The Forex market, also known as the foreign exchange market, is an over-the-counter global market for the trade of currencies. This market operates 24 hours a day, five days a week, for the purchase and selling of currencies for commerce, tourism, and investment. It is the world’s largest financial market, with a volume of more than $6 trillion traded daily.

Understanding the Forex Market

According to nerdwallet, The forex market, at its simplest level, allows its participants to buy, sell, exchange, and speculate on currencies. Unlike other centralized exchanges, forex trading is traded over-the-counter, or OTC, whereby transactions are made directly between parties without the supervision of an exchange. This model allows for the trading to continue seamlessly across time zones, making it a very global marketplace.

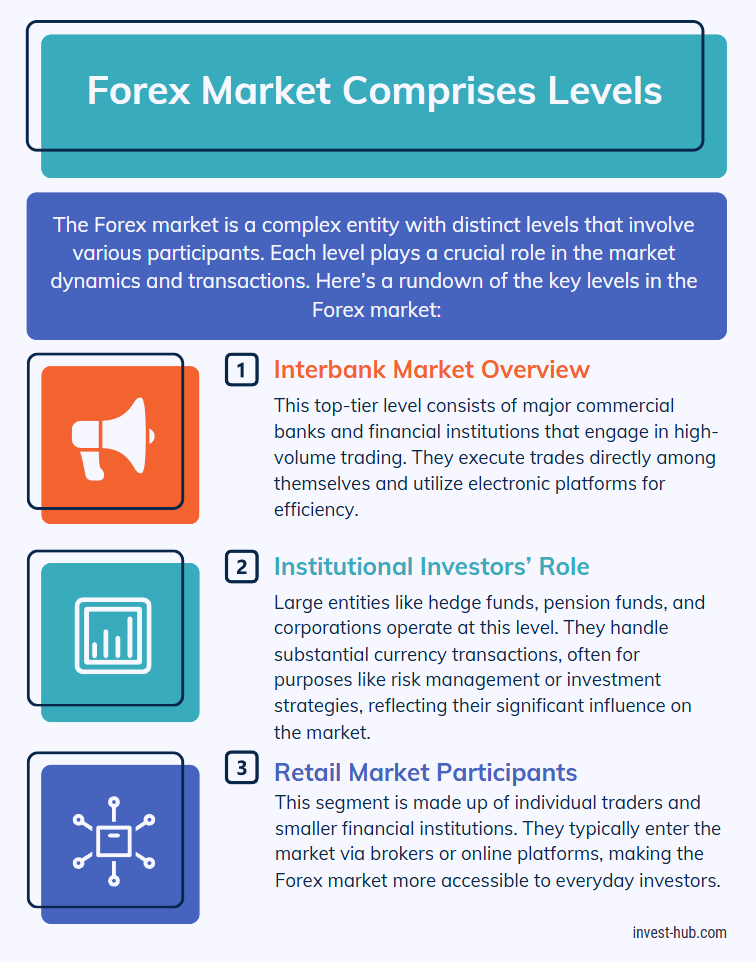

The Forex Market Comprises Several Levels—What Are They?

The Forex market is characterized by different levels, reflecting various participants and their roles in the operation of the market:

- Interbank Market: It is the highest level, where the largest commercial banks and/or security dealers are involved. They deal directly with one another and through electronic brokering.

- Institutional Investors: Hedge funds, pension funds, and multinational corporations are examples of participants at this level, which involves large-scale foreign exchange transactions, either for investments or to hedge against risk factors, or as part of their operations.

- Retail Market: This consists of individual traders and smaller financial institutions that usually access the market through either a broker or online trading platforms.

This hierarchical structure, in turn, ensures liquidity and efficient functioning within the forex market by facilitating seamless interaction between the different levels that comprise it. The interbank market provides pricing and major liquidity, institutional investors drive large transactions, and retail traders add to the volume. This dynamic keeps currency exchange fluid and responsive to market demands.

What is a pip in the Forex market?

According to IG, a “pip” is short for “percentage in point,” the smallest price move an exchange rate can make. The size of a pip is usually expressed as one decimal place of one percent, or, consequently, to a movement in the fourth decimal place, 0.0001 for most currency pairs. For example, if the EUR/USD pair moves from 1.1050 to 1.1051, then it has appreciated by one pip. The concept of a pip simplifies measuring price fluctuation and calculating probable profit or loss. You can read the IG Broker Review 2025 to learn more about IG broker.

What is liquidity in the Forex market?

Liquidity is a situation whereby one can sell or buy an asset without making any drastic impact on the price of such an asset. High liquidity within a forex market implies that huge amounts of transactions are possible without great changes in prices. The major currency pairs, such as EUR/USD or USD/JPY, would normally be considered to have high liquidity because of the huge trading volumes and hence tighter spreads with more efficient pricing.

What is leverage in the Forex market?

Leverage enables traders to hold a much larger position than the relatively small amount of capital would. For example, with a 100:1 leverage, using $1,000 of his or her own money, a trader can hold a $100,000 position. But should the market go against him by 1 percent, he would lose all his investment. This shows how leverage can amplify the gains and the losses, which makes risk management very important. For example, with a leverage of 100:1, a trader needs only $1,000 of his own money to control a position worth $100,000. While this leverage can give huge potential for profits, the same leverage might also increase the risk of considerable losses, thus making risk management crucial.

Spread in the Forex Market

The spread refers to the difference between the bid, or buying price, and the ask, or selling price, of a currency pair. It is a form of cost to trade and can be variable based on factors such as market liquidity, volatility, and the currency pair being traded. Tighter spreads are usually better for traders because they reduce the cost of the transaction.

What is the OTC market in Forex?

The over-the-counter market means decentralized trading, with direct contact between the parties to a transaction and without a centralized exchange. In the case of forex, the OTC nature implies that trading is conducted through an interbank network of banks, brokers, and other different financial institutions, thus enabling free and continuous trading across the globe.

Differences between the Forex Market and the Stock Market

Though both forex and stock markets involve trading financial instruments, there are quite a number of major differences between them:

| Aspect | Forex Market | Stock Market |

|---|---|---|

| Market Hours | Open 24 hours a day, 5 days a week to accommodate global participants across time zones. | Operates during specific hours based on the country’s exchange schedule. |

| Liquidity | Highly liquid, especially major currency pairs, allowing large orders with minimal price impact. | Liquidity varies by stock and market conditions; some stocks may have lower liquidity. |

| Leverage | Generally offers higher leverage, allowing traders to control larger positions with less capital but with higher risk. | Lower leverage compared to forex, meaning traders need more capital for larger positions. |

| Market Forces | Influenced by macroeconomic data, interest rates, and geopolitical events. | Prices are affected by company-specific news, earnings reports, and industry trends. |

Understanding these facts is crucial to enable traders to choose the correct market for them, which is in line with their trading style and risk tolerance.

Key points to take along include:

- The forex market is open 24/5; stock markets open and close at specific times.

- Forex offers higher liquidity, making trade execution faster and more efficient.

- Leverage in forex allows for higher position control but comes with increased risk.

- Market influences differ: forex is driven by macroeconomic factors, while stocks are influenced by company-specific events.

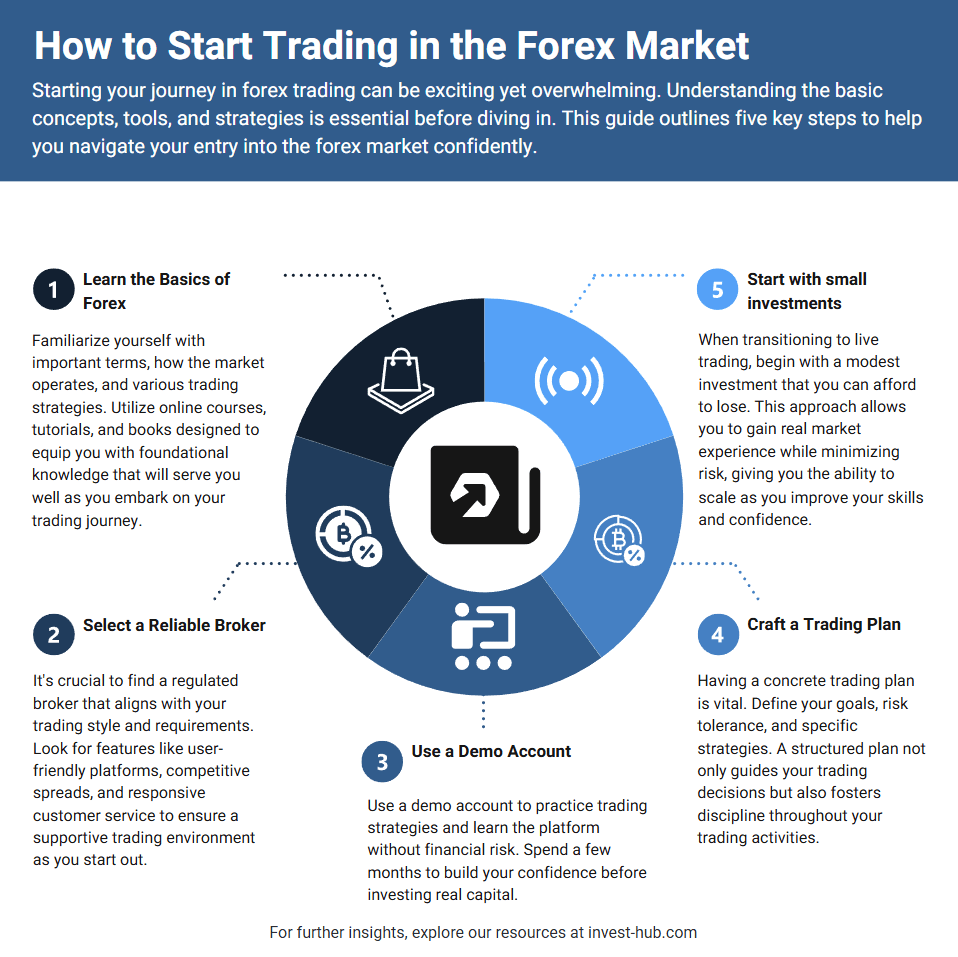

How to Start Trading in the Forex Market

According to Admiral Markets, For beginners interested in forex trading, here are some steps to get started:

- Educate yourself: Gain knowledge about various forex terminologies, understand the workings of the markets, and understand the strategies involved in trading. There are many online resources, courses, and books that one can use to acquire basic knowledge.

- Choose a Good Broker: A well-regulated forex broker with an easy-to-use trading platform, good spreads, and reliable customer support is important. Make sure that the broker fits your needs and goals of trading.

- Open a Demo Account: Before investing your real money into it, try practicing on a demo account to get acquainted with the platform and build your strategies without any risk. It is highly recommended that beginners use a demo account for at least three to six months to gain confidence and fine-tune their strategies before transitioning to live trading.

- Develop a Trading Plan: Develop a detailed trading plan specifying all your objectives, acceptable levels of risk, and more. A well-articulated plan works like a guide and preserves discipline in its wake.

- Start Small: Start with a minimal investment once you go live and get real-time exposure to scale up when you feel right about it.

You can read in-depth review of Admiral Markets broker in Admiral Markets Review 2025.

Conclusion

The forex market is the biggest and most liquid financial market in the world, presenting numerous opportunities for traders. Certain concepts are pip, leverage, spreads, and liquidity. Whether one is an amateur trader or an experienced trader, a trading plan and risk management strategy are required. Traders can efficiently cope with the forex market and hope to get financial success with knowledge and well-judged decisions. Keep learning, be aware of market trends, and polish your trading skills for maximum potential. Success in forex trading comes with patience, practice, and continuous education.

Frequently Asked Questions About the Forex Market

The forex market is an over-the-counter, global financial market for exchanging currencies. It runs for 24 hours a day, five days a week, and its daily trading volume surpasses $6 trillion.

Forex trading involves selling one currency while buying another simultaneously. Through such buy/sell decisions, traders make speculations about potential changes in currency prices based on economic data, interest rate differentials, and geopolitical events.

The participants in the forex market include banks, financial institutions, hedge funds, retail traders, and multinational corporations, which together contribute to the liquidity and pricing within the market.

A pip is the smallest movement a currency pair can have. It usually is 0.0001 for most currency pairs.

Leverage allows traders to control larger positions with a small amount of capital. For example, with 100:1 leverage, a trader can control a $100,000 position with just $1,000.

The forex market is 24/5, has higher liquidity, and is driven by macroeconomic factors. The stock market has fixed hours of trading, its liquidity changes, and it is driven by company news.

The spread is the difference between the bid, or buying price, and the ask, or selling price, of a currency pair. It reflects the cost of the transaction.

Beginners are best starting with at least three to six months of using a demo account to gain experience and fine-tune their strategies before they start trading with real money.

Yes, forex trading involves high risk, especially because of leverage. Effective risk management through stop-loss orders and position sizing is important.

To start trading forex, learn the basics of the market, choose a regulated broker, practice on a demo account, come up with a trading plan, and invest a small amount of money to get started.