Is StarTrader legit? Yes, StarTrader has regulatory credentials, a growing international presence, and generally positive user feedback, suggesting it is a legitimate broker. However, the decision to invest with any broker goes beyond simple legitimacy. In this article, we’ll examine StarTrader’s background, regulation, trading conditions, and user experiences to help you decide whether it fits your trading goals.

Understanding StarTrader

StarTrader is an online brokerage firm offering various financial instruments, including forex, commodities, indices, and cryptocurrencies. Their focus on user-friendly technology is designed to serve both novice and experienced traders.

- Founded: StarTrader, founded in 2012, was established with the goal of combining technological innovation and competitive trading terms.

- Services: The broker provides multiple account types, funding methods, and trading platforms for diverse client profiles.

- Growth and Recognition: StarTrader has expanded its global footprint and earned a reputation in different markets, including regions in Asia and beyond.

Quick Facts

| Category | Details |

| Headquarters | Multiple offices worldwide |

| Regulated By | Regulated in certain jurisdictions |

| Key Markets | Forex, CFDs, Indices, and Commodities |

| User Base | Global: suits beginners & pros |

| Website | StarTrader.com |

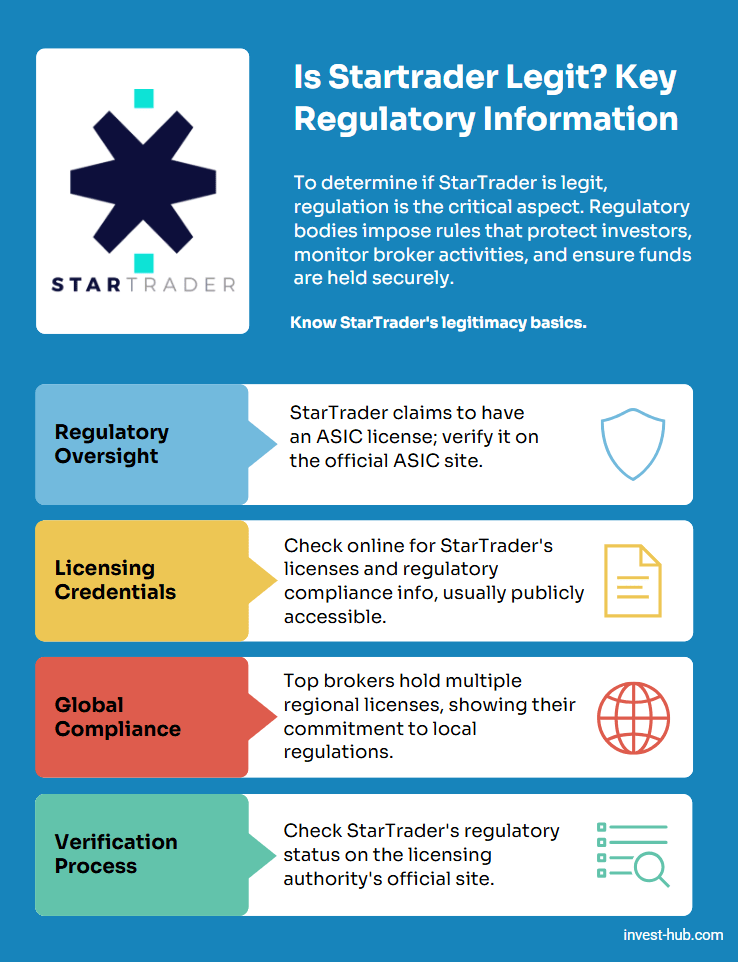

Is StarTrader legit? Key Regulatory Information

To determine if StarTrader is legit, regulation is the critical aspect. Regulatory bodies impose rules that protect investors, monitor broker activities, and ensure funds are held securely.

- Regulatory Oversight

- StarTrader claims to have secured an ASIC license, but this should be independently verified on the ASIC official website.

- Regulation by recognized bodies helps confirm the broker’s legitimacy, as it must adhere to strict financial and ethical standards.

- Licensing

- If you check online sources, you’ll find information related to its licenses and the status of its regulatory compliance.

- Brokers often display their license numbers or authorizations on their official websites. StarTrader provides some of these details in the “About Us” or “Legal” sections.

- Global Offices

- A truly global broker typically has multiple regulatory registrations. This is a sign of legitimacy, as each region can demand compliance with local laws.

- Regulatory Verification

- You can verify a broker’s regulation status by visiting the official website of the licensing authority (e.g., ASIC) and searching for the broker’s name or license number.

By holding reputable regulatory credentials and making them publicly accessible, StarTrader showcases that it is more than just a name—it is operating within recognized legal frameworks. Nonetheless, always conduct personal due diligence, as a license alone does not guarantee investment success. For more information, You can read Startrader’s legal documents.

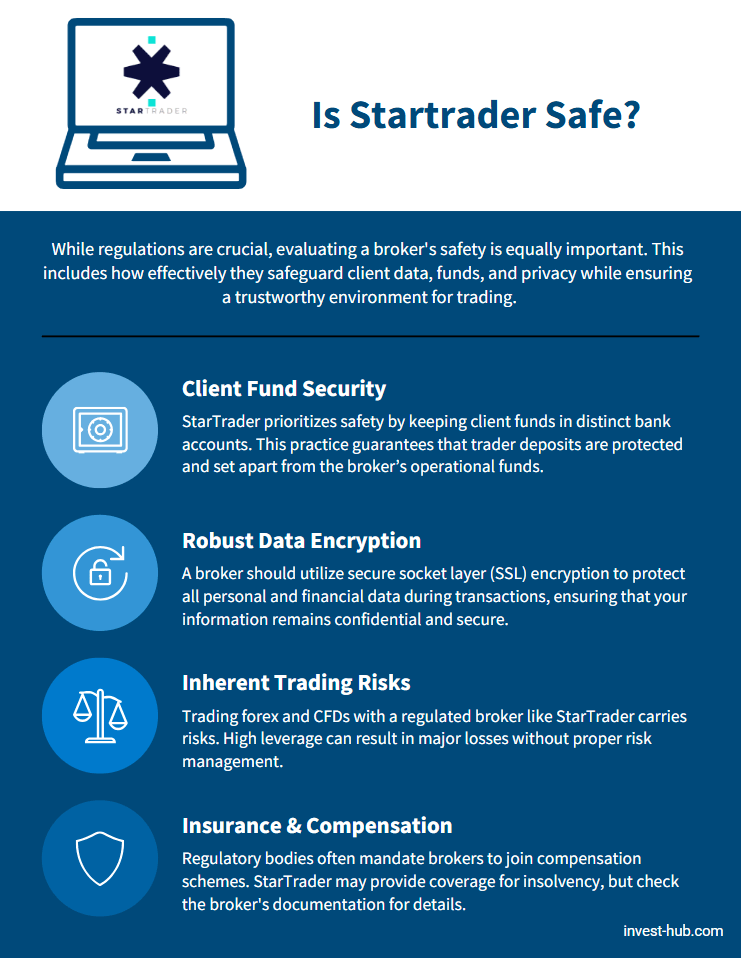

Is StarTrader Safe? Security Measures

Beyond mere legality, a broker’s safety profile involves how it protects client data, funds, and privacy.

- Segregated Client Funds

- Reputable brokers, including StarTrader, often keep clients’ funds in segregated bank accounts. This ensures company operational funds are separate from trader deposits.

- Data Protection

- Any broker claiming to be safe should use SSL (secure socket layer) encryption to safeguard personal and financial data during transmissions.

- Risk Management

- Even though the broker may be regulated and safe, forex and CFD trading carry inherent risks. Losses can exceed deposits if leverage is high and risk management strategies are not in place.

- Insurance Policies

- Some top-tier regulators require brokers to contribute to compensation schemes. Depending on the jurisdiction, StarTrader may have coverage that protects traders in case of insolvency, but verify these details in the broker’s documentation.

You can find any broker review on Invest Hub to check their security mesures.

Is StarTrader legit? StarTrader’s Reputation Among Traders

Social proof and user feedback also help clarify whether StarTrader is trusted.

- Trustpilot Reviews:

The company’s profile shows various user experiences, both positive and negative. Look for comments on execution speed, withdrawals, and overall satisfaction. - ForexpeaceArmy:

Another well-known platform for broker reviews is ForexpeaceArmy. Check user forums and feedback to see if any major, unresolved complaints exist. - Broker-Review Websites:

Independent broker comparison platforms, such as Invest Hub, often provide insight on fees, ease of use, and support.

Summarizing Community Feedback

Overall, StarTrader’s reputation is mixed but leans positive. Many traders highlight quick withdrawals, strong customer support, and user-friendly platforms. Negative remarks typically revolve around high spreads during volatile times or misunderstandings about bonus conditions.

Pro Tip: Always review multiple sources. A single negative or positive comment should not be your sole determinant.

Funding and Withdrawals

One of the key questions when evaluating StarTrader legit centers on how reliable its deposit and withdrawal processes are.

- Funding Methods

- As of 2025, StarTrader Funding may offer various deposit methods, which could include bank transfers, credit/debit cards, and e-wallets, depending on your region. However, available methods may have changed since this information was last updated. Multiple channels often signal a broker’s established partnerships and can be a mark of credibility.

- Withdrawal Speed

- The broker claims to process withdrawals efficiently, though actual times vary by method. Bank transfers may take longer due to standard bank processing delays, whereas e-wallets could be faster.

- Fees

- Deposit and withdrawal fees can apply based on the chosen payment method. Check the Startrader’s “Fees” or “Funding” section for up-to-date information.

- Transaction Limits

- Minimum and maximum deposit or withdrawal amounts might apply. Keep these in mind to avoid inconvenient surprises.

Transparency around funding details often indicates a serious broker. Issues like hidden fees or extremely slow withdrawals can be red flags. In StarTrader review, you can generally find StarTrader’s deposit and withdrawal processes straightforward.

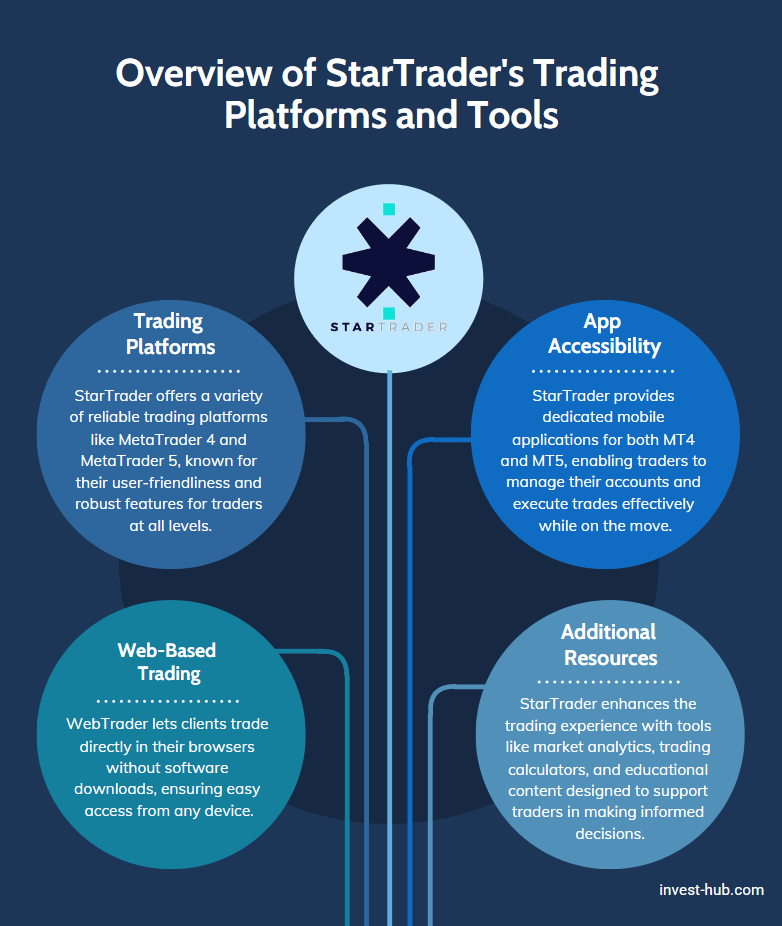

Trading Platforms and Tools

A legit broker typically offers stable, well-known platforms for executing trades. StarTrader provides a few options, commonly including:

- MetaTrader 4 (MT4)

- A standard across many brokers, MT4 offers advanced charting, technical indicators, and automated trading via Expert Advisors (EAs).

- MetaTrader 5 (MT5)

- An upgraded version of MT4 with additional technical analysis tools, more timeframes, and advanced order types.

- WebTrader

- Web-based platforms allow you to trade from any device with an internet browser, eliminating the need for software installation.

- Mobile Trading

- StarTrader likely has MT4/MT5 mobile apps for on-the-go trading. Check your device’s app store for official versions.

In addition to platforms, some brokers offer trading calculators, market analytics, and educational resources. These features cater to all traders, from novices seeking knowledge to experienced traders fine-tuning strategies.

Costs, Fees, and Commissions

Understanding StarTrader’s fee structure is vital in deciding whether StarTrader is legit for your trading style.

- Spreads

- StarTrader’s spreads may vary depending on the account type, asset class, and market volatility. A typical spread might be low for major currency pairs but wider for exotic pairs.

- Commissions

- Some account types have zero commission but higher spreads, while others have lower spreads but a per-lot commission. Verify the details on StarTrader’s official site.

- Overnight Financing (Swap)

- If you hold positions overnight, you’ll incur swap fees. Rates differ among instruments and can affect the overall cost.

- Inactivity Fees

- Some brokers charge a fee if your account remains dormant for a specific period. Always read the “Terms and Conditions” to avoid unexpected costs.

Quick Fee Comparison Table

| Fee Type | StarTrader’s Typical Range | Notes |

| Spreads | Variable, starting ~0.0 pips on some accounts | May widen during volatile market events |

| Commission | $0 to ~$7 per lot | Depends on the account type and asset class |

| Swaps | Varies by instrument & overnight rates | Check daily swap updates in the trading platform |

| Inactivity | Check T&Cs | Some accounts may waive this fee |

Pros and Cons of StarTrader

No broker is perfect, and understanding the pros and cons helps you see if StarTrader aligns with your needs.

Pros

- Regulatory Credentials: Securing an ASIC license indicates credibility and compliance.

- Multiple Platforms: Offers MT4, MT5, and potentially web-based solutions.

- Wide Range of Instruments: Forex, commodities, indices, and cryptocurrencies.

- Flexible Funding Methods: Various deposit and withdrawal options.

- User Feedback: Generally positive reviews on major sites.

Cons

- Limited Regulatory Coverage in Some Regions: Depending on where you reside, local oversight may differ.

- Spread Widening: Spreads can widen during high-volatility events.

- Potential Learning Curve: Beginners may find advanced platforms like MT5 overwhelming initially.

- Account Minimums: Some advanced account types may require higher initial deposits.

Conclusion: Is StarTrader Legit?

So, is StarTrader legit? Based on the available information as of our last update, StarTrader appears to have some regulatory oversight and positive trader feedback. However, potential traders should independently verify current regulatory status and recent user experiences before considering StarTrader as a legitimate broker. It provides a range of account types, trading tools, and educational resources suited to both newcomers and experienced traders. However, as with any investment, the onus is on you to conduct thorough research, demo-trade first if possible, and evaluate whether StarTrader’s specific features match your trading objectives.

Ultimately, regulation, transparency in fees, and user reviews give StarTrader a trustworthy standing in the competitive world of online trading. But remember that all trading involves risk, and it’s crucial to manage that risk with proper strategies.

Is StarTrader legit? FAQs

Yes, StarTrader holds regulatory licenses such as an ASIC license, a respected financial authority that enforces strict guidelines on brokers.

You can check StarTrader’s license details on the ASIC website or review aggregator sites.

StarTrader offers user-friendly platforms and educational resources, making it a viable option for beginners. However, new traders should start with a demo account to practice strategies.

Minimum deposit requirements vary by account type. Visit StarTrader’s official website or contact their customer support to confirm current figures.

Withdrawals are typically processed via the same method used for deposits. Depending on your location and chosen payment channel, processing times and fees may vary.

Yes, StarTrader provides crypto CFD trading alongside forex, commodities, and indices. Check their platform for specific coin availability and associated spreads.