In today’s fast-paced financial landscape, the term “broker” often comes up in conversations about investments, trading, and financial markets. Whether you’re new to investing or an experienced trader, understanding what a broker is and the various types available is essential to making informed decisions. Brokers serve as the middlemen between buyers and sellers, facilitating transactions and providing access to markets. In this guide, we’ll dive deep into the role of brokers in different financial markets, explain how they operate, and help you choose the right one for your needs.

What is a Broker?

A broker is a professional or a firm that acts as an intermediary between buyers and sellers, executing trades or transactions on behalf of clients. Their services are used in various industries, but they are especially critical in financial markets such as stock trading, forex, and cryptocurrency.

Definition of a Broker

A broker is an individual or firm that arranges transactions between a buyer and a seller for a commission. Brokers do not typically own the assets traded, rather they facilitate the process of buying and selling. Brokers can operate in various markets such as securities, real estate, and insurance, but the most common references are in finance and trading.

The Role of Brokers in Financial Markets

Brokers play a crucial role in the functioning of financial markets. They provide access to markets that individuals cannot directly access, such as stock exchanges or forex markets. Brokers offer a variety of services, from executing orders to providing investment advice and portfolio management, depending on the type of broker involved.

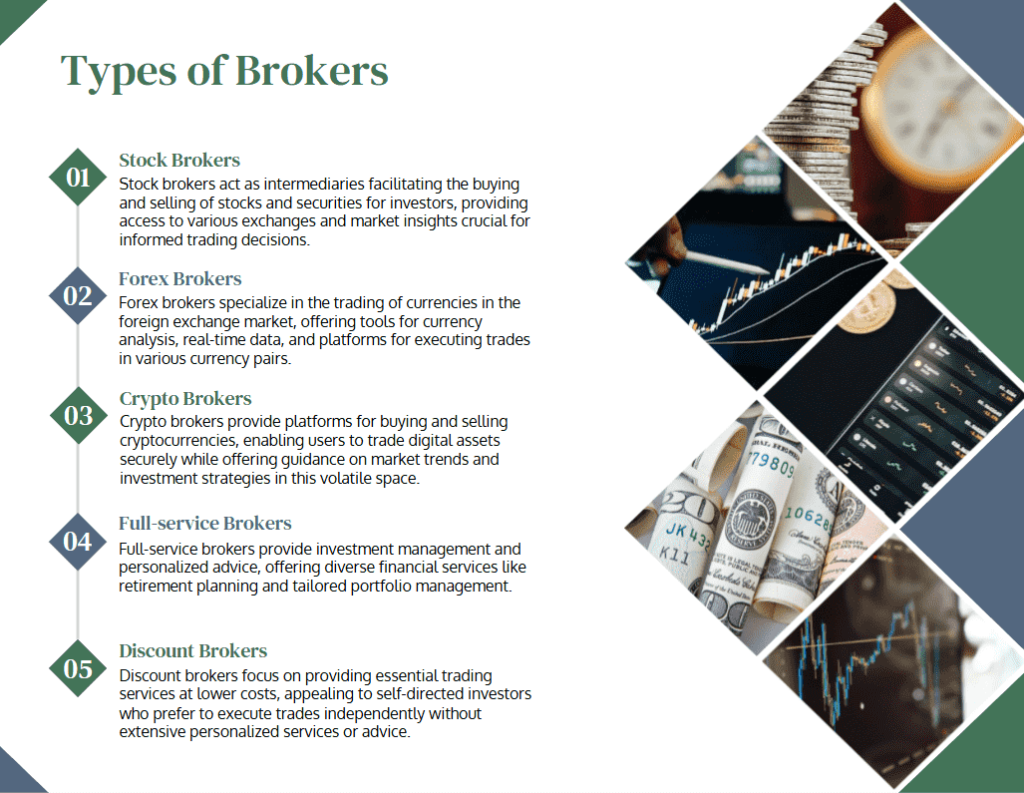

Different Types of Brokers

Brokers come in various forms, and they specialize in different sectors. The main types include:

- Stock Brokers: Facilitate buying and selling of stocks and securities.

- Forex Brokers: Specialize in currency trading.

- Crypto Brokers: Allow trading of cryptocurrencies.

- Full-service Brokers: Offer a range of services including investment advice.

- Discount Brokers: Provide basic services for a lower fee, often focused solely on trade execution.

What is a Broker in the Stock Market?

A stock market broker acts as a bridge between investors and the stock exchange, enabling individuals and institutions to buy and sell stocks.

The Role of Brokers in Stock Trading

Stock market brokers ensure that trades are executed in a timely and efficient manner. They provide the platform and tools necessary to place orders, access market data, and analyze stock performance. Brokers may offer additional services like research and analysis or advisory services.

How Stock Market Brokers Facilitate Transactions

When an investor wants to buy or sell a stock, they place an order with their broker. The broker then processes the order through the stock exchange, where the transaction is matched with a counterparty. This process involves order execution, settlement, and record-keeping.

Brokerage Accounts for Stock Traders

To trade stocks, investors need to open a brokerage account with a registered broker. This account acts as the investor’s hub for all trading activities. Brokerage accounts can either be cash accounts or margin accounts, allowing investors to trade with borrowed funds, increasing both potential returns and risks.

What is a Broker in Trading?

Trading brokers play an essential role by providing access to various financial markets. They connect traders with exchanges or liquidity providers to execute trades.

Definition of a Trading Broker

A trading broker, according to Investopedia, is a professional intermediary who facilitates the buying and selling of financial instruments such as stocks, commodities, forex, and cryptocurrencies. These brokers provide traders with a platform to execute trades and often offer additional services like market research.

The Broker’s Role in Different Trading Markets (Stock, Forex, Crypto)

- Stock Brokers allow clients to trade shares in publicly listed companies.

- Forex Brokers enable traders to buy and sell currencies.

- Crypto Brokers specialize in trading digital assets like Bitcoin and Ethereum.

Each market operates differently, and brokers tailor their services to meet the specific needs of their clients.

How Brokers Provide Trading Platforms

Brokers offer trading platforms that allow investors to place orders, analyze markets, and access real-time data. Some platforms are web-based, while others are downloadable software applications. The functionality of these platforms can range from basic order execution to advanced charting tools and automated trading systems.

What is a Broker in Trading Forex?

Forex brokers are specialized intermediaries who facilitate the trading of currencies in the foreign exchange market, one of the largest and most liquid financial markets in the world.

Forex Brokers Explained

Forex brokers provide access to currency markets where traders speculate on the value of one currency against another. These brokers typically operate through trading platforms that display live market prices and allow traders to place buy and sell orders.

How Forex Brokers Facilitate Currency Trades

Forex brokers enable currency trades by matching buyers and sellers in real-time. They act as intermediaries, either directly matching trades between clients or routing trades to liquidity providers. Forex brokers typically earn revenue through spreads (the difference between the buy and sell price of a currency pair), commissions, or a combination of both.

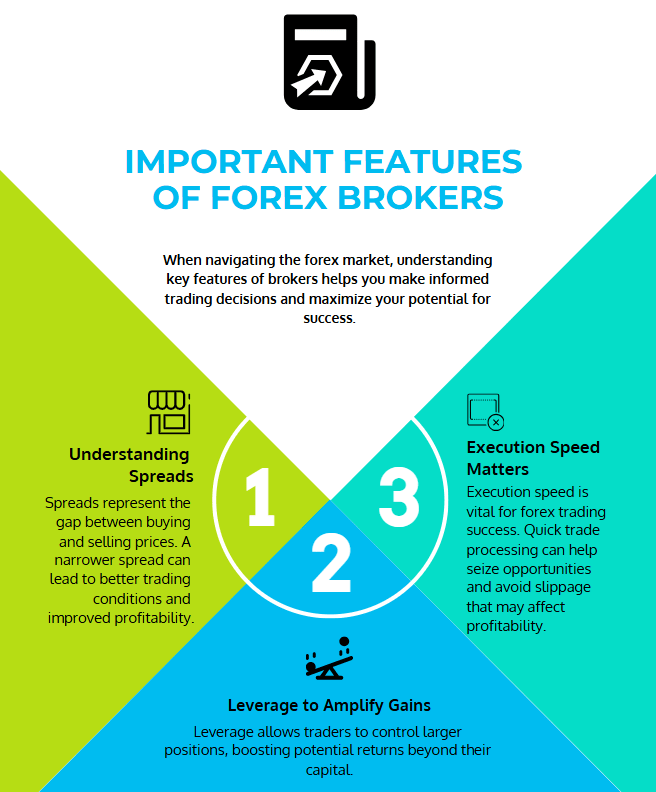

Important Features of Forex Brokers (Spreads, Leverage, etc.)

Key features of forex brokers include:

- Spreads: The difference between the bid and ask price.

- Leverage: Allows traders to control larger positions with a smaller capital outlay.

- Execution speed: How quickly trades are processed.

Regulated vs. Unregulated Forex Brokers

Choosing a regulated forex broker is crucial for ensuring the security of your funds. Regulated brokers are subject to oversight by financial authorities, which helps protect traders from fraud or malpractice. Unregulated brokers, on the other hand, operate without such oversight, making them riskier choices.

How Do Brokers Work?

The Brokerage Account

A brokerage account is essential for trading. It allows investors to deposit funds and use them to buy and sell financial assets. Most brokers offer different types of accounts, such as individual or joint accounts, as well as cash or margin accounts.

How Brokers Facilitate Trades

Brokers act as intermediaries by executing buy or sell orders on behalf of their clients. They do this by either matching trades internally or sending orders to external market makers or exchanges.

Commissions and Fees Structure

Brokers typically charge fees for their services, including commissions per trade or spreads in the case of forex. Full-service brokers tend to charge higher fees, whereas discount brokers offer more affordable trading options. Some brokers have introduced commission-free trading for stocks and ETFs, instead generating revenue through other means such as payment for order flow or premium account features.

Order Execution and Settlement

Order execution is the process by which a trade is completed. Once a trade is executed, it goes through a settlement process, where the asset is transferred from seller to buyer and the funds are exchanged.

Why Do Traders and Investors Use Brokers?

Access to Markets

Brokers provide access to various financial markets, including stock exchanges, forex markets, and cryptocurrency exchanges.

Expertise and Advisory Services

Many brokers offer advisory services, helping clients make informed investment decisions. This can be particularly useful for novice traders who need guidance in navigating complex markets.

Brokerage Platforms and Tools

Brokers provide trading platforms with real-time data, charting tools, and research reports, enabling traders to make better decisions.

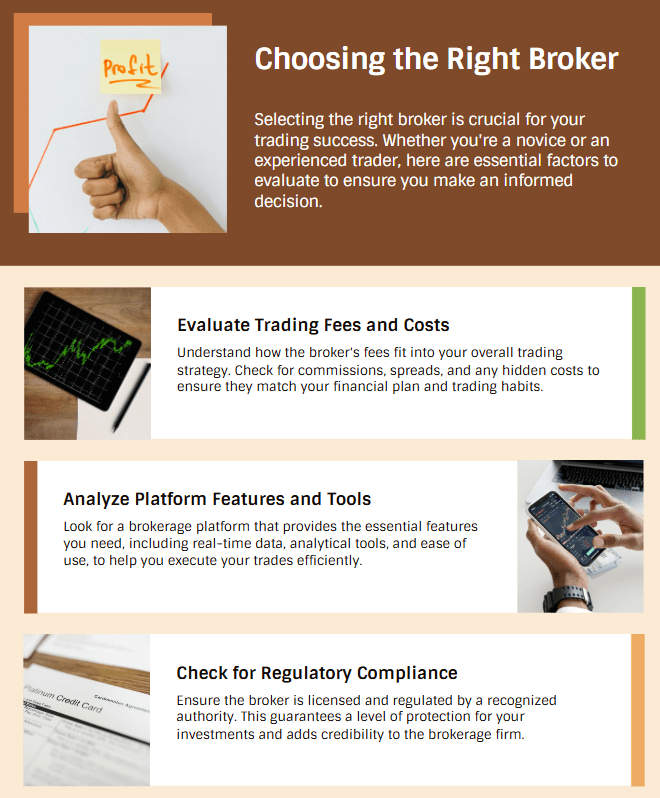

Choosing the Right Broker for Your Needs

Understanding Your Investment Goals

Your choice of broker will depend largely on your investment goals. Are you looking for long-term investments, or do you plan to trade frequently? Answering these questions can help you narrow down your options.

Key Factors to Consider (Fees, Platform Features, etc.)

When choosing a broker, consider the following:

- Fees: Ensure that the broker’s fees align with your budget and trading style.

- Platform features: Look for a platform that offers the tools you need, such as charting, research, or automated trading.

- Regulation: Always ensure your broker is regulated by a reputable authority.

Comparing Broker Services

It’s essential to compare brokers based on the services they offer, fees, and reputation. Some brokers cater to specific types of traders, such as those focusing on forex or stocks, while others provide more general services.

Conclusion

The Importance of a Reliable Broker in Your Financial Journey

Choosing the right broker is a critical decision in your trading and investing journey. A broker acts as your gateway to financial markets, providing the tools, platforms, and expertise you need to achieve your financial goals. Whether you’re trading stocks, forex, or cryptocurrencies, having a reliable broker by your side can make all the difference in your success. Take the time to evaluate your options, understand your needs, and select a broker that aligns with your investment strategy.

FAQs

A broker is an individual or firm that acts as an intermediary between buyers and sellers in various markets, facilitating transactions for a commission or fee.

Brokers can be categorized into stock brokers, forex brokers, crypto brokers, full-service brokers, and discount brokers, each specializing in specific markets and services.

Brokers typically earn revenue through commissions, spreads, account fees, or a combination of these. Some offer commission-free trading but may profit from payment for order flow or premium services.

Yes, most individual investors require a broker to access stock exchanges, as brokers provide the platform and tools necessary for trading.

Full-service brokers offer comprehensive services like investment advice and portfolio management, while discount brokers focus on low-cost trade execution without additional advisory services.

A brokerage account is an account opened with a broker that allows you to deposit funds, buy and sell financial assets, and manage your investments.

Yes, regulated brokers are crucial for ensuring the safety of your funds, as they comply with industry standards and are monitored by financial authorities.

Key factors include fees, platform features, regulatory status, customer support, and the broker’s specialization in your preferred market.

In most markets, direct access to exchanges is restricted, so a broker is necessary. However, decentralized finance (DeFi) platforms allow some trades without traditional brokers.

Forex brokers facilitate currency trading by providing access to the forex market, offering trading platforms, and earning through spreads or commissions.