Where Is XM Broker Located? XM Broker is primarily headquartered in Limassol, Cyprus, under the umbrella of Trading Point Holdings. The firm also has additional offices and operational centers in countries such as Australia, where it is regulated by the Australian Securities and Investments Commission (ASIC), and Belize, overseen by the International Financial Services Commission (IFSC). As a globally recognized forex and CFD provider, XM operates with multiple regulatory licenses, reflecting its compliance with strict financial guidelines and international best practices.

XM Broker Key Features

As you can read in our XM Broker review, XM Broker is a global brokerage brand that specializes in online forex and CFD (Contract for Difference) trading. Established under the banner of Trading Point Holdings Ltd., the company has grown significantly over the years to provide financial services to millions of traders worldwide. Key offerings include:

- Forex Trading: A wide range of currency pairs.

- CFDs on Stocks, Indices, and Commodities: Options to diversify portfolios and manage risk.

- Multiple Account Types: Ranging from micro accounts for newcomers to zero-spread accounts for more advanced users.

Given XM’s international presence, the question “Where is XM Broker located?” often arises among prospective traders. Let’s delve deeper into its origins, regulatory reach, and ownership.

Which Country Is XM Broker From?

A common misconception is that XM Broker is tied to only one specific country. While the brand originated under an entity in Cyprus, the scope of XM’s operations extends across several continents. The XM broker’s key legal framework falls under Cypriot law, primarily because its parent entity, Trading Point Holdings, is registered in Cyprus.

Core Regulatory Infrastructure

- Cyprus: The Cyprus Securities and Exchange Commission (CySEC) is one of the primary regulators overseeing XM’s activities in the European region.

- Australia: XM holds an Australian Financial Services License (AFSL) under ASIC.

- Belize: The firm is also recognized by the IFSC in Belize for certain international segments.

These legal bases help XM cater to a wide range of clients while adhering to financial protocols specific to each region.

Ownership and Background

Trading Point Holdings Ltd. owns XM Broker. Within the group are several subsidiary entities that operate under different regulatory licenses. Key points include:

- Founding Team: A group of financial market experts established the brand to offer transparent trading conditions, which remains a core philosophy.

- Corporate Structure: Multiple subsidiaries exist under the Trading Point umbrella, each authorized by a different regulatory body.

- Notable Acquisitions: Over the years, XM has grown through strategic expansions rather than high-profile acquisitions.

If you explore CB Insights, you can find insights into the leadership team, indicating that XM’s executive board consists of professionals with backgrounds in finance, risk management, and technology.

Where Is XM Broker Regulated?

XM Broker’s international licensing structure means clients benefit from:

- Strict Capital Requirements: Regulators enforce minimum capital thresholds, ensuring XM remains solvent and can meet client withdrawal requests.

- Investor Compensation Schemes: In Cyprus, for instance, the Investors Compensation Fund (ICF) protects eligible retail clients under certain conditions.

- Regular Audits: Regulatory bodies mandate periodic audits, reinforcing transparency in XM’s business operations.

| Region | Regulator | License |

| Europe (Cyprus) | Cyprus Securities and Exchange Commission | CIF License (Trading Point) |

| Australia | Australian Securities and Investments Commission | Australian Financial Services License |

| Belize | International Financial Services Commission | Various IFSC Regulations |

XM Broker Headquarters and Global Offices

Cyprus Headquarters

- Location: Limassol, Cyprus

- Role: Core administrative, legal, and executive decision-making hub

Australia Office

- Location: Sydney, Australia

- Role: Oversees operations in Asia-Pacific region; regulated by ASIC

Other Notable Regional Offices

- Belize: primarily caters to clients outside the EU and Australia.

- Greece, UK, and Beyond: Representative offices offering localized support.

While Cyprus remains the “official” home base, XM’s global presence means it can deliver language-specific customer service and tailored trading conditions.

User Experiences and Case Studies

Over the years, user experiences have showcased XM’s global reputation. Although experiences vary from trader to trader, a few recurring themes stand out:

- Fast Execution: Low latency and minimal slippage, important for forex scalpers.

- Responsive Customer Support: Users often cite 24/5 live chat as a key advantage, with multilingual support staff available.

- Educational Resources: XM frequently hosts webinars, seminars, and online tutorials.

Case Study: A Beginner’s Experience

- Trader Profile: Emily, a newcomer from the UK with minimal trading experience.

- Challenge: Finding a platform with clear tutorials and minimal deposit requirements.

- XM Experience: Emily noted that the low minimum deposit and the demo account offered a smooth onboarding. She particularly appreciated the “Learn to Trade” webinars. Her initial gains were modest, but she attributed her confidence to XM’s educational framework.

Case Study: Transition to XM from Another Broker

- Trader Profile: David, an intermediate trader focused on commodities and currency pairs.

- Challenge: High spreads and slow order execution with his old brokerage.

- XM Experience: David reported improved execution speeds and narrower spreads on major currency pairs. He now uses XM’s Zero Account for scalping. While no broker is perfect, David highlights XM’s transparency about fees as a key differentiator.

These examples underline XM’s commitment to trader-centric features while also illustrating that individual results can vary based on strategy, market conditions, and personal trading habits.

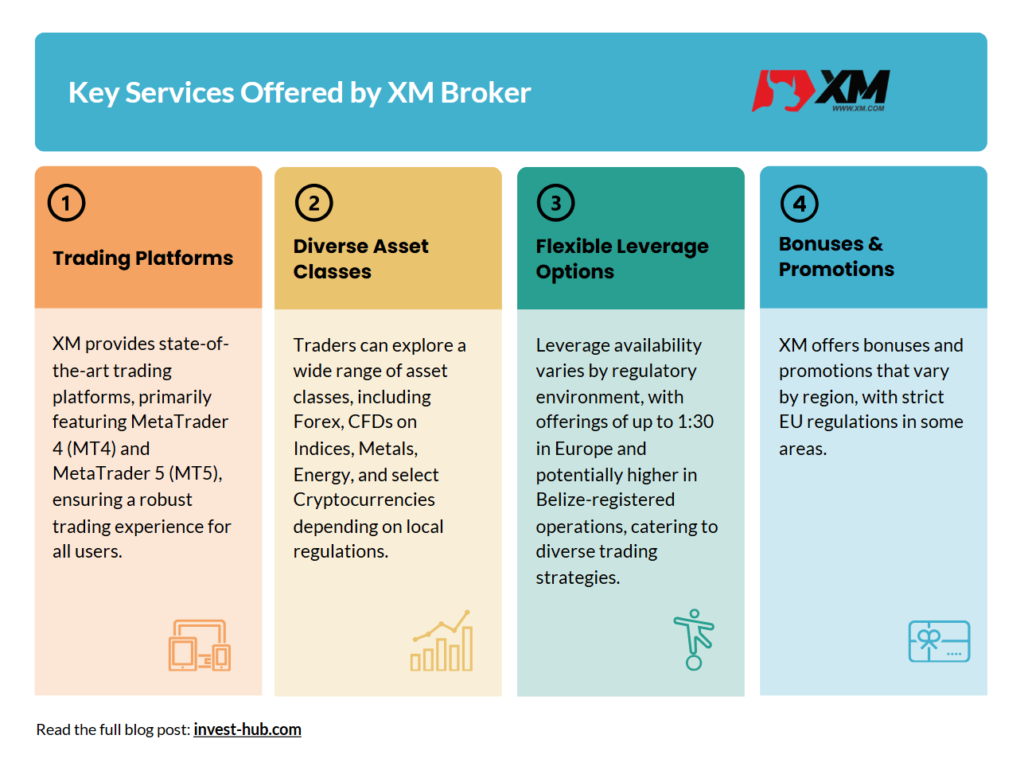

Key Services Offered by XM Broker

XM caters to both retail and professional traders by offering:

- Trading Platforms: Primarily MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Asset Classes: Forex, CFDs on Indices, Metals, Energy, and Cryptocurrencies (in certain jurisdictions).

- Leverage: Varies based on the regulatory regime (e.g., up to 1:30 in Europe, higher in Belize-registered segments).

- Bonuses/Promotions: Available in specific regions, though strictly regulated in others (for instance, promotions are restricted in EU jurisdictions).

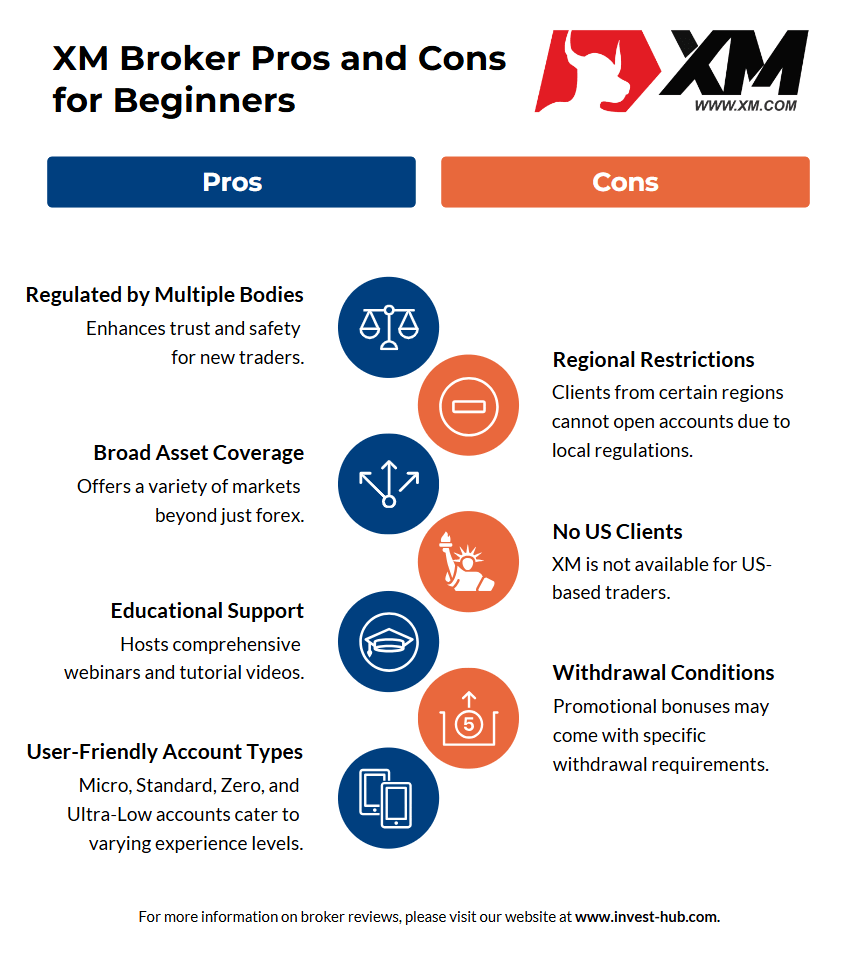

Potential Pros and Cons for Beginners

Pros

- Regulated by Multiple Bodies: Enhances trust and safety for new traders.

- Broad Asset Coverage: Offers a variety of markets beyond just forex.

- Educational Support: Hosts comprehensive webinars and tutorial videos.

- User-Friendly Account Types: Micro, Standard, Zero, and Ultra-Low accounts cater to varying experience levels.

Cons

- Regional Restrictions: Clients from certain regions cannot open accounts due to local regulations.

- No US Clients: XM is not available for US-based traders.

- Withdrawal Conditions: Promotional bonuses may come with specific withdrawal requirements.

Conclusion

Where Is XM Broker Located? Primarily, it is headquartered in Limassol, Cyprus, operating under multiple regulatory frameworks to serve a global client base. From ASIC oversight in Australia to IFSC regulations in Belize, XM’s multi-jurisdictional approach ensures compliance, transparency, and reliability. Its global presence, diverse asset offerings, and user-centric service model make XM a notable choice for beginners and experienced traders alike.

If you are exploring brokerage options or simply want to learn more, be sure to check out our main page, read our latest broker review. These resources can help you navigate the world of trading platforms, features, and regulatory standards to find a broker that meets your needs.

FAQs

XM Broker is headquartered in Limassol, Cyprus, under Trading Point Holdings Ltd. However, they also maintain offices in Australia (ASIC-regulated) and Belize, among others.

The brand originated under an entity in Cyprus, though it has since expanded into multiple markets worldwide.

XM Broker is owned by Trading Point Holdings Ltd., a group that oversees various subsidiaries, each regulated in different jurisdictions.

XM is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the International Financial Services Commission (IFSC) in Belize, among other bodies.

Yes, XM is often considered beginner-friendly due to its low minimum deposit, multiple account types, and extensive educational tools. However, always do your own research before investing.

Yes, XM has offices in Australia (for ASIC oversight), Belize (IFSC), and representative locations in several other countries.