When was IG Broker founded? This is a question many aspiring traders ask when researching one of the world’s leading online trading platforms. In this article, we will dive deep into the history of IG Broker, shedding light on its foundation and evolution over the years. We’ll also address key questions like where IG is located and its legality in India and the USA, as well as restricted countries (official IG website). Whether you’re a beginner trader looking to open an account or a seasoned pro exploring new brokers, understanding IG’s origins and global presence can help you make more informed decisions. For a comprehensive analysis of IG’s current offerings, you can refer to our IG Broker Review.

Answer: IG Broker was founded in 1974 by Stuart Wheeler under the name “IG Index,” making it one of the earliest spread betting firms in the UK. Over the decades, it expanded its offerings to include forex, CFDs, and more, eventually becoming IG Group.

Known for pioneering financial spread betting, IG has played a crucial role in shaping the modern online trading landscape. With tens of thousands of clients worldwide and a range of financial instruments to trade, IG has earned its place as a reputable broker. Below, we’ll cover its foundation date, headquarters, regulatory compliance, and global reach.

When Was IG Broker Founded? – The Historical Overview

IG Broker, officially part of the IG Group, traces its roots back to 1974. It was founded by businessman Stuart Wheeler under the name “IG Index,” originally providing a novel way for retail investors to speculate on gold prices. At the time, spread betting was still emerging, and IG Index quickly evolved into one of the earliest companies to offer a convenient and regulated framework for retail traders.

Over the years, IG Index expanded its product offerings to include forex, indices, commodities, and other instruments. By the late 1990s, the company recognized the burgeoning demand for online trading platforms and began investing heavily in digital infrastructure. This strategic pivot would help IG broaden its horizons beyond the UK, eventually leading to its rebranding as IG Group and listing on the London Stock Exchange in 2000.

Here is a concise timeline of IG’s key milestones:

- 1974: IG Index founded by Stuart Wheeler to offer gold spread betting.

- 1990s: Expansion into other trading instruments, including forex and indices.

- Late 1990s: Adoption of online trading technology.

- 2000: Listed on the London Stock Exchange as IG Group.

- 2006: Rebranding to “IG Markets” for certain operations.

- Present Day: Operates worldwide with tens of thousands of clients.

Since its founding in 1974, IG has grown into a multi-faceted brokerage offering contracts for difference (CFDs), spread betting, share dealing, and more. A testament to its long history and large client base, the IG Group currently employs over 2,000 people globally and has a reputation for being one of the most established brokerages in the world.

Where Is IG Broker Located?

While IG has a global footprint, its primary headquarters remains in London, United Kingdom. Specifically, the corporate office is often listed as located in Cannon Bridge House, 25 Dowgate Hill, London, EC4R 2YA. As one of the pioneers of the UK’s spread betting industry, IG has maintained a strong presence in London’s financial district.

Apart from the London HQ, IG has established offices in several major financial hubs around the world. For instance:

- London, UK (Headquarters): The heart of IG’s operations, research, and development.

- Chicago, USA: Serves the US market, particularly focusing on forex trading under strict regulatory compliance.

- Melbourne, Australia: Caters to Australian traders looking for CFDs and other products.

- Singapore: Oversees operations for parts of the Asian market, offering a local spin on global financial instruments.

- Other Offices: Located in countries like Germany, France, Spain, and South Africa, among others.

The scope of IG’s operations and offices reflects its commitment to being a globally accessible broker. Being headquartered in London also underscores the broker’s adherence to some of the world’s most stringent financial regulations set by the UK’s Financial Conduct Authority (FCA).

Is IG Broker Legal in India?

The legality of IG Broker in India is multifaceted due to the local regulatory environment. Foreign exchange and CFD trading are heavily regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Generally, Indian residents are only permitted to trade currency pairs that include the Indian Rupee (INR) on domestic exchanges or with brokers regulated within India. Engaging with overseas brokers offering full-scale forex or CFD trading on non-INR pairs can be a gray area.

While IG is a globally recognized broker, Indian regulation for online forex trading falls under tight restrictions. Here’s what you should know:

- Compliance with RBI and SEBI Rules: Indian regulations mandate that retail traders primarily engage in currency pairs approved by Indian authorities. As per current guidelines, IG does not hold a local Indian license, so it may not openly market its services for INR-based pairs.

- Access to International Markets: Some advanced Indian traders bypass domestic restrictions by opening overseas accounts. However, these methods can be legally complex, and traders risk running afoul of RBI and SEBI directives.

- Potential Loopholes: While many international brokers (including IG) will allow accounts from various jurisdictions, whether an Indian resident can legally trade through IG remains subject to local regulations that can change over time.

Those looking to trade with IG while residing in India should consult legal advisors to ensure full compliance with national laws. Certain reports suggest that Indians have indeed opened accounts with IG in the past, although it is not explicitly endorsed for Indian residents. It’s critical to understand the local laws, keep updated with regulatory changes, and proceed accordingly.

Is IG Broker Legal in the USA?

In the United States, retail trading in forex, stocks, and other financial instruments is regulated primarily by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). IG does operate in the US but with a specialized focus:

- IG US (Forex): IG offers a separate portal for US-based traders, mainly focusing on spot forex trading and limited CFD or spread betting services where permissible. Operating under NFA and CFTC regulation, IG US ensures compliance with one of the world’s strictest trading frameworks.

- Local Licenses and Oversight: IG US is required to maintain segregated client funds, adhere to comprehensive disclosure, and uphold high capital requirements in line with American regulations.

- Restrictions on CFDs and Spread Betting: The US has a general prohibition on CFD trading and spread betting for retail clients. As a result, IG’s US clients mainly access spot forex pairs. Notably, IG’s global offerings are more extensive than what is made available in the American market.

Overall, IG is indeed legal in the USA, but the services offered there are more limited compared to other global jurisdictions. This is primarily due to the stricter financial regulations enforced by US authorities.

IG Broker Restricted Countries

Despite its extensive global footprint, IG Broker is not universally available in every country. Regulatory environments and political restrictions can limit brokers from offering services to certain regions. While the list of restricted countries may change over time, some are consistently off-limits.

Common Reasons for Restrictions

- Lack of Local Licenses: If IG has not obtained the necessary regulatory approval or local licenses, it will not legally operate in that region.

- Sanctions & Embargoes: Government-imposed restrictions may prohibit financial institutions from dealing with certain countries.

- Regulatory Policies: Some nations heavily restrict or ban CFDs, forex trading, and other speculative markets.

Notable Restricted Countries

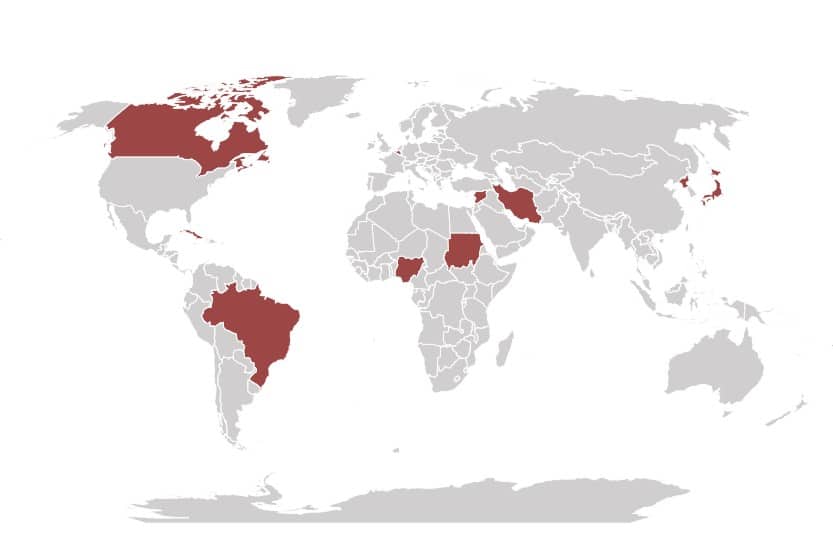

While this list may evolve, here are some known examples of countries where IG’s services are limited or not available at all:

- North Korea & Iran: These are pretty obvious. International sanctions keep IG out.

- Cuba & Syria: Similarly, due to trade restrictions, IG is unavailable in these regions.

- Belgium: Known to have strict rules on the marketing of CFDs and binary options to retail clients.

- Canada: Each province has its own regulations, and IG generally does not hold the local licenses required to serve Canadians.

- New Zealand: Regulatory conditions can be stringent, prompting IG to limit some of its offerings here.

- Japan: Has its own local rules for forex trading, requiring local licensing that IG may not currently maintain.

- Other Regions: Crimea, Nigeria, Brazil, and Sudan

IG’s Global Regulatory Oversight

One of the key hallmarks of a reputable broker is transparent regulation and oversight. IG’s reach spans multiple major regulatory jurisdictions, enhancing its credibility. Below are some of the most notable regulatory bodies that oversee IG Group’s operations:

- Financial Conduct Authority (FCA)—UK: IG is fully regulated by the UK’s premier financial watchdog, known for its strict guidelines on capital requirements, risk disclosure, and consumer protection. IG is regulated by leading authorities, including the UK’s Financial Conduct Authority (FCA).

- Australian Securities and Investments Commission (ASIC): The Australian arm of IG operates under ASIC’s purview, ensuring compliance with local laws regarding CFDs and derivatives.

- Monetary Authority of Singapore (MAS): In Singapore, IG is regulated by MAS, one of the most recognized regulators in the Asia-Pacific region.

- Commodity Futures Trading Commission (CFTC) & National Futures Association (NFA)—USA: IG’s US entity abides by stringent US regulations primarily for forex trading.

Being multi-regulated not only underscores IG’s commitment to fair trading practices but also offers added security for clients, who may benefit from segregated accounts and investor compensation schemes, depending on local regulations.

IG’s Product and Service Offerings

IG Group is publicly traded on the London Stock Exchange. Although our primary focus is on the broker’s founding date, location, and legal status, it’s worth briefly touching on IG’s broad range of offerings. This variety is one of the reasons IG remains a market leader:

- Spread Betting: A unique product widely used in the UK. It is tax-free for UK residents but restricted in several other jurisdictions, including the US.

- Contracts for Difference (CFDs): Covers various assets such as forex, indices, commodities, shares, and cryptocurrencies. This is one of IG’s core offerings internationally.

- Share Dealing and Stockbroking: IG also operates as a stockbroker, allowing clients to invest in actual shares on multiple global exchanges.

- Forex Trading: A popular segment, IG offers hundreds of currency pairs for retail and professional traders.

- Options Trading: In some jurisdictions, IG provides options on various markets, giving traders multiple ways to hedge or speculate.

These instruments demonstrate IG’s commitment to servicing a diverse clientele. From novices dabbling in share dealing to advanced traders utilizing spread bets or CFDs, IG aims to accommodate varying risk appetites and trading preferences.

IG’s Global Reputation and Client Base

IG’s long-standing history since 1974 has cultivated a strong reputation among both retail and institutional traders. Some points reinforcing its credibility include:

- Public Listing: IG Group Holdings plc is listed on the London Stock Exchange under the ticker IGG. Being a publicly traded company means it must regularly publish financial statements and adhere to strict corporate governance rules.

- High Trust Scores: Various independent broker review sites, like Forexbroker.com and Commodity.com, rate IG highly for reliability, fees, and platform technology.

- Diverse International Presence: With offices in 14+ countries, IG can adapt to various regulatory landscapes, offering localized products and customer support.

- Long Track Record: Surviving—and thriving—through multiple market cycles since 1974 is a testament to robust risk management and evolving client-focused services.

These factors, combined with multi-jurisdictional regulation, position IG as one of the most recognized names in online trading. For those prioritizing security, longevity, and a wide product range, IG often features at or near the top of broker recommendation lists.

Advantages and Disadvantages of Choosing IG

When selecting a broker, it’s vital to weigh both advantages and drawbacks. Below is a snapshot table summarizing IG’s key pros and cons:

| Pros | Cons |

Long-standing reputation since 1974 Regulated in multiple jurisdictions (FCA, ASIC, MAS, CFTC/NFA) Wide range of tradable assets (CFDs, forex, stocks, etc.) Modern trading platforms, including proprietary web and mobile apps Robust educational resources for beginners | Spread betting is only available in a limited number of regions. CFD and forex offerings can be restricted in certain countries (e.g., India, US for CFDs). Minimum deposit requirements may be higher than some budget brokers. Not available to residents of certain restricted countries |

How to Stay Compliant When Trading with IG

Given the diverse regulatory landscape across the globe, traders should be proactive in ensuring they remain compliant with local laws. Here are some practical guidelines:

- Research Your Local Regulations: Before signing up for an IG account, understand the regulatory framework in your country or state. This includes permissible trading instruments and licensing requirements.

- Register with the Correct IG Entity: IG often directs users to the subsidiary that serves their region. Make sure you open an account with the entity specifically licensed to operate in your jurisdiction (e.g., IG US for American residents).

- Use Verified Payment Methods: Deposits and withdrawals through legitimate banking channels help maintain compliance and protect against fraud or money laundering risks.

- Stay Updated on Changes: Regulations can change without much notice. Monitor IG’s official announcements and your local financial regulator’s website for any evolving policies.

- Consult Legal or Tax Experts: If you’re unsure about the legality of certain trades or financial instruments in your region, consult qualified professionals for tailored advice.

Conclusion

When was IG Broker founded? The answer takes us back to 1974, marking a journey of several decades during which IG has expanded its product lineup, achieved multi-jurisdictional regulation, and built a global client base. Headquartered in London and publicly listed on the London Stock Exchange, IG remains one of the most recognized and enduring brokerage firms worldwide. If you’re interested in comparing IG with other top trading platforms, check out our Best Brokers Review.

Whether you’re curious about its legality in India or the USA, or you need to confirm where it’s restricted, the key takeaway is that IG is both an established and heavily regulated institution. From a compliance standpoint, its multi-jurisdictional oversight ensures a relatively secure trading environment; however, traders must still ensure they’re adhering to local regulations in their own countries.

If you’re considering IG for your trading journey, make sure to verify the broker’s availability in your region, research the local laws, and leverage IG’s educational resources to get started. Ready to explore IG further? Visit their official site and review their range of offerings or seek guidance from experienced traders in your community. Return to our Invest Hub for more articles and resources on trading and broker insights.

Frequently Asked Questions (FAQs)

IG Broker was founded in 1974 by Stuart Wheeler under the name “IG Index.” It began as a spread betting firm focused on gold prices and has since expanded into a global brokerage offering forex, CFDs, and more.

G’s global headquarters is in London, United Kingdom, specifically at Cannon Bridge House, 25 Dowgate Hill. The firm also maintains offices worldwide, including in the US, Australia, and Singapore, among other major financial hubs.

IG Broker does not hold a local Indian license, and online forex/CFD trading in India is heavily regulated by the RBI and SEBI. Indian residents wishing to trade through international platforms like IG should consult local regulations and potentially seek legal advice to ensure compliance.

Yes, IG operates in the US under regulatory oversight from the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). However, US clients mainly have access to spot forex trading, as CFDs and spread betting are largely restricted for retail traders in the US.

IG’s restricted countries may include Belgium, Canada, New Zealand, Japan, and others where it does not hold local licenses or is subject to national embargoes/sanctions. These restrictions can change over time, so it’s best to check IG’s official website or contact their support for the latest information.

IG is regulated by multiple entities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), and the CFTC/NFA in the US, among others. This multi-jurisdictional oversight enhances its global credibility.

IG provides spread betting (in select regions), Contracts for Difference (CFDs) on forex, commodities, indices, and stocks, as well as traditional share dealing. Some jurisdictions may also access options trading and other specialized products, subject to local regulations.

IG is considered reputable and secure, largely due to its public listing on the London Stock Exchange and oversight by top-tier regulators worldwide. It also segregates client funds and has a long track record dating back to its founding in 1974. Still, individual traders should always conduct personal due diligence before opening an account.