ActivTrades Review 2025 Review: Pros and Cons of this Forex Broker Covered

ActivTrades

United Kingdom

United Kingdom

-

Minimum Deposit $1

-

Withdrawal Fee $0

-

Leverage 400:1

-

Spread From 0.5

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Broker-Dealer License

Broker-Dealer License

Softwares & Platforms

Customer Support

+442071700500

(English)

+442071700500

(English)

Supported language: Chinese (Simplified), English, French, German, Italian, Portuguese, Spanish

Social Media

Summary

ActivTrades is a UK-based forex and CFD broker regulated by the Financial Conduct Authority (FCA) and other global regulators. Established in 2001, it offers competitive spreads, negative balance protection, and access to platforms like MT4, MT5, and its proprietary ActivTrader. The broker has no minimum deposit requirement, making it accessible to traders of all levels. ActivTrades is known for its strong customer support, educational resources, and a secure trading environment with investor protection.

- Well-regulated by top-tier authorities like the FCA

- Competitive spreads starting from 0.5 pips

- No minimum deposit requirement (except in Brazil/China)

- Wide range of 1000+ tradable instruments

- MetaTrader 4/5, ActivTrader and TradingView platforms

- Negative balance protection for all retail clients

- Multilingual 24/5 customer support

- Comprehensive educational resources including webinars

- Fast account opening within 1 day

- No fees for deposits/withdrawals

- Limited to CFD/forex trading, no real stocks, bonds, etc.

- Maximum leverage of 30:1 may be too low for some

- Inactivity fee after 1 year dormancy

- No US clients accepted

- No managed accounts or copy trading

- Charges an overnight financing fee

- Lacks advanced features on proprietary platform

- Some funding methods have minimum deposit

- Trails best brokers for research and education

- Does not publish average spreads data

Overview

ActivTrades, a well-established UK-based broker, has been providing online trading services in the forex and CFD markets since its foundation in 2001. With a global presence and a strong focus on delivering a user-friendly trading experience, ActivTrades has earned a solid reputation among traders worldwide. The broker is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK, ensuring a high level of client protection and financial security.

ActivTrades offers a comprehensive range of tradable instruments, including over 80 currency pairs, popular indices, shares, commodities, bonds, and ETFs. Traders can access these markets through the industry-standard MetaTrader 4 and MetaTrader 5 platforms, as well as ActivTrades' proprietary web-based platform, ActivTrader. The broker also supports mobile trading apps for both iOS and Android devices, allowing clients to trade on the go.

One of ActivTrades' core strengths lies in its commitment to providing competitive trading conditions. The broker offers tight spreads, starting from just 0.5 pips on major forex pairs, and leverage up to 1:30 for retail clients. ActivTrades also boasts fast execution speeds and a variety of account types, including Islamic accounts, to cater to different trading preferences.

To support its clients' trading journey, ActivTrades provides a range of educational resources, including webinars, video tutorials, and market analysis. The broker's customer support team is available 24/5 via live chat, email, and telephone, ensuring prompt assistance whenever needed.

While ActivTrades has received numerous industry awards and recognitions, it is essential for potential clients to conduct thorough research and consider their individual trading needs before opening an account. For more information about ActivTrades' services and offerings, visit their official website at activtrades.com.

ActivTrades Overview Table

| Company Name | ActivTrades |

|---|---|

| Headquarters | London, United Kingdom |

| Founded | 2001 |

| Regulation | FCA (UK), CMVM (Portugal), SCB (Bahamas) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, ActivTrader (proprietary web platform) |

| Minimum Deposit | $0 (except Brazil and China: $500) |

| Tradable Instruments | Forex, Indices, Shares, Commodities, Bonds, ETFs |

| Customer Support | 24/5 via Live Chat, Email, Telephone |

| Educational Resources | Webinars, Video Tutorials, Market Analysis |

| Awards | Best Forex Broker 2021 (Online Personal Wealth Awards), Best Forex Customer Service 2020 (Global Forex Awards) |

| Website | www.activtrades.com |

Facts List

- ActivTrades was founded in 2001 and is headquartered in London, United Kingdom.

- The broker is regulated by top-tier authorities, including the FCA (UK), CMVM (Portugal), and SCB (Bahamas).

- ActivTrades offers trading in over 80 currency pairs, along with popular indices, shares, commodities, bonds, and ETFs.

- Clients can choose from multiple trading platforms, including MetaTrader 4, MetaTrader 5, and the proprietary ActivTrader web platform.

- The minimum deposit requirement is $0, except for clients in Brazil and China, who must deposit at least $500.

- ActivTrades provides competitive trading conditions, with spreads starting from 0.5 pips on major forex pairs and leverage up to 1:30 for retail clients.

- The broker offers a range of account types, including Islamic accounts, to cater to different trading preferences.

- ActivTrades supports mobile trading through dedicated apps for iOS and Android devices.

- Educational resources, such as webinars, video tutorials, and market analysis, are available to help clients improve their trading skills and knowledge.

- Customer support is provided 24/5 via live chat, email, and telephone, ensuring prompt assistance for clients' inquiries and concerns.

ActivTrades Licenses and Regulatory

ActivTrades operates under a robust regulatory framework, ensuring a high level of client protection and financial security. The broker holds licenses from multiple top-tier regulatory bodies, demonstrating its commitment to compliance and industry best practices.

| Regulatory Authority | Country | Reference/Registration Number | Key Features/Notes |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | 434413 | Widely recognized for stringent oversight; requires strict capital requirements, client fund segregation, and transparent operations. |

| Comissão do Mercado de Valores Mobiliários (CMVM) | Portugal | 295 | Ensures compliance with Portuguese financial regulations, adding an extra layer of client protection. |

| Securities Commission of the Bahamas (SCB) | The Bahamas | SIA-F249 | Provides additional multi-jurisdictional oversight, reducing the risk of fraud or malpractice. |

Moreover, ActivTrades offers negative balance protection to its clients, ensuring that they cannot lose more than their account balance. This feature is crucial for managing risk and protecting traders from unexpected market volatility.

Compared to industry standards, ActivTrades' regulatory framework is robust and comprehensive. While some brokers may operate with a single license or be registered in jurisdictions with less stringent regulations, ActivTrades has taken a proactive approach to ensure maximum client protection and trust.

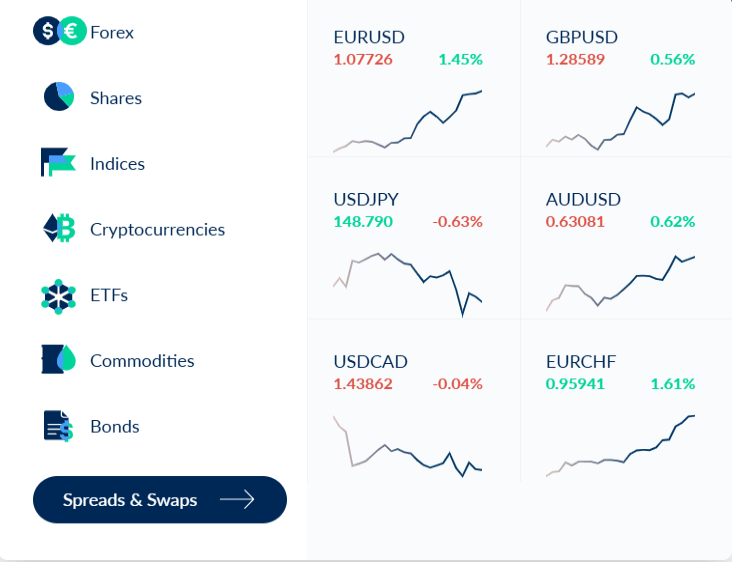

Trading Instruments

ActivTrades offers a comprehensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 1,000 instruments available across multiple asset classes, the broker provides ample opportunities for portfolio diversification and exposure to various market sectors.

| Asset Class | Description | Key Instruments/Examples |

|---|---|---|

| Forex | Wide selection of currency pairs including majors, minors, and exotics. Competitive spreads starting from 0.5 pips. | Over 50 pairs (e.g., EUR/USD, GBP/USD) |

| Indices | Trade on global stock indices with flexible contract sizes and competitive spreads. | US 30 (Dow Jones), US 500 (S&P 500), UK 100 (FTSE 100), Europe 50 (Euro Stoxx 50) |

| Shares | Trade individual company stocks with leverage (up to 1:20) from major global exchanges. | Over 500 shares (e.g., Apple, Amazon, Microsoft) |

| Commodities | Opportunities in precious metals, energies, and agricultural products with competitive pricing. | Gold, silver, oil, natural gas |

| Bonds | Trade government and corporate bonds with potential for income generation. | US Treasuries, German Bunds, UK Gilts (leverage up to 1:10) |

| ETFs | Gain exposure to entire markets or sectors in one instrument, cost-effectively. | ETFs tracking indices like the S&P 500 or sector-specific funds (e.g., technology, healthcare) |

Having a diverse portfolio of tradable assets is crucial for investors, as it allows for greater flexibility and risk management. By offering a wide range of instruments across multiple asset classes, ActivTrades enables traders to adapt to changing market conditions, diversify their exposures, and implement various trading strategies.

Compared to industry standards, ActivTrades' asset offerings are comprehensive and competitive. While some brokers may specialize in specific asset classes, ActivTrades provides a well-rounded selection that caters to the needs of both novice and experienced traders.

Trading Platforms

ActivTrades offers a diverse range of trading platforms to cater to the needs and preferences of its clients. By providing access to both industry-standard platforms and proprietary software, the broker ensures that traders can choose the tools that best suit their trading style and level of experience.

MetaTrader 4 (MT4)

MetaTrader 4 is a widely-used trading platform known for its user-friendly interface, advanced charting capabilities, and extensive customization options. ActivTrades provides clients with access to the full version of MT4, which includes a wide range of built-in indicators, as well as the ability to create and use custom indicators and Expert Advisors (EAs). MT4 is available as a desktop application for Windows and Mac, as well as a mobile app for iOS and Android devices.

MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4, offering enhanced features and functionality. ActivTrades offers the full version of MT5, which includes advanced charting tools, a greater number of timeframes, and the ability to trade a wider range of assets. Like MT4, MT5 is available as a desktop application for Windows and Mac, as well as a mobile app for iOS and Android devices.

ActivTrader

In addition to the MetaTrader platforms, ActivTrades offers its proprietary web-based platform, ActivTrader. This platform is designed to provide a streamlined and intuitive trading experience, with a clean and customizable interface. ActivTrader includes advanced charting tools powered by TradingView, as well as a range of order types and risk management features. The platform is accessible through web browsers, making it easy for traders to access their accounts from any device with an internet connection.

Mobile Trading

For traders who prefer to manage their accounts on the go, ActivTrades offers mobile trading apps for both iOS and Android devices. The broker's mobile apps include key features such as real-time quotes, interactive charts, and the ability to place and manage trades. The mobile apps also provide access to account information, transaction history, and market news and analysis.

ActivTrades' range of trading platforms caters to the diverse needs of its clients, from beginners to advanced traders. By offering stable and popular platforms like MT4 and MT5, alongside its proprietary ActivTrader platform, the broker ensures that clients can access the tools and features they need to make informed trading decisions.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | ActivTrader |

|---|---|---|---|

| Platform Type | Desktop, Web, Mobile | Desktop, Web, Mobile | Web-based |

| Operating Systems | Windows, Mac, iOS, Android | Windows, Mac, iOS, Android | Any (web browser) |

| Charting Tools | 30+ built-in indicators, 9 timeframes | 38+ built-in indicators, 21 timeframes | Advanced TradingView charts |

| Customization | Extensive (indicators, EAs) | Extensive (indicators, EAs) | Limited |

| Automated Trading | Yes (EAs) | Yes (EAs) | No |

| Order Types | Market, Pending (Limit, Stop, Stop Limit) | Market, Pending (Limit, Stop, Stop Limit) | Market, Limit, Stop, Trailing Stop |

| Risk Management | Stop Loss, Take Profit | Stop Loss, Take Profit | Stop Loss, Take Profit, Guaranteed Stop Loss |

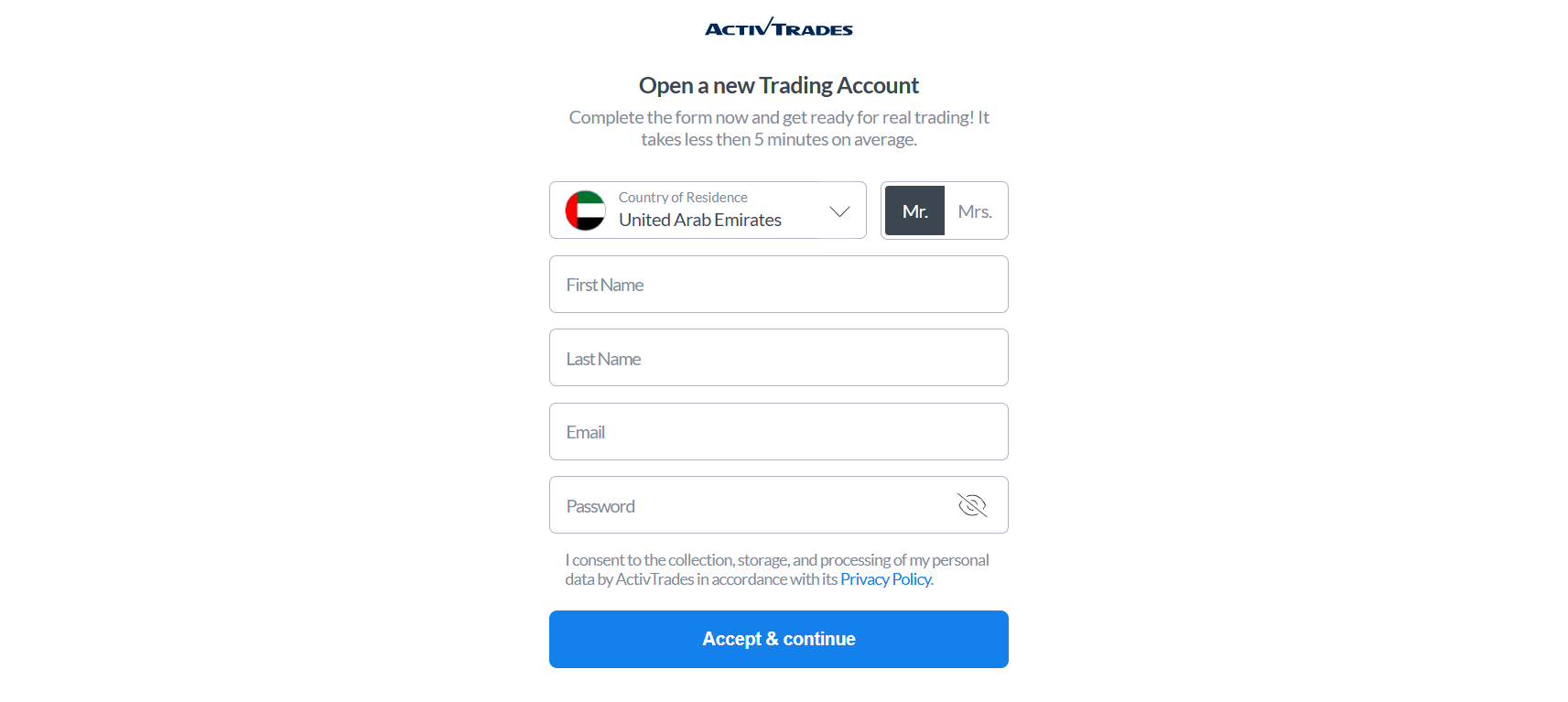

ActivTrades How to Open an Account: A Step-by-Step Guide

Opening an account with ActivTrades is a straightforward and user-friendly process. Follow these simple steps to get started:

Step 1: Visit the ActivTrades website

Go to the official ActivTrades website at activtrades.com and click on the "Open an Account" button.

Step 2: Select your account type

Choose the type of account you wish to open from the available options, such as Individual, Joint, or Corporate accounts.

Step 3: Provide personal information

Fill in the required personal information, including your name, date of birth, address, phone number, and email address.

Step 4: Complete the questionnaire

Answer a series of questions designed to assess your trading experience, financial knowledge, and risk tolerance. This information helps ActivTrades ensure that their services are appropriate for your needs.

Step 5: Verify your identity and address

Upload the necessary documents to verify your identity and address, such as a government-issued ID (passport or driver's license) and a recent utility bill or bank statement. ActivTrades uses advanced technology to quickly and securely process your documents.

Step 6: Fund your account

Once your account is approved, you can fund it using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallets like Skrill or Neteller. ActivTrades does not charge any deposit fees, and most payment methods are processed instantly.

Step 7: Start trading

After your account is funded, you can download and install the trading platform of your choice (such as MetaTrader 4 or ActivTrader) and start trading.

ActivTrades has a low minimum deposit requirement of just $1, making it accessible for beginner traders. The broker also offers a demo account option, allowing you to practice trading with virtual funds before committing real money.

The account opening process is typically completed within 24 hours, subject to the successful verification of your documents. ActivTrades' customer support team is available 24/5 to assist you with any questions or issues you may encounter during the account opening process.

By following these simple steps and providing the necessary information and documents, you can quickly and easily open an account with ActivTrades and start trading in the global financial markets.

Charts and Analysis

ActivTrades provides a comprehensive suite of educational resources and trading tools to support its clients in their trading journey. These resources are designed to cater to traders of all levels, from beginners to advanced traders, and cover a wide range of topics related to forex, CFDs, and general financial market education.

| Resource | Description |

|---|---|

| Market Analysis | Daily insights and commentary on trends, news, and events affecting major currency pairs, indices, commodities, and more. Delivered through articles, video updates, and webinars. |

| Economic Calendar | A comprehensive, user-friendly calendar listing global economic events and data releases, with expected impacts on currency pairs and other assets to help traders plan and manage risk. |

| Webinars | Regular, free educational sessions led by experienced traders and analysts covering market trends, trading strategies, and risk management techniques. Accessible live and as recorded sessions. |

| Trading Central | Partnership with a leading provider of technical analysis offering daily reports, trading signals, and market alerts to help identify trading opportunities and inform decisions. |

| Educational Articles & Videos | An extensive library of content covering trading basics, technical and fundamental analysis, risk management, and platform tutorials, aimed at both beginners and experienced traders. |

In comparison to industry standards, ActivTrades' educational resources and trading tools are comprehensive and well-developed. The broker's commitment to providing a wide range of high-quality educational content sets it apart from many of its competitors, who may offer more limited resources or focus primarily on a single type of content (e.g., written articles or videos).

By investing in a diverse suite of educational resources, ActivTrades demonstrates its dedication to supporting the growth and development of its clients. These resources can significantly benefit traders by enhancing their understanding of financial markets, improving their trading skills, and helping them make more informed trading decisions.

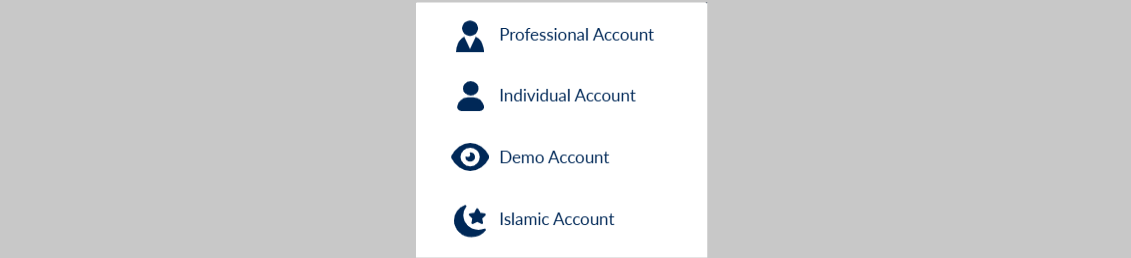

ActivTrades Account Types

ActivTrades offers a range of trading account types to cater to the diverse needs of its clients, from novice traders to experienced professionals. By providing multiple account options, the broker ensures that traders can select an account that best suits their trading style, experience level, and financial goals.

Individual Account

The Individual Account is the standard account type offered by ActivTrades, suitable for most retail traders. This account type features competitive spreads, starting from 0.5 pips on major forex pairs, and leverage up to 1:30 for retail clients. There is no minimum deposit requirement for Individual Accounts, making it accessible for traders with various budgets.

Professional Account

The Professional Account is designed for experienced traders who meet specific criteria, such as having a significant trading volume or working in the financial sector. Professional Accounts offer higher leverage, up to 1:200, and may provide access to additional trading tools and resources. However, Professional Account holders may not be eligible for certain regulatory protections afforded to retail clients.

Demo Account

ActivTrades offers a Demo Account, which allows traders to practice trading in a risk-free environment using virtual funds. Demo Accounts provide access to the same trading platforms and tools as live accounts, enabling traders to familiarize themselves with the broker's offerings and test their trading strategies without risking real money. Demo Accounts are an excellent resource for beginners and experienced traders alike.

Islamic Account

For traders who adhere to Islamic religious principles, ActivTrades provides Islamic Accounts, also known as swap-free accounts. These accounts are designed to comply with Sharia law, which prohibits the earning or paying of interest. Islamic Accounts do not incur overnight swap fees, making them suitable for Muslim traders who wish to avoid interest-based transactions.

ActivTrades' range of account types demonstrates the broker's commitment to accommodating the diverse needs of its clientele. By offering accounts with varying features and requirements, ActivTrades ensures that traders can select an account that aligns with their trading objectives, experience level, and religious beliefs.

Account Types Comparison Table

| Feature | Individual Account | Professional Account | Demo Account | Islamic Account |

|---|---|---|---|---|

| Minimum Deposit | No minimum | No minimum | N/A | No minimum |

| Leverage | Up to 1:30 | Up to 1:200 | Up to 1:30 | Up to 1:30 |

| Spread | From 0.5 pips | From 0.5 pips | From 0.5 pips | From 0.5 pips |

| Commission | No | No | N/A | No |

| Swap-Free | No | No | N/A | Yes |

| Negative Balance Protection | Yes | No | N/A | Yes |

| Access to Trading Tools | Yes | Yes | Yes | Yes |

| Feature | Individual Account | Professional Account | Demo Account | Islamic Account |

|---|---|---|---|---|

| Ideal For | Retail traders | Experienced traders | Practice trading | Muslim traders |

| Real Money Trading | Yes | Yes | No | Yes |

| Platform Access | MT4, MT5, ActivTrader | MT4, MT5, ActivTrader | MT4, MT5, ActivTrader | MT4, MT5, ActivTrader |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/5 |

| Educational Resources | Yes | Yes | Yes | Yes |

| Eligible for Promotions | Yes | No | No | Yes |

Negative Balance Protection

ActivTrades' negative balance protection policy applies to all retail clients, regardless of the account type or trading platform used. However, professional clients may not be eligible for negative balance protection, as they are considered to have a higher level of trading experience and knowledge. In addition to negative balance protection, ActivTrades also segregates client funds from its operating funds, providing an additional layer of security. This segregation ensures that clients' money is protected in the event of the company's insolvency. By offering negative balance protection, ActivTrades demonstrates its commitment to prioritizing its clients' interests and fostering a secure trading environment. This protection is a testament to the broker's adherence to strict regulatory standards and its dedication to maintaining a transparent and trustworthy platform for its clients.

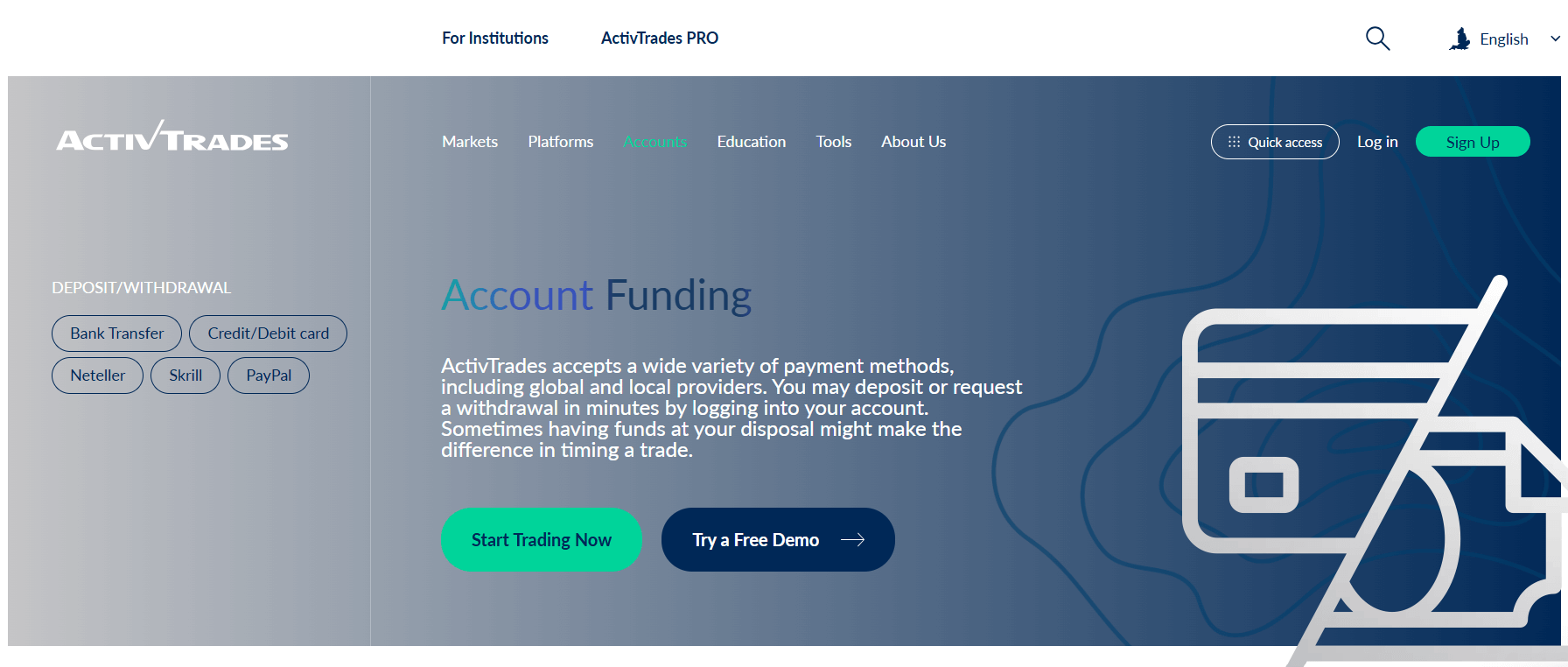

ActivTrades Deposits and Withdrawals

ActivTrades offers a range of convenient and secure deposit and withdrawal options to facilitate seamless transactions for its clients. The broker understands the importance of efficient fund management and strives to provide a smooth and hassle-free experience for traders.

Deposit Methods

ActivTrades accepts the following deposit methods:| Payment Method | Minimum Deposit | Deposit Fees | Processing Times | Description |

|---|---|---|---|---|

| Bank Wire Transfer | $1 | None | 1-3 business days | Direct deposit from your bank account; processing time varies with the bank. |

| Credit/Debit Cards | $1 | None | Instant | Deposits via Visa or Mastercard are credited instantly, allowing immediate trading. |

| E-wallets | $1 | None | Instant | Deposit funds using services such as Skrill and Neteller; funds are typically credited instantly. |

Withdrawal Methods

ActivTrades offers the following withdrawal methods:| Payment Method | Description | Minimum Withdrawal | Fees | Processing Times |

|---|---|---|---|---|

| Bank Wire Transfer | Funds are withdrawn directly to your bank account. | $1 | No withdrawal fees | 1-3 business days |

| Credit/Debit Cards | Withdrawals are processed back to the original Visa or Mastercard used for deposit. | $1 | No withdrawal fees | 1-3 business days |

| E-wallets | Withdraw funds to your Skrill or Neteller account. | $1 | No withdrawal fees | Usually credited instantly |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require prompt assistance with account-related queries, technical issues, or trading guidance. ActivTrades recognizes the importance of providing excellent customer support and offers multiple channels for traders to reach out for help.

Support Channels

ActivTrades provides the following customer support channels:- Live Chat: Traders can access instant support through the live chat feature available on the ActivTrades website. This channel is ideal for quick queries and real-time assistance.

- Email: For less urgent inquiries or detailed questions, traders can send an email to ActivTrades' customer support team. The email address for general support is support@activtrades.com.

- Phone: ActivTrades offers multilingual phone support for traders who prefer verbal communication. The main support phone number is +44 (0) 207 6500 500, and country-specific numbers are available for several regions, including Brazil, Chile, Germany, Italy, Spain, and the UAE.

- Social Media: Traders can also reach out to ActivTrades through their official social media channels, such as Facebook, Twitter, and LinkedIn, for general inquiries and updates.

Support Hours and Languages

ActivTrades provides customer support 24 hours a day, 5 days a week (24/5), catering to traders in different time zones. The support team is available from Sunday 21:00 GMT to Friday 20:59 GMT, covering the entire trading week. ActivTrades offers support in multiple languages, including English, Arabic, Bulgarian, Chinese, French, German, Italian, Polish, Portuguese, Russian, and Spanish. This multilingual support ensures that traders from diverse backgrounds can communicate effectively with the support team.

Response Times and Quality

ActivTrades strives to provide prompt and efficient customer support. The average response time for live chat inquiries is under 2 minutes, allowing traders to receive quick assistance for their urgent needs. Email inquiries are typically responded to within 24 hours, depending on the complexity of the query. The customer support team at ActivTrades consists of knowledgeable and experienced professionals who are well-versed in the broker's products, platforms, and services. They aim to provide accurate and helpful information to traders, assisting them in resolving any issues or concerns promptly. In addition to the support channels, ActivTrades also offers a comprehensive FAQ section on its website, addressing common questions related to account management, trading, deposits and withdrawals, and more. This self-help resource enables traders to find answers to their queries quickly and independently.Customer Support Comparison Table

| Feature | ActivTrades |

|---|---|

| Support Hours | 24/5 |

| Support Languages | English, Arabic, Bulgarian, Chinese, French, German, Italian, Polish, Portuguese, Russian, Spanish |

| Live Chat Response Time | Under 2 minutes |

| Email Response Time | Within 24 hours |

| Phone Support | Yes |

| Social Media Support | Yes |

| FAQ Section | Yes |

Prohibited Countries

ActivTrades is committed to complying with international regulations and operating within the legal frameworks of the countries where it provides services. Due to various factors, such as local regulations, licensing requirements, and geopolitical considerations, ActivTrades is prohibited from offering its services in certain countries and regions.

The primary reason behind these restrictions is the lack of appropriate licenses or authorizations in specific jurisdictions. Each country has its own set of regulations governing the provision of financial services, and failing to comply with these regulations can result in legal consequences for both the broker and the trader.

In some cases, geopolitical factors, such as economic sanctions or political instability, may also prevent ActivTrades from operating in certain regions. These restrictions are put in place to ensure the safety and security of the broker's clients and to maintain the integrity of the financial markets.

It is essential for traders to be aware of these restrictions and understand the potential consequences of attempting to trade with ActivTrades from a prohibited country. Violating these restrictions may result in the termination of the trading account, the forfeiture of funds, and potential legal action.

ActivTrades is prohibited from offering its services in the following regions:

- United States

- Canada

- Japan

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- Crimea

Traders from these countries or regions are not eligible to open an account with ActivTrades. It is the responsibility of the trader to ensure that they are not violating any local laws or regulations by engaging in online trading activities.

Special Offers for Customers

At the time of this review, ActivTrades does not offer any special offers. However, they might have such plans in the future. You can always check their official website for the most up-to-date information.

Conclusion

Throughout this comprehensive review, I have carefully examined various aspects of ActivTrades, assessing their safety, reliability, and overall reputation as a broker. Drawing upon the insights gathered from analyzing their regulatory compliance, geographical jurisdictions, trading platforms, customer support, and more, I have formed a well-rounded evaluation of their trustworthiness and dependability.

One of the standout features of ActivTrades is their strong regulatory compliance. They are authorized and regulated by top-tier financial authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom, which holds them to the highest standards of transparency and integrity. This robust regulatory oversight provides a significant level of protection and peace of mind for traders who choose to entrust their funds with ActivTrades.

In terms of trading platforms, ActivTrades offers a diverse range of options to cater to the needs and preferences of different types of traders. From the industry-standard MetaTrader 4 and MetaTrader 5 platforms to their proprietary ActivTrader web-based platform, traders have access to a variety of powerful tools and features to enhance their trading experience. The user-friendly interface and advanced charting capabilities of these platforms make them suitable for both novice and experienced traders alike.

Another area where ActivTrades excels is in their commitment to providing exceptional customer support. With a dedicated multilingual support team available 24/5 through various channels, including live chat, email, and phone, traders can easily access prompt and knowledgeable assistance whenever they need it. This level of customer service is a testament to ActivTrades' dedication to ensuring a smooth and satisfactory trading experience for their clients.

While ActivTrades may not currently offer any special promotions or bonuses, they do provide competitive trading conditions, such as tight spreads and flexible leverage options, which can be more valuable in the long run. The absence of short-term incentives demonstrates their focus on delivering a reliable and transparent trading environment that prioritizes the long-term success of their clients.

Throughout this review, I have found ActivTrades to be a trustworthy and reputable broker that prioritizes the safety and satisfaction of their clients. With their strong regulatory compliance, advanced trading platforms, comprehensive educational resources, and dedicated customer support, they have established themselves as a leading choice for traders seeking a reliable and user-focused trading environment.

See where this platform ranks in our broker reviews hub.

Check niche crypto pairs in our NRDX review.