Yes, generally we can consider FXCM (Forex Capital Markets) as an ECN (Electronic Communication Network) broker that offers account types with an ECN-like, No Dealing Desk (NDD) execution model, but it is not universally considered a “true ECN broker” across all accounts and jurisdictions. Its model can vary between ECN-like and hybrid structures depending on the account type and regulatory framework. For a detailed breakdown of FXCM’s account types, trading platforms, and fee structures, visit our in-depth FXCM review.

FXCM, a well-known player in the forex and CFD trading industry, has often described its services in ways that resemble an Electronic Communication Network (ECN) model, but the situation is slightly more nuanced. Historically, the broker offered what it called a “No Dealing Desk” (NDD) model, implying it connects traders with external liquidity providers rather than always acting as a sole market maker. However, FXCM has also provided certain trading conditions that may blend features of both ECN-style execution and traditional market-making. In essence, whether FXCM is an ECN broker depends on specific account types, regulatory frameworks, and partnerships with liquidity venues. Below is a thorough exploration of how FXCM operates and whether it truly functions as an ECN broker.

Understanding the ECN Model

What is an ECN Broker? An Electronic Communication Network (ECN) is a trading technology that connects various market participants—such as banks, hedge funds, and individual traders—into one centralized platform. This connection enables real-time matching of buy and sell orders, often resulting in transparent pricing and typically narrow spreads. Because of its structure:

- No Dealing Desk: ECN brokers generally operate without a dealing desk. They merely match orders among different traders and liquidity providers.

- Variable Spreads: ECN brokers often present variable spreads. Prices depend on the actual supply and demand flowing through the network.

- Commission Structure: Since ECN brokers do not earn from spreads alone, they usually charge a commission on every trade.

The potential advantage of an ECN is a transparent and competitive market environment that discourages price manipulation by the broker. It is widely considered a beneficial setup for experienced traders who desire direct, unfiltered market access.

Key Features of Market Makers vs. ECN Brokers

Before diving deeper into Is FXCM an ECN Broker, it helps to compare the basic traits of market makers and ECN brokers. Below is a concise table:

| Feature | Market Maker | ECN Broker |

| Execution Model | Internal dealing desk, often taking the other side | Directly routes orders to liquidity providers without internalization |

| Pricing | Often fixed or synthetic spreads | Variable spreads based on market conditions |

| Potential Conflict of Int. | Possible, as broker can profit from client losses | Limited, since broker earns via commissions, not from client losses |

| Transparency | Less transparent quotes, broker controls pricing | Higher transparency, real-time quotes |

| Typical Fees | Embedded in spread; no (or minimal) commissions | Commissions on each trade, plus raw or near-raw spreads |

Market makers can offer consistent pricing and straightforward trading options, which some beginners find appealing. Yet, critics argue that market makers might have a conflict of interest with traders. Conversely, ECN brokers act as intermediaries by connecting traders to a network of liquidity providers. This model, in theory, limits conflicts of interest because the broker’s main income is from commissions, rather than trades executed against clients.

If you’re still evaluating which broker model suits you best, check out our comprehensive best brokers review to see how various market participants stack up.

FXCM’s Background and Evolution

FXCM (short for Forex Capital Markets) has been a significant name in the forex industry for over two decades. Its evolution includes rapid international expansion, regulatory scrutiny, and business model shifts:

- Initial Growth: FXCM grew quickly in the retail forex space, attracting traders worldwide.

- Regulatory Attention: Over the years, various regulators have scrutinized the company, requiring changes in its operational model.

- Partnerships and Liquidity: FXCM has partnered with multiple liquidity providers to give clients more direct market access.

- Multiple Platforms: From proprietary trading platforms to popular third-party platforms, FXCM offers multiple options to cater to different trading styles.

Despite these changes, debate remains on whether FXCM fully fits the definition of an ECN broker or operates partly as a market maker, depending on account type and jurisdiction.

Is FXCM an ECN broker? Breaking Down the Trading Model

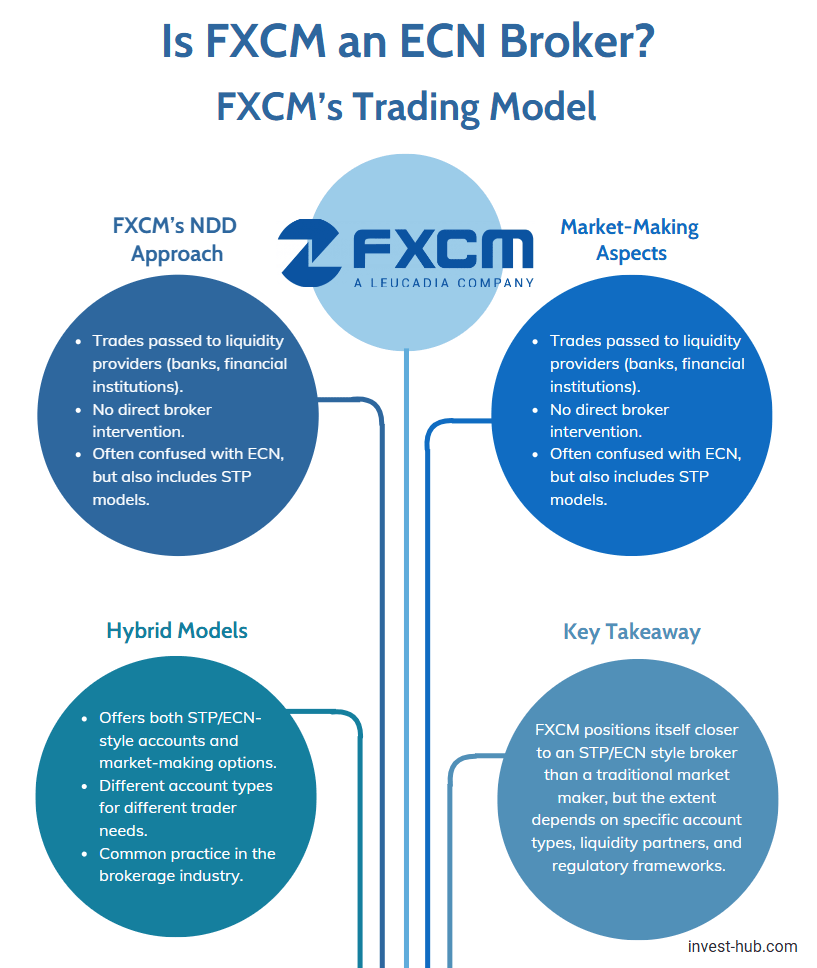

FXCM’s “No Dealing Desk” (NDD) Approach

FXCM has long promoted its No Dealing Desk (NDD) execution. The core concept is that trades are passed on to liquidity providers—banks, financial institutions, and other market participants—without a dealing desk intervention. The “NDD” label often leads traders to assume “ECN,” because both imply a broker is not acting as the direct counterparty. However, NDD execution is a broader term that might include Straight Through Processing (STP), where the broker still aggregates quotes from various sources but could add markups.

Potential Market-Making Aspects

While FXCM emphasizes its connections to liquidity providers, it has also—at certain times and account structures—functioned similarly to a market maker by internalizing a portion of trades. Regulatory actions and user discussions have highlighted periods where FXCM’s revenue model might have included markups and order routing practices that were less than fully transparent. Therefore, labeling FXCM as purely ECN can be misleading without specifying the exact account type or region.

Hybrid Models

Some brokers utilize a hybrid model, offering both STP/ECN-like accounts and accounts with a dealing desk. FXCM has offered various account types over the years, which may lead to confusion. This blending of approaches is not unusual in the industry; many large brokers cater to both new traders (who often prefer fixed spreads or simpler setups) and advanced traders seeking raw market access.

Key Takeaway: FXCM positions itself closer to an STP/ECN style broker than a traditional market maker, but the extent depends on specific account types, liquidity partners, and regulatory frameworks.

Examining FXCM Pro Services

For institutional clients, FXCM Pro explicitly states it offers direct access to Tier 1 liquidity, prime brokerage solutions, and a modern, low-latency trading environment that closely resembles an ECN. Institutions, high-frequency traders, and professional money managers can work with FXCM Pro to gain near-instant execution and narrower spreads. This segment of FXCM’s business underscores the broker’s efforts to align itself with the ECN philosophy, especially for well-capitalized, professional clients.

If you want additional insight straight from the source, visit the official FXCM website to learn more about their service categories, which may differ by region.

Regulatory Oversight and Transparency

- Licensing and Regulation: FXCM operates under multiple regulatory bodies across different regions, each imposing distinct rules on execution and reporting.

- Disclosure Requirements: Regulators often require brokers to disclose whether trades pass through a dealing desk, how the broker handles order flow, and any potential conflicts of interest.

- Transparency Initiatives: FXCM, like many brokers, publishes certain execution statistics. However, the complexity of liquidity pools and contractual relationships can still create grey areas for everyday traders.

Financial authorities can keep brokers in check, but traders should review the terms offered in each account type, including any disclaimers on internal liquidity, markups, or additional commissions.

Advantages of an ECN-Like Model with FXCM

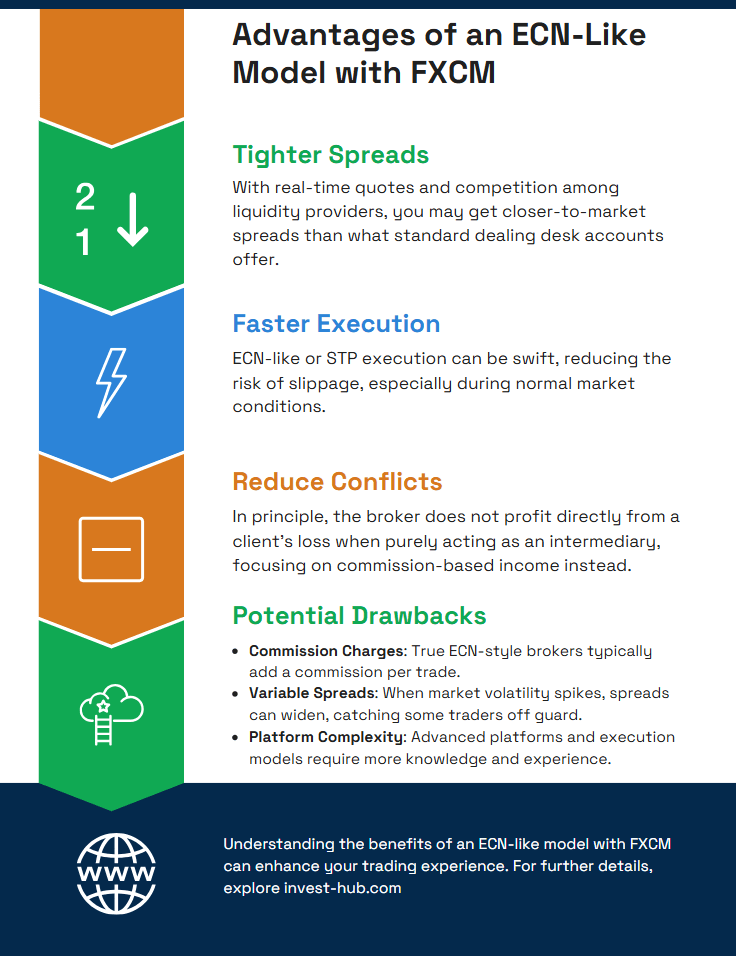

If you manage to sign up under FXCM’s accounts that come closest to an ECN configuration, you might benefit from:

- Tighter Spreads: With real-time quotes and competition among liquidity providers, you may get closer-to-market spreads than what standard dealing desk accounts offer.

- Faster Execution: ECN-like or STP execution can be swift, reducing the risk of slippage, especially during normal market conditions.

- Lower Conflict of Interest: In principle, the broker does not profit directly from a client’s loss when purely acting as an intermediary, focusing on commission-based income instead.

Potential Drawbacks

- Commission Charges: True ECN-style brokers typically add a commission per trade.

- Variable Spreads: When market volatility spikes, spreads can widen, catching some traders off guard.

- Platform Complexity: Advanced platforms and execution models require more knowledge and experience.

Considerations for Choosing ECN vs. Market Maker

When deciding whether FXCM or any broker truly suits your needs, compare ECN and market-maker characteristics:

- Trading Style: High-volume day traders or scalpers often benefit from raw spreads and direct execution. More casual traders might be comfortable with slightly higher spreads and no commissions.

- Account Requirements: ECN or STP-style accounts sometimes require higher minimum deposits.

- Trading Costs: ECN accounts typically list a low or zero spread plus a commission, while market-makers often have “all-in” spreads.

- Risk Tolerance: Understand how your broker handles order flow. If transparency is critical for you, an ECN or STP broker may suit you better.

- Tools & Platforms: Ensure the broker’s platform supports advanced charting, auto-trading, or any custom metrics you require.

A Deeper Dive: User Perspectives on FXCM’s ECN Claims

Community Feedback

Online trading forums and user review platforms frequently discuss whether FXCM is genuinely ECN. Some users claim they experience direct market execution and minimal re-quotes, indicative of an ECN approach. Others report spread markups or occasional re-quotes, more characteristic of a market maker or hybrid structure.

Importance of Account Type

FXCM offers multiple account levels—Standard, Premium, Professional, etc.—and each may handle orders differently. The difference can be subtle but important:

- Standard Accounts: May have higher spreads, smaller minimum deposits, and possibly partial dealing desk intervention.

- Premium or Pro Accounts: Often provide lower spreads, direct interbank pricing, and pass-through execution.

Conclusion from the Community: Whether FXCM acts like an ECN broker can hinge on choosing the right account and platform.

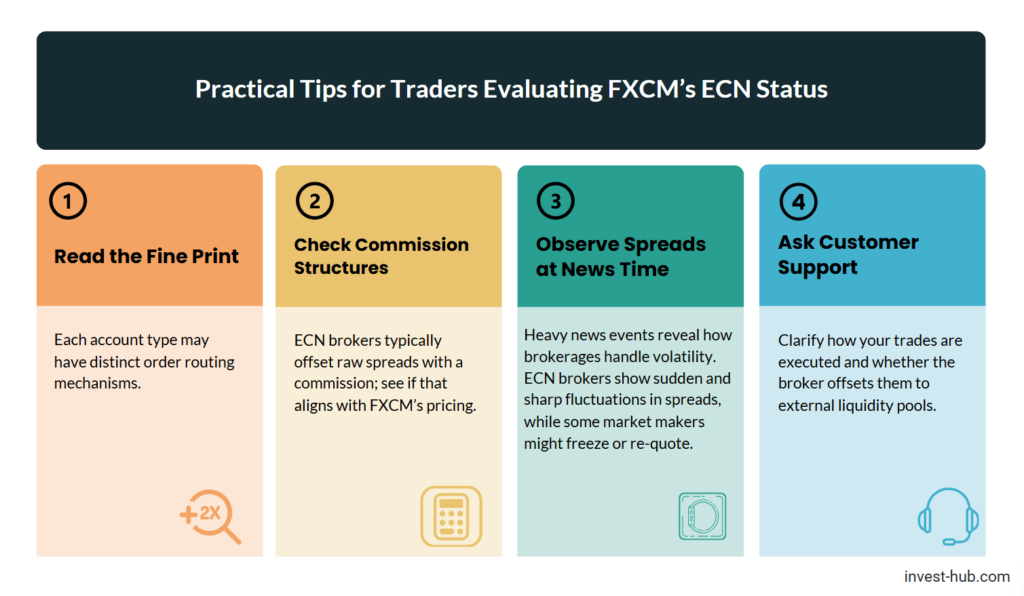

Practical Tips for Traders Evaluating FXCM’s ECN Status

- Read the Fine Print: Each account type may have distinct order routing mechanisms.

- Check Commission Structures: ECN brokers typically offset raw spreads with a commission; see if that aligns with FXCM’s pricing.

- Observe Spreads at News Time: Heavy news events reveal how brokerages handle volatility. ECN brokers show sudden and sharp fluctuations in spreads, while some market makers might freeze or re-quote.

- Ask Customer Support: Clarify how your trades are executed and whether the broker offsets them to external liquidity pools.

Conclusion on Is FXCM an ECN broker?

So, is FXCM an ECN broker? The answer varies based on which account type or service you choose and under which regulatory framework you trade. Certain FXCM offerings align more closely with a genuine ECN or STP model—characterized by direct routing to liquidity providers and transparent commissions—while other accounts may exhibit features that resemble a market maker structure. Ultimately, traders seeking a true ECN environment with FXCM should focus on specific professional or premium accounts, confirm the execution model, and evaluate commission rates.

If you prioritize transparency, tight spreads, and a model with minimal conflict of interest, the ECN-like accounts offered by FXCM could be a strong option. However, always do your due diligence, verify the specific account terms, and consider your trading strategy before making a final decision. Interested in other trading guides or resources? Head back to Invest Hub for more in-depth articles, expert tips, and the latest updates on broker reviews.

FAQs for Is FXCM an ECN broker?

No. FXCM has various account models. Some operate more like an ECN or STP, while others may incorporate aspects of a dealing desk

In theory, a pure ECN or STP model limits broker revenue to commissions and small markups, not trading against clients. However, FXCM may have different structures depending on the account. Always check the specific terms.

Generally, ECN brokers offer tight spreads, transparency, and minimal conflict of interest. Traders also get faster execution. However, they often charge a commission per trade.

ECN accounts may require a higher minimum deposit and typically charge a commission. Spreads can also become volatile during major news events.

No. While an ECN broker provides a more transparent market environment, profitability ultimately depends on market conditions, trader skill, risk management, and overall strategy.

Check if the broker discloses full details about order routing, liquidity partners, and commission structures. Additionally, test the platform during different market conditions to see if performance aligns with what you’d expect from an ECN broker.