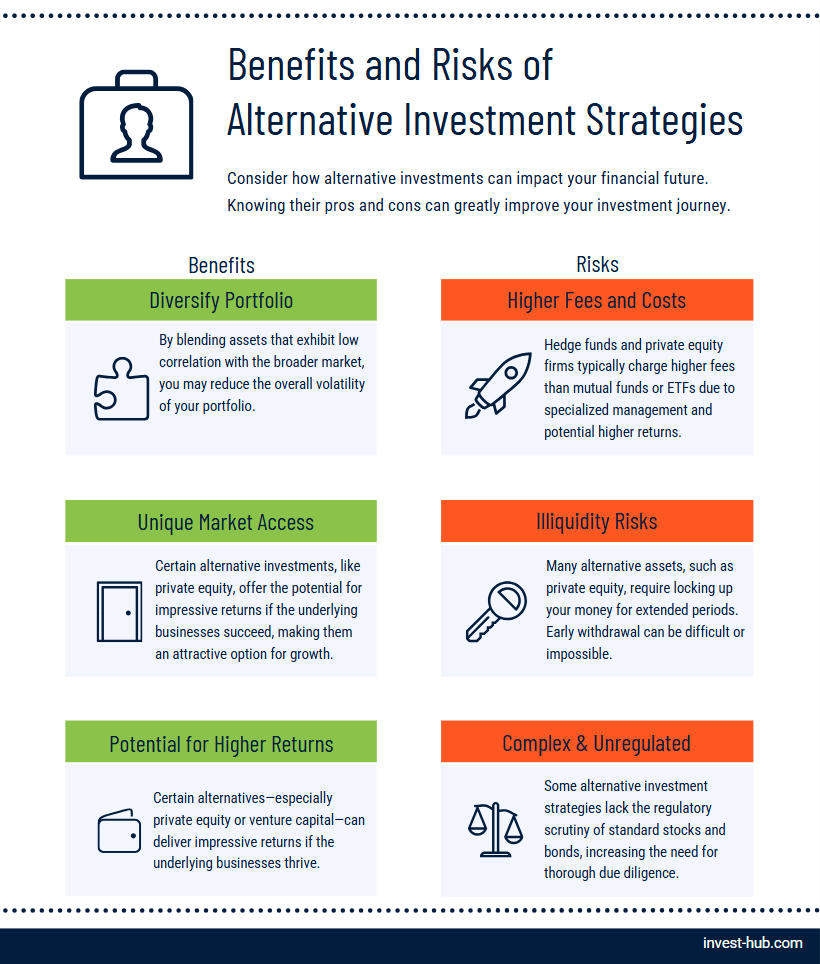

Benefits and Risks of Alternative Investment Strategies

Like all types of investing, alternative investment strategies for beginners and experienced professionals come with both advantages and risks. Understanding these factors helps create a balanced view of how these strategies might fit into your financial goals.

Benefits

- Portfolio Diversification

By blending assets that exhibit low correlation with the broader market, you may reduce the overall volatility of your portfolio. - Potential for Higher Returns

Certain alternatives—especially private equity or venture capital—can deliver impressive returns if the underlying businesses thrive. - Access to Unique Markets

Alternative investments can open doors to sectors like renewable energy, emerging technology, or luxury collectibles, which might be inaccessible through public markets.

Risks

- Illiquidity

Many alternative assets, such as private equity, require locking up your money for extended periods. Early withdrawal can be difficult or impossible. - Higher Fees and Costs

Hedge funds and private equity firms often charge performance fees and management fees that exceed those typical of mutual funds or ETFs, reflecting their specialized management and potential for higher returns. - Complex and Less Regulated

Some alternative investment strategies lack the regulatory scrutiny of standard stocks and bonds, increasing the need for thorough due diligence.

By weighing these benefits and risks, individuals can better determine if alternative investment strategies align with their financial objectives and risk tolerance. Many professional wealth managers recommend allocating only a portion of a portfolio to alternatives, especially for beginners.

Common Types of Alternative Investment Strategies

Alternative investment strategies span a wide spectrum of asset classes. Below is an overview of the most commonly cited categories, along with their key attributes. Research from Harvard Business School Online notes that real estate, private equity, and hedge funds are the three most common alternative classes retail investors first encounter.

Real Estate

Real estate investing involves purchasing properties—residential, commercial, or industrial—for the purpose of generating rental income or capital gains. It can also include real estate investment trusts (REITs) or real estate crowdfunding platforms, which allow you to invest indirectly without directly managing a property.

- Advantages: Steady cash flow from rentals, potential appreciation, tangible asset

- Drawbacks: High upfront costs, property management obligations, market fluctuations

Private Equity and Venture Capital

Private equity refers to investments in privately held companies, often with the aim of restructuring or improving operations to increase value. Venture capital, a subset of private equity, focuses on early-stage or high-growth companies, generally in exchange for equity stakes.

- Advantages: Opportunity for significant returns, involvement in shaping company growth

- Drawbacks: High risk of failure, long lock-up periods, limited liquidity

Hedge Funds

Hedge funds are pooled investment vehicles managed by professionals using a variety of strategies, such as long-short equity, global macro, and event-driven trades. These funds often employ leverage and derivatives, aiming for absolute returns regardless of market conditions. Morgan Stanley Wealth Management points out that minimum buy-ins for many hedge funds have fallen in recent years, making the space more accessible to qualified investors.

- Advantages: Potential for high returns, professional management, flexible strategies

- Drawbacks: High fees, complex strategies, can carry significant risk

Commodities and Managed Futures

Commodities include a wide range of physical goods such as precious metals, energy products, agricultural items, livestock, and soft commodities. Managed futures allow investors to access global futures markets in a diversified manner. These instruments are often used to hedge inflation risk.

- Advantages: Inflation hedge, diversification benefits

- Drawbacks: Price volatility, geopolitical and climatic factors can impact supply and demand

Structured Products and Other Niche Investments

Structured products combine assets such as bonds with derivatives to tailor risk and return profiles. Other niche investments might include art, collectibles, or intellectual property royalties.

- Advantages: Highly customizable risk-return profiles, can cater to specific investment goals

- Drawbacks: Complexity, less transparency, reliance on specialized market knowledge

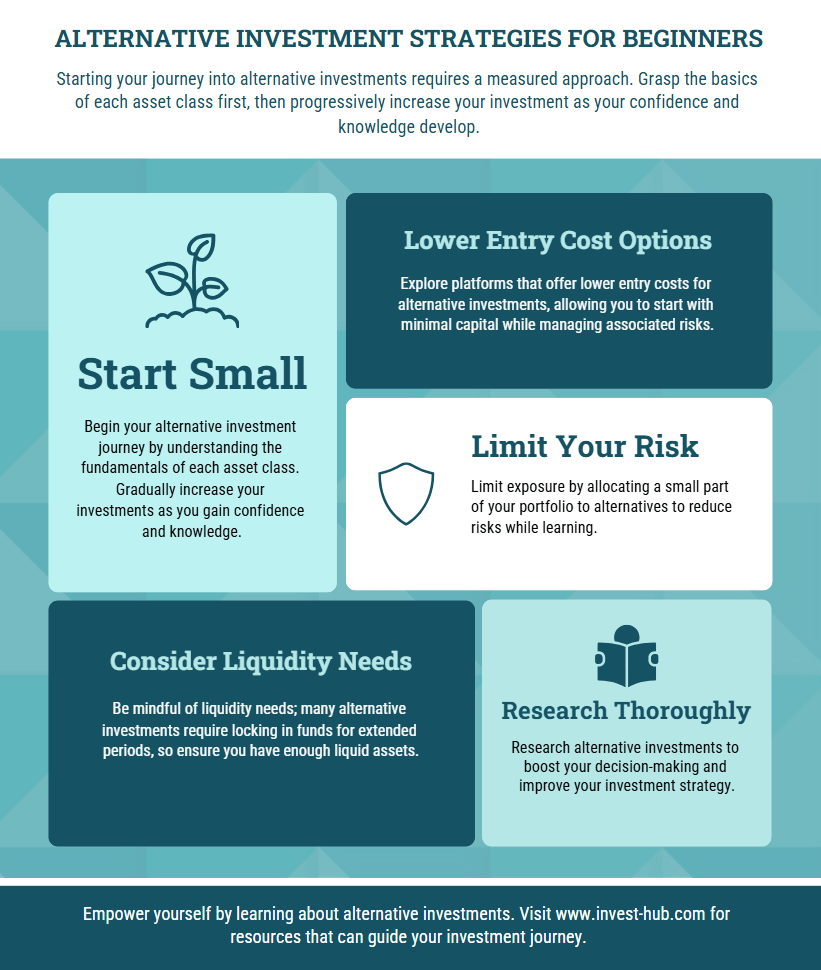

Alternative Investment Strategies for Beginners

When exploring alternative investment strategies for beginners, it is crucial to start slowly and build a foundational understanding of each asset class. Over time, you can expand your exposure as your knowledge and comfort level grow.

- Start Small

- Low Initial Capital Platforms: Certain crowdfunding sites and online marketplaces allow investments in private equity, real estate, or fine art with lower entry costs, though it’s crucial to understand the associated risks and complexities.

- Risk Control: Allocating a small percentage of your overall portfolio to alternatives can help limit downside while you learn the ropes.

If you’re looking to start small and need a trustworthy platform, our Best Brokers Review can help you decide.

- Evaluate Liquidity Needs

- Lock-up Periods: Many alternatives require locking in your money for extended durations. Make sure you have sufficient liquid funds in your traditional investments or emergency savings.

- Secondary Markets: Some platforms have secondary markets where you can sell shares of private deals, but the liquidity might still be lower than public stocks.

- Do Your Homework

- Research and Education: Study the asset class, read whitepapers, watch educational webinars about trading, and consult financial professionals to solidify your understanding.

- Community and Networking: Joining investment groups or online forums can help beginners learn from experienced investors’ successes and mistakes. Review Invest Hub for more information.

Alternative Investment Strategies Management

Proper management of alternative investment strategies is essential to achieve desired returns and maintain a balanced risk profile. Below are core practices for those who wish to incorporate alternative investment management strategies into their portfolios.

Diversification and Asset Allocation

- Spreading Out Risk: Diversify across multiple asset classes and strategies—real estate, hedge funds, private equity, and more—to reduce the impact of any single underperforming investment.

- Portfolio Weighting: Some financial advisors suggest allocating only 10–20% of a portfolio to alternatives; however, this can vary based on your goals, experience, and risk tolerance.

Due Diligence

- Thorough Research: Investigate the investment manager’s track record, the financial health of the underlying business, and the macroeconomic factors that may influence performance.

- Legal and Regulatory Checks: Confirm that the investment adheres to relevant regulations or guidelines. Some alternative investments operate in a less-regulated environment, so extra scrutiny is vital.

Monitoring and Risk Management

- Ongoing Evaluation: Keep an eye on market conditions, quarterly reports, and strategic updates from investment managers.

- Exit Strategies: For private equity or venture capital, plan your timeline for exiting the investment through buyouts, IPOs, or secondary market sales.

- Hedging Techniques: In certain hedge fund strategies, derivatives may be used to manage market risk. Alternatively, spreading your investments across various sectors can act as a natural hedge.

Conclusion on Alternative Investment

Alternative investment strategies provide an exciting avenue for diversifying your portfolio beyond traditional stocks and bonds. Whether you are a novice looking to explore alternative investment strategies for beginners or a seasoned investor aiming to refine your portfolio with advanced techniques, these investments can offer uncorrelated returns, unique growth opportunities, and a hedge against market volatility. However, it is crucial to conduct thorough research, understand the potential risks, and employ solid management strategies to make the most of these assets. By starting small, diversifying intelligently, and monitoring your holdings, you can harness the full potential of alternative investment strategies and steer your financial journey toward long-term success.

Ready to take the next step? Consider outlining a clear plan, consulting with financial professionals if needed, and gradually adding alternative investments that align with your goals. Over time, you may discover that the right blend of alternatives can significantly enhance both the stability and the growth prospects of your portfolio.

Alternative Investment Frequently Asked Questions (FAQ)

Alternative investment strategies refer to methods of investing in non-traditional assets such as real estate, hedge funds, private equity, and commodities. These strategies often have different risk-return profiles than stocks and bonds and can add diversification to a portfolio.

Yes, but with caution. Beginners should start small, thoroughly research each asset class, and possibly consult professionals to ensure they understand the associated risks. Many new platforms now allow smaller initial investments, making alternatives more accessible.

There is no one-size-fits-all rule. Many experts suggest 10–20% as a starting point, but the optimal allocation depends on your financial goals, risk tolerance, and time horizon.

They can be riskier due to lower liquidity, higher fees, and less regulatory oversight. However, alternative strategies can also provide diversification benefits and potentially higher returns. Proper research and due diligence are essential.

Due diligence involves analyzing the fund’s performance history, assessing management’s track record, and understanding market conditions. It is a critical step to minimize risks and make informed decisions before committing capital.

Certain alternative assets, such as specific commodities and real estate investments, can potentially serve as a hedge against inflation, though their effectiveness can vary depending on market conditions. By holding tangible or limited-supply assets, investors may preserve purchasing power when prices rise.