Achiever Global Markets Review: Company Overview and Insights

Achiever Global Markets

United Arab Emirates

United Arab Emirates

-

Minimum Deposit $250

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

+971557547696

(English)

+971557547696

(English)

Supported language: English, Arabic

Social Media

Summary

Achiever FX, established in June 2023 and registered in Saint Lucia, is an unregulated forex broker offering trading in forex, commodities, stocks, indices, and cryptocurrencies. Despite providing MetaTrader 5 and offering leverage up to 1:500, the broker lacks proper financial regulation, which raises concerns about its legitimacy. User reviews are overwhelmingly negative, with many clients reporting difficulties withdrawing funds. These issues, along with the lack of regulatory oversight, suggest that Achiever FX may pose significant risks to traders and could potentially be a scam.

- Offers the popular MetaTrader 5 platform for desktop, web, and mobile

- Wide range of tradable instruments including forex, stocks, indices, commodities

- Islamic swap-free accounts available

- Unregulated broker with no license from a reputable authority

- Numerous negative client reviews reporting withdrawal issues and poor support

- Minimal disclosure of corporate background and key personnel

- No guaranteed client protections around segregation of funds or capital reserves

- Lack of transparency around trading fees like swaps and commissions

- Limited educational resources compared to those of leading brokers

Overview

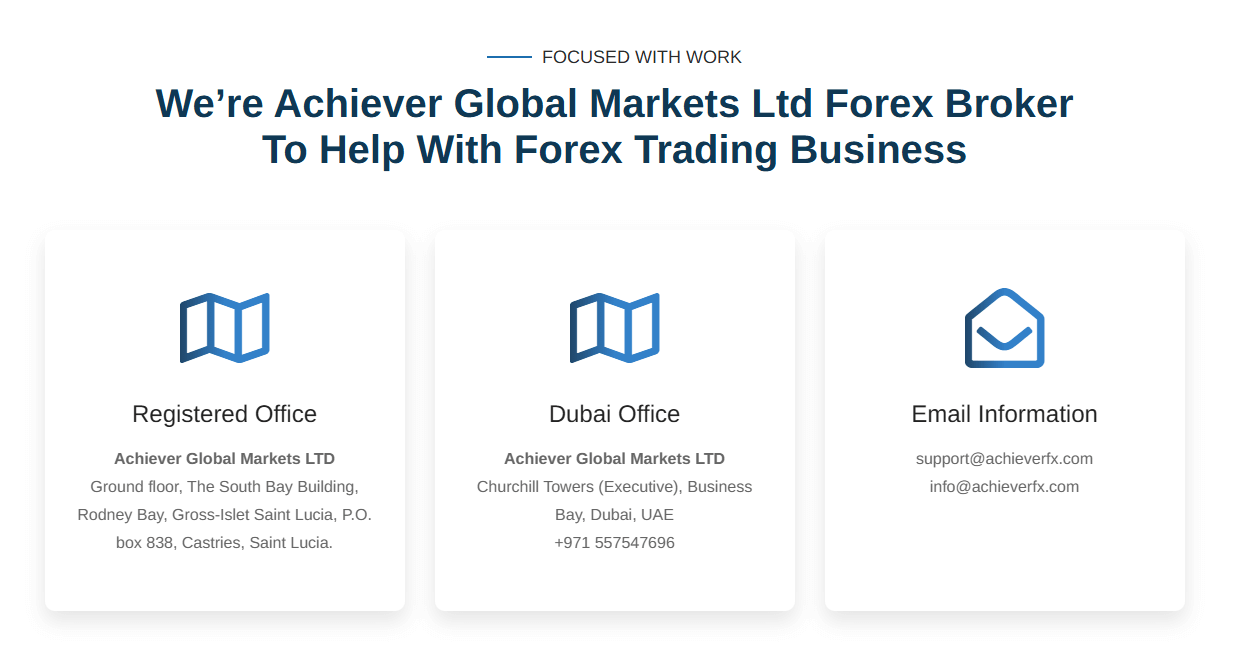

Achiever Global Markets LTD, also known as Achiever FX, is a forex broker established in June 2023 and registered in Saint Lucia. The company provides financial trading services such as forex, indices, stocks, futures and social trading to clients. However, Achiever FX lacks proper financial regulation, as it is not licensed by authorities in Saint Lucia where it is based or any other jurisdictions.

This lack of oversight raises serious red flags about the safety and legitimacy of Achiever FX as a broker. Online user reviews are overwhelmingly negative, with many clients reporting difficulties withdrawing their funds, leading to suspicions that this may be a scam operation. As an unproven entity with a minimal track record, Achiever FX does not inspire confidence – potential clients should be very wary of entrusting their money to this broker.

Overview Table

| Feature | Details |

|---|---|

| Founded | June 2023 |

| Headquarters | Dubai, UAE |

| Regulation | Unregulated |

| Instruments | Forex, commodities, crypto, indices, stocks, futures |

| Platforms | MetaTrader 5 |

| Minimum Deposit | $250 |

Facts List

- Achiever FX was registered in Saint Lucia in June 2023

- It is not licensed or regulated by financial authorities

- The broker offers trading in forex, stocks, indices, futures and more

- MetaTrader 5 is the trading platform provided

- Three account types are available with leverage up to 1:500

- The minimum deposit to open an account is $250

- Funds can be deposited and withdrawn via credit/debit card and other methods

- Most online user reviews of Achiever FX are negative

- Many clients report issues withdrawing money from their accounts

- There are strong indications Achiever FX may be operating as a scam

Achiever Global Markets Licenses and Regulatory

As an offshore broker registered in Saint Lucia, Achiever FX operates without a license from the country's Financial Services Regulatory Authority or any other reputable financial regulator. This lack of oversight is a major concern, as unregulated brokers are not subject to the strict standards and supervision that help protect clients' interests.

Without a regulatory license, there is no assurance that Achiever FX segregates client funds, maintains adequate capital reserves, or follows proper procedures for handling deposits and withdrawals. The risk of fraud or misappropriation of funds is significantly higher when dealing with an unregulated entity.

Proper regulation, such as licensing from top-tier authorities like the FCA, CySEC or ASIC, provides an important layer of protection and recourse for clients. Regulated brokers must adhere to strict guidelines, submit to audits, and offer negative balance protection and insurance for client deposits.

The absence of any regulatory status for Achiever FX is a glaring red flag that should give serious pause to anyone considering investing with this broker. It is highly advisable to only trade with properly licensed and reputable brokers to safeguard one's funds and ensure a fair, transparent trading environment.

Regulations List

- Achiever FX does not hold any licenses with financial regulatory authorities.

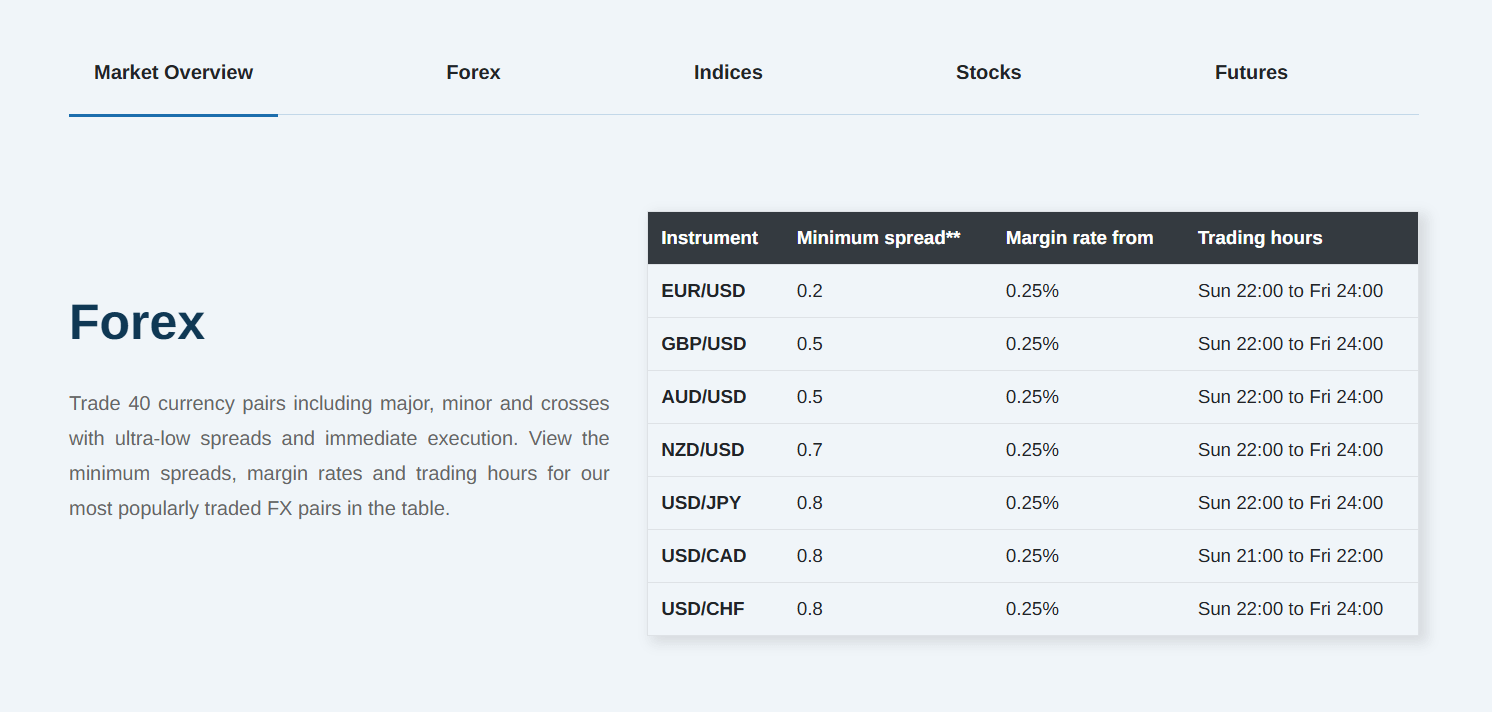

Trading Instruments

According to information on its website, Achiever FX offers tradable assets across a wide range of instruments:

| Asset Class | Details |

|---|---|

| Forex | Over 140 currency pairs |

| Metals | Gold, Silver, Copper |

| Indices | Major indices like the Dow Jones 30, S&P 500, NASDAQ, DAX 30 |

| Energy | Oil, Natural Gas |

| Agriculture | Wheat, Corn, Soybeans |

| Stocks | Hundreds of global company stocks |

| Futures | Commodity futures contracts |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, and others |

This represents a broad selection covering most of the major markets and asset classes that traders look for. The ability to trade forex, commodities, indices, and cryptocurrencies through a single broker can be appealing to those looking to diversify. However, the range of assets alone doesn't make up for the serious concerns around Achiever FX's lack of regulation.

It's important to verify the spreads, commissions, and trading conditions for each asset class, as an extensive offering doesn't necessarily equate to competitive pricing and execution. Achiever FX's lack of transparency around its business practices and the many negative user reviews call into question the true accessibility and quality of its tradable assets.

A diverse product portfolio is only an advantage if backed by a solid regulatory foundation and proven track record of integrity. Potential clients should weigh the allure of Achiever FX's broad asset range against the substantial risks of trading with an unregulated, unproven broker. It's advisable to thoroughly compare offerings with those of regulated brokers before making any decisions.

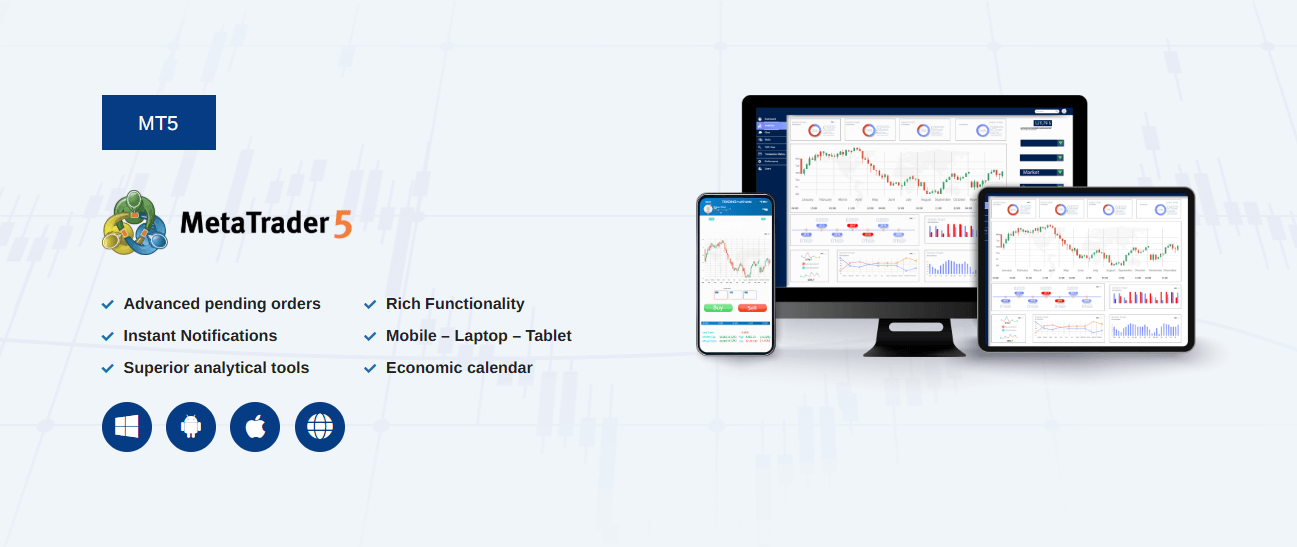

Trading Platforms

Achiever FX provides clients with the MetaTrader 5 (MT5) terminal for trading activities. MT5 is an upgrade from the popular MT4 platform, offering enhanced features and wider integration of markets beyond forex.

Key features of MT5 include:

- More technical indicators and graphical objects for analysis

- Improved interface and more time frames

- MQL5 programming language for building custom strategies

- Algorithmic trading with expert advisors

- Cloud storage of settings

MT5 Web Terminal allows for trading through a browser without requiring installation. There are also MT5 mobile apps available for iOS and Android devices to manage positions on the go.

While MT5 is a robust platform choice used by many leading brokers, Achiever FX's offering of it does little to offset the serious concerns around trading with an unregulated broker. Platform alone doesn't determine the safety and integrity of one's funds – proper regulatory oversight does.

Clients should be aware that unregulated brokers may manipulate pricing, delay order processing, or put other limitations on their versions of MT5. The full capabilities of algorithmic trading and MQL5 strategies cannot be relied upon without the certainty that comes from using a licensed broker.

The MT5 apps on iOS and Android may also lack the stability and responsiveness found with versions put out by leading regulated brokers. There is no guarantee Achiever FX is using authentic MT5 software without modifications.

In short, while MT5 has many analytical and trading advantages, its availability at Achiever FX does not compensate for the lack of regulatory compliance. Potential clients should look to open MT5 accounts at properly licensed brokers to have full confidence in the platform's integrity and their trading experience.

Platforms Comparison Table

| PLATFORM | DESKTOP | WEBTRADER | MOBILE APP | FEATURES |

|---|---|---|---|---|

| MetaTrader 5 | Yes | Yes | Yes (iOS/Android) | • 80+ indicators and tools • 21 timeframes (M1–MN) • Integrated Economic Calendar • Expert Advisors, copy trading • Market depth • Customizable interface |

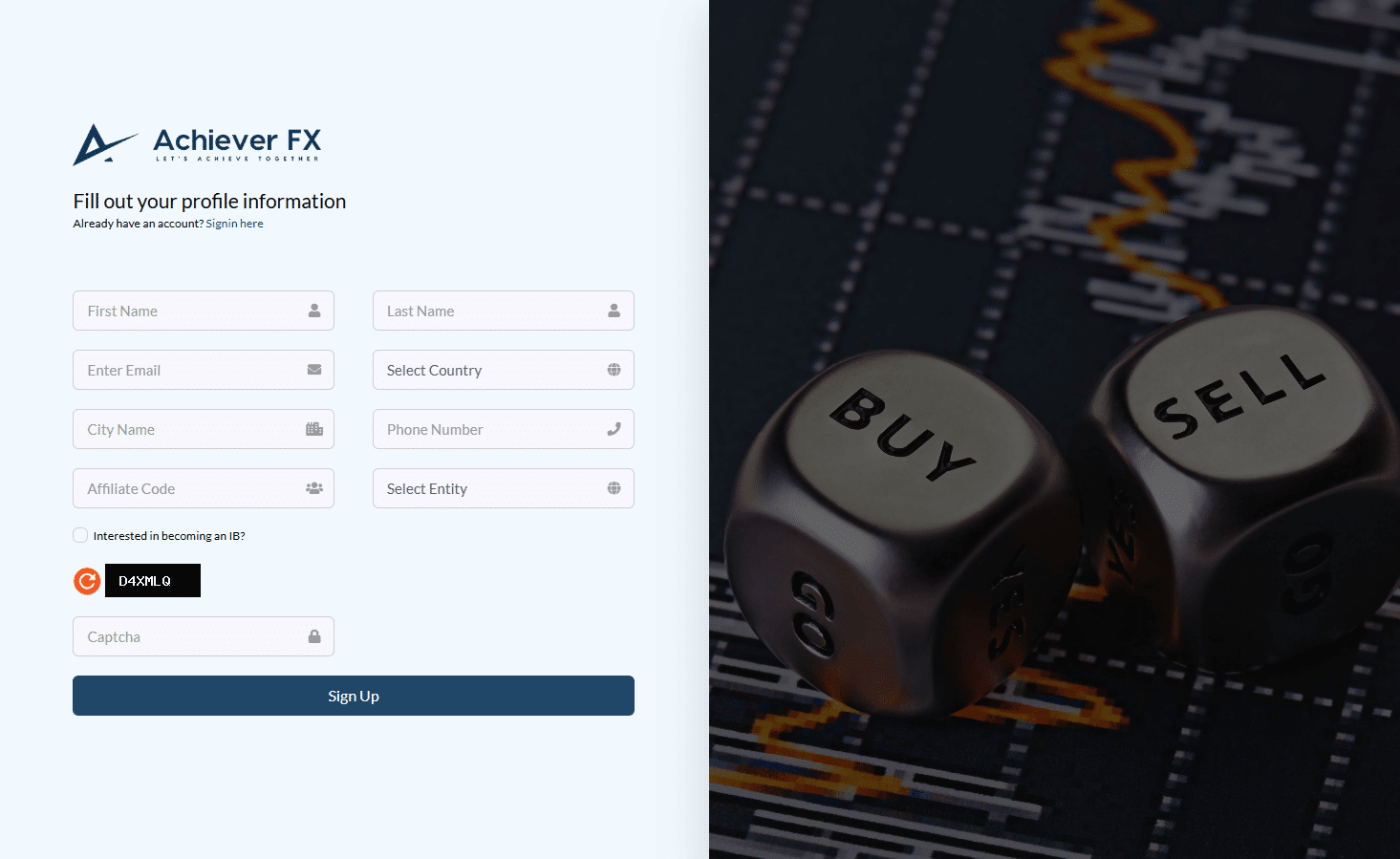

Achiever Global Markets How to Open an Account: A Step-by-Step Guide

To open a live trading account with Achiever FX, follow these steps:

- Visit the official website at achieverfx.com and click on the "Open Live Account" button.

- Fill out the registration form with your personal details, including full name, country of residence, email address, and phone number.

- Choose your preferred account type (Standard, VIP, or ECN) and base currency.

- Agree to the terms & conditions and submit the form.

- Verify your email address by clicking the link sent to your registered email.

- Log in to the client portal using your registered credentials.

- Submit identity verification documents as requested, such as a passport copy and proof of residence. Achiever FX requires these to comply with anti-money laundering (AML) procedures.

- Make a deposit using one of the available payment methods to fund your account. The minimum deposit is $250 for Standard accounts.

- Once your deposit is processed, you can download the MT5 platform or access the web terminal to start trading.

While the account opening process at Achiever FX is fairly standard, potential clients should be very cautious about providing personal information or funding an account with an unregulated broker. The AML document checks cannot be relied upon without regulatory oversight to audit the procedures.

Charts and Analysis

Achiever FX provides clients with access to a suite of educational and analytical resources to support their trading activities.

The major building blocks for market analysis available include:

| FEATURE | DETAILS |

|---|---|

| Charting | 80+ built-in technical indicators, 44 drawing tools, 21 timeframes, and the ability to save charts and apply templates for comprehensive analysis. |

| Market News | Daily market updates and analysis from an in-house research team, covering economic events, price action rundowns, and strategy guides. |

| Economic Calendar | Integrated a full calendar of upcoming economic data releases and geopolitical events, showing previous, forecast, and actual figures. |

Achiever FX's educational offering is very sparse compared to the extensive academies and knowledge bases provided by leading brokers. Clients looking for in-depth learning materials, webinars, and strategy guides will likely find the resources insufficient.

While MT5 is a robust analytical platform on its own, Achiever FX's unregulated status casts doubt over the integrity of price feeds and trade execution. There's no regulatory oversight to ensure clients receive fair, transparent pricing without manipulation. Analytical tools are only as good as the underlying data they process.

The market news flow on Achiever FX is quite thin, with minimal expert insights to help clients interpret the impact of major developments. The research lacks the depth and global multi-asset coverage found with regulated brokers' teams.

Achiever Global Markets Account Types

Achiever FX offers three main account types to suit different trading styles and experience levels:

Standard Account

- Minimum deposit: $250

- Spreads from 1.4 pips

- Commission: None

- Leverage up to 1:500

- Tradable assets: Forex, metals, indices, energies, agricultural, crypto, stocks

VIP Account

- Minimum deposit: $5,000

- Spreads from 0.9 pips

- Commission: None

- Leverage up to 1:400

- Tradable assets: Forex, metals, indices, energies, agricultural, crypto, stocks

- Dedicated account manager

ECN Account

- Minimum deposit: $15,000

- Spreads from 0.2 pips

- Commission: $5 per lot per side

- Leverage up to 1:100

- Tradable assets: Forex, metals, indices, energies, agricultural, crypto, stocks

- Dedicated account manager

- Priority withdrawal processing

The account types cater to a range of budgets with progressively tighter spreads and more features for larger deposits. The option of a commission-free VIP account with tighter spreads than Standard could suit more active traders, while ECN offers the lowest possible spreads in exchange for per lot commissions.

Account Types Comparison Table

| FEATURE | STANDARD | VIP | ECN |

|---|---|---|---|

| Minimum Deposit | $250 | $5,000 | $15,000 |

| Spreads from | 1.4 pips | 0.9 pips | 0.2 pips |

| Commission per lot | None | None | $5 |

| Max. Leverage | 1:500 | 1:400 | 1:100 |

| Account Manager | No | Yes | Yes |

| Withdrawal Priority | No | No | Yes |

Negative Balance Protection

Achiever FX states on its website that all trading accounts are protected from going into a negative balance. This means clients cannot lose more than their account balance, even if losses from open positions exceed the deposited funds. Negative balance protection is an important risk management tool, especially when trading with leverage. Since leveraged positions can control larger trade sizes than the account balance, sharp adverse price movements could cause losses greater than the initial capital, theoretically putting the account into debt to the broker. With negative balance protection, Achiever FX absorbs the excess losses rather than pursuing clients for additional funds beyond their deposits. This type of backstop is common among regulated brokers in the EU and UK.

Achiever Global Markets Deposits and Withdrawals

Deposit Methods Table

| Method | Available for | Fees | Processing Time |

|---|---|---|---|

| Debit/Credit Cards | Standard, VIP, ECN | No fees | Instant |

| Bank Wire Transfer | Standard, VIP, ECN | No fees | 1-3 business days |

| Electronic Wallets (Neteller, Skrill) | Standard, VIP, ECN | No fees | Instant |

Withdrawal Methods Table

| Method | Available for | Fees | Processing Time |

|---|---|---|---|

| Debit/Credit Cards | Standard, VIP, ECN | No fees | 1-5 business days |

| Bank Wire Transfer | Standard, VIP, ECN | No fees | 1-5 business days |

| Electronic Wallets (Neteller, Skrill) | Standard, VIP, ECN | No fees | 1-5 business days |

Support Service for Customer

Achiever FX offers customer support via the following channels:

- Phone: +97155 754 7696

- Email: support@achieverfx.com

- Live chat: 24/7

There is no information provided about the languages supported or typical response times for each communication method. The lack of transparency around service level standards is concerning.

Customer reviews frequently mention unresponsive or unhelpful support from Achiever FX.

Common complaints include:

There is no information provided about the languages supported or typical response times for each communication method. The lack of transparency around service level standards is concerning.

Customer reviews frequently mention unresponsive or unhelpful support from Achiever FX.

Common complaints include:

- Long delays in receiving responses to email inquiries

- Live chat representatives unable to resolve basic account or platform issues

- Difficulty reaching anyone by phone

- Support staff offering excuses or evasive answers to withdrawal queries

Customer Support Comparison Table

| SUPPORT HOURS | CHANNELS | LANGUAGES | REGULATION |

|---|---|---|---|

| 24/7 | Phone, Email, Live Chat | Not specified | Unregulated |

Prohibited Countries

Achiever FX does not explicitly list any prohibited countries on its website. However, the broker's terms and conditions state that it is the client's responsibility to ensure compliance with local laws and regulations when accessing Achiever FX's services.

Special Offers for Customers

At the time of this review, Achiever FX does not appear to have any active promotions or special offers listed on its website. The broker does not mention any welcome bonus, deposit incentive, or other rewards program.

Conclusion

Throughout this comprehensive review of Achiever FX, I've found numerous areas of concern that call into question the broker's integrity and suitability for traders.

The most glaring issue is Achiever FX's lack of regulation. The broker operates from the offshore jurisdiction of Saint Lucia without any license from the local financial authorities or reputable bodies like CySEC or the FCA. This lack of oversight is a major red flag, as it means Achiever FX is not subject to the strict standards that protect clients' interests. There are no assurances that client deposits are segregated, withdrawals are honoured, or trading conditions are fair and transparent.

The opacity around Achiever FX's ownership and management is another troubling sign. The broker provides minimal information about its background and key personnel, making it difficult to gauge the experience and intentions of those running the firm. Many regulated brokers offer extensive disclosure about their history and leadership to build trust with potential clients.

Adding to the concern are the numerous negative reviews from Achiever FX clients. Complaints center around difficulties withdrawing funds, unresponsive customer support, and suspected manipulation of trading conditions. These issues are consistent with the exploitative practices often seen at unregulated brokers. Without licensing, there is little recourse for traders to recover funds or settle disputes.

While Achiever FX offers the popular MetaTrader 5 platform and a range of tradable assets, these features alone do not compensate for the serious shortcomings in regulatory compliance. No amount of advanced trading tools can substitute for the peace of mind that comes with a well-regulated broker. Even the simple lack of detail around swap rates and other trading fees is worrisome.

In conclusion, I cannot recommend Achiever FX as a trustworthy broker. The substantial risks of trading with an unregulated entity far outweigh any superficial benefits. Traders should exercise extreme caution when considering this broker and instead opt for one of the many licensed alternatives with proven track records of fair dealing and client protection.

Find copy-trading stars on our broker reviews social-trader list.

African focus? Read the CMTrading review.