Is TIOmarkets a regulated broker? — Yes. The TIOmarkets group holds three active licenses: FCA (UK) ref 488900, CySEC (EU) license 429/23, and M.I.S.A. (Mwali) license T2023224, giving the firm multi-jurisdictional oversight and investor-protection layers up to £85,000 in the UK and €20,000 in the EU. You can read our TIOmarkets Review for more information.

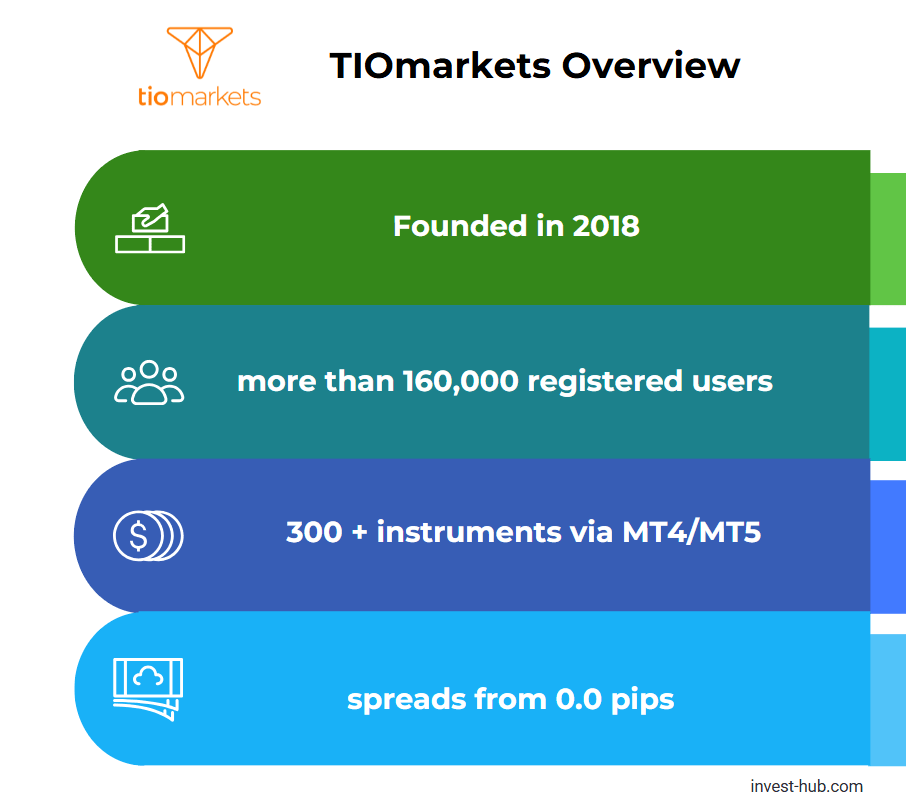

TIOmarkets at a Glance

Founded in 2018, TIOmarkets today serves more than 160,000 registered users and offers 300 + instruments via MT4/MT5, spreads from 0.0 pips, and leverage tiers that differ by regulatory regime. The brand operates three legal entities—UK, EU, and Mwali—coordinated from Cyprus.

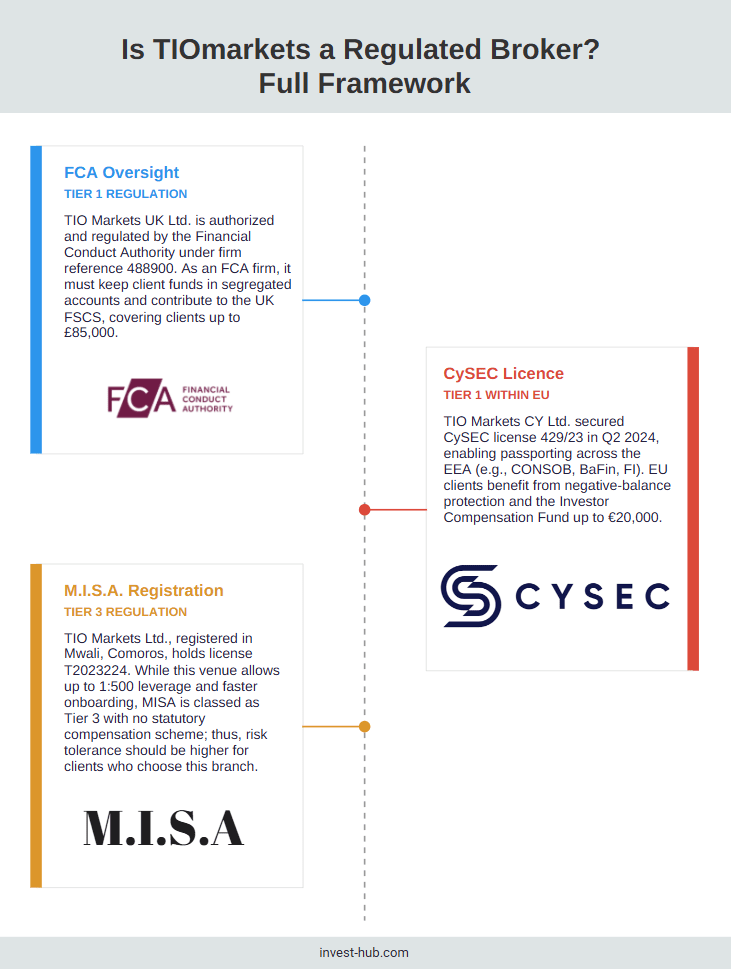

Is TIOmarkets a Regulated Broker? Full Framework

FCA Oversight (Tier 1)

TIO Markets UK Ltd. is authorized and regulated by the Financial Conduct Authority under firm reference 488900. As an FCA firm, it must keep client funds in segregated accounts and contribute to the UK FSCS, covering clients up to £85,000.

CySEC Licence (Tier 1 within EU)

TIO Markets CY Ltd. secured CySEC license 429/23 in Q2 2024, enabling passporting across the EEA (e.g., CONSOB, BaFin, FI). EU clients benefit from negative-balance protection and the Investor Compensation Fund up to €20,000.

M.I.S.A. Registration (Tier 3)

TIO Markets Ltd., registered in Mwali, Comoros, holds license T2023224. While this venue allows up to 1:500 leverage and faster onboarding, MISA is classed as Tier 3 with no statutory compensation scheme; thus, risk tolerance should be higher for clients who choose this branch.

Is TIOmarkets Safe?

Independent reviewers rate TIOmarkets as “trusted” because of its dual Tier-1 licenses and transparent segregation of funds. BrokerChooser’s 2024 safety audit explicitly notes the firm “is not a scam but a legitimate entity” under top-tier regulation.

The FCA requires daily capital-adequacy reporting, while CySEC enforces leverage caps (1:30 retail) and mandatory risk disclosures. The broker also deploys SSL encryption and two-factor authentication and maintains audited statements—key operational controls that lower counterparty risk.

For a broader comparison of regulated venues, see our updated list of the best brokers.

Corporate Structure & Leadership: Who Is the CEO of TIOmarkets?

The group is steered from Cyprus by Group CEO Stefanos Mitsi, a 20-year industry veteran, while Simon Quirke heads the FCA entity in London. Recent hires such as Nick Jay (COO, Jan 2025) and Andreas Skianis (Global Head of Partners) underline a strategy of seasoned leadership expansion.

Management’s European base facilitates consolidated governance across the three licenses and aligns compliance, customer support, and liquidity-provider relationships. Full corporate information is available on the broker’s official TIOmarkets website.

Is TIOmarkets Legit? Reputation & Reviews

2025 reviewer TradingFinder scores TIOmarkets 5/5 for regulation and platform transparency, confirming FCA, CySEC, and MISA status. TradersUnion likewise categorizes the broker as “Tier-1 regulated and highly secure” in its January 2025 dossier.

Trustpilot ratings average 4 stars, with praise for 24/7 chat response and VIP Black zero-commission accounts. Reported negatives focus on offshore leverage enticing high-risk behavior; however, no substantiated fraud claims have emerged in FCA or CySEC warning lists up to April 2025.

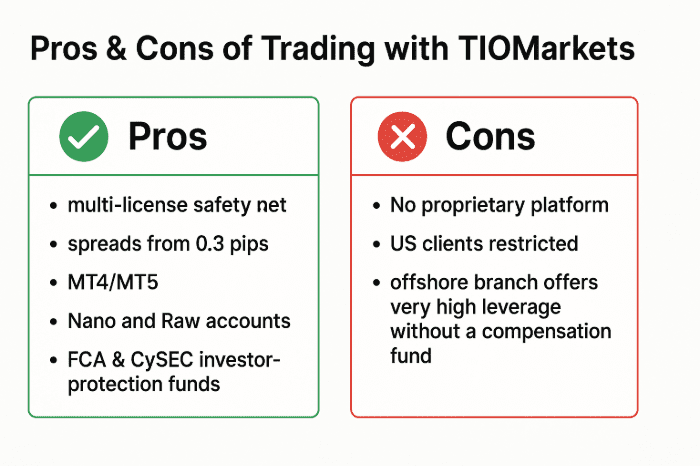

Pros & Cons of Trading with TIOmarkets

Pros—multi-license safety net; spreads from 0.3 pips; MT4/MT5; Nano and Raw accounts; FCA & CySEC investor-protection funds.

Cons—No proprietary platform; US clients restricted; offshore branch offers very high leverage without a compensation fund.

Conclusion on Is TIOmarkets a Regulated Broker?

Is TIOmarkets a regulated broker? Absolutely—holding FCA, CySEC, and MISA licenses, it meets Tier-1 standards in two regions and offers layered investor protection. Its Group CEO, Stefanos Mitsi, oversees a veteran team focused on compliance, while independent audits in 2024–25 corroborate that TIOmarkets is safe, regulated, and legit for most traders, provided leverage is selected in line with personal risk tolerance. Explore more expert research and tools at Invest Hub.

FAQ

Yes, by the FCA under ref 488900.

EU clients trade via CySEC-licensed TIO Markets CY Ltd. and are covered up to €20,000 by the Investor Compensation Fund.

Group CEO is Stefanos Mitsi; Simon Quirke is the UK CEO.

Yes, on its FCA and CySEC entities; offshore accounts may not carry the same safeguard.

No. TIOmarkets explicitly restricts US residents from opening accounts.

Up to 1:30 retail under FCA/CySEC and up to “1:500” under the Mwali entity—extreme caution advised.