PhillipCapital is a Singapore-headquartered financial services group that offers multi-asset brokerage, wealth management, banking, and research across 15 countries, backed by top-tier regulation and more than USD 65 billion in client assets—making it a broadly trusted choice for retail and institutional investors alike. (en.wikipedia.org)

PhillipCapital at a Glance

| Key Fact | Detail |

|---|---|

| Founded | 1975, Singapore |

| Clients Served | 1.5 million+ worldwide |

| Assets Under Custody | > USD 65 billion |

| Shareholders’ Equity | > USD 1.5 billion (group) (phillipcapital.com) |

| Global Footprint | Offices in 15 countries across Asia-Pacific, Europe & North America |

| Flagship Platform | POEMS online trading (launched 1996) |

Experience & Expansion

- Started as a stock-broking firm; now spans brokerage, banking, fund management, fintech investing, and trust services.

- Introduced Asia’s first US‑equities‑during‑Asian‑hours service in 2022, underscoring its tech focus.

- Recent milestones include bank acquisitions in Cambodia and fractional-share trading rollouts.

Core Services Offered by PhillipCapital

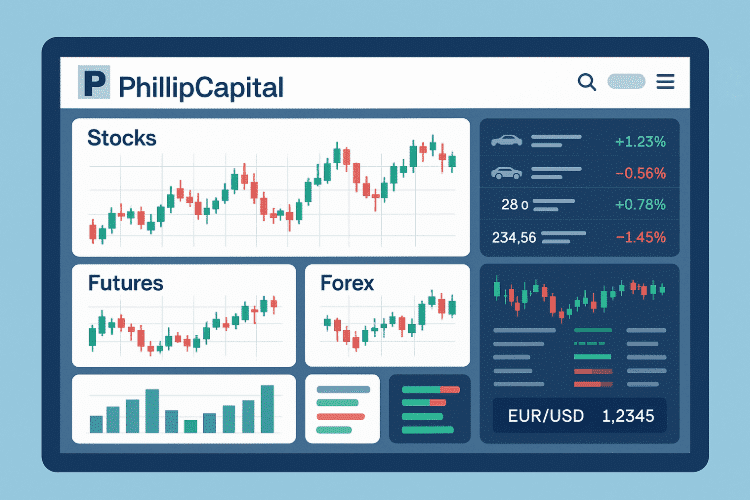

Multi‑Asset Brokerage

- Equities & ETFs on 55+ exchanges via POEMS and institutional direct market access.

- Derivatives & Futures clearing memberships on CME, SGX, Bursa, HKEX, TOCOM, and more.

- Forex & Commodities trading with competitive margin requirements.

Wealth & Asset Management

- Managed portfolios (PMS) rated 4 stars by CRISIL.

- Mutual funds, insurance, corporate finance, and private equity through subsidiaries.

Banking & Treasury

- Phillip Bank in Cambodia—the third-largest branch network post-merger—offers retail and SME banking.

Global Presence & Regulatory Oversight

| Region | Regulator | License/Membership |

| Singapore | Monetary Authority of Singapore (MAS) | Capital Markets Services licence for dealing, fund management, corporate finance (eservices.mas.gov.sg) |

| United States | SEC & CFTC; FINRA member | Futures Commission Merchant & Broker-Dealer (CRD 173869). |

| India | SEBI, NSE, BSE, MCX, NSDL/CDSL DP | Stockbroker license INZ000169632 & PMS/RA/IA registrations. |

| UAE (DIFC) | DFSA | Category 3A license for dealing and arranging credit. |

| UK, Japan, Malaysia, etc. | FCA, FSA, SC, and local authorities | Various dealing & clearing permissions. |

Bottom line: PhillipCapital’s multi-jurisdictional regulation and segregated client-fund rules offer layered protection to investors.

Is PhillipCapital a Good Company?

Awards & Recognition

- Best Retail Broker—SIAS Investors’ Choice Awards 2017, 2019 & 2024

- Businessman of the Year 2018 for founder Lim Hua Min (Singapore Business Awards).

- MENA Fund Manager Services Award 2018 (UAE).

- Multiple institutional derivatives and market contribution accolades across Malaysia, India, and Indonesia.

Independent Reviews

- For a deeper dive into the question “Is PhillipCapital a good company?”, read our detailed PhillipCapital review.

Is PhillipCapital Safe?

- Segregated Client Funds: Required in Singapore, the US, and the UK, meaning your assets are ring-fenced from company funds.

- Investor Protection Schemes: Coverage via SIPC (US) and equivalent schemes in MAS jurisdictions.

- Shareholders’ Equity > USD 1.5 bn & No Long-Term Debt: Signals financial resilience.

- No Proprietary Trading: Eliminates house-trader conflict of interest.

Verdict: PhillipCapital meets the definition of a low-to-moderate-risk broker for most investors, provided you understand its fee tiers and minimum-deposit thresholds.

Pros and Cons of Using PhillipCapital

| Pros | Cons |

| Multi-asset access across 55+ exchanges | High minimum deposit for some accounts (USD 5,000+) |

| Strong global regulation & long profitability record | Fee schedule can be complex for beginners |

| Proprietary platforms (POEMS & back‑office) | Limited instant chat support in certain regions |

| Award-winning research from 60+ analysts | No crypto spot trading (derivatives only) |

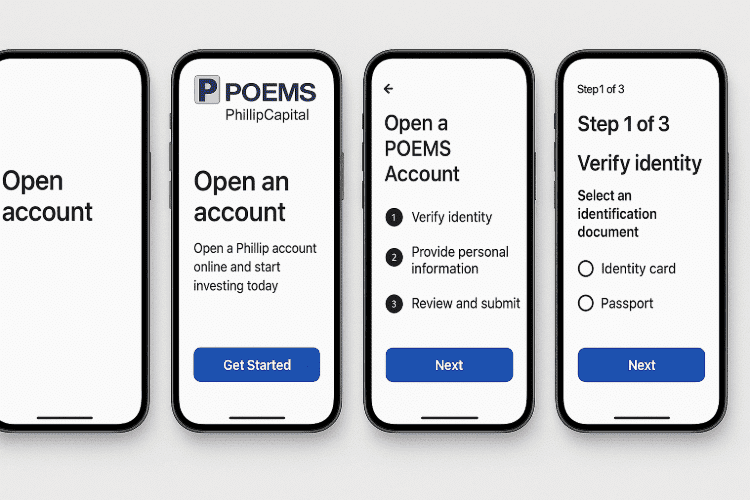

How to Open an Account with PhillipCapital

- Choose Your Jurisdiction: Singapore, India, US, or other local entity—regulation and product range vary.

- Complete e‑KYC: Upload ID, proof of address, and tax information online or via POEMS mobile app.

- Fund Your Account: Bank transfer or cheque; some entities do not support e‑wallets or cards.

- Select Platform: POEMS 2.0 for retail; FIX/EMSX or Bloomberg EMS for institutional desks.

- Start Trading: Access equities, futures, options, funds, and more after clearance.

Conclusion on What Does PhillipCapital Do

PhillipCapital offers a diversified, globally regulated financial ecosystem—from stockbroking and futures clearing to wealth management and banking—serving over 1.5 million investors across 15 countries. Its strong capital base, multi-layer regulatory oversight, and decades-long profitability record make it a sound option for experienced traders and high-net-worth investors seeking broad market access. However, newcomers should weigh its steeper minimum deposits and carefully review the fee structure to determine if PhillipCapital aligns with their trading style and budget.

Be sure to compare top online brokers for fees, execution quality, and account features. Want more data-driven broker insights? Explore the full library on Invest-Hub for platform tutorials, market analysis, and expert reviews.

Frequently Asked Questions (FAQ)

PhillipCapital is a full-service financial group providing brokerage, research, asset management, banking, and fintech investment services across Asia-Pacific, Europe, and North America.

Yes. Key entities are supervised by MAS in Singapore, SEC/CFTC in the US, SEBI/NSE in India, DFSA in the UAE, and other top-tier regulators.

Client funds are segregated, investor-protection schemes apply, and the group boasts over USD 1.5 bn in equity with no long-term debt—making it generally safe when used responsibly.

Retail traders use the POEMS suite (desktop, web & mobile); institutional clients can opt for Bloomberg EMSX, Bluewater, Stealth Trader, and API/FIX connectivity.

Minimums vary by region; for the US entity, it starts at USD 5,000, while Singapore and India offer lower-tier accounts for smaller balances.

Only derivatives (futures) on regulated exchanges—no spot crypto pairs at present.