Where is MultiBank Group located? As a globally renowned financial brokerage firm, MultiBank Group operates across multiple regions, making it somewhat challenging to pinpoint just one “location.” Founded by Naser Taher, the company has grown from its original base in the United States into a worldwide presence, with key offices in Asia, the Middle East, and beyond. Naser Taher himself has been recognized among the 50 most influential figures in the global financial market, underscoring the leadership and vision driving MultiBank Group’s expansion. In this article, we’ll explore the broker’s origins, headquarters, global footprint, and ownership, drawing upon up-to-date information, expert insights, and personal anecdotes to offer a clear, well-rounded perspective.

What Is MultiBank Group?

As you can read in MultiBank Group review, MultiBank Groupis a prominent financial services provider in the realm of Forex and Contracts for Difference (CFDs). Over the years, it has garnered a reputation for offering cutting-edge trading platforms, robust liquidity, and stringent regulatory compliance. Many traders choose MultiBank Group for its advanced trading tools and competitive spreads, while institutional clients appreciate its deep liquidity pool.

The firm’s product portfolio typically spans foreign exchange (FX) pairs, precious metals, indices, commodities, and even cryptocurrencies. MultiBank Group has established itself as an industry authority by securing multiple regulatory licenses, adhering to global standards, and prioritizing transparency in its operations. This emphasis on compliance reinforces trust among both retail and institutional traders worldwide.

For a comprehensive comparison of leading brokerage firms, visit our broker review.

Origins and Early History

Established in California in 2005 by Naser Taher, MultiBank Group set out with a revolutionary vision for the financial brokerage landscape—one that emphasized technological innovation, transparent trading conditions, and a global mindset. During its early years, the group primarily served a burgeoning community of forex traders in North America, offering competitive spreads and fast trade execution.

The global financial crisis tested many institutions worldwide, yet MultiBank Group emerged stronger by investing in real-time trade-processing technologies and enhancing its latency-reduction measures. As it navigated these market challenges successfully, the group gained traction not only in North America but also in parts of Europe and Asia. Key partnerships with technology providers and financial institutions soon followed, accelerating the firm’s growth into a global player.

By the late 2000s, MultiBank Group had expanded its product offering beyond FX, venturing into CFDs, commodities, and indices. This broader scope allowed it to cater to a more diverse clientele, including retail traders, high-net-worth individuals, and institutional investors. With this foundation laid, the company embarked on a phase of worldwide expansion, which now extends to Asia, the Middle East, and Europe.

Where Is MultiBank Group Located?

Where is MultiBank Group located? This frequently asked question arises because of the organization’s extensive global reach. While it was originally founded in the United States, the company’s strategic headquarters and main operational hubs have evolved over time. Today, one of its key headquarters is in Asia, particularly Hong Kong, while another significant presence is in the United Arab Emirates (UAE).

According to public milestones and expert insights, these locations were chosen due to their prominence as international financial centers, robust regulatory frameworks, and proximity to major trading communities. Hong Kong provides a vital link to the rapidly growing Asian markets, while the UAE office broadens the group’s appeal to traders in the Middle East, North Africa, and beyond.

Though Hong Kong and the UAE stand out as primary hubs, MultiBank Group also maintains a presence in several other regions, including Europe. Each office plays a specialized role in offering localized customer support, complying with regional regulations, and facilitating the unique needs of traders in those markets.

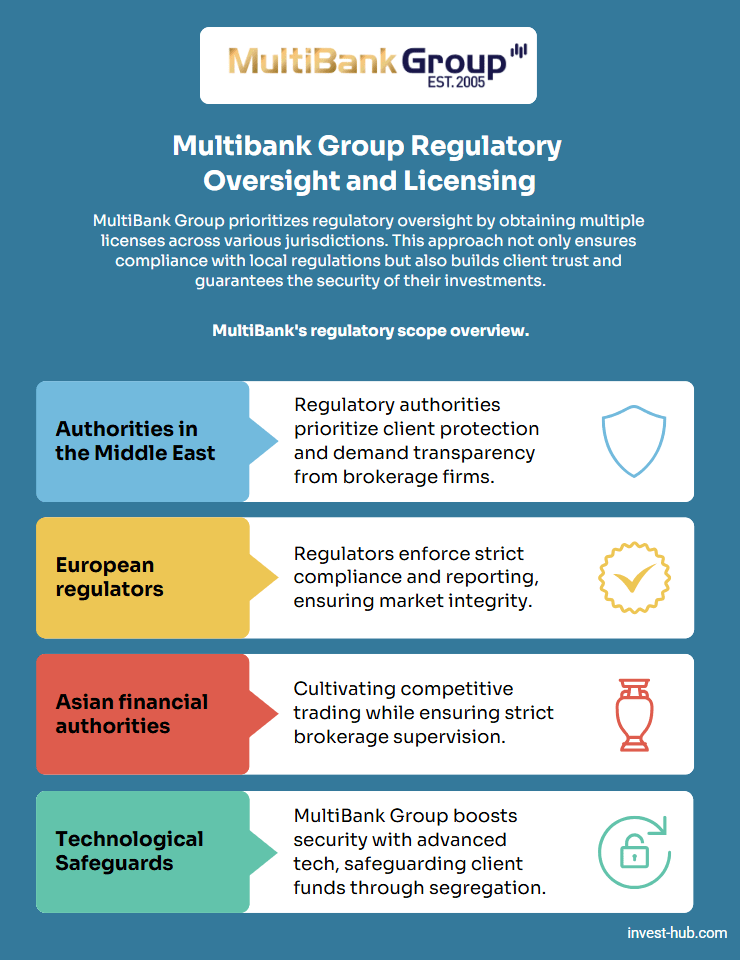

Regulatory Oversight and Licensing

Regulatory oversight is paramount in the world of brokerage services, and MultiBank Group has made acquiring multiple licenses a top priority. Various global financial authorities oversee the group’s subsidiaries, ensuring adherence to local laws, capital adequacy requirements, and client protections.

Some notable regulatory bodies that license aspects of MultiBank Group include:

- Authorities in the Middle East are ensuring robust client protection and operational transparency.

- European regulators are known for their detailed compliance requirements and strict reporting standards.

- Asian financial authorities are fostering competitive, well-supervised trading environments.

In addition to formal licensing, MultiBank Group invests in secure technology infrastructures that include segregated client funds, negative balance protection, and advanced risk management features. These measures collectively provide clients with a secure and transparent trading environment.

Offices Around the World

The group’s global expansion strategy has resulted in multiple offices across prominent financial hubs. Notable Multibank Group offices locations include:

- Hong Kong

As one of Asia’s leading financial centers, Hong Kong hosts a major hub for MultiBank Group. This office typically manages coordination with Asian markets and partners, offering direct engagement and support to traders in the region. - Dubai (United Arab Emirates)

The UAE’s welcoming business environment and strategic location make Dubai a prime spot for financial institutions. MultiBank Group leverages this to serve traders in the Middle East and North Africa while also providing international clients with accessible services. - Europe

Different offices across Europe cater to the diverse regulatory requirements and language preferences of European clients. They offer region-specific account types, promotions, and localized support. - Other Locations

Beyond these key centers, MultiBank Group has smaller offices or partner networks in other jurisdictions, ensuring 24/5 market access and customer assistance.

This expansive network underscores the company’s aim to be both physically and digitally close to traders worldwide. It also allows for easy adaptation to regional regulations, giving clients confidence in dealing with a broker that understands local market nuances.

Who Owns MultiBank Group?

When exploring who owns MultiBank Group, it’s clear that the driving force is Mr. Naser Taher, the founder and chairman. Recognized globally for his leadership in the financial sector—having been named among the 50 most influential figures in global financial markets—Naser Taher has steered MultiBank Group with a focus on compliance, transparency, and continuous innovation.

His extensive background spans over two decades in corporate and investment banking, shaping a strategic mindset that balances aggressive global expansion with stable financial oversight. Industry analysts often highlight this leadership approach as a key factor behind MultiBank Group’s remarkable growth. The firm’s ownership structure under Naser Taher has allowed the agility required to adapt to changing market conditions, reinforcing the group’s status as a leader in the brokerage world.

The Growth and Achievements of MultiBank Group

MultiBank Group’s achievements stand as a testament to its commitment to traders and partners worldwide:

- Technological Innovations

From pioneering proprietary trading platforms to implementing real-time risk management tools, the company invests heavily in research and development. This ensures it remains competitive in an evolving marketplace. - Awards and Recognitions

The group has garnered numerous accolades over the years, celebrating excellence in areas like customer service, trading technology, and market execution. Such awards further solidify MultiBank Group’s standing as a premier global brokerage. - Strategic Partnerships

Collaborations with top-tier liquidity providers and technology firms expand the broker’s reach and improve trading conditions for clients. This synergy leads to tighter spreads and reliable trade execution. - Philanthropic and CSR Efforts

MultiBank Group occasionally participates in various community projects, scholarships, or charitable endeavors in regions where it operates. This holistic approach to business builds goodwill and fosters community engagement.

Taken together, these milestones highlight how MultiBank Group views success as not merely about profit but also about technological advancement, stakeholder satisfaction, and societal impact.

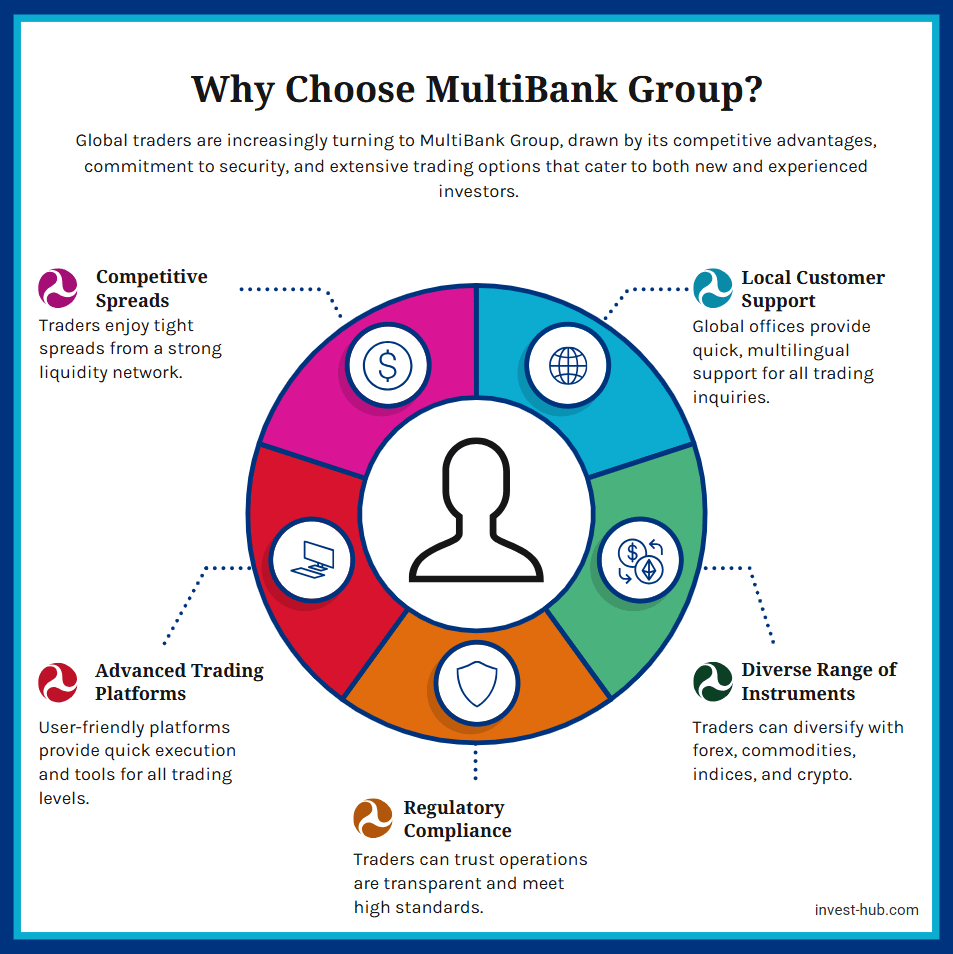

Why Traders Choose MultiBank Group

Global traders often cite a series of compelling reasons for selecting MultiBank Group as their broker of choice:

- Competitive Spreads

The firm’s extensive liquidity network helps keep spreads tight, which is essential for both day traders and long-term investors. - Advanced Trading Platforms

Whether you’re a novice or a seasoned professional, MultiBank Group’s user-friendly platforms offer intuitive navigation, fast trade execution, and robust analytical tools. - Regulatory Compliance

MultiBank Group’s multi-jurisdictional licenses provide traders with added security. Each regional office adheres to local regulations, ensuring transparent business operations. - Diverse Range of Instruments

With everything from forex pairs to commodities, indices, and cryptocurrencies, traders have the flexibility to diversify and explore various markets. - Local Customer Support

Offices in different geographic zones ensure support in multiple languages and quick resolutions to trading issues or account queries.

Moreover, continual improvements in technology, such as automated risk management and advanced charting options, enable traders to keep pace with volatile market conditions. Many professionals highlight the reliability of MultiBank Group’s infrastructure, which remains robust during peak trading sessions or major news events.

Personal Anecdotes and Expert Insights

- Expert Perspective

A long-time industry analyst who has monitored MultiBank Group’s evolution praises its transition into global markets. He points out that the shift from a U.S.-based brokerage to one with major offices in Hong Kong and the UAE required “strategic foresight and commitment to compliance,” both of which were championed by founder Naser Taher. - Personal Anecdote

A trader who moved from Europe to the Middle East found that MultiBank Group’s local offices made the transition seamless. She was impressed by the company’s prompt regional customer service and the ease of transferring her account between different regulatory environments.

Such experiences illustrate how MultiBank Group appeals to a wide spectrum of traders, from beginners seeking user-friendly platforms to seasoned professionals requiring reliable execution and advanced tools. The overall sentiment among many clients is that MultiBank Group strives to deliver an institutional-level trading experience across all skill and investment levels.

Conclusion

Where is MultiBank Group located? Thanks to its founder Naser Taher and his vision, the company has grown beyond its origins in the United States to establish significant footholds in Hong Kong, the United Arab Emirates, and several other key financial centers. This multi-regional presence not only benefits traders seeking local expertise and support but also underscores the group’s dedication to building a truly global brokerage.

With a strong emphasis on technology, compliance, and client satisfaction, MultiBank Group has solidified its reputation as a reliable partner for both retail and institutional traders. If you’re exploring options in forex, CFDs, or other financial instruments, consider delving deeper into what MultiBank Group offers.

Call to Action: Ready to begin or expand your trading journey? Explore account types, review available platforms, or reach out to their global offices to find the support tailored to your market needs.

To learn more about MultiBank Group and other top brokerages, visit Invest Hub.

Frequently Asked Questions (FAQs)

While the group started in the United States, it now has major operational hubs in Hong Kong and the United Arab Emirates, functioning as key headquarters.

MultiBank Group was founded by Mr. Naser Taher, who serves as its chairman. He has been recognized among the most influential figures in global finance, bringing years of experience in banking and brokerage to the firm’s leadership.

Yes. Multiple subsidiaries of the group operate under different regulatory bodies worldwide, ensuring compliance with stringent rules and offering added fund security to clients.

Absolutely. The company offers educational resources, demo accounts, and user-friendly platforms, making it accessible for novices. Customer support is also available around the clock in various regions.

You can trade a wide variety of instruments, including Forex pairs, commodities, indices, shares, and cryptocurrencies, accommodating diverse trading strategies.

Many traders highlight the reliability of MultiBank Group’s servers and platforms, citing stable performance even during periods of extreme market volatility.