Choosing a broker can be like trying to pick the right flavor at an ice cream shop—there are so many options, and each seems to have its own unique appeal. IG Broker and Exness are two big names that often come up when traders are searching for the best platforms. But, let’s face it, what works for one person may not work for another. Whether you’re just dipping your toes into trading or you’re an old hand, comparing the two can help you make a smart choice. So, let’s break down the main differences and see which broker might fit you best, IG Broker vs. Exness.

Why Compare IG Broker and Exness?

We all know the importance of finding the right broker, especially with so many choices out there. It’s not just about picking a name you’ve heard before—it’s about making sure that the broker fits your needs, whether you’re looking for low fees, a great platform, or top-notch customer service. By the end of this, you’ll hopefully have a better idea of whether IG or Exness ticks your boxes.

A Quick Look at IG Broker and Exness

IG Broker

IG Broker has been around since 1974, making it one of the oldest and most trusted brokers out there. With over four decades under its belt, IG offers a wide range of trading options—forex, CFDs, commodities, you name it. What’s great about IG is that it’s incredibly beginner-friendly. They’ve really invested in education and tools for people who are just getting started. If you’re new to trading, you’ll find a lot of hand-holding here, which can be a real comfort when you’re diving into something as complex as the financial markets. You can read a complete IG Broker Review here.

Exness

As you can see in the in-depth Exness Review, On the flip side, Exness is the new kid on the block, relatively speaking, having launched in 2008. But don’t let its youth fool you—Exness has quickly gained a solid reputation, especially among more seasoned traders. Why? Simple. It’s all about the low spreads, fast execution, and minimal slippage. This broker is designed with more experienced traders in mind, particularly those who like to play the high-volume game. They also offer a wider variety of account types, making it flexible depending on whether you trade casually or professionally.

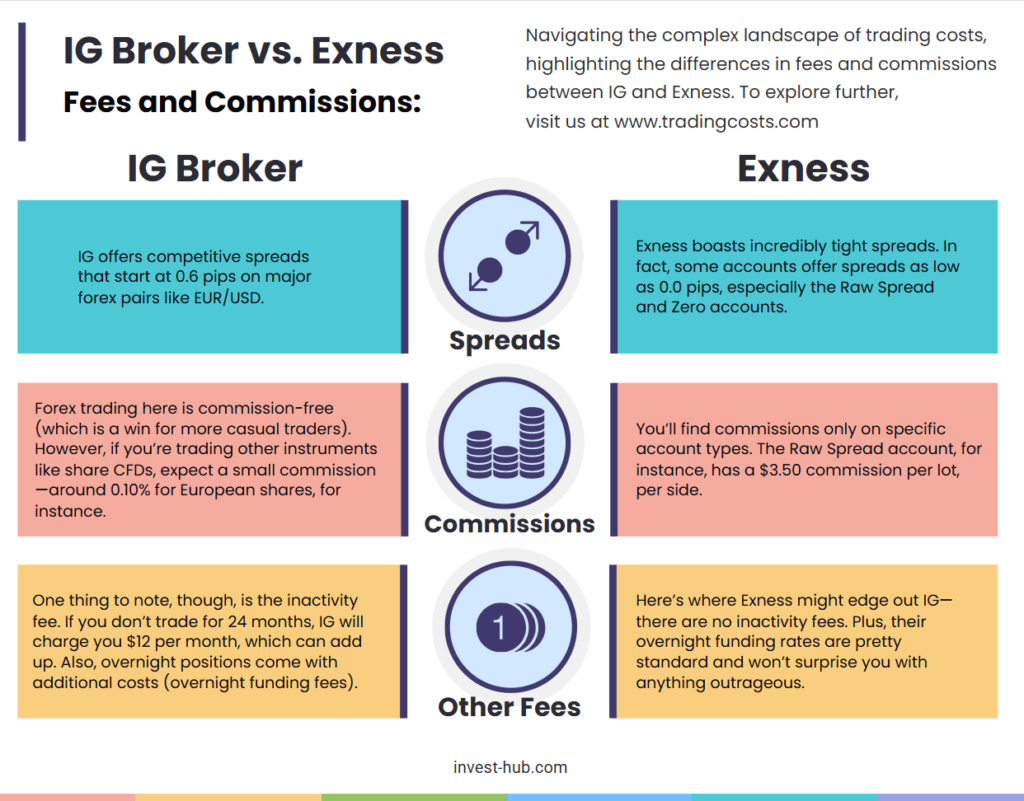

Fees and Commissions: IG Broker vs. Exness, How Much Will It Cost You?

Let’s be honest—trading costs can eat into your profits. So, it’s always good to know upfront what you’re getting into when it comes to fees. Here’s how IG and Exness stack up:

IG Broker’s Fees

- Spreads: IG offers competitive spreads that start at 0.6 pips on major forex pairs like EUR/USD.

- Commissions: Forex trading here is commission-free (which is a win for more casual traders). However, if you’re trading other instruments like share CFDs, expect a small commission—around 0.10% for European shares, for instance.

- Other Fees: One thing to note, though, is the inactivity fee. If you don’t trade for 24 months, IG will charge you $12 per month, which can add up. Also, overnight positions come with additional costs (overnight funding fees).

Exness’ Fees

- Spreads: Exness boasts incredibly tight spreads. In fact, some accounts offer spreads as low as 0.0 pips, especially the Raw Spread and Zero accounts.

- Commissions: You’ll find commissions only on specific account types. The Raw Spread account, for instance, has a $3.50 commission per lot, per side.

- Other Fees: Here’s where Exness might edge out IG—there are no inactivity fees. Plus, their overnight funding rates are pretty standard and won’t surprise you with anything outrageous.

Which is More Cost-Effective?

If you’re someone who’s trading large volumes, Exness might be the better deal, particularly with those tight spreads on the Raw Spread or Zero accounts. But for traders who prefer to keep things simple and commission-free, IG’s transparent and straightforward fee structure makes it very appealing.

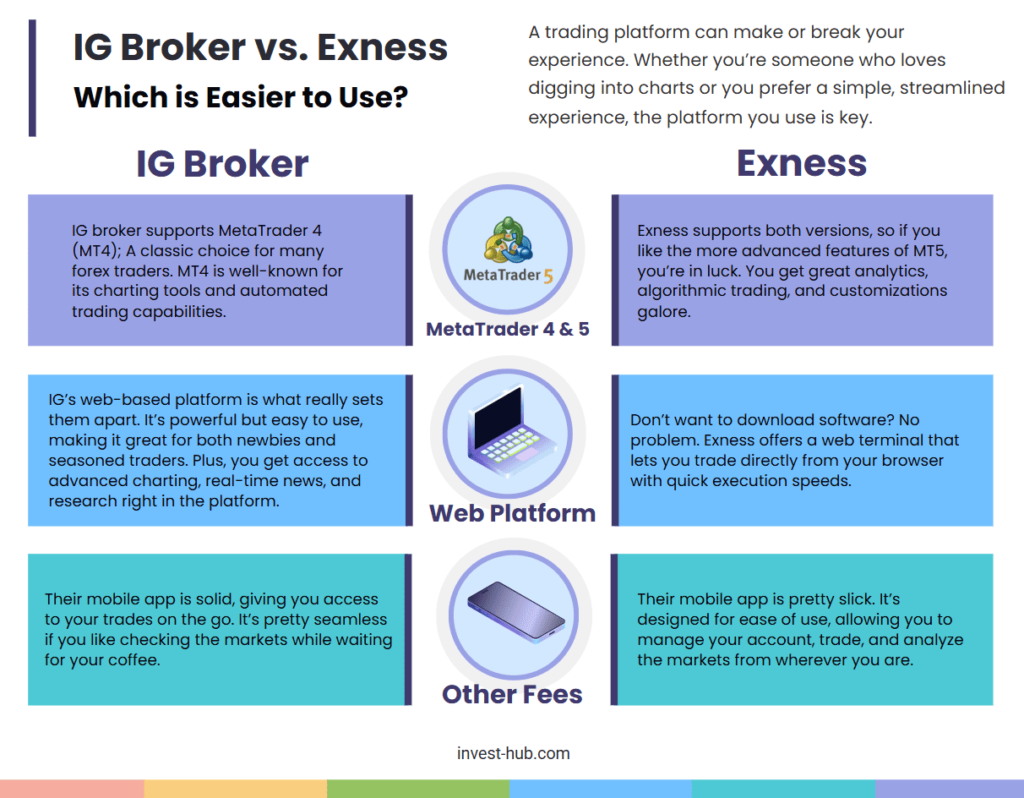

Trading Platforms: Which is Easier to Use?

A trading platform can make or break your experience. Whether you’re someone who loves digging into charts or you prefer a simple, streamlined experience, the platform you use is key.

IG Broker Platforms

- MetaTrader 4 (MT4): A classic choice for many forex traders. MT4 is well-known for its charting tools and automated trading capabilities.

- Proprietary Web Platform: IG’s web-based platform is what really sets them apart. It’s powerful but easy to use, making it great for both newbies and seasoned traders. Plus, you get access to advanced charting, real-time news, and research right in the platform.

- Mobile Trading: Their mobile app is solid, giving you access to your trades on the go. It’s pretty seamless if you like checking the markets while waiting for your coffee.

Exness Platforms

- MetaTrader 4 & 5 (MT4/MT5): Exness supports both versions, so if you like the more advanced features of MT5, you’re in luck. You get great analytics, algorithmic trading, and customizations galore.

- Exness Trader App: Their mobile app is pretty slick. It’s designed for ease of use, allowing you to manage your account, trade, and analyze the markets from wherever you are.

- WebTerminal: Don’t want to download software? No problem. Exness offers a web terminal that lets you trade directly from your browser with quick execution speeds.

Which platform is better?

If you’re all about ease of use and want something that’s both simple and powerful, IG’s proprietary platform might be a game-changer for you. However, for more advanced traders, especially those who rely on MT5, Exness could be your go-to.

IG Broker vs. Exness, Account Types: What Options Do You Have?

The types of accounts available can tell you a lot about how a broker caters to different kinds of traders. Some people like simplicity; others want more tailored options. Let’s compare.

IG Broker Account Types

- Standard Account: The bread-and-butter option. It gives you access to all the markets and trading platforms with no minimum deposit.

- Premium Account: This is for high-net-worth individuals who want personalized service and premium features.

- Demo Account: Want to practice first? IG offers a free demo account loaded with $10,000 in virtual funds. Perfect for those who want to get their feet wet before jumping in with real money.

Exness Account Types

- Standard Account: Like IG, Exness offers a no-minimum-deposit, commission-free standard account.

- Raw Spread Account: If you like those razor-thin spreads, this account starts from 0.0 pips but does come with commissions.

- Zero Account: Zero spreads on key instruments most of the time, though you’ll pay commissions.

- Pro Account: Commission-free but with tight spreads, this one is great for pros.

- Demo Account: Exness gives you a demo account on both MT4 and MT5, so you can test the waters risk-free.

Which Broker is More Flexible?

Exness definitely stands out for offering more tailored account types, especially if you’re an advanced trader who wants raw or zero spreads. On the other hand, if simplicity is what you’re after, IG’s standard account keeps things straightforward, and their demo account is one of the best for beginners.

Regulation and Safety: IG Broker vs. Exness, Who’s Got Your Back?

It’s always smart to check how well a broker is regulated. After all, you’re trusting them with your money.

IG Broker Regulation

IG is regulated by top-tier authorities like the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and even the U.S. Commodity Futures Trading Commission (CFTC). They also make sure client funds are safely stored in segregated accounts with top-tier banks. And, if something goes wrong, they offer a financial compensation scheme for added protection.

Exness Regulation

Exness doesn’t fall short here either. They’re regulated by the Cyprus Securities and Exchange Commission (CySEC) and the FCA, so you know they follow strict safety protocols. They also segregate client funds, just like IG.

Which is Safer?

Both brokers are highly regulated, but IG’s longer history and broader regulatory coverage might offer a bit more peace of mind, especially if you like that extra layer of security.

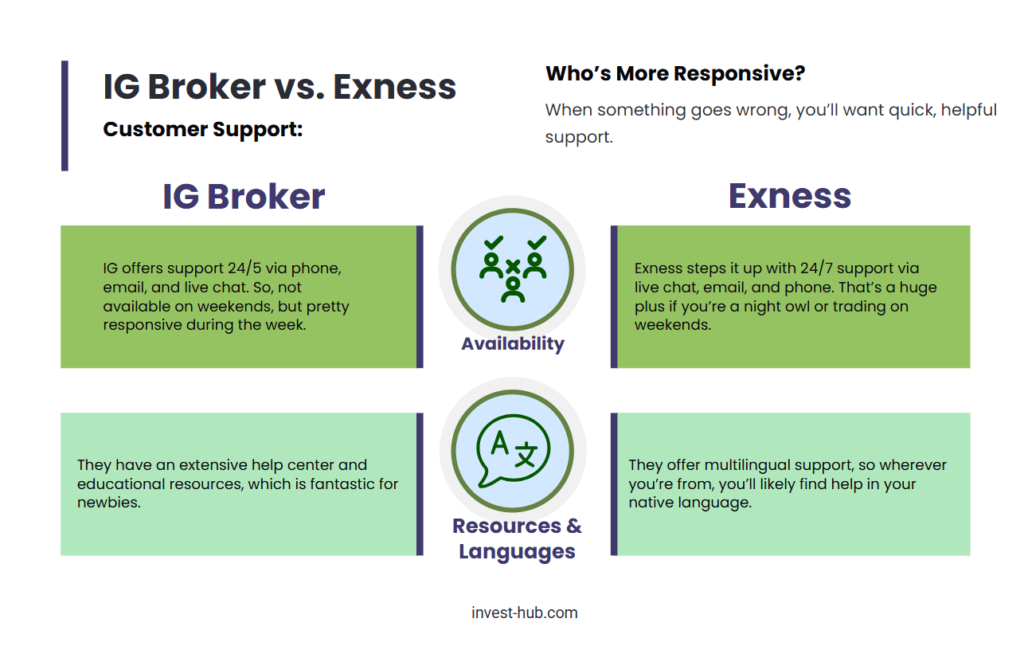

Customer Support: Who’s More Responsive?

When something goes wrong, you’ll want quick, helpful support.

IG Broker Support

- Availability: IG offers support 24/5 via phone, email, and live chat. So, not available on weekends, but pretty responsive during the week.

- Resources: They have an extensive help center and educational resources, which is fantastic for newbies.

Exness Support

- Availability: Exness steps it up with 24/7 support via live chat, email, and phone. That’s a huge plus if you’re a night owl or trading on weekends.

- Languages: They offer multilingual support, so wherever you’re from, you’ll likely find help in your native language.

Who’s Got Better Support?

For around-the-clock support, Exness is your go-to. But both brokers have solid teams, so you’re in good hands either way.

Conclusion: IG Broker vs. Exness, Which Broker Should You Choose?

So, which one’s right for you? Honestly, it depends on what you’re after:

- Beginners might find IG Broker to be the better choice thanks to its user-friendly platform and educational resources.

- Advanced traders, especially those trading large volumes or focused on forex, may lean toward Exness with its low spreads, fast execution, and variety of account options.

Still undecided? See our full list of best brokers, or try out their demo accounts to find which platform feels right for you.

FAQs

Both IG and Exness are known for competitive pricing, but the exact costs can vary by account type, trading instrument, and market conditions. IG typically offers tight spreads on major currency pairs, whereas Exness may provide lower spreads on certain account types (e.g., Raw Spread accounts). Always compare up-to-date spreads, commissions, and any non-trading fees before choosing a broker.

Yes. IG is regulated by reputable authorities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and others. Exness is licensed through the Financial Services Commission (FSC) in certain jurisdictions and the Cyprus Securities and Exchange Commission (CySEC). Each broker’s oversight can differ based on regions, so check the specific regulations in your country.

IG offers an extensive range of educational materials, webinars, and a demo account, making it beginner-friendly. Exness also provides educational resources and a demo account, but some find IG’s educational suite more comprehensive. Ultimately, it comes down to personal preference, learning style, and the specific tools each broker offers.

IG does not always enforce a strict minimum deposit, but they may recommend a starting amount depending on the account type and region. Exness typically has low or no minimum deposit requirements for some account types, making it accessible to traders with smaller budgets. Always confirm specific deposit rules on the broker’s official website.

IG features its proprietary trading platform, a web-based platform, and offers MetaTrader 4 (MT4) for certain accounts. Exness primarily supports MetaTrader 4 and MetaTrader 5, both well-known for technical analysis tools and automated trading. If you prefer a proprietary platform, IG’s is robust and user-friendly. If you prefer the MetaTrader ecosystem, both brokers deliver solid options.

Yes. Both IG and Exness have mobile trading apps that mirror much of the functionality found on their desktop and web platforms. You can monitor trades, execute orders, and manage your account on the go.

IG accepts bank transfers, credit/debit cards, and (in some regions) e-wallets. Exness offers a variety of payment methods, including credit/debit cards, bank transfers, and popular e-wallets like Neteller and Skrill. Processing times and fees vary, so check each broker’s policy for your preferred payment method.

Both IG and Exness offer multilingual customer support via live chat, phone, and email. IG’s support is often praised for promptness and professionalism, while Exness is known for its 24/7 support in multiple languages. Consider contacting both brokers to gauge response times and support quality.

IG rarely promotes bonuses but may occasionally offer refer-a-friend or spread rebates, depending on the region. Exness may run bonus promotions or rebates in certain jurisdictions. Whether or not they are available depends on your location and local regulations, so always check official broker announcements.

Advanced traders typically value comprehensive analytical tools, direct market access, algorithmic trading support, and reliable order execution. IG’s advanced charting tools, ProRealTime integration, and direct market access (DMA) could appeal to experienced traders. Exness stands out for high leverage options (depending on jurisdiction) and fast execution on popular trading platforms. Ultimately, the “best” choice depends on specific trading needs.

Yes. Many traders maintain multiple broker accounts to take advantage of each platform’s unique benefits—such as differing spreads, market coverage, and special promotions. Just ensure you meet each broker’s requirements and fully understand their terms and conditions.

Trading Forex and CFDs carries inherent risks, including market volatility and potential losses exceeding deposits when using high leverage. Regulation adds a layer of safety, but you should use risk management techniques—like stop losses and limiting leverage—to protect your capital. Always ensure you trade with funds you can afford to lose.