When it comes to online forex and CFD trading, Exness often stands out as a recognized global broker. But where is Exness broker from, and what key details should traders know before registering an account? In this comprehensive guide, we’ll answer all of your pressing questions—covering ownership, location, regulations, legality in India, halal trading, and more. Whether you’re a novice seeking basic information or a seasoned trader verifying broker credentials, this article will offer valuable insights drawn from multiple online sources. For a detailed analysis of Exness’s offerings, read our comprehensive Exness review.

Founded in 2008, Exness is a global brokerage headquartered in Cyprus, with operations in regions like Seychelles, the UK, and South Africa. Regulated by CySEC and FSA, it provides multi-jurisdictional services to traders worldwide.

Who Owns Exness Broker?

One of the most frequently asked questions about Exness is regarding its ownership. Having insight into who stands behind a brokerage is crucial for gauging transparency, reliability, and governance practices. Here’s what our research shows:

- Founded by Finance and Information Technology Specialists: Exness was established in 2008 by a group of professionals with strong backgrounds in finance and information technology. This dual expertise helped shape the broker’s technological infrastructure and customer-focused service.

- Private Ownership: Exness is under private ownership rather than being publicly listed on any stock exchange. The company has expanded substantially over the years, but it has remained privately held.

- Global Footprint: Although the exact names of the founding members are not always front and center in marketing materials, some sources indicate that key stakeholders come from Europe and Asia, contributing to the multinational presence of the brand.

The core takeaway is that Exness operates under the umbrella of multiple legal entities tailored to different regions. Each entity is responsible for obtaining respective licenses and adhering to local regulations, thereby maintaining a compliance-driven environment.

Where Is Exness Broker Located?

The question “Where is Exness broker located?” often arises because location can influence a broker’s legal framework, regulatory oversight, and overall trustworthiness. Contrary to the assumption that Exness has only one headquarters, the company operates through several offices worldwide to better serve different jurisdictions.

Registered Offices and Headquarters

- Cyprus: One of Exness’ main offices is located in Limassol, Cyprus. The brand entity here is Exness (EU) Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Seychelles: Another major base of operations for the Exness group is in Seychelles under Exness (SC) Ltd. Seychelles is a popular offshore jurisdiction where several retail brokers operate.

- United Kingdom: In the past, the company also held operations under the Financial Conduct Authority (FCA) in the UK, though at present, it may be serving clients through its other entities.

- South Africa: Exness has an entity regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

- Regional Offices Worldwide: The broker also maintains satellite and support offices in various regions, reflecting its global customer base and multi-jurisdictional presence.

This multi-office setup aligns with the company’s goal of offering a streamlined trading experience across different markets. Having local and regional offices helps with customer support, payment processing, and ensuring regulatory compliance in diverse regions.

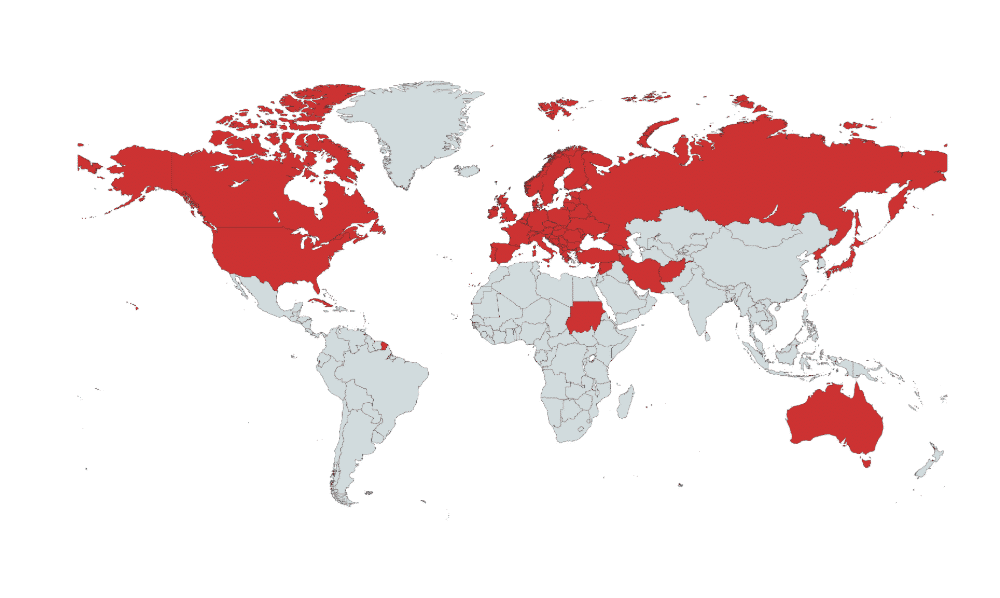

Countries Where Exness Is Banned

While Exness is widely recognized and used by traders worldwide, some jurisdictions restrict or do not allow the broker’s services. Understanding these restrictions is pivotal for traders who might be traveling or residing temporarily in another country, as regulations and availability can affect account accessibility.

List of Restricted Regions

Exness does not offer services in several locations, including but not limited to:

- USA: Like many other international brokers, Exness does not operate in the United States due to the stringent regulatory requirements of the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

- Canada: Securities regulations in Canada also differ from one province to another, making it complicated for foreign brokers to establish a uniform presence.

- Belgium: Belgium imposes strict regulations on certain types of derivative products, limiting broker offerings.

Countries Where Exness Is Banned:

- Europe

- United Kingdom

- Japan

- Australia

- Russian Federation

- North Korea

- Iran

- Syria

- Sudan

- Cuba

- Region of Crimea

- Sevastopol

- Afghanistan

Reasons for Bans or Restrictions

- Regulatory Barriers: Some nations have specialized regulations that require brokers to meet high capital requirements or adhere to unique licensing standards.

- Compliance Risk: If the cost or complexity of complying with local financial regulations is too high, brokers may choose not to operate in those markets.

- Sanctions: Political or economic sanctions can block broker access to particular regions.

If you live in or plan to move to one of these restricted countries, confirm the broker’s stance on providing services there. Attempting to trade from banned locations could lead to account restrictions or closures.

Exness Broker Is Legal in India

A common query among Indian traders is whether Exness is legal and accessible within the country. Brokers who wish to operate in India must navigate the complicated regulatory landscape governed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). While India does not explicitly forbid forex trading on foreign platforms, the regulations around currency pairs and capital remittances can be restrictive.

Regulatory Considerations in India

- RBI Guidelines: The RBI permits currency trading primarily with INR-based pairs (USD/INR, EUR/INR, GBP/INR, and JPY/INR). Trades on other currency pairs might face regulatory ambiguity.

- SEBI Stance: SEBI supervises securities and futures markets. Some foreign brokers, including Exness, do not hold a direct SEBI license but operate through offshore entities to serve Indian residents.

Exness does accept Indian traders, provided they comply with international anti-money laundering (AML) measures and local regulations regarding fund transfers. This arrangement suggests that, practically, trading with Exness from India is possible. However, it is crucial for traders to stay informed about any updates in Indian forex regulations to ensure compliance.

Tips for Indian Traders

- Verify Payment Methods: Make sure the broker’s deposit and withdrawal methods are allowed in India.

- Stay Updated on RBI Circulars: Keep an eye on RBI’s latest guidelines concerning outward remittances for trading purposes.

- Consult with Financial Advisors: To remain fully compliant, it’s wise to seek guidance from professionals familiar with forex regulations in India.

Is Exness Broker Halal?

For traders who are Muslim, abiding by Sharia principles in financial transactions is essential. This raises the question of whether Exness provides halal trading options through Islamic accounts. In Islamic finance, earning or paying interest is generally not permitted, so many forex brokers address this concern by offering swap-free accounts.

Exness’ Islamic Account Options

- Swap-Free Accounts: Exness reportedly offers Islamic or swap-free accounts, where traders do not pay or receive overnight interest fees on positions kept open past the market close.

- Availability by Region: Typically, Islamic accounts are automatically accessible for clients from majority-Muslim countries or upon special request. You may need to contact customer support to confirm the option’s availability in your jurisdiction.

- No Hidden Fees: While many brokers waive interest charges, some impose additional administrative fees. Make sure to read the terms and conditions or reach out to customer service to confirm the fee structure for Islamic accounts.

Thus, for Muslim traders seeking a Sharia-compliant brokerage experience, Exness can be considered as an option. However, always verify with official sources or the broker’s support team to ensure compliance with Islamic finance principles, as terms can vary by account type and region.

Is Exness Broker Regulated?

Regulation is arguably the most important factor in a broker’s credibility. Traders want to know if there is any form of oversight ensuring customer funds’ safety, fair dealing, and legal accountability. In this regard, Exness holds multiple licenses and registrations across several regulatory bodies.

Regulatory Bodies Overseeing Exness

Exness broker is regulated by:

- CySEC (Cyprus Securities and Exchange Commission): The entity Exness (EU) Ltd operates under license number 178/12. CySEC is renowned for maintaining EU-based financial standards.

- FSA (Seychelles): The Seychelles Financial Services Authority provides oversight to Exness (SC) Ltd. This license focuses on compliance with international Anti-Money Laundering (AML) guidelines and other financial regulations.

- FSCA (South Africa): Exness holds an authorization in South Africa under the Financial Sector Conduct Authority. This is especially valuable for traders based in African countries.

- Additional Registrations: Different Exness entities may hold other local registrations or authorizations, depending on their operational regions.

Why Regulation Matters

- Funds Security: Regulated brokers must keep client funds segregated from the company’s operational accounts.

- Fair Trading Environment: Regulators mandate compliance with best-execution practices and fair dealing guidelines.

- Investor Protection: In many cases, regulated entities contribute to compensation schemes that protect client funds if the broker becomes insolvent.

In short, Exness meets multiple oversight requirements in different parts of the world, increasing its credibility in the eyes of traders. Nevertheless, always verify which entity you are contracting with so you understand the exact regulatory framework that applies to your account.

Conclusion

Choosing a reliable broker means taking a close look at several factors: ownership, physical and regulatory locations, legal status in your country, account features like Islamic trading, and any operational bans. In answering the question, “Where is Exness broker from?” we’ve seen that Exness is a globally active broker with strong roots in Cyprus and Seychelles. Its worldwide presence, coupled with multiple regulatory licenses, reflects a commitment to serving diverse markets and maintaining compliance with financial guidelines.

For traders seeking an online forex and CFD broker, Exness can be an appealing choice thanks to its:

- Comprehensive regulation by CySEC, FSA, FSCA, and other entities

- Availability in many countries, including India

- Islamic (swap-free) account options

- Wide range of trading instruments and user-friendly platforms

However, do keep in mind that not all jurisdictions permit Exness, so verifying local regulations and the specific entity you will be trading under is crucial. If you are ready to begin, consult Exness’ official support team for personalized guidance or open an account to explore the platform’s features. To compare Exness with other top brokers, check out our best brokers review.

Return to Invest Hub for more insights and resources.

Frequently Asked Questions (FAQs)

Exness’s main office is in Limassol, Cyprus, under the entity Exness (EU) Ltd, which is regulated by the Cyprus Securities and Exchange Commission (CySEC). The company also maintains other offices in Seychelles, South Africa, and other regions around the globe.

Exness was established in 2008 by a group of finance and information technology experts. It is privately held, meaning it is not listed on any stock exchange. While the exact names of the founding members are not widely advertised, they hail from various regions, contributing to the firm’s global character.

Exness does not operate in several jurisdictions, including the United States and Canada, primarily due to strict local regulations. Some other countries are also restricted due to political or economic sanctions. For a complete list, you can consult Exness’s official regulation page or customer support.

Yes. Exness accepts Indian traders, although it doesn’t hold a direct SEBI license. Many traders operate under the offshore entities, which provide access to currency pairs within the regulatory framework. It’s crucial, however, to stay updated on the guidelines issued by the Reserve Bank of India (RBI) and consult financial advisors to remain compliant.

Yes. Exness provides an Islamic or swap-free account option, allowing Muslim traders to avoid overnight interest charges in compliance with Sharia principles. Always review the terms and conditions or contact customer support to confirm the specifics of any additional administration fees.

Absolutely. Exness is regulated in multiple jurisdictions. Key licenses include CySEC in Cyprus, the Seychelles Financial Services Authority (FSA), and the Financial Sector Conduct Authority (FSCA) in South Africa. Each region imposes its own regulatory requirements to ensure client fund safety and fair dealing.

Generally, you only need one Exness account, but the entity you trade under may differ based on your location. Each entity is regulated by its local financial authority. It is best to confirm with Exness customer support which jurisdiction applies to your account.

Exness supports various methods including bank transfers, credit/debit cards, e-wallets (like Skrill and Neteller), and sometimes local payment solutions, depending on your region. Verify in advance that your chosen payment method is accepted and meets any local regulations.