A digital wallet is a secure and convenient electronic platform that stores payment information, passwords, and other personal data, enabling users to make quick, cashless transactions on various devices. From facilitating online payments to tapping at physical stores, digital wallets have evolved significantly, offering benefits like enhanced security, speed, and improved organization of finances—all in a single application or platform.

Answer: A digital wallet—sometimes called an electronic wallet—is a software-based system designed to securely store users’ payment details, identity credentials, loyalty cards, and more. By eliminating the need for physical cards or cash, digital wallets streamline transactions, making them nearly instantaneous and often more secure than traditional payment methods.

According to N26, digital wallets are used worldwide and continue to grow in popularity, thanks to the rise of smartphone usage and the increasing acceptance of contactless payments in retail. Popular providers include Apple Pay, Google Pay, Samsung Pay, and Paytm, among others.

Key Points to Remember

- Digital wallets store financial and personal information.

- They facilitate online and offline (in-store) payments.

- They often integrate with loyalty programs, coupons, and ticketing systems.

- Security features such as encryption, tokenization, and biometric authentication (fingerprint or facial recognition) offer added protection.

The Digital Wallet: Definition and Meaning

When people ask, “What is a digital wallet?” they often want a concise explanation: A digital wallet is an online service or software application that allows you to store payment information—such as credit card numbers, bank details, coupons, and even identification documents—on your electronic device. This “wallet” acts just like a physical wallet, except it exists in a secure, virtual environment.

- Digital Wallet Meaning: Simplifies how you pay for goods and services—online or in-store—by using electronic credentials.

- Digital Wallet Definition: A technology-based tool (often a mobile app) that replaces the need to carry physical cards or cash.

Digital wallets can also store event tickets, gift cards, and boarding passes, further centralizing and organizing your personal information. Paytm mentions the convenience factor: the ability to pay or transfer funds with just a few taps on a screen.

Why Does This Matter for Beginners?

- Convenience: You only need your smartphone or smartwatch.

- Speed: Eliminates the need to fumble through physical cards.

- Security: Advanced encryption and biometric locks reduce fraud risk.

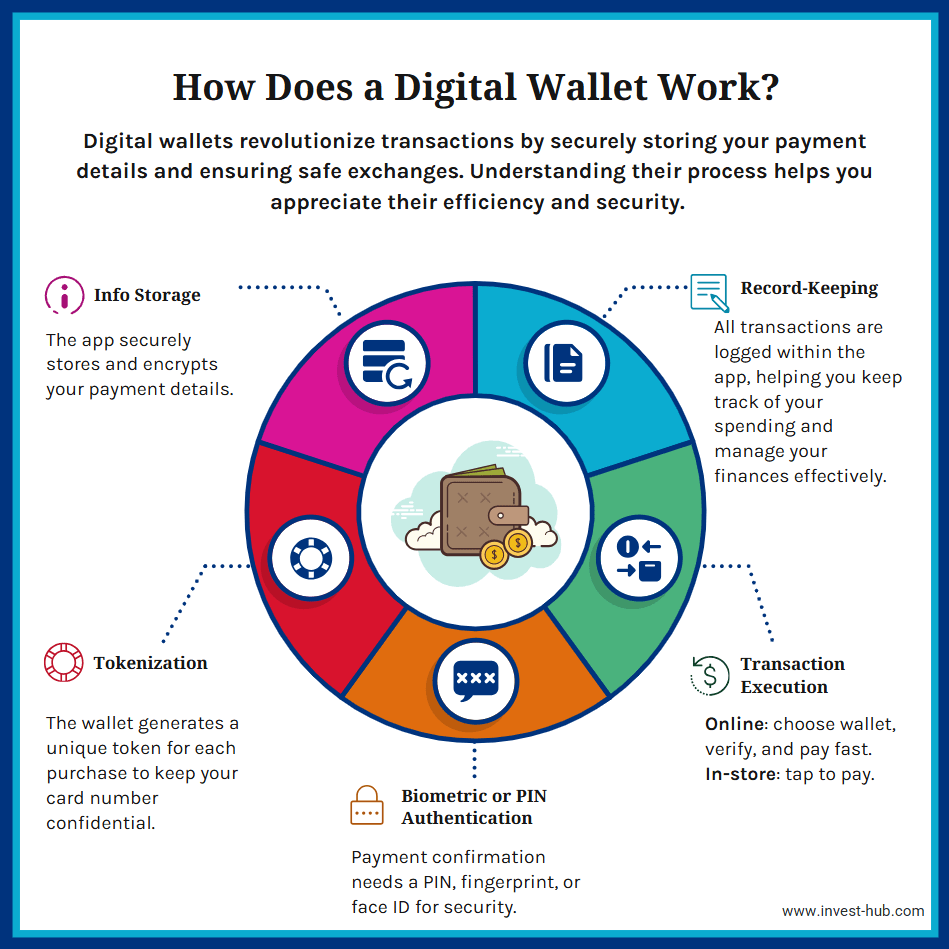

How Does a Digital Wallet Work?

At its core, a digital wallet uses sophisticated encryption and tokenization to secure your financial data. Here’s a simple breakdown:

- Storage of Information

After you install a digital wallet app, you add payment details—like a credit or debit card—through a secure setup process. The app encrypts this data, ensuring it remains hidden from unauthorized parties. - Tokenization

Instead of sharing your actual card number with the merchant, the digital wallet generates a token (a randomized number) for each transaction. That way, your real data isn’t exposed during the payment process. - Biometric or PIN Authentication

You typically confirm a payment via PIN, fingerprint, or facial recognition, safeguarding your account from misuse. - Transaction Execution

- Online Payments: Select your digital wallet at checkout, authenticate, and the transaction is processed instantly.

- In-Store Payments: Tap your phone or wearable device on a compatible card reader (NFC or QR code), authenticate if needed, and the payment completes within seconds.

- Record-Keeping

Each payment is recorded within the digital wallet app, making it easy to track spending and manage finances.

This multi-layered security approach significantly reduces the risk of stolen card details while also simplifying the user experience.

Types of Digital Wallets

One size does not fit all. There are different types of digital wallets, each designed for specific use cases or ecosystems. Understanding these varieties will help you choose the digital wallet that suits your needs best.

Below is the information formatted into a table for clarity.

| Type | Definition | Examples | Advantages/Benefits | Limitations/Drawbacks |

|---|---|---|---|---|

| 1. Closed Wallets | Issued by a company for exclusive use with their products or services. | Amazon Pay (usable only within Amazon ecosystem) | Often offer loyalty rewards—faster checkout – Targeted promotions | Restricted to the company’s own platform or specific partner merchants |

| 2. Semi-Closed | Operate within a limited network of merchants and partners. | Paytm (accepted at partner outlets, online stores) | Broader usage than closed wallets—convenient for daily transactions | Not universally accepted everywhere |

| 3. Open Wallets | Issued by banks or partnered institutions; usable for withdrawals, bank transfers, and more. | Bank-backed wallets (allow multiple platform use + ATM withdrawals) | Most flexible—universal acceptance | May involve fees—additional requirements set by the issuing bank |

| 4. Mobile Wallets | Specifically designed for use on mobile devices (smartphones, tablets), often with NFC support. | Apple Pay, Google Pay, Samsung Pay | Contactless payments—Integration with wearables | Dependent on device compatibility—limited to certain OS ecosystems |

| 5. Crypto Wallets | Specialized digital wallets for storing, sending, and receiving cryptocurrencies. | Coinbase Wallet, Ledger Nano S, MetaMask | Public/private key management—Secure blockchain transactions | Complex for beginners—security heavily reliant on user practices |

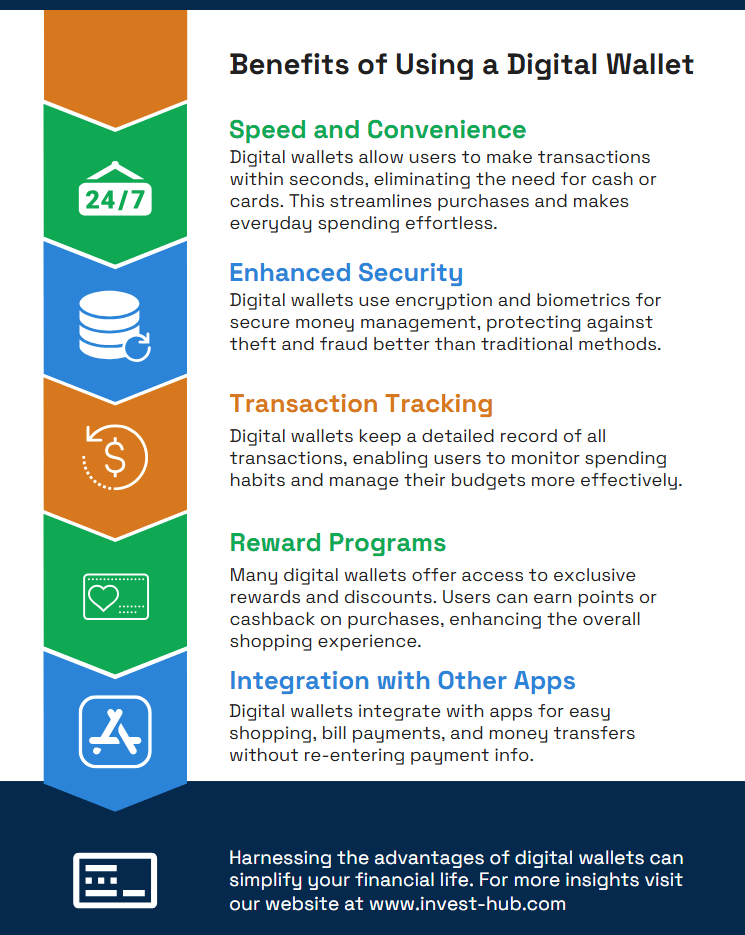

Benefits of Using a Digital Wallet

A digital wallet offers several advantages—ranging from convenience to enhanced security—that appeal to beginners and advanced users alike. Below are some key benefits:.

Speed and Convenience

A digital wallet provides multiple advantages that attract both beginners and experienced users. One of its key strengths lies in how quickly you can complete transactions.

Whether you’re shopping online or tapping your phone at a checkout counter, digital wallets save time by removing the need to sift through physical cards or handle cash.

This speed also translates into greater convenience because you effectively carry all your financial instruments—credit cards, debit cards, and even loyalty programs—in your smartphone or smartwatch.

Enhanced Security

Another major benefit is the heightened security that comes with digital wallets. Many platforms employ encryption and tokenization, so your sensitive financial data remains hidden from merchants and potential cyber threats.

For added protection, features such as biometric authentication and real-time notifications help ensure that only you can authorize transactions and that any unusual activity is immediately flagged. In turn, this can reduce the risk of fraud compared to carrying around physical cards that can be lost or stolen.

Transaction Tracking

Digital wallets also bring efficiency to personal financial management. Instead of relying on paper receipts or combing through multiple bank statements, you can view your spending history in one place.

Most apps provide clear breakdowns of your recent transactions, which allow you to track expenses with ease. This centralization of data can be particularly helpful if you’re trying to maintain a budget or monitor your cash flow closely.

Reward Programs

Beyond these core points, digital wallets often integrate seamlessly with loyalty and reward programs.

By storing coupons or points in the same app you use to pay, it becomes much simpler to apply promotions at checkout, saving both time and money.

Some digital wallets even highlight relevant offers automatically, which makes redeeming discounts nearly effortless.

On a broader scale, digital wallets are increasingly accepted worldwide; global compatibility means you can use a single payment method to shop on international websites or at physical stores in many countries, easing the friction of travel and cross-border commerce.

Integration with Other Apps

Lastly, these platforms frequently integrate with other applications you may use daily, such as ride-sharing or food-delivery services.

By linking your wallet to these apps, you can minimize the need to repeatedly enter your payment information. This level of convenience not only streamlines your day-to-day financial activities but also helps you develop a cohesive view of your overall spending habits.

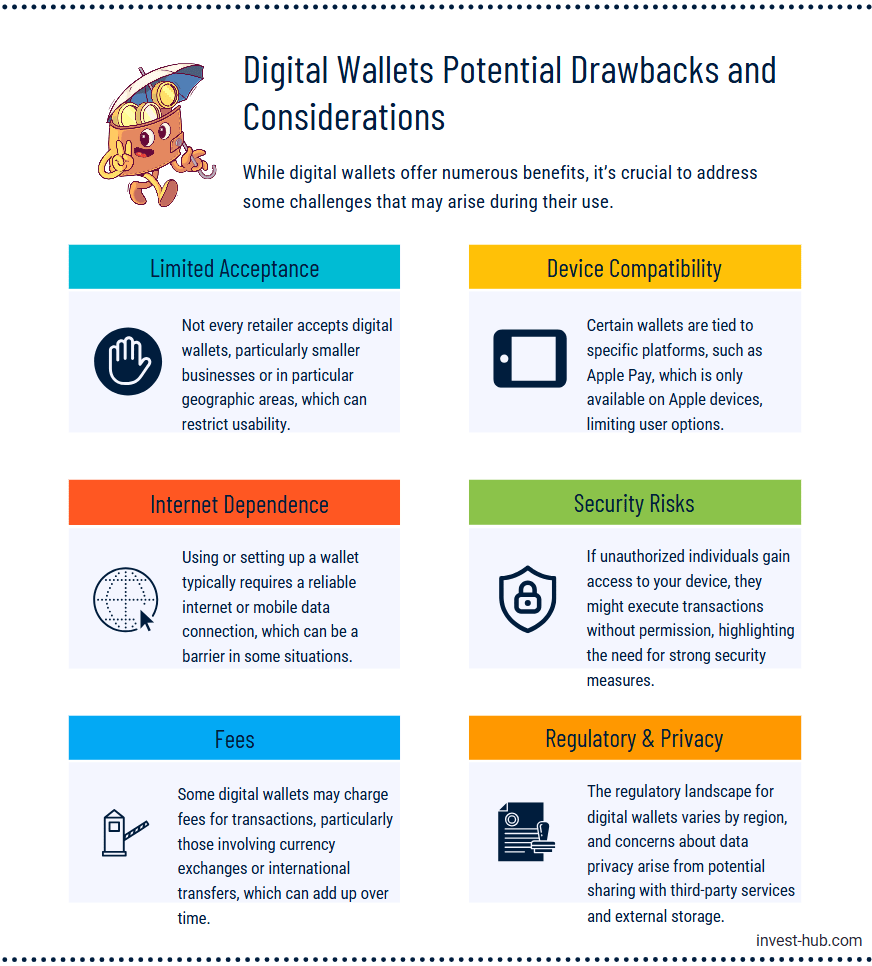

Potential Drawbacks and Considerations

While digital wallets bring many conveniences, it’s also important to be aware of potential challenges:

- Limited Acceptance

Not all merchants accept digital wallets—especially smaller retailers or in certain regions. - Device Compatibility

Some wallets are exclusive to specific operating systems (e.g., Apple Pay is limited to Apple devices). - Internet Dependence

You generally need a stable internet or mobile data connection to use or set up your wallet. - Security Risks

- If someone gains access to your phone without proper authentication controls, they may attempt unauthorized transactions.

- Phishing or social engineering attacks can compromise user credentials.

- Fees

Certain wallets may include transaction fees, especially for cross-border or currency exchange. - Regulatory and Privacy Concerns

- Different regions may have varying regulations affecting digital wallet usage.

- Sensitive data might be shared with third-party apps or stored on external servers, raising privacy questions.

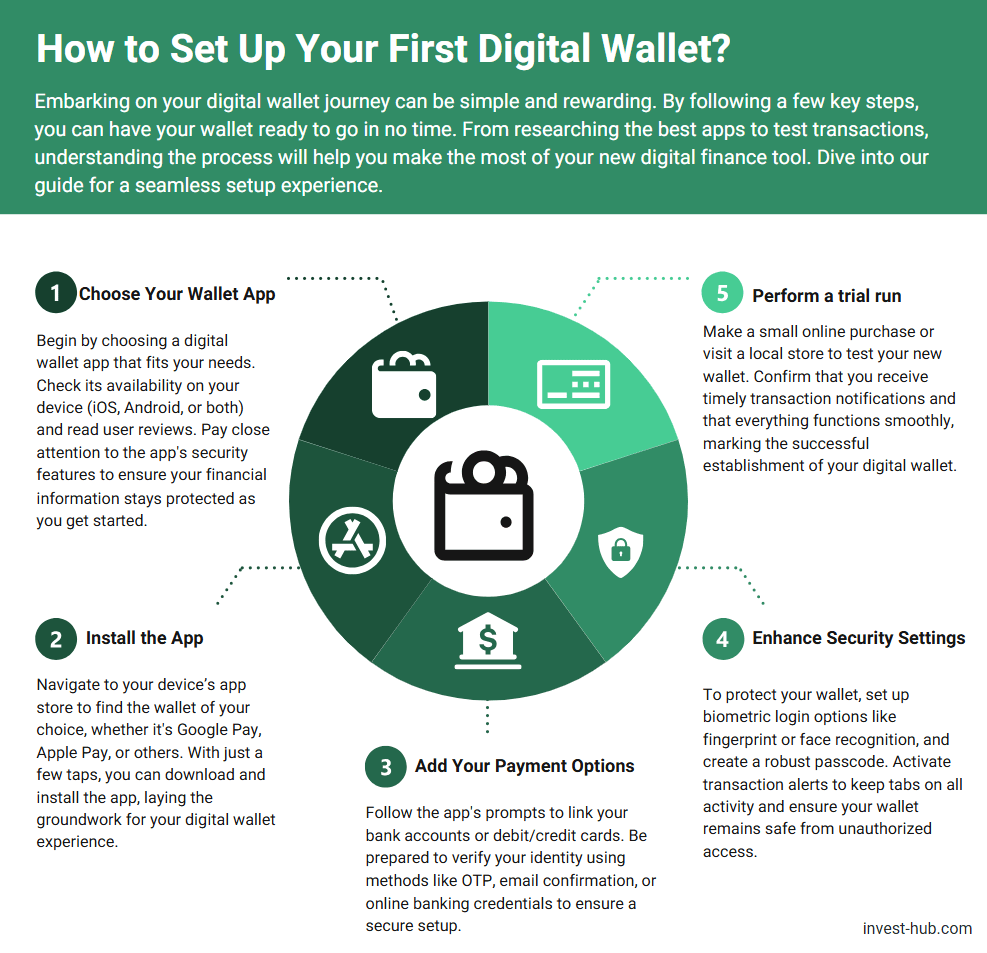

Setting Up Your First Digital Wallet

For beginners looking to jump into the digital wallet world, the process usually involves a few straightforward steps.

- Choose a Digital Wallet App

- Research compatibility (iOS, Android, or both).

- Read reviews and check security features.

- Download and Install

- Go to your device’s official app store (e.g., Google Play Store, Apple App Store).

- Download the wallet of your choice (Google Pay, Apple Pay, Paytm, etc.).

- Add Payment Methods

- Link your debit/credit cards or bank accounts by following in-app instructions.

- You might be asked to verify via OTP (One-Time Password), email confirmation, or bank login.

- Enable Security Features

- Set up biometric authentication (fingerprint or face ID) or a strong passcode/PIN.

- Activate notifications for each transaction to monitor activity in real time.

- Make a Test Payment

- Start with a small purchase, either online or at a retail store, to ensure everything works correctly.

- Confirm that you receive transaction alerts and that your new wallet is securely set up.

Helpful Tips

- Update Regularly: Keep your wallet app updated to benefit from new security patches.

- Check Merchant Compatibility: If you often shop in certain places, verify that they accept your chosen wallet.

- Stay Vigilant: Watch out for suspicious links or emails claiming to represent your wallet provider.

Popular Digital Wallet Apps for Beginners

Below are some well-known digital wallet apps that frequently top user-choice lists, especially for beginners:

- Apple Pay

- Platform: iOS

- Features: Integrates with Apple Watch and Safari browser, supports tokenized transactions, works with major credit/debit cards.

- Ideal For: Apple device users who want a simple, secure payment method.

- Google Pay

- Platform: Android (also compatible with some iOS devices in select regions)

- Features: Unified payments interface, contactless payments, easy peer-to-peer transfers.

- Ideal For: A wide range of Android users and those who prefer Google’s ecosystem.

- Samsung Pay

- Platform: Android (Samsung devices)

- Features: MST (Magnetic Secure Transmission) support, accepted even at many older card readers.

- Ideal For: Users with Samsung smartphones, especially in regions without widespread NFC.

- Paytm

- Platform: Android, iOS

- Features: Popular in India; offers bill payments, recharges, shopping, and money transfers.

- Ideal For: Users seeking an all-in-one platform with extensive acceptance in the Indian market.

- PayPal

- Platform: Web, Android, iOS

- Features: Long-standing global presence, easy cross-border transactions, robust buyer protection.

- Ideal For: International shoppers and freelancers who receive payments worldwide.

- Venmo

- Platform: Android, iOS

- Features: Peer-to-peer payments with a social media twist, splitting bills with friends, transferring funds quickly.

- Ideal For: Younger audience and those looking to split expenses frequently.

Each wallet has its unique advantages, from user-friendly interfaces to different reward structures. Choosing the right wallet is mostly about matching the service to your daily financial habits and device compatibility.

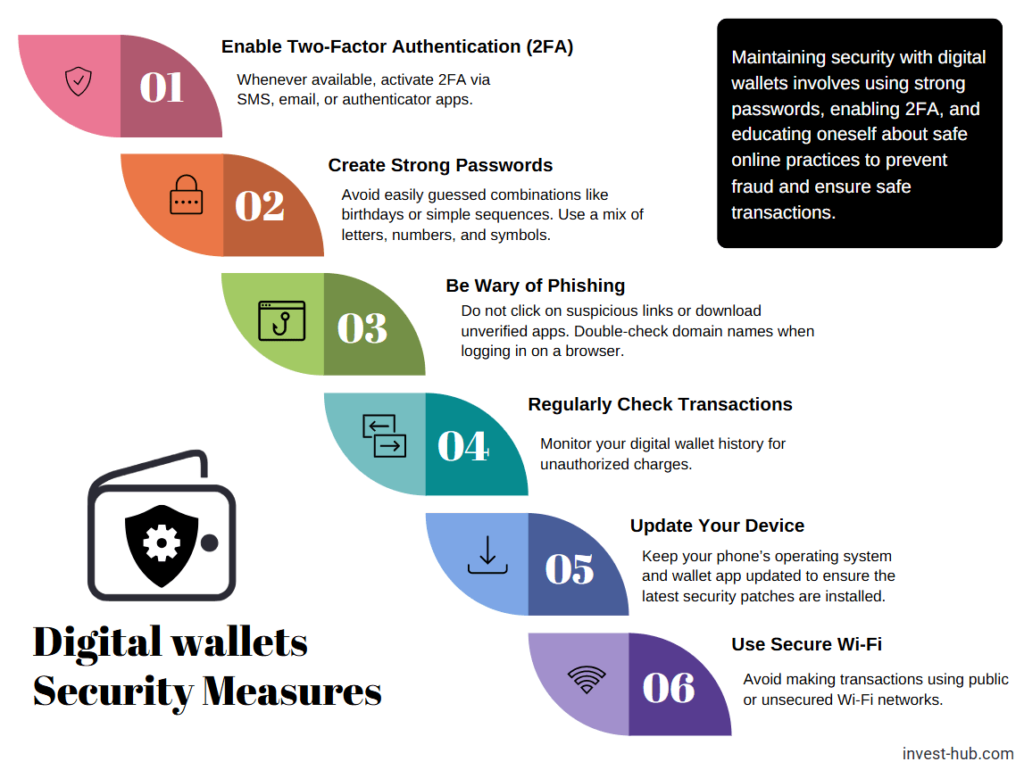

Digital Wallet Security Measures to Keep in Mind

While digital wallets incorporate strong encryption, users must also play an active role in maintaining security.

- Enable Two-Factor Authentication (2FA)

- Whenever available, activate 2FA via SMS, email, or authenticator apps.

- Create Strong Passwords

- Avoid easily guessed combinations like birthdays or simple sequences. Use a mix of letters, numbers, and symbols.

- Be Wary of Phishing

- Do not click on suspicious links or download unverified apps.

- Double-check domain names when logging in on a browser.

- Regularly Check Transactions

- Monitor your digital wallet history for unauthorized charges.

- Update Your Device

- Keep your phone’s operating system and wallet app updated to ensure the latest security patches are installed.

- Use Secure Wi-Fi

- Avoid making transactions using public or unsecured Wi-Fi networks.

Bank of America also advises users to remain cautious when linking new cards or bank accounts, verifying each step to minimize the chance of errors or fraudulent activity.

Conclusion

A digital wallet stands at the forefront of modern financial technology, transforming the way we conduct transactions and manage personal data. For beginners, understanding its definition, features, types, and security protocols is the key to confidently embracing this convenient and secure payment method. By choosing the right wallet—be it Apple Pay, Google Pay, Paytm, or another option—and following basic precautions like strong authentication and vigilant monitoring, you can streamline your everyday payments while staying protected.

Ready to take the leap? Explore the different digital wallet apps, test them with small purchases, and discover how they can simplify your life. As digital payments continue to evolve, early adoption and mindful usage can offer both convenience and a glimpse into the future of personal finance.

Frequently Asked Questions (FAQs)

A digital wallet is a secure online application that stores payment information, allowing you to make purchases or transfers directly from your device without needing physical cash or cards.

Yes. Most digital wallets employ encryption, tokenization, and biometric authentication to protect user data. However, it’s essential to follow best practices like using strong PINs or passwords and regularly reviewing transactions.

Most major digital wallet apps are compatible with both iOS and Android. However, some are exclusive to specific devices (e.g., Apple Pay only works on Apple devices), so check your phone’s compatibility.

Many digital wallet transactions are free, especially within the same country. However, international transfers or certain credit card operations might incur fees. Always check the terms and conditions of your chosen wallet.

You can typically add money by linking a bank account or debit card and transferring funds through the digital wallet app. Some wallets also allow adding funds through partner retailers or ATMs.

It depends on your location, device, and personal preferences. Apple Pay, Google Pay, and Paytm are popular due to ease of use, broad acceptance, and strong security measures.