Answer: Yes, Interactive Brokers is legal in India, as the company operates through its local entity, Interactive Brokers (India) Private Limited, which is regulated by the Securities and Exchange Board of India (SEBI). This means you can open a trading account and invest in Indian and international markets—subject to certain guidelines and restrictions—legally within the framework of Indian financial regulations. However, the regulatory environment can be complex, especially for those seeking to invest in foreign assets, so it’s important to understand the relevant rules set by SEBI, the Reserve Bank of India (RBI), and the Foreign Exchange Management Act (FEMA) before diving in.

Is Interactive Brokers Legal in India? Exploring the Regulatory Framework

Is Interactive Brokers legal in India? Absolutely. The primary factor determining a broker’s legitimacy in any jurisdiction is local regulation, and As you can read in our Interactive Brokers review, Interactive Brokers is registered with SEBI to offer brokerage services to Indian residents. When a broker meets the requirements set forth by local financial authorities and abides by compliance protocols, it can be considered legal and safe for customers.

SEBI and Other Regulatory Bodies

- SEBI (Securities and Exchange Board of India): Governs securities markets in India. SEBI registration indicates that a brokerage firm follows essential guidelines for transparency and fairness.

- RBI (Reserve Bank of India): Manages foreign exchange and cross-border remittances. Investors looking to use Interactive Brokers for international trading must also comply with RBI guidelines, especially under the Liberalised Remittance Scheme (LRS).

- FEMA (Foreign Exchange Management Act): Outlines rules regarding cross-border currency transactions. FEMA compliance is crucial when transferring funds outside India to invest in foreign assets.

The local presence of Interactive Brokers India Private Limited (IBI) ensures compliance with these regulations. The company details account types, fees, and trading instruments specifically designed for Indian clients.

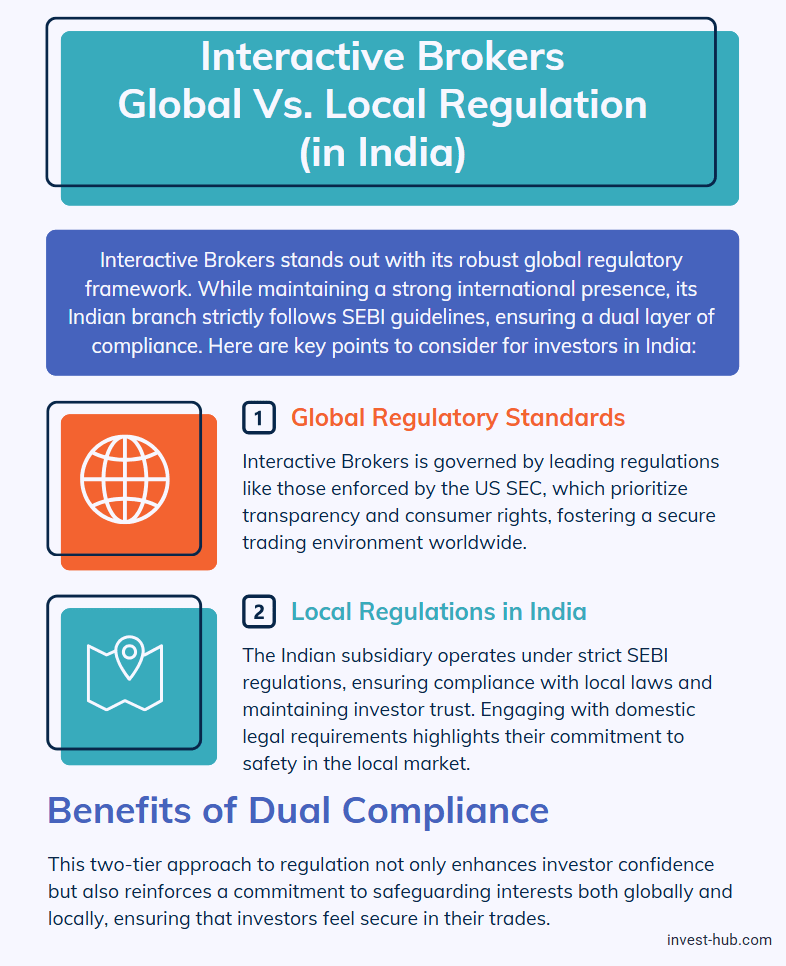

Are Interactive Brokers regulated? Understanding Broker Oversight

Are Interactive Brokers regulated? Yes, Interactive Brokers operates on a global scale and is regulated in multiple jurisdictions. In the United States, the firm is overseen by the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority). In the United Kingdom, it’s regulated by the Financial Conduct Authority (FCA). In India, as mentioned, SEBI is the primary watchdog.

Global vs. Local Regulation

While Interactive Brokers has strong global regulatory credentials, the Indian subsidiary specifically adheres to SEBI rules. This two-tiered approach to compliance—global plus local—offers investors in India added confidence. For instance:

- Global Framework: IB is subject to top-tier regulations like the US SEC, which enforces stringent transparency and consumer-protection norms.

- Local Compliance: The Indian entity must meet Indian regulatory requirements, ensuring that it operates in alignment with domestic laws and norms.

For investors, this combination typically means robust safety measures, segregated client funds, secure technology, and stringent reporting protocols.

Are Interactive Brokers Legit? Evaluating Trustworthiness and Credibility

A common question is, are Interactive Brokers legit? Given its global footprint, long-standing reputation, and multi-jurisdictional regulations, Interactive Brokers is widely recognized as one of the most credible online brokerages.

Track Record and Industry Recognition

- Longevity: Interactive Brokers was founded in 1977, providing decades of operational experience.

- Awards & Accolades: The platform frequently appears in top broker rankings for various categories, including low fees, market access, and trading technology.

- Customer Reviews: Interactive Brokers’ comprehensive range of investment products, competitive fees, and advanced trading interface.

How Does Interactive Brokers Operate in India?

To answer, is Interactive Brokers legal in India? In-depth, it helps to understand how the platform operates within the country.

Local Entity Setup

- Interactive Brokers (India) Private Limited: Serves Indian residents, enabling them to trade on Indian stock exchanges like NSE and BSE.

- KYC (Know Your Customer) Compliance: Prospective clients must complete the standard KYC process. This includes submitting identity and address proofs as required by Indian regulators.

Account Types and Offerings

You can open:

- Individual Account: Ideal for solo traders and investors, allowing access to both Indian and international markets (subject to LRS regulations when funding foreign accounts).

- Joint Accounts, Corporate Accounts, and Others: Varying levels of features for different user needs, though not all account types may be available directly in India.

Trading Instruments

- Indian Stocks and ETFs: Investors can buy equity shares and exchange-traded funds listed on Indian exchanges.

- Bonds and Fixed Income: Access to certain corporate or government bonds, depending on availability.

- US Equities: By transferring funds under LRS, Indian investors can trade or invest in US equities (review local tax implications).

- Forex & Others: Forex trading in India is heavily regulated. IB does offer currency derivatives, but you must ensure compliance with RBI guidelines.

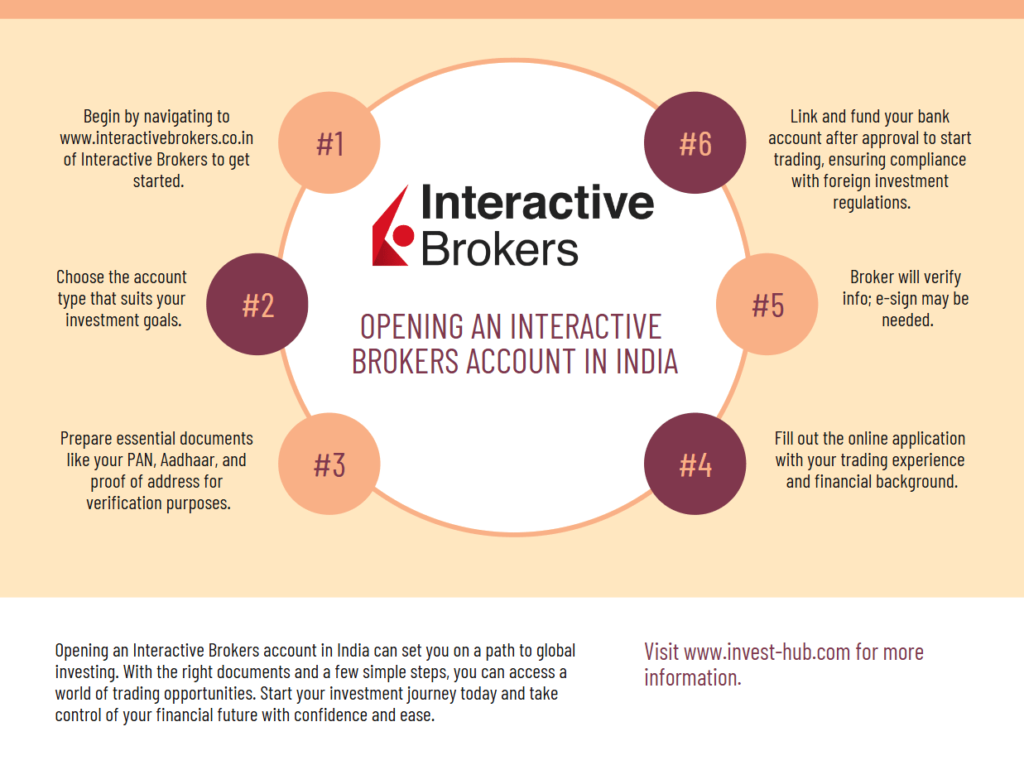

Opening an Interactive Brokers Account in India

If you decide to open an Interactive Brokers account in India, the process is relatively straightforward:

Step-by-Step Registration

- Visit the Official Website: Head to the Indian portal of Interactive Brokers ( interactivebrokers.co.in ).

- Account Selection: Choose the account type (individual, joint, etc.) suited to your needs.

- KYC & Documentation: Provide your PAN (Permanent Account Number), Aadhaar (if applicable), proof of address, and bank details.

- Online Application: Fill out the online form, which includes questionnaires on your trading experience, financial background, and risk tolerance.

- Verification & Approval: The broker will verify your details, often requiring you to e-sign documents. Approval may take a few business days.

- Funding Your Account: Once approved, you can link your bank and fund the account using INR. If you want to invest in foreign markets, you’ll have to comply with the LRS or any other RBI guidelines for outward remittances.

Trading in Global Markets: What Indian Investors Need to Know

One of the biggest attractions of Interactive Brokers is the possibility of trading in global markets. However, you must observe specific Indian regulations to avoid any legal complications.

Liberalised Remittance Scheme (LRS)

- Annual Limit: Under LRS, resident individuals can remit up to a certain limit (commonly USD 250,000 per financial year) outside India for investments, travel, education, or other permitted purposes.

- Paperwork: You’ll need to fill out declarations with your bank before transferring funds abroad. This is typically handled through Form A2.

- Currency Conversion: Converting INR to USD (or other currencies) involves bank charges and forex rates.

Tax Implications

- Capital Gains Tax: Depending on how long you hold the asset (short-term vs. long-term), you’ll need to pay capital gains tax on profits.

- Dividend Income: Dividends from foreign stocks can be subject to both US and Indian taxes (though you may qualify for certain treaties or exemptions, so consult a tax professional).

- Reporting Requirements: Indian residents must disclose foreign assets in their annual tax returns if the total holdings exceed certain thresholds.

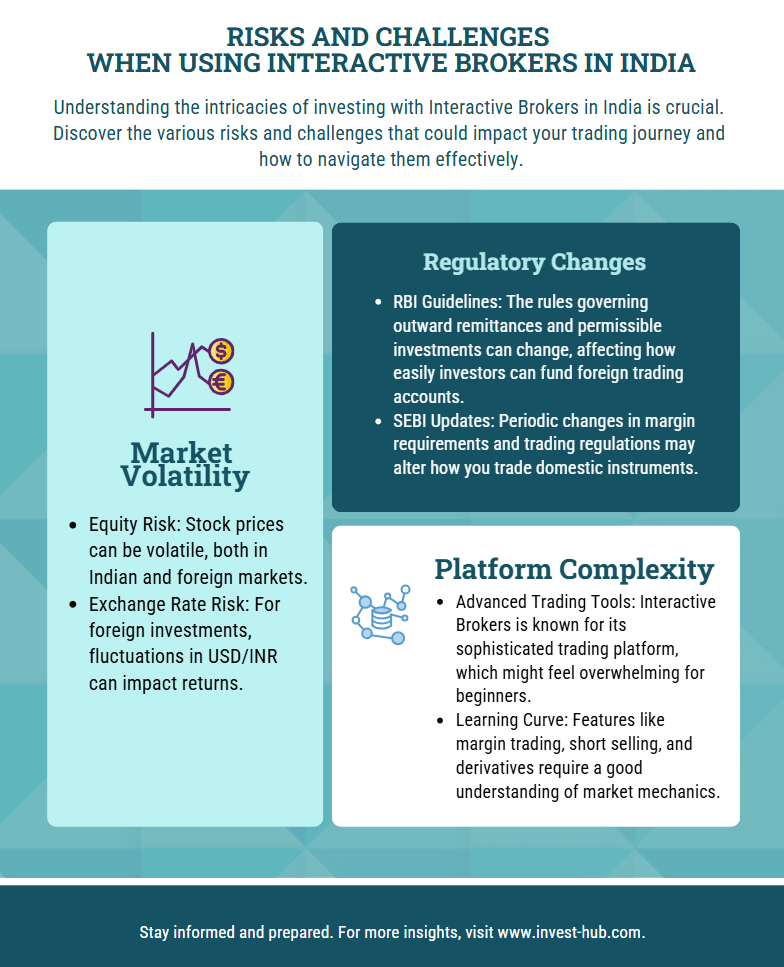

Risks and Challenges When Using Interactive Brokers in India

Even though Interactive Brokers is legal in India, investing always carries some risks. It’s important to be aware of these before making any decisions.

Market Volatility

- Equity Risk: Stock prices can be volatile, both in Indian and foreign markets.

- Exchange Rate Risk: For foreign investments, fluctuations in USD/INR can impact returns.

Regulatory Changes

- RBI Guidelines: The rules governing outward remittances and permissible investments can change, affecting how easily investors can fund foreign trading accounts.

- SEBI Updates: Periodic changes in margin requirements and trading regulations may alter how you trade domestic instruments.

Platform Complexity

- Advanced Trading Tools: Interactive Brokers is known for its sophisticated trading platform, which might feel overwhelming for beginners.

- Learning Curve: Features like margin trading, short selling, and derivatives require a good understanding of market mechanics.

Comparing Interactive Brokers with Other Indian Brokerages

While Interactive Brokers provides extensive market access, many Indian investors compare it to local discount brokerages like Zerodha or Upstox. Here are a few areas to consider:

Fees and Commissions

- Interactive Brokers generally offers highly competitive fees for high-volume traders, especially when trading globally.

- Local brokers may provide lower fees for Indian equity trades but can offer fewer global investment options.

Platform and Tools

- Interactive Brokers: A robust platform loaded with research tools, market data, and advanced charting.

- Local Brokers: Usually simpler interfaces, focusing primarily on Indian markets.

Range of Markets

- Interactive Brokers: Access to US equities, options, futures, ETFs, and certain European or Asian markets, all under one account (subject to LRS for Indians).

- Local Brokers: Often limited to Indian exchanges (NSE, BSE, MCX).

If you’re primarily interested in Indian stocks and prefer a user-friendly interface, you might opt for a local broker. But if global diversification is key, Interactive Brokers is an attractive option. For a deeper dive into fees, market coverage, and user experience across different brokers, check out our broker review page.

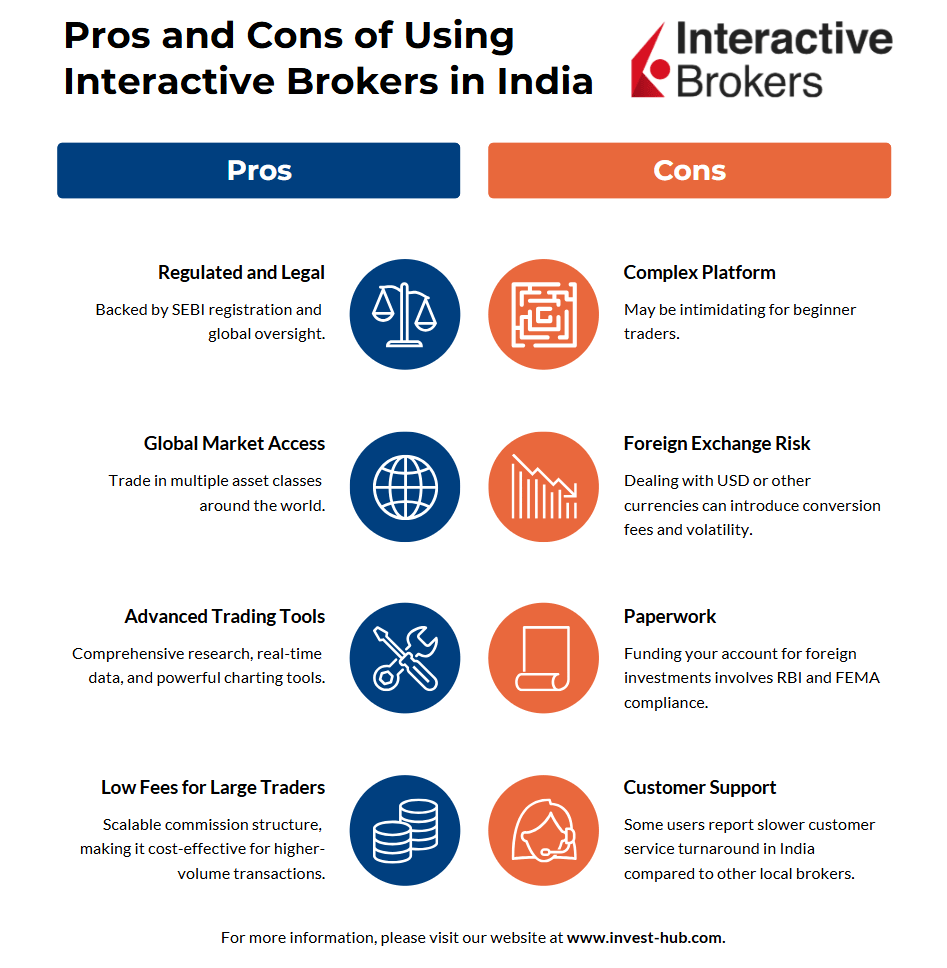

Pros and Cons of Using Interactive Brokers in India

It’s always helpful to summarize the key advantages and drawbacks.

Pros

- Regulated and Legal: Backed by SEBI registration and global oversight.

- Global Market Access: Trade in multiple asset classes around the world.

- Advanced Trading Tools: Comprehensive research, real-time data, and powerful charting tools.

- Low Fees for Large Traders: Scalable commission structure, making it cost-effective for higher-volume transactions.

Cons

- Complex Platform: May be intimidating for beginner traders.

- Foreign Exchange Risk: Dealing with USD or other currencies can introduce conversion fees and volatility.

- Paperwork: Funding your account for foreign investments involves RBI and FEMA compliance.

- Customer Support: Some users report slower customer service turnaround in India compared to other local brokers.

Conclusion

So, is Interactive Brokers legal in India? Absolutely—Interactive Brokers (India) Private Limited is SEBI-regulated and operates fully within Indian law. With a global trading infrastructure, competitive fees, and access to multiple markets, Interactive Brokers is an attractive choice for investors seeking diversification beyond domestic equities. Still, Indian residents must remain compliant with local regulations like FEMA and follow RBI’s guidelines for foreign remittances, particularly under the Liberalised Remittance Scheme. If you’re comfortable with its advanced trading tools and global focus, Interactive Brokers can be a powerful solution for building a well-rounded portfolio.

As always, exercise due diligence and consult a financial advisor or tax professional if you have questions about legal or regulatory obligations. Interactive Brokers offers immense potential, but it’s crucial to stay informed to make the most of its services while staying on the right side of the law.

For more in-depth broker reviews, up-to-date market insights, and expert tips on trading, don’t forget to visit our website invest hub.

Frequently Asked Questions (FAQ)

Yes, Interactive Brokers is legal in India and allows trading in US stocks via the LRS route. You must adhere to RBI regulations for overseas remittances.

Interactive Brokers typically does not impose a very high initial deposit for Indian residents, but you should consult their latest fee schedule and account requirements on their website.

Profits from overseas investments are generally subject to capital gains tax in India. If the investment is in the US market, you might be taxed on dividends at the source as well. Consult a tax professional for personalized guidance.

Yes, day trading is permitted for Indian markets via Interactive Brokers, and you can also day trade in global markets. However, be aware of margin requirements, market hours, and regulations that differ by region.

Interactive Brokers provides customer support via email, phone, and chat. Indian clients can access local support, though some users report it being less immediate than certain domestic discount brokers.

For INR deposits, you can typically do a direct bank transfer. For foreign currency trading, you must comply with LRS guidelines, which involve completing specific paperwork through your bank.