Introduction Deepseek

DeepSeek has revolutionized AI research by adopting innovative approaches in the development of AI models. Founded with a vision to redefine the scalability and computational efficiency of AI, DeepSeek has revolutionized the sector. Its primary goal is to create AI architecture that is both cost-effective and high-performing, capable of surpassing the current industry leaders.

DeepSeek revolutionizes the stock market by leveraging AI to analyze trends, predict movements, and enhance decision-making for investors and traders.

Key Achievements in DeepSeek’s Journey

- Genesis and Founding: DeepSeek was a research-first company that started with its main function of optimizing AI efficiency with the help of new architectures concerning algorithms.

- Introduction of the R1 AI Model: For the very first time, this model showed unprecedented efficiency metrics benchmarked over the current industry at that time and also introduced a very new approach to AI training.

- Industry Strategic Integrations: Deep integrations of DeepSeek’s innovations with leading technology conglomerates for seamless applications across leading enterprises in various sectors.

- Market Disruption: The invention of this breakthrough technology at DeepSeek has sent ripples in the stock market. It upsets investor psychology and capital allocation plans. Not only does it impact stocks, but it also ripples through venture capital and strategic investments globally.

DeepSeek’s Technological Breakthroughs

R1: A New Computation Paradigm by AI MODEL

DeepSeek’s R1 AI model is an example of how neural network architectures have been changed in important ways that have led to huge reductions in computational overhead. While standard AI models are much more expensive in hardware resources, R1 can perform equally well but at a cost much less than one can imagine, hence paradigm-changing for enterprise usage. This model also introduced some new algorithmic efficiencies that reframe the capability of AI-driven automation.

Comparative analysis with contemporary AI models

Comparison table including DeepSeek R1, OpenAI’s GPT models, Google DeepMind’s Gemini, and Anthropic’s Claude:

| Feature | DeepSeek R1 | OpenAI’s GPT Models (GPT-4, GPT-3.5) | Google DeepMind’s Gemini | Anthropic’s Claude |

|---|---|---|---|---|

| Developer | DeepSeek | OpenAI | Google DeepMind | Anthropic |

| Architecture | Transformer-based LLM | Transformer-based LLM | Mixture of Experts (MoE) Transformer | Transformer-based LLM |

| Training Data | Multilingual, code-focused, web & proprietary data | Diverse internet data, books, academic texts, proprietary sources | Web data, books, multimodal sources | Ethical-focused dataset, web data, books |

| Performance | Strong in coding and reasoning | Leading in general NLP, reasoning, and creativity | Strong multimodal capabilities | Strong safety and alignment focus |

| Context Length | High (varies by model) | GPT-4-Turbo: 128k tokens, GPT-3.5: 16k tokens | Gemini 1 Ultra: 1M tokens (longest) | Claude 2: 200k tokens |

| Multilingual | Supports multiple languages | Strong multilingual support | Excellent multilingual ability | Supports multiple languages |

| Fine-tuning | Some customization options | Fine-tuning available for GPT-3.5 (limited for GPT-4) | Limited fine-tuning | Fine-tuning options available |

| APIs & Deployment | Available for developers | API access via OpenAI | Available via Google Cloud AI Studio | API access via Anthropic |

| Code Generation | Strong performance | GPT-4 excels in code generation | Good code capabilities | Good coding abilities, but less tested |

| Creativity & Writing | More structured, technical | Strong in creative writing and storytelling | Strong multimodal creativity | High-quality writing with ethical considerations |

| Multimodal Capabilities | Text and some code focus | GPT-4 has vision (GPT-4V) capabilities | Strong multimodal (text, image, audio, video) | Primarily text-based |

| Availability | Open-source or API-based pricing | API access via OpenAI, some models proprietary | Available via Google AI services | API access, chatbot available |

| Cost | Open-source or API-based pricing | API pricing varies (GPT-3.5 is cheaper than GPT-4) | Google Cloud pricing varies | API pricing varies |

| Inference Speed | Optimized for performance | GPT-4-Turbo is optimized for speed and efficiency | Gemini Ultra may be slower due to complexity | Generally optimized for efficiency |

AI Training Efficiency Enhancement

DeepSeek represents one approach to the development of AI through novel structuring methods of data, where the optimum models should have an ideal allocation of memory. Thanks to its leading distributed framework, DeepSeek optimized both the speed of training and inference accuracy to establish a new milestone in efficiency.

Economic Efficiency of DeepSeek’s AI Development

Innovations in cost-effective training methods

- Algorithmic Efficiency: This would mean ways to better avoid superfluous iterations of computation and hence reduce energy consumption with operational costs.

- Distributed Computing Architectures: These leverage the capabilities provided by the cloud while deferring energy expenditure to allow overall scalability for enterprise-scale AI.

- Active learning: Active learning is the ability to reduce repetition in several redundant training iterations of the network. Once more, the model should incorporate this feature efficiently to achieve high accuracy with less incoming data.

Resource Optimization Strategies

Additionally, DeepSeek’s AI models are designed to have very minimal dependence on high-end computational infrastructure. DeepSeek guarantees a high reduction in floating-point calculations based on advanced state-of-the-art tensor optimization methodologies for superior performance metrics and optimized cost structures. With DeepSeek, organizations will finally be able to deploy AI applications at scale without the economics that prevent the mainstreaming of AI through traditional AI frameworks.

Immediate Market Reactions to DeepSeek’s Innovations

Impact on Key Technology Stocks

DeepSeek’s announcement of its R1 AI model had the stock move in a wild fashion within hours and continued the volatile trend for many trading sessions.

- Nvidia (NVDA): Showing acute volatility in speculation that demand for AI chips will fall with high-powered GPUs no longer necessary.

- Microsoft (MSFT) & Google (GOOGL): The investors have reassessed the course of AI investments and accordingly made strategic shifts in portfolio rebalancing.

- AMD (AMD): AMD managed to balance investors’ risks and opportunities, taking into account the shift in demand for AI infrastructure.

Market Volatility and Investor Sentiment

Financial analysts described how this has brought increased volatility in markets, reflected in shifts in trading volumes, movement in implied volatility indexes, and fast-changing stock prices. Some of the trends are as follows:

- Sell-off in semiconductor equities due to concern over reduced hardware dependence.

- Strategic capital reallocation to cost-effective AI solutions making use of the least possible hardware resources.

- Speculative overtrading while investors adjusted the valuations of AI sectors in response to the possible paradigm shift in technology.

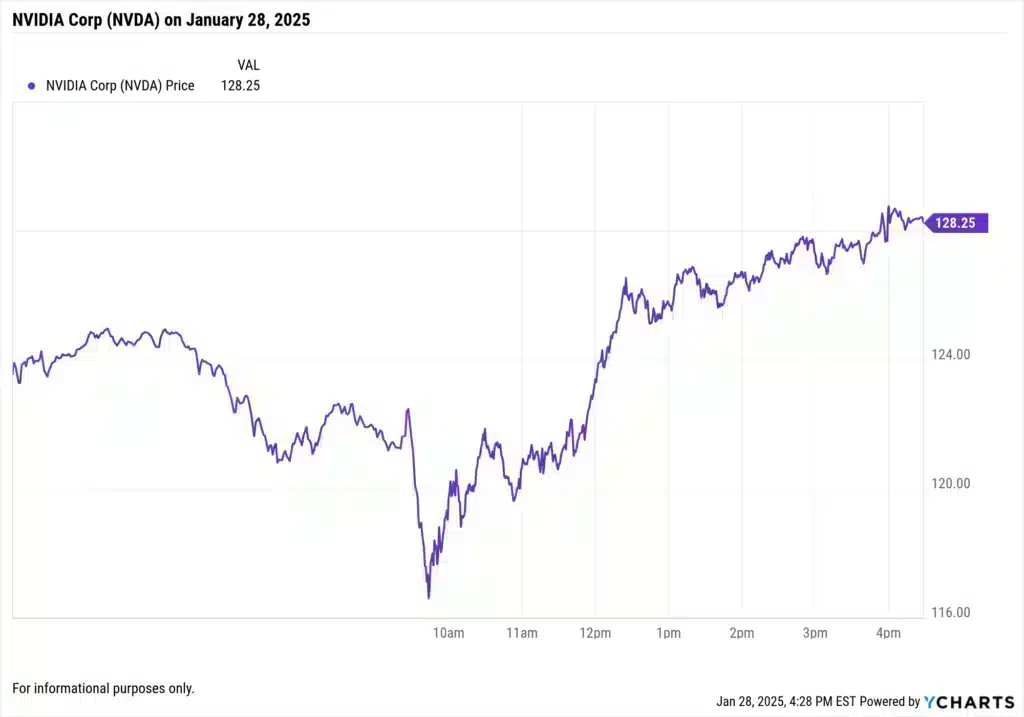

Case Study: Market Fluctuations of Nvidia After DeepSeek’s Announcement

Stock Trend of Nvidia

Nvidia’s stock saw a full pendulum swing due to the breakthrough technology announced by DeepSeek.

The company bounced back the following quarter, showing that investors were still investing in the infrastructure of AI as Nvidia refocused with an announcement to begin offering software for optimizing AI.

Further turbulence reflects shifting investor expectations on demand for AI hardware—especially for those companies focusing on making AI more efficient.

Impact on Semiconductor Industry

- Lower demand for high-quality GPUs: Some of these efficiencies in AI models could translate to lesser demands at the high end— another kind of dynamic in the highly competitive semiconductor world.

- Proliferation of optimization-driven AI solutions: Scaling optimization-driven AI solutions involves seeking ways to find models with lower power consumption, thereby opening up avenues for developing AI alternatives.

- Potential opportunities for mid-tier semiconductor manufacturers: Prospects for growth among middle-tier semiconductor manufacturers catering to DeepSeek’s new design in AI are growing due to AI’s thrifty processing units.

Long-term Impact on Investment Strategy in AI

Capital Re-Alignment

Efficiency-driven AI architecture makes market participants, including but not limited to hedge funds, institutional investors, and venture capital firms, align in a different direction with regard to the investment being undertaken in the market, as follows:

- Lower capital expenditure on hardware-embodied AI models

- Increased interest in software-based methods for optimization

- Cost-efficient implementation in the systems of AI with improved algorithms supported by spending on AI

Investor Shift

- Greater AI investment in its software and innovations in its algorithms

- Less emphasis on hardware-embodied AI models

- A growing fascination with innovative approaches to AI architecture that surpass the deep learning benchmark

Conclusion on DeepSeek’s Impact on the Stock Market

DeepSeek has created waves of change in the financial market. It has been doing this in particular concerning the AI/semiconductor market. For example, when DeepSeek unveiled its R1 model of AI, Nvidia stock went down 7% in one day of trading before going up. It pointed to investor uncertainty. By comparison, funding by venture capital to AI startups of the efficiency-driven models increased by 15% in the next quarter—the real shift in investment priorities. However, DeepSeek continues to have an effect on the AI landscape: effects on long-term investment strategy, market composition, and geopolitics are also within the players’ interest. Serious changes lie ahead for the trajectory of AI innovation, hence embedding vigilance in the markets and strategic foresight. All players within the markets, policymakers, and researchers into AI have to buckle up with these developments if they are to keep ahead in the fast-changing technological world.

FAQ: DeepSeek’s Impact on the Stock Market

DeepSeek’s announcement led to immediate stock fluctuations, particularly in semiconductor and tech companies like Nvidia, Microsoft, and Google, as investors reassessed AI-related investments.

Nvidia’s stock initially dropped by 7% due to concerns over reduced GPU demand but later rebounded as the long-term AI hardware demand remained strong.

Investors are shifting focus from hardware-intensive AI models to cost-efficient AI software, impacting capital allocation strategies, venture funding, and AI market valuations.

DeepSeek’s AI efficiency could enhance China’s competitiveness in AI, potentially leading to new trade policies and regulatory scrutiny from the U.S. and other global markets.

Sectors including semiconductors, AI research, cloud computing, and financial services are likely to experience significant shifts due to DeepSeek’s cost-efficient AI models.