Answer: A broker commission is a fee charged by a trade broker—often a stock or commodities broker—for facilitating transactions between buyers and sellers in financial markets. This charge compensates the broker for their expertise, platform, and services, such as executing trades, providing market insights, and handling administrative tasks. Broker commission structures can vary widely, ranging from flat fees to tiered rates based on trading volume, and understanding them is essential for anyone looking to trade efficiently and cost-effectively.

Broker Commission Meaning

The term broker commission refers to a fee that a broker charges for conducting trades in financial markets such as stocks, bonds, and commodities. Whether you are an individual investor, a day trader, or an institutional investor, a broker facilitates the trade on your behalf and ensures that it is executed correctly and in a timely manner.

Key Points

- Purpose: Compensation for the services provided by the broker

- Structure: Can be flat, percentage-based, or a combination of both

- Significance: Directly affects your net profits or losses

Brokers are heavily regulated and must follow strict guidelines. Broker commissions help fund essential brokerage operations such as maintaining secure trading platforms, offering customer support, and ensuring compliance with market regulations.

Broker Commission Percentage

In many trading scenarios, especially in higher-value trades, brokers apply a broker commission percentage based on the total transaction amount. While some brokerage houses opt for a flat-fee model, percentage-based structures can be more favorable (or less so) depending on:

- Trade Size: Larger trades often mean higher total fees if you pay a percentage.

- Trading Frequency: Active traders may seek lower flat rates to minimize cumulative costs.

- Service Level: Full-service brokers who offer personalized advice may charge higher percentage fees.

By understanding whether your broker uses a percentage-based or a flat-fee model, you can better anticipate the overall cost of your trades. Many people compare brokers based on how they structure these fees to find the most cost-effective solution.

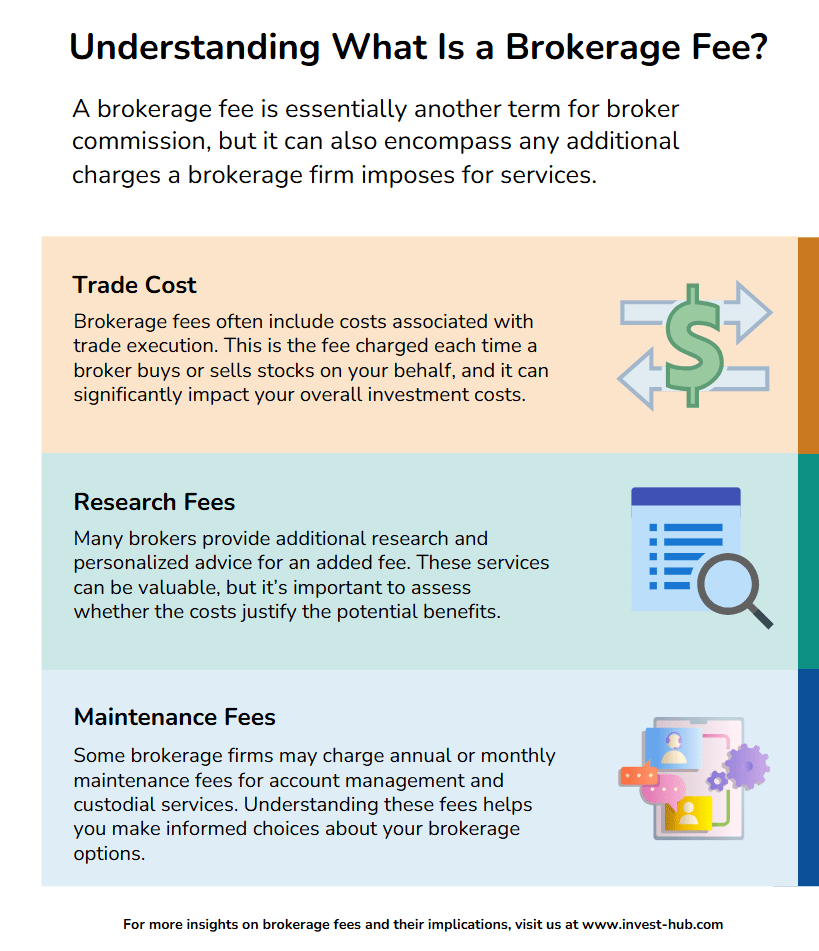

What Is a Brokerage Fee?

A brokerage fee is essentially another term for broker commission, but it can also encompass any additional charges a brokerage firm imposes for services. Brokerage fees vary depending on the services offered, such as:

- Trade Execution: The act of buying or selling a security on the client’s behalf.

- Research & Advice: Some brokers charge an extra fee for premium research and tailored advice.

- Maintenance: For custodial services and account management, some firms impose annual or monthly fees.

It’s important to distinguish between commission on individual trades and ongoing brokerage fees. Some firms may bundle these, while others list them separately.

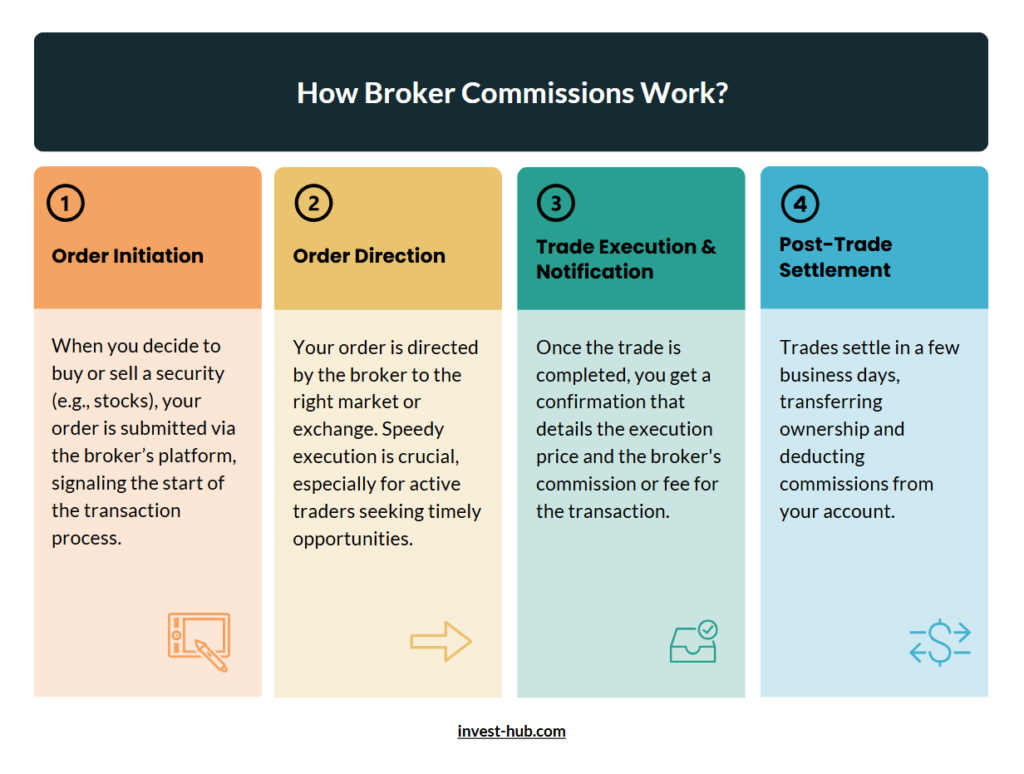

How Broker Commissions Work in Practice

1. Order Placement

You place a buy or sell order for a security (e.g., stocks). The broker receives this order through their trading platform.

2. Order Routing

The broker routes your order to the appropriate market or exchange. High-frequency traders and active investors often look for brokers with fast execution.

3. Execution & Confirmation

After the trade executes, you receive a trade confirmation indicating the price at which it was executed, along with the broker commission or fee charged.

4. Settlement

Securities typically take a few business days to “settle,” after which the buyer owns the security and the seller receives the proceeds. The commission is deducted from your account or added to your cost basis.

Broker Commission on Mutual Funds

Although mutual funds differ from stocks in their structure and trading methodology, broker commissions on mutual funds can still apply. Typically, mutual fund fees include:

- Front-End Load: A percentage of your investment that is paid upfront to the broker or the fund company.

- Transaction Fee: Some brokers charge a flat transaction fee when you buy or sell mutual fund shares.

- 12b-1 Fees: Ongoing marketing and distribution fees that come out of the fund’s assets.

Not all mutual funds carry commissions or transaction fees; certain brokers offer no-load or no-transaction-fee (NTF) mutual funds.

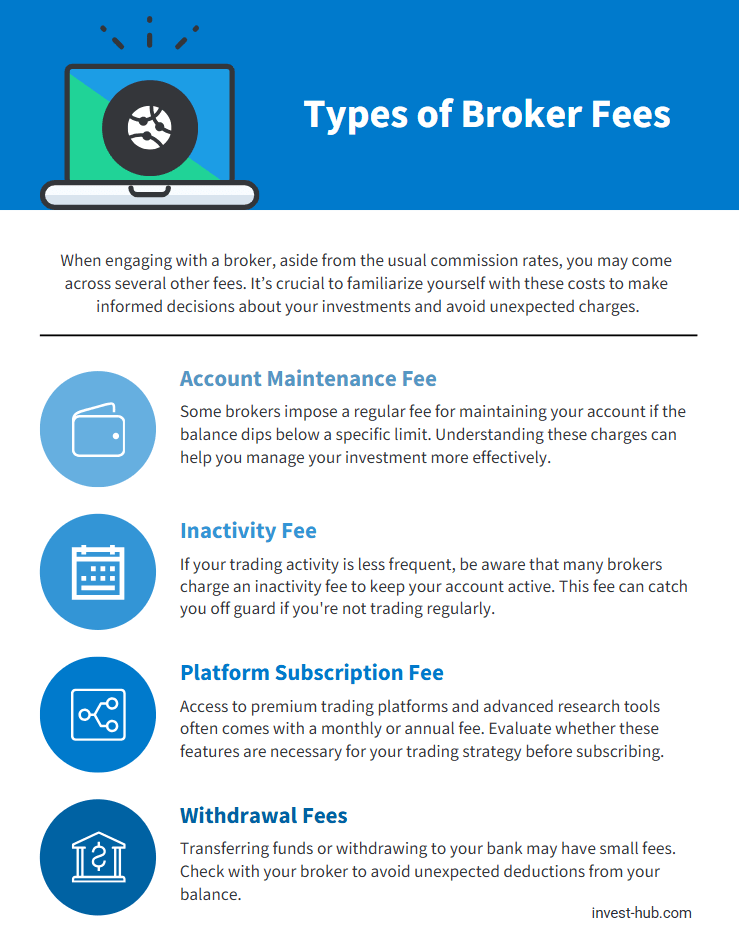

Types of Broker Fees

Apart from the standard commission, you may encounter a variety of other broker fees:

- Account Maintenance Fee

- Some brokers charge a recurring fee if your account balance is below a certain threshold.

- Inactivity Fee

- If you don’t trade frequently, you might face an inactivity fee to keep your account operational.

- Platform Fee

- Advanced trading platforms or research tools may come with a monthly or annual subscription fee.

- Withdrawal or Transfer Fees

- When you transfer funds between accounts or withdraw money to a bank account, certain brokers impose small transaction fees.

All these fees add up, so it’s essential to review a broker’s full fee schedule before committing to an account.

Factors Affecting Broker Commissions

1. Market Volatility

During periods of high market volatility, brokers may adjust their fees to manage the increased risk or the high volume of trades.

2. Brokerage Model

- Full-Service Brokers: Provide extensive research, personalized advice, and advanced services—often at higher commission rates.

- Discount Brokers: Offer basic order execution with minimal extras, typically charging lower commissions.

3. Investment Products

- Stocks & ETFs: Many discount brokers now offer zero-commission or low-cost trades on certain stocks and ETFs.

- Derivatives (Options & Futures): Often priced per contract, adding a layer to the commission.

- Mutual Funds: May involve transaction fees or loads, as discussed above.

4. Trading Volume

- Frequent Traders: Some brokers have tiered pricing; the more you trade, the less you pay per trade.

- Casual Investors: May pay higher fees per trade but can sometimes benefit from no ongoing maintenance fees.

How to Calculate Broker Commission

Using a brokerage calculator can be extremely helpful when you want to gauge the cost of a trade before actually placing it. Tools like the Groww Brokerage Calculator are commonly used for the Indian stock market, but many brokers worldwide have similar estimators on their platforms.

Example Calculation

Suppose you buy 100 shares of a stock at $10 per share:

- Trade Value = 100 shares * $10 = $1,000

- Commission (Flat Rate) = $5 per trade (example)

- Commission (Percentage Rate) = 0.5% of Trade Value = $5

If your broker charges either a flat $5 or a 0.5% fee, the total cost in both scenarios is $5. However, the percentage-based fee scales with trade size, meaning if you bought 1,000 shares ($10,000 trade), your commission would jump to $50.

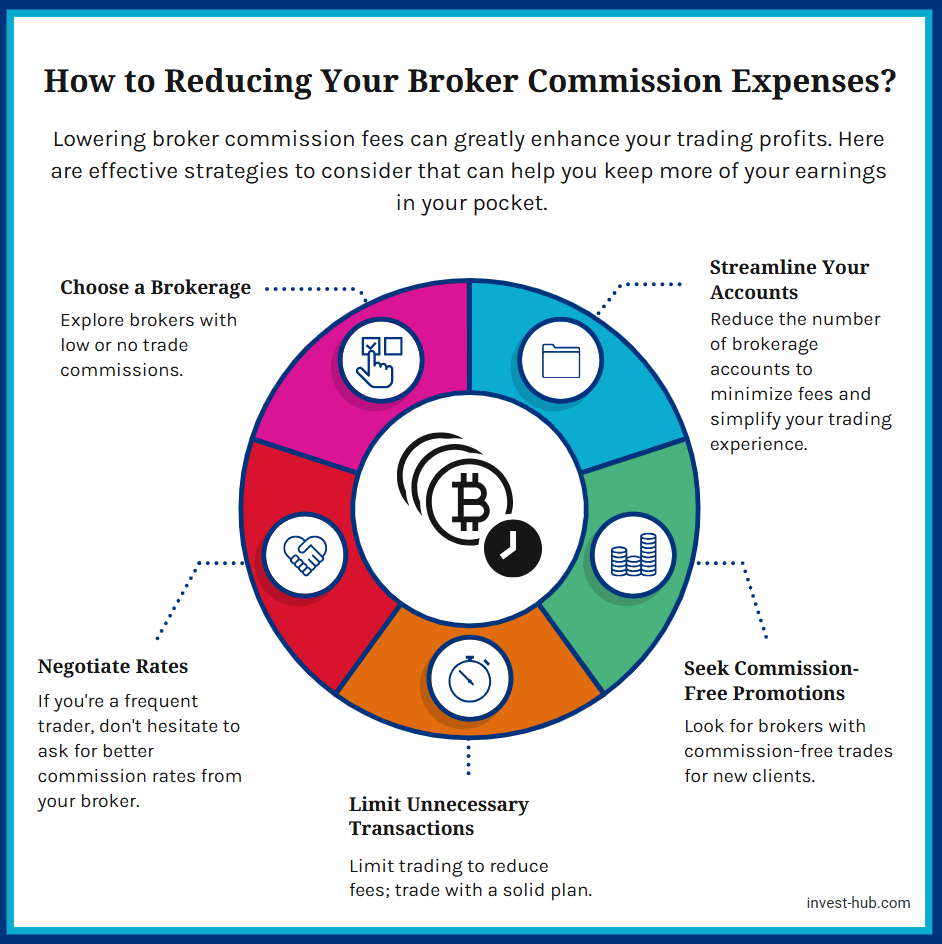

Reducing Your Broker Commission Expenses

Saving on broker commission can significantly impact your bottom line, especially for frequent traders. Here are practical tips:

- Choose the Right Broker

- Compare fee schedules: Look for discount brokers offering zero or low commissions on stocks and ETFs.

- Negotiate

- High-volume traders sometimes can negotiate lower commission rates.

- Avoid Unnecessary Trades

- Overtrading can rack up fees. Ensure each trade aligns with a solid strategy.

- Look for Commission-Free Offers

- Some platforms run promotions for new clients, offering reduced or commission-free trades for a limited time.

- Consolidate Accounts

- Maintaining multiple brokerage accounts can mean multiple sets of fees. Simplify to manage fees effectively.

Conclusion on What is Broker Commission?

Understanding broker commission is crucial for anyone actively trading in the stock or commodity markets. From flat fees to percentage-based models, brokers charge these commissions to cover the cost of order execution, platform maintenance, and regulatory compliance. By knowing the various fee structures—including mutual fund fees, inactivity fees, and percentage-based or flat-rate commissions—you’ll be better positioned to make informed decisions about your investments.

Ultimately, choosing a broker that aligns with your trading frequency, portfolio size, and investment strategy can help you optimize costs and maximize returns. Whether you’re a new investor taking your first steps in the market or a seasoned trader looking to refine your approach, being aware of how commissions work is indispensable. Make sure to compare different brokerage offerings, use fee calculators, and pick the service that best meets your needs.

Call to Action: Ready to find a cost-effective broker? Research and compare multiple brokerage platforms to see which fee structure suits your trading style and objectives. Always read the fine print and consider seeking professional financial advice when necessary.

What is Broker Commission? FAQs

A broker commission typically refers to the fee per trade, while a brokerage fee can be a broader term, including account maintenance, service charges, and transaction fees beyond just trade execution.

Compare your broker’s fee schedule with competitors. Also, evaluate how fees affect your net returns; if fees are significantly reducing gains, it might be time to switch or negotiate.

Yes. Many discount brokers now offer zero-commission trading on stocks and ETFs, though options, futures, or mutual fund trades may still incur fees.

This depends on your local tax laws and whether you are trading in a personal or professional capacity. Consult a tax professional for personalized guidance.

Not always. Some brokers offer no-transaction-fee mutual funds, and many funds come with waived fees under specific conditions. Check your broker’s fee schedule carefully.

Sometimes. Full-service brokers who charge higher fees may provide more research, personalized advice, and faster execution speeds, which can be beneficial for specific traders or large accounts.