Equiti is a privately held, multi-asset brokerage group headquartered in Dubai and London. It provides online trading, liquidity, wealth management, and physical gold services through a network of eight regulated subsidiaries on five continents, and it is led by co-founder and CEO Iskandar Najjar. The firm’s flagship Equiti Gold platform delivers insured, DMCC-licensed ownership of investment‑grade bullion, while its wider ecosystem spans FX, CFDs, crypto, and institutional liquidity. This article explains what Equiti does, who owns and runs it, and whether its gold product is safe—drawing on the latest public filings, regulator records, and reputable industry outlets.

What Is Equiti?

Founded in 2016 after the acquisition and rebrand of Divisa Capital, Equiti Group is a global fintech and brokerage provider authorized in the UK, EU, UAE, Jordan, Kenya, and other jurisdictions. Equitiequiticapital.co.uk

Its regulated entities include Equiti Capital UK Ltd. (FCA), Equiti Securities Currencies Brokers LLC (UAE SCA), and Equiti Group Ltd. Jordan (JSC).

Today the group services both retail and institutional clients with FX, indices, shares, commodities, futures, crypto, and ETF CFDs, prime-of-prime liquidity, and white-label solutions.

For a detailed scorecard of spreads, platforms, and regulations, read our full Equiti review before you open an account.

Key Milestones

- 2017–18: Acquisition of Divisa entities and global rebrand.

- 2018: First global broker to secure a Jordan Securities Commission license.

- 2020–24: New licenses from the UAE SCA, CySEC, and Dubai VARA MVP; launch of tokenized gold and wealth management units.

What Does Equiti Do?

Retail & Professional Trading

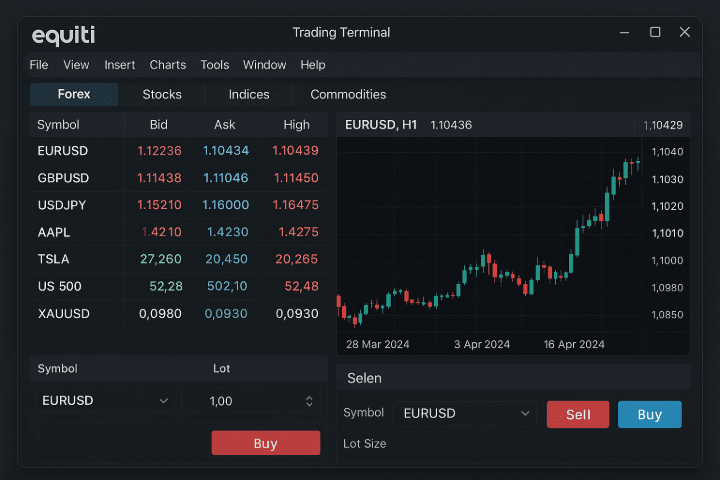

Equiti’s MT4/MT5 and web-based platforms offer 66+ FX pairs, major indices, metals, energies, single-stock and ETF CFDsith ECN-style pricing, and up to 1:500 leverage (varies by regulator).

Clients benefit from tier-1 bank liquidity aggregated by Equiti Capital in London, winner of multiple execution and liquidity awards.

Institutional Liquidity & B2B Solutions

Equiti Capital acts as a prime‑of‑prime, streaming customised liquidity to broker‑dealers, fintech platforms and hedge funds, supported by Equiti’s €730 k FCA licence that permits matched‑principal dealing.

Wealth Management

In February 2025 Equiti obtained in‑principle SCA approval for “Equiti Wealth”, a balanced multi‑asset fund aimed at mass-affluent investors.

Global Footprint & Regulation

| Region | Legal entity | Licence | Authority |

|---|---|---|---|

| UK | Equiti Capital UK Ltd | 528328 | FCA |

| EU | Equiti Cyprus Ltd | CIF 422/22 | CySEC |

| UAE | Equiti Securities Currencies Brokers LLC | 20200000026 | SCA |

| Jordan | Equiti Group Ltd | 2025‑E/9 | JSC |

| Kenya | EGM Securities Ltd (FXPesa) | 107 | CMA |

Equiti emphasizes “regulation first” expansion, citing robust governance as a competitive edge.

Leadership at Equiti

Who Is the CEO of Equiti?

Iskandar Najjar is co-founder and Group CEO. A two-decade markets veteran, he champions technology‑led access to underserved regions and oversees 300+ staff.

Najjar frequently appears at industry summits (e.g., iFX EXPO, Forex Expo Dubai) outlining plans for MENA expansion and digital-asset innovation.

Executive Team & Governance

Co‑founder Mohammed AlAhmad Ketmawi serves as Group MD and UAE CEO. Other key officers include CFO Rick Fulton and CISO Omar Keshtari, ensuring financial and cybersecurity resilience.

Ownership Structure: Who Owns Equiti?

Equiti is privately held. Its Jersey-registered holding company, Equiti Group Ltd, is the sole shareholder of downstream units such as Equiti AM CJSC.

Co-founders Najjar and Ketmawi retain significant stakes, alongside senior managers and early investors, according to interviews and corporate profiles.

Is Equiti Gold Safe?

Product Overview

Equiti Gold is the trade name of Equiti Commodities DMCC, licensed by the Dubai Multi Commodities Centre (licence 846279). Equiti Gold

The mobile app lets users buy 99.5%‑pure UAEGD‑certified bullion in weights from 1 g to 1 kg, store it in insured Brinks vaults, or request delivery within two working days.

Safety Factors

- Regulatory oversight—DMCC audits compliance and customer‑asset segregation.

- Full insurance—Bullion is covered against loss or damage until the customer signs for receipt.

- Parent company strength—Eight financial licenses and capital adequacy at the group level support operational continuity.

How Equiti Protects Clients

- Segregated accounts with tier-1 banks in London and the UAE.

- Negative-balance protection for retail traders in FCA and ESMA jurisdictions.

- Cybersecurity led by a dedicated CISO team and ISO 27001-aligned controls.

Pros & Cons of Trading with Equiti

| Pros | Cons |

|---|---|

| Multi‑jurisdictional regulation | Product range varies by entity |

| Institutional‑grade liquidity | No US clients |

| Insured physical‑gold option | Higher spreads on micro accounts |

| Wealth‑management arm for diversification | Limited educational webinars outside MENA |

To see how Equiti compares side-by-side with other leading platforms, visit our best brokers review for objective rankings and user scores.

Conclusion

Equiti positions itself as a technologically agile, regulation-focused broker that bridges retail, institutional, and physical-asset markets. Its privately held ownership underpins strategic flexibility, while CEO Iskandar Najjar’s leadership steers rapid yet compliant expansion. For clients, Equiti offers a broad multi-asset suite plus the distinctive Equiti Gold product—protected by DMCC licensing and full insurance—making it a compelling but jurisdiction‑dependent choice in 2025’s crowded brokerage space. Equiti’s ongoing push into wealth management and tokenized assets suggests the brand will continue to innovate while prioritizing safety and governance. Explore more trading insights, tools and webinars at Invest Hub, your trusted partner for informed investing.

Frequently Asked Questions

Equiti provides online trading, institutional liquidity, wealth management, and insured physical gold services across eight regulated entities.

Iskandar Najjar is the co-founder and current group CEO.

Equiti Gold is DMCC-licensed, uses insured vaults, and segregates customer metal.

Equiti is privately owned by its Jersey-registered holding company and its co-founders.

Key regulators include the UK FCA, CySEC, UAE SCA, Jordan JSC, and Kenya’s CMA.

Yes, selected entities stream spot crypto CFDs subject to regional rules and VARA MVP permissions.