Trading is the act of buying and selling financial instruments—such as stocks, currencies, commodities, or derivatives—with the goal of making a profit. In today’s globalized world, trading goes beyond just the stock market. It also includes foreign exchange (forex), cryptocurrencies, and many other markets.

Understanding what trading is and why it matters can help both beginners and experienced investors make informed decisions. It also enables them to capitalize on opportunities in the financial markets. this article aims to give you an in-depth overview that draws from reputable sources, including IG, Bajaj Finserv, and more.

Key Points in This Guide

- Fundamentals of Trading: What trading involves and why it’s important

- Different Trading Styles and Strategies: Explore various approaches, from day trading to long-term investing

- Risk Management: Learn how to protect your capital through effective strategies

Why This Matters

- Beginners gain a solid foundation for entering the market.

- Experienced Traders can refine their strategies and improve decision-making.

Below is a simple breakdown of common financial instruments involved in trading:

| Type of Instrument | Examples |

|---|---|

| Stocks | Apple (AAPL), Amazon (AMZN), Tesla (TSLA) |

| Currencies (Forex) | EUR/USD, GBP/USD, USD/JPY |

| Commodities | Gold, Crude Oil, Natural Gas |

| Derivatives | Options, Futures, Swaps |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) |

What to Expect

This comprehensive guide will:

- Break down the fundamentals of trading

- Explore different styles and strategies

- Highlight key considerations for managing risk

By the end, you’ll have an in-depth overview of trading drawn from reputable sources—helping you make more informed decisions in today’s dynamic financial markets.

Understanding the Basics of Trading

Defining “trading” in financial markets

In financial markets, “trading” refers to the process of buying and selling assets with the intention of profiting from price movements. Trading typically involves short-term strategies where trades can be executed within minutes, hours, or days, depending on one’s chosen style. However, the broader concept of trading can also encompass longer time frames.

Traders use various tactics—ranging from fundamental research to technical chart analysis—to decide when to enter or exit positions. Some of the most commonly traded assets include:

- Stocks: Shares of publicly listed companies.

- Currencies: Pairs of global currencies like USD/EUR, USD/JPY, etc.

- Commodities: Goods like gold, silver, oil, or agricultural products.

- Derivatives: Contracts such as options or futures that derive their value from an underlying asset.

Why trading is important for the stock market and other financial markets

Trading plays a crucial role in the overall health and functionality of financial markets.

- Liquidity: Active trading ensures there’s always a buyer and a seller, allowing markets to function smoothly.

- Price Discovery: Consistent buying and selling helps establish fair market prices for assets.

- Risk Transfer: Traders can hedge or offset risks by entering into positions, making markets more efficient.

- Capital Formation: In stock markets, trading activity enables companies to raise capital by issuing shares.

Overall, trading influences market dynamics, helps in price stabilization, and facilitates the flow of capital from investors to businesses.

Brief History of Trading

Trading isn’t new; it’s been around for centuries, evolving from bartering goods to the sophisticated electronic systems we have today.

- Barter Era: Early civilizations exchanged commodities like salt, spices, and precious metals for goods or services.

- Establishment of Stock Exchanges: The 17th century saw the formation of the first modern stock exchanges, such as the Amsterdam Stock Exchange.

- Rise of Electronic Trading: From the 1970s onward, technology revolutionized trading, introducing electronic order matching and real-time quotes.

- Online Trading Boom: With internet access becoming widespread in the late 20th century, retail investors gained direct access to markets through online platforms.

This evolution shows that while the tools and technologies may change, the fundamental principles of buying and selling for profit remain the same.

Why Do People Trade?

Profit Potential

The primary motivator for most traders is the potential to earn profits. Significant returns are possible when traders accurately predict market movements and time their entries/exits correctly. The pursuit of profit can come in different forms:

- Capital Gains: Earning from the rise in asset prices.

- Short Selling: Profiting from the decline in asset prices.

- Leveraged Products: Using margin or derivatives can amplify gains (but also losses).

Diversification & Hedging

People also engage in trading for diversification and hedging purposes:

- Diversification: Holding multiple types of assets—like stocks, forex positions, and commodities—can spread risk.

- Hedging: Traders or investors can use derivative instruments like options and futures to protect existing holdings from adverse price movements.

These strategies help manage portfolio volatility and can preserve capital during uncertain market conditions.

Key Financial Markets for Trading

Stock Market

According to HDFC Bank’s Learning Centre, The stock market is where shares of publicly traded companies are bought and sold. Stock trading involves analyzing companies’ financials, market conditions, and economic indicators to speculate on share price movements. Stock markets are typically regulated by government bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Securities and Exchange Board of India (SEBI).

Forex (Foreign Exchange) Market

With an average daily turnover surpassing $6 trillion (as noted in various market reports), the foreign exchange market is the largest financial market globally. Traders buy and sell currency pairs—like EUR/USD—anticipating changes in exchange rates. The forex market is open 24 hours a day, five days a week, providing numerous trading opportunities.

Commodity Markets

Commodity markets focus on raw materials like crude oil, gold, agricultural products, and metals. These can be traded in spot markets or via derivative contracts like futures. The price of commodities is influenced by supply-demand factors, geopolitical events, weather conditions (in the case of agricultural commodities), and broader economic indicators.

Cryptocurrency Markets

Cryptocurrency trading has gained massive popularity over the last decade. Assets like Bitcoin, Ethereum, and other altcoins are traded on various crypto exchanges around the clock. While the potential for high returns is significant, crypto markets are extremely volatile and come with higher risks compared to more traditional markets.

Types of Trading

What Is Intraday Trading?

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day. Traders aim to capture intraday price movements without holding positions overnight.

Characteristics of intraday trades

- Short Holding Period: Positions are closed before the market closes to avoid overnight market risks.

- Leverage: Day traders often use margin to magnify gains (and potential losses).

- High Liquidity Assets: Traders focus on instruments with substantial volume, such as popular stocks or forex pairs.

- Frequent Trades: Multiple transactions can occur in a single session.

Common intraday trading strategies

- Scalping: Targeting small profits from many quick trades.

- Momentum Trading: Riding strong price trends, often based on news or high-volume spikes.

- Reversal Trading: Attempting to profit from a change in trend direction.

- Breakout Trading: Entering trades when the price moves outside a defined support or resistance range.

While intraday trading can be lucrative, it’s also high-risk and requires discipline, proper risk management, and market expertise.

What Is Swing Trading?

Swing trading involves holding positions for several days to a few weeks. The aim is to capitalize on medium-term price trends or “swings” in the market.

Holding periods and market analysis

- Holding Period: Ranges from a couple of days to several weeks.

- Market Analysis Tools: Swing traders use both fundamental and technical analysis to confirm trend directions.

- Trade Frequency: Lower than intraday traders; fewer trades mean less stress and fewer transaction costs.

Advantages and disadvantages of swing trading

- Advantages:

- More flexibility in time management.

- Potentially larger gains per trade compared to scalping.

- Less stress than intraday trading.

- More flexibility in time management.

- Disadvantages:

- Exposure to overnight and weekend market moves.

- Requires patience and discipline to hold positions.

- May miss short-term market movements that day traders exploit.

- Exposure to overnight and weekend market moves.

What Is Option Trading?

Option trading involves buying and selling options contracts, which give the holder the right—but not the obligation—to buy or sell an underlying asset at a predetermined price before a certain date.

Basics of options (calls and puts)

- Call Option: Allows you to buy an asset at a set price (strike price) before the contract expires.

- Put Option: Allows you to sell an asset at a set price before the contract expires.

- Premium: The cost of purchasing the option contract.

How option trading differs from stock trading

- Leverage: Options allow control of a larger position with a smaller capital outlay.

- Time Decay: Options lose value as they approach expiration, adding a unique time-sensitive dimension.

- Profit Strategies: Traders can profit from bullish, bearish, or even sideways markets using different option strategies like spreads or straddles.

What Is Forex Trading?

Forex trading focuses on the exchange of one currency for another, with the goal of profiting from fluctuations in exchange rates.

Major currency pairs and market hours

- Major Pairs: Typically involve the USD, such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

- Minor/Exotic Pairs: Currency pairs that don’t involve the USD or involve less-traded currencies.

- Market Hours: The forex market runs 24 hours a day from Monday to Friday, moving across major trading sessions in Sydney, Tokyo, London, and New York.

Factors influencing currency prices

- Economic Indicators: GDP, inflation rates, employment data.

- Central Bank Policies: Interest rate changes, quantitative easing.

- Political Stability: Elections, geopolitical tensions.

- Market Sentiment: Risk appetite or risk aversion among global investors.

What Is Colour Trading?

“Color trading” is a lesser-known style, often referencing a simplistic visual approach to analyze market trends or momentum by using color-coded indicators.

The concept behind “colour” in trading decisions

- Color Coding Indicators: Some traders use green, red, and other colors on candlestick charts or momentum indicators to identify bullish or bearish shifts.

- Psychological Clarity: Colors can reduce information overload by visually signaling market trends, breakouts, or reversals.

Pros and Cons of Colour-Based Market Analysis

Pros:

- Immediate Visualization: Simplifies complex data, making it easier to spot trends.

- Reduced Analysis Paralysis: Quick visual cues can speed up decision-making.

Cons:

- Oversimplification: Important fundamental or nuanced technical factors might be overlooked.

- Subjectivity: Color-based cues vary by platform and may conflict with traditional analysis.

What Is a Trading Account?

A trading account is a specialized account used to buy and sell financial instruments like stocks, bonds, or derivatives. Unlike a regular bank account, a trading account is designed for frequent transactions and often includes additional services such as real-time market data, margin facilities, and research tools. Opening a trading account is one of the first steps for anyone looking to participate in the stock market.

Key Differences from a Regular Account:

- Facilitates Trades: Allows direct access to stock exchanges or forex markets.

- Margin Trading: Provides borrowing capacity to trade larger amounts than the account balance.

- Integration with Demat Account: In many countries, particularly India, a Demat account is also required to hold securities in electronic form.

Types of trading accounts (cash, margin, etc.)

- Cash Account: Trades must be fully funded with your own money.

- Margin Account: The broker lends you funds or securities, enabling leveraged positions.

- Options & Futures Account: Special permissions are required to trade derivatives.

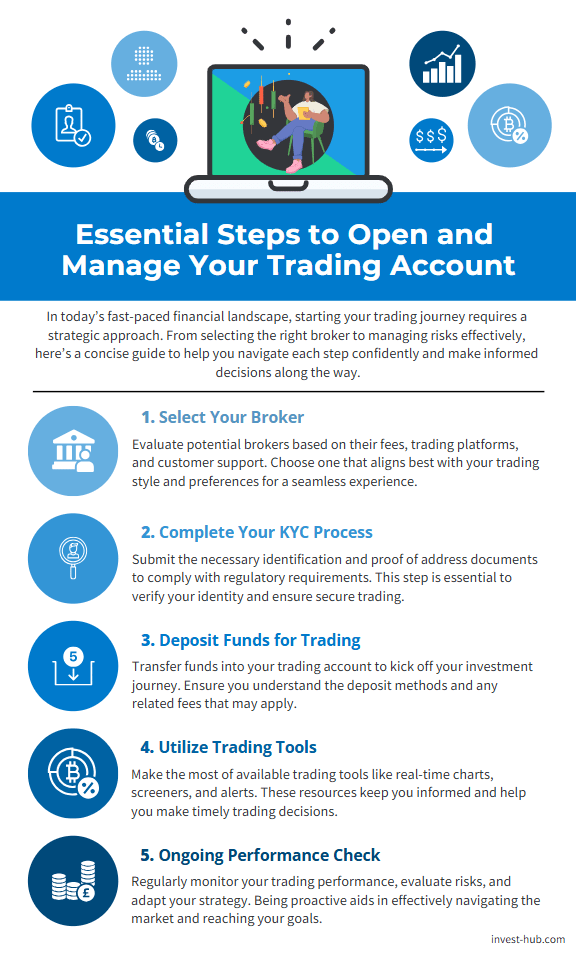

How to open and manage a trading account

- Choose a Broker: Compare fees, platforms, and support services.

- Complete KYC: Submit identification and proof of address documents.

- Fund Your Account: Transfer money to start trading.

- Use trading tools: real-time charts, screeners, and notifications to stay updated.

- Monitor Regularly: Track performance, manage risk, and update your strategy as needed.

Key Trading Strategies and Techniques

Technical analysis vs. fundamental analysis

Traders generally rely on two broad types of analysis to make decisions:

- Technical Analysis: Focuses on price charts, patterns, and indicators (moving averages, oscillators, etc.).

- Fundamental Analysis: Evaluates an asset’s intrinsic value by looking at economic indicators, financial statements, and market news.

Combining both can often provide a more holistic view of market conditions.

Trend-Following Strategy

The trend-following strategy involves identifying the prevailing market trend (uptrend or downtrend) and trading in its direction:

- Tools: Moving averages, trendlines, MACD indicator.

- Advantages: Simple to understand; works well in strongly trending markets.

- Disadvantages: Can lead to whipsaw losses in sideways or choppy conditions.

Mean Reversion Strategy

Mean reversion strategies assume that prices and returns eventually move back toward the average or mean:

- Indicators: Bollinger Bands, RSI (Relative Strength Index).

- Advantages: Potentially lucrative when markets are range-bound.

- Disadvantages: Can be risky in trending markets that don’t revert quickly.

Breakout Strategy

Breakout traders look for significant price movements outside established support or resistance levels:

- Entry Trigger: Price closing above resistance or below support.

- Stop-Loss Placement: Often placed just inside the previous range.

- Advantages: Capitalizes on strong momentum.

- Disadvantages: False breakouts can lead to quick losses.

Fundamental Analysis vs. Technical Analysis

Understanding Fundamental Analysis

Fundamental analysis involves evaluating an asset’s intrinsic value based on economic data, company financials, or industry trends. For stocks, it might include:

- Earnings Reports: Revenue, profit margins, and growth potential.

- Economic Indicators: Interest rates, GDP growth, and consumer sentiment.

- Competitive Position: Market share, management efficiency, and brand strength.

This approach is often favored by longer-term investors who seek undervalued assets with good growth prospects.

Basics of Technical Analysis

Technical analysis relies on historical price and volume data, chart patterns, and mathematical indicators to predict future price movements. Common tools include:

- Candlestick Charts: Visual representation of price movements over specific periods.

- Support and Resistance: Key price levels where buying or selling pressure might intensify.

- Indicators: Moving Averages, RSI, Stochastic Oscillator, MACD, etc.

Technical analysts believe that all market-influencing information is reflected in current and historical price data.

How Traders Combine Both Approaches

Many traders use a blend of fundamental and technical analysis:

- Fundamental Screen: Select stocks with strong earnings, growth forecasts, or undervalued metrics.

- Technical Timing: Use charts and indicators to pinpoint optimal entry and exit points.

- Macro Context: Assess economic climate to confirm the feasibility of the trade idea.

This hybrid approach can help traders refine decision-making and manage risk more effectively.

Risk Management in Trading

Importance of risk-reward ratios

A favorable risk-reward ratio is critical for long-term success. For instance, aiming for a 1:2 risk-reward ratio means you’re looking to earn twice as much as you’re prepared to lose. Consistently applying a positive ratio can offset losses and potentially boost overall profitability.

Setting Stop-Loss Orders

A stop-loss order automatically closes a trade when the price hits a specified level. This safeguard:

- Limits Potential Losses: Prevents minor downturns from becoming devastating losses.

- Removes Emotion: Objective exit levels reduce the impact of fear and greed on trading decisions.

Position Sizing & Leverage

- Position Sizing: Determining the quantity of shares or contracts to trade based on account size and risk tolerance.

- Leverage: Borrowing funds from a broker to trade more than your account balance. While leverage can amplify gains, it can also magnify losses, making cautious use crucial.

Diversifying Your Portfolio

Diversification involves spreading investments across multiple asset classes or sectors to mitigate the risk of a single underperforming asset. For example, a portfolio containing stocks, bonds, and commodities may fare better over the long term than one focused solely on technology stocks.

Trading Psychology and Emotional Control

Overcoming Fear and Greed

Emotional biases can lead to irrational decision-making:

- Fear: May cause traders to exit profitable trades prematurely or avoid taking trades altogether.

- Greed: Can push traders to hold onto winning positions for too long or over-leverage in hopes of quick, large gains.

Recognizing these tendencies is the first step toward managing emotional pitfalls.

Developing Discipline

Discipline in trading is about following a well-thought-out plan consistently. This includes:

- Defining Entry/Exit Rules: Sticking to them regardless of emotional pressures.

- Maintaining a Trading Journal: Tracking decisions to identify strengths and weaknesses.

- Planning for Contingencies: Being prepared for unexpected events and market moves.

Maintaining Realistic Expectations

The allure of quick profits often tempts new traders to take excessive risks. However, trading is not a get-rich-quick scheme. Setting realistic goals—such as a small, consistent percentage return—can help you avoid disappointment and manage risk more effectively.

Tools for emotional control (journals, checklists, etc.)

- Trading Journal: Document reasons for entering/exiting trades, emotional state, and results.

- Pre-Trade Checklist: Ensures you’ve reviewed technicals, fundamentals, and market conditions before committing capital.

- Mindfulness Techniques: Deep breathing or short breaks can help reset emotional extremes.

Tools and Platforms for Traders

Trading Platforms and Software

Modern trading platforms are generally web-based or app-based, offering live quotes, charting tools, and order execution services. A good platform should have:

- User-Friendly Interface: Easy navigation and clear order placement features.

- Research & Analysis Tools: Built-in screeners, analytics, and educational resources.

- Mobile Compatibility: Many traders use smartphones to keep track of market movements on the go.

Real-Time Market Data and News Services

Timely information can be a competitive advantage. Subscription-based services or free news feeds from reputable outlets (e.g., Bloomberg, Reuters) offer real-time data, breaking news, and expert analysis. Staying informed helps traders respond quickly to market-changing events.

Charting Tools and Indicators

Charting software provides in-depth technical analysis features:

- Multiple Time Frames: From 1-minute to weekly or monthly charts.

- Custom Indicators: Ability to code or integrate specialized indicators.

- Drawing Tools: Trendlines, Fibonacci retracement levels, and other visual aids.

These features help traders spot emerging patterns and plan trades efficiently.

Common Mistakes to Avoid

Lack of a Trading Plan

Entering the market without a clear strategy is a recipe for failure. A detailed plan includes:

- Goals & Objectives: Define why you’re trading.

- Risk Parameters: Maximum capital at risk, stop-loss levels.

- Entry & Exit Criteria: Conditions for initiating or closing positions.

Overtrading

Trading too frequently can rack up transaction costs and dilute returns. It often stems from emotional impulses rather than logical analysis. Setting strict criteria for trade setups helps prevent overtrading.

Ignoring Risk Management

Even if you have an excellent track record, failing to apply proper risk management can lead to large losses. Protective measures—like stop-loss orders, position sizing, and diversification—are crucial pillars for sustainable trading.

Final Thoughts on What Is Trading

Recap of main points

In essence, what is trading? It’s the buying and selling of financial instruments with the primary goal of generating profits. Over time, trading has evolved from simple barter systems to complex digital markets. There are multiple types of trading styles—intraday, swing, options, forex, and even more nuanced methods like color-based analysis. Success in trading depends on knowledge, experience, disciplined strategy execution, robust risk management, and emotional control.

Next steps for aspiring traders

If you’re new to the world of trading, consider the following steps:

- Educate Yourself: Dive deeper into topics like technical analysis and fundamental analysis.

- Choose Your Market: Explore stock, forex, commodity, or cryptocurrency markets to find your comfort zone.

- Open a Trading Account: Compare brokers, ensure the platform suits your trading style, and start small.

- Practice on a Demo Account: Test strategies without risking real capital.

- Implement Risk Management: Always trade with a plan, stop-loss orders, and position-sizing rules.

- Stay Updated and Adapt: Markets evolve; continuous learning and adaptation are key.

With the right foundation and a commitment to lifelong learning, anyone can develop the skills needed to trade successfully.

Frequently Asked Questions (FAQ)

Trading is the act of buying and selling financial instruments—like stocks, currencies, commodities, and derivatives—to profit from price movements. Traders use various strategies based on technical or fundamental analysis (or both) to identify potential opportunities in the market.

While both trading and investing aim to grow capital, they differ in time horizon and strategy:

Traders often focus on short-term price fluctuations, entering and exiting positions frequently.

Investors generally hold positions for longer periods, relying on an asset’s fundamental value for growth.

Common trading styles include:

Intraday (Day) Trading: Opening and closing positions within a single trading day.

Swing Trading: Holding trades from a few days to weeks to capitalize on medium-term “swings.”

Option Trading: Buying or selling contracts that give you the right (but not obligation) to buy or sell an asset at a specified price.

Forex Trading: Trading currency pairs in the foreign exchange market.

Colour Trading: A less common, visually driven approach that uses color-coded indicators to guide decisions.

A Trading Account: You need a specialized account to buy and sell assets.

Initial Capital: This can be your own funds or margin (borrowed).

Trading Platform & Tools: Charting software, real-time market data, and analysis tools.

Basic Knowledge: Understanding market mechanics, risk management, and analysis methods.

You can open a trading account through a brokerage firm or an online trading platform. The usual process involves:

Choosing a reputable broker.

Completing the KYC (Know Your Customer) process.

Linking a bank account for fund transfers.

Funding the trading account to start buying and selling assets.

Risk management involves techniques and strategies—like setting stop-loss orders, diversifying your portfolio, and using appropriate position sizes—to minimize potential losses. It is crucial because it prevents small setbacks from turning into large capital losses and helps maintain consistent performance over time.

Trend-Following: Identifying and trading along with existing market trends.

Mean Reversion: Buying or selling when prices deviate too far from their average.

Breakout Trading: Entering positions when price breaks established support or resistance levels.

Fundamental & Technical Analysis: Using economic data or price chart indicators to inform trades

Traders often struggle with fear (leading to premature exits) and greed (leading to over-leveraging or holding onto losing positions too long). A strong trading plan, disciplined approach, and tools like trading journals and checklists can help manage these emotional biases.

People trade for various reasons, such as the potential for quicker returns, the ability to capitalize on short-term market volatility, and the opportunity to use leverage. Additionally, some traders enjoy the active, hands-on approach and the challenge of constantly analyzing market movements.

Most online brokerages and trading platforms offer demo accounts or paper trading features, which allow you to simulate trades using virtual capital. This helps beginners learn platform navigation, test strategies, and build confidence before committing real funds.

Lack of a solid plan: Trading without specific entry and exit criteria.

Overtrading: Taking too many trades without clear signals.

Ignoring risk management: Not using stop-loss orders or appropriate position sizing.

Emotional Decision-Making: Letting fear or greed override rational analysis.

Yes, many traders diversify their portfolios by participating in different markets—such as stocks, forex, commodities, and cryptocurrencies—to spread risk and capitalize on various opportunities. However, managing multiple markets requires more research, time, and discipline.