Introduction to Forex Market Timings

The forex market timings are crucial for traders looking to maximize their profits and manage risk. As one of the largest and most liquid financial markets, the forex market operates almost continuously across different time zones, making it accessible to traders worldwide. Knowing when currency pairs are most active, how global sessions overlap, and the significance of various time zones can help traders plan their strategies more effectively.

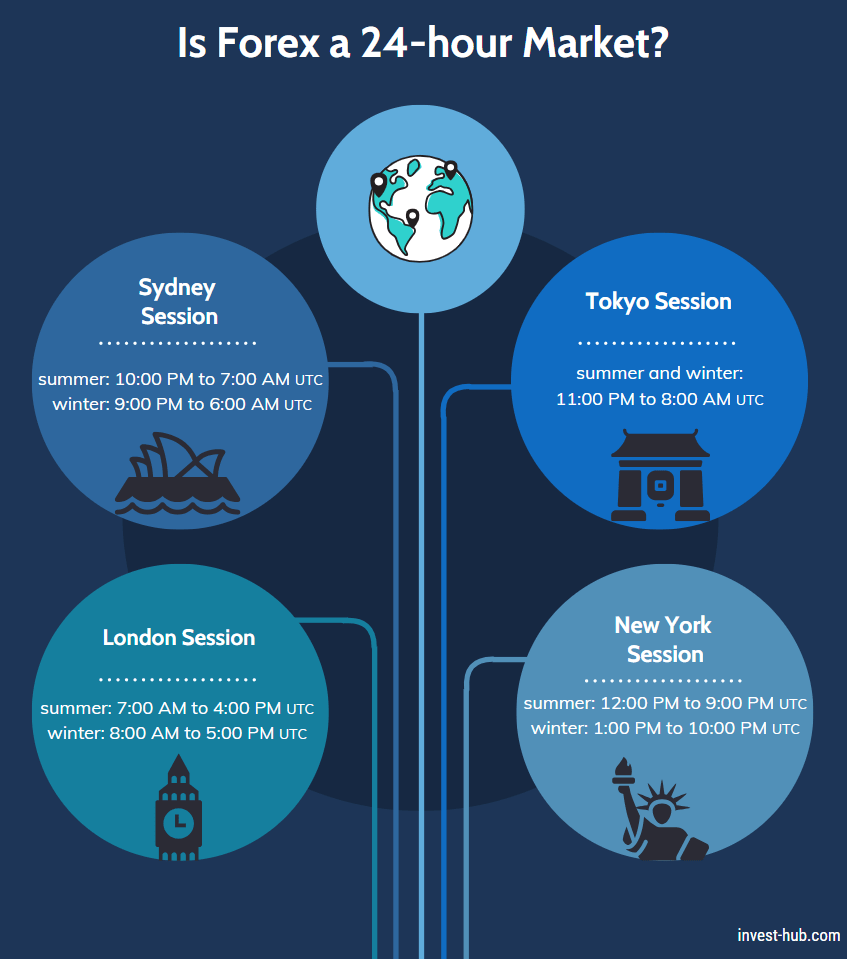

Answer: The forex market operates 24/5, starting Monday morning in Asia and closing Friday evening in New York. Key trading sessions include:

- Sydney: 10 PM – 7 AM UTC

- Tokyo: 11 PM – 8 AM UTC

- London: 7 AM – 4 PM UTC

- New York: 12 PM – 9 PM UTC

Best Times to Trade: Overlaps like London-New York (1 PM – 4 PM UTC) offer the highest liquidity and volatility

What Are Forex Market Timings?

The forex market timings refer to the specific hours during which currency trading occurs around the world. The foreign exchange market is open 24 hours a day, 5 days a week (Monday to Friday). This continuous trading window exists because forex transactions take place across major financial centers in different time zones. While this near-constant market is advantageous, there are still specific periods when trading volumes and volatility are higher, presenting optimal conditions for trades. The Forex Market Hours tool shows liquidity peaks whenever London and New York sessions overlap.

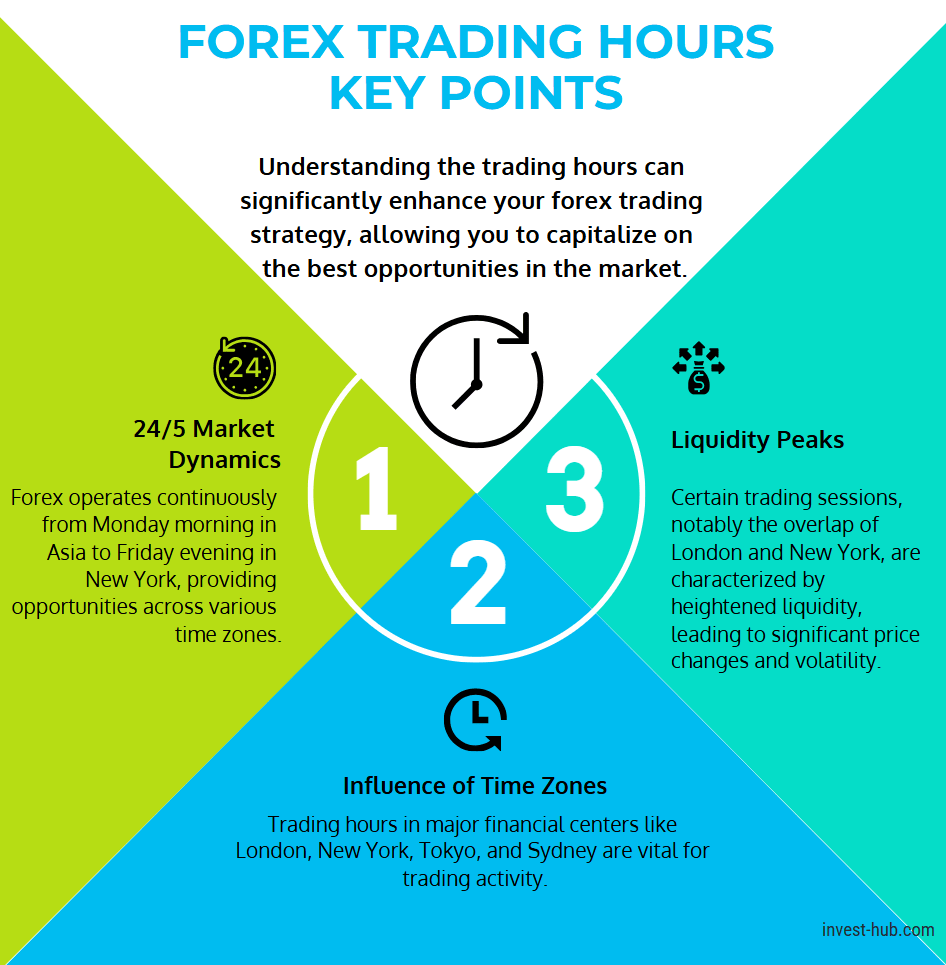

Key Points About Forex Trading Hours

- 24/5 Market: The market typically starts on Monday morning in the Asia-Pacific region and closes on Friday evening in New York.

- Time Zones: Major trading hubs (London, New York, Tokyo, Sydney) influence currency trading hours.

- High Liquidity: Certain overlaps, such as the London-New York session, attract the most liquidity and price movements.

Is Forex a 24-Hour Market?

Yes, forex is a 24-hour market, but it’s important to note that “24 hours” doesn’t mean equal trading opportunities at all times. Understanding the ebb and flow of market activity can help you gauge when to trade specific currency pairs. Here’s a rough breakdown of how the market transitions across global trading sessions:

- Sydney Open (Australia): Kicks off the week’s trading on Monday morning local time (Sunday evening in many Western countries).

- Tokyo Open (Asia): Begins shortly after Sydney; Japan is one of the largest forex centers, so activity picks up substantially.

- London Open (Europe): Overlaps with Tokyo; London is considered the world’s primary forex hub.

- New York Open (North America): Overlaps with London, creating the most liquid time of day, especially for USD currency pairs.

During these overlapping sessions, market liquidity and volatility often increase, offering traders better chances for profit.

What Time Is the Forex Market Open?

When traders ask, “What time is the forex market open?” they often want to pinpoint the exact moment each major session starts. Though the forex market technically opens at 5:00 p.m. EST on Sunday (when the Sydney session begins) and runs continuously until 5:00 p.m. EST on Friday (when the New York session closes), local times differ:

What Are the Four Sessions of Forex Time?

| Major Financial Center | Local Opening Time (Approx.) | Local Closing Time (Approx.) |

| Sydney (Australia) | 7:00 AM AEST | 4:00 PM AEST |

| Tokyo (Japan) | 9:00 AM JST | 6:00 PM JST |

| London (UK) | 8:00 AM GMT/BST | 5:00 PM GMT/BST |

| New York (USA) | 8:00 AM EST/EDT | 5:00 PM EST/EDT |

- Sydney Session (Pacific Session)

- Hours: Approximately 10:00 PM GMT to 7:00 AM GMT (5:00 PM EST to 2:00 AM EST)

- Currency Focus: AUD, NZD currency pairs

- Market Characteristics: Generally lower volatility, good for beginners or those who prefer a more stable market.

- Tokyo Session (Asian Session)

- Hours: Approximately 12:00 AM GMT to 9:00 AM GMT (7:00 PM EST to 4:00 AM EST)

- Currency Focus: JPY, AUD, NZD

- Market Characteristics: Moderate activity; news from Asia can affect price movements of major currency pairs related to the Japanese yen.

- London Session (European Session)

- Hours: Approximately 8:00 AM GMT to 5:00 PM GMT (3:00 AM EST to 12:00 PM EST)

- Currency Focus: GBP, EUR

- Market Characteristics: Known for high liquidity and volatility; major economic announcements from Europe can drastically move the market.

- New York Session (North American Session)

- Hours: Approximately 1:00 PM GMT to 10:00 PM GMT (8:00 AM EST to 5:00 PM EST)

- Currency Focus: USD, CAD, and cross-pairs with USD

- Market Characteristics: Overlaps with London for a few hours, offering the most active trading window of the day; U.S. economic data releases heavily influence currency prices.

BlinkX’s guide to forex market timing notes that daylight-saving shifts can push session start times forward or back by an hour.

“Note that these times are approximate and may shift by an hour due to daylight saving time changes in various countries.”

These times can vary slightly depending on Daylight Saving Time (DST) changes. For example, when it’s daylight saving in the U.S. or the UK, the opening and closing times shift by an hour.

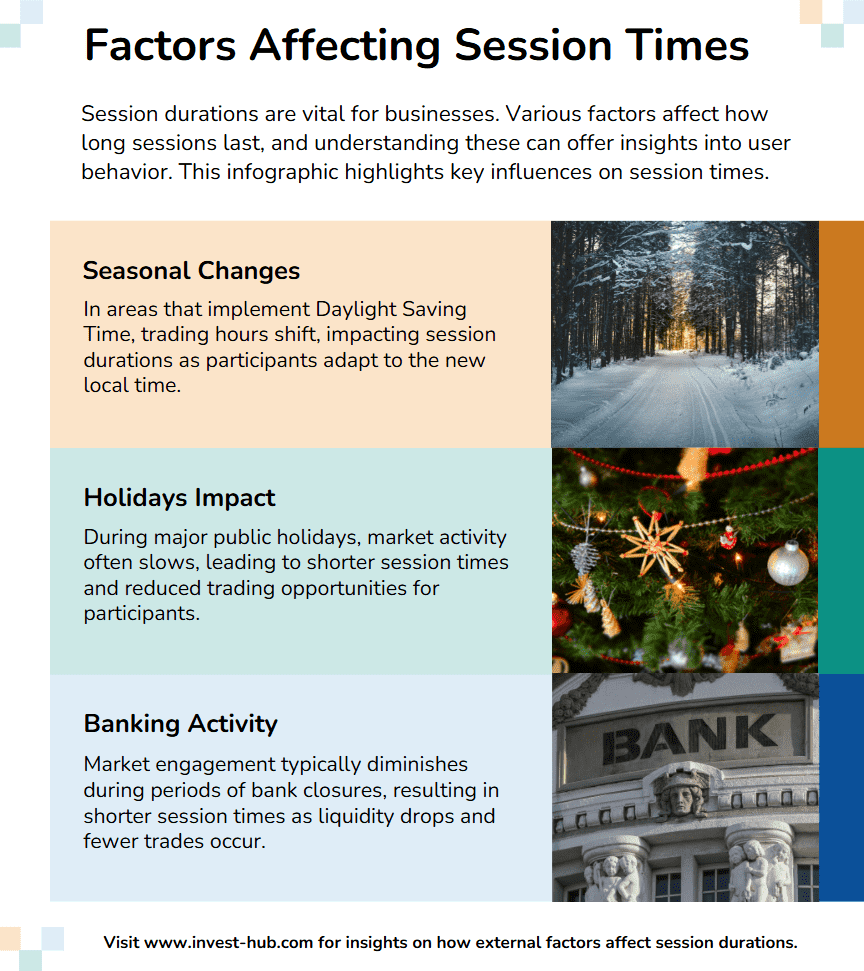

Factors Affecting Session Times

- Seasonal Time Changes: In regions that observe DST, market hours adjust to reflect local time shifts.

- Public Holidays: The market can see lower liquidity and less volatility during significant holidays like Christmas or major national festivities.

- Bank closures: Market activity frequently decreases when well-known banks close.

Forex Market Opening Time in the World

Although many refer to the forex market as having a single forex market opening time in the world, it’s more accurate to describe it as multiple openings that follow the sun. The “main” opening for the global market can be considered the start of the Sydney session, which corresponds to 5:00 p.m. EST on Sunday in the United States. From there, trading continues nonstop, shifting to Tokyo, then to London, and finally to New York, before closing on Friday at 5:00 p.m. EST.

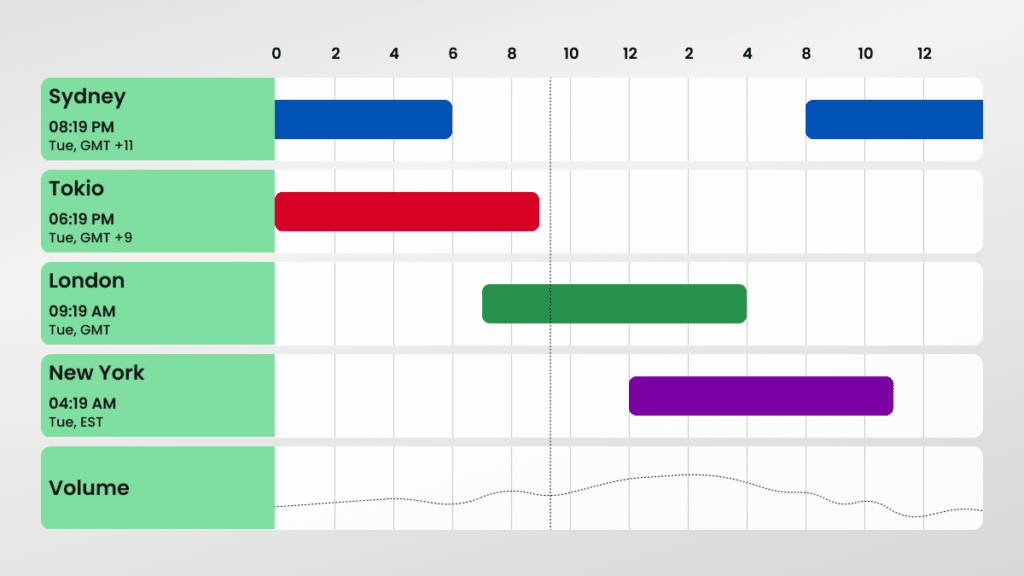

Global Session Overlaps

The reason forex is seen as a 24-hour market is due to overlapping sessions. For instance:

- Sydney-Tokyo Overlap: Offers moderate liquidity, primarily influenced by AUD, JPY, and nearby currency pairs.

- Tokyo-London Overlap: Marked by increased activity. As Tokyo is winding down, London is ramping up.

- London-New York Overlap: This is the most significant overlap in terms of volatility and liquidity, driven heavily by USD, EUR, and GBP.

Bajaj Finserv’s summary of forex market hours highlights that the early Sydney–Tokyo overlap often sets the week’s initial volatility tone.

Understanding these overlaps is pivotal for traders seeking to trade during periods of higher volatility and liquidity.

Forex Market Timings India

For traders in India, understanding the forex market timings is crucial for planning trades effectively. The Reserve Bank of India (RBI) has specific regulations concerning currency trading within the country, and there are two aspects to consider:

- Overseas Forex Market Hours (for Indian Traders)

- The global forex market runs from Monday to Friday.

- • In Indian Standard Time (IST), the market opens on Monday at around 2:30 a.m. IST (the Sydney session) and closes on Saturday at approximately 2:30 a.m. IST (the New York session closes on Friday).

- • Indian exchanges for currency trading.

- In India, currency futures and options are traded on local stock exchanges like the NSE, BSE, and MCX-SX.

- The typical operating hours for currency derivatives are 9:00 AM IST to 5:00 PM IST for most currency pairs involving INR, with extended hours until 7:30 PM IST for certain cross-currency pairs. Most currency pairs involving INR, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR, operate from Monday to Friday.

- Cross-currency pairs (like EUR/USD, GBP/USD, etc.) can often be traded until 7:30 PM IST, but regulations can vary.

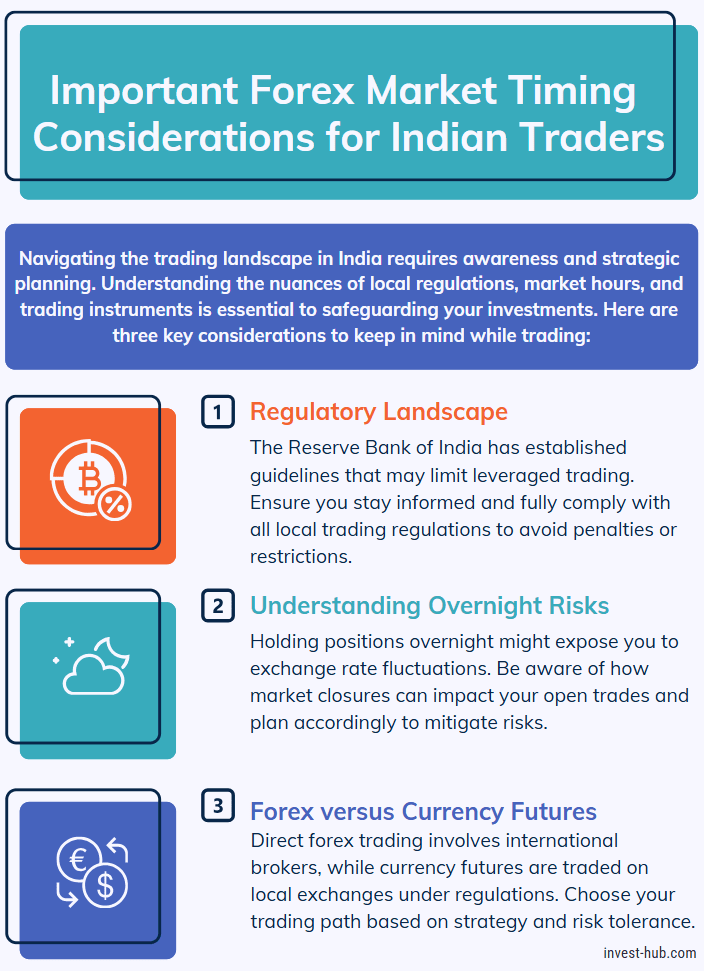

Important Considerations for Indian Traders

- Regulatory Environment: RBI guidelines restrict leveraged trading in some cases. Always ensure compliance with local rules.

- Overnight Risk: If you hold open positions past local trading hours, you might face exchange rate fluctuations when the domestic market is closed.

- Forex vs. Currency Futures: Trading directly in the forex market might involve an international broker, whereas currency futures trading happens through Indian exchanges with regulated brokers.

What is the 5-3-1 rule in Forex?

When researching what the 5-3-1 rule in forex is, you’ll often come across variations of trading guidelines aimed at discipline and consistency. One common interpretation of the “5-3-1” rule is:

- Focus on Up to 5 Currency Pairs: Rather than spreading your attention too thin across numerous pairs, concentrate on a handful that you understand well, typically the majors (e.g., EUR/USD, GBP/USD, USD/JPY).

- Use 3 Strategies: Develop or adopt three reliable trading strategies that you can apply consistently. These strategies might involve technical indicators, chart patterns, or fundamental analysis.

- Trade at 1 Specific Time: Choose a consistent trading session or time of day that aligns with your schedule and suits your strategies. This consistency helps you master the behavior of the market during that period.

Adhering to this rule can foster discipline, reduce overtrading, and help new traders develop mastery over specific currency pairs and times.

How Forex Market Timings Affect Liquidity and Volatility

One of the most critical aspects of forex market timings is their direct impact on liquidity and volatility:

- Liquidity: Refers to how easily a currency pair can be bought or sold without affecting its exchange rate. During major session overlaps (e.g., London-New York), liquidity is at its highest.

- Volatility: Indicates the rate at which the price of a currency pair increases or decreases. Volatility often spikes during economic data releases, especially within active sessions.

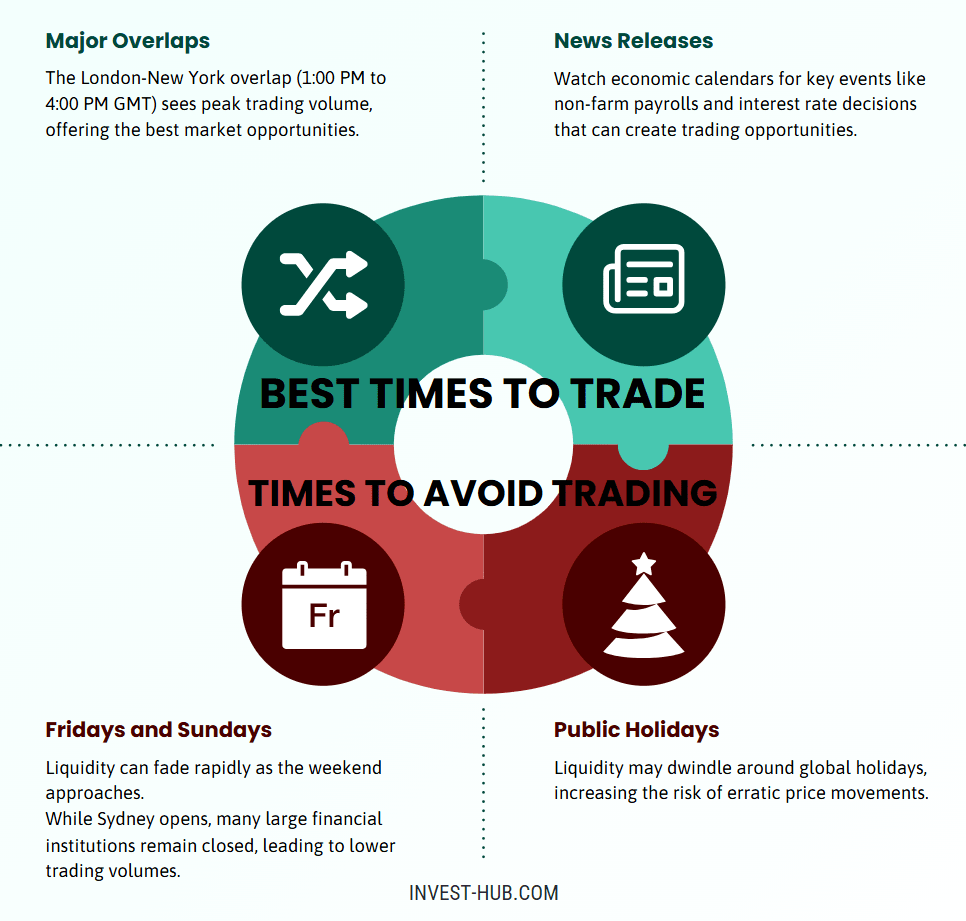

Best Times to Trade

- Major Overlaps: London-New York overlap (around 1:00 PM GMT to 4:00 PM GMT) typically yields the highest volume.

- News Releases: Economic calendars highlight events (e.g., non-farm payrolls, CPI, interest rate decisions) that can cause sharp moves.

Times to Avoid

- Fridays: Liquidity can fade rapidly as the weekend approaches.

- Sundays: While Sydney opens, many large financial institutions remain closed, leading to lower trading volumes.

- Public Holidays: Liquidity may dwindle around global holidays, increasing the risk of erratic price movements.

Strategies for Different Forex Sessions

Because sessions differ in liquidity and volatility, a trader’s approach may vary:

- Asian Session Strategy

- Ideal Pairs: USD/JPY, AUD/USD

- Approach: Range trading strategies often work well due to lower volatility.

- European Session Strategy

- Ideal Pairs: EUR/USD, GBP/USD

- Approach: Look for breakouts as volatility increases. Economic news from the Eurozone or the UK often moves these pairs significantly.

- London-New York Overlap Strategy

- Ideal Pairs: All major pairs, with a focus on USD crosses

- Approach: Momentum and breakout strategies can yield good results due to high volatility.

- Late New York Session Strategy

- Ideal Pairs: USD, CAD, cross-pairs

- Approach: Volatility gradually decreases; scalping or short-term trades can be considered if market conditions support it.

Conclusion

In summary, forex market timings play a pivotal role in determining trading opportunities. While the forex market is open 24 hours a day for five days a week, not all hours carry the same weight in terms of liquidity and volatility. Understanding the four major sessions—Sydney, Tokyo, London, and New York—along with their overlaps, can help you pinpoint the most optimal times to trade. Whether you are based in India or elsewhere, planning your trades around these key windows can significantly influence your success. Always remember to align your strategy with the right session, stay updated on economic news, and use disciplined methods like the 5-3-1 rule to maintain consistency in your trading journey.

FAQs

The forex market technically opens at 5:00 p.m. EST on Sunday (Sydney session) and runs until 5:00 p.m. EST on Friday (New York session). Different financial centers around the world open and close at varied local times, creating a 24-hour trading cycle.

The 5-3-1 rule encourages traders to focus on five currency pairs, use three trading strategies, and trade at one specific time or session. This approach helps maintain discipline and consistency.

The four major sessions include Sydney (Pacific), Tokyo (Asian), London (European), and New York (North American). Each session has its own characteristics regarding liquidity and volatility.

Yes, forex is considered a 24-hour market from Monday to Friday, but trading activity and liquidity vary across different sessions and time zones.

During this overlap, there’s a significant increase in market liquidity and volatility, making it one of the best times to trade, especially for major currency pairs involving the USD, EUR, and GBP.

For Indian traders, the global forex market starts around Monday at 2:30 AM IST and closes around Saturday at 2:30 AM IST. However, local exchanges usually allow currency derivative trading (USD/INR, EUR/INR, GBP/INR, JPY/INR) between 9:00 AM IST and 5:00 PM IST, with some cross-currency pairs trading until 7:30 PM IST.