In a world where traders constantly seek competitive rates and transparent pricing, Plus500 fees stand out for their simplicity. The platform is primarily known for its commission-free trading, but that doesn’t mean it’s entirely free of charges. From spreads to overnight funding and inactivity fees, there are several cost components to consider. Below is a thorough breakdown of all the key fees and charges on Plus500, helping you make more informed trading decisions.

What Are Plus500 Fees and Charges?

When people ask, “What are Plus500 fees?” they are usually curious about the different ways this broker can bill users. Plus500 is widely known for not charging commissions on most trades, which can be appealing for new and experienced traders alike. Instead, the broker primarily profits through its spreads (the difference between the buy and sell price of a financial instrument). However, there are additional fees and charges that may apply depending on trading activities and account status. You can read more about Plus500 Fees here.

Key points about Plus500 fees and charges:

- Zero Commission on Most Products: Plus500 generally does not impose a separate commission on trades.

- Spread-Based: The main fee typically arises from the spread.

- Other Potential Charges: These include overnight fees, inactivity fees, and currency conversion charges where applicable.

To explore more on official rates, you can visit the official Plus500 website.

How Much Does Plus500 Charge?

Beyond spreads, many traders want to know, “How much does Plus500 charge?” The short answer is that charges depend on how you use the platform. For instance:

- Overnight Funding (Swap): If you hold positions overnight, you may incur an overnight funding fee, also known as a swap or rollover charge.

- Currency Conversion: If you trade in a currency different from your account currency, conversion fees may apply.

- Guaranteed Stop Orders: When you set a guaranteed stop order to cap your losses, you may encounter wider spreads in exchange for the added security.

All these factors collectively determine your total costs on Plus500. Remember, while commission-free trading sounds attractive, other fees could apply, so budgeting for such is crucial.

Understanding Plus500 Spreads

One of the most critical aspects of Plus500 fees is the spread. The spread is essentially the difference between the “Ask” (buy) and “Bid” (sell) price of a given instrument. This cost is automatically factored into your trade when you open or close a position.

- Variable Spreads: On many instruments, including popular forex pairs like EUR/USD or commodities like gold, spreads can be variable. They may widen during times of high volatility or when market liquidity is low.

- Fixed Spreads: Spreads are variable for all instruments and may widen during periods of low liquidity or high volatility, providing more certainty about your transaction costs.

Traders who execute numerous trades in a single day or week should pay close attention to spread values, as even small differences can accumulate over multiple transactions.

Plus500 Minimum Deposit Requirements

Understanding the Plus500 minimum deposit is another step toward setting up your account and managing costs. Generally, the platform has a relatively low minimum deposit threshold. While the exact minimum can vary by region and payment method, it’s often in the range of 100 to 200 USD (or the equivalent in other currencies).

- Credit/Debit Card Deposits: Usually one of the fastest methods, though local regulations and card policies can influence the minimum deposit.

- Bank Transfers: These may have slightly higher minimum deposits, and processing times can be longer.

- Electronic Wallets: Options like PayPal or Skrill often allow convenient transactions with similar minimum requirements.

If you’d like a deeper dive into various broker offerings, take a look at Invest Hub, where we discuss multiple platforms and their financial requirements.

Additional Fees and Charges on Plus500

While spreads and overnight funding are significant, there are other Plus500 charges traders should be aware of:

- Inactivity Fee

- Plus500 charges an inactivity fee if you do not log in to your trading account for a certain period (often three months). A $10 monthly inactivity fee is charged after three months of account dormancy until you reactivate your account or the balance reaches zero.

- If you’re a long-term investor who doesn’t trade frequently, consider periodically logging in to avoid this charge.

- Plus500 charges an inactivity fee if you do not log in to your trading account for a certain period (often three months). A $10 monthly inactivity fee is charged after three months of account dormancy until you reactivate your account or the balance reaches zero.

- Guaranteed Stop Order Fee

- A guaranteed stop order ensures your position closes at a specified price even if the market moves against you abruptly. Because of the added protection, Guaranteed stop orders incur a premium fee (e.g., 0.3% of the position value) for added protection, resulting in slightly higher trading costs.

- A guaranteed stop order ensures your position closes at a specified price even if the market moves against you abruptly. Because of the added protection, Guaranteed stop orders incur a premium fee (e.g., 0.3% of the position value) for added protection, resulting in slightly higher trading costs.

- Currency Conversion Fee

- When your trading instrument’s currency differs from your account currency, Plus500 may apply a currency conversion cost on realized net profits and losses. This fee might appear small on individual trades but can accumulate over time.

- When your trading instrument’s currency differs from your account currency, Plus500 may apply a currency conversion cost on realized net profits and losses. This fee might appear small on individual trades but can accumulate over time.

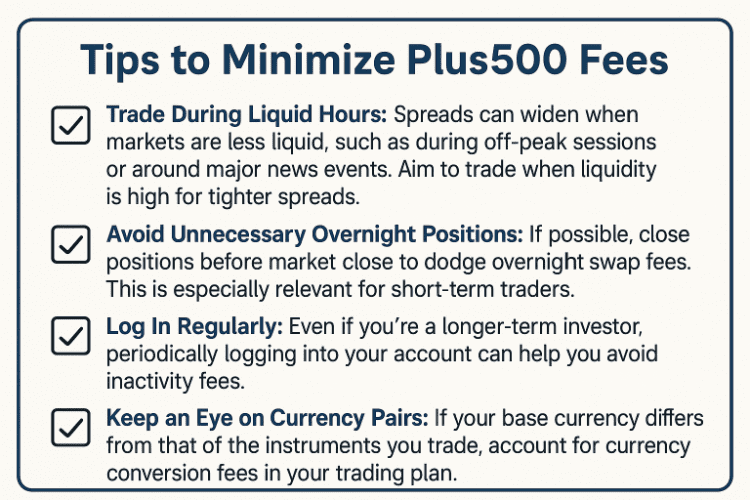

Tips to Minimize Plus500 Fees

Reducing how much Plus500 charges you often boils down to making informed decisions:

- Trade During Liquid Hours: Spreads can widen when markets are less liquid, such as during off-peak sessions or around major news events. Aim to trade when liquidity is high for tighter spreads.

- Avoid Unnecessary Overnight Positions: If possible, close positions before market close to dodge overnight swap fees. This is especially relevant for short-term traders.

- Log In Regularly: Even if you’re a longer-term investor, periodically logging into your account can help you avoid inactivity fees.

- Keep an Eye on Currency Pairs: If your base currency differs from that of the instruments you trade, account for currency conversion fees in your trading plan.

For additional strategies on cutting down trading expenses, you can check out our best brokers reviews, where we delve into cost-effective trading tips across multiple platforms.

How Plus500 Handles Commissions

One reason traders gravitate toward Plus500 is the absence of a traditional commission structure on most trades. Unlike some brokers that charge a flat fee or a percentage per transaction, Plus500 typically includes its profit margin in the spread.

- No Fixed Commission on Forex, Indices, and Commodities

- Commission-Free Stock and ETF CFDs: Plus500 offers CFDs (contracts for difference) on stocks and ETFs in some regions, with costs embedded in spreads, though local regulations may affect availability.

- Cost Visibility: Because everything is wrapped into the spread, you can often see your total estimated cost right on the trading interface.

If you want a more detailed breakdown, be sure to visit our plus500 broker review, which provides an in-depth analysis of its fee structure alongside other broker comparisons.

Funding and Withdrawal Charges

Deposit Fees

Plus500 generally does not impose deposit fees for most payment methods. However, your bank or payment provider may charge its own transaction or currency conversion fees. Always verify the specific terms with your financial institution to avoid surprises.

Withdrawal Fees

- Free Withdrawals: Plus500 allows a certain number of free withdrawals within a given month. Exceeding that limit could incur a nominal charge.

- Minimum Withdrawal Amount: If your requested withdrawal is below a certain threshold, a small fee may apply.

Processing Times

- Electronic Wallets: Usually processed within one or two business days.

- Credit/Debit Cards: It Can take several business days for funds to appear in your bank statement.

- Bank Transfers: Typically require the longest processing times, influenced by interbank transfer speeds.

Conclusion

Navigating Plus500 fees doesn’t have to be overwhelming. By understanding spreads, overnight funding, inactivity fees, and other cost elements, you can plan your trades more strategically. Remember to check local regulations and keep up with official updates, as fee structures can change over time. Always weigh the benefits of commission-free trades against possible overnight fees or wider spreads.

Before you finalize any decisions, conduct thorough research and, if needed, consult a financial advisor to ensure that Plus500 aligns with your trading style. Given the inherent risks of leveraged trading, having a comprehensive grasp of all fees and charges helps you preserve capital and optimize returns. If you want to read more information about Plus500, you can click here.

Frequently Asked Questions (FAQ)

Plus500 fees mainly come from spreads, overnight funding (swap) fees, and inactivity charges. The broker does not typically charge direct commissions, bundling most costs into the spread.

If you do not log in for three months, a monthly inactivity fee is deducted from your account balance. The exact amount can vary but is generally a small fixed charge.

Yes, the minimum deposit often ranges from 100 to 200 USD (or equivalent), though it may vary based on your region and the payment method chosen.

Plus500 typically offers a set number of free withdrawals per month. If you exceed that limit or withdraw below a certain threshold, you may pay a small fee.

Most stock CFDs on Plus500 do not carry a separate commission; costs are built into the spread. Some regions, however, may have specific rules or fees, so always check your local regulations.

Trading during peak liquidity hours, closing positions before overnight funding takes effect, and regularly logging in to avoid inactivity fees can help lower your costs.