In the world of stock markets and trading, a common question that often arises is, “What is sub broker?” This term plays a crucial role in the broader financial ecosystem, acting as an intermediary between investors and major brokerage houses. Whether you’re a budding investor looking for reliable guidance or someone interested in establishing a business in finance, understanding sub brokers can be a game-changer. Sub brokers, also referred to by some as “Authorised Persons,” help expand the reach of stockbrokers, offering personalized support to clients at a local level.

Answer: A sub broker is an intermediary who operates under a main broker’s license to facilitate trading activities for clients. They onboard investors, provide personalized guidance, and ensure regulatory compliance. By leveraging the main broker’s infrastructure, sub brokers can offer a local, hands-on approach, particularly beneficial in regions underserved by large brokerage firms. This personalized service promotes financial inclusion, helping more people participate in the stock market.

This article explores every aspect of sub-brokerage, including the sub-broker’s meaning, responsibilities, and a step-by-step guide on how to become one. It also addresses common challenges faced by sub-brokers, potential earning opportunities, and best practices for success.

Sub-brokers play a crucial role as intermediaries between clients and the stock market. They ensure smooth transactions, provide advisory services, and maintain regulatory compliance.

By the end of this guide, you’ll clearly understand what a sub-broker is and gain valuable insights into becoming one. This article is based on a combination of reliable online sources. Keep reading to learn how sub-brokers operate, the benefits and challenges of this role, and practical strategies for building a successful career in the field.

Sub Broker Meaning: Understanding the Basics

When navigating financial markets, you’ll often encounter terms like broker, sub broker, and dealer. Before diving into advanced concepts, it’s essential to understand the sub broker’s meaning.

At its core, a sub broker is an individual or entity acting on behalf of a stockbroker to bring in clients and facilitate trades. According to Alice Blue, a sub-broker enters into a formal agreement with a main brokerage house to extend the broker’s services to investors who might not have direct access otherwise.

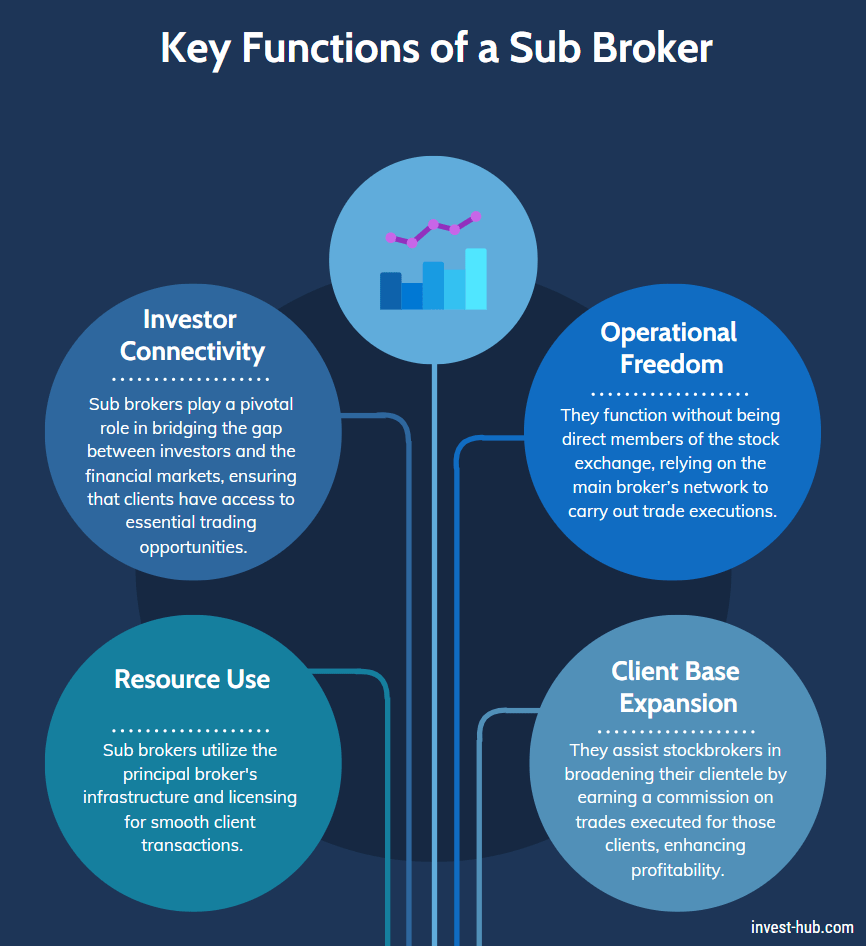

Key Functions of a Sub Broker

- Acts as a critical link between investors and the broader financial markets.

- Operates without direct membership in the stock exchange (reserved for the main broker).

- Leverages the principal broker’s infrastructure and license to execute transactions.

- Helps the stockbroker expand its client base while earning a commission share on client trades.

As highlighted by Angel One, in the Indian market, sub-brokers are often referred to as “Authorised Persons.” They are formally recognized by regulatory bodies like the Securities and Exchange Board of India (SEBI). SEBI enforces strict guidelines for sub brokers, ensuring:

- A streamlined trading experience for clients.

- Transparency in operations.

- Fairness in dealings.

What Is a Sub-Broker in Financial Markets?

What is a sub-broker in financial markets? In financial markets, the smooth buying and selling of financial instruments rely on a network of participants. A sub-broker plays a critical role in this network by acting as an intermediary, ensuring clients have easy access to trading services.

Unlike brokers who are directly licensed by stock exchanges like the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE), sub brokers operate under a broker’s license.

Responsibilities of a Sub Broker

- Client Acquisition & Guidance: Sub-brokers focus on acquiring, guiding, and serving a pool of clients.

- Local Expertise: They often possess deep knowledge of local markets, investor psychology, and regional client needs, enabling brokers to reach underserved communities.

- Value-Added Services: Many sub-brokers provide additional services, such as

- Risk assessments

- Investment advice

- Personalized portfolio management

Regulatory Compliance

Sub-brokers must adhere to the regulatory framework established by authorities like SEBI. While they enjoy some autonomy, their work involves meeting compliance standards, including

- Following trading protocols

- Ensuring data privacy

- Upholding ethical client interactions

Contribution to Financial Markets

Sub-brokers play a vital role in ensuring the trust, liquidity, and efficiency of financial markets by

- Nurturing long-term client relationships

- Facilitating seamless transaction flows

They serve as the “feet on the ground” for large brokerage firms, offering a personal touch. This helps retail investors—especially those new to the complexities of the stock market—feel confident and engaged in their financial journey.

Key Differences Between a Stockbroker and a Sub Broker

The terms “stockbroker” and “sub-broker” are closely related, but there are important distinctions between the two.

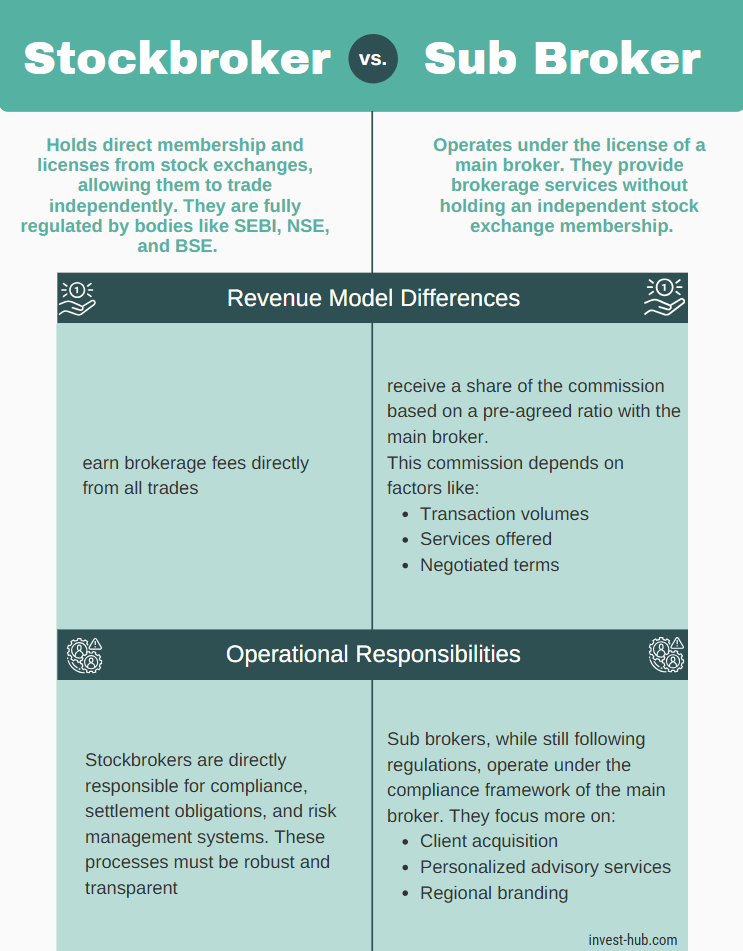

- Stockbroker: Holds direct membership and licenses from stock exchanges, allowing them to trade independently. They are fully regulated by bodies like SEBI, NSE, and BSE.

- Sub Broker: Operates under the license of a main broker. They provide brokerage services without holding an independent stock exchange membership.

Revenue Model Differences

- Stockbrokers earn brokerage fees directly from all trades.

- Sub brokers receive a share of the commission based on a pre-agreed ratio with the main broker. This commission depends on factors like:

- Transaction volumes

- Services offered

- Negotiated terms

Operational Responsibilities

- Stockbrokers are directly responsible for compliance, settlement obligations, and risk management systems. These processes must be robust and transparent.

- Sub-brokers, while still following regulations, operate under the compliance framework of the main broker. They focus more on:

- Client acquisition

- Personalized advisory services

- Regional branding

The core trading infrastructure (e.g., back-office settlement, technology platforms) remains under the main broker’s management.

Key Takeaway

The relationship between brokers and sub brokers is symbiotic. While brokers handle the core trading framework, sub brokers emphasize client relationships and local outreach. Understanding these roles helps investors and finance professionals identify the path that best suits their goals.

Role and Responsibilities of a Sub Broker

The role of a sub broker is to bridge the gap between individual clients and the broader financial market. Their responsibilities go far beyond facilitating trades. Sub brokers often play a consultative role, offering clients insights into market trends, portfolio structuring, and compliance requirements. This hands-on approach requires a strong understanding of financial instruments such as equities, mutual funds, commodities, and derivatives.

Sub brokers handle essential tasks like:

- Onboarding new clients

- Conducting KYC (Know Your Customer) checks

- Ensuring proper documentation

These steps help maintain compliance standards and credibility as per their partnering stockbroker. Many sub brokers also leverage technology, such as user-friendly trading platforms, to provide clients with:

- Market news

- Real-time quotes

- Investment alerts

This technology-driven approach enables them to meet modern investors’ expectations for convenient digital solutions.

In many cases, sub brokers act as the “face” of the brokerage house in their locality. They simplify market jargon for new investors, address queries, and provide ongoing education on topics like reading market signals or interpreting financial reports. In regions with limited financial literacy, sub brokers serve as essential financial educators.

Another critical aspect of a sub broker’s role is building brand trust. Large brokerage houses can feel impersonal to local investors, but sub brokers add a personalized touch. They leverage community ties and transparent communication to build a loyal client base. Their role extends beyond advising on trades—they often help shape a client’s broader financial strategy, focusing on risk management and long-term growth.

To succeed, sub brokers must:

- Consistently upskill

- Network effectively

- Stay aligned with regulatory frameworks

This dynamic role combines financial expertise, technology adoption, and strong interpersonal skills, making sub brokers invaluable to the evolving financial markets.

Providing Client Support and Investment Guidance

One of the key responsibilities of a sub broker is providing client support and investment guidance. Unlike large brokerage firms that rely on automated, impersonal systems, sub brokers often adopt a more hands-on approach. They help new investors understand the basics of stock market investing, such as:

- How to read candlestick charts

- The fundamentals of stock analysis

- How global events can influence share prices

This personalized attention is particularly valuable for first-time investors.

Sub brokers frequently engage with clients through face-to-face meetings, phone calls, or online sessions. These interactions cover topics like market strategies, portfolio updates, or new investment opportunities. This high level of engagement helps foster trust and loyalty among clients, distinguishing sub brokers in a competitive market where digital platforms alone may not meet all investor needs.

In addition to regular communication, sub brokers analyze clients’ risk profiles and financial goals. They recommend suitable investment products such as:

- Blue-chip stocks

- Systematic Investment Plans (SIPs) in mutual funds

This tailored guidance helps clients build balanced portfolios aligned with their risk tolerance. Sub brokers are also the first point of contact for clients when challenges arise, whether it’s troubleshooting a trading platform issue or clarifying regulatory changes. Prompt and effective support significantly enhances the client experience.

Sub brokers also stay updated on market trends, corporate announcements, and macroeconomic developments. They share this knowledge with clients through:

- Newsletters

- Social media updates

- One-on-one consultations

By blending human insight with digital tools, sub brokers create a robust support system that empowers investors to make well-informed decisions over the long term.

Compliance and Regulatory Requirements

Navigating compliance and regulatory requirements is a cornerstone of any sub broker’s responsibilities. Although the primary accountability lies with the main broker, sub brokers also operate under the oversight of financial authorities like SEBI. In India, for instance, SEBI has established specific guidelines for sub brokers—now referred to as “Authorised Persons”—to promote ethical practices and safeguard investor interests.

As highlighted by Religare, a sub broker must adhere to several critical requirements:

- Follow proper KYC protocols.

- Maintain transparent financial records.

- Abide by guidelines on client data protection.

Any misconduct can damage not only the sub broker’s reputation but also that of the principal brokerage firm. Compliance is a shared responsibility that involves meticulous record-keeping, periodic audits, and accurate transaction reporting. A strong compliance framework reassures investors that their money is secure.

To ensure regulatory adherence, sub brokers and their teams often:

- Undergo compliance training.

- Stay updated on evolving market rules.

- Adapt their processes when new regulations are introduced.

For example, if SEBI implements changes to margin requirements or insider trading norms, sub brokers must quickly adjust their business models to remain compliant.

Compliance isn’t just about meeting legal obligations; it’s about building long-term trust and credibility. Clients are more likely to invest and remain loyal when they see their sub broker upholding high professional standards.

Building Trust and Long-Term Client Relationships

Building trust and nurturing long-term client relationships is one of the most rewarding aspects of sub brokerage. Financial services are inherently personal—clients entrust a sub broker with their hard-earned money, retirement goals, and dreams of wealth creation. To earn and maintain this trust, sub brokers must consistently demonstrate integrity, confidentiality, and dependability.

Effective communication is essential. Regularly updating clients about market trends, portfolio adjustments, and investment strategies reassures them that their interests are being actively managed. A customized approach further enhances this trust. For instance:

- Aggressive investors may benefit from small-cap stock recommendations.

- Conservative clients might prefer safer mutual fund investments.

Tailoring services to individual preferences not only improves satisfaction but also boosts client retention.

Transparency in fee structures is another critical factor. Clients appreciate sub brokers who clearly outline all charges, including:

- Trading commissions

- Account maintenance fees

Hidden costs can damage trust and drive clients to competitors. For this reason, top-performing sub brokers prioritize openness and clarity in all financial dealings.

Building trust extends beyond routine transactions. Offering added value, such as workshops or seminars, can educate clients on topics like market dynamics, tax benefits, or retirement planning. These initiatives position sub brokers as resourceful partners rather than mere service providers.

Over time, such efforts foster strong, lasting relationships. Satisfied clients often provide word-of-mouth referrals, which can significantly drive new business and reinforce the importance of trust in the sub brokerage domain.

How to Become a Sub Broker?

To become a sub broker, a rewarding and client-focused career in financial markets, you must follow several key steps.

- Start by conducting thorough research on market trends, regulations, and potential opportunities, especially in underserved areas.

- Partner with a reputable stockbroker, as their brand and compliance framework will support your operations.

- Complete the required registration and obtain “Authorised Person” status by submitting necessary documents and, in some cases, passing regulatory exams like NISM certifications.

- Set up your sub brokerage with essential tools such as trading platforms, back-office software, and marketing materials.

- Focus on creating a strong operational framework, including client onboarding, compliance, and effective marketing strategies.

- Sub brokers typically need a bachelor’s degree in finance or a related field, relevant experience, financial solvency, and strong interpersonal skills.

- Staying updated on regulatory changes and leveraging technology for streamlined operations can help you build credibility, attract clients, and sustain success in this competitive field.

Benefits and Challenges of Working as a Sub Broker

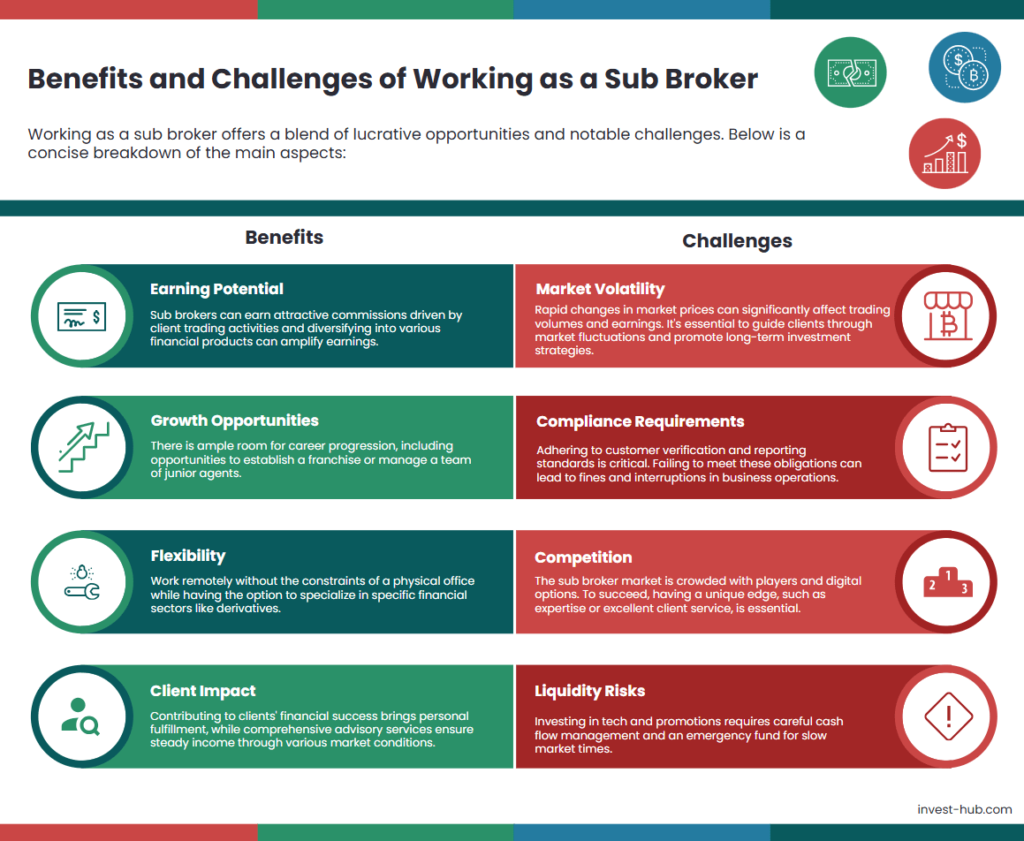

Working as a sub broker offers a blend of lucrative opportunities and notable challenges. Below is a concise breakdown of the main aspects:

Benefits

- Earning Potential:

- Sub brokers earn commissions based on client trading volumes.

- Diversification into equity, commodities, and currency enhances income streams.

- Cross-selling financial products like insurance or loans adds additional revenue.

- Referral programs can exponentially grow the client base.

- Growth Opportunities:

- Potential to evolve into a franchise or expand operations by hiring junior agents.

- Building a strong, loyal client base rewards long-term efforts.

- Flexibility:

- Digital tools reduce the need for physical offices, offering operational freedom.

- Ability to specialize in niches like derivatives or mutual funds.

- Client Impact:

- Helping clients achieve financial goals provides intrinsic satisfaction.

- Providing end-to-end advisory services stabilizes income across market cycles.

Challenges

- Market Volatility:

- Sudden price fluctuations can impact trading activity and commissions.

- Educating clients on market cycles and long-term strategies is crucial.

- Compliance Requirements:

- Strict adherence to KYC norms and transaction reporting is essential.

- Non-compliance risks include penalties and operational suspension.

- Competition:

- The market is crowded with brokers, sub brokers, and digital platforms.

- A unique value proposition, such as niche expertise or excellent service, is key to standing out.

- Liquidity Risks:

- Upfront expenses like technology and marketing require sound cash flow management.

- A contingency fund ensures smooth operations during slow market periods.

Best Practices for Success

Modern technology meets client expectations for speed and accuracy. for long-term success in the dynamic world of stock market brokerage.

Continuous Learning:

Stay updated on economic indicators, regulations, and market trends.

Deep knowledge enables better client guidance.

Diversification:

Encourage spreading investments across sectors and asset classes to minimize risks.

Reduces portfolio volatility during sector-specific downturns.

Transparency and Ethics:

Clear communication about fees and risks fosters client trust.

Ethical practices lead to client loyalty and positive referrals.

Leverage Technology:

Use tools for data analysis, automated alerts, and efficient trade execution.

Conclusion: Key Takeaways on Sub Broker Meaning and Path

We’ve explored the nuanced landscape of sub brokerage, covering everything from the meaning of a sub broker to their responsibilities, earning potential, and the challenges they face. Sub brokers act as a valuable bridge, offering localized and personalized services that large brokerage firms often struggle to deliver. Their ability to nurture trust, educate clients, and streamline the trading process makes them indispensable in financial markets.

Whether you’re an aspiring sub broker or an investor seeking the personal touch of a local expert, it’s clear that sub brokers are vital to the market’s infrastructure. They go beyond merely facilitating trades—they educate clients, ensure compliance, and significantly contribute to financial inclusion. If you’ve ever wondered, “What is a sub broker?” the answer is multifaceted. A sub broker is an essential link in the investment chain, bringing market access and informed decision-making to a broader audience.

Why “What Is Sub Broker” Matters for Financial Markets

Sub brokers serve as grassroots connectors between retail investors and the sophisticated world of equity, commodities, and derivatives trading. Their localized expertise simplifies complex financial concepts, enabling people from diverse backgrounds to participate in wealth-building opportunities. This diversity promotes liquidity and resilience in the market.

Key contributions of sub brokers include:

- Expanding market reach: Sub brokers often operate in semi-urban or rural areas where large brokerage firms have limited presence.

- Promoting retail participation: By bridging gaps, they encourage broader demographics to invest, contributing to economic growth.

- Building trust: Personalized, face-to-face interactions foster trust, which digital platforms often lack.

The question “What is sub broker?” also underscores the dual structure of brokerage services. A primary broker provides compliance and infrastructure, while a sub broker focuses on client engagement and advisory. This synergy supports both technological advancements (vertical growth) and increased market inclusion (horizontal growth). Sub brokers keep markets dynamic, benefiting both existing participants and new entrants.

Final Tips on “How to Become Sub Broker” Successfully

Here are practical tips to thrive as a sub broker:

- Commit to continuous learning:

Financial markets evolve rapidly. Stay updated through courses, webinars, and market analyses to provide fresh, data-driven insights and strengthen your credibility. - Prioritize transparency and integrity:

Build long-term client relationships by being honest about fees, risks, and services. Trust is the foundation of any successful business. - Leverage technology:

Use tools like customer relationship management (CRM) software and mobile trading apps. These streamline operations, enhance client experiences, and differentiate you in a crowded marketplace. - Ensure regulatory compliance:

Adhere strictly to KYC norms, transaction reporting, and other regulatory requirements. Regular audits and checklists can prevent errors that might harm your reputation or halt operations. - Carve out a niche:

Stand out by focusing on specific sectors, offering specialized advisory services, or organizing investor education seminars. A unique angle that resonates with your target audience can set you apart.

By combining expertise, authenticity, and innovation, you can build a thriving sub brokerage business. Sub brokers remain indispensable in the ever-evolving financial landscape, bridging gaps and opening doors for countless investors.

FAQs on What Is Sub Broker

A sub broker, also known as an Authorised Person, is an intermediary who operates under a main broker’s license. They help clients buy and sell securities, offer investment guidance, and handle certain compliance procedures on behalf of the principal broker.

A stockbroker has direct membership with stock exchanges and can execute trades in their own name. In contrast, a sub broker does not have direct membership; they work under the umbrella of a main broker’s license, earning a share of the commissions.

Sub brokers typically handle client onboarding (including KYC), offer personalized trading advice, and ensure compliance with regulations. They may also provide ongoing support, market insights, and risk management advice to their clients.

Although formal requirements can vary, many brokerages prefer candidates with at least a bachelor’s degree in finance, commerce, or a related field. Prior financial services experience, good communication skills, and passing certain regulatory exams (like NISM certifications) can also enhance eligibility.

Sub brokers earn through a commission-sharing arrangement with the main broker. The exact share depends on the agreement; higher trading volumes and diverse financial products often lead to greater earnings.

Yes, it can be. A successful sub broker with a loyal and active client base can generate significant commissions. The earning potential varies based on factors like the number of clients, their trading volume, and the range of services offered.

Common challenges include market volatility, stiff competition, and stringent regulatory requirements. Sub brokers also need to continuously adapt to technological changes and manage client expectations in a fast-moving financial landscape.

Sub brokers often operate in smaller cities or rural areas, bringing stock market opportunities closer to investors who might not otherwise have direct access. Their localized presence and face-to-face interaction can encourage more people to participate in the markets.

Many sub brokers expand into related fields like mutual funds, insurance, or loans. Providing these additional services can diversify income streams and offer clients a one-stop solution for multiple financial needs.

Look for factors like reputation, experience, technological support, and the clarity of their fee structure. A reliable sub broker should communicate openly, stay compliant with regulations, and provide consistent, high-quality client support.