In today’s fast-paced financial markets, having the right trading platform can make all the difference between success and frustration. Phillip Sekuritas Indonesia, part of the global Phillip Capital Group network spanning 16 countries since 1975, offers traders a robust solution designed to navigate modern market complexities. The Phillip Capital Trading Platform combines powerful analytical tools, real-time market data, and intuitive interfaces to help both novice and experienced traders make more informed investment decisions.

As digital technologies continue to transform global financial systems, platforms like Phillip Capital stand out by providing access to multiple asset classes while maintaining the security and reliability that serious investors demand. I’ve found their platform particularly valuable for those looking to diversify their portfolio across international markets while maintaining a unified view of their investments.

Key Takeaways

- The Phillip Capital Trading Platform offers comprehensive tools for market analysis backed by a global network operating in 16 countries.

- Real-time data and intuitive interfaces make the platform accessible for both beginning and experienced investors seeking to optimize their trading strategies.

- Technical support and educational resources provide users with ongoing assistance to navigate market complexities and improve investment outcomes.

Key Features of the Phillip Capital Trading Platform

The Phillip Capital Trading Platform combines advanced trading capabilities with user-friendly design to provide a comprehensive solution for traders across global markets. The platform stands out with its multi-asset coverage, customizable interface, and powerful analytical tools.

Multi-Asset Trading Capabilities

The platform offers extensive coverage across multiple asset classes and exchanges. I can trade stocks on major exchanges like NSE and BSE in India, as well as access international markets through a single interface. This global reach eliminates the need for multiple trading accounts.

Futures and options trading is seamlessly integrated, with support for commodity trading on exchanges like MCX. The platform provides real-time data feeds for these markets, ensuring I have the latest information for making trading decisions.

For advanced traders, the platform supports leveraged financial instruments with clear margin requirements and risk parameters. I can easily switch between different asset classes without logging into separate systems.

The fee structure is transparent, with competitive rates for various transaction types and volume-based discounts for active traders.

Read our Phillip Capital Full Review.

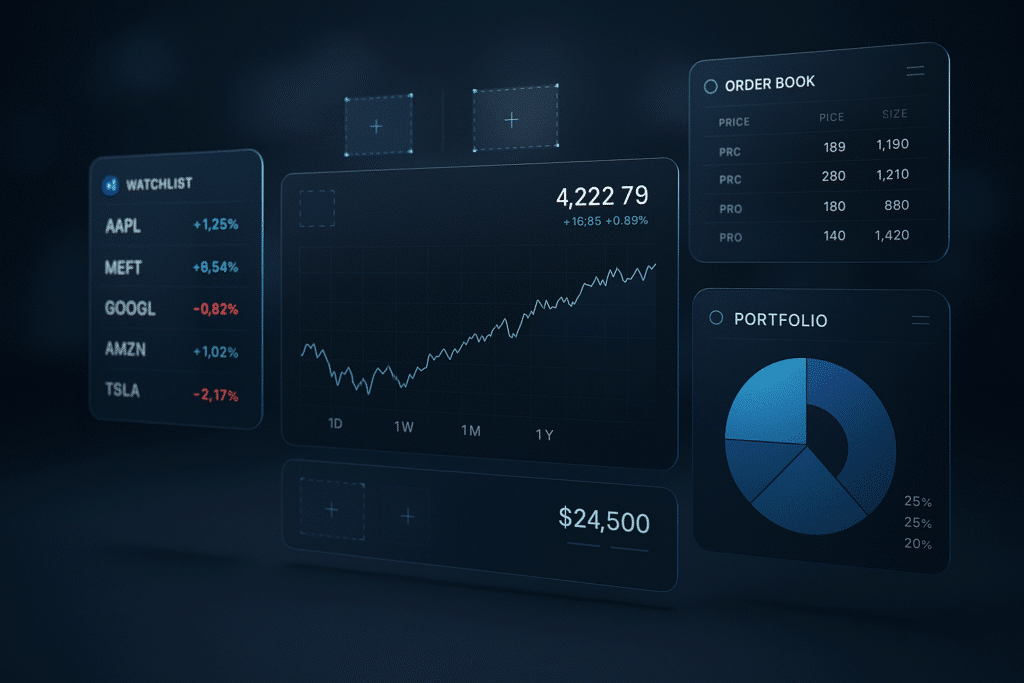

Personalised Interface and User Experience

The customizable dashboard allows me to arrange components according to my trading style. I can create multiple watchlists organized by sector, strategy, or time horizon, making market monitoring efficient.

Quick-access features include:

- Exchange top 30 movers

- Most active securities by volume

- Portfolio performance metrics

- Real-time balance updates

The platform remembers my preferences across sessions, creating a consistent trading experience. Color schemes and alert settings can be personalized to reduce eye strain during extended trading sessions.

Mobile compatibility ensures I can monitor positions and execute trades when away from my desk. The responsive design maintains functionality across different screen sizes without sacrificing essential features.

Integrated Trading and Analytical Tools

The platform incorporates TradingView charts with extensive technical indicators and drawing tools. I can conduct thorough technical analysis without switching to external applications.

Market depth visualization helps identify support and resistance levels through:

- Bid-ask spreads

- Volume at price

- Order book heat maps

Real-time analytics include:

| Tool | Function |

|---|---|

| Options Calculator | Evaluate pricing scenarios |

| Risk Analyzer | Assess portfolio exposure |

| Correlation Matrix | Identify diversification opportunities |

Fundamental data integration provides earnings reports, corporate actions, and news alerts directly within the platform. This comprehensive approach helps me make informed decisions based on both technical and fundamental factors.

Read our Phillip Capital POEMS Platform breakdown.

Platform Innovations and Technology

Phillip Nova and POEMS Global MY 3.0 represent the latest technology upgrades, featuring enhanced security protocols and faster execution speeds. The platform architecture supports high-frequency trading with minimal latency.

API access allows for automated trading strategy implementation and integration with external analysis tools. I can develop and deploy custom algorithms without complex coding requirements.

Cloud-based infrastructure ensures reliable access during peak market volatility. System redundancies prevent downtime during critical trading periods.

Regular software updates introduce new features and security enhancements without disrupting the trading experience. The development team actively incorporates user feedback into platform improvements, making the system more intuitive with each iteration.

Mobile app capabilities mirror desktop functionality, with biometric security for quick and secure access.

Compliance, Resources, and Client Support

Phillip Capital’s trading platform stands on a foundation of regulatory compliance while offering comprehensive resources and responsive client support across global markets.

Regulatory Credentials and Security

Phillip Capital maintains strict adherence to regulatory requirements across multiple jurisdictions. The platform operates with proper licensing including broker-dealer credentials and a Capital Markets Services License in Singapore and other regions where it operates.

I’ve found that Phillip Capital implements robust security protocols to protect client data and assets. Their compliance team regularly updates security measures to address emerging threats in the financial technology landscape.

The platform follows customer identification programs tailored to their business model, a critical requirement from regulatory bodies like FINRA. This helps prevent fraud and ensures compliance with anti-money laundering regulations.

Phillip Capital also maintains compliance with SEBI regulations in India, ensuring their trading services meet local regulatory standards in each market they serve.

Research, Learning, and Market Support

I can access comprehensive research reports through Phillip Capital’s platform that cover various market segments and investment opportunities. These reports help inform my trading decisions with expert analysis and market insights.

The platform regularly hosts webinars and seminars on trading strategies, market trends, and investment opportunities. These educational resources are designed for traders at all experience levels.

Phillip Capital provides real-time market data and analysis tools that help me identify trading opportunities across different asset classes. Their charting tools and technical indicators support both beginner and advanced trading strategies.

Learning resources include on-demand video tutorials, trading guides, and market commentaries that keep me informed about market developments and trading best practices.

Read our Phillip Capital Full Review.

Client Services and Regional Presence

Phillip Capital offers multi-channel support through phone, email, and live chat with representatives knowledgeable about specific markets and trading instruments. Their support team is available during market hours to address trading concerns.

Phillip Capital Malaysia is part of their extensive regional network that includes offices across Asia, North America, Europe, and Australia. This global presence enables localized support tailored to regional market requirements.

I’ve found their client portal provides access to account statements, tax documents, and trading history for portfolio management and reporting purposes.

Their regional experts understand local market nuances and regulatory requirements, offering specialized guidance for trading in specific markets.

Achieving Financial Goals with Phillip Capital

Phillip Capital offers portfolio management services that help align trading strategies with my long-term financial goals. Their advisors work with me to develop personalized investment plans based on my risk tolerance and objectives.

I can use their goal-setting tools to track progress toward specific financial targets and adjust strategies as needed. The platform provides regular portfolio reviews and performance metrics.

Their electronic trading platforms continue to evolve with more sophisticated features that help manage larger order flows cost-effectively.

The platform supports diverse investment strategies including:

- Long-term wealth building

- Active day trading

- Retirement planning

- Sector-specific investments

I can leverage their analytical tools to measure performance against benchmarks and make data-driven adjustments to my trading approach.

Frequently Asked Questions

Phillip Capital provides comprehensive support to help clients navigate their trading journey. The following answers address common questions about account creation, charges, login procedures, app installation, and company information.

I’ll need to fill out the online application form with my personal details, upload required documents for KYC verification (PAN card, Aadhaar, bank statements), and complete the in-person verification process.

After document verification, I’ll receive my login credentials via email and SMS within 1-2 business days.

hillip Capital offers a competitive fee structure for various trading activities. For equity delivery, they charge 0.5% per executed order.

For intraday equity trading and F&O trading, they offer plans starting from ₹20 per order or percentage-based options depending on my trading volume.

Additional charges include securities transaction tax (STT), exchange transaction charges, GST, and SEBI turnover fees which are regulatory in nature and vary by transaction type.

I can log in to my Phillip Capital account by visiting their official website and clicking on the “Client Login” button in the top right corner.

I need to enter my User ID and password that I received during account creation. For added security, they implement two-factor authentication.

If I forget my password, I can click on the “Forgot Password” link on the login page and follow the instructions to reset it using my registered email or mobile number.

The Phillip Capital trading app is available on both Android and iOS platforms. I can download it from the Google Play Store or Apple App Store by searching for “Phillip Capital Trading.”

After installation, I need to open the app and log in using my existing credentials. First-time users will need to complete a one-time setup process.

The app requires permission to send notifications for trade alerts and market updates, which I can manage in my device settings.

Phillip Capital offers diverse career paths in financial markets and related services. Positions typically include roles in trading, analysis, client services, and technology.

They provide opportunities for both experienced professionals and fresh graduates. Job listings are regularly updated on their careers page.

Their recruitment process typically includes an online application, aptitude assessments, technical interviews, and a final HR round.

The management team at Phillip Capital India is headed by the Managing Director who oversees all operations and strategic initiatives in the country.

Key leadership positions include the Chief Executive Officer, Chief Financial Officer, Chief Technology Officer, and heads of various departments like Equity, Derivatives, and Compliance.

The team brings extensive experience from across the financial services industry with many executives having worked at leading global financial institutions before joining Phillip Capital.