Alpari is a long-standing online forex and CFD broker founded in 1998 that now serves over two million clients worldwide. Operated today under the Exinity Group umbrella and regulated offshore in Mauritius and Mwali, Alpari offers access to MetaTrader 4/5 with spreads from 0.0 pips and leverage up to 1:3000. While its global footprint is real, traders must weigh the benefits of deep market experience against the higher risks that come with light-touch regulation.

For a deeper dive, see our detailed Alpari review covering platform nuances and real-world testing results.

A Brief History of Alpari (1998–2025)

Founded in Kazan, Russia, in December 1998 by Andrey Dashin, Alpari expanded rapidly, opening a UK subsidiary in 2004 and entering India four years later. After the 2015 Swiss-franc shock forced Alpari UK into insolvency, the brand regrouped under offshore entities and, in 2020, became part of Exinity Group alongside FXTM. Headquarters today are listed in Fomboni, Mohéli, Comoros, with operational hubs in Mauritius, Cyprus, Dubai, and Kenya. Over its 25-plus-year journey, Alpari has evolved from a local Russian brokerage into a multilingual platform with clients in more than 150 countries.

How the Alpari Platform Works

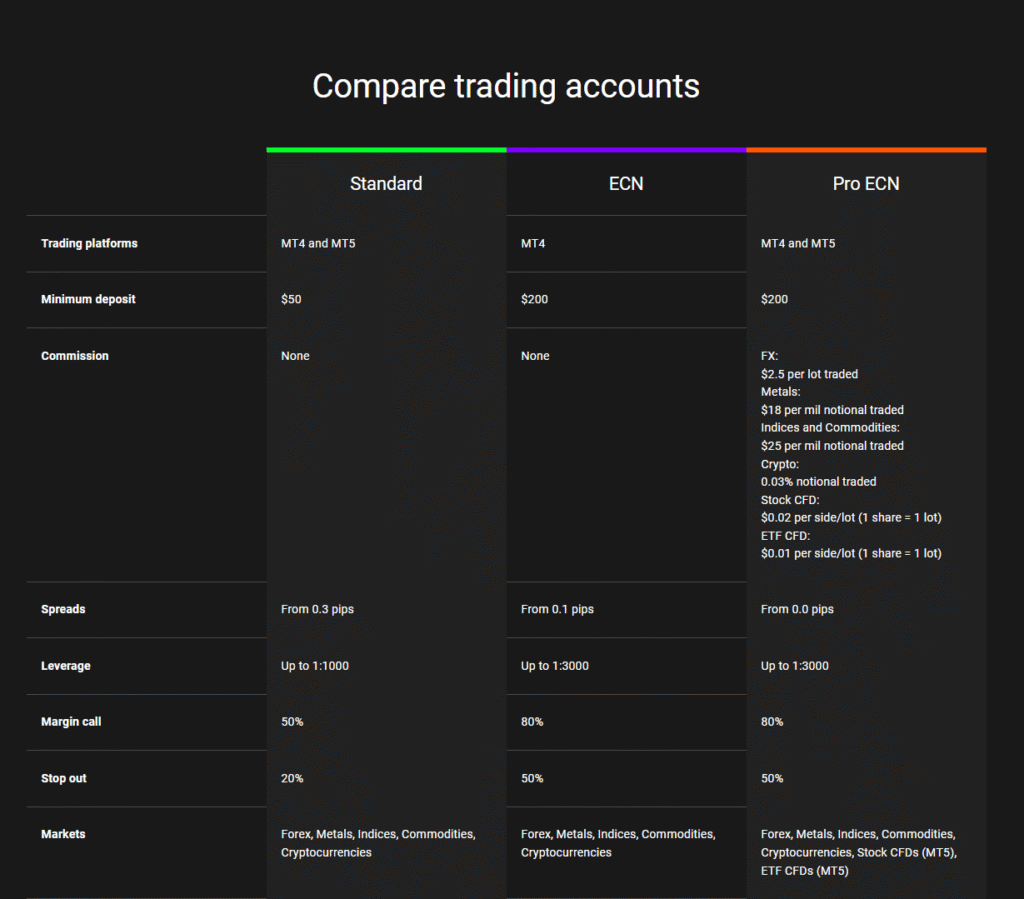

Alpari offers four live account tiers—Micro, Standard, ECN, and Pro—plus swap-free Islamic options. Most accounts run on MT4/MT5 desktop and mobile, but availability may vary by account type. Order execution is market-based. Spreads start at 0.8 pips (Standard) or 0.0 pips plus commission (ECN/Pro). Copy trading is available through PAMM and CopyTrade, while seasoned users can connect VPS and algorithmic strategies. Advanced charting, one-click trading, and in-house analytics round out the toolset.

Minimum Deposit Requirements

- Standard: $50

- ECN: $200

- Pro ECN: $200

These low entry points enable beginners to test strategies with limited capital, but serious ECN trading still demands deeper pockets. Deposits can be made via cards, e-wallets, or local bank transfer, with most methods credited instantly.

Is Alpari Forex Real or Fake?

Alpari is a real broker-it has verifiable corporate entities and public offices. However, “real” does not always equal “low-risk.” The broker’s most active entity today is Exinity Limited, licensed by the Financial Services Commission (FSC) of Mauritius, an offshore regulator with moderate oversight. Alpari (Comoros) Ltd operates under the Mwali International Services Authority (MISA), an even lighter framework. Traders therefore face higher counterparty risk than with top-tier jurisdictions such as the FCA or ASIC.

Is Alpari a Scammer?

There is no evidence that Alpari systematically defrauds clients, but the brand’s history includes notable failures (for example, Alpari UK’s collapse in 2015). Negative reviews often stem from misunderstandings about high leverage, margin calls, or slow withdrawals rather than outright fraud. As always, risk management and due diligence are essential.

Is Alpari Broker Regulated?

- Mauritius: Exinity Limited holds an FSC investment-dealer license C113012295.

- Comoros (Mwali): Alpari (Comoros) Ltd claims licence T2023236 under MISA.

- Historical licences: Alpari entities once held FCA and CySEC permissions but have since been renounced or lapsed.

Because Mauritius and Mwali are category B regulators, client funds are segregated and negative-balance protection applies, but the frameworks do not offer the same compensation schemes available in the EU, UK, or Australia.

Is Alpari Legal in India?

Forex trading on pairs that do not involve the Indian rupee is illegal for residents under FEMA rules enforced by the Reserve Bank of India (RBI). Alpari lacks RBI or SEBI authorization and appears on the RBI’s alert list of unregulated platforms. Indian citizens using Alpari therefore do so at their own regulatory risk and could face fines. The broker explicitly warns it cannot accept clients where local laws forbid its services.

Restricted Countries for Alpari

According to the broker’s compliance notices and third-party audits, Alpari currently does not onboard residents of:

- United States

- Canada

- European Union/UK

- Japan

- Myanmar

- Democratic Republic of Korea (North Korea)

- Syria, Sudan, and other OFAC-sanctioned nations

- Additional jurisdictions subject to United Nations or EU sanctions

This list evolves with geopolitical sanctions and internal risk policy. Traders should verify eligibility during account registration.

Safety Measures and Client Protection

- Segregated client funds

- Negative balance protection to cap losses

- Two-factor authentication on the client portal

- SSL encryption across all web assets

- Membership in external dispute-resolution schemes (FSC Mauritius) for eligible complaints

Although these features add layers of security, compensation coverage is limited compared with EU investor-protection funds.

Pros and Cons of Trading With Alpari

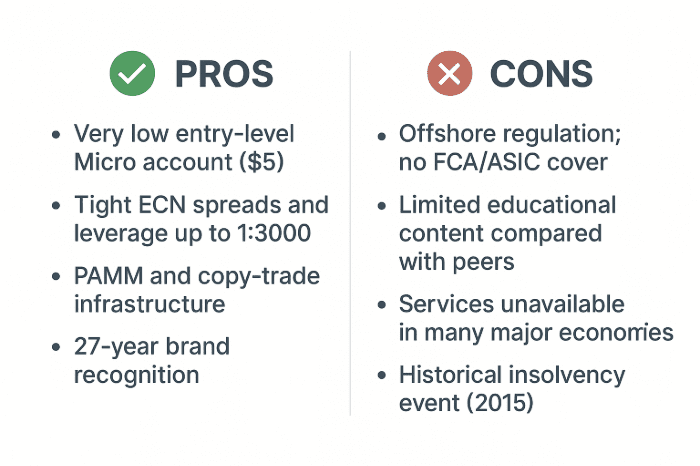

Pros

- Very low entry-level Micro account ($5)

- Tight ECN spreads and leverage up to 1:3000

- PAMM and copy-trade infrastructure

- 27-year brand recognition

Cons

- Offshore regulation; no FCA/ASIC cover

- Limited educational content compared with peers

- Services unavailable in many major economies

- Historical insolvency event (2015)

If you’re still weighing your choices, check out our curated list of best forex brokers for 2025.

Conclusion

Alpari remains a real and experienced forex broker in 2025, but it is not without caveats. Traders gain cost-effective market access, flexible account tiers, and PAMM-style investing, yet must accept the governance of mid-tier regulators and the absence of protection in key jurisdictions. Weigh your risk appetite carefully, confirm your country’s legal stance, and consider starting with a Micro or Standard account to test execution before scaling up. In short, Alpari offers opportunity, but informed caution is still the best strategy. You’ll find more trading insights and broker guides on Invest‑Hub.

Frequently Asked Questions (FAQ)

Alpari is a legitimate broker with registered entities and more than 25 years in business, though it operates under offshore regulation.

No. Alpari is not authorized by RBI or SEBI, and Indian law restricts forex trading to INR-paired instruments.

From $5 for a Micro account and $100 for a Standard MT4 account in 2025.

The USA, Canada, the EU/UK, Japan, and other OFAC-sanctioned or high-risk jurisdictions.

No systemic fraud is proven, but offshore regulation means weaker safeguards, so due diligence is vital.

Yes—primarily by the FSC of Mauritius and MISA of Comoros, not by top-tier agencies.