AccentForex Review 2025: Reliable Forex Broker or Scam?

AccentForex

Vanuatu

Vanuatu

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Unavailable

Licenses

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+442032892929

(English)

+442032892929

(English)

Supported language: English, Russian

Social Media

Summary

AccentForex is a forex broker established in 2010 and headquartered in Vanuatu, regulated by the Vanuatu Financial Services Commission (VFSC). The broker offers a wide range of trading instruments, including forex, commodities, CFDs on shares, indices, and cryptocurrencies. It provides trading on MetaTrader 4 (MT4) and offers various account types such as Micro, Mini, and STP. With a minimum deposit of $50 and leverage up to 1:500, AccentForex supports multiple deposit methods, offers fast withdrawal processing within 24 hours, and provides customer support 24/5.

- AccentForex offers competitive spreads, especially on STP accounts, starting from 0.1 pips.

- Multiple account types are available to cater to different trading styles and experience levels.

- The broker provides the user-friendly and feature-rich MetaTrader 4 (MT4) platform.

- Negative balance protection is offered to safeguard traders from losing more than their account balance.

- Client funds are segregated from the company's operating funds for added security.

- AccentForex is only regulated by the offshore VFSC, which may provide less oversight than top-tier regulators.

- Educational resources and market analysis tools are relatively limited compared to some competitors.

- The broker primarily focuses on forex trading, with limited offerings in other asset classes.

- Customer support options are limited, with no phone support and a lack of information on supported languages.

- Some promotional offers come with strict terms and conditions, such as high trading volume requirements.

Overview

AccentForex is a forex brokerage firm established in 2010 and headquartered in Vanuatu. The company is regulated offshore by the Vanuatu Financial Services Commission (VFSC) and focuses primarily on providing forex trading services to clients worldwide.

AccentForex offers trading on the MetaTrader 4 (MT4) platform across four main account types – Micro, Mini, PROFIT, and STP. These account options cater to various trading styles and experience levels, with minimum deposits starting from $50. The broker provides competitive trading conditions, including tight spreads from 0.1 pips on STP accounts and leverage up to 1:500.

Clients can fund their accounts using multiple methods, such as bank transfers, credit/debit cards, e-wallets like Skrill and Neteller, and cryptocurrencies. AccentForex processes withdrawal requests within 24 hours, although fees and processing times vary depending on the payment method.

While AccentForex delivers an accessible and feature-rich trading environment for forex enthusiasts, it's essential to consider the broker's offshore regulatory status and the potential risks associated with trading leveraged products. Traders are encouraged to conduct thorough due diligence and compare AccentForex's offerings with other regulated brokers to determine if it aligns with their trading objectives and risk tolerance.

Overview Table

| Attribute | Details |

|---|---|

| Broker | AccentForex |

| Established Year | 2010 |

| Headquarters | Vanuatu |

| Regulated By | Vanuatu Financial Services Commission (VFSC) |

| Core Offering | Forex |

| Trading Platforms | MetaTrader 4 (MT4) |

| Account Types | Micro, Mini, PROFIT, STP, Islamic |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:500 |

| Deposit Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Cryptocurrencies |

| Withdrawal Processing Time | Within 24 hours |

| Website | www.accentforex.com |

Facts List

- AccentForex was founded in 2010 and is based in Vanuatu.

- The broker is regulated offshore by the Vanuatu Financial Services Commission (VFSC).

- AccentForex specialises in forex trading and offers services on the MetaTrader 4 (MT4) platform.

- The company provides four main account types: Micro, Mini, PROFIT, and STP.

- Minimum deposits start at $50, making it accessible to a wide range of traders.

- AccentForex offers competitive spreads, with STP accounts featuring spreads as low as 0.1 pips.

- Clients can access leverage up to 1:500, depending on the account type.

- The broker supports various funding methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies.

- Withdrawal requests are processed within 24 hours, although fees and processing times vary by payment method.

- While AccentForex provides a feature-rich trading environment, traders should consider the potential risks associated with offshore regulation and leveraged trading.

AccentForex Licenses and Regulatory

AccentForex operates under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). The VFSC is the primary regulator for financial services providers in Vanuatu, a South Pacific island nation known for its offshore financial sector.

As an offshore-regulated broker, AccentForex must comply with the VFSC's regulatory requirements, which include maintaining segregated client funds, adhering to anti-money laundering (AML) and know-your-customer (KYC) policies, and providing transparent and fair trading conditions.

However, it's important to note that offshore regulators like the VFSC may have less stringent oversight and enforcement compared to top-tier regulatory bodies such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These tier-1 regulators often impose stricter capital requirements, reporting obligations, and consumer protection measures.

While AccentForex's VFSC regulation provides a level of legal compliance, traders should be aware of the potential risks associated with offshore-regulated brokers, such as limited recourse in case of disputes or insolvency. It's crucial for traders to conduct thorough due diligence and consider the regulatory status of a broker before opening an account.

When compared to industry standards, AccentForex's single offshore regulatory license may not offer the same level of client protection and trust as brokers with multiple licenses from top-tier regulators. Traders should assess their risk tolerance and priorities when choosing a broker and compare AccentForex's regulatory standing with other brokers in the industry.

Regulations List

- Vanuatu Financial Services Commission (VFSC)

- License Type: Retail Forex License

- License Number: 17926

- Current Status: Offshore Regulated

Trading Instruments

Forex :

AccentForex primarily focuses on providing forex trading services to its clients. The broker offers a comprehensive range of currency pairs, including majors, minors, and exotics. Traders can access popular pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF, as well as less frequently traded pairs like EUR/TRY and USD/SEK.

With competitive spreads starting from 0.1 pips on STP accounts, AccentForex aims to provide cost-effective trading conditions for forex enthusiasts. The broker's emphasis on forex trading reflects its commitment to catering to the needs of currency traders and delivering a specialised trading experience.

Precious Metals & Commodities :

While AccentForex's core offering revolves around forex trading, the broker also provides limited access to precious metals and commodities. Traders can speculate on the price movements of gold and silver, allowing them to diversify their portfolios and take advantage of market fluctuations in these popular safe-haven assets.

However, it's important to note that AccentForex's range of precious metals and commodities is relatively limited compared to other multi-asset brokers in the industry. Traders seeking exposure to a wide array of commodities, such as oil, natural gas, or agricultural products, may need to explore other brokers with more extensive offerings.

Indices, Stocks, Bonds, and ETFs At present, AccentForex does not offer trading in indices, stocks, bonds, or exchange-traded funds (ETFs). The broker's focus remains primarily on the forex market, with limited exposure to precious metals and commodities.

Traders interested in accessing a diverse range of asset classes may need to consider other brokers that provide a more comprehensive trading experience. Multi-asset brokers often offer a wide selection of indices, stocks, bonds, and ETFs, enabling traders to construct well-diversified portfolios and capitalise on opportunities across various market segments.

While AccentForex's specialised focus on forex trading may appeal to currency traders, it's crucial for investors to assess their trading needs and goals when selecting a broker. Those seeking a more versatile trading environment may find better alternatives among brokers with a broader asset offering.

Trading Platforms

Trading Platforms AccentForex offers its clients the popular MetaTrader 4 (MT4) platform for trading. MT4 is a widely used trading platform in the forex industry, known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators.

MetaTrader 4 (MT4)

The MT4 platform provided by AccentForex is available for desktop, web, and mobile devices, allowing traders to access the markets from anywhere at any time. Some of the key features of the MT4 platform include:

- Customizable charts with 9 timeframes and 30+ built-in technical indicators

- Three execution modes: Instant Execution, Request Execution, and Market Execution

- One-click trading and trading from charts

- Expert Advisors (EAs) for automated trading

- Customizable alerts and trading signals

- Multilingual support

AccentForex's MT4 platform caters to both beginner and experienced traders, providing a reliable and feature-rich trading environment. The platform's extensive range of tools and customisation options allow traders to analyse the markets, develop trading strategies, and execute trades efficiently.

Mobile Trading AccentForex offers a mobile trading app for both iOS and Android devices, enabling traders to manage their accounts and trade on the go. The mobile app provides key features of the MT4 platform, such as real-time quotes, charts, and the ability to place and manage trades directly from a smartphone or tablet.

The mobile trading app ensures that traders can stay connected to the markets and react to price movements even when away from their desktop computers. This flexibility is particularly important for traders who need to monitor their positions closely and make timely decisions.

While AccentForex does not offer the MetaTrader 5 (MT5) platform or any proprietary trading software, the broker's focus on providing a solid MT4 experience ensures that traders have access to a reliable and widely recognised platform. The MT4 platform's popularity and extensive community support make it an attractive choice for many traders.

Trading Platforms Comparison Table

| Feature | MT4 Desktop | MT4 WebTrader | MT4 Mobile |

|---|---|---|---|

| Customizable charts | Yes | Yes | Yes |

| Technical indicators | Yes | Yes | Yes |

| One-click trading | Yes | Yes | Yes |

| Expert Advisors (EAs) | Yes | No | No |

| Customizable alerts | Yes | Yes | Yes |

| Multilingual support | Yes | Yes | Yes |

| Automated trading | Yes | No | No |

| Trading signals | Yes | Yes | Yes |

| Real-time quotes | Yes | Yes | Yes |

| Market news | Yes | Yes | Yes |

AccentForex How to Open an Account: A Step-by-Step Guide

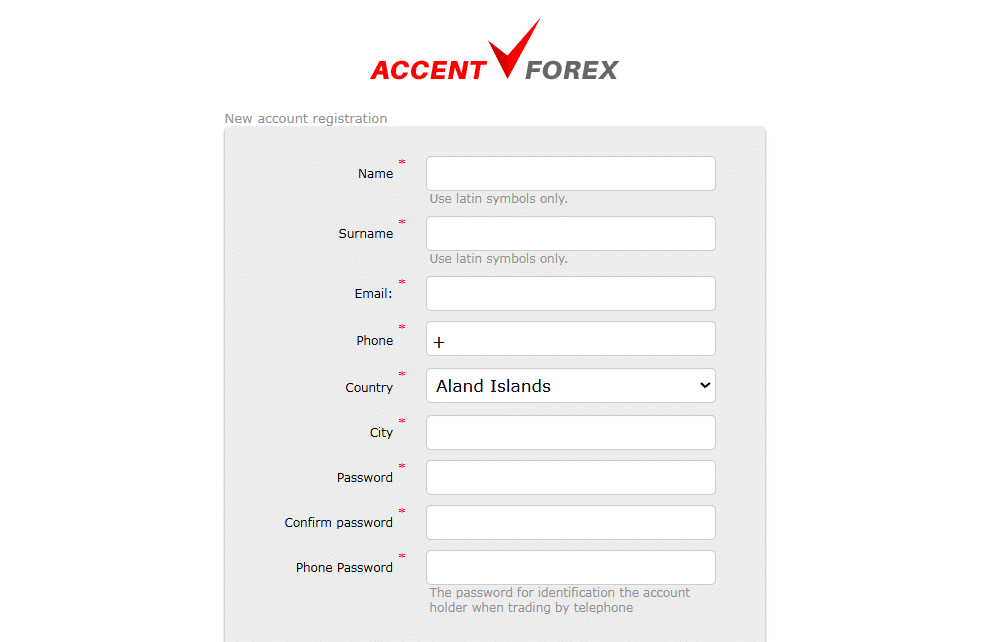

Opening an account with AccentForex is a straightforward process that can be completed online. Follow these step-by-step instructions to get started:

Step 1: Visit the AccentForex website Go to the AccentForex official website at www.accentforex.com and click on the "Open Account" or "Register" button, usually located in the top right corner of the homepage.

Step 2: Complete the registration form Fill out the registration form with your personal information, including your full name, email address, phone number, country of residence, and preferred account currency (USD or EUR). Ensure that all the information provided is accurate and up-to-date.

Step 3: Choose your account type Select your preferred account type from the available options: Micro, Mini, PROFIT, or STP. Each account type has its own set of features, minimum deposit requirements, and trading conditions. Choose the one that best suits your trading style and experience level.

Step 4: Verify your email address After submitting the registration form, you will receive a verification email from AccentForex. Click on the link provided in the email to verify your email address and activate your account.

Step 5: Provide identification documents To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, AccentForex requires clients to submit proof of identity and proof of residence. Upload a valid government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement that confirms your address.

Step 6: Fund your account Once your account is verified, you can fund it using one of the accepted payment methods, such as bank wire transfer, credit/debit card, Skrill, Neteller, or cryptocurrencies. The minimum deposit amount varies depending on your chosen account type, starting from $50 for Micro accounts.

Step 7: Download and install the trading platform Download and install the MetaTrader 4 (MT4) trading platform on your desktop, or access the MT4 WebTrader through your web browser. You can also download the MT4 mobile app for iOS or Android devices to trade on the go.

Step 8: Start trading Once your account is funded and you have access to the trading platform, you can start trading forex and other available assets offered by AccentForex. Be sure to familiarize yourself with the platform's features and tools, and always adhere to proper risk management practices.

Charts and Analysis

AccentForex offers a limited selection of educational resources and tools to support its clients' trading activities. While the broker provides some basic materials, the depth and breadth of these resources are relatively modest compared to industry leaders.

| Feature | Details |

|---|---|

| Trading Platform | MetaTrader 4 (MT4) |

| Charting & Tools | 30+ built-in indicators and drawing tools; real-time data; customizable charts |

| Proprietary Tools | None; standard MT4 package only |

| Market News & Analysis | Basic analytics section; occasional blog updates; limited in frequency and depth |

| Economic Calendar | Not available; traders must use third-party sources |

| Educational Articles | Sparse; covers only basic forex concepts |

| Video Tutorials/Webinars | Not offered |

While AccentForex's educational resources may be sufficient for traders who already have a solid foundation in forex trading, they may not be comprehensive enough for beginners seeking to build their knowledge from the ground up. The lack of advanced tools, regular market insights, and in-depth educational content could be a drawback for some traders.

AccentForex Account Types

AccentForex offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and investment capacity. By providing multiple account options, the broker aims to ensure that clients can select the most suitable trading environment based on their individual goals, trading styles, and risk tolerance.

Micro Account

The Micro account is tailored for novice traders who are new to the forex market and wish to start trading with a small initial investment. Key features of the Micro account include:

- Minimum deposit: $50

- Leverage: Up to 1:500

- Spreads: From 2 pips

- Commission: None

- Minimum lot size: 0.01 lots

- Maximum trade volume: 5 lots

This account type is ideal for beginners who want to gain practical experience in a live trading environment while limiting their risk exposure.

Mini Account

The Mini account is designed for traders who have gained some experience and are ready to trade with a slightly larger investment. Characteristics of the Mini account include:

- Minimum deposit: $100

- Leverage: Up to 1:200

- Spreads: From 0.5 pips

- Commission: $0.001 per lot

- Minimum lot size: 0.1 lots

- Maximum trade volume: 5 lots

The Mini account offers tighter spreads compared to the Micro account, making it an attractive option for traders looking to minimise trading costs.

PROFIT Account

The PROFIT account caters to more experienced traders who are seeking advanced trading conditions and higher potential returns. Key features of the PROFIT account include:

- Minimum deposit: $1,000

- Leverage: Up to 1:100

- Spreads: From 0.5 pips

- Commission: $0.001 per lot

- Minimum lot size: 1 lot

- Maximum trade volume: 5 lots

This account type offers competitive spreads and is suitable for traders who are comfortable with larger trade sizes and higher risk exposure.

STP Account

The STP (Straight-Through Processing) account is designed for experienced traders who prioritize fast execution speeds and tight spreads. Characteristics of the STP account include:

- Minimum deposit: $100

- Leverage: Up to 1:200

- Spreads: From 0.1 pips

- Commission: $0.001 per lot

- Minimum lot size: 1 lot

- Maximum trade volume: 5 lots

The STP account offers the lowest spreads among AccentForex's account types, making it an attractive choice for active traders and scalpers.

Islamic Account

AccentForex also offers Islamic accounts, which are designed to comply with Sharia law. These accounts do not incur overnight interest charges (swap-free), making them suitable for Muslim traders who wish to adhere to their religious principles while trading.

Demo Account

AccentForex provides a demo account option, allowing traders to practice trading strategies and familiarize themselves with the MetaTrader 4 platform in a risk-free environment. The demo account is funded with virtual money and offers the same trading conditions as the live accounts.

To learn more about AccentForex's account types and their specific terms and conditions, visit the broker's official website at www.accentforex.com.

Account Types Comparison Table

| Feature | Micro | Mini | PROFIT | STP |

|---|---|---|---|---|

| Min. Deposit | $50 | $100 | $1,000 | $100 |

| Leverage | Up to 1:500 | Up to 1:200 | Up to 1:100 | Up to 1:200 |

| Spreads (From) | 2 pips | 0.5 pips | 0.5 pips | 0.1 pips |

| Commission | None | $0.001/lot | $0.001/lot | $0.001/lot |

| Min. Lot Size | 0.01 lots | 0.1 lots | 1 lot | 1 lot |

| Max. Trade Volume | 5 lots | 5 lots | 5 lots | 5 lots |

Negative Balance Protection

AccentForex's Negative Balance Protection Policy AccentForex demonstrates a commitment to protecting its clients' funds by offering negative balance protection as a standard feature across all account types. This means that AccentForex traders will never lose more than the total balance of their trading account, even in the event of extreme market volatility or unexpected developments. Under AccentForex's negative balance protection policy, if a trader's account balance falls below zero due to trading losses, the broker will absorb the negative balance and reset the account balance to zero. Traders will not be required to pay back any negative balances to the broker, providing peace of mind and limiting their maximum potential loss to the funds they have deposited. It is important to note that while negative balance protection is an essential risk management tool, it should not be relied upon as a substitute for proper risk management practices, such as setting appropriate stop-loss orders and maintaining reasonable leverage levels. Traders should always strive to manage their risk responsibly and never invest more than they can afford to lose.

AccentForex Deposits and Withdrawals

AccentForex offers a range of convenient deposit and withdrawal methods to cater to the preferences of its global client base. By providing multiple payment options, the broker aims to ensure that traders can efficiently manage their funds and access their trading accounts with ease.

Deposit Methods

AccentForex accepts the following deposit methods:| Method | Currencies Accepted | Minimum Deposit | Maximum Deposit | Processing Time | Fees |

|---|---|---|---|---|---|

| Bank Wire Transfer | USD, EUR | $50 / €50 | No limit | 3–5 business days | Depends on sending bank |

| Credit/Debit Cards | USD, EUR | $50 / €50 | $5,000 / €5,000 | Instant | 5.1% + 0.5 USD/EUR (Free for deposits ≥ 1000 USD/EUR) |

| E-wallets (Skrill, Neteller) | USD, EUR | $50 / €50 | No limit | Instant | 7% |

| Cryptocurrencies (BTC, ETH, USDT) | Crypto equivalents | ~$50 (equivalent) | No limit | Up to 24 hours | Aggregator fee |

Withdrawal Methods

AccentForex supports the following withdrawal methods:| Method | Currencies Accepted | Minimum Withdrawal | Maximum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|---|

| Bank Wire Transfer | USD, EUR | $5 / €5 | No limit | Up to 7 business days | 0.50% |

| Credit/Debit Cards | USD, EUR | $5 / €5 | No limit | Up to 7 business days | Bank fees |

| E-wallets (Skrill, Neteller) | USD, EUR | $5 / €5 | No limit | Up to 24 hours | 1% (Skrill), 2% up to $30 (Neteller) |

| Cryptocurrencies (BTC, ETH, USDT) | Crypto equivalent | ~$5 equivalent | No limit | Up to 24 hours | Aggregator fee |

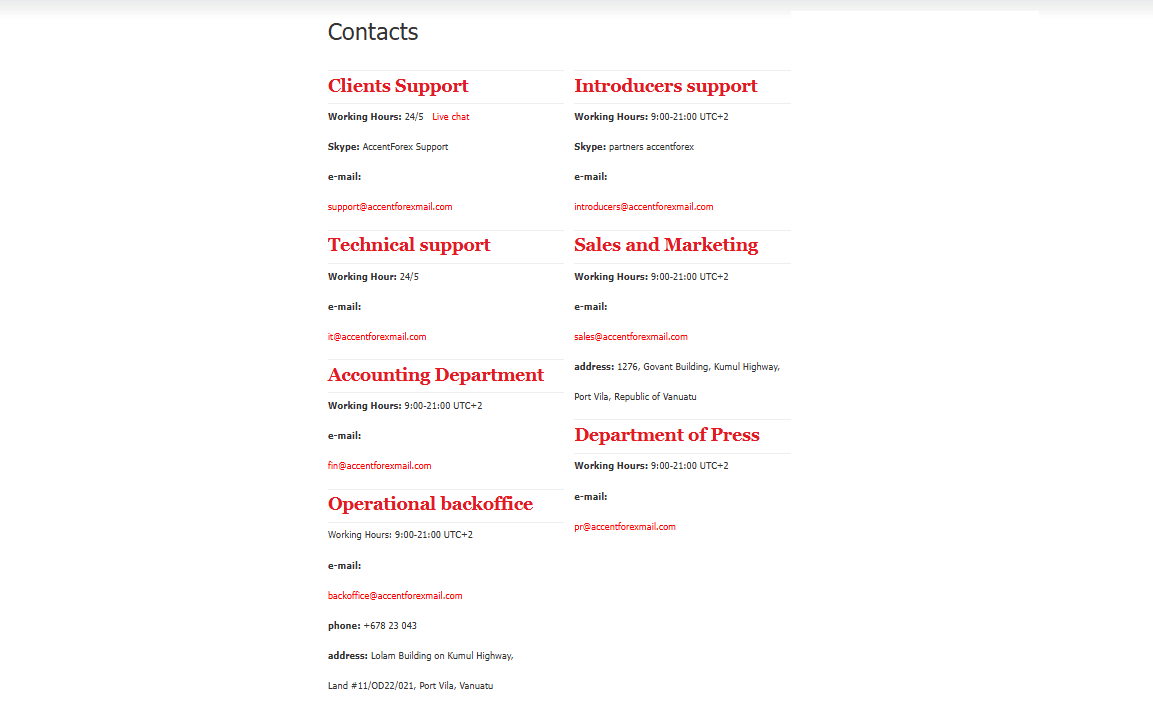

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for ensuring a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general guidance, and a broker's ability to provide prompt and effective support can make a significant difference in client satisfaction and loyalty.

Customer Support Channels

- Email Support

- Email address: support@accentforexmai.com

- Available 24/5

- Live Chat

- Accessible through the AccentForex website

- Available 24/5

- Phone Support

- Not provided

- Social Media

- Not specified

Customer Support Comparison Table

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| 24/5 | Not specified | Not specified | |

| Online Chat | 24/5 | Not specified | Not specified |

| Phone | Not provided | Not specified | Not specified |

| Social Media | Not specified | Not specified | Not specified |

Prohibited Countries

AccentForex, like many other forex brokers, is subject to various regulations and restrictions that limit its ability to offer services in certain countries and regions. These restrictions may be due to local laws, licensing requirements, or geopolitical factors that make it challenging or impossible for the broker to operate in specific jurisdictions.

It is essential for traders to be aware of these restrictions to ensure compliance with international regulations and avoid any potential legal consequences or risks associated with attempting to trade with a broker that is not permitted to operate in their country.

According to the information provided, AccentForex is explicitly banned from operating in the following countries:

- United States

- United Kingdom

- Russian Federation

- Belarus

- FATF blacklisted countries (countries identified by the Financial Action Task Force as having strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks)

The reasons behind these prohibitions vary. For example, the United States has strict regulations governing forex brokers, requiring them to be registered with the Commodity Futures Trading Commission (CFTC) and to be members of the National Futures Association (NFA). Many offshore brokers, including AccentForex, do not meet these requirements and are therefore not permitted to accept US clients.

Similarly, the United Kingdom has its own set of regulations and licensing requirements for forex brokers operating within its jurisdiction. The Russian Federation and Belarus may have restrictions in place due to geopolitical factors or local laws that prohibit or limit the operation of foreign brokers.

FATF blacklisted countries are generally prohibited due to their higher risk of money laundering and terrorist financing activities, which could expose the broker to potential legal and financial liabilities.

Traders from these prohibited countries who attempt to open an account with AccentForex may face account termination, seizure of funds, or other legal consequences. It is crucial for traders to comply with their local laws and regulations and to only trade with brokers that are properly licensed and authorised to operate in their jurisdiction.

If you are unsure whether AccentForex is permitted to provide services in your country, it is recommended to contact the broker directly or consult with a local financial authority to clarify any restrictions or requirements.

Prohibited Regions List

- United States, United Kingdom, Russian Federation, Belarus, FATF blacklisted countries

Special Offers for Customers

AccentForex provides a range of promotional offers designed to attract new clients and reward existing traders for their loyalty. These offers can help traders maximise their trading potential and enhance their overall experience with the broker.

- 40% Deposit Bonus

- Traders can receive a 40% bonus on their deposits

- The bonus amount is added to the trader's account balance and can be used for trading purposes

- To qualify for the bonus, traders must meet specific trading volume requirements

- The bonus is subject to terms and conditions, including withdrawal restrictions and time limitations

- 35% Cash Bonus

- Traders can receive a 35% cash bonus on their deposits

- Unlike the deposit bonus, the cash bonus can be withdrawn once the required trading volume is met

- The cash bonus is subject to terms and conditions, including minimum deposit requirements and trading volume thresholds

It is essential for traders to carefully review the terms and conditions associated with each promotional offer before participating. Some key factors to consider include:

- Minimum deposit requirements

- Trading volume thresholds

- Time limitations

- Withdrawal restrictions

- Eligible account types and trading instruments

Traders should also be aware that bonus funds may be subject to additional risks, as they can amplify potential losses just as they can increase potential gains. It is crucial to maintain responsible trading practices and effective risk management strategies when utilising bonus funds.

While AccentForex's promotional offers can provide a boost to traders' accounts, it is important to evaluate these offers in the context of the broker's overall trading conditions, such as spreads, commissions, and available trading instruments. Traders should consider their individual trading needs and goals when deciding whether to participate in a promotional offer.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of AccentForex's operations, including their regulatory compliance, trading platforms, account types, and customer support. By consolidating the findings and insights gathered, I aim to provide a cohesive summary that addresses AccentForex's safety, reliability, and overall reputation as a broker.

AccentForex, established in 2010 and headquartered in Vanuatu, is an offshore-regulated broker operating under the oversight of the Vanuatu Financial Services Commission (VFSC). While offshore regulation provides a level of legal compliance, it is important to note that the VFSC's oversight may not be as stringent as that of top-tier regulatory bodies like the FCA or ASIC.

One of AccentForex's strengths is its focus on providing a user-friendly trading environment, particularly for forex traders. They offer the popular MetaTrader 4 (MT4) platform, which is known for its intuitive interface, advanced charting capabilities, and automated trading features. However, the broker's educational resources and market analysis tools are relatively limited compared to some of its competitors.

AccentForex offers a range of account types catering to different trading styles and experience levels, with the Micro account being an attractive option for beginners due to its low minimum deposit requirement. The broker's STP account, with its tight spreads and fast execution speeds, is well-suited for more experienced traders and scalpers.

In terms of customer support, AccentForex provides email and online chat assistance 24 hours a day, 5 days a week. However, the absence of phone support and the lack of information on supported languages and average response times may be a drawback for some traders who prefer more immediate or personalised support.

AccentForex's promotional offers, such as the 40% deposit bonus and 35% cash bonus, can provide traders with additional funds to enhance their trading potential. However, it is crucial to carefully review the terms and conditions associated with these offers, as they may come with trading volume requirements and withdrawal restrictions.

When it comes to the safety of client funds, AccentForex segregates client deposits from the company's operating funds and offers negative balance protection to ensure that traders do not lose more than their account balance. However, as with any offshore-regulated broker, traders should be aware of the potential risks associated with limited regulatory oversight.

In conclusion, AccentForex presents itself as a user-friendly broker with a focus on forex trading. While they offer competitive trading conditions and a range of account types, traders should carefully consider the implications of offshore regulation and the broker's limited educational resources and customer support options. As with any financial decision, it is essential to conduct thorough due diligence and assess individual trading needs and risk tolerance before choosing a broker.

Filter by payment methods in the broker funding matrix.

For STP execution fans, check the Anzo Capital review.