What is KOSPI index?

The KOSPI Index (Korea Composite Stock Price Index) is South Korea’s flagship stock market index, tracking the market-capitalization-weighted performance of every common share listed on the Korea Exchange’s (KRX) main board. It serves the same role for Seoul that the S&P 500 does for New York—offering investors a real-time gauge of the entire Korean large-cap universe. For real-time movements, check our KOSPI live price page.

What Does KOSPI Stand For?

“KOSPI” is an acronym for Korea Stock Price Index, officially introduced in 1983 with a base level of 100 points set on 4 January 1980. (en.wikipedia.org)

Key Facts

- Base date: 4 Jan 1980

- Launch year: 1983

- Weighting: free-float market capitalisation

- Currency: Korean won (KRW)

The Significance & Uses of KOSPI as Korea’s Main Stock Index

South Korea reports several equity indices, yet KOSPI remains the primary barometer of its economy. Like other broad benchmarks (S&P 500, Nikkei 225), it captures roughly 70% of total domestic market cap and is the underlying for a deep derivatives complex spanning futures, options, ETFs, and total-return swaps. (eurex.com)

How Many Companies Are Listed in KOSPI?

As of March 2025, the KOSPI comprises over 700 constituents (928 at the last formal rebalance), representing every common stock on the KRX main board. Constituents range from the megacap Samsung Electronics to regional banks and shipbuilders. The index is reviewed quarterly for corporate actions and liquidity shifts.

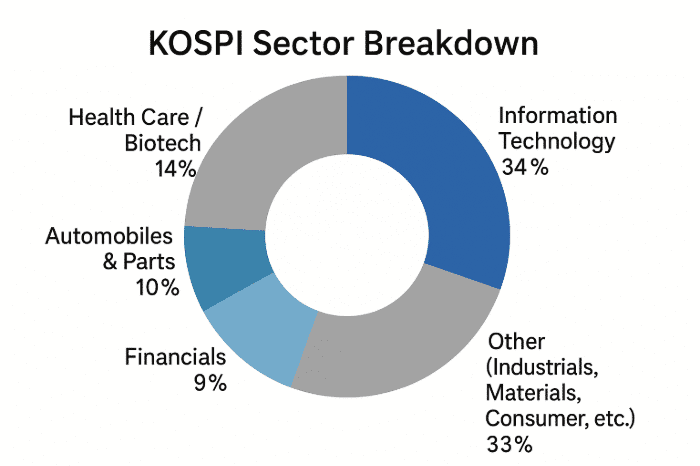

Sector Weighting (approx.)

- Information Technology: Largest sector (exact percentage not confirmed in sources).

- Health Care/Biotech: 14 %

- Automobiles & Parts: 10 %

- Financials: 9 %

- Other (Industrials, Materials, Consumer, etc.): 33 %

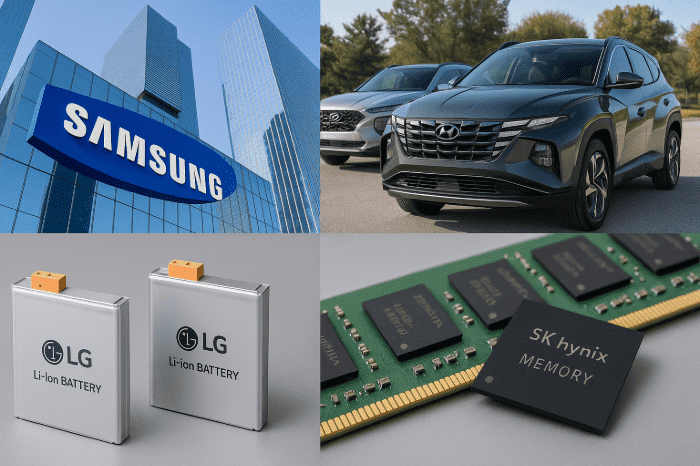

Key Companies in the KOSPI Composite Index

Below are the ten largest stocks by free-float market capitalization (April 2025):

- Samsung Electronics Co. (005930.KS)

- SK Hynix Inc. (000660.KS)

- Samsung Biologics Co. (207940.KS)

- LG Energy Solution Ltd. (373220.KS)

- Hyundai Motor Company (005380.KS)

- Celltrion Inc. (068270.KS)

- Kia Corp. (000270.KS)

- Naver Corporation (035420.KS)

- KB Financial Group Inc. (105560.KS)

- Hanwha Aerospace (012450.KS)

KS11: The Ticker Symbol & Live Market Data

International data vendors designate the composite index “^KS11” (Yahoo Finance) or “KOSPI:IND” (Bloomberg). At the close of 24 April 2025, the index stood at 2,546.30 points, up 5.1% year-to-date. You can track global benchmarks side-by-side on our indices live price dashboard.

Take a look at our breakdown of the KOSPI Price Today.

Recent Performance Snapshot

| Period | Level | % Change |

|---|---|---|

| 1 Day | 2 522 | –0.13 % |

| 1 Week | 2 558 | –1.4 % |

| 1 Month | 2616 | –3.6 % |

| YTD 2025 | 2 400 | +5.1 % |

KOSPI vs KOSPI 200 vs KOSDAQ (Comparison Table)

The table below contrasts South Korea’s primary stock market indices. Visit the Invest-Hub market section for deeper dives into regional equity benchmarks.

| Index | Coverage | No Companies | Weighting | Launch | Typical Use |

| KOSPI | All main-board common stocks | ≈ 930 | Free-float M-cap | 1983 | Broad market gauge |

| KOSPI 200 | 200 large-caps from KOSPI | 200 | Free-float M-cap | 1990 | Futures & options benchmark |

| KOSDAQ | Growth & tech board | ≈ 1 700 | Free-float M-cap | 1996 | Small/cap growth proxy |

Historical Milestones

- 3 Jan 1990: KOSPI 200 launched (base 100)

- 25 Jul 2007: KOSPI first closes above 2 000

- 7 Jan 2021: Index surpasses 3 000 for the first time

- 6 Jul 2021: All-time closing high: 3 305.21

- Mar 2020: Short-selling ban amid COVID-19 volatility

How the KOSPI Is Calculated

KOSPI is a market-capitalization-weighted index. Each constituent’s float-adjusted market cap is divided by a free-float adjustment factor (FIF). The aggregate free-float value is divided by a divisor that is periodically adjusted for corporate actions: rights issues, bonus shares, splits/mergers, and delistings ensure continuity of the index level. Rebalances occur on the third Friday of March, June, September, and December.

Futures, Options & 0‑DTE Trading on KOSPI

- KOSPI 200 futures: Launched in 1996 on KRX; one contract represents KRW 500 000 × KOSPI 200 level.

- Mini-KOSPI futures & options: Lower notional for retail investors.

- Eurex-listed USD-denominated KOSPI derivatives allow international access during European trading hours.

- Increasingly popular 0‑days‑to‑expiry (0DTE) options provide intraday exposure for volatility traders.

How to Invest in KOSPI

- Domestic brokerage account with KRX membership.

- Cross-listed ETFs (e.g., iShares MSCI South Korea ETF – EWY).

- KOSPI-linked derivatives on KRX or Eurex.

- American Depositary Receipts (ADRs) for individual Korean megacaps.

Foreign investors must register with the Financial Supervisory Service (FSS) and appoint a custodian bank before trading Korean securities directly.

Conclusion on What is KOSPI index?

The KOSPI Index condenses the performance of Over 700 South Korean corporations into a single, market-cap-weighted number. Investors and policymakers alike track its moves to gauge the health of Asia’s fourth-largest economy. Whether accessed via ETFs, futures, or direct share ownership, understanding KOSPI’s structure, constituents, and historic milestones is essential for anyone analyzing Korean equities. Explore more insights and tools across Invest Hub to sharpen your trading strategy.

Frequently Asked Questions (FAQ)

The KOSPI Composite Index (ticker ^KS11) is the primary benchmark of the Korean equity market.

South Korea; the index is calculated and published by the Korea Exchange (KRX) in Seoul.

KS11 is the ticker symbol used by data vendors (e.g., Yahoo Finance) for the KOSPI Composite Index. (finance.yahoo.com)

Approximately 930 as of March 2025, covering all KRX main-board common shares.

The index contains every blue blue‑chip in Korea, with Samsung Electronics, SK Hynix, Hyundai Motor, and LG Energy Solution among the largest constituents.

“Korea Composite Stock Price Index.”