Introduction to How to Use AI for Trading

Artificial Intelligence (AI) is revolutionizing the world of trading. By automating decision-making, analyzing vast datasets, and identifying market opportunities in real time, AI enhances efficiency and profitability while reducing human errors. AI is no longer an emerging technology; it has become an essential tool in stock trading, cryptocurrency, and forex markets.

Learn how to use AI for trading by analyzing data, automating decisions, managing risks, optimizing portfolios, and predicting trends effectively.

This guide explores how traders can leverage AI to optimize their trading strategies. We will discuss the best AI tools available, AI’s role in different trading approaches, and the potential risks associated with AI-driven trading models. Additionally, we will examine the evolution of AI trading strategies and provide insights into the future of AI in financial markets.

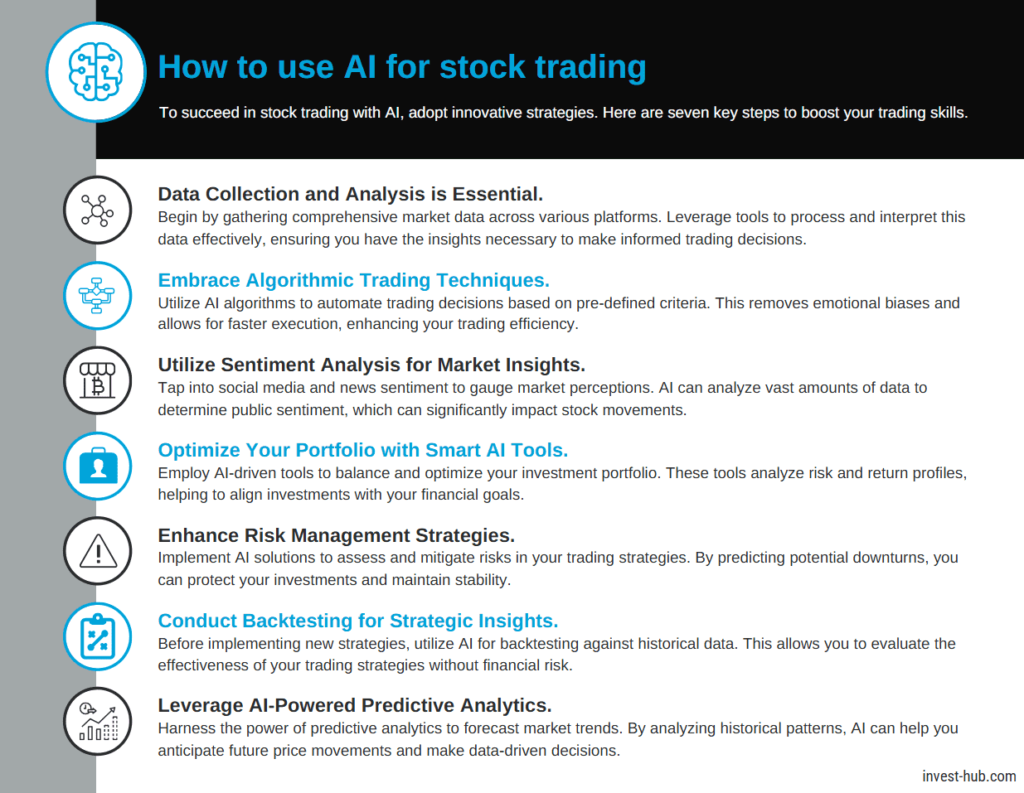

How to use AI for stock trading

According to nasdaq, AI-powered trading employs machine learning, big data, and algorithmic strategies to make intelligent market predictions. AI provides traders with systematic, data-driven methods for analyzing trends and executing trades effectively. For example, AI-driven models accurately predicted market movements during the COVID-19 pandemic by analyzing real-time news sentiment and economic indicators, enabling traders to make proactive decisions.

1. Data collection and analysis.

AI algorithms analyze historical stock prices, company financials, and macroeconomic indicators to identify patterns and trends. AI systems can process large amounts of data at high speeds, providing traders with real-time insights. Advanced AI models also integrate alternative data sources such as satellite imagery, social media sentiment, and credit card transactions to enhance predictive accuracy.

2. Algorithmic Trading

Automated trading bots execute trades based on predefined conditions, reducing emotional biases and improving execution speed. These bots use complex mathematical models and historical data to make real-time trading decisions that maximize profits and minimize risks. AI-powered algorithmic trading continuously optimizes its parameters using reinforcement learning techniques to adapt to changing market conditions.

3. Sentiment Analysis

AI processes news articles, social media discussions, and earnings reports to gauge market sentiment and predict stock movements. Natural language processing (NLP) models analyze real-time financial reports and regulatory filings, providing traders with an additional edge in decision-making.

4. Portfolio Optimization

AI-driven portfolio management tools balance risk and return by analyzing asset allocations and suggesting adjustments. These tools offer actionable recommendations based on an individual’s risk tolerance, financial goals, and prevailing market conditions. AI can also dynamically rebalance portfolios, adjusting exposure based on changing market conditions and risk parameters.

5. Risk Management

AI enhances risk mitigation by detecting anomalies and responding to market fluctuations in real time. It tells the difference between normal market changes and real risks by looking at past volatility, finding strange trading patterns, and using macroeconomic indicators. AI-driven systems continuously monitor market conditions and adjust trading strategies to minimize losses and maximize returns.

6. Backtesting Strategies

AI enables traders to backtest strategies using historical data. By simulating different scenarios, traders can refine their strategies before implementing them in live markets. AI-powered backtesting optimizes trading parameters and provides insight into how strategies would have performed in past market conditions.

7. AI-Powered Predictive Analytics

AI-driven predictive models help traders anticipate price movements with greater accuracy. AI analyzes real-time economic indicators, geopolitical events, and market trends, offering precise forecasts. By leveraging deep learning techniques, AI identifies non-linear relationships in financial data that traditional models may overlook.

The best AI tools for trading

AI-driven tools cater to various trading needs, ranging from predictive analytics to automated trading. Below are some top AI-powered platforms categorized by their primary functions:

- Predictive Analytics Tools: Analyze market data to forecast price trends. Examples: AlphaSense, Sigmoidal Trading.

- Automated Trading Platforms: Execute trades based on AI-driven strategies. Examples: Trade Ideas, MetaTrader 4/5 with AI Plugins, and CoinRule.

- Portfolio Management Solutions: Optimize asset allocation and risk management. Examples: Kavout, TuringTrader.

- Market Intelligence Software: Provide deep insights into financial markets using big data and NLP. Examples: Zebra AI, QuantConnect.

These tools were selected based on efficiency, accuracy, ease of use, and suitability for different trading styles, ensuring that both beginners and experienced traders can benefit from them.

AI for Intraday Trading: Is It Effective?

Intraday trading, which involves buying and selling financial instruments within the same trading day, requires rapid decision-making. AI enhances trade execution by offering real-time market analysis and automation. High-frequency trading (HFT) is a key area where AI plays a crucial role, as even milliseconds can impact profitability.

1. High-Frequency Trading (HFT)

AI executes trades within milliseconds, capitalizing on minor price fluctuations. HFT firms leverage AI-powered strategies to detect arbitrage opportunities and optimize trade execution. AI’s ability to process and analyze vast amounts of data in real time gives traders an edge in fast-moving markets.

2. AI vs. Human Traders

While AI eliminates emotional biases, human traders still play a critical role in strategy development and market adaptation. For example, during the 2021 GameStop short squeeze, AI-driven trading models failed to anticipate the impact of retail investor sentiment, leading to unexpected volatility. However, human traders identified the social media-driven movement and adjusted their strategies accordingly, demonstrating the need for human oversight in dynamic market conditions.

3. Risks and Best Practices

- Use AI tools with built-in risk management features such as stop-loss automation.

- Monitor AI-generated strategies to prevent overfitting to past data.

- Stay updated with market regulations and AI advancements.

- Diversify AI strategies to avoid over-reliance on one system.

The future of AI trading

AI continues to evolve, with advancements in deep learning, quantum computing, and blockchain integration set to further transform trading strategies.

1. AI and quantum computing

Quantum computing could revolutionize trading by solving complex financial models at unprecedented speeds. Unlike traditional computing, which processes data sequentially using binary bits (0s and 1s), quantum computing utilizes quantum bits (qubits) that exist in multiple states simultaneously. This enables quantum AI to evaluate multiple market scenarios at once, significantly enhancing predictive modeling and optimization in trading strategies.

2. Ethical and regulatory challenges

As AI reliance grows, stricter regulations are required to ensure fair trading practices and prevent market manipulation. Financial regulators are actively exploring ways to balance technological innovation with accountability in AI-driven trading.

3. How Can Traders Adapt?

- Learn and incorporate AI-driven strategies for better decision-making.

- Stay informed about emerging AI trends in financial markets.

- Use AI as a complementary tool rather than relying on it exclusively.

Conclusion on How to Use AI for Trading

AI is transforming trading by providing automation, advanced analytics, and predictive decision-making. Traders who adopt AI-driven tools and strategies gain a competitive edge in today’s fast-moving financial markets. While AI offers numerous advantages, human oversight remains essential for managing unpredictable market conditions. As AI technology continues to evolve, traders who integrate it effectively will be best positioned for long-term success.

Are you interested in beginning your journey with AI trading? Explore AI-driven tools today and stay ahead of market trends to maximize your trading potential!

Frequently Asked Questions (FAQ)

AI improves trading by analyzing vast amounts of data, identifying patterns, and making predictions based on historical and real-time market conditions. It enables algorithmic trading, risk management, portfolio optimization, and sentiment analysis.

While AI automates many aspects of trading, human oversight is still essential for interpreting unexpected events, adjusting strategies, and making nuanced decisions that AI may not anticipate.

AI trading comes with risks such as overfitting to historical data, lack of adaptability to black swan events, and reliance on algorithms that may not fully capture market sentiment. Regulatory concerns and ethical considerations are also factors.

Some of the best AI tools for trading include Trade Ideas, MetaTrader 4/5 with AI Plugins, Kavout, TuringTrader, Coinrule, QuantConnect, and AlphaSense. These tools serve different purposes, such as predictive analytics, portfolio management, and automated trading.

Traders can start using AI by integrating AI-powered trading platforms, learning about algorithmic trading, and experimenting with AI-based predictive analytics tools. It is also advisable to stay updated with market regulations and best practices.