ADSS Broker Review 2025: Is This Forex Broker Worth Your Trade?

ADSS

United Arab Emirates

United Arab Emirates

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Securities Brokerage License

Securities Brokerage License

Softwares & Platforms

Customer Support

+97126572414

(English)

+97126572414

(English)

Supported language: English, Arabic, French, Hindi, Urdu

Social Media

Summary

ADSS (ADS Securities) is a regulated multi-asset broker based in Abu Dhabi, established in 2011. It offers access to over 2,000 instruments across forex, commodities, equities, indices, bonds, and cryptocurrencies. Traders can choose from three account types and trade via the ADSS Web Trader, MetaTrader 4, or mobile app. The broker is licensed by the UAE’s SCA and provides competitive spreads, up to 1:500 leverage, and strong educational resources. ADSS supports 24/5 multilingual customer service and has earned awards such as “Best Forex Broker Middle East” and “Best Trading App.”

- Well-regulated by the SCA in the UAE

- Wide range of tradable assets (2,000+ instruments)

- Multiple trading platforms (Web Trader, MT4, mobile app)

- Competitive spreads starting from 0.0 pips

- Leverage up to 1:500

- Three account types to suit different trader needs

- Comprehensive educational resources

- 24/5 multilingual customer support

- Occasional special offers and promotions

- Long-standing reputation in the MENA region

- No negative balance protection

- $5 withdrawal fee applies to all methods

- Limited cryptocurrency offerings (10 instruments)

- Not available to traders in the US, Canada, and other restricted countries

- Relatively high minimum deposit for Elite and Pro accounts ($100,000)

- No MetaTrader 5 (MT5) support

- Limited customization options on Web Trader platform

- No copy trading or social trading features

- Overnight swaps can be high compared to some competitors

- Inactivity fees may apply after 90 days of no trading activity

Overview

ADSS (ADS Securities) is a multi-asset online broker established in 2011 and headquartered in Abu Dhabi, United Arab Emirates. With a strong presence in the Middle East and North Africa (MENA) region, ADSS offers access to over 2,000 tradable instruments across forex, commodities, equities, indices, bonds, and cryptocurrencies.

The broker is regulated by the Securities and Commodities Authority (SCA) in the UAE and has received multiple awards for its services, including "Best Forex Broker Middle East" at the Forex Expo Dubai 2022 and "Best Trading App" in 2024. For more information, visit the ADSS official website at [adss.com].

Overview Table

| Feature | ADSS |

|---|---|

| Headquarters | Abu Dhabi, United Arab Emirates |

| Established | 2011 |

| Regulation | Securities and Commodities Authority (SCA) in the UAE |

| Tradable Instruments | Forex, Commodities, Equities, Indices, Bonds, Cryptocurrencies |

| Trading Platforms | ADSS Web Trader, MetaTrader 4 (MT4), ADSS Mobile App |

| Account Types | Standard, Elite, Pro |

| Minimum Deposit | $100 |

| Customer Support | 24/5 via live chat, email, phone |

| Education & Research | Market analysis, economic calendar, trading guides, webinars |

Facts List

- ADSS (ADS Securities) was established in 2011 and is headquartered in Abu Dhabi, United Arab Emirates.

- The broker is regulated by the Securities and Commodities Authority (SCA) in the UAE, holding licenses for Dealing in Securities and Arrangement and Advice (Introduction).

- ADSS offers access to over 2,000 tradable instruments across forex, commodities, equities, indices, bonds, and cryptocurrencies.

- Clients can choose from three account types: Standard (minimum deposit $100), Elite ($100,000), and Pro ($100,000).

- The broker provides multiple trading platforms, including the proprietary ADSS Web Trader, MetaTrader 4 (MT4), and a mobile trading app.

- ADSS offers competitive spreads starting from 0.0 pips (Pro account) and leverage up to 1:500.

- The broker provides comprehensive educational resources, such as market analysis, an economic calendar, trading guides, and webinars.

- Customer support is available 24/5 in multiple languages through various channels, including live chat, email, phone, and WhatsApp.

- ADSS has received numerous industry awards, such as "Best Forex Broker Middle East" at the Forex Expo Dubai 2022 and "Best Trading App" in 2024.

- The broker has a long-standing reputation in the MENA region and caters to both retail and institutional clients.

ADSS Licenses and Regulatory

ADSS operates under the regulatory oversight of the Securities and Commodities Authority (SCA) in the United Arab Emirates. The broker holds a First Category license for Dealing in Securities and a Fifth Category license for Arrangement and Advice (Introduction). ADSS is also a Limited Liability Company – Sole Proprietorship Company incorporated under UAE law and registered with the Department of Economic Development of Abu Dhabi (No. 1190047).

Trading Instruments

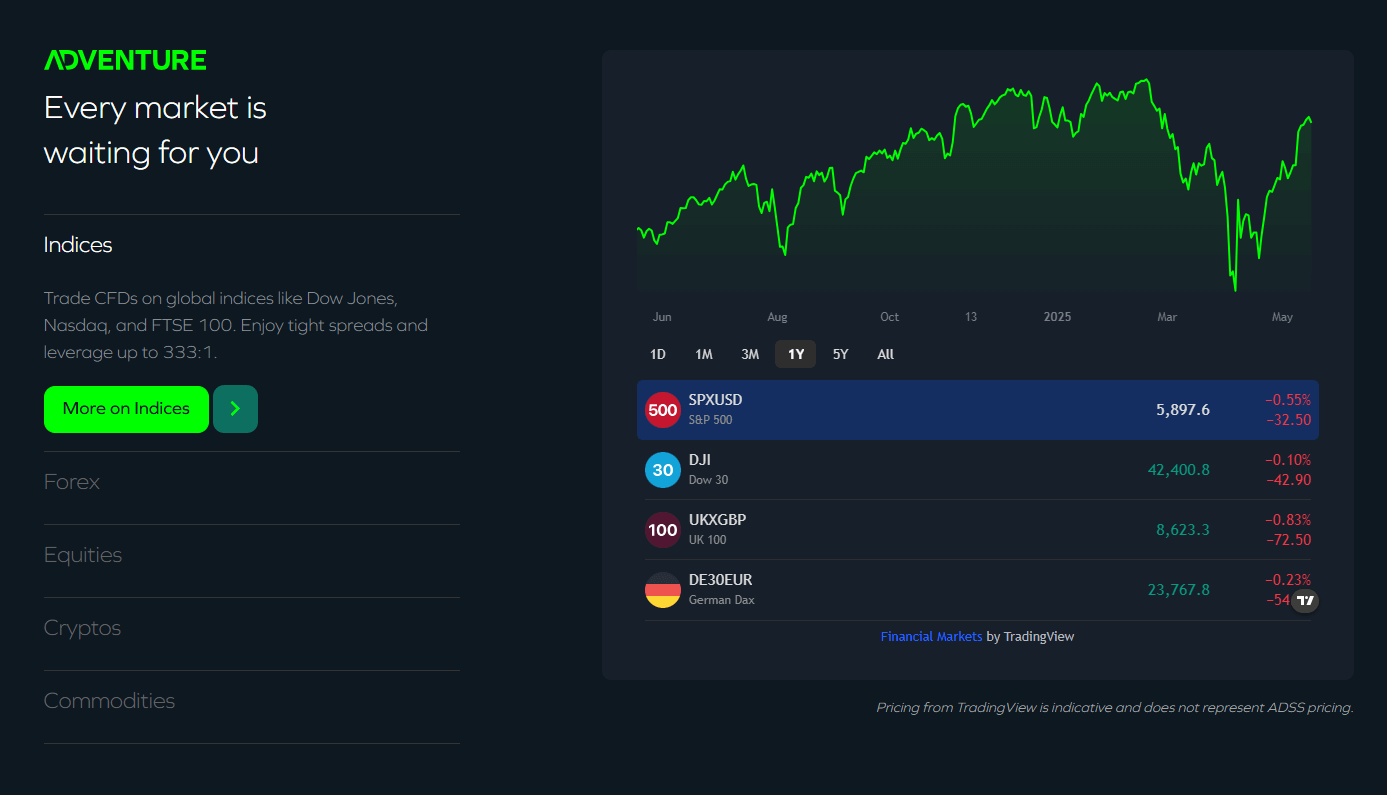

ADSS provides access to a wide range of tradable assets, allowing traders to diversify their portfolios and take advantage of various market opportunities.

The broker's offering includes:

| Asset Class | Available Instruments |

|---|---|

| Forex | 51 currency pairs, including majors, minors, and exotics |

| Commodities | 33 instruments, including metals, energies, and agricultural products |

| Equities & ETFs | 950+ share CFDs from sectors like retail, technology, finance, and more |

| Indices | 22 global indices, covering major markets in the US, EU, and UK |

| Cryptocurrencies | 10 digital assets, including both major and minor cryptocurrencies |

| Bonds | 2 instruments from the UK and US government bond markets |

Trading Platforms

ADSS offers multiple trading platforms to cater to different trader preferences and needs:

ADSS Web Trader

A proprietary platform with a user-friendly interface, advanced charting, and integrated market research.

MetaTrader 4 (MT4)

The industry-standard platform known for its extensive customisation options, automated trading capabilities, and wide range of technical indicators.

ADSS Mobile App

A mobile trading solution that allows traders to access their accounts, execute trades, and manage positions on the go.

Trading Platforms Comparison Table

| Feature | ADSS Web Trader | MetaTrader 4 (MT4) |

|---|---|---|

| Customization | Limited | Extensive |

| Automated Trading | No | Yes (Expert Advisors) |

| Technical Indicators | 120+ | 50+ (expandable) |

| Charting Tools | 37+ | 30+ |

| Integrated Research | Yes | No |

| Mobile App | Yes | Yes |

ADSS How to Open an Account: A Step-by-Step Guide

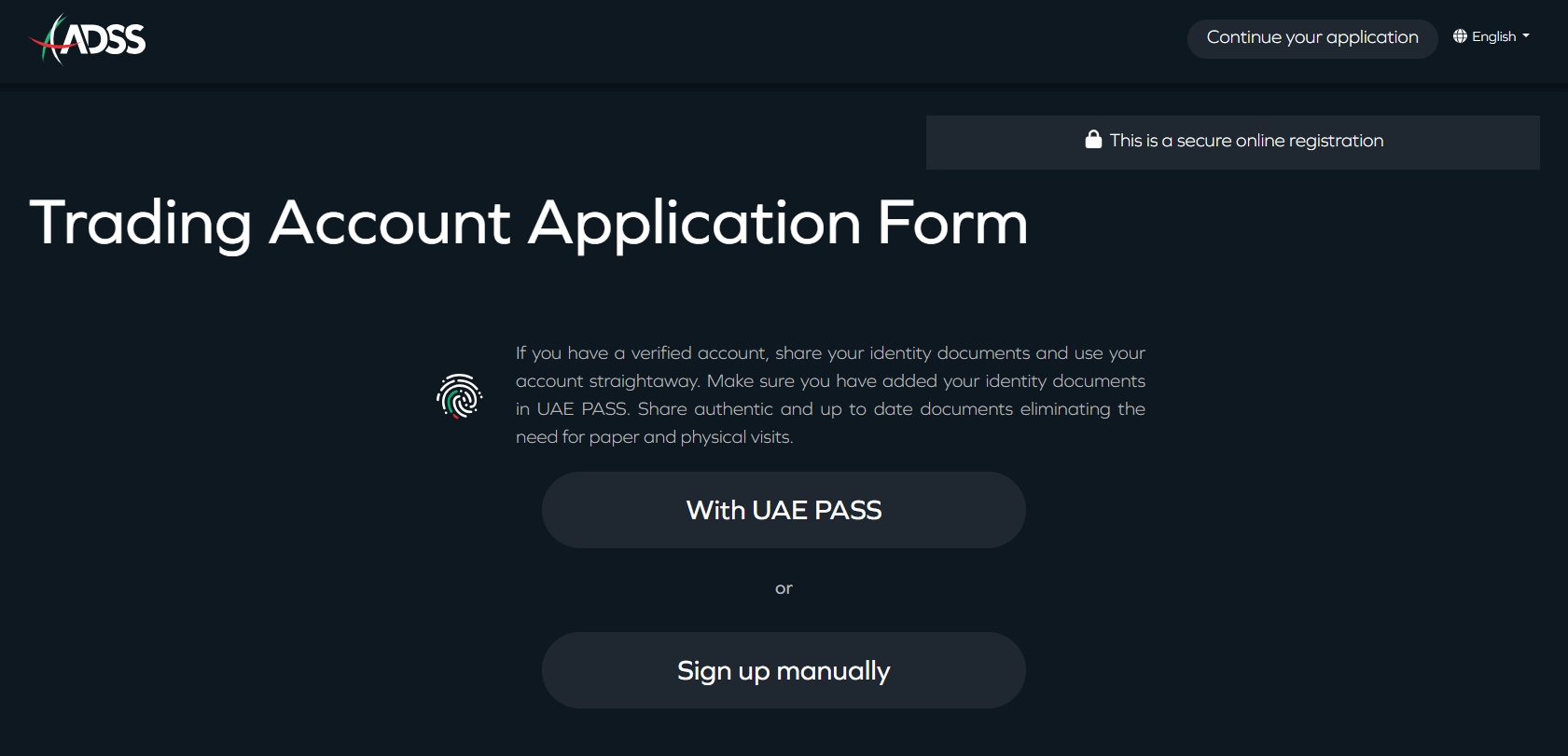

To open an account with ADSS, follow these simple steps:

- Visit the ADSS official website and click on the "Open Account" button.

- Fill in the registration form with your personal details, including name, email, phone number, and country of residence.

- Choose your preferred account type (Standard, Elite, or Pro) and base currency (USD only).

- Complete the questionnaire about your trading experience and financial knowledge.

- Submit the required identification documents (proof of identity and proof of address) for account verification.

- Fund your account using one of the available payment methods, such as bank wire transfer, credit/debit card, or e-wallets.

- Download and install your preferred trading platform (ADSS Web Trader, MT4, or mobile app).

- Start trading!

Charts and Analysis

ADSS provides a comprehensive suite of educational resources and tools to help traders make informed decisions and improve their skills.

| Feature | Description |

|---|---|

| Market Analysis | In-depth insights into the latest market trends, economic events, and trading opportunities. |

| Economic Calendar | A detailed schedule of upcoming economic releases and their potential market impact. |

| Trading Central | Actionable trading ideas, technical analysis, and market sentiment indicators. |

| Dow Jones News | Real-time news updates from a trusted source to keep traders informed of market-moving events. |

| Trading Guides | Comprehensive educational materials covering a range of topics from beginner to advanced strategies. |

| Webinars | Live and on-demand webinars hosted by industry experts, offering insights and training. |

ADSS Account Types

ADSS offers three account types to suit different trader needs and preferences:

Standard Account

- Minimum deposit: $100

- Spreads from 1.4 pips

- Commission-free trading

- Maximum leverage up to 1:500

- Access to all tradable assets

- Suitable for beginner traders

Elite Account

- Minimum deposit: $100,000

- Spreads from 0.7 pips (25% lower than Standard)

- Commission-free trading

- Maximum leverage up to 1:500

- Access to all tradable assets

- Dedicated senior account manager

- Invitation to exclusive ADSS events

- Suitable for experienced traders

Pro Account

- Minimum deposit: $100,000

- Spreads from 0.0 pips

- Commissions apply (negotiable)

- Maximum leverage up to 1:500

- Access to all tradable assets

- Dedicated sales trader

- Invitation to exclusive ADSS events

- Suitable for professional traders

All account types come with access to the ADSS Web Trader, MT4, and mobile trading platforms. Islamic swap-free accounts are also available upon request.

Account Types Comparison Table

| Feature | Standard | Elite | Pro |

|---|---|---|---|

| Minimum Deposit | $100 | $100,000 | $100,000 |

| Spreads From | 1.4 pips | 0.7 pips | 0.0 pips |

| Commissions | No | No | Negotiable |

| Maximum Leverage | 1:500 | 1:500 | 1:500 |

| Account Manager | No | Senior | Sales Trader |

| Exclusive Events | No | Yes | Yes |

Negative Balance Protection

ADSS does not offer negative balance protection to its clients. This means that traders can potentially lose more than their initial deposit if the market moves against their positions. To mitigate this risk, ADSS encourages traders to use appropriate risk management tools, such as stop-loss orders and position sizing, and to always trade within their means.

ADSS Deposits and Withdrawals

ADSS supports multiple payment methods for deposits and withdrawals:

Deposit Methods

| Payment Method | Processing Time | Fees Charged by ADSS |

|---|---|---|

| Bank Wire Transfer | 1–3 business days | None |

| Credit/Debit Card | Instant | None |

| E-wallets (Skrill, Neteller, WebMoney, etc.) | Instant | None |

| UAEPGS | Instant | None |

| Apple Pay / Samsung Pay | Instant | None |

Withdrawal Methods

| Payment Method | Processing Time | ADSS Fee | Notes |

|---|---|---|---|

| Bank Wire Transfer | 3–5 business days | $5 | Third-party fees may apply |

| Credit/Debit Card | Within 24 hours | $5 | Third-party fees may apply |

| E-wallets (Skrill, Neteller, WebMoney, etc.) | Within 24 hours | $5 | Third-party fees may apply |

| UAEPGS | Within 24 hours | $5 | Third-party fees may apply |

| Apple Pay / Samsung Pay | Within 24 hours | $5 | Third-party fees may apply |

Support Service for Customer

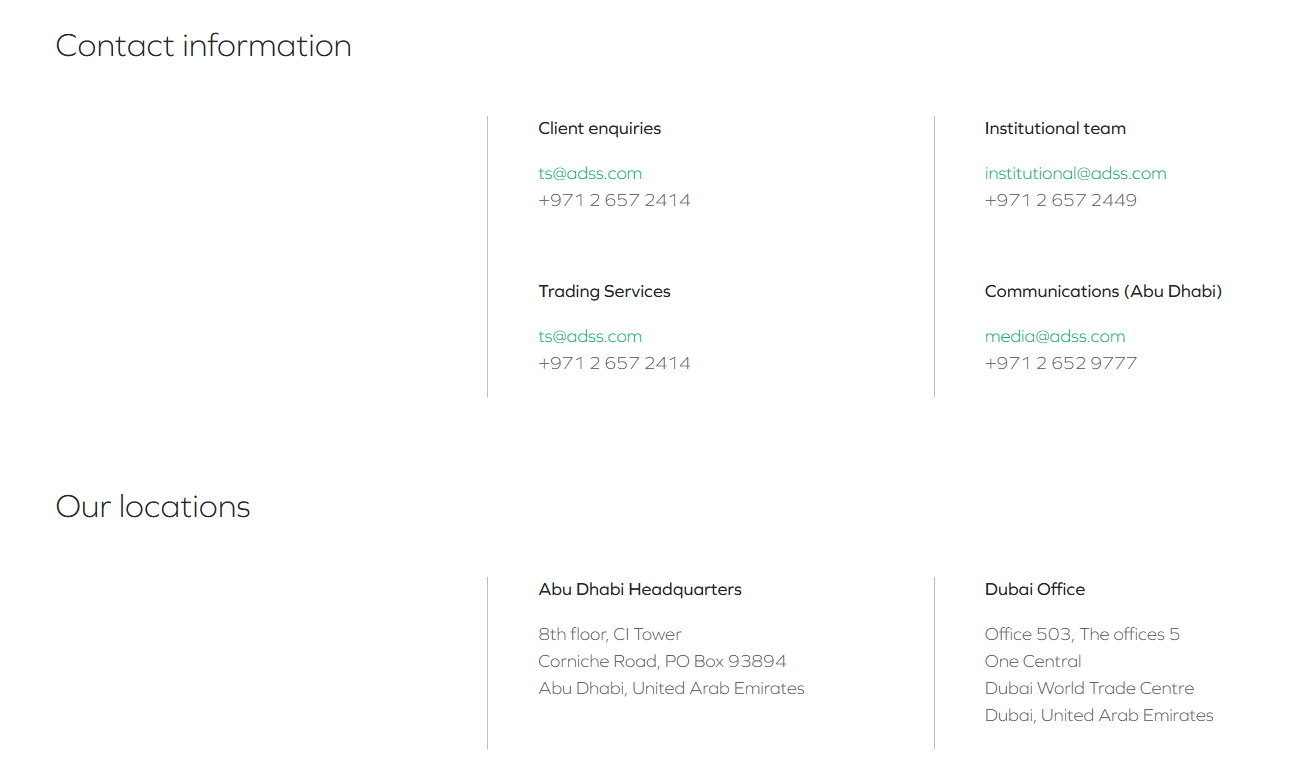

ADSS offers 24/5 multilingual customer support through various channels:

- Live Chat: Available on the ADSS website during market hours

- Email: support@adss.com

- Phone: +971 2 657 2414

- WhatsApp: +971 52 683 8345

- Social Media: Facebook, Twitter, LinkedIn, YouTube, Instagram, Telegram

The support team is knowledgeable and responsive, with an average response time of under 5 minutes for live chat and 1 hour for email enquiries. Support is available in English, Arabic, French, Hindi, and Urdu.

The support team is knowledgeable and responsive, with an average response time of under 5 minutes for live chat and 1 hour for email enquiries. Support is available in English, Arabic, French, Hindi, and Urdu.

Customer Support Comparison Table

| Channel | Availability | Languages | Avg. Response Time |

|---|---|---|---|

| Live Chat | 24/5 | English, Arabic, French, Hindi, Urdu | < 5 minutes |

| 24/5 | English, Arabic, French, Hindi, Urdu | 1 hour | |

| Phone | 24/5 | English, Arabic, French, Hindi, Urdu | < 1 minute |

| 24/5 | English, Arabic, French, Hindi, Urdu | < 5 minutes | |

| Social Media | 24/7 | English, Arabic | 1-2 hours |

Prohibited Countries

ADSS does not accept clients from the following countries due to regulatory restrictions or company policy:

- United States

- Canada

- Japan

- Brazil

- New Zealand

- Iran

- North Korea

- Sudan

- Syria

- Yemen

Special Offers for Customers

ADSS occasionally runs special promotions and offers for both new and existing clients. Some of the current offers include:

- Welcome Bonus: New clients can receive a 10% bonus on their first deposit, up to a maximum of $1,000. The bonus is subject to a trading volume requirement of 100 times the bonus amount.

- Loyalty Program: Clients can earn loyalty points based on their trading activity, which can be redeemed for cash rebates, trading credits, or other rewards.

- Trading Competition: ADSS regularly hosts trading competitions with prize pools of up to $100,000. Traders can compete for the highest trading volume or profits over a specified period.

Conclusion

After thoroughly reviewing ADSS, I can confidently say that they are a trustworthy and reliable broker. With their strong regulatory compliance, segregation of client funds, and long-standing reputation in the MENA region, traders can feel secure in choosing ADSS as their trading partner.

One of the standout features of ADSS is their comprehensive range of tradable assets, which includes over 2,000 instruments across forex, commodities, equities, indices, bonds, and cryptocurrencies. This extensive offering allows traders to diversify their portfolios and take advantage of various market opportunities.

ADSS also caters to different trader preferences by providing multiple trading platforms, including their proprietary Web Trader, the industry-standard MT4, and a user-friendly mobile app. These platforms come equipped with advanced charting tools, integrated market research, and a wide range of order types, making it easier for traders to analyse the markets and execute their strategies.

In terms of customer support, ADSS offers 24/5 multilingual assistance through various channels, ensuring that clients can get help whenever they need it. The support team is knowledgeable and responsive, with an average response time of under 5 minutes for live chat enquiries.

While ADSS does have some limitations, such as the lack of negative balance protection and the $5 withdrawal fee, these are relatively minor drawbacks compared to the overall benefits of trading with this broker.

In conclusion, ADSS is a solid choice for traders looking for a reliable, well-regulated broker with a wide range of tradable assets and advanced trading tools. Their commitment to providing a secure and user-friendly trading environment, combined with their competitive pricing and excellent customer support, makes them a strong contender in the online brokerage space.