Choosing the right online brokerage can significantly impact your trading experience, especially when considering two industry powerhouses: Saxo Bank vs. Interactive Brokers. Both brokers cater to beginner and expert investors alike, offering extensive trading products, competitive fee structures, and advanced platforms. This in-depth comparison will explore their fees, trading platforms, account types, regulatory background, and customer support. By the end, you’ll have a clear view of which broker aligns best with your financial goals and trading style. You can also read in-depth broker reviews at invest-hub.com.

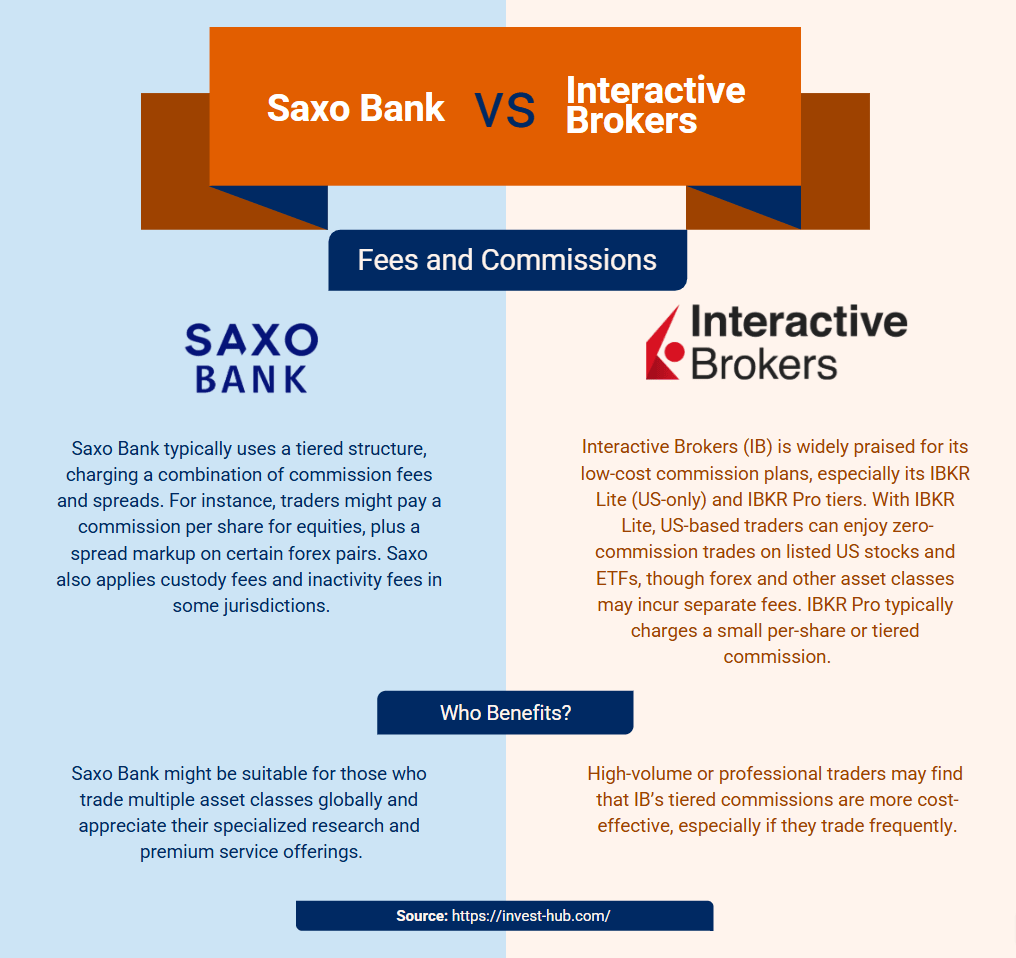

Saxo Bank vs. Interactive Brokers: Fees and Commissions

Fees and commissions often top the list of considerations when choosing a broker, as you can read in our Saxo Bank Review. Saxo Bank and Interactive Brokers both provide transparent fee structures but differ in how they charge commissions.

- Saxo Bank Commission Model

Saxo Bank typically uses a tiered structure, charging a combination of commission fees and spreads. For instance, traders might pay a commission per share for equities, plus a spread markup on certain forex pairs. Saxo also applies custody fees and inactivity fees in some jurisdictions. You can read more about it on Saxo Bank official website. - Interactive Brokers Commission Model

Interactive Brokers (IB) is widely praised for its low-cost commission plans, especially its IBKR Lite (US-only) and IBKR Pro tiers. With IBKR Lite, US-based traders can enjoy zero-commission trades on listed US stocks and ETFs, though forex and other asset classes may incur separate fees. IBKR Pro typically charges a small per-share or tiered commission. You can read more about it on Interactive Brokers official website.

Who Benefits?

- High-volume or professional traders may find that IB’s tiered commissions are more cost-effective, especially if they trade frequently.

- Saxo Bank might be suitable for those who trade multiple asset classes globally and appreciate their specialized research and premium service offerings.

Saxo Bank vs. Interactive Brokers: Low Fees

While “fees and commissions” and “low fees” may appear to overlap, many traders specifically seek brokers known for minimal overall costs—beyond just commissions. Interactive Brokers often ranks among the most cost-friendly in the market.

- Interactive Brokers

- Low Forex Spreads: IB typically offers very tight spreads, especially under IBKR Pro.

- Minimal Spread Markups: Thanks to its large client base and volume-based discounting, IB can negotiate better pricing with liquidity providers.

- Low Financing Rates: IB offers some of the lowest margin interest rates globally.

- Saxo Bank

- Volume Discounts: High-volume traders can benefit from Saxo’s discounted fees.

- Bundled Service Fees: Some advanced tools, research, or data feeds might be rolled into their service charges, which can add to overall costs but also provide added value.

Key Takeaway: If your primary goal is absolute low fees, many industry reports—including reviews from Business Insider and Benzinga—often point to Interactive Brokers as a cost leader. Saxo Bank remains competitive but can be pricier when factoring in custody and data fees, depending on your trading habits.

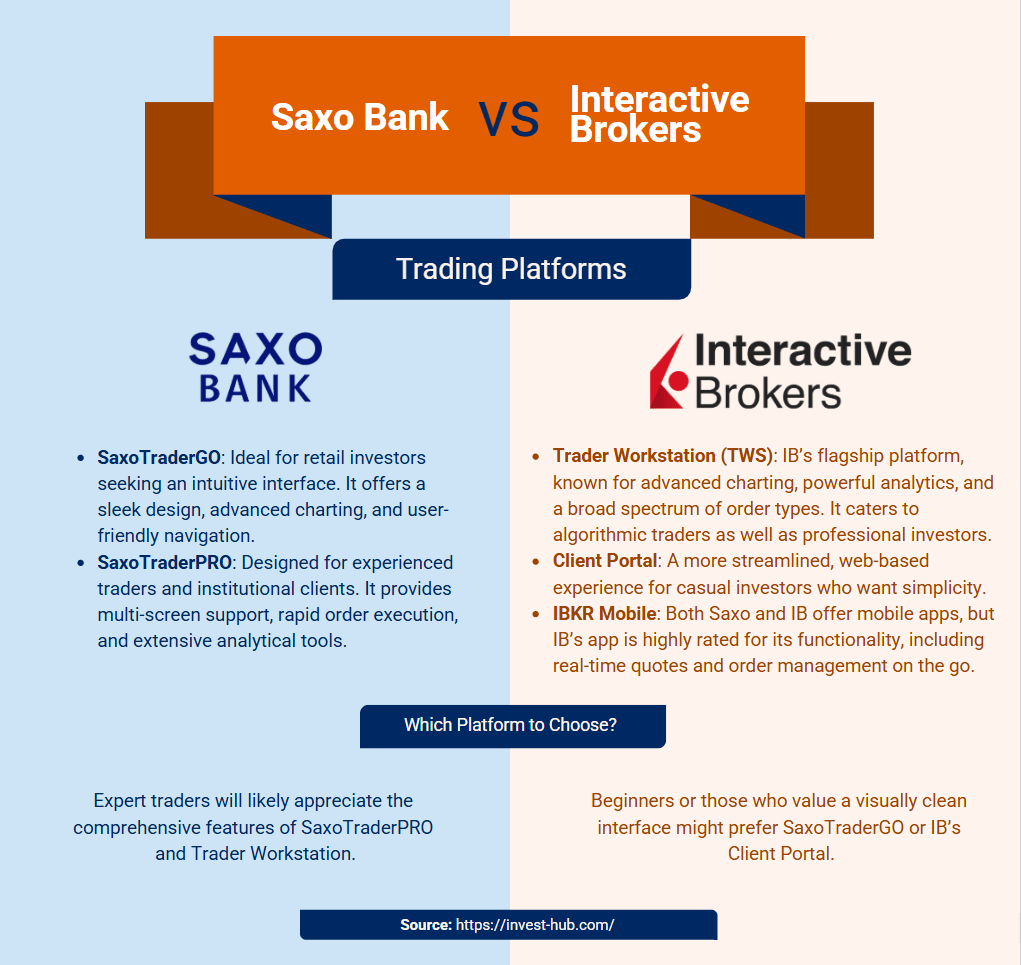

Saxo Bank vs. Interactive Brokers: Trading Platforms

Both Saxo Bank and Interactive Brokers pride themselves on offering robust, feature-rich trading platforms suitable for beginners exploring basic investments and experts running complex strategies.

Saxo Bank Platforms

- SaxoTraderGO: Ideal for retail investors seeking an intuitive interface. It offers a sleek design, advanced charting, and user-friendly navigation.

- SaxoTraderPRO: Designed for experienced traders and institutional clients. It provides multi-screen support, rapid order execution, and extensive analytical tools.

Interactive Brokers Platforms

- Trader Workstation (TWS): As you can read in our Interactive Brokers Review, IB’s flagship platform, known for advanced charting, powerful analytics, and a broad spectrum of order types. It caters to algorithmic traders as well as professional investors.

- Client Portal: A more streamlined, web-based experience for casual investors who want simplicity.

- IBKR Mobile: Both Saxo and IB offer mobile apps, but IB’s app is highly rated for its functionality, including real-time quotes and order management on the go.

Which Platform to Choose?

- Beginners or those who value a visually clean interface might prefer SaxoTraderGO or IB’s Client Portal.

- Expert traders will likely appreciate the comprehensive features of SaxoTraderPRO and Trader Workstation.

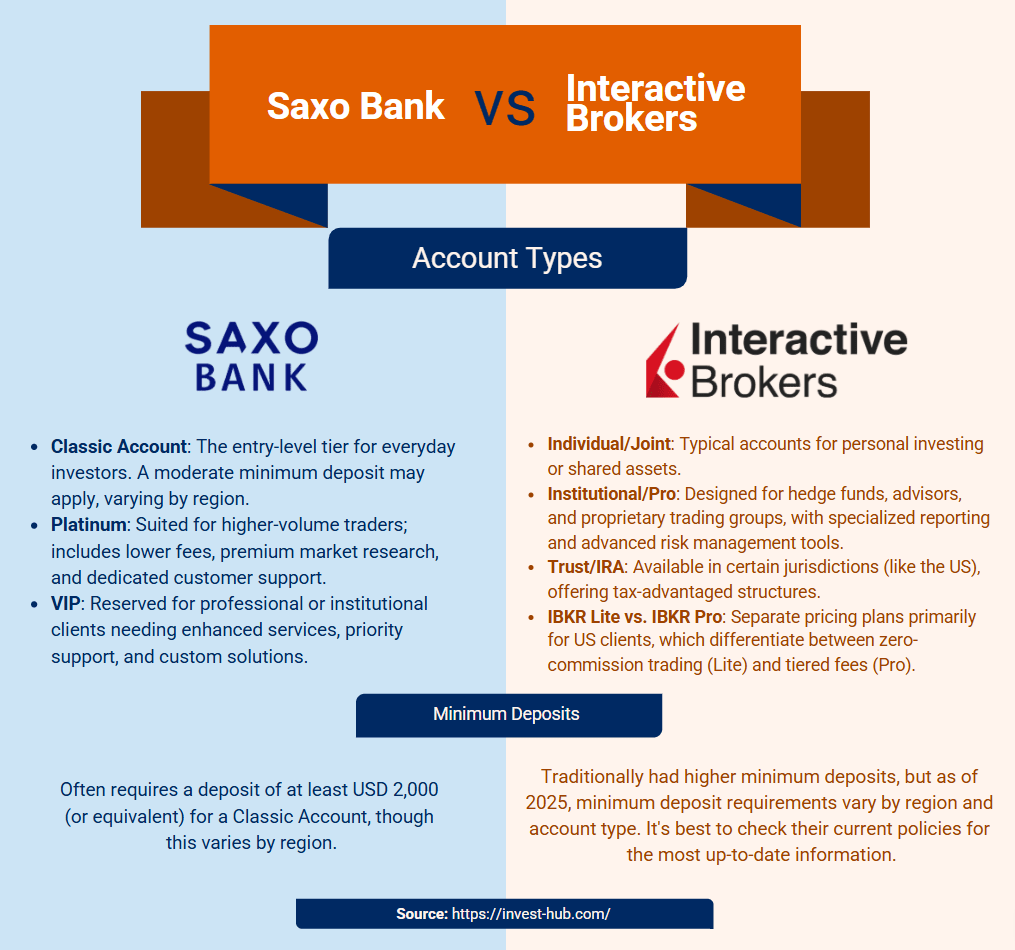

Saxo Bank vs. Interactive Brokers Account Types

From everyday retail investors to seasoned pros, both Saxo Bank and Interactive Brokers cater to a wide range of traders. However, each broker labels and structures its accounts a bit differently.

Saxo Bank Account Types

- Classic Account: The entry-level tier for everyday investors. A moderate minimum deposit may apply, varying by region.

- Platinum: Suited for higher-volume traders; includes lower fees, premium market research, and dedicated customer support.

- VIP: Reserved for professional or institutional clients needing enhanced services, priority support, and custom solutions.

Interactive Brokers Account Types

- Individual/Joint: Typical accounts for personal investing or shared assets.

- Institutional/Pro: Designed for hedge funds, advisors, and proprietary trading groups, with specialized reporting and advanced risk management tools.

- Trust/IRA: Available in certain jurisdictions (like the US), offering tax-advantaged structures.

- IBKR Lite vs. IBKR Pro: Separate pricing plans primarily for US clients, which differentiate between zero-commission trading (Lite) and tiered fees (Pro).

Minimum Deposits

- Interactive Brokers: Traditionally had higher minimum deposits, but as of 2025, minimum deposit requirements vary by region and account type. It’s best to check their current policies for the most up-to-date information.

- Saxo Bank: Often requires a deposit of at least USD 2,000 (or equivalent) for a Classic Account, though this varies by region.

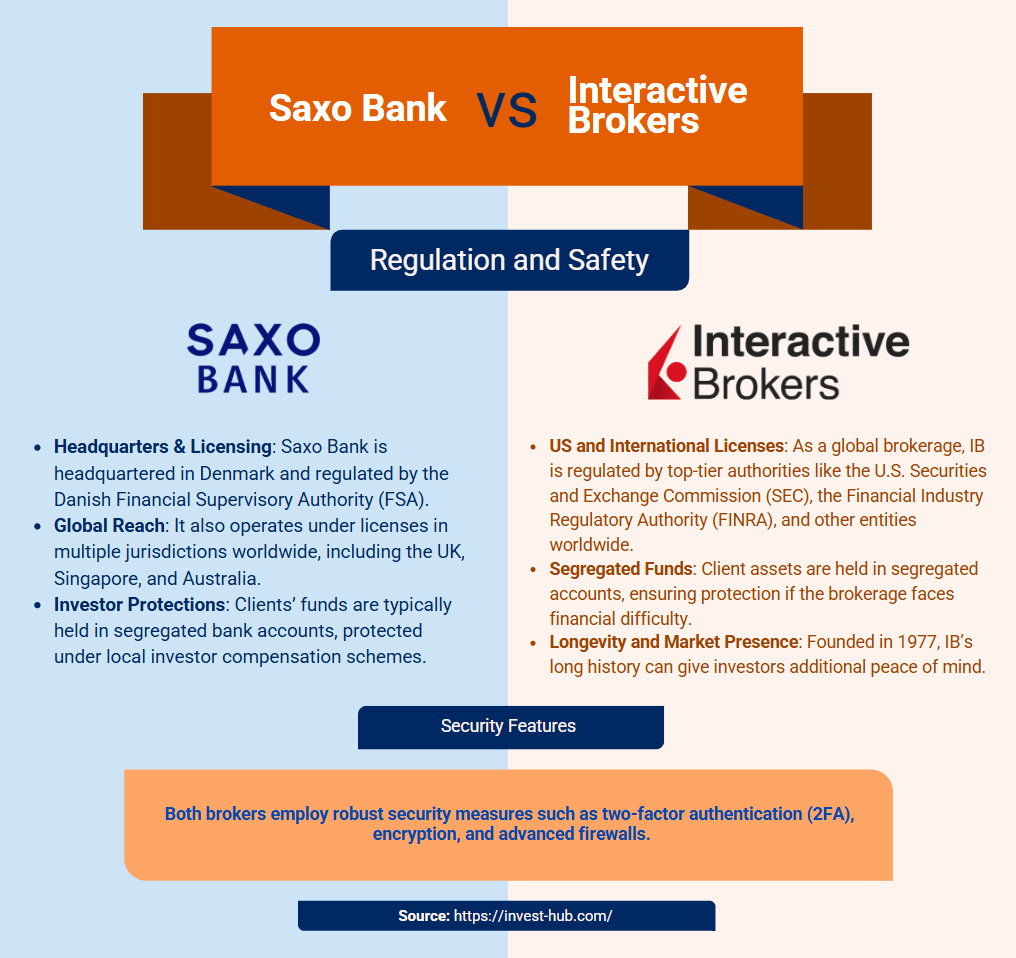

Saxo Bank vs. Interactive Brokers: Regulation and Safety

When entrusting your money to any broker, verifying their regulatory status and financial safeguards is crucial.

Saxo Bank

- Headquarters & Licensing: Saxo Bank is headquartered in Denmark and regulated by the Danish Financial Supervisory Authority (FSA).

- Global Reach: It also operates under licenses in multiple jurisdictions worldwide, including the UK, Singapore, and Australia.

- Investor Protections: Clients’ funds are typically held in segregated bank accounts, protected under local investor compensation schemes.

Interactive Brokers

- US and International Licenses: As a global brokerage, IB is regulated by top-tier authorities like the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and other entities worldwide.

- Segregated Funds: Client assets are held in segregated accounts, ensuring protection if the brokerage faces financial difficulty.

- Longevity and Market Presence: Founded in 1977, IB’s long history can give investors additional peace of mind.

Security Features

Both brokers employ robust security measures such as two-factor authentication (2FA), encryption, and advanced firewalls.

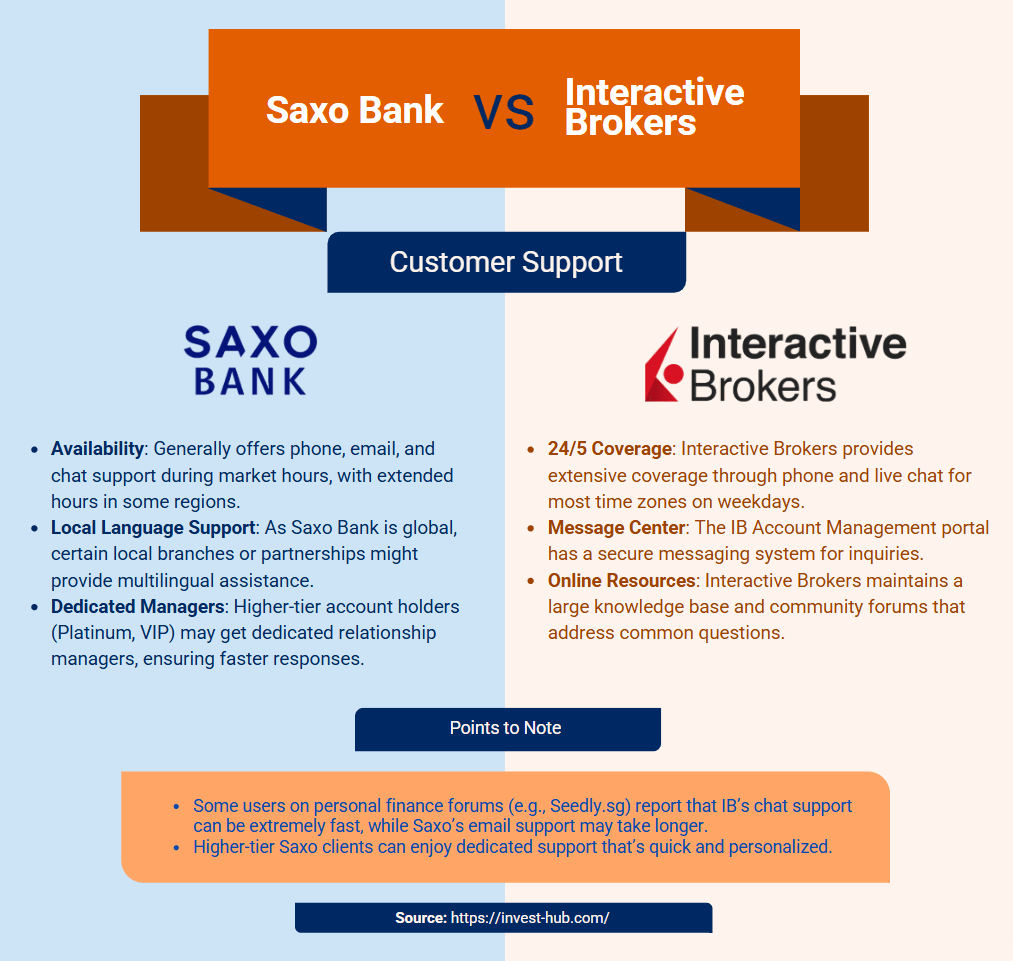

Interactive Brokers vs. Saxo: Customer Support

Customer support can make a significant difference, whether you’re a beginner needing guidance on the basics or an expert running into a complex trading issue.

Saxo Bank Support

- Availability: Generally offers phone, email, and chat support during market hours, with extended hours in some regions.

- Local Language Support: As Saxo Bank is global, certain local branches or partnerships might provide multilingual assistance.

- Dedicated Managers: Higher-tier account holders (Platinum, VIP) may get dedicated relationship managers, ensuring faster responses.

Interactive Brokers Support

- 24/5 Coverage: Interactive Brokers provides extensive coverage through phone and live chat for most time zones on weekdays.

- Message Center: The IB Account Management portal has a secure messaging system for inquiries.

- Online Resources: Interactive Brokers maintains a large knowledge base and community forums that address common questions.

Points to Note

- Some users on personal finance forums (e.g., Seedly.sg) report that IB’s chat support can be extremely fast, while Saxo’s email support may take longer.

- Higher-tier Saxo clients can enjoy dedicated support that’s quick and personalized.

Conclusion

In the Saxo Bank vs. Interactive Brokers debate, choosing the right broker depends on your goals, trading habits, and personal preferences. Interactive Brokers stands out for its low fees, advanced platform (Trader Workstation), and robust regulatory framework. Saxo Bank excels with its intuitive platform options (SaxoTraderGO and SaxoTraderPRO), extensive global market access, and tiered accounts that offer premium services.

Before making any final decision, consider the types of securities you plan to trade, your average trading volume, and any specific features (like advanced charting tools, research access, or customer service quality) that matter most to you. Ultimately, both brokers offer a secure, professional environment suitable for both beginners looking to learn and experts seeking advanced functionality.

FAQs

Both are relatively advanced brokers, but Interactive Brokers’ IBKR Lite (in select regions) and SaxoTraderGO’s user-friendly interface can help beginners. IBKR offers more cost-efficient trades, while Saxo’s platform is praised for its intuitive design.

Saxo Bank typically has a minimum deposit of around USD 2,000 for its Classic Account, though it varies by region. Interactive Brokers used to have a minimum but has relaxed this requirement in many jurisdictions.

Both have extensive offerings—stocks, ETFs, forex, futures, options, bonds, and CFDs. If you’re looking at very specialized products or certain global exchanges, it’s best to compare directly based on your region. In general, Saxo Bank and IB both have a strong global reach.

Yes. Saxo Bank is regulated by the Danish Financial Supervisory Authority and other regulators in major financial hubs. Interactive Brokers is regulated by the SEC, FINRA, and numerous other global agencies.

Interactive Brokers is renowned for low commissions and margin rates, making it a top choice for frequent traders. Saxo Bank can be competitive for high-volume traders under its Platinum and VIP tiers, but casual traders may find IB more cost-effective.

Interactive Brokers has removed inactivity fees for many account types, but this depends on your region and account plan. Saxo Bank may charge inactivity fees if you don’t trade for a certain period, so it’s worth confirming based on your local terms.