The Straits Times Index (STI) is Singapore’s flagship equity benchmark, tracking the performance of the city-state’s 30 largest and most liquid stocks. For investors wondering, “What is the STI Index?” it is the pulse of the Singapore Exchange (SGX), representing approximately ~77% of SGX’s total market capitalization. Launched in 1966 and revamped in 2008 under the FTSE STI methodology, the STI uses free-float market-capitalization weighting and stringent liquidity screens to ensure investability and transparency.

What is the STI Index? Definition and History

Brief History of the Straits Times Index

- 1966: Introduced by The Straits Times newspaper to track blue-chip performance after Singapore’s separation from Malaysia.

- 1998: Adopted modern free-float weighting to align with global standards.

- 2008: FTSE Russell, Singapore Press Holdings (SPH), and SGX formed the FTSE STI partnership, codifying rules-based semi-annual reviews with additional quarterly adjustments.

- 2025: Continues to serve as the preferred benchmark for Singapore equity funds, ETFs, and derivatives.

Methodology: How the STI Index Is Calculated

- Universe: SGX Mainboard ordinary shares.

- Constituent selection: Top 30 companies by free-float adjusted market cap that pass liquidity and free-float screens.

- Weighting: Free-float market capitalization.

- Rebalancing: Semi-annual (March, September), with additional quarterly reviews for certain adjustments.

- Sector Alignment: Uses the Industry Classification Benchmark (ICB).

How Many Companies Are in the STI Index?

As of April 30 2025, the STI consists of 30 constituent companies spanning eight primary sectors, with financials and real estate making up about 55–60% of the weighting.

Sector Breakdown of the STI Constituents

| Sector | Approx. Weight (%) | Notable Constituents |

| Financials | 51.44 | DBS, OCBC, UOB |

| Real Estate | 12 | CapitaLand Ascendas REIT, City Developments |

| Industrials | 8.5 | Keppel Ltd., Singapore Technologies Engineering |

| Telecommunications | 6.9 | Singtel |

| Consumer Discretionary | 4.9 | Genting Singapore |

| Utilities | 4.2 | Sembcorp Industries |

| Consumer Staples | 3.1 | Thai Beverage |

| Technology | 0.9 | Venture Corporation |

Total index market capitalization is roughly SGD 400 billion, reflecting Singapore’s large-cap universe.

Why the STI Index Matters for Investors

- Market Barometer: Captures ~55% of SGX market cap, offering a quick read on Singapore’s economic health.

- Income Potential: Many STI constituents are mature, dividend-paying firms; the index’s dividend yield has historically trended above 4%—attractive in a low-rate environment.

- Diversification within ASEAN: Provides exposure to Southeast Asia’s financial hub without single-stock risk.

- Currency Stability: The Singapore dollar’s AAA-rated backdrop offers lower FX volatility versus regional peers.

Performance Trends and Historical Returns

- 2024: The STI delivered a 23.5 % total return in SGD terms, outperforming several regional benchmarks.

- Volatility: 10-year annualized volatility of ~12 %, lower than most emerging-market indices.

- Long-term CAGR: About 6.5 % over the past decade, including dividends.

For real‑time quotes and interactive charts, visit our STI live price page for the Straits Times Index.

How to Buy the STI Index

Investing via Singapore-Listed ETFs

| ETF | SGX Ticker | TER (p.a.) | Unit Size |

| SPDR® Straits Times Index ETF | ES3 | 0.30 % | 10 units |

| Nikko AM Singapore STI ETF | G3B | 0.30 % | 100 units |

Both track the STI price return index, distribute dividends, and can be purchased during SGX trading hours (09:00–17:00 SGT).

Buying the STI Index from Overseas

- International Brokers: Platforms such as Interactive Brokers, Saxo, and Tiger Brokers offer SGX access.

- Over-the-Counter Products: Some banks issue STI-linked structured notes or certificates.

- Currency Considerations: Non-SGD investors should hedge or accept SGD exposure.

For a detailed breakdown of fees, research tools, and global market access, see our in‑depth Interactive Brokers review.

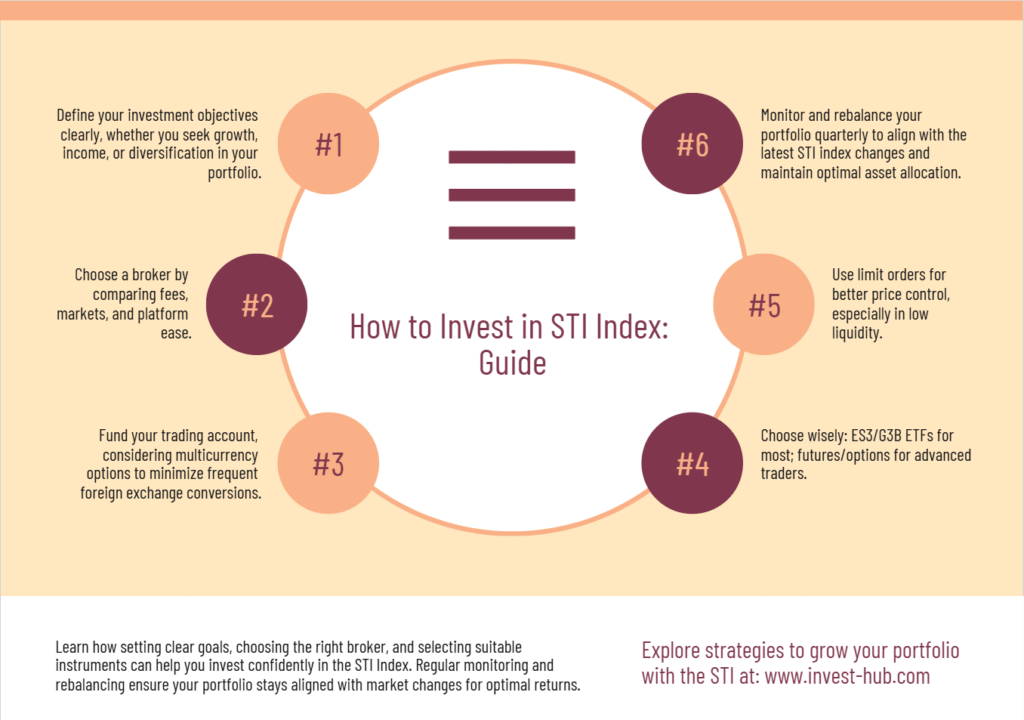

How to Invest in the STI Index: Step-by-Step Guide

- Define Objectives: Are you seeking growth, income, or diversification?

- Select a Broker: Compare fees, market access, platform usability.

- Fund Your Account: Consider multicurrency accounts to avoid frequent FX conversions.

- Choose Your Instrument: ES3 or G3B ETFs suit most retail investors; futures and options cater to advanced traders.

- Place Your Order: Use limit orders for better price control in low-liquidity periods.

- Monitor & Rebalance: Review holdings quarterly in line with STI rebalances.

Costs, Fees, and Tax Considerations

- Brokerage Commissions: Typically 0.05–0.28 % per trade on SGX.

- Bid-Ask Spreads: ES3 often < 0.1 %, reflecting high liquidity.

- Dividend Withholding Tax: Singapore levies 0% on dividends from most resident companies, except cooperatives.

Not sure which platform suits your needs? Compare the leading trading platforms in our Best Brokers guide before you open an account.

What Is STI Finance? Clearing Up the Acronym

While “STI” in finance usually refers to the Straits Times Index, it can also signify Short-Term Incentives (executive bonuses) or Short-Term Investments on corporate balance sheets. Context matters. In audio engineering circles, STI stands for Speech Transmission Index, a measure of speech intelligibility. Understanding which STI you’re reading about prevents costly mix-ups.

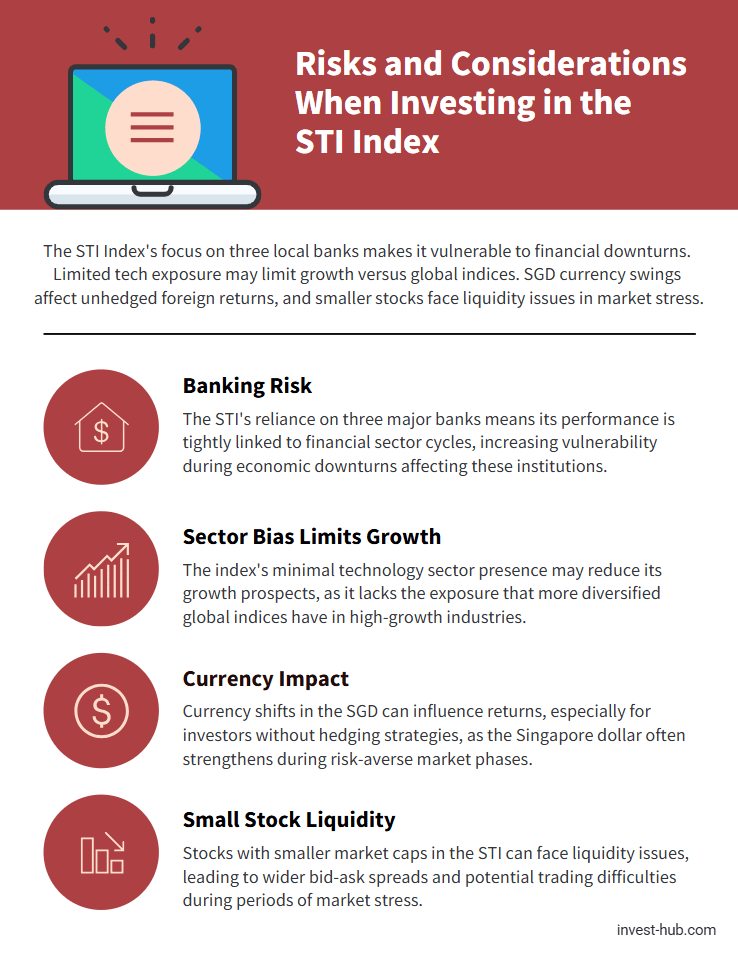

Risks and Considerations When Investing in the STI Index

- Concentration Risk: Heavy weighting in three local banks, which account for over 50% of the index, exposes the index to financial-sector cycles.

- Sector Bias: Under-representation of technology may limit growth upside versus global indices.

- Currency Risk: SGD can appreciate during risk-off periods, hurting unhedged foreign returns.

- Liquidity Risk: Smaller constituents may see wider spreads during market stress.

Conclusion

The Straits Times Index (STI) is more than just a Singapore stock gauge—it is the cornerstone of Southeast Asian equity investing. By tracking 30 of the Lion City’s leading companies, the STI offers diversified exposure, attractive dividends, and a transparent methodology that appeals to both amateur and semi-expert investors. Whether you buy the index via ETFs like ES3 or G3B or use it as a performance benchmark, understanding what the STI Index is empowers you to make informed, strategic investment decisions.

Explore more market insights, strategy guides, and product reviews on Invest‑Hub to stay ahead of the curve.

Frequently Asked Questions (FAQ)

It’s a basket of the 30 largest and most liquid Singapore-listed companies, serving as the country’s main stock-market benchmark.

Exactly 30 constituents, reviewed semi-annually with additional quarterly adjustments.

The SPDR® Straits Times Index ETF (ES3) and Nikko AM Singapore STI ETF (G3B) both replicate the STI.

Yes. Many constituents pay steady dividends; the index yield often exceeds 4 %.

International brokers that offer SGX access allow global investors to buy STI-tracking ETFs.

The former is a stock-market benchmark; the latter measures speech intelligibility in acoustics—they’re unrelated.