AETOS Forex Broker Review 2025: Is It the Right Broker for You?

AETOS

Australia

Australia

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 400:1

-

Spread From 1.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

Australia Retail Forex License

Australia Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+61299292100

(English)

+61299292100

(English)

Supported language: English

Social Media

Summary

AETOS Capital Group is an Australian-based online broker founded in 2007, offering access to Forex, indices, metals, and more via MT4/MT5 platforms. Regulated by ASIC and other offshore authorities, it serves clients in over 100 countries. AETOS offers low minimum deposits from $50, leverage up to 1:400, and competitive spreads starting at 1.2 pips. While it has won awards for its trading services, some users have reported withdrawal concerns.

- Regulated by top-tier authority ASIC, ensuring a secure trading environment

- Wide range of trading instruments, including forex, indices, commodities, metals, and share CFDs

- User-friendly and feature-rich trading platforms, MetaTrader 4 and MetaTrader 5

- Competitive trading conditions, such as low minimum deposits, tight spreads, and high leverage options

- Reliable and responsive customer support through multiple channels

- Decent selection of educational resources, including market analysis, trading guides, webinars, and video tutorials

- Several account types catering to different trading needs and preferences

- User-friendly account opening process with a low minimum deposit requirement

- Occasional special promotions and bonuses, providing additional value for traders

- Established broker with a strong reputation in the industry

- Previous FCA license canceled, and offshore regulations in Vanuatu, Mauritius, and the Cayman Islands

- Some negative reviews regarding withdrawal delays

- Lacks advanced features for experienced traders, such as VPS hosting, algorithmic trading, and social trading capabilities

- Geographic restrictions limit accessibility to traders in certain regions, including the US, UK, and several European and Asian countries

- Educational content may not be as extensive as some industry leaders

- No 24/7 customer support

- Inactivity fee of $25 per month after a dormant period

- Limited range of deposit and withdrawal options compared to some competitors

- Relatively high stock CFD commissions

- No negative balance protection outside Australia

Overview

AETOS Capital Group is a global online trading service provider offering access to Forex, indices, global stocks, precious metals, and commodities through the MetaTrader 4 (MT4) platform. Founded in 2007, AETOS is a non-banking financial institution based in Australia, serving clients from over 100 countries. The company operates through subsidiaries regulated by top-tier authorities like ASIC (Australia), FCA (UK) [now cancelled], VFSC (Vanuatu), FSC (Mauritius), and CIMA (Cayman Islands).

AETOS has received industry awards for excellence in trading execution and brokerage services. More details about their offerings are available on the official AETOS website. While AETOS provides a robust trading environment, some user reviews mention withdrawal issues, which slightly impacts its otherwise strong reputation.

Overview Table

| Criteria | Details |

|---|---|

| Website | www.aetoscg.com |

| Founded | 2007 |

| Headquarters | Australia |

| Regulation | ASIC, previously FCA [now cancelled]; also VFSC, FSC, CIMA |

| Instruments | Forex, Indices, Metals, Energy, Share CFDs |

| Platforms | MetaTrader 4, MetaTrader 5, Mobile Apps |

| Account Types | General, Advanced |

| Minimum Deposit | $50 |

| Base Currencies | USD, EUR, AUD, CAD |

| Demo Account | Yes, 14 days with $10,000 virtual funds |

| Leverage | Up to 1:400 on Forex |

| Spread | From 1.8 pips (General) / 1.2 pips (Advanced) |

| Commissions | None on most instruments; applicable to Share CFDs |

| Educational Resources | Market analysis, economic calendar, trading guides |

Facts List

- Established in 2007 with a global presence in 100+ countries

- Regulated by ASIC, previously by FCA [now cancelled], and offshore by VFSC, FSC and CIMA

- Offers 200+ trading instruments including Forex, metals, energy, indices, share CFDs

- MetaTrader 4 and MetaTrader 5 platforms for desktop, web, and mobile

- Competitive spreads from 1.2 pips (Advanced) and 1.8 pips (General)

- Leverage up to 1:400 on Forex pairs

- Low minimum deposit of $50 for live accounts

- Demo account with $10,000 virtual funds for practice

- Diverse account types – General, Advanced, MAM/PAMM, Swap-Free

- Award-winning broker recognized for trading execution and services

AETOS Licenses and Regulatory

AETOS operates under the following licenses:

- Australian Securities and Investment Commission (ASIC), license #000313016

- Previously regulated by Financial Conduct Authority (FCA) in the UK, but license has been canceled

- Vanuatu Financial Services Commission (VFSC)

- Financial Services Commission (FSC) in Mauritius

- Cayman Islands Monetary Authority (CIMA)

While AETOS enjoys oversight from top-tier ASIC, their regulatory status is mixed with offshore licenses from VFSC, FSC and CIMA, which offer comparatively less protection. The previous FCA license provided a strong regulatory backing, but its cancellation reduces AETOS' regulatory credibility. Nonetheless, ASIC regulation ensures a safe trading environment with client fund segregation, negative balance protection and fair practices.

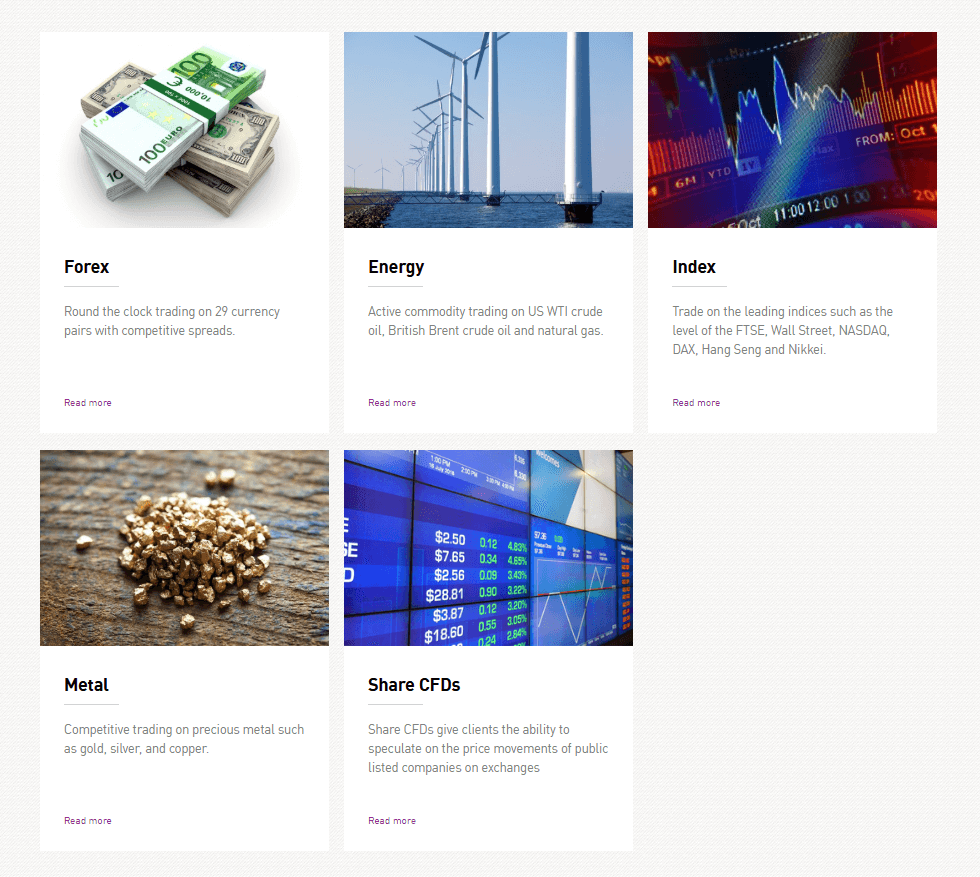

Trading Instruments

AETOS provides access to 200+ trading instruments across key asset classes:

| Asset Class | Instruments | Spreads / Commissions |

|---|---|---|

| Forex | 29 currency pairs (major, minor, exotic) | Competitive spreads from 1.2 pips |

| Indices | Global stock indices: Wall Street, FTSE, DAX, Nikkei | Industry-low spreads from 1 pip |

| Metals | Precious metals: Gold, Silver, Copper | Gold spreads from 26 cents |

| Energy | Commodities: US WTI Crude Oil, UK Brent Oil, Natural Gas | Spreads from 3 pips |

| Share CFDs | Global company stock price movements | Commission from 7 AUD per trade |

Trading Platforms

AETOS offers the following trading platforms:

MetaTrader 4 (MT4)

- Popular platform with advanced tools and customizability

- Available for desktop (Windows, Mac), web, mobile (iOS, Android)

- Supports automated trading with Expert Advisors (EAs)

- One-click trading and advanced charting tools

- MQL4 for developing custom indicators

MetaTrader 5 (MT5)

- Next-generation platform with enhanced features

- Available for desktop (Windows), web, mobile (iOS, Android)

- 38+ preloaded technical indicators

- Advanced Risk Management with hedging

- Access to Depth of Market (DOM)

- MQL5 for EA and script development

Both platforms provide a user-friendly and feature-rich environment catering to traders of all skill levels. MT4 has wider usability and is ideal for beginners, while MT5 offers advanced functionalities for experienced traders. Mobile apps sync seamlessly with the desktop platforms for on-the-go trading.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| Developer | MetaQuotes | MetaQuotes |

| Operating Systems | Windows, Mac, Web, iOS, Android | Windows, Web, iOS, Android |

| Order Types | Market, Pending | Market, Pending, Stop Limit |

| Technical Indicators | 30+ | 38+ |

| Timeframes | 9 | 21 |

| Automated Trading | Yes | Yes |

| Hedging | No | Yes |

| Depth of Market | No | Yes |

| Programming Language | MQL4 | MQL5 |

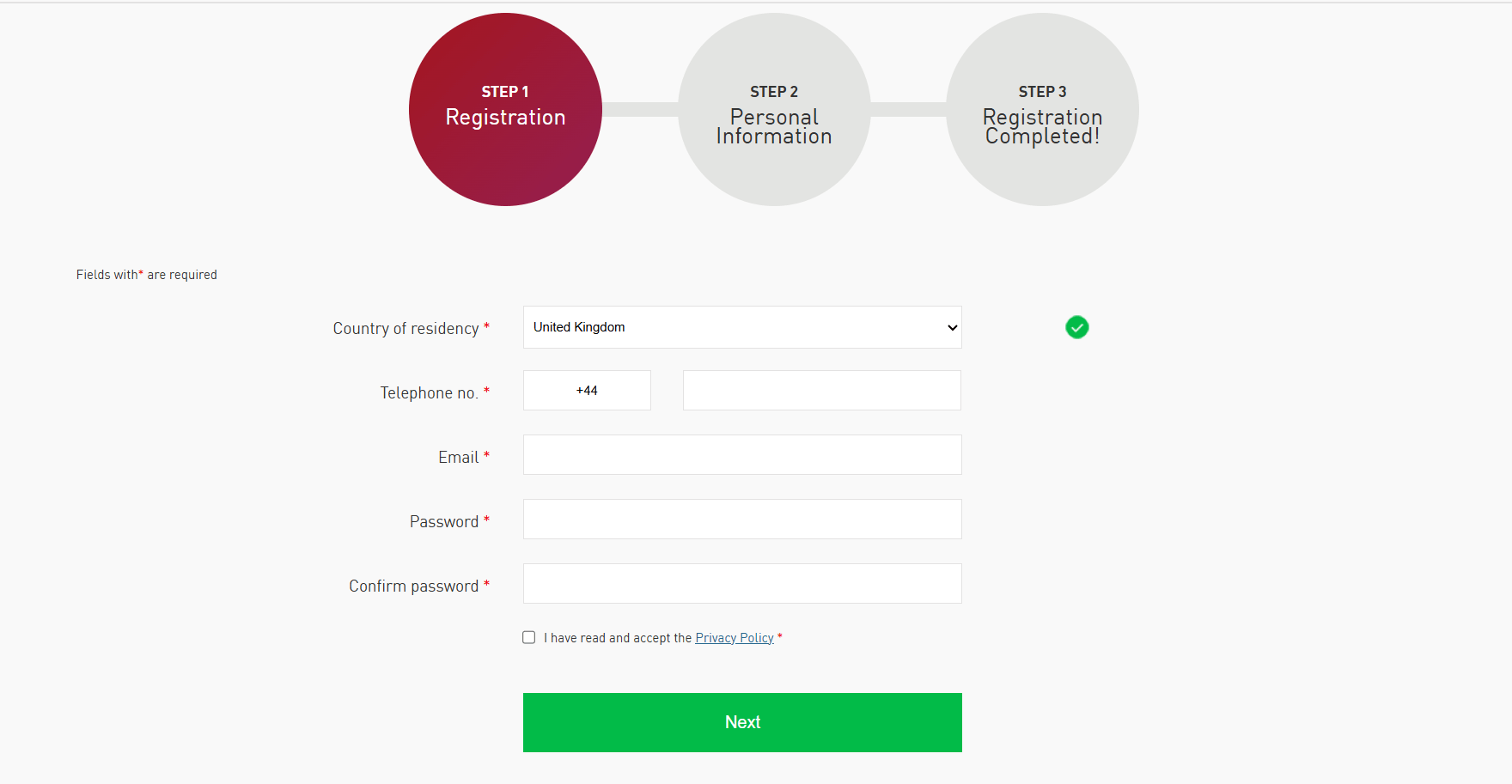

AETOS How to Open an Account: A Step-by-Step Guide

Opening a trading account with AETOS is a straightforward process that can be completed online in just a few steps. Here's a detailed guide on how to get started:

Step 1: Visit the AETOS website Go to the official AETOS website at www.aetoscg.com and click on the "Open Live Account" button in the top right corner of the homepage.

Step 2: Choose your account type Select the type of account you wish to open from the available options: Individual or Corporate. Individual accounts are suitable for most retail traders, while Corporate accounts are designed for businesses and institutional clients.

Step 3: Fill out the registration form Provide your personal information in the registration form, including your full name, date of birth, country of residence, email address, and phone number. Ensure that all the details are accurate and up-to-date.

Step 4: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, AETOS requires new clients to submit proof of identity and address. You'll need to upload a valid government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement confirming your residential address.

Step 5: Choose your trading platform Select your preferred trading platform from the available options, which include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are available for desktop, web, and mobile devices, catering to various trading styles and preferences.

Step 6: Fund your account To start trading, you'll need to make an initial deposit into your AETOS account. The minimum deposit required is $50-500, which is lower than many other brokers in the industry. AETOS accepts several payment methods, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Processing times vary depending on the chosen method, with e-wallets generally offering the quickest deposits.

Step 7: Start trading Once your account is funded, you can download and log in to your chosen trading platform. AETOS offers a wide range of trading instruments, including forex, indices, metals, energy, and share CFDs, which can be accessed through the platform. Be sure to familiarise yourself with the platform's features and tools before placing any trades.

Charts and Analysis

AETOS provides a range of educational resources and tools to support traders in their learning journey and decision-making process. These resources cater to various skill levels and learning styles, helping clients enhance their trading knowledge and strategies. Let's take a closer look at the key offerings:

| Resource | Description |

|---|---|

| Market Analysis | Daily insights from AETOS' in-house research team, including technical/fundamental analysis, market commentary, and trading ideas. |

| Economic Calendar | Comprehensive calendar tracking key economic events, expected impact, and forecasted/previous data to help inform trading decisions. |

| Trading Guides & Articles | Covers basic trading concepts, market analysis, risk management, and trading psychology to help traders build a strong foundation. |

| Webinars | Regularly hosted by industry experts, these sessions cover market trends, strategies, and platform usage with live Q&A opportunities. |

| Video Tutorials | Step-by-step visual guides for using MT4 and MT5 platforms, ideal for beginners learning platform setup, order placement, and chart analysis. |

| Downloadable Resources | In-depth PDFs and e-books on various trading topics for structured, self-paced learning. |

AETOS Account Types

AETOS offers two live trading account types, along with a demo option:

General Account

- Minimum deposit: $50

- Spreads from 1.8 pips

- Margin: 2% for metals, 0.25% for Forex

- Commission-free trading

- Minimum trade size: 0.01 lots

- Max trade size: 50 standard lots

Advanced Account

- Minimum deposit: $500

- Spreads from 1.2 pips on Forex and 26 cents on Gold

- Leverage up to 1:400 on FX pairs

- Commission-free trading

- Minimum trade size: 0.01 lots

- Max trade size: 50 standard lots

Demo Account

- 14-day trial with $10,000 virtual funds

- Real-time pricing identical to live accounts

- Practice platform for all asset classes

AETOS also offers swap-free accounts for Muslim traders, complying with Sharia law. MAM and PAMM accounts are available for money managers.

Account Types Comparison Table

| Feature | General Account | Advanced Account |

|---|---|---|

| Minimum Deposit | $50 | $500 |

| Spreads (EUR/USD) | From 1.8 pips | From 1.2 pips |

| Margin Requirement | 2% (Metals), 0.25% (Forex) | 400:1 (FX pairs) |

| Commission | None | None |

| Minimum Trade Size | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 50 standard lots | 50 standard lots |

Negative Balance Protection

AETOS offers negative balance protection to its clients, but the extent of this protection depends on the client's country of residence and the regulatory jurisdiction under which they fall. For clients based in Australia and regulated by the Australian Securities and Investments Commission (ASIC), AETOS provides full negative balance protection. This means that Australian clients cannot lose more than their account balance, and AETOS will absorb any negative balances that may occur due to trading activities. However, for clients residing outside of Australia and regulated by other authorities, such as the Vanuatu Financial Services Commission (VFSC), the negative balance protection may not apply. In these cases, traders should be aware that they could potentially be liable for losses exceeding their account balance. It is crucial for traders to carefully review the terms and conditions of their chosen account type and understand the level of negative balance protection provided by AETOS in their specific jurisdiction. AETOS is committed to safeguarding its clients' funds and promoting responsible trading practices. The broker employs several risk management tools and strategies to help traders control their exposure and minimize potential losses. These tools include customizable stop-loss orders, which automatically close positions when a pre-determined price level is reached, and margin calls, which alert traders when their account balance falls below a certain threshold.

AETOS Deposits and Withdrawals

AETOS supports the following deposit and withdrawal methods:

Deposit Methods

| Method | Details |

|---|---|

| Bank Wire Transfer | Supported |

| Credit/Debit Card | Supported |

| E-wallets | Skrill, Neteller, POLi (for AUD), PayTrust |

| Fees | No deposit fees on most methods |

| Minimum Deposit | $50 |

Withdrawal Methods

| Method | Details |

|---|---|

| Bank Wire Transfer | Only supported withdrawal method |

| Fees | $25 fee may apply if there is no trading activity |

| Processing Time | 1–5 business days |

Support Service for Customer

AETOS provides multilingual customer support via the following channels:

- Live Chat (24/5)

- Email: cs_markets@aetoscg.com

- Phone: +61(2)99292100 (Australia), +44(0)20810494001 (UK)

- Fax: +61(2)99292055 (Australia), +44(0)2081049401 (UK)

- Social Media: Facebook, Twitter, LinkedIn, Instagram, YouTube

Customer Support Comparison Table

| Support Channel | Availability | Details |

|---|---|---|

| Live Chat | 24/5 | Real-time assistance via website |

| 24/5 | Support through email inquiries | |

| Phone | 24/5 | Direct customer support via telephone |

| Social Media | — | Facebook, Twitter, LinkedIn, Instagram, YouTube |

Prohibited Countries

AETOS, like many other international forex and CFD brokers, is subject to various regulations and licensing requirements that restrict its operations in certain countries and regions. These restrictions are put in place to ensure compliance with local laws, protect consumers, and mitigate potential legal and financial risks for both the broker and its clients.

Reasons for Country Restrictions

- Local regulations: Some countries have strict laws governing online trading activities, requiring brokers to obtain specific licenses or meet certain requirements before offering services to residents.

- Licensing requirements: AETOS may not have the necessary licenses to operate in certain jurisdictions, making it illegal for the broker to solicit clients from those countries.

- Geopolitical factors: Political tensions, economic sanctions, or international trade agreements can also influence a broker's ability to provide services in specific regions.

Prohibited Countries and Regions AETOS does not accept clients from the following countries and regions:

North America

- United States

- Canada

Europe

- Belgium

- France

- Italy

- Netherlands

- Spain

- United Kingdom

Asia

- Hong Kong

- Japan

- Malaysia

- Singapore

Other Regions

- New Zealand

Special Offers for Customers

AETOS occasionally runs promotional offers like:

- Cash Reward Bonus: Up to $3 per lot traded for meeting volume thresholds

- 10.4% Annual Return: On investments during the promotion period

Conclusion

Throughout this comprehensive review of AETOS, I have thoroughly examined various aspects of their operations, including regulatory compliance, trading platforms, account types, customer support, and educational resources. After analysing these factors, I have come to the conclusion that AETOS is a reliable and trustworthy broker that offers a solid trading experience for both beginner and experienced traders.

One of the key strengths of AETOS is their commitment to regulatory compliance. They are regulated by top-tier authorities such as ASIC, which ensures a high level of safety and security for clients' funds. Although their previous FCA license has been cancelled, and they have offshore regulations in Vanuatu, Mauritius, and the Cayman Islands, AETOS still maintains a strong regulatory framework that prioritises the protection of their clients' interests.

AETOS offers a user-friendly and efficient trading environment through their MetaTrader 4 and MetaTrader 5 platforms. These platforms provide a wide range of tools and features that cater to different trading styles and preferences. The broker also offers competitive trading conditions with low minimum deposits, tight spreads, and high leverage options, making it accessible to a broad range of traders.

In terms of customer support, AETOS provides reliable and responsive assistance through various channels, including live chat, email, and phone. Their support team is available 24/5 and is knowledgeable and helpful in addressing clients' queries and concerns. However, it is worth noting that there have been some negative reviews regarding withdrawal delays, which may be a concern for some traders.

AETOS offers a decent selection of educational resources, including market analysis, trading guides, webinars, and video tutorials. While their educational content may not be as extensive as some industry leaders, it still provides a solid foundation for traders to enhance their knowledge and skills.

One area where AETOS could improve is in their offerings for more advanced traders. The broker lacks some of the advanced features and tools that experienced traders may require, such as VPS hosting, algorithmic trading, and social trading capabilities. Additionally, AETOS' geographic restrictions limit their accessibility to traders in certain regions, including the United States, the United Kingdom, and several European and Asian countries.

Despite these limitations, I believe that AETOS is a solid choice for traders who are looking for a reliable and well-regulated broker with competitive trading conditions. Their user-friendly platforms, responsive customer support, and educational resources make them a suitable option for both new and experienced traders.