Is Oanda broker legal? In many jurisdictions worldwide, Oanda holds the necessary licenses and adheres to strict regulatory standards—indicating that it is indeed recognized as a legitimate and compliant broker. Various financial authorities, including those in the United States, United Kingdom, Canada, Australia, and other regions, have granted licenses to Oanda. Still, specific rules and restrictions may apply depending on the country of residence. Investors are advised to conduct detailed research on local regulations and consult legal or financial experts before trading.

Is Oanda Broker Legal? Oanda Broker Operative Regions

Oanda is a globally recognized online forex and CFD broker that caters to a diverse range of traders. You can read more about it in the Oanda review. To address the question “Is Oanda broker legal?” on a global scale, it helps to understand the different regulatory bodies overseeing its operations.

- United States: Oanda Corporation is registered with the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA).

- Europe: Oanda Europe Limited is authorized and regulated by the Financial Conduct Authority (FCA) in the UK and complies with the Markets in Financial Instruments Directive (MiFID II) across the European Economic Area.

- Asia-Pacific: Oanda Asia Pacific Pte Ltd is regulated by the Monetary Authority of Singapore (MAS). It also operates under the Australian Securities and Investments Commission (ASIC) licensing for Australian residents.

- Canada: Oanda (Canada) Corporation ULC is regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

These regulatory frameworks ensure that Oanda meets compliance requirements, such as maintaining sufficient capital reserves, adhering to risk management protocols, and observing fair-trading practices.

Key Regulatory Websites and Information

Oanda’s official portals provide information about licenses, compliance standards, and user agreements.

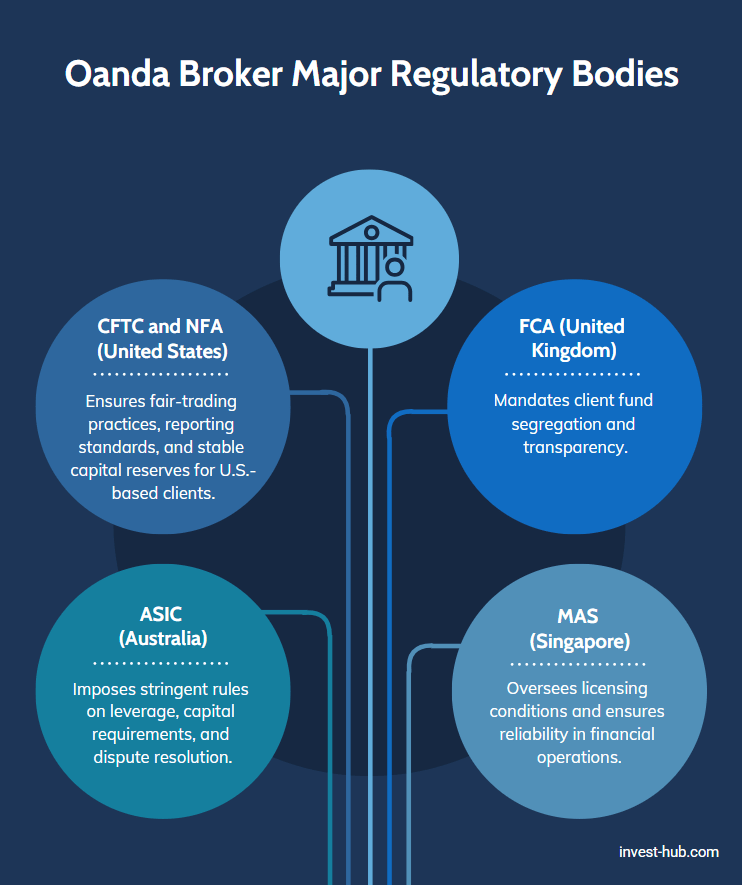

Is Oanda Broker Regulated? Oanda Broker Major Regulatory Bodies

Regulation is a cornerstone for any legitimate brokerage operation. Oanda’s compliance with multiple regulators underscores its serious approach to consumer protection and market integrity.

Major Regulatory Bodies

- CFTC and NFA (United States): Ensures fair trading practices, reporting standards, and stable capital reserves for U.S.-based clients.

- FCA (United Kingdom): Mandates client fund segregation and transparency.

- ASIC (Australia): Imposes stringent rules on leverage, capital requirements, and dispute resolution.

- MAS (Singapore): Oversees licensing conditions and ensures reliability in financial operations.

All these bodies frequently audit licensed brokers to maintain accountability. Traders should confirm that the particular Oanda entity they engage with is licensed to operate in their respective countries.

Is Oanda Broker Legal in India?

One specific question often asked is whether Oanda is legal in India. India has stringent foreign exchange (forex) regulations, overseen primarily by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). While Oanda does not maintain an official physical presence in India, Indian residents can technically open accounts if they meet certain criteria regarding permissible currency trading (e.g., trades are usually allowed in INR-based pairs if routed through recognized exchanges or channels).

- Regulatory Environment: India’s regulatory framework requires brokers to adhere to guidelines aimed at preventing money laundering and unauthorized capital outflows.

- Local Limitations: Residents may face restrictions when funding trading accounts in foreign currencies. Individuals should check local laws to ensure compliance.

Important Note: This information is not legal advice. Individuals in India should consult financial professionals or legal experts to confirm the exact regulatory standing before trading.

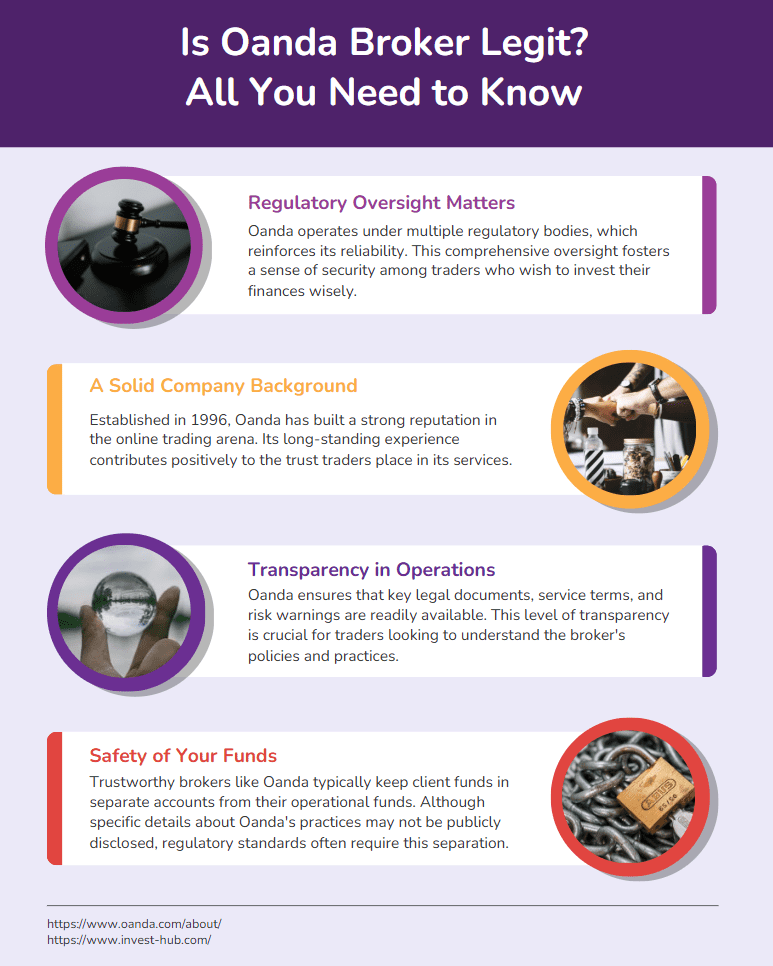

Is Oanda Broker Legit? What makes Oanda a reliable broker

When evaluating the legitimacy of a broker, traders often look at several criteria: regulatory oversight, corporate reputation, financial transparency, and the security of client funds. In the case of Oanda:

- Regulatory Oversight: As mentioned, Oanda is regulated in multiple jurisdictions. This multi-regional oversight enhances its credibility.

- Corporate Reputation: Founded in 1996, Oanda has a relatively long history in the online brokerage industry, which helps bolster its image as a stable and experienced broker.

- Financial Transparency: Oanda publishes legal documents, terms of service, and risk disclosures, making its operations fairly transparent.

- Client Fund Security: Reputable brokers segregate client funds from operating capital. While not explicitly detailed in public sources, Oanda’s regulatory affiliations typically mandate segregated accounts.

What Makes a Broker Legit?

- Proper licensing in the region of operation

- Positive industry reputation

- Compliance with global Know Your Customer (KYC) and Anti-Money Laundering (AML) standards

- Transparent fee structures and reliable customer support

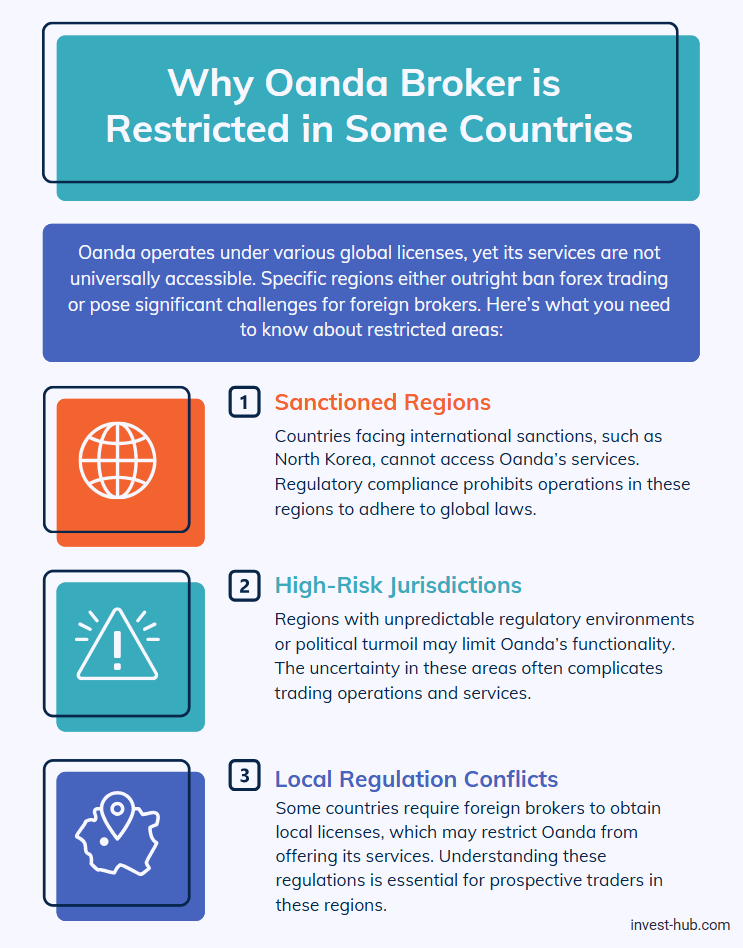

Oanda Broker Restricted Countries

Even though Oanda holds multiple global licenses, it is not available everywhere. Certain jurisdictions either ban forex trading outright or impose barriers to foreign brokers.

- Sanctioned Regions: Countries under international sanctions (e.g., North Korea) will find Oanda’s services blocked.

- High-Risk Jurisdictions: Nations with uncertain regulatory frameworks or political instability may present challenges for Oanda’s operations.

- Local Regulation Conflicts: Some governments disallow foreign brokers from providing services without a locally issued license.

Checking for Your Country

Oanda provides detailed lists or disclaimers on its official regional websites specifying the jurisdictions in which it cannot operate. You can review these notices under the “where-we-are” section to determine your country’s status.

Additional Considerations for Traders

When asking, “Is Oanda broker legal?” it’s beneficial to look beyond legality and also examine:

- Trading Fees: Spreads, overnight charges, and withdrawal fees affect overall profitability.

- Platform Technology: Oanda is known for its proprietary platforms and compatibility with MetaTrader 4.

- Customer Support: Availability of multilingual support and multiple contact channels is crucial for resolving issues.

- Fund Deposits & Withdrawals: Options can vary depending on the country of residence—commonly bank transfers, credit cards, or e-wallets.

For more insights, see broker review to learn about fees and platform features of more brokers in detail. You can also return to our website invest-hub.com at any time for broader financial market updates.

Conclusion

Is Oanda broker legal? The short answer is yes, in most regions that enforce clear regulatory guidelines for forex and CFD trading. Oanda’s status as a regulated broker in the U.S., UK, Canada, Australia, Singapore, and other regions demonstrates a robust commitment to compliance. However, certain local restrictions apply, and prospective clients should always verify specific country regulations and consult professional advice when in doubt. As one of the pioneers in online currency trading, Oanda continues to maintain its reputation through a blend of technological innovation, transparent fee structures, and global compliance efforts.

FAQ

No. Although Oanda operates in multiple regions, certain countries restrict foreign brokers due to local regulations or international sanctions.

In line with international regulatory standards, Oanda typically keeps client funds in segregated accounts. This practice reduces risks associated with broker insolvency.

While technically possible, Indian residents must comply with RBI and SEBI guidelines on forex trading. Always consult a financial expert to verify whether your specific trading strategy is permissible.

Oanda is regulated by the CFTC and is a member of the NFA. This ensures strict requirements around reporting, fair trading, and financial stability.

Oanda does not always specify a strict minimum deposit for standard accounts, but funding requirements can vary by region. Check Oanda’s official regional site for local conditions.

Visit Oanda’s “Legal Information” pages for the relevant region or consult your local financial regulatory authority to confirm the broker’s status.