Which AI tool is best for trading?

Artificial intelligence has now turned into a transformational force in stock trading as the tools leveraging big data analytics identify patterns and execute trades with precision. The participation of AI algorithms in U.S. equity trades has varied over time, as have the estimates, which partly depend on what one means by AI-driven trading. That is how AI revolutionized modern trading by bringing more efficiency and profitability. In such a context, beginners entering stock trading would leverage AI tools to improve their decision-making and probably their trading outcomes. This article examines some of the best AI tools a novice trader could use, including free ones and those available in India.

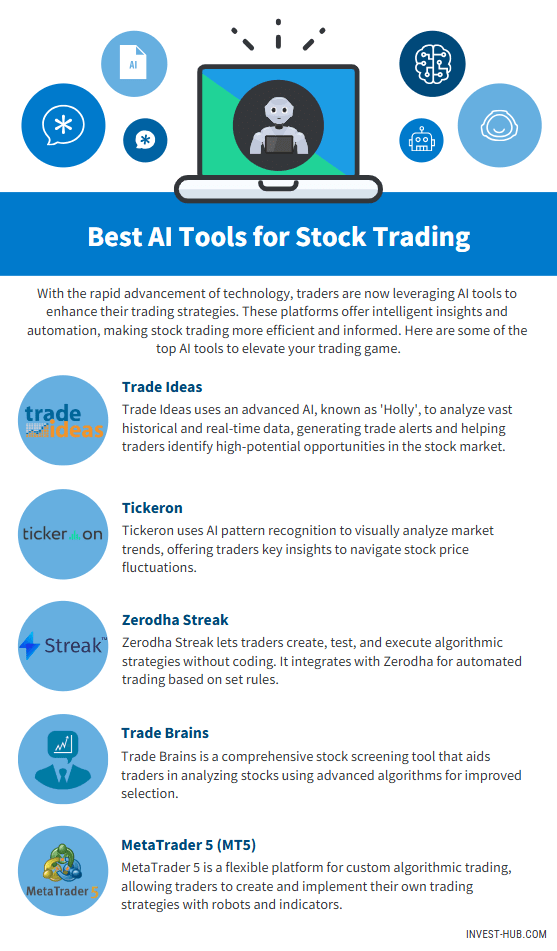

Explore 2025’s top AI tools for stock trading, including Trade Ideas, Tickeron, Zerodha Streak, Trade Brains, and MetaTrader 5, to optimize your strategies.

Understanding AI in Stock Trading

AI in stock trading has undergone rapid evolution in recent decades. Early AI applications in trading during the 1980s were rule-based systems used by hedge funds and institutional investors. In the 1990s and 2000s, the refinement of trading strategies by machine learning models led to an improvement in the sphere of accuracy and efficiency. One of the most popular early examples is Renaissance Technologies, which pioneered quantitative trading using AI-driven models. Nowadays, AI keeps on changing stock trading with the inclusion of deep learning, neural networks, and real-time data analysis to execute trades with much greater precision.

AI in stock trading makes use of algorithms and machine learning models that analyze market data, predict trends, and perform certain aspects of automated trading. Such tools can process information at speeds and accuracies beyond human capabilities, thus helping traders by providing insights into the market movements on which to make informed decisions. AI-driven trading tools are being used by hedge funds, institutional investors, and retail traders alike.

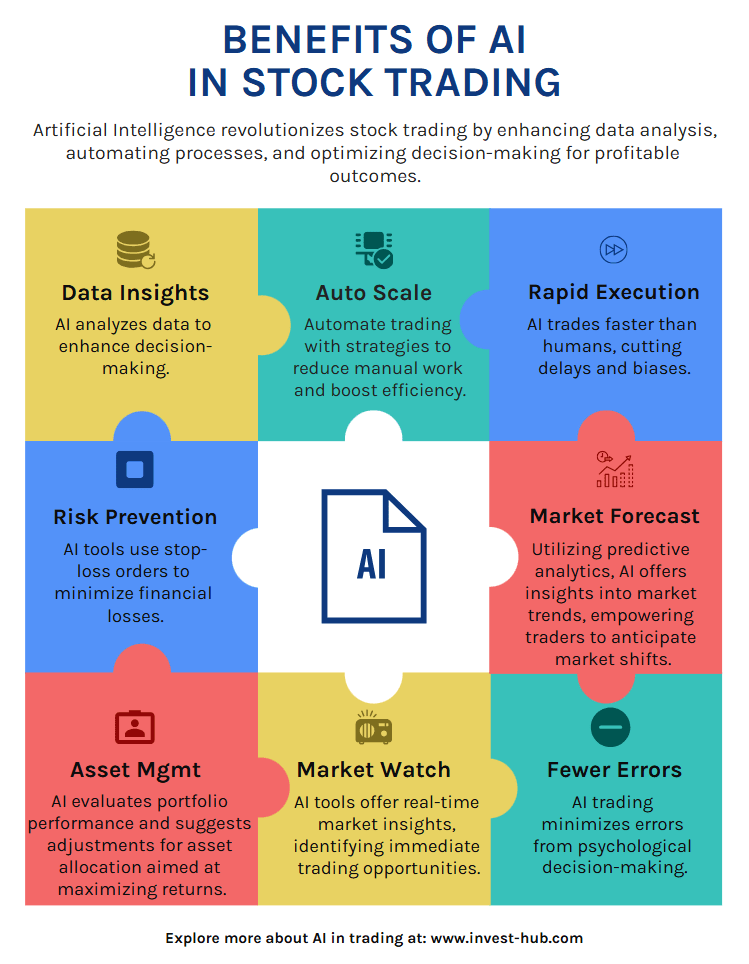

Benefits of AI in Stock Trading

- Data Analytics: AI analyzes large volumes of historical and real-time data to identify patterns that improve the speed and precision in making decisions.

- Automation: It allows trading automation using previously defined strategies, reducing human effort and increasing efficiency.

- Speed and Accuracy: Performs trading at faster speeds than any human trader, hence minimizing delays and emotional biases associated with investment decisions.

- Risk Management: The AI-powered tools may use stop-loss orders and risk assessment models to minimize further losses.

- Market Prediction: It uses predictive analytics to provide insights into market trends that will help traders understand when the market is likely to change.

- Portfolio Optimization: AI can analyze portfolio performance and recommend asset allocation adjustments to maximize returns.

- Real-time Market Insights: AI-powered analytics tools monitor market conditions constantly, identifying real-time trading opportunities.

- Elimination of Human Error: AI-driven trading reduces the chances of making mistakes due to psychological influences.

Top AI Tools for Stock Trading

1. Trade Ideas

Trade Ideas is a leading AI-powered platform that offers real-time stock scanning and alerts. The AI, named ‘Holly,’ finds potential trades by running complex algorithms on vast amounts of historical data combined with current market conditions.

Trade Ideas features include:

- Real-time alerts for potential trades based on AI predictions.

- Backtesting of trading strategies to evaluate past performance.

- Simulated trading environment for practicing trading before actually executing a trade.

- AI-powered stock scanning tools to identify the next great opportunity.

- Customizable trading strategies that adapt to market fluctuations.

Trade Ideas is especially good for beginners because it has a very friendly interface and educational resources. However, it is a premium service and requires subscriptions.

2. Tickeron

Tickeron offers AI-powered pattern recognition and predictive analytics. It provides visual trend analysis that helps traders understand the market fluctuations.

Tickeron’s key features include:

- Pattern search engine to identify and predict trading patterns in real-time.

- AI-generated trade ideas to support informed decision-making.

- Being able to backtest the AI predictions against historical trends.

- A customizable AI advisor to provide trading recommendations based on predefined parameters.

- Integration with brokerage for automatic execution of trades.

Tickeron has both free and premium services, making it accessible for beginners who want to get a feel for AI-driven trading insights.

3. Zerodha Streak

Zerodha Streak Streak is a platform for strategy creation, backtesting, and deploying algorithmic trading strategies without any coding. It integrates with Zerodha’s brokerage service to enable automated trading based on pre-set conditions. It will seamlessly integrate with the brokerage service of Zerodha to enable automated trading on pre-set conditions.

Zerodha Streak features include:

- Strategy creation with a user-friendly, no-code interface.

- Real-time alerts and notifications of trade opportunities.

- Extensive backtesting with historical data analysis in order to fine-tune strategies.

- Cloud-based execution for seamless trade management.

- AI-powered stock-picking and risk assessment tools.

Most Indian traders would like using Zerodha Streak, and it is free as well for new users.

4. Trade Brains

Trade Brains is a comprehensive stock screener and analysis platform that helps traders filter stocks according to fundamental and technical data. It uses advanced algorithms to identify high-potential stocks, simplifying the process of stock selection.

Trade Brains features:

- Custom Stock Screeners: It filters stocks according to various criteria set.

- AI-Driven Financial Analysis and Metrics to Better Evaluate Stocks.

- Market sentiment analysis to estimate investor confidence.

- Easy-to-use portfolio tracking and management tools.

- Learning resources for beginners in AI-based trading.

Trade Brains comes with both a free and a premium version; the free one meets all the requirements of beginning traders.

5. MetaTrader 5 (MT5)

MetaTrader 5 is a multi-asset trading platform that supports algorithmic trading through custom-built trading robots and indicators. It allows traders to create and implement their own trading algorithms.

Features of MetaTrader 5 include

- Advanced charting tools with customizable indicators.

- Automated trading capabilities via AI-driven bots.

- Access to multiple financial markets, including forex, stocks, and commodities.

- Expert advisor support for AI-based trade automation.

- AI-assisted risk management tools to minimize losses.

MT5 is free to use, though some features may require payment. It is ideal for beginners looking to delve into algorithmic trading.

Free AI Tools for Stock Trading

Free services for those who are only beginning to familiarize themselves with AI tools are represented by free basic services by Tickeron, a free version of Trade Brains, and MetaTrader 5. The mentioned sites offer their functionality, which helps beginners take their first steps in applying AI strategies in trading. As a rule, free resources lack some additional functionality compared to paid ones, have limited functionality, limited ability for backtesting, fewer timely updates, or poor customer support.

Best Free AI Trading Platforms:

- TradingView: Provides free charting tools and AI-powered market insights; however, it requires a paid plan for more advanced analytics.

- Finviz: Stock screeners are available along with AI-powered analytics, while premium users will have access to more filters along with real-time data.

- Yahoo Finance AI: Offers free stock screening tools and market analysis, with some premium features behind a paywall, like advanced portfolio analysis. While it uses data analytics, it does not specifically advertise AI-driven insights.

- Alpaca AI: free of commission, AI-driven trading, though with limited historical data and execution algorithms, which are available in its paid rivals.

- QuantConnect: an open-source AI-powered trading tool offering free backtesting, although for high-frequency traders, access to cloud computing is usually purchased.

A trader should, therefore, consider his needs in advance of using any free AI tool and decide whether he needs to purchase some premium subscription for the essential additional functionality.

Those would be great options for starters looking for free AI tools: basic services from Tickeron, the free version of Trade Brains, and MetaTrader 5. Each of these resources provides key functionalities to a budding trader in order to experiment with AI-driven trading strategies.

AI Tools for Stock Trading in India

Indian traders have AI tools designed for the local market. For instance, Zerodha Streak and Trade Brains are designed for Indian stocks, while their features and support are more localized. Global platforms such as MetaTrader 5 are also available for Indian users, offering a wide array of trading tools.

Challenges of AI in Stock Trading

While AI trading tools offer immense benefits, they also have their own set of challenges:

- Market Volatility: Unpredictable market changes may be tricky for AI models alone.

- Over-reliance on Data: Historic data does not always predict future movements very well.

- High Initial Cost: Most AI-powered platforms need a premium subscription to get good results.

- Regulatory Concerns: AI-based trading is no exception to financial regulations, which vary by country.

- Cybersecurity Risks: AI-driven trading platforms are potentially vulnerable to being hacked and manipulated.

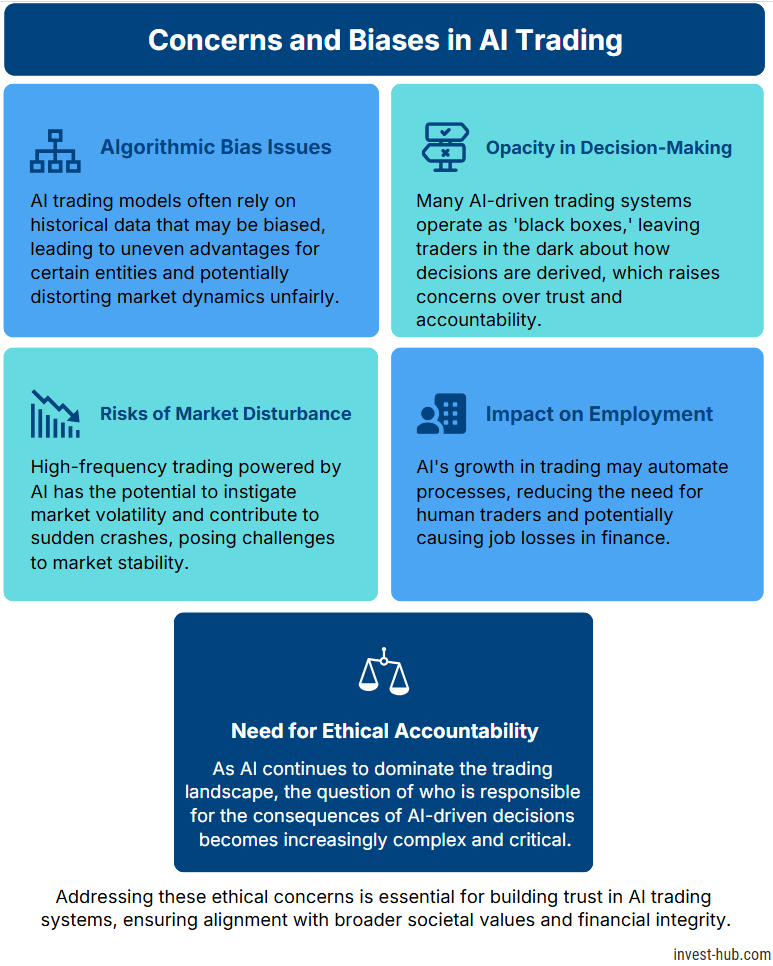

Ethical Concerns and Biases in AI Trading

- Bias in Algorithms: AI trading models are normally trained on biased historical data. This may promote certain unfair advantages or cause some unintended market distortions.

- Lack of Transparency: Most AI-driven trading systems are “black boxes” in which traders don’t understand how decisions are made.

- Market Manipulation Risks: AI-driven high-frequency trading sometimes contributes to market instability and flash crashes.

- Job Loss: Increased automation in trading due to AI will further reduce the need for human traders, contributing to job loss in the financial sector.

- Ethical Responsibility: As AI in trading increases, accountability for damages increases, something that remains highly ambiguous in most instances of AI-driven decisions.

Conclusion

AI-powered trading tools have revolutionized the stock market, allowing traders to analyze huge data, automate their trading strategies, and make informed decisions based on data analysis. These tools have a number of advantages, such as increased efficiency, speed, and management of risk. However, they also come with a number of challenges, including market volatility, regulatory concerns, and ethical implications.

For beginners, it is crucial to start with user-friendly AI trading platforms that provide educational resources and support. While free AI tools can provide a certain level of insight, it’s often the premium versions that offer additional features such as real-time updates, advanced backtesting, and better analytics. Understanding both the advantages and limitations of AI in stock trading can help traders develop informed strategies and navigate the financial markets effectively. Ultimately, traders should align AI tools with their investment goals and risk tolerance to maximize their trading success.

Integrating AI tools into your stock trading can potentially improve your capability to analyze markets and make informed decisions, but it’s important to understand their limitations and use them in conjunction with other analysis methods. To a novice trader, it’s always wise to begin with user-friendly platforms that offer educational resources and support. Always ensure any chosen trading tool aligns with your individual trading goals and risk tolerance.

FAQs

AI tools in stock trading are basically software applications that employ artificial intelligence to analyze market data for the prediction of trends and help one decide about trading.

Yes, a number of platforms offer free AI tools or basic versions such as Tickeron, Trade Brains, and MetaTrader 5.Yes, a number of platforms offer free AI tools or basic versions such as Tickeron, Trade Brains, and MetaTrader 5.

For example, Zerodha Streak and Trade Brains are for Indian markets and are very easy for any beginner to use.

No, though AI tools can enhance your decision-making capabilities by providing insights through data, profits cannot be guaranteed because of the very inherent risks and volatility associated with stock markets.

Not necessarily. Many AI trading platforms offer user-friendly interfaces that do not require coding skills, though advanced users can customize algorithms.