CapTrader vs Interactive Brokers is a comparison that often comes up for traders who want low costs, global market access, and robust platforms. While both brokers offer access to the same backend infrastructure — Interactive Brokers’ Trader Workstation — they cater to slightly different audiences. CapTrader, a German-based introducing broker, is favored by European clients for its localized services and tax advantages, whereas Interactive Brokers (IBKR) serves a global user base with more account flexibility and direct service. Choosing between the two comes down to your preferences for fees, platform usability, regulatory support, and trading goals.

A Quick Look at CapTrader Vs Interactive Brokers

Broker Type

- CapTrader is an introducing broker of Interactive Brokers. This means it offers IBKR’s technology and clearing services but provides its own customer service, branding, and account structure. It’s headquartered in Germany and primarily targets European clients. Learn more about CapTrader’s offerings, tools, and fees in our complete CapTrader review.

- Interactive Brokers (IBKR) is a direct-access global brokerage that operates independently across numerous jurisdictions. It is a fully regulated broker with its own licenses in the U.S., UK, EU, and Asia-Pacific. For a deeper breakdown of this broker’s features, read our full Interactive Brokers review.

Core Features

Both brokers share many core features due to their shared backend:

- Global Market Access: Over 160 markets in 33 countries.

- Product Range: Stocks, ETFs, options, futures, forex, bonds, and CFDs.

- Platform: Access to Trader Workstation (TWS), WebTrader, and mobile apps.

- Real-Time Data: Market data subscriptions are identical and come at a cost.

What differs:

- CapTrader adds German-language customer service, EU tax reporting support, and curated onboarding for Europeans.

- Interactive Brokers allows for more flexible account types, more funding currencies, and direct support for non-EU clients.

Target Audience

- CapTrader is ideal for:

- German-speaking clients

- EU-based retail investors seeking local support

- Long-term investors needing tax documentation compliant with EU regulations

- German-speaking clients

- Interactive Brokers suits:

- Institutional and retail traders worldwide

- Professional traders or day traders needing low-latency execution

- Clients who want broader account and funding options

- Institutional and retail traders worldwide

Key Highlights

| Feature | CapTrader | Interactive Brokers |

| Headquarters | Germany | United States |

| Platform Backend | Interactive Brokers (TWS) | Interactive Brokers (TWS) |

| Local Language Support | German | Multi-language, incl. English |

| Minimum Deposit | $2,000 | $0 (varies by region) |

| Base Currencies | EUR, USD, GBP, CHF | 24+ currencies |

| Tax Reporting | EU/German-compliant | Varies by account jurisdiction |

| Ideal For | EU-based, passive investors | Global, active traders |

Who It’s Best For

- Choose CapTrader if you are a European investor who values local language support, EU tax optimization, and a guided experience with access to IBKR’s advanced tools.

- Choose Interactive Brokers if you want the full range of IBKR services, broader account flexibility, and direct access to one of the most powerful trading platforms in the industry.

Pros and Cons of CapTrader Vs Interactive Brokers

| Category | CapTrader | Interactive Brokers (IBKR) |

| ✅ Pros | – German-speaking customer service- EU tax-compliant documentation- Trader Workstation access- Tailored for EU clients- Some educational content, but mainly for experienced traders | – No minimum deposit- Direct IBKR platform access- 20+ base currencies- Tiered/fixed pricing models- Wide global regulatory presence |

| ❌ Cons | – $2,000 minimum deposit- Fewer base currencies and funding methods- Limited control over backend features- Some IBKR tools not fully accessible | – Complex onboarding process- Less local support for EU clients- Tax documents not optimized for EU use- Steep learning curve for TWS/API |

Strengths

Both brokers offer access to industry-leading infrastructure, but they shine in different areas depending on user needs.

CapTrader Strengths:

- EU-focused onboarding: Tailored for German and broader EU clients with region-specific forms, regulatory guidance, and support.

- German-speaking customer service: Native language support is a key advantage for clients uncomfortable with English-only platforms.

- Simplified tax documentation: CapTrader assists in providing tax-compliant statements aligned with German and EU standards.

- Same technology as IBKR: Clients benefit from the powerful Trader Workstation, IBKR mobile app, and advanced execution systems.

- Curated educational content: Offers some resources, but mainly for experienced traders and less for beginners.

Interactive Brokers Strengths:

- Direct account with IBKR: Full access to IBKR’s ecosystem including advanced funding methods, account types, and regulatory frameworks.

- No minimum deposit: Especially appealing for entry-level traders.

- Wider currency and funding options: Over 20 base currencies supported, compared to CapTrader’s smaller list.

- More flexible fee structures: Tiered and fixed pricing models give advanced users control over their costs.

- Wider geographic support: IBKR supports clients in more countries and with more regulatory licenses than CapTrader.

Weaknesses

No broker is perfect. Here’s where each one might fall short depending on your preferences:

CapTrader Weaknesses:

- Higher minimum deposit: $2,000 may be a barrier for new investors.

- Less flexible funding: Fewer currencies and fewer supported funding methods compared to IBKR directly.

- Same backend, less control: As an introducing broker, CapTrader has limited ability to change core platform features or pricing.

- No access to IBKR’s full product suite: Certain innovations (like IBKR GlobalTrader or Impact app) may be delayed or unavailable.

Interactive Brokers Weaknesses:

- Complex onboarding: Can be intimidating for beginners due to the breadth of options and regulatory disclosures.

- Less localized support: Non-English users might find the support channels and documents less accessible.

- Tax documentation may lack EU-specific clarity: German clients in particular may face more manual work for tax filing.

- Occasional over-engineering: The learning curve for TWS and API setups is steep for casual traders.

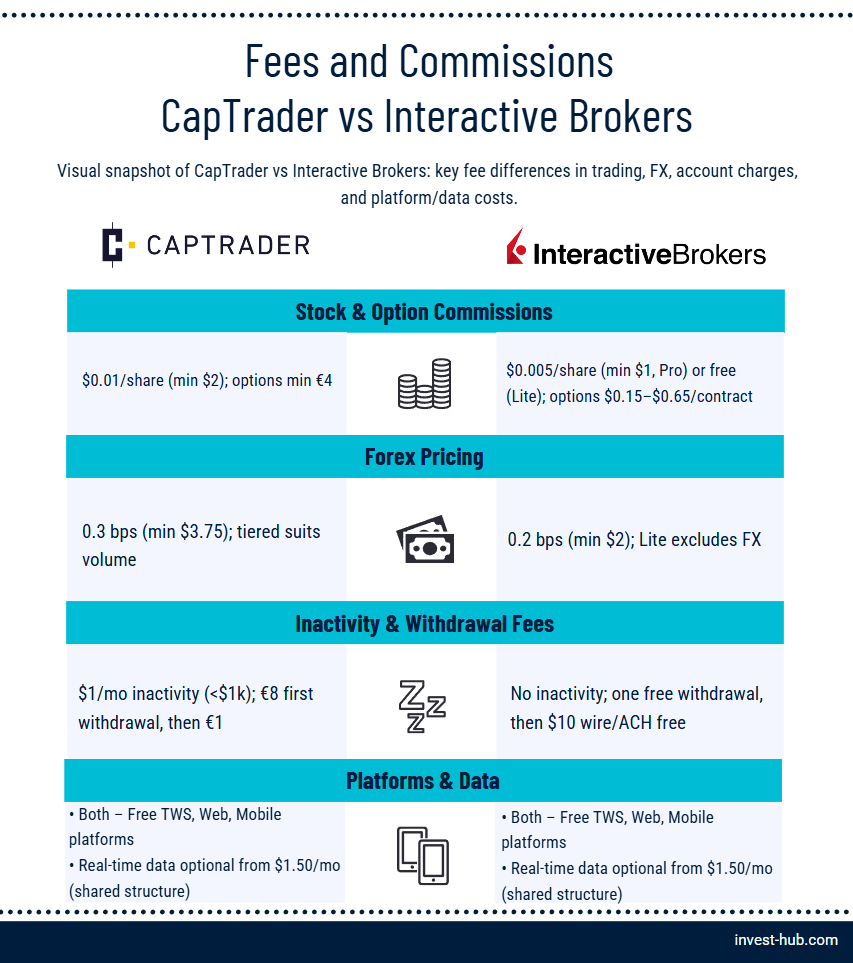

Fees and Commissions of CapTrader Vs Interactive Brokers

Fees are among the most important considerations for both beginners and high-frequency traders. While CapTrader and Interactive Brokers share similar fee structures due to their shared infrastructure, there are key differences in pricing transparency, minimums, and account-related charges.

Trading Fees

CapTrader:

- Offers two models: Fixed Pricing and Tiered Pricing

- Stocks (Germany): 0.1% of trade value, minimum €4 per trade

- US Stocks: $0.01 per share (minimum $2.00)

- Options: min €4 per trade (Germany); US options: $2.00 per contract

- Forex: 0.3 bps (0.003%) of trade value, minimum $3.75 per trade

- Lower volumes might not benefit from tiered pricing

- No commission-free trading

Interactive Brokers:

- Also offers Fixed and Tiered pricing

- US Stocks: $0.005 per share, minimum $1.00 (IBKR Pro); commission-free for US stocks/ETFs via IBKR Lite (US clients only)

- Options: From $0.15–$0.65 per contract (tiered)

- Forex: 0.2 bps (0.002%) of trade value, minimum $2 per trade

- IBKR Lite (U.S. clients): Offers commission-free U.S. stock and ETF trades

- More beneficial for high-volume and U.S.-based traders

Non-Trading Fees

Non-trading fees include charges for account maintenance, withdrawals, data feeds, and inactivity. These often vary based on the entity, account size, and region.

Inactivity Fees

- CapTrader: $1 monthly inactivity fee if portfolio below $1,000 and no trades during the month

- IBKR: No inactivity fee since July 2021

Withdrawal/Deposit Fees

- CapTrader:

- €8 for first withdrawal per month

- Additional withdrawals: €1 for each additional withdrawal

- €8 for first withdrawal per month

- IBKR:

- One free withdrawal/month

- Additional: $10 (wire), free with ACH/SEPA (if supported)

- One free withdrawal/month

Hidden/Extra Charges

- CapTrader:

- Some charges for reporting features

- Custody fees may apply under specific account types

- Some charges for reporting features

- IBKR:

- Market data fees can be complex and regionally dependent

- Hidden margin interest costs if not carefully monitored

- Market data fees can be complex and regionally dependent

Platform Subscription Costs

- CapTrader:

- TWS is free

- Market data subscriptions can be added à la carte

- TWS is free

- IBKR:

- Free platforms (TWS, Mosaic, Web, Mobile)

- Optional premium market data subscriptions are paid

- Free platforms (TWS, Mosaic, Web, Mobile)

Data Feed Charges

- CapTrader & IBKR:

- Identical fee structures

- Example: Real-time U.S. stock data ~ $1.50/month (non-professional), other markets vary

- Identical fee structures

Summary Table: CapTrader vs Interactive Brokers Fees

| Fee Type | CapTrader | Interactive Brokers |

| Stock Trading (US) | $0.01/share (min $2.00) | $0.005–$0.01/share (min $1.00, IBKR Pro) or commission-free (IBKR Lite, US clients) |

| Options Trading | min €4 per trade (Germany) | $0.15–$0.65 per contract (tiered) |

| Inactivity Fee | $1/month if portfolio below $1,000 and no trades that month | None |

| Withdrawal Fee | €8 for first withdrawal/month, €1 for each additional | 1 free/month, then $10 (wire), free for ACH/SEPA |

| Data Feed | Paid, same as IBKR | Paid |

| Platform Costs | Free (TWS, Web, Mobile) | Free |

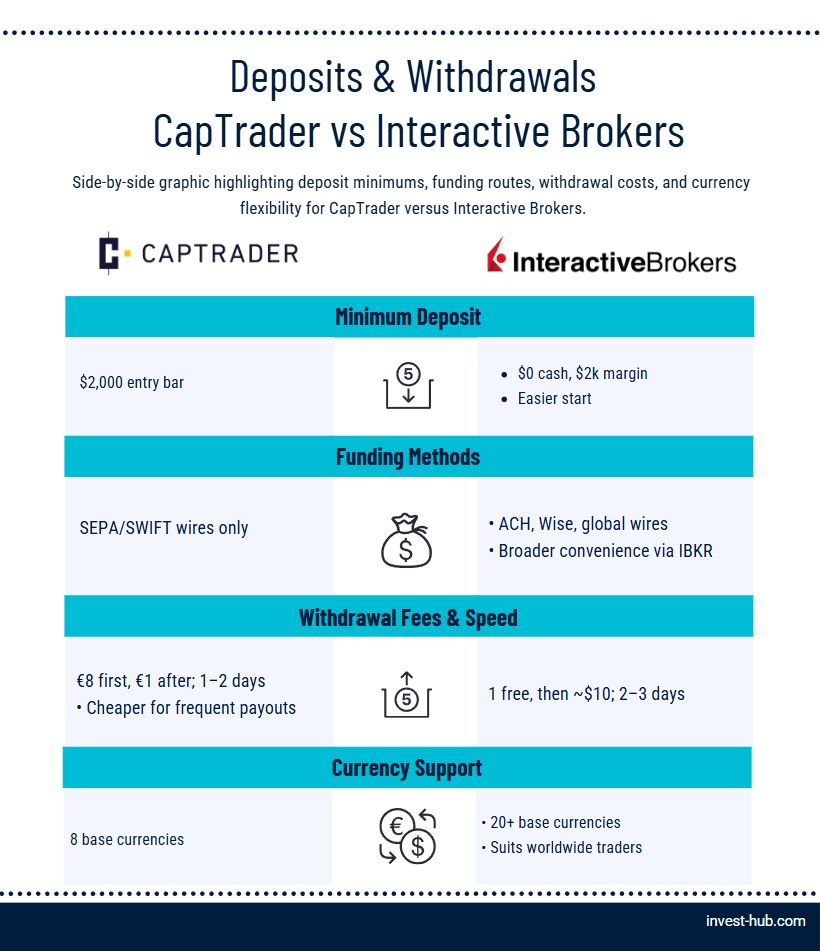

Deposits & Withdrawals with CapTrader Vs Interactive Brokers

Smooth funding and withdrawal processes are essential for both new and seasoned traders. While CapTrader and Interactive Brokers both offer solid infrastructure, their deposit options, minimums, and currency support differ — particularly in how they cater to European vs. international clients.

Minimum Deposit

- CapTrader:

- Minimum deposit: $2,000

- Intended to filter for more serious investors

- Accounts not funded within 90 days may be closed

- Minimum deposit: $2,000

- Interactive Brokers:

- No minimum deposit required for cash accounts; $2,000 minimum for margin accounts

- Ideal for beginners or passive investors wanting to start small

- Some margin and portfolio margin accounts may have funding thresholds

- No minimum deposit required for cash accounts; $2,000 minimum for margin accounts

Funding Methods

| Method | CapTrader | Interactive Brokers |

| Bank Transfer (Wire) | ✅ Supported (SEPA, SWIFT) | ✅ Supported globally |

| ACH Transfer | ❌ Not available | ✅ U.S. clients only |

| Credit/Debit Card | ❌ Not supported | ❌ Not supported |

| Wise/TransferWise | ❌ Not officially supported; only bank transfers accepted | ✅ Supported (may require pre-registration) |

| PayPal/Skrill | ❌ Not supported | ❌ Not supported |

| Internal Transfers | ✅ Between CapTrader accounts | ✅ Between IBKR accounts |

- CapTrader: Funding must be made from accounts held in the client’s name. Localized SEPA transfers are often faster for EU clients.

- Interactive Brokers: Supports a broader range of funding currencies and pre-registered transfer templates. Faster processing via ACH (U.S.) or BACS (UK).

Withdrawal Policies

- CapTrader:

- €8 for the first withdrawal per month

- €1 for each additional withdrawal

- Withdrawals processed within 1–2 business days

- €8 for the first withdrawal per month

- Interactive Brokers:

- 1 free withdrawal/month

- Additional wire withdrawals ~ $10 each

- SEPA/ACH withdrawals €1/$1 after first free

- Funds typically available within 2–3 business days

- 1 free withdrawal/month

Potential Restrictions

- CapTrader:

- Supports base currencies including EUR, GBP, USD, CHF, CZK, PLN, DKK, NOK, SEK

- Currency conversion required for deposits in other currencies

- Can delay funding speed if not pre-validated

- Supports base currencies including EUR, GBP, USD, CHF, CZK, PLN, DKK, NOK, SEK

- Interactive Brokers:

- Supports 20+ base currencies including AED, AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, MXN, NOK, NZD, PLN, SEK, SGD, USD, ZAR, and more

- More efficient for global investors

- Some funding methods may require extra KYC documentation based on jurisdiction

- Supports 20+ base currencies including AED, AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, MXN, NOK, NZD, PLN, SEK, SGD, USD, ZAR, and more

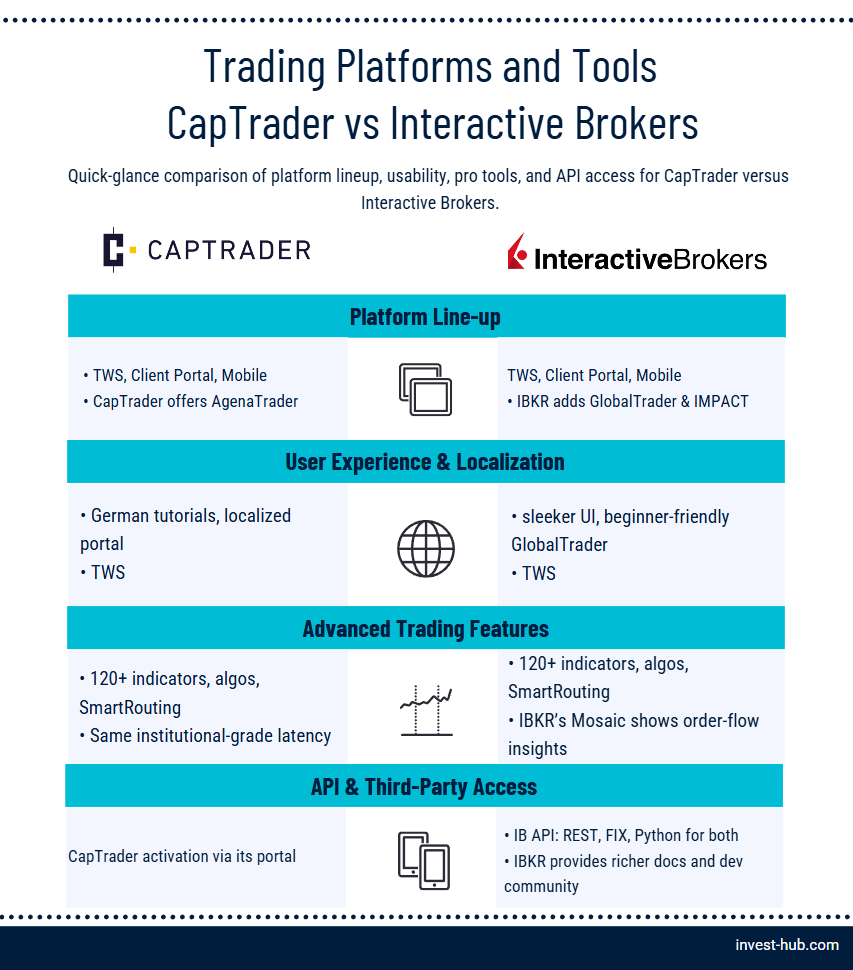

Trading Platforms and Tools in CapTrader Vs Interactive Brokers

When evaluating CapTrader vs Interactive Brokers, it’s crucial to understand that both brokers provide access to the same core trading platforms — primarily Trader Workstation (TWS), Client Portal, and Mobile Trader — developed by Interactive Brokers. However, how these tools are presented, supported, and optimized varies.

Platform Types

| Platform | CapTrader | Interactive Brokers |

| Trader Workstation | ✅ Yes | ✅ Yes |

| WebTrader/Client Portal | ✅ Yes | ✅ Yes |

| Mobile App | ✅ (IBKR Mobile app) | ✅ (IBKR Mobile app) |

| Specialized Platforms | ✅ Trader Workstation (TWS), AgenaTrader | ✅ IBKR GlobalTrader, IMPACT app (limited by region) |

- Both brokers offer:

- Desktop TWS for advanced traders

- Client Portal for managing trades, funding, and analytics

- Mobile apps with full functionality including trading, alerts, and watchlists

- Desktop TWS for advanced traders

- Only IBKR offers:

- IBKR GlobalTrader (streamlined mobile platform for beginners)

- IMPACT App (sustainable investing)

- IBKR GlobalTrader (streamlined mobile platform for beginners)

User Interface & Ease of Use

- CapTrader:

- Onboarding includes German-language tutorials and email support

- Interface of TWS is identical, but Client Portal is localized in German

- Designed for investors already comfortable with technical tools

- Onboarding includes German-language tutorials and email support

- Interactive Brokers:

- More polished mobile and web UIs for international use

- IBKR GlobalTrader is more beginner-friendly than TWS

- Can be overwhelming for new users due to the high density of features

- More polished mobile and web UIs for international use

Technical Analysis Tools

Both brokers (via TWS) provide:

- Over 120 technical indicators

- Customizable charting

- Strategy backtesting

- Real-time data overlays

- Advanced chart drawing tools

Advanced Order Types

- Full access to:

- Algo trading (VWAP, Iceberg, Adaptive)

- Bracket orders, OCA, OTO, and conditional orders

- SmartRouting™ for best execution

- Algo trading (VWAP, Iceberg, Adaptive)

- IBKR also adds:

- Easier access to order flow visualization tools via Mosaic

- Access to API order routing insights

- Easier access to order flow visualization tools via Mosaic

Automation & APIs

| Feature | CapTrader | Interactive Brokers |

| API Trading | ✅ Yes (IB API) | ✅ Yes (REST, FIX, Python, C++) |

| Third-party Platforms | ✅ (via IBKR backend) | ✅ (e.g. MetaTrader via bridge, NinjaTrader) |

| Algo Execution | ✅ Supported | ✅ Supported |

- CapTrader clients use the same IB API suite but must configure access via CapTrader’s portal.

- IBKR offers more complete documentation and community tools for developers and quants.

Reliability & Speed

- Both platforms:

- Use Interactive Brokers’ server infrastructure

- Provide real-time execution with low latency

- Are known for institutional-grade uptime and reliability

- Use Interactive Brokers’ server infrastructure

- No noticeable speed difference between CapTrader and IBKR unless specific backend restrictions are imposed, which is rare.

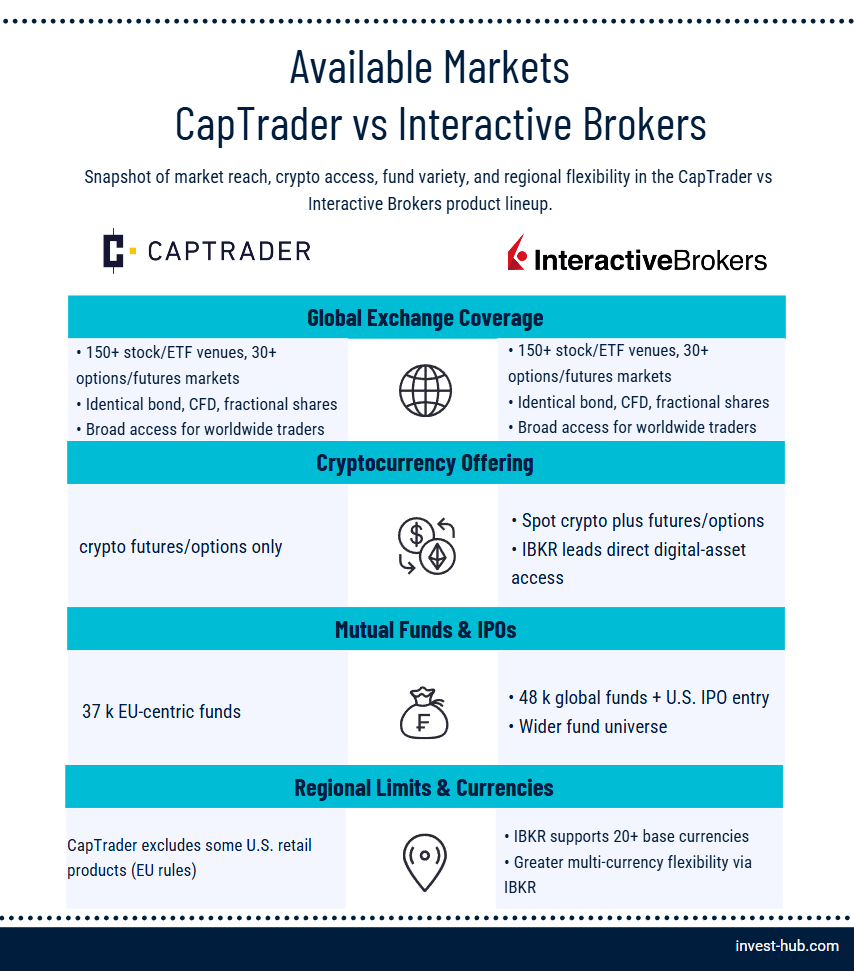

Available Markets on CapTrader Vs Interactive Brokers

A core advantage in the CapTrader vs Interactive Brokers comparison is that both brokers provide access to a vast array of global markets and instruments. Because CapTrader relies on IBKR’s infrastructure, most product offerings are identical — with slight variation in exposure to specialized products and regional access.

Asset Classes

| Asset Type | CapTrader | Interactive Brokers |

| Stocks & ETFs | ✅ 150+ markets | ✅ 150+ markets |

| Options & Futures | ✅ Global options/futures on 30+ exchanges | ✅ Global options/futures on 30+ exchanges |

| Forex | ✅ 105+ currency pairs | ✅ 100+ currency pairs |

| Bonds | ✅ 1+ million government, corporate, and municipal bonds | ✅ 1+ million government, corporate, and municipal bonds |

| CFDs | ✅ On indices, stocks, and forex | ✅ Same as CapTrader |

| Cryptocurrencies | ✅ Crypto futures/options | ✅ Spot crypto (BTC, ETH, LTC, SOL, ADA, XRP, DOGE, and more) for eligible IBKR clients |

| Mutual Funds | ✅ 37,000+ funds (CapTrader, mainly EU/UCITS) | ✅ 48,000+ funds (IBKR, global) |

| Metals | ✅ Futures only | ✅ Spot and futures (via CME etc.) |

- CapTrader restricts access to:

- U.S. spot cryptocurrencies and U.S. mutual funds

- Certain U.S.-specific instruments due to EU regulations

- U.S. spot cryptocurrencies and U.S. mutual funds

- IBKR users in eligible regions (esp. U.S.) gain access to:

- Spot crypto

- Thousands of mutual funds

- Structured products, including warrants and convertible bonds

- Spot crypto

Global Access

- CapTrader:

- Access to 150+ global markets including EU, North America, Asia-Pacific

- May exclude U.S.-only retail products due to EU compliance rules

- Best suited for clients investing in European and international blue-chips

- Access to 150+ global markets including EU, North America, Asia-Pacific

- Interactive Brokers:

- Access to 150+ global markets/exchanges, with extended support for niche U.S. instruments

- Traders can hold assets in 20+ currencies, enabling true multi-currency investing

- Access to 150+ global markets/exchanges, with extended support for niche U.S. instruments

Specialty Products

| Product Type | CapTrader | Interactive Brokers |

| Fractional Shares | ✅ For U.S. and some European stocks | ✅ For U.S. and some European stocks |

| IPO Access | ❌ Limited or unavailable | ✅ Available for U.S.-based accounts |

| Green/Sustainable Products | ❌ Not curated | ✅ Via the IMPACT App (ESG filters) |

| Cryptocurrency Products | ✅ Crypto futures/options | ✅ Spot crypto (BTC, ETH, LTC, SOL, ADA, XRP, DOGE, and more) for eligible IBKR clients |

| Mutual Funds | ✅ 37,000+ funds (CapTrader, mainly EU/UCITS) | ✅ 48,000+ funds globally (IBKR) |

- CapTrader provides core trading products for long-term investors and retail traders.

- IBKR has a more comprehensive product suite, especially for U.S.-based and professional investors.

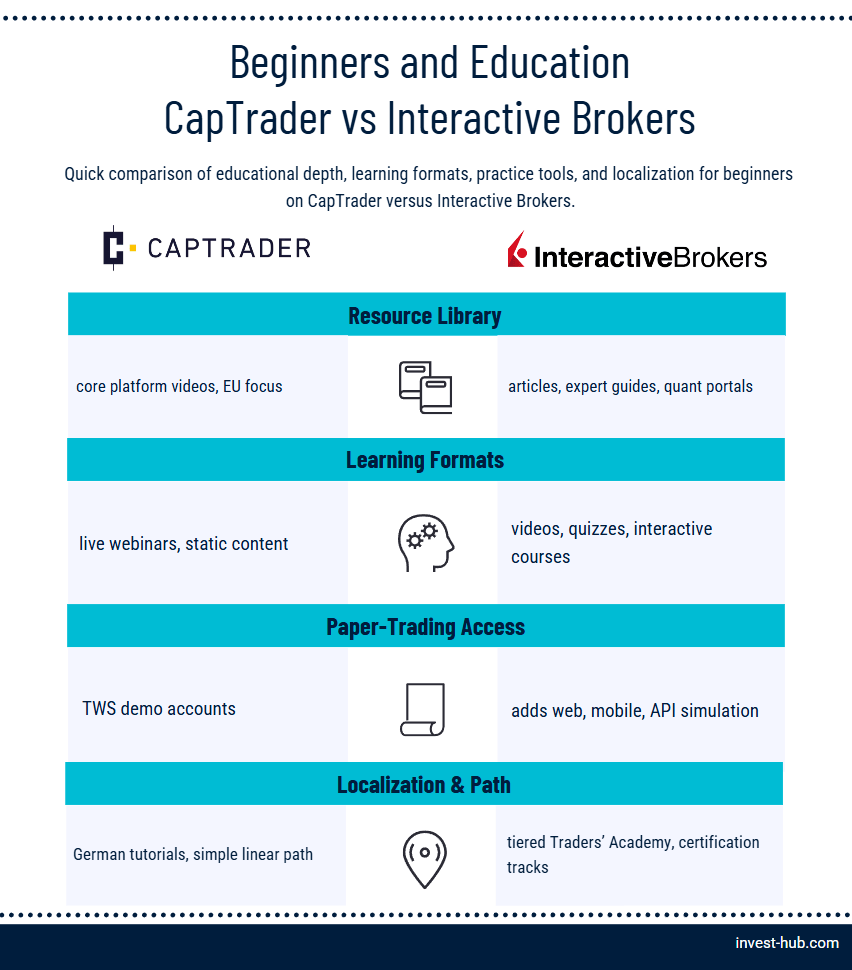

Beginners and Education on CapTrader Vs Interactive Brokers

In the CapTrader vs Interactive Brokers matchup, both brokers offer educational resources — but they cater to different learning styles and client bases. CapTrader focuses on curated, regionally relevant content for European investors, while IBKR maintains a broad, institutional-grade knowledge base for global audiences.

Educational Resources

| Resource Type | CapTrader | Interactive Brokers (IBKR) |

| Webinars | ✅ Webinars in English and other languages (global themes) | ✅ English webinars (global themes) |

| Video Tutorials | ✅ TWS basics, order types | ✅ Broad library covering all platforms |

| Articles & Glossary | ✅ Simple, localized trading concepts | ✅ Extensive IBKR Campus with deep finance topics |

| Strategy Guides | ❌ Basic coverage only | ✅ Covers options, futures, margin, etc. |

| Learning Formats | Mostly static content + live webinars | Video, text, interactive quizzes, and courses |

- CapTrader:

- Some beginner-friendly videos focused on platform use, but overall education is less extensive than IBKR

- Offers German-focused content and market coverage

- Simplified onboarding material for EU investors

- Some beginner-friendly videos focused on platform use, but overall education is less extensive than IBKR

- Interactive Brokers:

- Access to IBKR Campus, Traders’ Academy, and IBKR Quant portals

- Includes quizzes, instructor-led courses, and institutional-level content

- Offers resources for all levels, but platform is best suited for advanced/professional users

- Access to IBKR Campus, Traders’ Academy, and IBKR Quant portals

Demo Accounts

- CapTrader:

- Offers demo access to Trader Workstation (TWS)

- Simulated environment using delayed or real-time data feeds depending on instrument

- Ideal for practice with advanced order types

- Offers demo access to Trader Workstation (TWS)

- Interactive Brokers:

- Full-featured paper trading account

- Allows strategy testing with all platforms (TWS, Web, Mobile)

- APIs and algos can also be tested in simulation

- Full-featured paper trading account

Learning Path

- CapTrader:

- Linear progression: platform navigation → trading basics → Q&A support

- Useful for German-speaking beginners

- Lacks structured certifications or modular courses

- Linear progression: platform navigation → trading basics → Q&A support

- Interactive Brokers:

- Structured learning path via Traders’ Academy

- Topics: Portfolio management, derivatives, macroeconomics, API development

- Tiers: Beginner, intermediate, expert

- Topics: Portfolio management, derivatives, macroeconomics, API development

- Strong alignment with professional standards and certifications

- Structured learning path via Traders’ Academy

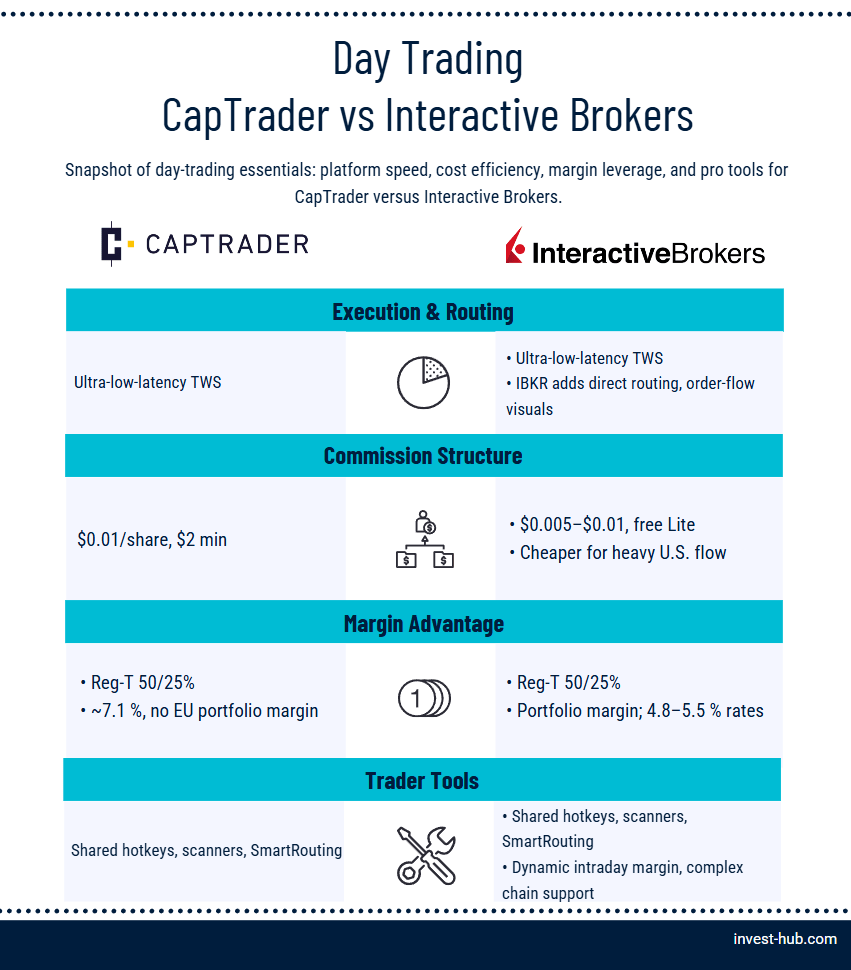

Day Trading with CapTrader Vs Interactive Brokers

When it comes to high-frequency and intraday strategies, both CapTrader and Interactive Brokers deliver exceptional capabilities thanks to the powerful TWS platform and ultra-low latency execution. However, certain fee structures, account services, and margin policies may influence which broker is more suitable for serious day traders.

Platform Suitability

Both brokers rely on Trader Workstation (TWS), a platform designed with active traders in mind:

| Feature | CapTrader | Interactive Brokers |

| Real-time charting | ✅ Yes | ✅ Yes |

| Market scanners | ✅ Available | ✅ More advanced filters |

| Hotkeys & speed execution | ✅ Yes | ✅ Yes |

| Order routing control | ✅ Via SmartRouting | ✅ Via SmartRouting + Direct Routing |

| Multi-monitor support | ✅ Yes | ✅ Yes |

- CapTrader offers full access to TWS with SmartRouting™ and bracket orders.

- IBKR supports more custom routing options, faster order visualization, and better tools for complex order chains.

Fees for Active Traders

CapTrader:

- No discounted fee tiers specifically for high-volume trading

- Trading costs:

- US stocks: $0.01/share, min $2.00

- Futures: US micro e-mini stock index futures: $3.50/contract; German e-mini index futures: €2/contract

- US stocks: $0.01/share, min $2.00

- Bundled and unbundled pricing available, but less flexible than IBKR

Interactive Brokers:

- Tiered pricing for stocks and options:

- US stocks: $0.005–$0.01/share

- Options: $0.15–$0.65/contract

- US stocks: $0.005–$0.01/share

- Access to IBKR Pro for lowest execution costs

- IBKR Lite (U.S. only): Commission-free trading with less granular control

Result: IBKR is more cost-efficient for high-volume day traders, especially in the U.S.

Margin Policies

| Aspect | CapTrader | Interactive Brokers |

| Reg T Margin | ✅ 50% initial, 25% maintenance | ✅ Same |

| Portfolio Margin | ❌ Not available for EU clients; available for some non-EU clients | ✅ Available (qualified clients only) |

| Intraday Margin | ✅ Offered during trading hours | ✅ Offered with dynamic calculations |

| Margin Rates (EUR/USD) | CapTrader USD margin rate ~7.1%; IBKR USD margin rates start at 6.83% and decrease with higher balances | ~5.5% down to ~4.8% (for large balances) |

| Negative Balance Protection | ❌ Not available | ❌ Not available for all; available for some EU/UK retail clients |

- CapTrader follows standard IBKR margin rules but does not offer portfolio margining.

- IBKR gives qualified users access to portfolio margin, which greatly reduces capital requirements for hedged positions — ideal for pros.

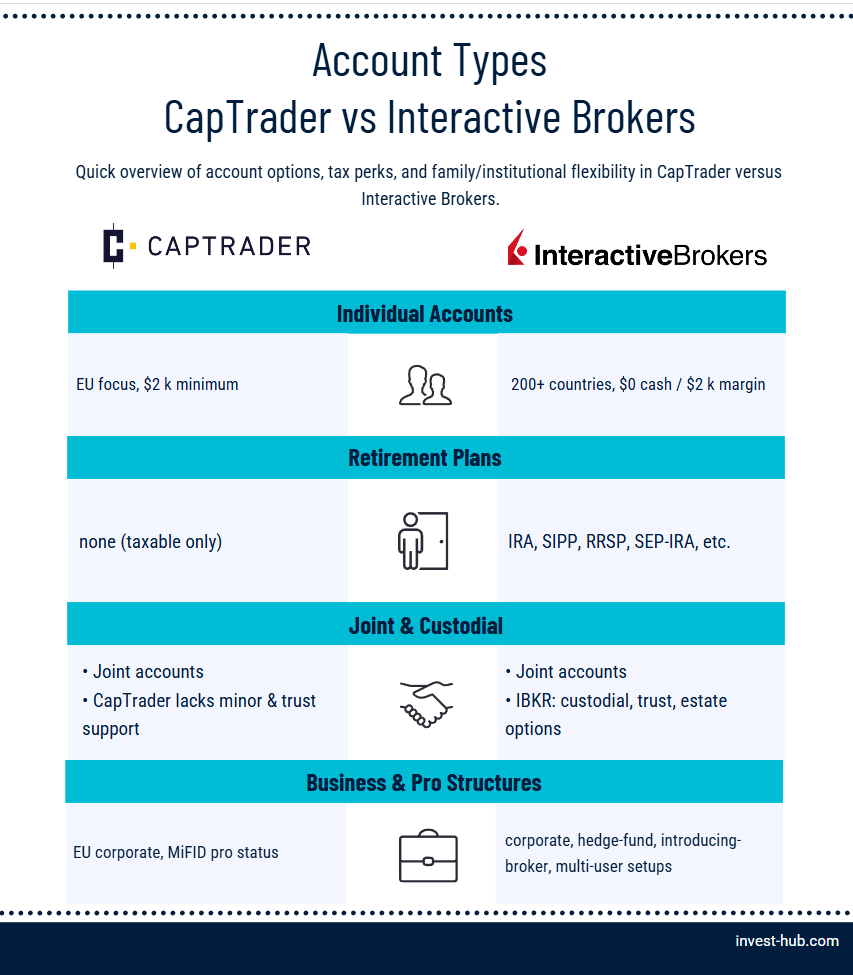

Account Types for CapTrader Vs Interactive Brokers

Choosing the right account type can significantly affect how you trade, access tax benefits, or manage joint finances. In the CapTrader vs Interactive Brokers comparison, both brokers support a variety of account types — though Interactive Brokers provides more flexibility, especially for global and institutional clients.

Individual Brokerage

- CapTrader:

- Standard individual investment accounts

- Focused on European residents, particularly Germany and Austria

- Includes access to all trading platforms and asset classes (except U.S. mutual funds and spot crypto; crypto futures/options and EU/UCITS funds available)

- Requires $2,000 (or equivalent) minimum funding

- You can also visit the official CapTrader website to explore account options and pricing.

- Standard individual investment accounts

- Interactive Brokers:

- Individual accounts with broader regional support

- Available to residents in 200+ countries

- No minimum deposit for cash accounts; $2,000 minimum for margin accounts

- Choice between IBKR Pro and IBKR Lite for U.S. clients

- Individual accounts with broader regional support

Retirement Accounts

- CapTrader:

- No dedicated retirement accounts (e.g., no IRA, SIPP)

- Users must manage retirement investing through standard taxable accounts

- No dedicated retirement accounts (e.g., no IRA, SIPP)

- Interactive Brokers:

- Offers IRA, Roth IRA, SEP IRA (U.S. clients only)

- Also supports RRSP/SRSP (Canada), SIPP (UK), and other region-specific retirement accounts

- Tax-advantaged plans available with specific custodial rules

- Offers IRA, Roth IRA, SEP IRA (U.S. clients only)

Joint or Custodial Accounts

| Account Type | CapTrader | Interactive Brokers |

| Joint Accounts | ✅ Available | ✅ Available globally |

| Custodial Accounts | ❌ Not offered (family accounts available, but not true custodial/minor accounts) | ✅ For minors (U.S. residents only, via UGMA/UTMA) |

| Trust Accounts | ❌ Not supported (custody accounts for foundations available) | ✅ Available for U.S., EU, and other eligible regions |

- CapTrader supports joint accounts for couples or business partners, but does not support custodial or standard trust accounts (family and foundation custody accounts are available).

- Interactive Brokers provides a broader family and institutional setup, including:

- Custodial (minor) accounts

- Trust accounts

- Estate and business accounts

- Custodial (minor) accounts

Specialized Accounts

CapTrader:

- Offers a Business/Corporate Account for legal entities in the EU

- Professional client status possible under MiFID II rules

- Focus on taxable structures only

Interactive Brokers:

- Offers an extensive range of specialized accounts:

- Corporate and institutional

- Introducing broker accounts

- Hedge fund and proprietary trading group accounts

- Corporate and institutional

- Greater flexibility for legal structures, margin arrangements, and multi-user access

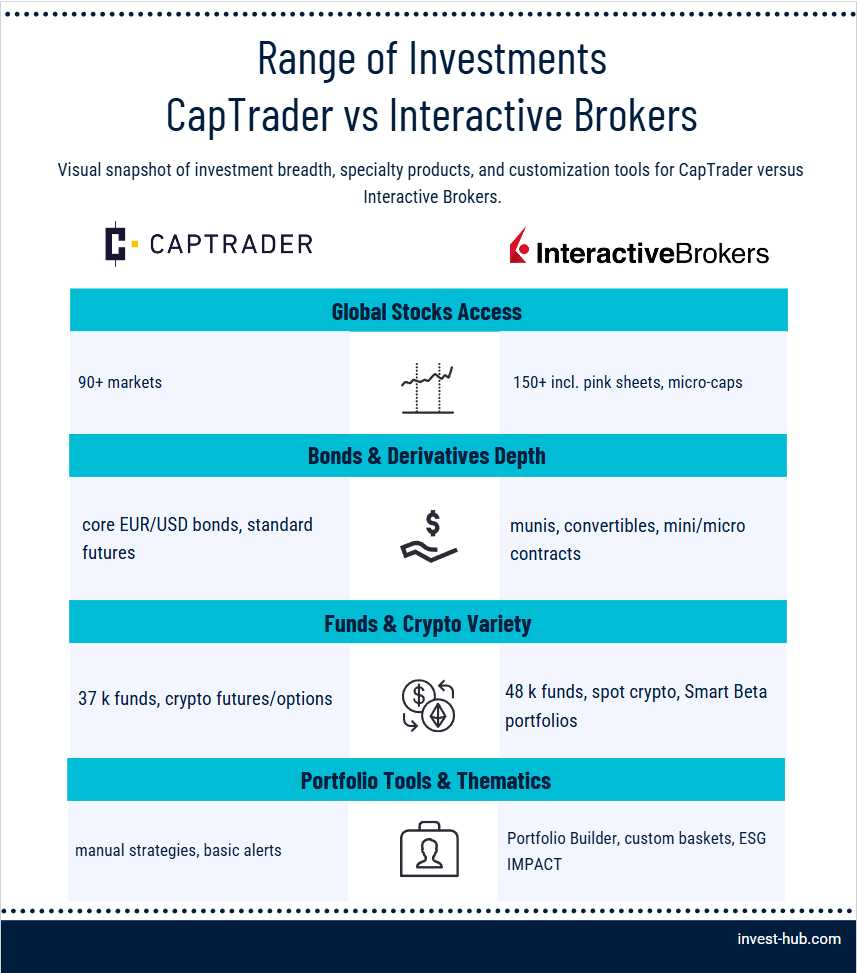

Range of Investments in CapTrader Vs Interactive Brokers

The investment universe is vast, and both CapTrader and Interactive Brokers offer impressive depth. However, IBKR leads in overall variety, especially when it comes to mutual funds, cryptocurrencies, and sustainable portfolios.

Depth in Each Category

| Asset Category | CapTrader | Interactive Brokers (IBKR) |

| Stocks & ETFs | ✅ Extensive (90+ global markets: Europe, U.S., Asia) | ✅ Broader (150+ global markets, including pink sheets and micro caps) |

| Options & Futures | ✅ Major global exchanges (limited mini/micro contracts) | ✅ Full access including mini/micro contracts |

| Bonds | ✅ Corporate & sovereign, mainly EUR/USD (limited U.S. municipal/convertible bonds) | ✅ Wide inventory: municipal, convertible, global bonds |

| Forex | ✅ 105+ currency pairs | ✅ 100+ pairs, more cross-currency margin flexibility |

| CFDs | ✅ On 7,000+ stocks, indices, metals, and forex | ✅ On indices, stocks, metals, forex, with broader international coverage |

- CapTrader covers the core needs well, especially for European clients.

- IBKR adds:

- Micro-cap stocks

- Emerging markets

- Expanded bond markets (U.S. municipal, structured, callable)

- Micro-cap stocks

Specialized Portfolios

- CapTrader:

- Does not offer robo-advisory services or pre-built portfolios

- Traders must create custom strategies manually

- Offers ESG screening tools for sustainable investing

- Does not offer robo-advisory services or pre-built portfolios

- Interactive Brokers:

- Offers IBKR Portfolios and Smart Beta ETFs

- Access to robo-advisory tools like IBKR Portfolio Builder

- Specialized portfolios for:

- Dividend investing

- Sector allocation

- ESG-compliant investing via the IMPACT App

- Dividend investing

- Offers IBKR Portfolios and Smart Beta ETFs

Custom Options

| Customization Area | CapTrader | Interactive Brokers |

| Watchlists | ✅ Yes | ✅ Yes |

| Alerts & Triggers | ✅ Basic alerts | ✅ Complex, multi-variable alerts |

| Saved Strategies | ❌ Manual only | ✅ Via Portfolio Builder and API |

| Custom ETF Baskets | ❌ Not supported | ✅ Available |

| Thematic Investing | ❌ Not offered | ✅ Through GlobalAnalyst and IMPACT |

- CapTrader focuses on execution — not portfolio engineering.

- IBKR supports:

- Thematic screeners

- Custom ETFs via basket orders

- Smart rebalancing features

- Thematic screeners

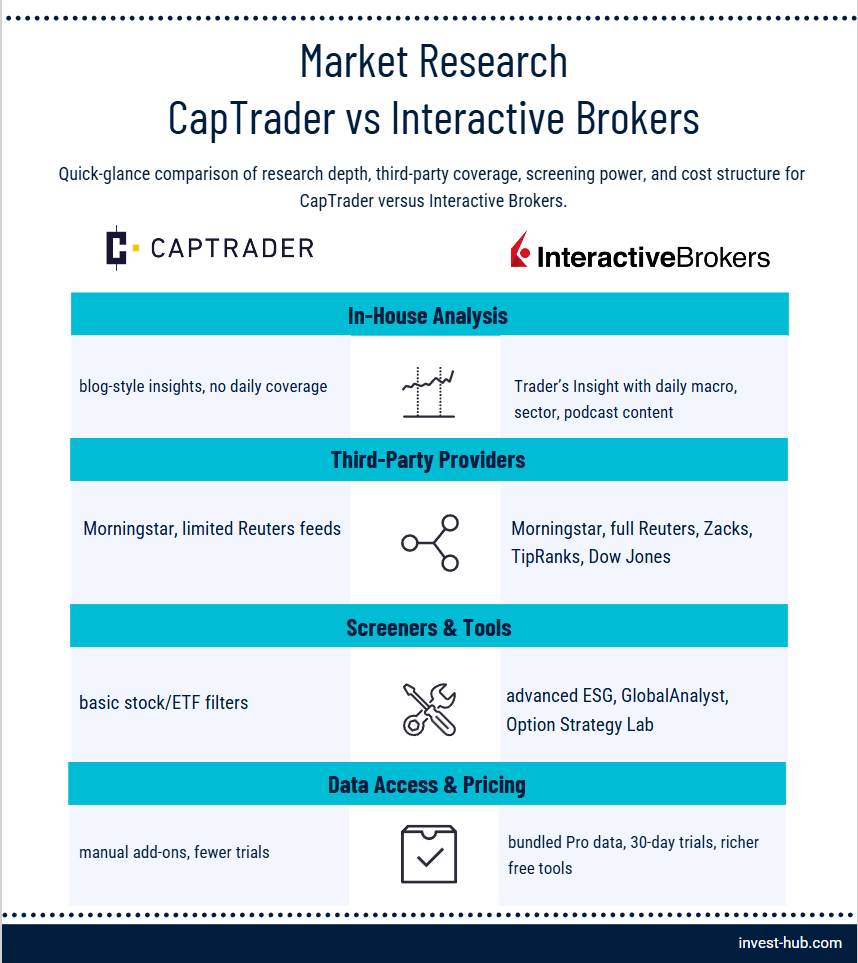

Market Research at CapTrader Vs Interactive Brokers

For traders and investors who rely on robust research and screening tools, Interactive Brokers provides one of the most comprehensive research ecosystems in the industry. CapTrader, while offering access to some of the same data via IBKR’s backend, is more limited in custom tools and exclusive content.

In-House Research

- CapTrader:

- Does not produce its own proprietary research

- Offers blog articles, market commentaries, and some original market analyses from in-house experts

- Provides some trading ideas and signals, but not daily analyst coverage

- Does not produce its own proprietary research

- Interactive Brokers:

- Publishes in-house market commentary, macro updates, and strategy insights

- IBKR’s Trader’s Insight platform offers:

- Daily expert analysis

- Sector-focused content

- Technical trend articles

- Daily expert analysis

- Provides exclusive IBKR podcasts and video analysis

- Publishes in-house market commentary, macro updates, and strategy insights

Third-Party Research Providers

| Provider | CapTrader | Interactive Brokers |

| Morningstar | ✅ Available | ✅ Available |

| Thomson Reuters | ✅ Limited access | ✅ Full access |

| Zacks | ❌ Not supported | ✅ Included in IBKR Pro |

| TipRanks | ❌ Not available | ✅ Via IBKR Marketplace |

| Dow Jones Newswires | ✅ Partial (via TWS) | ✅ Full integration |

| Refinitiv | ✅ Access via platform | ✅ Broader coverage |

- CapTrader provides access to select IBKR research feeds, but often requires:

- Manual activation

- Additional subscriptions

- Manual activation

- IBKR offers one-click integration and often bundles more data for Pro clients

Tools & Screeners

CapTrader:

- Access to:

- Stock, ETF, and option screeners via IBKR Client Portal

- Basic filter capabilities (market cap, price, volume)

- Stock, ETF, and option screeners via IBKR Client Portal

- Fewer customization options for long-term investors or sector analysis

Interactive Brokers:

- Rich ecosystem of tools:

- Stock Screener: Advanced filters, ESG, dividend growth, profitability

- ETF & Fund Screeners: 15+ filtering metrics

- Option Strategy Lab: Suggests spreads based on market view

- IBKR GlobalAnalyst: Highlights undervalued markets and stocks globally

- Stock Screener: Advanced filters, ESG, dividend growth, profitability

Premium vs. Free

| Feature Type | CapTrader | Interactive Brokers |

| Free Tools | ✅ Basic screeners, some data feeds | ✅ Many in-house tools and free feeds |

| Premium Data | ✅ Paid subscriptions (a la carte) | ✅ Same, but more bundled options |

| Trial Access | ❌ Not always available | ✅ Often includes 30-day trials |

| Mobile Access | ✅ Via TWS App | ✅ Fully optimized across platforms |

- IBKR offers more bundled research in its Pro accounts and a broader range of trial data.

- CapTrader clients must manage feeds more manually, sometimes with slower integration.

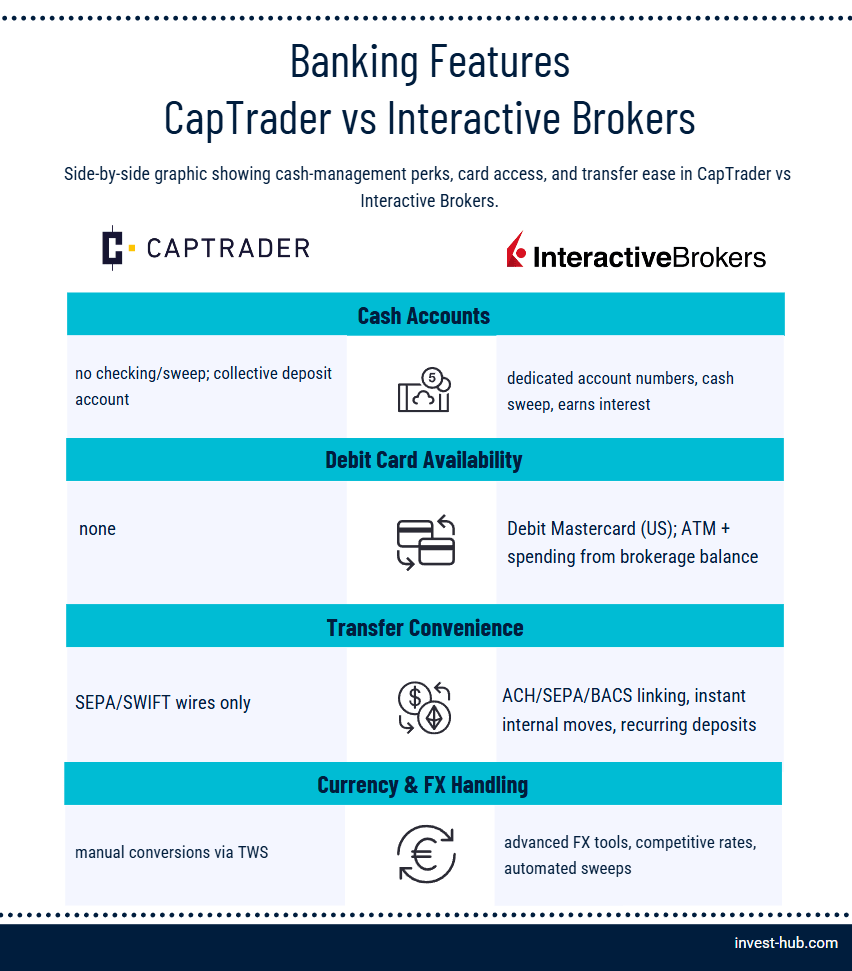

Banking Features of CapTrader Vs Interactive Brokers

While neither CapTrader nor Interactive Brokers is a traditional bank, both offer a variety of banking-like features. These tools improve account funding flexibility, spending power, and integration with external financial services — especially important for active investors who want cash management options.

Integrated Bank Accounts

- CapTrader:

- Does not offer integrated banking services like checking or savings accounts

- Clients must use external bank transfers (SEPA/SWIFT) for funding

- CapTrader uses collective accounts for deposits; clients do not receive personal IBANs or dedicated account numbers for incoming third-party payments

- Does not offer integrated banking services like checking or savings accounts

- Interactive Brokers:

- Offers IBKR Integrated Investment Accounts with:

- Dedicated account numbers (U.S. clients)

- Direct ACH/SEPA/BACS capabilities

- Interest on uninvested cash balances above $10,000 (Pro and Lite, rates vary)

- Dedicated account numbers (U.S. clients)

- In some regions (e.g., U.S.), IBKR acts as a brokerage-cash sweep hybrid

- Offers IBKR Integrated Investment Accounts with:

Debit/Credit Cards

- CapTrader:

- ❌ No debit or credit card services

- No integration with third-party card providers

- ❌ No debit or credit card services

- Interactive Brokers:

- ✅ Offers IBKR Debit Mastercard (U.S. clients)

- Enables ATM withdrawals

- Real-time access to uninvested balances

- Card spending tied to brokerage account cash

- Enables ATM withdrawals

- Not yet available to EU or APAC clients, but expansions are planned

- ✅ Offers IBKR Debit Mastercard (U.S. clients)

Seamless Transfers

| Transfer Functionality | CapTrader | Interactive Brokers |

| Instant internal transfers | ✅ Between accounts held by the same client | ✅ Between IBKR accounts |

| Currency conversion | ✅ Manual via TWS or Client Portal | ✅ Advanced FX tools, better rates |

| Third-party bank linking | ❌ Manual bank transfer only | ✅ Secure bank linking (ACH, SEPA, BACS) |

| Real-time cash updates | ❌ Delayed with wire processing | ✅ Instant for internal and linked bank transfers |

- IBKR supports more seamless banking interactions, including:

- Automated FX conversions

- Recurring deposits/withdrawals

- Cash optimization through sweep and credit features

- Automated FX conversions

- CapTrader remains broker-focused, with minimal banking convenience.

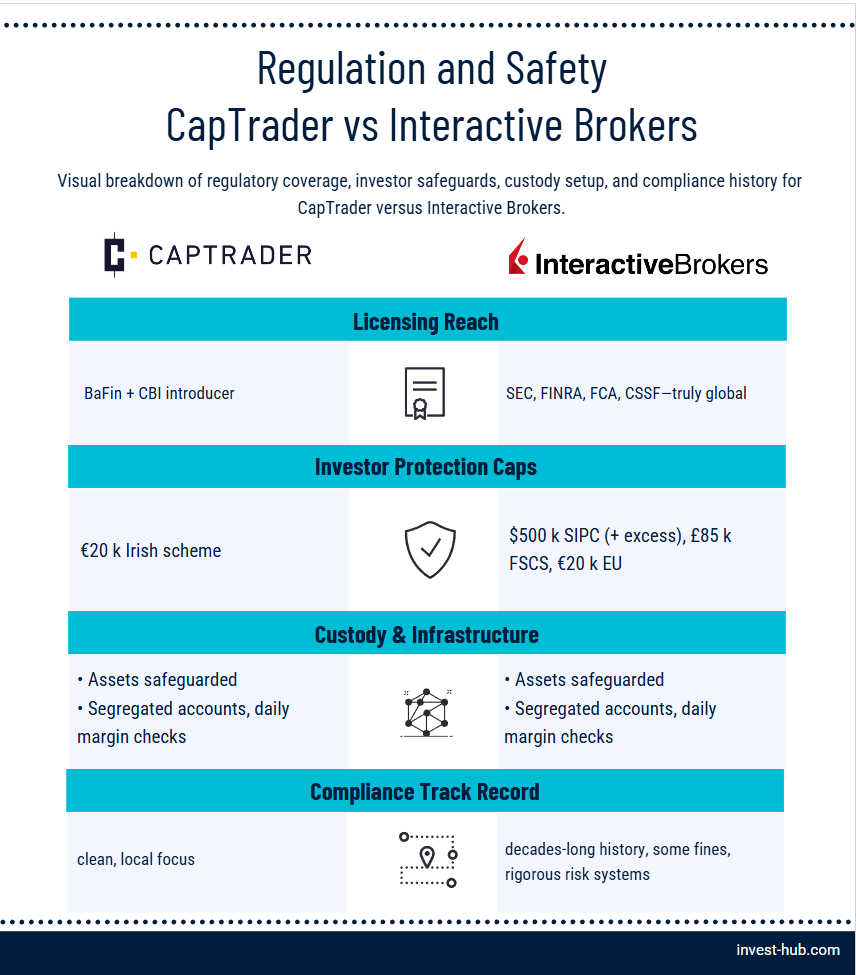

Regulation and Safety: CapTrader Vs Interactive Brokers

When trading large amounts or storing assets for the long term, regulatory protection and institutional credibility are non-negotiable. Both CapTrader and Interactive Brokers are considered highly secure, but they differ in licensing jurisdictions, investor protection schemes, and transparency.

Regulatory Bodies

| Entity | CapTrader | Interactive Brokers (IBKR) |

| Licensing Entity | CapTrader GmbH (introducing broker) | Interactive Brokers LLC, UK Ltd, Europe SARL, etc. |

| Regulator | BaFin (Germany) | SEC, FINRA, CFTC (U.S.), FCA (UK), CSSF (EU) |

| Clearing & Custody | Done through Interactive Brokers | Native to IBKR |

- CapTrader is regulated by the Central Bank of Ireland (CBI) for most clients and also holds a BaFin license in Germany, operating as an introducing broker.

- Interactive Brokers holds direct licenses in multiple jurisdictions, making it more robust for clients across continents. For full details and regional availability, see the Interactive Brokers website.

Investor Protection

| Protection Scheme | CapTrader | Interactive Brokers |

| Custody Entity | Interactive Brokers | Interactive Brokers |

| Account Protection (EU) | €20,000 (Irish Investor Compensation Scheme for most clients) | €20,000 (Central Bank of Ireland, EU protection) |

| U.S. Clients (IBKR LLC) | ❌ Not applicable | Up to $500,000 (SIPC), incl. $250,000 cash; excess SIPC coverage up to $30 million per account (aggregate limits apply) |

| UK Clients (IBKR UK) | ❌ Not applicable | £85,000 FSCS protection |

| Additional Coverage | ❌ None | ✅ Lloyd’s excess SIPC (U.S. only) |

- Regardless of the platform, assets are held with Interactive Brokers, meaning CapTrader users indirectly benefit from IBKR’s infrastructure.

- However, legal claims and protections depend on the entity holding your account:

- CapTrader: Regulated under Irish law with €20,000 investor protection (Irish scheme for most clients; EdW for German-registered accounts only)

- IBKR: Protection levels vary — highest in the U.S., moderate in the EU/UK

- CapTrader: Regulated under Irish law with €20,000 investor protection (Irish scheme for most clients; EdW for German-registered accounts only)

Compliance History

- CapTrader:

- Strong reputation in Germany and Austria

- No major compliance violations

- Transparent about its reliance on IBKR’s systems

- Strong reputation in Germany and Austria

- Interactive Brokers:

- Long-standing global broker since 1978

- Occasional regulatory fines (e.g., 2020 AML settlement), but maintains:

- Top-tier risk controls

- Daily margining

- Real-time compliance monitoring

- Top-tier risk controls

- Long-standing global broker since 1978

- Both brokers adhere to MiFID II, FATCA, and OECD CRS reporting standards for tax compliance.

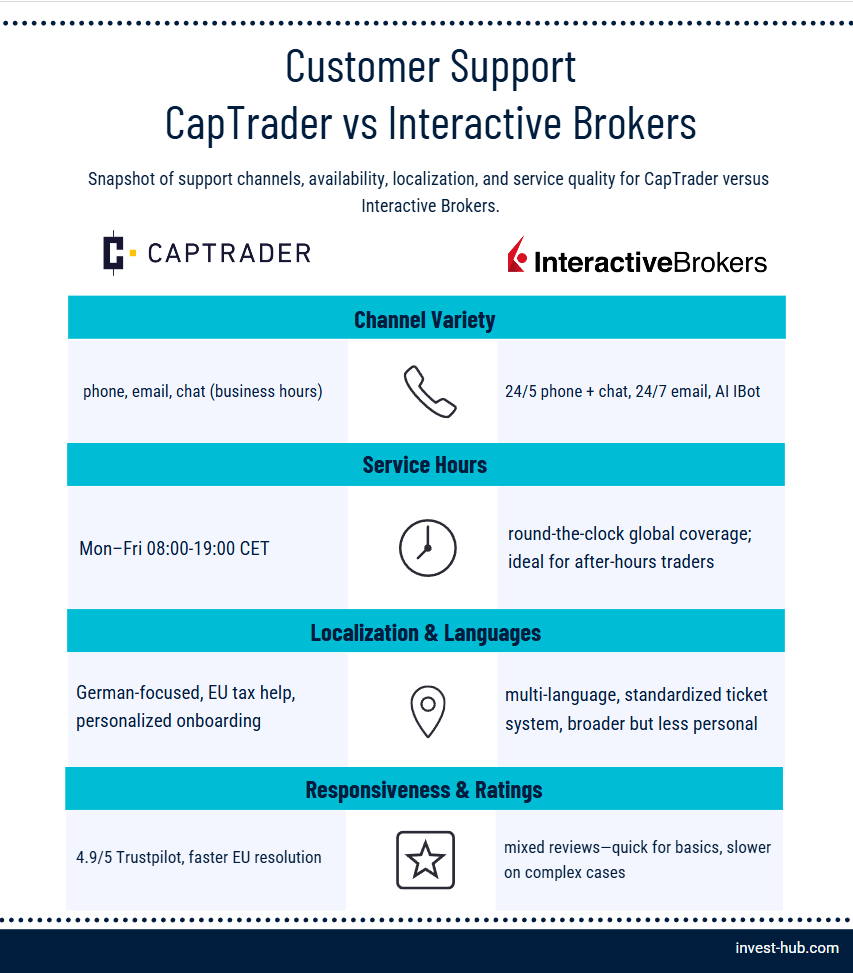

Customer Support at CapTrader Vs Interactive Brokers

Customer service quality can make a significant difference, especially during onboarding, technical issues, or live trading problems. In the CapTrader vs Interactive Brokers comparison, the main contrast lies in localization and accessibility. CapTrader is more personal and EU-focused, while IBKR offers broader availability but more standardized, ticket-based service.

Support Channels

| Channel | CapTrader | Interactive Brokers (IBKR) |

| Phone Support | ✅ Yes, with German and English agents (Mon–Fri, 8:30–20:00 CET) | ✅ Yes, 24/5 in multiple languages |

| Email Support | ✅ Yes | ✅ Yes, 24/7 with responses typically within 1 business day |

| Live Chat | ✅ Available via website (business hours, German and English) | ✅ Available 24/5, in multiple languages |

| Help Desk/Ticket System | ✅ Basic ticketing via email | ✅ Advanced Client Portal ticketing |

| AI Chatbot | ❌ Not offered | ✅ IBot: Supports basic queries 24/7 |

- CapTrader:

- Strong focus on German-speaking customer service

- Generally faster response for EU clients with region-specific queries

- Personal support in account setup, document validation, and tax handling

- Strong focus on German-speaking customer service

- Interactive Brokers:

- Offers 24/5 live support and 24/7 email support in multiple languages

- Includes technical support, trade disputes, and funding issues

- IBot can handle basic functions (e.g., balance checks, symbol lookup)

- Offers 24/5 live support and 24/7 email support in multiple languages

Availability

| Service Hours | CapTrader | Interactive Brokers |

| Phone & Chat | Mon–Fri 8:00–19:00 CET | 24/5, global coverage |

| Email/Tickets | 24/7 response within 1 business day | 24/7 email; live support aligned to market hours |

- CapTrader operates in standard European business hours.

- IBKR supports nearly all time zones, making it ideal for global or after-hours traders.

Quality & Responsiveness

- CapTrader:

- Known for more personal, high-touch service

- Better at handling EU-specific concerns like documentation or tax

- Rated highly among German investors for approachability (4.9/5 Trustpilot, 300+ reviews)

- Known for more personal, high-touch service

- Interactive Brokers:

- Mixed reviews on support:

- Support-fast for routine issues

- Slow for complex/high-level cases

- Support-fast for routine issues

- Live chat and IBot provide quick responses, but user complaints about delays are common

- Mixed reviews on support:

Conclusion on CapTrader Vs Interactive Brokers

Choosing between CapTrader vs Interactive Brokers ultimately depends on your trading profile, geographic location, and support preferences. Both brokers offer access to the same institutional-grade technology — including Trader Workstation, global market coverage, and competitive fees. However, their strengths are tailored to different audiences. Want to explore other top options? Visit our curated list of the best brokers for every trading style and goal.

CapTrader is best for:

- German and EU-based investors

- Traders who value local language support and region-specific onboarding

- Users needing tax-compliant documentation under German/EU law

- Investors who want personal guidance while accessing a professional-grade platform

Interactive Brokers is best for:

- Global, high-frequency, and professional traders

- Those needing full portfolio margin, advanced account types, or access to crypto and mutual funds

- U.S.-based clients seeking commission-free trading (IBKR Lite)

- Investors requiring broad research tools, custom APIs, and cash management features

Potential Drawbacks

| Broker | Drawbacks |

| CapTrader | $2,000 minimum deposit, limited account types, no spot crypto or U.S. mutual fund access, fewer banking features |

| IBKR | Complex onboarding, limited EU tax support, steep learning curve for TWS |

Both platforms are industry leaders in functionality and pricing. The decision comes down to localized service vs. full direct access. For many European clients, CapTrader is more approachable for those needing local support. For advanced, globally diversified traders, Interactive Brokers delivers unmatched scope and flexibility.

Next step: Assess your location, support needs, and trading goals to determine which broker aligns with your strategy. For more trading insights, guides, and broker comparisons, head over to Invest-Hub.

FAQs

CapTrader is an introducing broker for Interactive Brokers. It uses IBKR’s platform and clearing systems but operates under its own brand, providing localized services primarily for European clients.

Interactive Brokers generally offers lower fees, especially for U.S. stocks and high-frequency trading. CapTrader has competitive pricing but fewer pricing tiers and no commission-free options.

No, CapTrader does not support direct spot cryptocurrency trading (only crypto futures/options). IBKR allows eligible clients (mainly U.S.-based) to trade spot crypto via Paxos.

Yes. CapTrader is well-suited for beginners in the EU who want guided onboarding, native-language support, and access to advanced tools through a simpler interface.

CapTrader requires a $2,000 (or equivalent) minimum deposit. Interactive Brokers has no minimum deposit requirement for cash accounts and a $2,000 minimum for margin accounts.

Yes. Both CapTrader and Interactive Brokers offer demo (paper trading) environments to help users test strategies and learn the platforms.