Admiral Markets Review 2025: A Broker for Trading Forex & CFDs

Admiral Markets

-

Minimum Deposit $1

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Broker-Dealer License

Broker-Dealer License

Softwares & Platforms

Customer Support

+3726309306

(English)

+3726309306

(English)

Supported language: English, French, German, Spanish

Social Media

Summary

Admiral Markets is a global online broker offering trading services in forex, stocks, commodities, and cryptocurrencies. Established in 2001, it provides access to various financial markets through platforms like MetaTrader 4 and 5. The broker is regulated by multiple financial authorities, ensuring security and compliance. It offers competitive spreads, leverage options, and educational resources for traders. Admiral Markets rebranded to Admirals in 2021, expanding its financial services beyond trading.

- Well-regulated by top-tier financial authorities (FCA, ASIC, CySEC)

- Wide range of tradable assets across multiple markets

- Competitive spreads and low commissions

- Advanced trading platforms (MT4 and MT5) with powerful tools

- Comprehensive educational resources for all skill levels

- Responsive and knowledgeable customer support available 24/7

- Negative balance protection for added security

- Transparent and client-centric approach

- Suitable for both novice and experienced traders

- Strong reputation and long-standing history in the industry

- Limited range of account types compared to some competitors

- No US clients accepted due to regulatory restrictions

- Inactivity fees charged on dormant accounts

- No direct telephone support for some countries

- Educational materials primarily focus on technical analysis

- Some payment methods may incur additional fees

- Lacks social trading or copy trading features

- No cryptocurrency deposits or withdrawals

- Minimum deposit requirements may be high for some account types

- Limited bonuses or promotions compared to other brokers

Overview

Admiral Markets, established in 2001, is an award-winning online financial services provider offering trading and investing opportunities across a wide range of instruments, including Forex, CFDs, stocks, indices, commodities, and cryptocurrencies. With a strong global presence and offices in 18 countries, Admiral Markets serves clients in over 130 countries worldwide, providing a transparent trading experience through top-notch technology and competitive trading conditions.

Regulated by several top-tier financial authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC), Admiral Markets maintains a high level of trust and security for its clients. The company has received numerous accolades over the years, cementing its position as a leading player in the industry.

Admiral Markets offers access to more than 4,000 financial instruments, competitive spreads starting from 0 pips, and leverage up to 1:500 for professional clients. The broker provides advanced trading platforms, including MetaTrader 4 and MetaTrader 5, along with a user-friendly mobile trading app for both iOS and Android devices. Clients can choose from a variety of account types, with minimum deposits ranging from $1 to $100, depending on the selected account.

The broker's commitment to client satisfaction is evident through its 24/5 customer support, available via live chat, email, and telephone. Additionally, Admiral Markets offers a comprehensive suite of educational resources, including webinars, seminars, articles, and tutorials, catering to both novice and experienced traders. For more information about Admiral Markets' services, visit their official website at www.admiralmarkets.com.

Overview Table

| Admiral Markets | |

|---|---|

| Founded | 2001 |

| Headquarters | Tallinn, Estonia |

| Regulation | FCA (UK), ASIC (Australia), CySEC (Cyprus), EFSA (Estonia), JSC (Jordan), FSA (Seychelles) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading Apps |

| Instruments | Forex, CFDs (Indices, Stocks, Commodities, Bonds, Cryptocurrencies), Stocks, ETFs |

| Minimum Deposit | $1 - $100 (depending on account type) |

| Spreads | Starting from 0 pips |

| Commissions | From $0.01 on Stocks/ETFs, $6 per round turn on Forex |

| Leverage | Up to 1:500 (for professional clients) |

| Education | Webinars, Seminars, Articles, Tutorials |

| Customer Support | 24/5 via Live Chat, Email, Telephone |

Facts List

- Admiral Markets was founded in 2001 and has since expanded its global presence to 18 offices worldwide, serving clients in over 130 countries.

- The broker is regulated by several top-tier financial authorities, including the FCA, ASIC, CySEC, EFSA, JSC, and FSA, ensuring a high level of trust and security for its clients.

- Admiral Markets offers access to more than 4,000 financial instruments, including Forex, CFDs, stocks, ETFs, indices, commodities, and cryptocurrencies.

- Clients can trade using advanced platforms such as MetaTrader 4 and MetaTrader 5, as well as user-friendly mobile trading apps for iOS and Android devices.

- The broker provides competitive trading conditions, with spreads starting from 0 pips and leverage up to 1:500 for professional clients.

- Minimum deposit requirements range from $1 to $100, depending on the selected account type, making it accessible to a wide range of traders.

- Admiral Markets offers commission-free trading on most instruments, with low commissions starting from $0.01 on stocks and ETFs, and $6 per round turn on Forex.

- The broker provides a comprehensive suite of educational resources, including webinars, seminars, articles, and tutorials, catering to both novice and experienced traders.

- Clients can access 24/5 customer support via live chat, email, and telephone, ensuring prompt assistance whenever needed.

- Over the years, Admiral Markets has received numerous industry awards, recognising its excellence in providing high-quality services and innovative trading solutions.

Admiral Markets Licenses and Regulatory

Admiral Markets operates under a robust regulatory framework, holding licenses from several top-tier financial authorities worldwide. This multi-jurisdictional regulation ensures a high level of client protection, security, and trust, as the broker must adhere to strict guidelines and industry standards set by these regulators.

The Admiral Markets Group consists of several entities, each regulated by a well-respected financial authority in its jurisdiction:

- Admiral Markets UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, with registration number 595450. The FCA is known for its stringent oversight and client protection measures, ensuring a safe trading environment for UK clients.

- Admiral Markets Cyprus Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 201/13. CySEC is the supervisory authority for investment firms in Cyprus and is responsible for ensuring compliance with the Markets in Financial Instruments Directive (MiFID) across the European Union.

- Admiral Markets Pty Ltd holds an Australian Financial Services License (AFSL) issued by the Australian Securities and Investments Commission (ASIC), with license number 410681. ASIC is well-regarded for its robust regulatory framework and commitment to protecting the interests of Australian investors.

- Admiral Markets AS is authorised and supervised by the Estonian Financial Supervision Authority (EFSA) under license number 4.1-1/46 for the provision of investment services. The EFSA oversees the activities of financial institutions in Estonia and ensures compliance with European Union directives.

- In Jordan, Admiral Markets operates as Admiral Markets AS Jordan Ltd, regulated by the Jordan Securities Commission (JSC) with registration number 57026.

- Aglobe Investments Ltd, the international arm of Admiral Markets, is licensed by the Financial Services Authority of Seychelles (FSA) as a securities dealer under license number SD073.

The significance of these multiple regulatory licenses lies in the enhanced protection and security they provide to Admiral Markets' clients. By adhering to the strict standards and guidelines set by these regulators, the broker demonstrates its commitment to transparency, fair business practices, and the safeguarding of client funds. This multi-jurisdictional regulation also ensures that clients can access various investor protection schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, which covers up to £85,000 per client in the event of broker insolvency.

Moreover, Admiral Markets has established additional measures to protect client funds, such as segregating client accounts from the company's own funds and holding client money with reputable banks. The broker also offers negative balance protection, ensuring that clients cannot lose more than their account balance.

In comparison to industry standards, Admiral Markets' regulatory framework is comprehensive and on par with other well-established, reputable brokers. The multiple licenses demonstrate the broker's commitment to operating transparently and in compliance with the highest industry standards across different jurisdictions.

By maintaining a strong regulatory standing, Admiral Markets instills confidence in its clients and reinforces its position as a trustworthy and reliable broker in the competitive world of online trading.

Regulations List

- Financial Conduct Authority (FCA) in the United Kingdom – Admiral Markets UK Ltd, registration number 595450

- Cyprus Securities and Exchange Commission (CySEC) – Admiral Markets Cyprus Ltd, license number 201/13

- Australian Securities and Investments Commission (ASIC) – Admiral Markets Pty Ltd, AFSL license number 410681

- Estonian Financial Supervision Authority (EFSA) – Admiral Markets AS, license number 4.1-1/46

- Jordan Securities Commission (JSC) - Admiral Markets AS Jordan Ltd, registration number 57026

- Financial Services Authority of Seychelles (FSA) - Aglobe Investments Ltd, securities dealer license number SD073

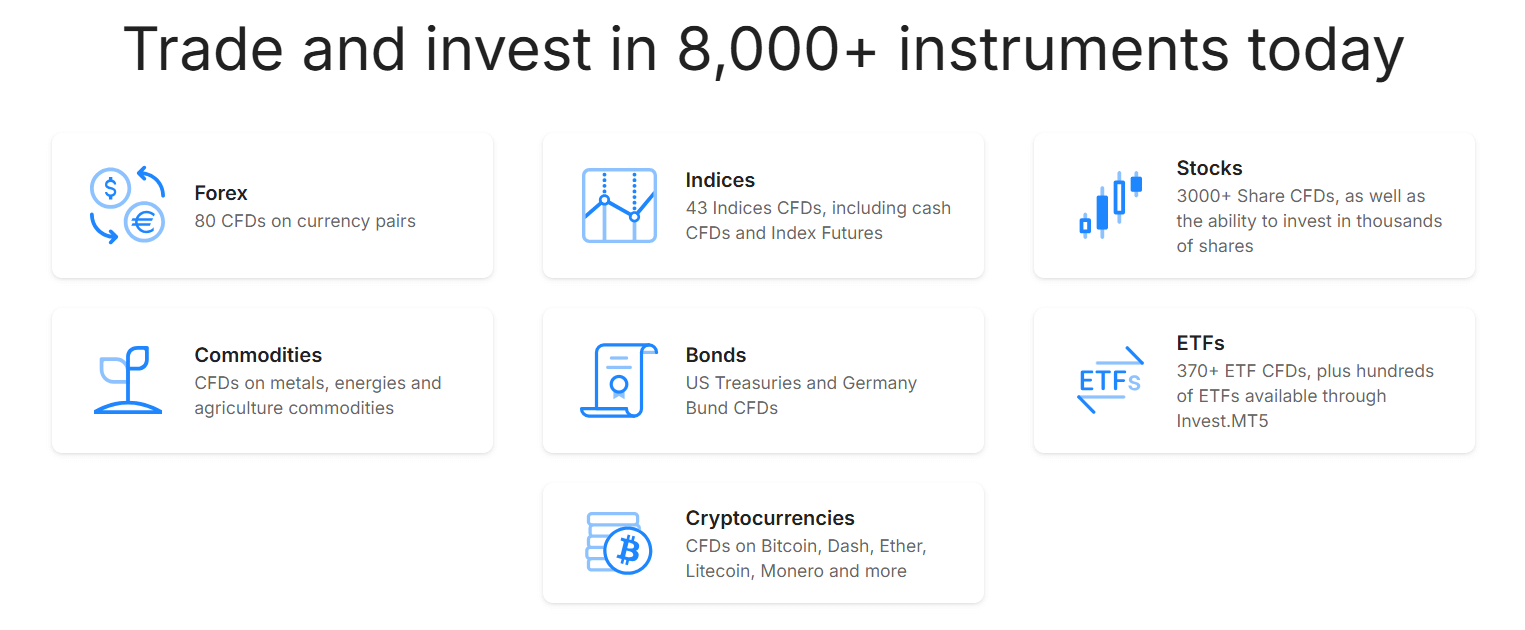

Trading Instruments

Admiral Markets offers an extensive range of tradable assets, catering to the diverse needs and preferences of traders and investors worldwide. With over 4,000 financial instruments available, the broker provides access to a comprehensive selection of markets, allowing clients to diversify their portfolios and capitalise on various trading opportunities.

| Asset Class | Available Instruments | Key Features |

|---|---|---|

| Forex | 45+ currency pairs (major, minor, exotic) | Spreads from 0 pips, leverage up to 1:30 (retail) / 1:500 (pro) |

| Indices | 19 global index CFDs (e.g., S&P 500, NASDAQ 100, DAX 30) | Leverage up to 1:20 (retail) / 1:500 (pro), exposure to broad markets |

| Stocks & ETFs | 78 stock CFDs, 3,350+ stocks, 300 ETFs | Commissions from $0.02 per share, access to 15 major stock exchanges |

| Commodities & Energies | Gold, silver, oil, natural gas, wheat, coffee | Leverage up to 1:10 (retail) / 1:100 (pro), trade on price fluctuations |

| Bonds | U.S. & German government bond CFDs | Leverage up to 1:5 (retail) / 1:50 (pro), portfolio diversification |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple CFDs | Leverage up to 1:2 (retail) / 1:5 (pro), trade without owning assets |

The diverse range of tradable assets offered by Admiral Markets is a testament to the broker's commitment to providing clients with ample trading opportunities across various market conditions. By offering a wide selection of instruments, Admiral Markets enables traders to construct well-diversified portfolios, manage risk effectively, and adapt to evolving market trends.

Trading Platforms

Admiral Markets offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as a web-based trading platform and mobile trading apps for both iOS and Android devices.

MetaTrader 4 (MT4)

MT4 is a widely used trading platform known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators and tools. Admiral Markets' MT4 platform offers all the standard features, including:

- 30 built-in technical indicators

- 24 graphical objects for advanced charting

- 9 timeframes for in-depth market analysis

- 3 chart types (bar, candlestick, and line)

- One-click trading and trailing stop functionality

The broker also offers the MT4 Supreme Edition plugin, which enhances the platform's capabilities with additional features such as the Mini Terminal, Tick Chart Trader, and Advanced Trading Calculator.

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced functionality and a more extensive range of tradable assets. Admiral Markets' MT5 platform includes all the features of MT4, plus:

- Additional timeframes (21 in total)

- 38 built-in technical indicators

- 44 graphical objects for advanced charting

- Economic calendar and market sentiment widgets

- Depth of Market (DOM) for advanced market analysis

MT5 also supports the trading of stocks and ETFs, in addition to forex, indices, commodities, and cryptocurrencies.

Web Trader For traders who prefer to access their accounts via a web browser, Admiral Markets offers a web-based trading platform. The Web Trader provides a streamlined trading experience, with key features such as:

- Real-time quotes and charts

- One-click trading functionality

- Account management tools

- Secure access from any web browser

Mobile Trading Apps Admiral Markets offers mobile trading apps for both iOS and Android devices, allowing traders to manage their accounts and execute trades on the go. The mobile apps provide a range of features, including:

- Real-time quotes and charts

- Multiple order types (market, limit, stop, and trailing stop)

- Account management tools

- Secure login with biometric authentication

The mobile apps are user-friendly and offer a seamless trading experience, ensuring that traders can stay connected to the markets even when away from their desktops.

The stability and reliability of Admiral Markets' trading platforms are crucial for ensuring a satisfactory trading experience for clients. The broker continuously updates and maintains its platforms to meet the evolving needs of traders and to keep pace with market demands and technological advancements.

By offering a diverse range of trading platforms, Admiral Markets caters to the preferences of both novice and experienced traders, providing them with the tools and resources needed to make informed trading decisions and execute their strategies effectively.

Trading Platforms Comparison Table

| MT4 | MT5 | Web Trader | Mobile Apps | |

|---|---|---|---|---|

| Timeframes | 9 | 21 | - | - |

| Technical Indicators | 30 | 38 | - | - |

| Graphical Objects | 24 | 44 | - | - |

| One-click Trading | Yes | Yes | Yes | Yes |

| Advanced Charting | Yes | Yes | Basic | Basic |

| Stocks & ETFs | No | Yes | No | No |

| Market Analysis | Yes | Yes (incl. DOM) | Basic | Basic |

| Biometric Authentication | - | - | - | Yes |

| Supreme Edition | Yes | No | No | No |

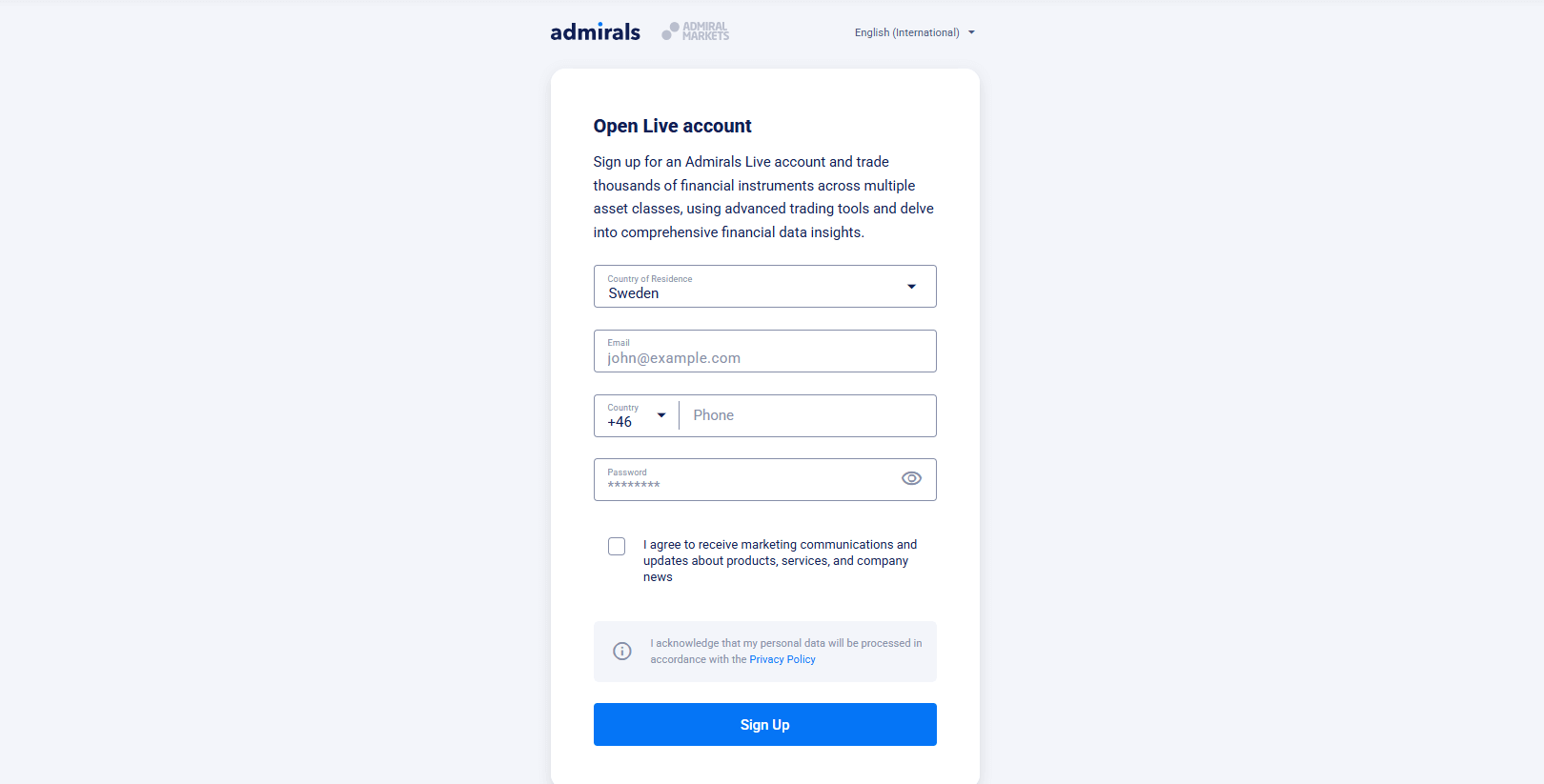

Admiral Markets How to Open an Account: A Step-by-Step Guide

Opening an account with Admiral Markets is a straightforward process that can be completed online in just a few steps. Here's a guide on how to get started:

Step 1: Visit the Admiral Markets website Go to www.admiralmarkets.com and click on the "Open an Account" button.

Step 2: Choose your account type Select the account type that best suits your trading needs. Admiral Markets offers several account types, including Trade, Invest, and Zero accounts, each with different features and minimum deposit requirements.

Step 3: Complete the registration form Fill in the required personal information, such as your name, date of birth, address, and contact details. You will also need to provide information about your trading experience and knowledge.

Step 4: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you will need to provide proof of identity and address. Upload a copy of your government-issued ID (e.g., passport or driver's license) and a recent utility bill or bank statement.

Step 5: Choose your trading platform Select the trading platform you wish to use, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). You can also choose to trade via the web-based platform or mobile apps.

Step 6: Fund your account Choose your preferred payment method to deposit funds into your trading account. Admiral Markets accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The minimum deposit amount varies depending on the account type, ranging from $1 to $100.

Step 7: Start trading Once your account is funded and verified, you can start trading the wide range of financial instruments offered by Admiral Markets, including forex, stocks, indices, commodities, and cryptocurrencies.

Admiral Markets offers a user-friendly account opening process, with quick verification times and a variety of payment options. The broker also provides a demo account, allowing new traders to practise trading strategies and familiarise themselves with the platforms before investing real money.

Charts and Analysis

Admiral Markets provides a comprehensive suite of educational resources and tools to support its clients in their trading journey. These resources cater to traders of all skill levels, from beginners to advanced traders, and cover a wide range of topics related to forex, stocks, indices, commodities, and cryptocurrencies.

| Feature | Description |

|---|---|

| Market Analysis | Daily and weekly market reviews, fundamental and technical analysis reports, videos, and articles. |

| Economic Calendar | Real-time updates on economic events, expected impact, and forecasted values to help traders plan strategies. |

| Webinars & Seminars | Live and recorded sessions on trading strategies, platform tutorials, market insights, and risk management. |

| Educational Articles & Guides | Covers trading basics, analysis techniques, strategies, risk management, and platform usage. |

| Trading Calculators | Includes pip value, margin, swap calculators, and a currency converter to assist in trade planning. |

| Video Tutorials | Step-by-step guides on platform usage, trading strategies, and risk management for traders of all levels. |

Compared to industry standards, Admiral Markets' educational resources and tools are comprehensive and well-developed. The broker invests significantly in creating high-quality, informative content that caters to the diverse needs of its clientele. By providing a wide range of resources in various formats, Admiral Markets ensures that traders can access the information they need in a way that suits their learning style and preferences.

The breadth and depth of Admiral Markets' educational offerings demonstrate the broker's commitment to empowering its clients with the knowledge and skills necessary to succeed in the financial markets. By providing a solid foundation of education and support, Admiral Markets enables traders to make informed decisions, manage risk effectively, and continually improve their trading performance.

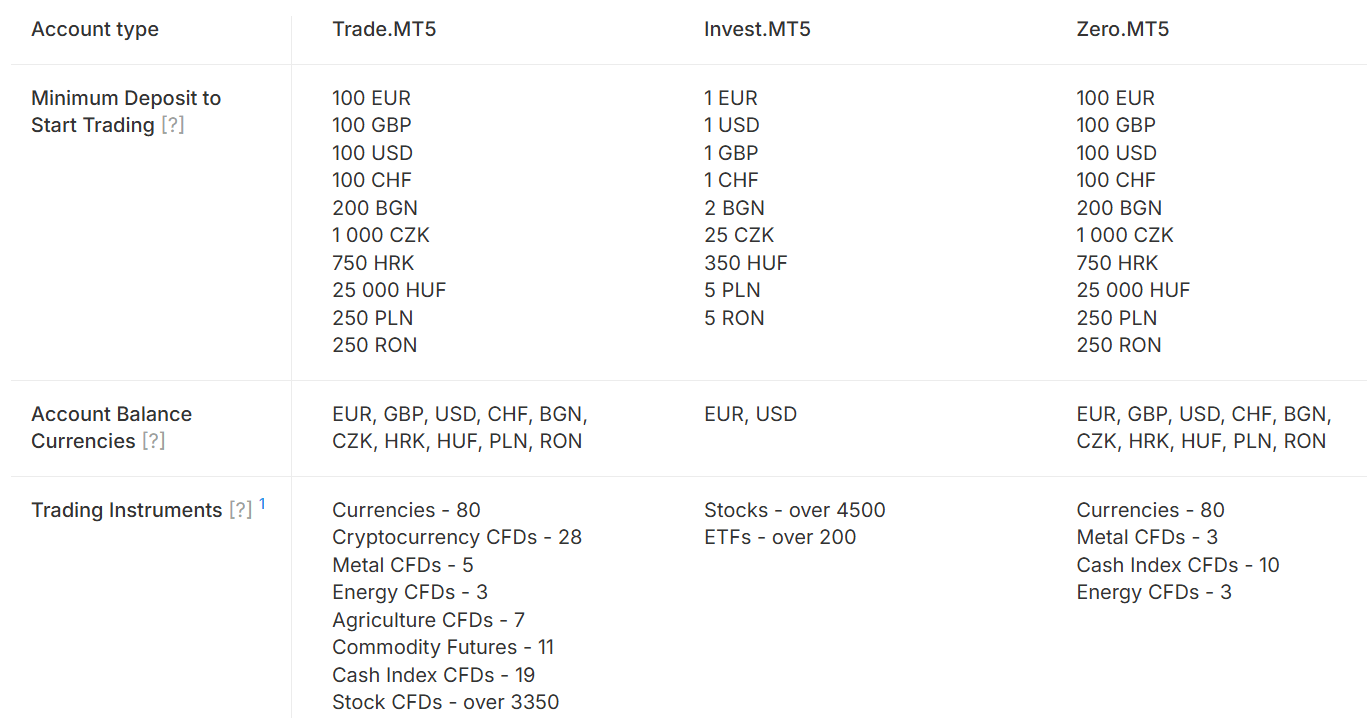

Admiral Markets Account Types

Admiral Markets offers a range of trading account types to cater to the diverse needs and preferences of its clients. These account types vary in terms of platform, minimum deposit, spread, commission, and available trading instruments.

The Trade.MT4 and Trade.MT5 accounts are the standard account types offered by Admiral Markets, available on the MetaTrader 4 and MetaTrader 5 platforms, respectively. Key features include:

- Minimum deposit: $100

- Spreads from 0.5 pips

- No commissions on most instruments

- Leverage up to 1:30 for retail clients and 1:500 for professional clients

- Access to a wide range of trading instruments, including forex, indices, stocks, commodities, and cryptocurrencies

The Zero.MT4 and Zero.MT5 accounts are designed for more active traders who prefer tighter spreads and are willing to pay a commission per trade. Key features include:

- Minimum deposit: $100

- Spreads from 0.0 pips

- Commission from $3 per lot per side

- Leverage up to 1:30 for retail clients and 1:500 for professional clients

- Access to a wide range of trading instruments, including forex, indices, stocks, commodities, and cryptocurrencies

The Invest.MT5 account is designed for clients who wish to invest in stocks and ETFs directly, without using CFDs. Key features include:

- Minimum deposit: $1

- Competitive spreads and low commissions on stocks and ETFs

- Access to over 4,000 stocks and 200 ETFs from 15 of the world's largest stock exchanges

- Ability to diversify portfolio with direct stock and ETF investments

Demo Account Admiral Markets offers a demo account that allows traders to practise their strategies and familiarise themselves with the trading platforms without risking real money. The demo account features:

- Virtual balance of $10,000

- Access to real-time market data and trading conditions

- Ability to test trading strategies and platform features

- No time limit or expiration

The variety of account types offered by Admiral Markets demonstrates the broker's commitment to providing flexibility and catering to the diverse needs of traders. By offering accounts with different minimum deposits, spread/commission structures, and trading instruments, Admiral Markets ensures that clients can choose the account that best aligns with their trading style, experience level, and financial goals.

Furthermore, the availability of a demo account allows potential clients to test the broker's platforms and services without risking real money, providing an opportunity to evaluate whether Admiral Markets is the right fit for their trading needs.

Account Types Comparison Table

| Feature | Trade.MT4 | Trade.MT5 | Zero.MT4 | Zero.MT5 | Invest.MT5 |

|---|---|---|---|---|---|

| Platform | MT4 | MT5 | MT4 | MT5 | MT5 |

| Min. Deposit | $100 | $100 | $100 | $100 | $1 |

| Spread | From 0.5 | From 0.5 | From 0.0 | From 0.0 | Competitive |

| Commission | No | No | From $3 | From $3 | Low |

| Leverage (Retail) | 1:30 | 1:30 | 1:30 | 1:30 | - |

| Leverage (Pro) | 1:500 | 1:500 | 1:500 | 1:500 | - |

Negative Balance Protection

Admiral Markets' negative balance protection policy ensures that clients cannot lose more than the funds available in their trading account. In the event that a client's account balance turns negative due to any of the aforementioned factors, Admiral Markets will absorb the losses and reset the account balance to zero. This means that clients will never owe money to the broker as a result of trading losses. It is important to note that negative balance protection applies to both retail and professional clients at Admiral Markets. This policy is an integral part of the broker's commitment to responsible trading and client protection. However, traders should be aware that negative balance protection does not negate the importance of proper risk management. It is still crucial for traders to:

- Use appropriate leverage levels based on their risk tolerance and trading experience

- Set realistic stop-loss and take-profit orders to manage potential losses

- Maintain sufficient margin in their account to avoid margin calls and forced position closures

- Stay informed about market news and events that could impact their trades

Admiral Markets Deposits and Withdrawals

Admiral Markets offers a wide range of deposit and withdrawal options to ensure that clients can easily manage their funds and maintain flexibility in their trading activities. The broker strives to provide a secure, efficient, and transparent process for both deposits and withdrawals.

Deposit Methods

| Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Bank Transfer | 2-3 business days | No (provider fees may apply) | $1 (Invest.MT5), $100 (Trade.MT4/MT5, Zero.MT4/MT5) |

| Credit/Debit Cards | Instant | No (provider fees may apply) | $1 - $100 (depends on account type) |

| E-wallets (Skrill, Neteller, PayPal) | Instant | No (provider fees may apply) | $1 - $100 (depends on account type) |

| Online Payment Systems (Klarna, Trustly, iDeal, Sofort, Giropay) | Instant | No (provider fees may apply) | $1 - $100 (depends on account type) |

Withdrawal Methods

| Method | Processing Time | Fees | Minimum Withdrawal |

|---|---|---|---|

| Bank Transfer | 2-5 business days | No (provider fees may apply) | $1 |

| Credit/Debit Cards | 1 business day | No (provider fees may apply) | $1 |

| E-wallets (Skrill, Neteller, PayPal) | 1 business day | No (provider fees may apply) | $1 |

| Not Available for Withdrawals | Klarna, Trustly, iDeal, Sofort, Giropay | - | - |

- A valid government-issued ID (e.g., passport, driver's license, or national ID card)

- Proof of address (e.g., utility bill or bank statement dated within the last 3 months)

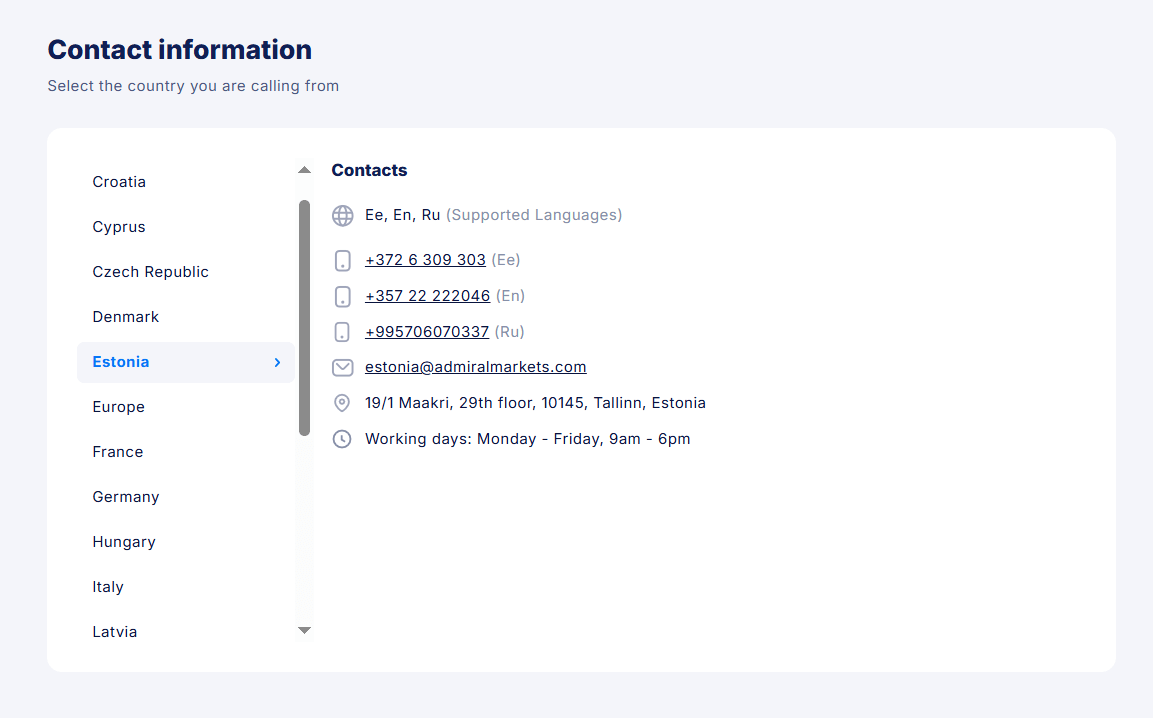

Support Service for Customer

Reliable customer support is crucial in the trading industry, as it helps traders navigate the complexities of the market and ensures a positive trading experience. Admiral Markets recognises the importance of providing prompt, knowledgeable, and accessible support to its clients, offering multiple channels through which traders can reach out for assistance.

- Live Chat: Available 24/7, live chat is the quickest way to get in touch with the support team. Clients can access the live chat feature directly from the Admiral Markets website.

- Email: Clients can send their enquiries to the support email address (support@admiralmarkets.com) and expect a response within 24 hours.

- Phone: Local phone numbers are available for clients in different countries, with multilingual support provided during trading hours.

- Social Media: Clients can reach out to Admiral Markets via their official Facebook, Twitter, and LinkedIn pages for general enquiries and updates.

- English

- German

- Spanish

- French

- Italian

- Polish

- Romanian

- Czech

- Hungarian

Customer Support Comparison Table

| Support Option | Availability | Details |

|---|---|---|

| Live Chat | 24/7 | Instant assistance anytime |

| Email Support | Yes | Response within 24 hours |

| Phone Support | Yes | Local numbers available during trading hours |

| Social Media | Yes | Monitored during business hours |

| Support Languages | 9+ | Includes English, German, Spanish, French, Italian, Polish, Romanian, Czech, Hungarian |

Prohibited Countries

Admiral Markets is a globally regulated broker that adheres to the legal and regulatory requirements of the jurisdictions in which it operates. As a result, there are certain countries and regions where the broker is not permitted to offer its services due to local regulations, licensing restrictions, or geopolitical factors.

Reasons for Restrictions The primary reasons behind Admiral Markets' country restrictions include:

- Local Regulations: Some countries have strict regulations governing the provision of financial services, including online trading. These regulations may require brokers to obtain specific licenses or meet certain requirements before they can legally operate within the jurisdiction.

- Licensing Limitations: Admiral Markets holds licenses from several top-tier regulators, including the FCA (UK), ASIC (Australia), and CySEC (Cyprus). However, these licenses may not cover all countries and regions, limiting the broker's ability to offer services in certain areas.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors can impact a broker's ability to operate in specific countries. Admiral Markets complies with international laws and regulations, which may restrict its services in certain regions.

Prohibited Countries List Admiral Markets does not provide services to residents of the following countries and regions:

North America

- United States of America

- Canada

Asia

- Japan

- North Korea

- Iran

- Syria

- Yemen

Africa

- Sudan

- South Sudan

Europe

- Belgium

Consequences of Trading from Prohibited Countries Attempting to trade with Admiral Markets from a prohibited country may result in the following consequences:

- Account Restriction: If Admiral Markets identifies that a client is accessing its services from a prohibited country, the broker may restrict or terminate the client's account without prior notice.

- Legal Implications: Trading with Admiral Markets from a prohibited country may violate local laws and regulations, potentially leading to legal consequences for the client.

- Limited Recourse: Clients from prohibited countries may not be eligible for the same level of protection or compensation schemes offered by the regulatory bodies that oversee Admiral Markets' operations.

It is essential for potential clients to review the list of prohibited countries and ensure that they are eligible to trade with Admiral Markets before attempting to open an account or access the broker's services.

Special Offers for Customers

Admirals offers Customised VIP Conditions for clients with deposits of $20,000 or more. VIP clients benefit from low spreads, up to 1:500 leverage, negative balance protection, and fund insurance up to $100,000. Additional perks include access to MetaTrader Supreme Edition, a Premium VPS service, and personalised trading offers based on trading volume and preferences. The more you deposit and trade, the greater the benefits available.

Conclusion

After conducting a thorough review of Admiral Markets, I have gained a comprehensive understanding of their services, regulatory compliance, and overall reputation within the online trading industry. By examining various aspects of their operations, I can confidently assess their trustworthiness and reliability as a broker.

Admiral Markets demonstrates a strong commitment to regulatory compliance, holding licenses from multiple top-tier financial authorities, including the FCA, ASIC, and CySEC. This multi-jurisdictional regulation ensures that the broker adheres to strict guidelines and maintains high standards of client protection and transparency. Admiral Markets' dedication to operating within a robust regulatory framework instills confidence in their stability and reliability.

One of Admiral Markets' key strengths is their extensive range of tradable assets, which includes forex, indices, stocks, commodities, and cryptocurrencies. This diverse offering caters to the needs of various types of traders, allowing them to access global markets and implement their preferred trading strategies. The broker's competitive trading conditions, such as tight spreads and low commissions, further enhance the appeal of their services.

Admiral Markets' advanced trading platforms, particularly the MetaTrader 4 and MetaTrader 5 suite, provide users with powerful tools and features to analyse markets, execute trades, and manage their portfolios effectively. The availability of these platforms across desktop, web, and mobile devices ensures that traders can access their accounts and trade seamlessly from anywhere at any time.

The broker's commitment to client education is evident through their comprehensive educational resources, which include webinars, seminars, articles, and video tutorials. These materials cater to traders of all skill levels, helping them expand their knowledge and make informed trading decisions. Admiral Markets' dedication to supporting their clients' growth and success sets them apart from many competitors.

Another area where Admiral Markets excels is customer support. The broker offers multiple channels for clients to seek assistance, including 24/7 live chat, email, and phone support in several languages. The knowledgeable and responsive support team ensures that traders can resolve any issues or concerns promptly, fostering a positive trading experience.

While Admiral Markets does not heavily promote special offers or bonuses, they focus on providing a comprehensive and transparent trading environment that prioritises the needs of their clients. The absence of aggressive promotions aligns with their reputation as a reliable and trustworthy broker.

In conclusion, Admiral Markets emerges as a reputable and dependable choice for traders seeking a well-regulated, feature-rich, and client-centric broker. Their strong regulatory standing, wide range of tradable assets, advanced trading platforms, educational resources, and responsive customer support make them a compelling option for both novice and experienced traders. By prioritising transparency, security, and client satisfaction, Admiral Markets has established itself as a reliable partner for those looking to navigate the dynamic world of online trading.

See which firms integrate TradingView in our chart-friendly broker reviews.

US clients welcomed in the OANDA review.