eToro vs Interactive Brokers is a question many beginners face when venturing into the world of online trading. Both platforms have carved out a reputation as industry leaders, offering a wealth of investment options, user-friendly platforms, and unique perks. In short, eToro stands out for its social trading features and intuitive interface, making it appealing for novices who want a community-driven experience. Meanwhile, Interactive Brokers offers a robust and sophisticated platform with advanced research tools and low fees, which can also work for beginners but especially appeals to more detail-oriented or active traders. Ultimately, the best choice depends on your specific trading goals, experience level, and the tools you value most.

Looking for the best brokers reviews? You can dive into our detailed eToro review and Interactive Brokers review for more insights.

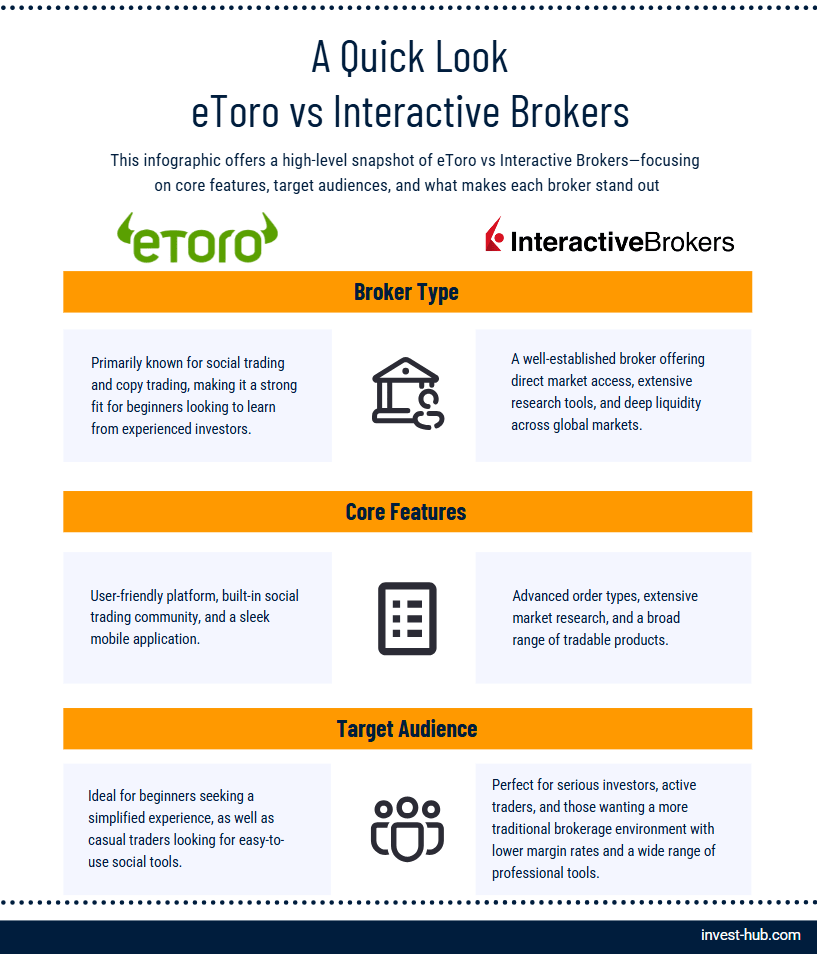

A Quick Look at eToro vs Interactive Brokers

Choosing the right brokerage is crucial for new traders, as it shapes your overall experience, the tools you have access to, and the fees you’ll pay. This section offers a high-level snapshot of eToro vs Interactive Brokers—focusing on core features, target audiences, and what makes each broker stand out. If you’re looking for a swift comparison to guide your initial decision, this is a great place to start.

- Broker Type:

- eToro: Primarily known for social trading and copy trading, making it a strong fit for beginners looking to learn from experienced investors. For the most accurate, up-to-date information on account types and regional availability, visit the official eToro website.

- Interactive Brokers: A well-established broker offering direct market access, extensive research tools, and deep liquidity across global markets. Prospective clients can explore margin calculators and global market listings directly on the Interactive Brokers official site.

- Core Features:

- eToro: User-friendly platform, built-in social trading community, and a sleek mobile application.

- Interactive Brokers: Advanced order types, extensive market research, and a broad range of tradable products.

- Target Audience:

- eToro: Ideal for beginners seeking a simplified experience, as well as casual traders looking for easy-to-use social tools.

- Interactive Brokers: Perfect for serious investors, active traders, and those wanting a more traditional brokerage environment with lower margin rates and a wide range of professional tools.

Key Highlights

- Low Fees: Interactive Brokers is renowned for ultra-low commissions, especially if you’re trading stocks or ETFs in high volumes. eToro, for its part, focuses on zero-commission stock trading in many regions, but may have slightly wider spreads for certain assets.

- Advanced Tools: Interactive Brokers excels with deep analysis tools, while eToro leads in social trading features.

- Special Offerings: Both provide unique offerings: eToro’s CopyTrader system lets you follow and replicate top traders’ portfolios, while Interactive Brokers gives you more advanced order types and global market access.

Who It’s Best For

- eToro: Beginners who value a community-based platform and want to learn from fellow traders.

- Interactive Brokers: Traders who desire a professional-grade platform, global reach, and potentially lower overall trading costs over the long term.

Pros and Cons of eToro vs Interactive Brokers

Breaking down the positives and negatives of each broker helps new traders quickly see where one might outperform the other. This section dives into eToro vs Interactive Brokers from a holistic viewpoint, covering their strengths and weaknesses so you can better match your trading style to the right platform.

| Aspect | eToro | Interactive Brokers |

| Pros | – Intuitive and beginner-friendly interface – Social and copy trading features – Zero-commission stock trading in some regions – Strong crypto offering in select jurisdictions | – Extremely low fees for active traders – Comprehensive research and charting tools – Broad access to global markets – Advanced order types and robust trading platform |

| Cons | – Spreads can be higher, especially for forex – Limited advanced technical analysis tools – Withdrawal fees may apply – Some features depend on region | – Platform can feel complex for novices – Monthly inactivity fees on some account types – Fewer “social” or collaborative trading features – Some advanced tools have a learning curve |

Strengths

- eToro: The social and copy trading features stand out, particularly beneficial for beginners looking to learn by mirroring more experienced investors’ trades.

- Interactive Brokers: Low commissions, extensive research capabilities, and advanced platform functionalities make it a favorite among professional or high-volume traders.

Weaknesses

- eToro: While the platform is user-friendly, it may lack certain in-depth research and charting tools advanced traders require.

- Interactive Brokers: The advanced interface can be daunting. If you’re completely new to trading, you may need extra time or educational resources to master the platform.

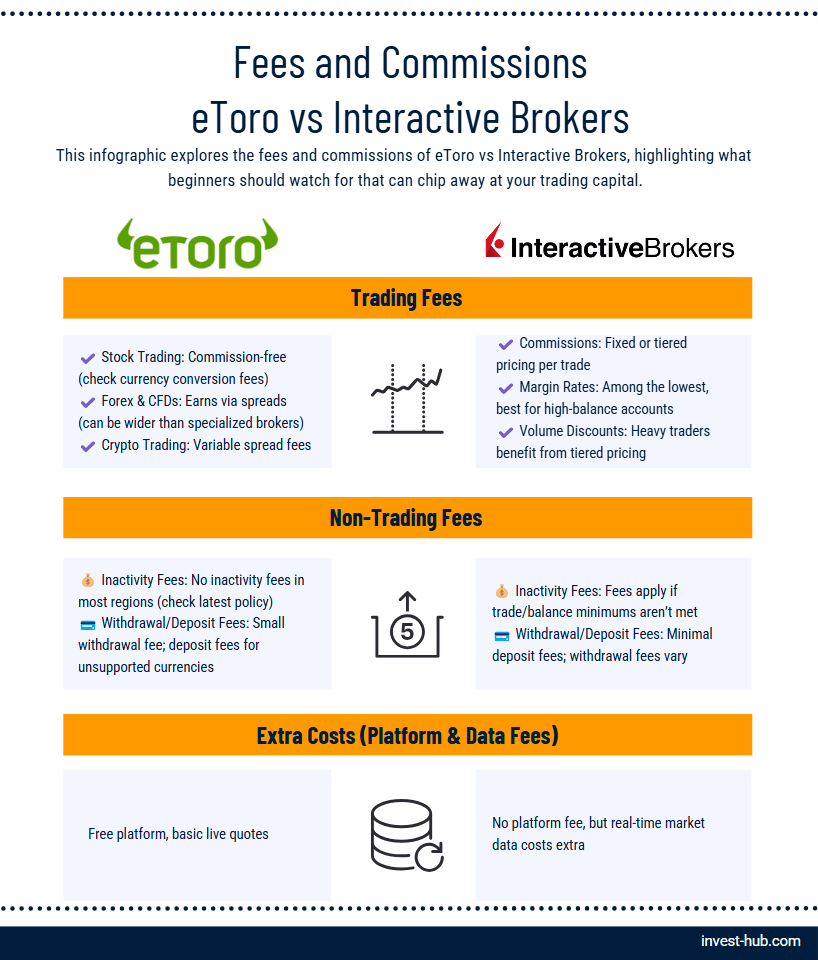

Fees and Commissions of eToro vs Interactive Brokers

Understanding the cost structure is one of the most critical steps when choosing a broker. This section explores the fees and commissions of eToro vs Interactive Brokers, highlighting what beginners should watch for—like spreads, inactivity fees, and other hidden costs that can chip away at your trading capital.

Trading Fees

- eToro:

- Stock Trading: Commission-free in numerous regions, but watch out for currency conversion if funding in a different currency.

- Forex & CFDs: The platform primarily earns through spreads, which might be wider compared to some dedicated forex brokers.

- Crypto Trading: Cryptocurrency spread fees are variable, so always confirm current rates.

- Interactive Brokers:

- Commissions: Offers a tiered or fixed pricing structure. Fixed pricing charges a small fee per trade, while tiered pricing charges per share with additional exchange fees.

- Margin Rates: Among the lowest in the industry, especially for higher-balance accounts.

- Volume Discounts: Heavy traders often benefit significantly from Interactive Brokers’ tiered pricing structure.

Non-Trading Fees

- Inactivity Fees:

- As of recent updates,eToro no longer charges inactivity fees in most regions. However, policies can vary, so it’s best to check the official eToro website for the most current information.

- Interactive Brokers imposes inactivity fees for accounts that do not meet minimum trade or balance requirements (especially in certain plan structures).

- Withdrawal/Deposit Fees:

- eToro typically charges a small withdrawal fee, and deposit fees may apply if you’re using non-supported currencies.

- Interactive Brokers rarely charges deposit fees, but wire transfers and withdrawals might incur costs depending on frequency and location.

Hidden/Extra Charges

- Platform Subscription Costs:

- eToro’s standard platform is free to use.

- Interactive Brokers generally does not charge a separate platform fee, though advanced market data packages can cost extra.

- Data Feed Charges:

- Interactive Brokers charges extra for real-time data from various exchanges.

- eToro usually provides basic live quotes at no additional charge, but does not offer the same depth of market data as Interactive Brokers.

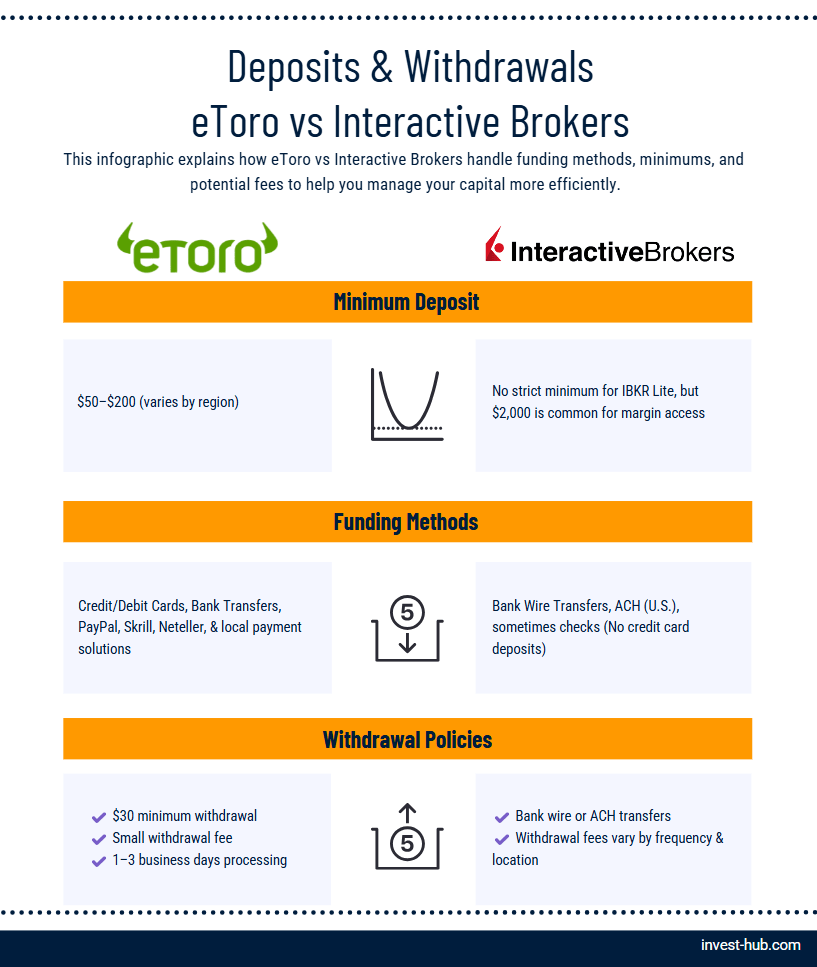

Deposits & Withdrawals with eToro vs Interactive Brokers

For beginners, the deposit and withdrawal process can be a deciding factor—nobody wants a complicated system for moving money in and out of a brokerage account. This section explains how eToro vs. Interactive Brokers handle funding methods, minimums, and potential fees to help you manage your capital more efficiently.

Minimum Deposit

- eToro:

- Typically around $50 to $200 depending on your region. There could be regional differences, so check your local requirements.

- Interactive Brokers:

- No strict minimum deposit for IBKR Lite in many regions, but having at least $2,000 is common if you want to access margin.

Funding Methods

- eToro:

- Credit/Debit Cards, Bank Transfers, and e-wallets like PayPal, Skrill, and Neteller.

- Sometimes local payment solutions (e.g., instant bank transfers) are available.

- Interactive Brokers:

- Primarily bank wire transfers, ACH in the U.S., and sometimes checks.

- Interactive Brokers primarily supports bank wire transfers and ACH, and they generally do not allow credit card deposits.

Withdrawal Policies

- eToro:

- Withdrawals incur a small fee and require a minimum withdrawal amount (often $30).

- Processing times typically range from 1–3 business days.

- Interactive Brokers:

- Generally processes withdrawals via bank wire or ACH.

- Interactive Brokers typically charges for wire transfers and withdrawals based on frequency and location, but the specifics can vary. It’s best to consult their official website for precise details.

Potential Restrictions

- Verification: Both brokers require identity verification before large deposits and withdrawals.

- Region-Specific Limits: Some jurisdictions cap the maximum deposit or withdrawal, especially for credit cards.

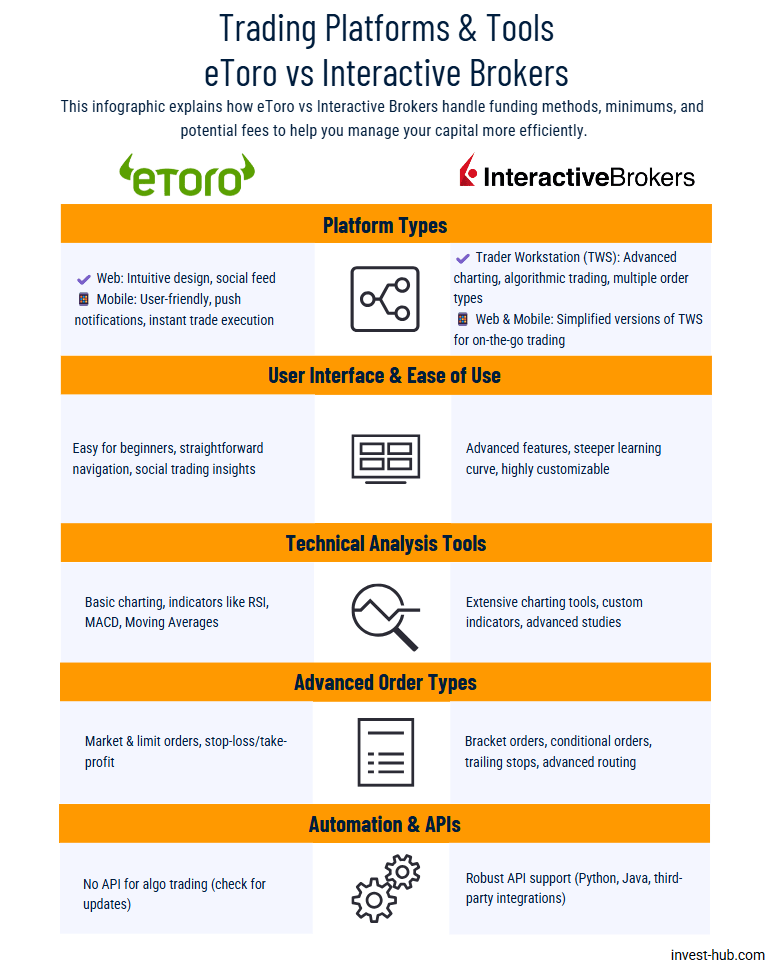

Trading Platforms and Tools in eToro vs Interactive Brokers

A platform’s design and functionality can either speed up your learning curve or hinder it. This section provides a closer look at trading platforms and tools in eToro vs Interactive Brokers, detailing the software, charting capabilities, and special features each platform offers.

Platform Types

- eToro:

- Web Platform: Known for its intuitive design, straightforward navigation, and social feed.

- Mobile App: Offers the same user-friendly experience, plus push notifications and instant trade execution.

- Interactive Brokers:

- Trader Workstation (TWS): A desktop platform with advanced charting, algorithmic trading features, and a wide range of order types.

- Web and Mobile: More streamlined versions of TWS, with user-friendly interfaces suitable for on-the-go trading.

User Interface & Ease of Use

- eToro: Minimal learning curve for novices, straightforward buy/sell buttons, and an interactive social feed featuring other traders’ insights.

- Interactive Brokers: More comprehensive but with a steeper learning curve. Beginners might feel overwhelmed at first but can gradually unlock advanced functionalities.

Technical Analysis Tools

- eToro: Provides basic charting and a decent selection of popular indicators like Moving Averages, RSI, and MACD.

- Interactive Brokers: Includes a vast library of charting tools, drawing functionalities, advanced technical studies, and even built-in coding options for custom indicators.

Advanced Order Types

- eToro:

- Offers market orders, limit orders, and stop-loss/take-profit settings.

- eToro does not offer complex order types like bracket orders or multi-contingent orders, which is accurate. However, it’s worth noting that eToro focuses more on straightforward trading and social features.

- Interactive Brokers:

- Provides bracket orders, conditional orders, trailing stops, and a range of professional-level order routing functionalities.

Automation & APIs

- eToro:

- eToro does not provide APIs for algorithmic trading in the same way Interactive Brokers does. However, it’s essential to check for any updates on eToro’s developer platform or API offerings.

- Interactive Brokers:

- Well-known for its API support, making it suitable for algorithmic traders using Python, Java, or third-party platforms.

Reliability & Speed

- eToro: Typically reliable, though social features may result in slight UI lag during peak hours.

- Interactive Brokers: Highly stable servers designed to handle large volumes, making it a top choice for active or day traders.

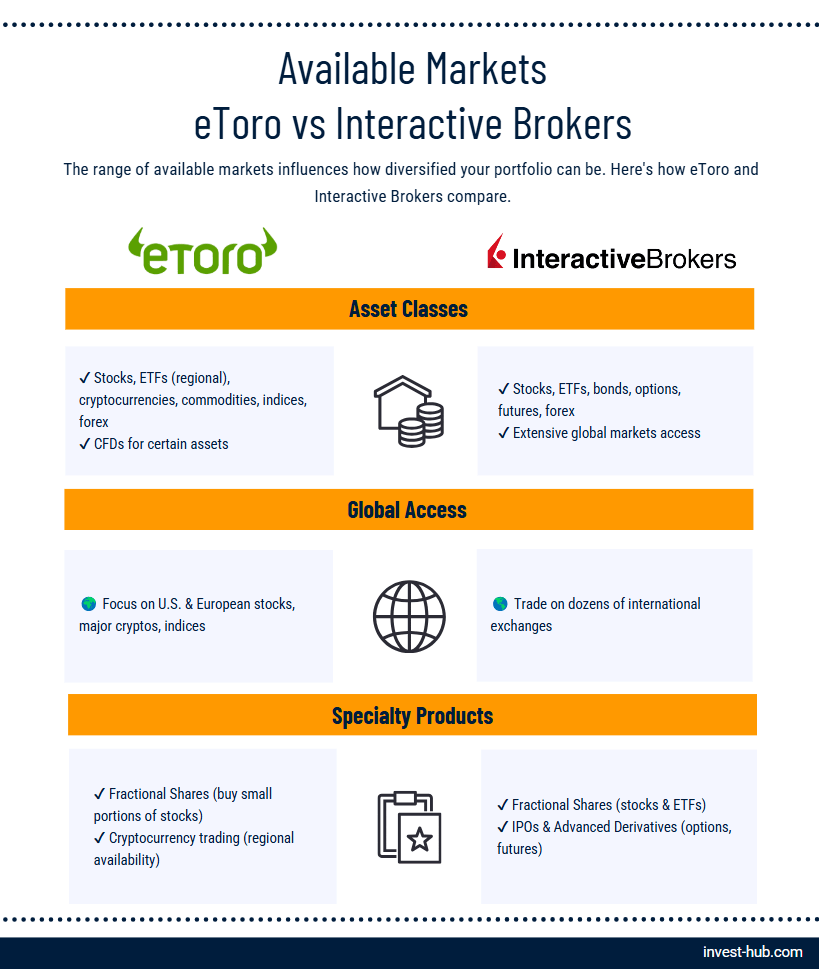

Available Markets on eToro vs Interactive Brokers

The breadth of available markets can determine how diversified your portfolio can be. In this section, we compare eToro vs Interactive Brokers by examining their offerings—stocks, crypto, commodities, bonds, and more—so you’ll know if the broker aligns with your investing goals.

Asset Classes

- eToro:

- Stocks, ETFs (in certain regions), cryptocurrencies, commodities, indices, and forex.

- Not all markets are available in every jurisdiction, and certain products may only be accessible via CFDs.

- Interactive Brokers:

- A vast offering: stocks, ETFs, bonds, options, futures, forex, and more.

- Access to global markets, including North America, Europe, Asia, and Australia.

Global Access

- eToro: Primarily focuses on popular U.S. and European stocks, alongside major cryptocurrencies and indices.

- Interactive Brokers: Renowned for wide-reaching global access, enabling you to trade on dozens of international exchanges from a single account.

Specialty Products

- eToro:

- Fractional Shares: Allows buying small portions of high-priced stocks.

- Cryptocurrencies: Broad coverage of popular digital coins, subject to regional regulations.

- Interactive Brokers:

- Fractional Shares: Also provides fractional shares on selected stocks and ETFs.

- IPOs & Advanced Derivatives: Depending on your account type, you may access IPOs and more complex instruments like options and futures.

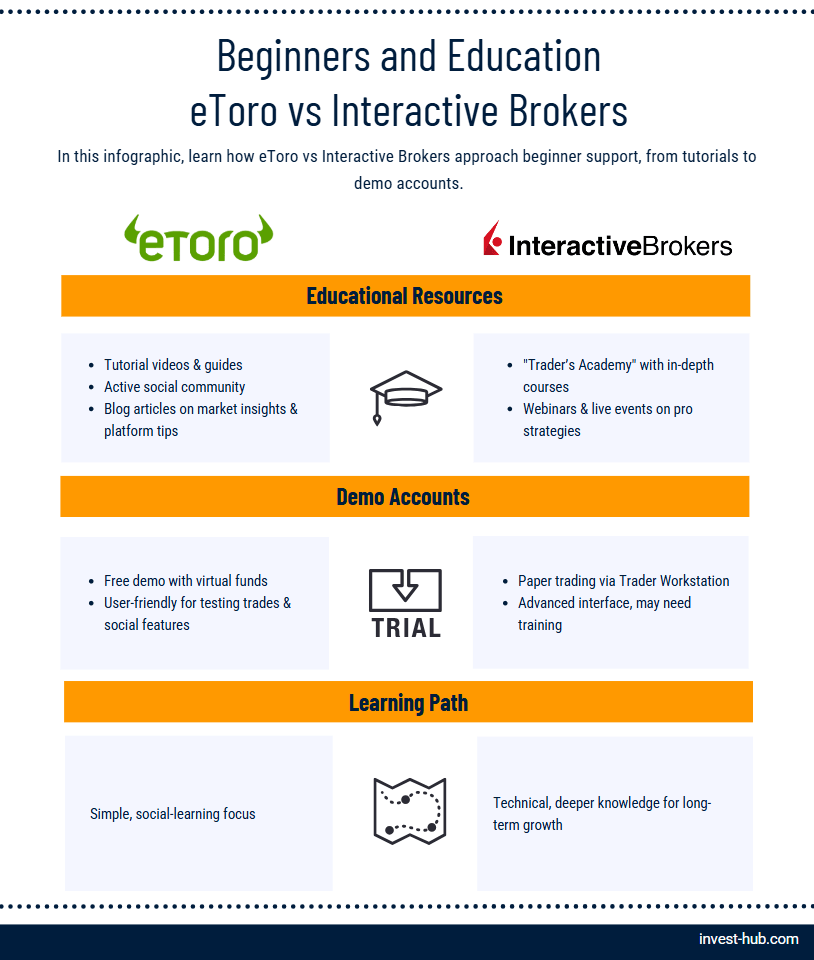

Beginners and Education on eToro vs Interactive Brokers

If you’re just starting out, educational resources can significantly influence how quickly you become comfortable with trading. In this section, learn how eToro vs Interactive Brokers approach beginner support, from tutorials to demo accounts.

Educational Resources

- eToro:

- Tutorial videos, guides, and an active social community that provides commentary on trades.

- Blog articles covering market insights, basic terminology, and platform tips.

- Interactive Brokers:

- “Trader’s Academy” offering in-depth courses on various markets, advanced order types, and platform tutorials.

- Webinars and live events focusing on professional trading strategies.

Demo Accounts

- eToro:

- Offers a free demo account with a virtual balance, perfect for practice.

- Beginners can simulate trades, test strategies, and explore social features without risking real money.

- Interactive Brokers:

- Also provides a paper trading mode, primarily through the Trader Workstation.

- Though powerful, the advanced interface might require some initial training to fully utilize.

Learning Path

- eToro: Straightforward, focusing on user-friendly lessons and social learning through community engagement.

- Interactive Brokers: Comprehensive, though it may feel more technical. Beginners must navigate a larger volume of information, but the depth is beneficial for long-term skill development.

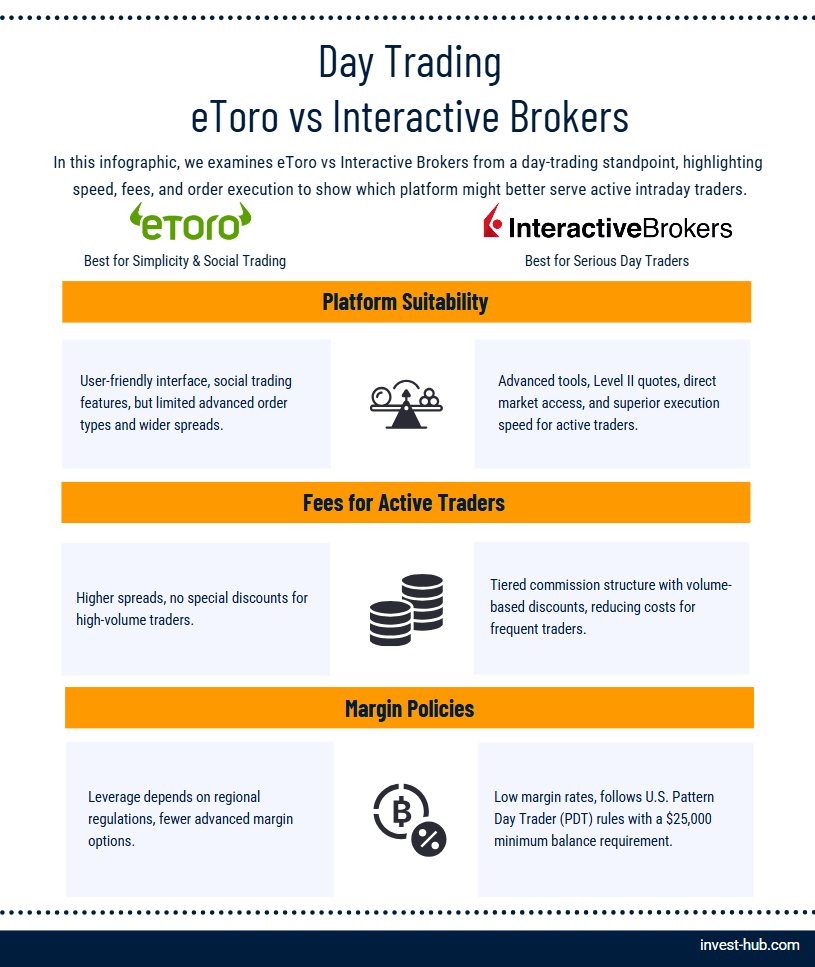

Day Trading with eToro vs Interactive Brokers

Day trading requires quick decisions, real-time data, and cost-effective execution. This section examines eToro vs Interactive Brokers from a day-trading standpoint, highlighting speed, fees, and order execution to show which platform might better serve active intraday traders.

Platform Suitability

- eToro:

- Offers a streamlined interface, but limited advanced order capabilities.

- The social focus can be useful for spotting trends, though spreads might be a concern for rapid intraday trades.

- Interactive Brokers:

- Trader Workstation is lauded for real-time Level II quotes, direct market access (DMA), and fast order execution.

- Suited for active traders who execute multiple daily trades and need advanced charting.

Fees for Active Traders

- eToro:

- Day traders might face higher costs due to spreads.

- No separate fee structure specifically tailored to high-volume day traders.

- Interactive Brokers:

- Offers volume-based discounts and tiered commission structures.

- Day traders can potentially reduce their total fees significantly if they trade large volumes.

Margin Policies

- eToro:

- eToro allows leverage based on regional regulations, with specific limits for stocks and cryptocurrencies that can vary significantly depending on the jurisdiction and client type.

- Fewer customized margin options for advanced day traders.

- Interactive Brokers:

- Known for low margin rates, which is highly beneficial for frequent traders.

- Complies with Pattern Day Trader rules in the U.S. (minimum $25,000 balance if you execute a certain number of day trades in a rolling period).

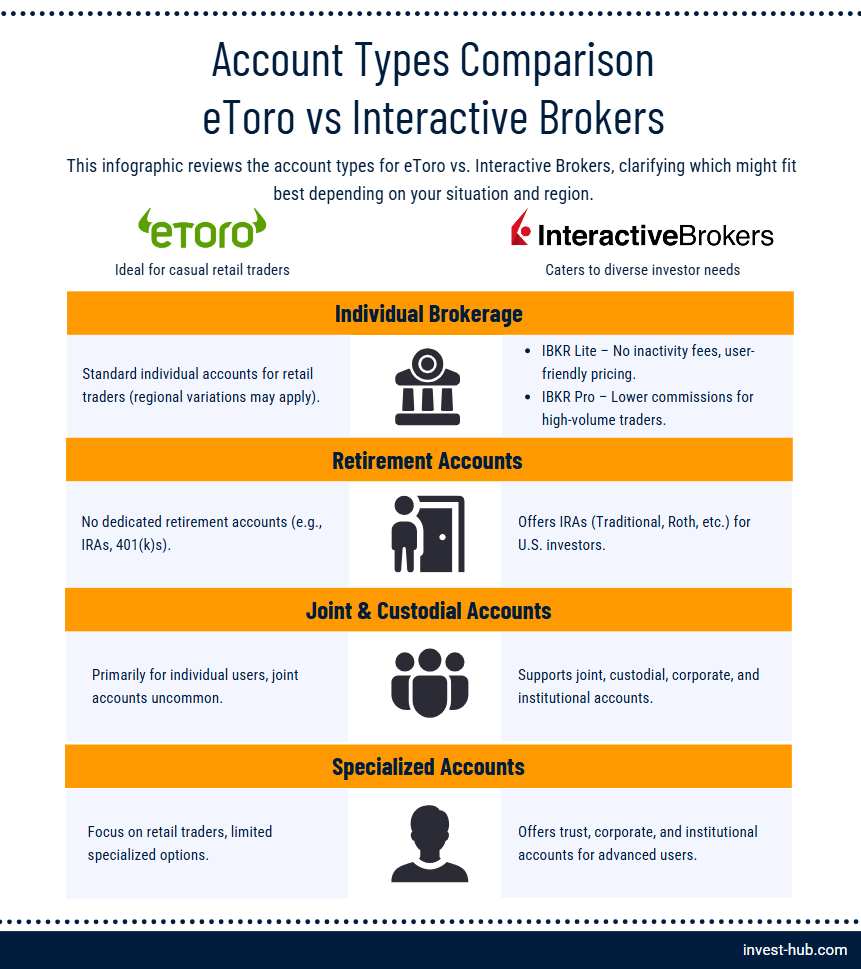

Account Types for eToro vs Interactive Brokers

Different account types cater to different trading needs—whether you’re a casual investor or looking to manage retirement funds. This section reviews the account types for eToro vs. Interactive Brokers, clarifying which might fit best depending on your situation and region.

Individual Brokerage

- eToro:

- The primary option for retail traders is a straightforward individual account.

- Regional variations may exist, but most features are accessible through the main account structure.

- Interactive Brokers:

- IBKR Lite (user-friendly pricing, no inactivity fees) vs. IBKR Pro (lower commissions for high-volume traders).

- Both accounts grant access to global products but differ in fee structure and available research tools.

Retirement Accounts

- eToro:

- Typically does not offer specific retirement-focused accounts like IRAs or 401(k) rollovers.

- Interactive Brokers:

- Supports IRAs, making it appealing to U.S. investors who want tax-advantaged trading.

- Variety includes Traditional IRA, Roth IRA, and more.

Joint or Custodial Accounts

- eToro:

- Largely geared toward individual retail users. Joint accounts are not commonly provided.

- Interactive Brokers:

- Offers joint accounts, custodial accounts for minors, and even corporate or institutional accounts.

Specialized Accounts

- Interactive Brokers also extends to trust accounts and corporate accounts, catering to advanced or institutional-level clients. eToro’s main focus is the retail audience, so specialized account options remain more limited.

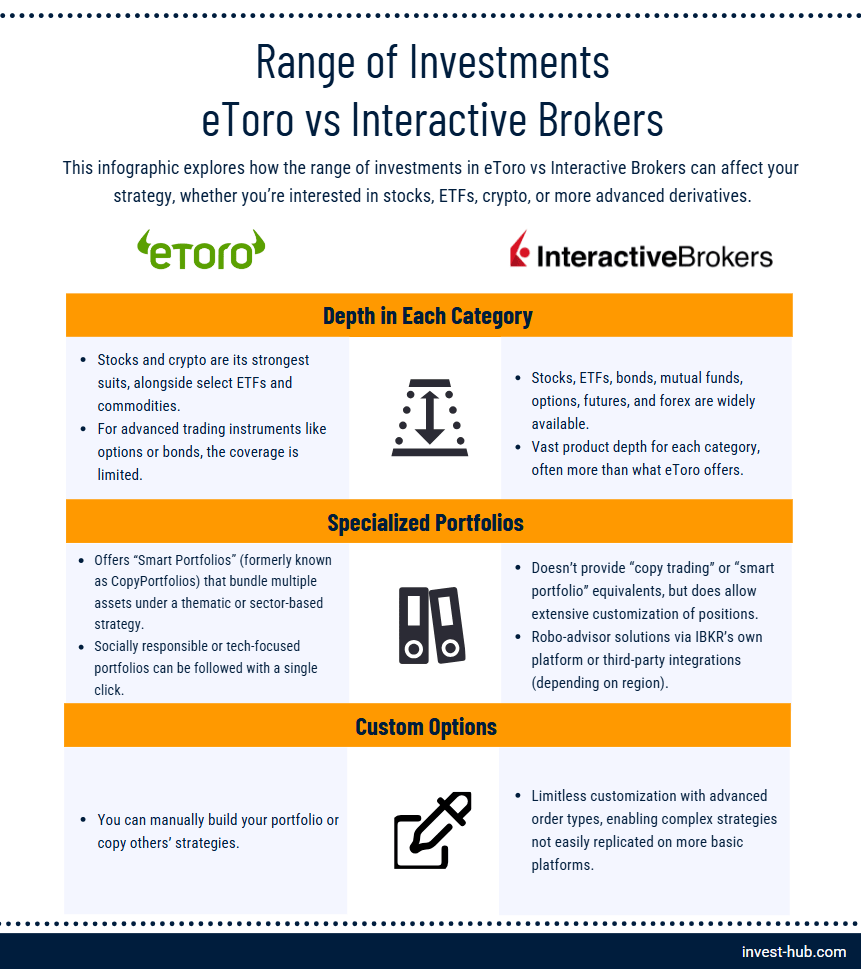

Range of Investments in eToro vs Interactive Brokers

Diversification is key to risk management and long-term growth. This section explores how the range of investments in eToro vs Interactive Brokers can affect your strategy, whether you’re interested in stocks, ETFs, crypto, or more advanced derivatives.

Depth in Each Category

- eToro:

- Stocks and crypto are its strongest suits, alongside select ETFs and commodities.

- For advanced trading instruments like options or bonds, the coverage is limited.

- Interactive Brokers:

- Stocks, ETFs, bonds, mutual funds, options, futures, and forex are widely available.

- Vast product depth for each category, often more than what eToro offers.

Specialized Portfolios

- eToro:

- Offers “Smart Portfolios” (formerly known as CopyPortfolios) that bundle multiple assets under a thematic or sector-based strategy.

- Socially responsible or tech-focused portfolios can be followed with a single click.

- Interactive Brokers:

- Doesn’t provide “copy trading” or “smart portfolio” equivalents, but does allow extensive customization of positions.

- Robo-advisor solutions via IBKR’s own platform or third-party integrations (depending on region).

Custom Options

- eToro:

- You can manually build your portfolio or copy others’ strategies.

- Interactive Brokers:

- Limitless customization with advanced order types, enabling complex strategies not easily replicated on more basic platforms.

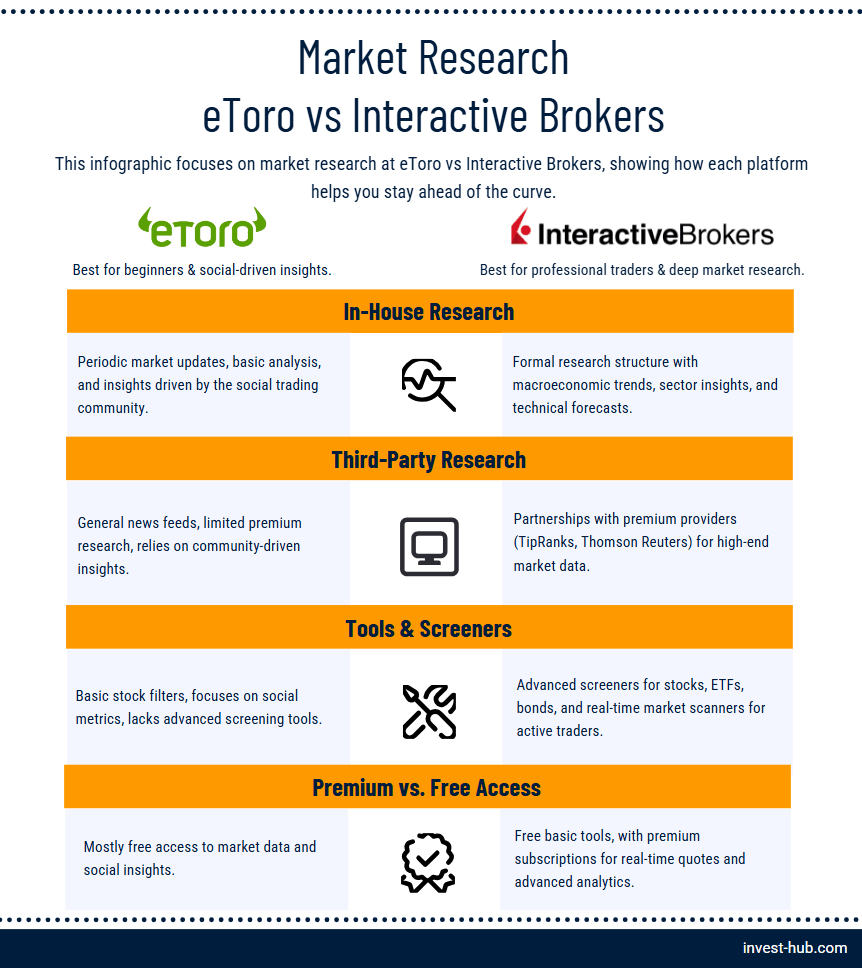

Market Research at eToro vs Interactive Brokers

Good market research tools can be a game-changer, especially for beginners who rely on accurate insights to make informed decisions. This section focuses on market research at eToro vs Interactive Brokers, showing how each platform helps you stay ahead of the curve.

In-House Research

- eToro:

- Produces periodic market updates and some basic analysis.

- The real “research” often comes through its social feed, where traders share opinions and insights.

- Interactive Brokers:

- Has a more formal structure, offering a wide array of daily briefs, commentary, and professional-level analysis.

- Their in-house research may delve into macroeconomic trends, sectoral insights, and technical forecasts.

Third-Party Research Providers

- eToro:

- Integrates general news feeds, but not typically high-end analysis from providers like Morningstar or Thomson Reuters.

- Relies more on community-generated content.

- Interactive Brokers:

- Collaborates with numerous third-party providers for data, news, and specialized research (e.g., TipRanks, Thomson Reuters).

- Some premium subscriptions may come at an extra cost.

Tools & Screeners

- eToro:

- Basic filters for finding popular stocks or top-performing traders.

- Limited advanced screening criteria beyond the social aspect.

- Interactive Brokers:

- Sophisticated screeners for stocks, ETFs, and bonds with numerous filters (fundamentals, technicals, and more).

- Real-time market scanners to spot unusual volume or volatility, favored by active traders.

Premium vs. Free

- eToro:

- Mostly free access to its social feed and standard market data.

- Interactive Brokers:

- Basic research tools are free, but premium data packages can include real-time quotes from multiple global exchanges and advanced analytics.

Banking Features of eToro vs Interactive Brokers

Some traders look for more than just a place to buy and sell stocks; they want integrated financial services. This section covers banking features of eToro vs Interactive Brokers, focusing on whether they offer cash management, debit cards, and other all-in-one solutions.

Integrated Bank Accounts

- eToro:

- Does not function as a traditional bank. Funds are held in brokerage accounts and cannot be used like a checking account.

- Interactive Brokers:

- Offers “IBKR Debit Card” in some regions, acting as a cash management feature.

- Allows you to spend or withdraw directly from your brokerage balance, subject to your local availability.

Debit/Credit Cards

- eToro:

- Primarily supports deposits via credit/debit cards, but does not offer a broker-issued card.

- Interactive Brokers:

- May offer an optional debit card, enabling you to use your account funds for purchases or ATM withdrawals.

Seamless Transfers

- eToro:

- Quick transfers between your trading account and e-wallet, but not designed for routine banking tasks like bill payments.

- Interactive Brokers:

- Emphasizes streamlined internal transfers for margin and trading, but also integrates with external bank accounts for easy deposits and withdrawals.

Regulation and Safety: eToro vs Interactive Brokers

Safety is a top concern for beginners who want to protect their initial investments. This section highlights regulation and safety in eToro vs Interactive Brokers, reviewing key regulatory bodies, investor protection measures, and compliance histories.

Regulatory Bodies

- eToro:

- Regulated by authorities such as the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC) in the EU, the Australian Securities and Investments Commission (ASIC), and others depending on user location.

- Interactive Brokers:

- Overseen by top-tier regulators including the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and equivalent bodies in multiple international jurisdictions.

Investor Protection

- eToro:

- Clients in the UK, EU, or Australia typically have compensation coverage up to a certain limit if the broker becomes insolvent.

- Funds are usually held in segregated accounts.

- Interactive Brokers:

- Offers SIPC coverage for U.S. clients, protecting up to $500,000 (including $250,000 for cash claims).

- Also segregates client funds as per regulatory requirements in various regions.

Compliance History

- Both platforms generally maintain a strong compliance track record. Minor regulatory fines or settlements are possible for large brokers operating worldwide, but there are no major red flags for either.

Customer Support at eToro vs Interactive Brokers

When you’re new to trading, questions can arise at any time, so reliable customer support is vital. This section compares customer support at eToro vs Interactive Brokers, noting their methods of contact, availability, and responsiveness.

Support Channels

- eToro:

- Live chat, email support, and an extensive online help center.

- No direct phone number in many regions, so chat is often the fastest route.

- Interactive Brokers:

- Offers phone support, live chat, and a detailed FAQ knowledge base.

- Email support is also available, and response times can vary based on query complexity.

Availability

- eToro:

- Typically covers weekdays with extended hours, though 24/7 chat is not always guaranteed.

- Interactive Brokers:

- Provides customer support during market hours, with some regions offering nearly round-the-clock assistance on weekdays.

Quality & Responsiveness

- eToro:

- Generally helpful for basic and platform-related questions.

- Advanced queries (e.g., complex technical issues) may take more time to resolve.

- Interactive Brokers:

- Staffed by more specialized representatives for advanced trading questions.

- Wait times may be longer during peak hours.

Conclusion on eToro vs Interactive Brokers

Wrapping up this extensive comparison, it’s clear that eToro vs Interactive Brokers each have distinct strengths that cater to different types of beginners. This section summarizes the highlights, potential drawbacks, and overall recommendations for first-time investors or those simply exploring new platforms.

When it comes to eToro vs Interactive Brokers, both brokers offer compelling features and strong regulation, but they cater to different segments of the beginner community:

- eToro excels at introducing newcomers to the world of trading through social features, an intuitive platform, and a robust crypto offering in certain regions. Its CopyTrader function can be a game-changer for those looking to learn hands-on from seasoned investors.

- Interactive Brokers stands out for its professional-grade trading tools, extensive global market coverage, and extremely competitive fee structures, especially for active traders willing to master its advanced interface.

Potential Drawbacks

- eToro’s higher spreads and fewer advanced customization options can frustrate those seeking professional-level trading features.

- Interactive Brokers, while cost-efficient for high-volume traders, has a steeper learning curve and inactivity fees in some account plans.

Ultimately, beginners looking for a social learning environment may lean toward eToro, whereas detail-oriented novices or those planning to become more active might find Interactive Brokers worth the extra effort. By aligning your choice with your goals—be it simplicity, social trading, or a comprehensive professional environment—you’ll ensure a smoother entry into the world of investing.

FAQ

Both have straightforward online account opening processes. You’ll need to provide identification (passport or driver’s license), proof of address, and answers to basic financial questions. Once verified, you can fund your account via bank transfer or other supported methods.

Yes. Both are regulated by top-tier financial authorities. eToro is governed by entities like the FCA, ASIC, and CySEC, while Interactive Brokers is overseen by the SEC, FINRA, and various global regulators. Client funds are also typically kept in segregated accounts.

Be mindful of spreads (especially on forex or crypto), inactivity fees if you don’t trade often, and withdrawal fees. Interactive Brokers has low commissions but may charge inactivity fees. eToro offers commission-free stock trading in many regions but charges withdrawal fees and potentially wider spreads.

Yes, both eToro and Interactive Brokers provide mobile apps. eToro’s is generally more user-friendly with a social feed, while Interactive Brokers offers a feature-rich app aligning with its advanced desktop platform.

Absolutely. eToro allows day trading across various markets but mainly relies on spreads for revenue, which can be more expensive for frequent traders. Interactive Brokers is favored by professional day traders due to its advanced order types, real-time Level II data, and volume-based commission discounts.

For U.S.-based customers, yes. Interactive Brokers enforces the Pattern Day Trader rule, requiring at least $25,000 in equity to maintain frequent day trading activities. eToro, being more oriented toward CFDs and non-U.S. entities, may apply leverage restrictions or other compliance measures depending on your region.