AMarkets Review 2025: Comprehensive Analysis of the Offshore Forex Broker

AMarkets

Mauritius

Mauritius

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Japan Forex Trading License

Japan Forex Trading License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+443307772222

(English)

+443307772222

(English)

Supported language: Arabic, Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

AMarkets is a forex and CFD broker founded in 2007, offering trading on assets like currencies, commodities, indices, and cryptocurrencies. It provides access to MT4, MT5, and a web-based platform with competitive spreads and fast execution. The broker has a minimum deposit of $100 and offers various account types, including fixed and ECN options. While AMarkets is not regulated by top-tier authorities like the FCA, it operates under The Financial Commission, providing client protection and dispute resolution. It is known for its high leverage, copy trading services, and strong customer support.

- AMarkets offers a wide range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies.

- The broker provides competitive trading conditions with tight spreads, low commissions, and high leverage.

- AMarkets offers the industry-standard MetaTrader 4 and MetaTrader 5 platforms, along with a proprietary mobile app.

- The broker prioritizes client satisfaction with 24/7 multilingual support and multiple communication channels.

- AMarkets provides a comprehensive suite of educational resources, including webinars, tutorials, and market analysis.

- The broker offers attractive promotions, bonuses, and loyalty programs to reward both new and existing clients.

- AMarkets supports a range of account types, catering to diverse trader needs and preferences.

- The broker demonstrates a commitment to transparency and adheres to international standards.

- AMarkets provides negative balance protection and segregates client funds for added security.

- The broker offers a user-friendly copy trading platform, allowing novice traders to learn from experienced professionals.

- AMarkets is regulated by offshore authorities, which may not provide the same level of oversight as top-tier regulators.

- The high leverage offered by the broker can amplify both profits and losses, presenting a risk for inexperienced traders.

- Some payment methods may incur withdrawal fees, which can impact overall profitability.

- The broker's educational resources, while comprehensive, could be further expanded to cater to more advanced traders.

- AMarkets' offshore regulatory status may be a concern for some traders, emphasizing the need for thorough due diligence.

- The broker's range of tradable assets, while extensive, may not include some niche instruments sought by specific traders.

- AMarkets' promotions and bonuses come with specific terms and conditions that may not suit all trading styles.

- The broker's copy trading platform, while beneficial for novice traders, may not provide the same level of customization as other social trading platforms.

- AMarkets' customer support, although responsive, may experience delays during peak trading hours.

- The broker's proprietary mobile app, while user-friendly, may not offer the same depth of features as the MetaTrader platforms.

Overview

AMarkets, founded in 2007, is an international forex and CFD broker providing services to clients worldwide. Regulated by the Financial Services Commission (FSC) in the Cook Islands, the Financial Services Authority (FSA) in Saint Vincent and the Grenadines, and the Mwali International Services Authority (MISA) in Comoros, AMarkets offers a wide range of trading instruments including forex, stocks, indices, commodities, and cryptocurrencies.

With a focus on cutting-edge technology, AMarkets provides traders access to popular platforms such as MetaTrader 4, MetaTrader 5, and a proprietary AMarkets App. The broker offers multiple account types catering to various trading styles and experience levels, including Standard, ECN, Fixed, and Crypto accounts. High leverage up to 1:3000 is available, along with competitive spreads starting from 0 pips on ECN accounts.

AMarkets emphasizes a client-centric approach, delivering fast order execution, a diverse range of deposit and withdrawal options, and 24/7 customer support. The broker's commitment to excellence has been recognized through numerous industry awards. However, potential traders should be aware of the risks associated with high leverage and the broker's offshore regulatory status.

For more information about AMarkets' services, trading conditions, and latest promotions, visit their official website at amarkets.com.

Overview Table

| Attribute | Details |

|---|---|

| Broker Name | AMarkets |

| Founded | 2007 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulation | FSC (Cook Islands), FSA (SVG), MISA (Comoros) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, AMarkets App |

| Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Standard, ECN, Fixed, Crypto |

| Minimum Deposit | $100 (Standard, Fixed); $200 (ECN, Crypto) |

| Leverage | Up to 1:3000 |

| Spread | From 0 pips (ECN) |

| Commission | $2.5 per lot per side (ECN) |

| Customer Support | 24/7 via live chat, email, and phone |

Facts List

- AMarkets has been operating in the forex and CFD market since 2007, providing services to clients worldwide.

- The broker is regulated by the FSC (Cook Islands), FSA (Saint Vincent and the Grenadines), and MISA (Comoros).

- AMarkets offers a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies.

- Traders can access popular platforms such as MetaTrader 4, MetaTrader 5, and the proprietary AMarkets App.

- The broker provides multiple account types, including Standard, ECN, Fixed, and Crypto accounts, catering to various trading styles and experience levels.

- High leverage up to 1:3000 is available, allowing traders to amplify their market exposure.

- ECN accounts offer competitive spreads starting from 0 pips, with a commission of $2.5 per lot per side.

- AMarkets provides fast order execution with an average speed of 35-50 ms, suitable for high-frequency and scalping strategies.

- The broker supports various deposit and withdrawal options, including credit/debit cards, e-wallets, and cryptocurrencies.

- 24/7 customer support is available via live chat, email, and phone, ensuring traders can access assistance when needed.

AMarkets Licenses and Regulatory

AMarkets operates under the regulatory oversight of several financial authorities, ensuring compliance with industry standards and providing a level of protection for clients' funds. The broker holds licenses from the Financial Services Commission (FSC) in the Cook Islands, the Financial Services Authority (FSA) in Saint Vincent and the Grenadines, and the Mwali International Services Authority (MISA) in Comoros.

| Regulatory Authority | Jurisdiction | Notes |

|---|---|---|

| Financial Services Commission (FSC) | Cook Islands | |

| Financial Services Authority (FSA) | Saint Vincent and the Grenadines | |

| Mwali International Services Authority (MISA) | Comoros | |

| The Financial Commission | Independent | Certified member of this self-regulatory organization |

In comparison to industry standards, AMarkets' regulatory framework is on par with many other offshore-regulated brokers. However, traders who prioritize working with a broker regulated by a top-tier authority may prefer to explore other options. As with any financial decision, it is essential to conduct thorough research and consider one's individual needs and risk tolerance before choosing a broker.

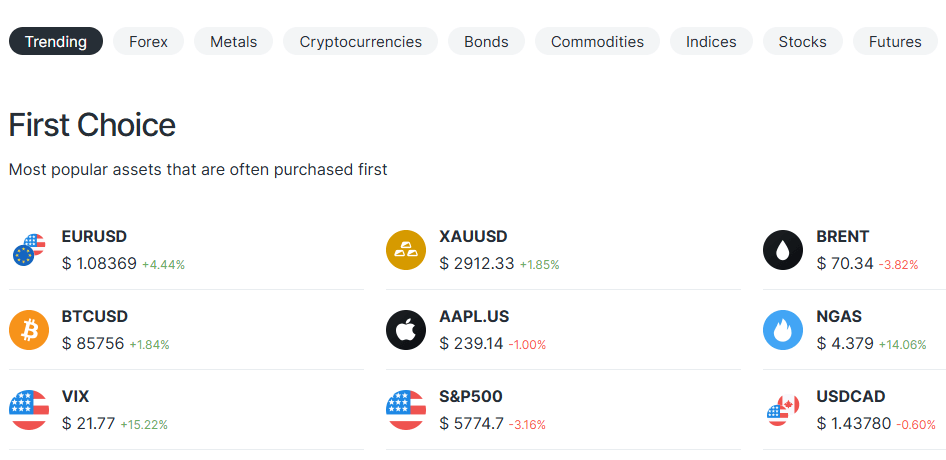

Trading Instruments

AMarkets offers a wide range of tradable assets, catering to the diverse needs and preferences of traders worldwide. The broker provides access to over 500 instruments across multiple asset classes, allowing clients to build diversified portfolios and take advantage of various market opportunities.

| Asset Class | Instruments / Count | Key Features & Examples |

|---|---|---|

| Forex | 48 currency pairs | Includes majors, minors, and exotics; spreads from 0.3 pips; leverage up to 1:3000; e.g., EUR/USD, GBP/USD, USD/JPY, USD/CHF |

| Stocks | Over 460 stock CFDs | Global access from major exchanges (US, UK, France, Germany, Italy); e.g., Apple, Amazon, Facebook, Tesla; competitive spreads and flexible margin requirements |

| Indices | 16 index CFDs | Exposure to major global markets; e.g., S&P 500, NASDAQ, FTSE 100, DAX 30, Nikkei 225 |

| Commodities | 18 commodity CFDs | Covers precious metals, energies, and agricultural products; e.g., gold, silver, WTI crude oil, natural gas, wheat, cotton; competitive spreads and high leverage |

| Cryptocurrencies | 29 cryptocurrency pairs | Access to popular digital assets; e.g., Bitcoin, Ethereum, Litecoin, Ripple; high leverage and competitive spreads |

| Bonds | 2 bond CFDs | Exposure to government debt; e.g., US 10-Year Treasury Notes, German Bunds |

| ETFs | Selection of ETF CFDs | Gain exposure to entire market sectors or asset classes with one instrument; e.g., SPY (S&P 500), QQQ (NASDAQ 100), GLD (Gold) |

In comparison to industry standards, AMarkets' extensive range of tradable assets is highly competitive. The broker's offerings surpass those of many other CFD providers, particularly in terms of the number of stock CFDs and cryptocurrency pairs available. This diverse selection of instruments allows traders to create well-rounded portfolios and take advantage of opportunities across various markets.

Trading Platforms

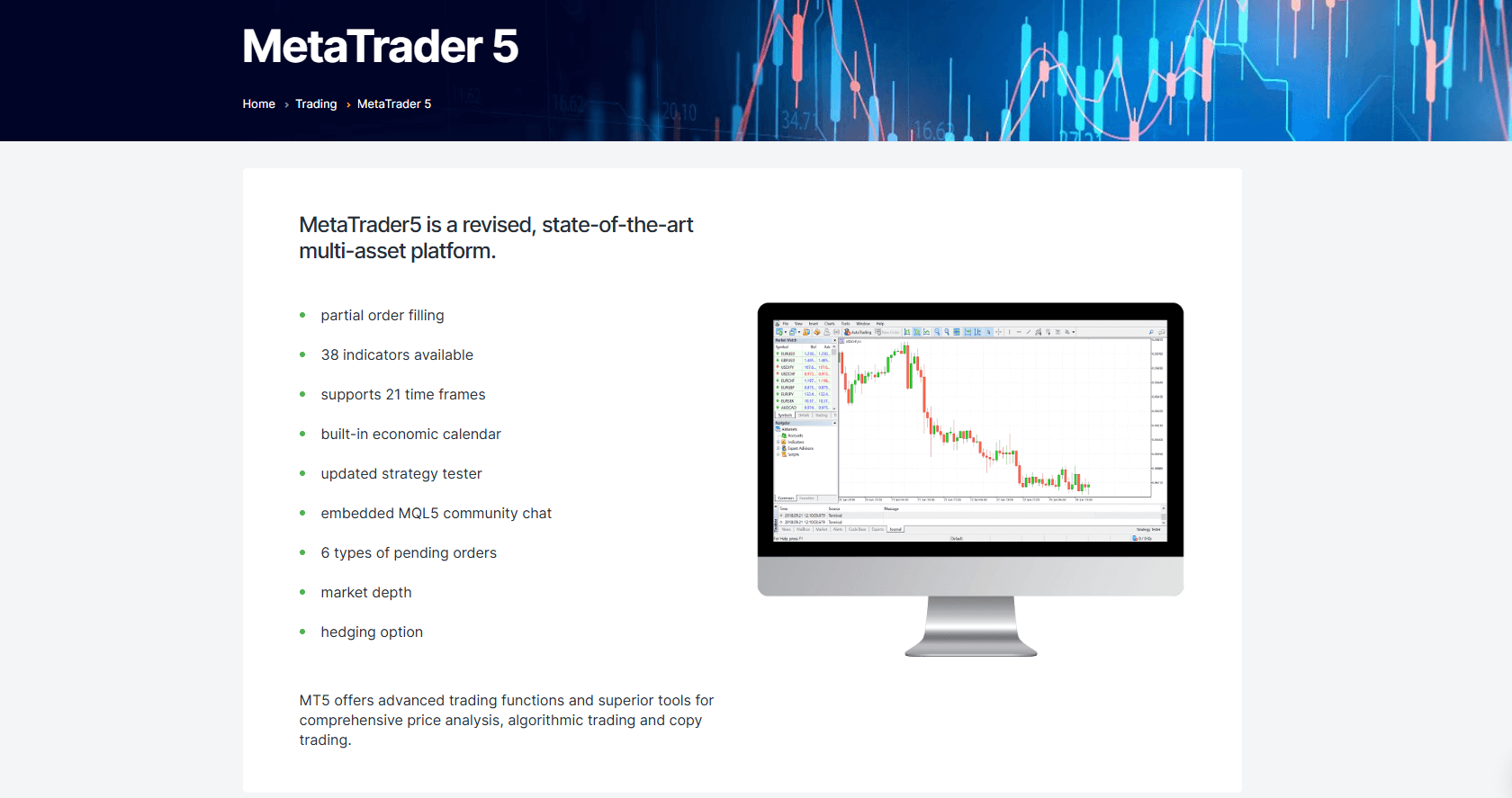

AMarkets offers a range of trading platforms to cater to the diverse needs and preferences of traders, ensuring a seamless and efficient trading experience. The broker provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, along with a proprietary AMarkets App for mobile trading.

| Platform | Description & Key Features |

|---|---|

| MetaTrader 4 (MT4) | Widely used for its user-friendly interface and advanced charting tools. Offers extensive customization, a wide range of technical indicators, expert advisors (EAs), and automated trading capabilities. Accessible on desktop, web, and mobile platforms for flexibility. |

| MetaTrader 5 (MT5) | Successor to MT4 with enhanced features and functionality. Provides access to a broader range of markets including stocks and commodities, advanced risk management tools, additional order types, and a built-in economic calendar. Supports algorithmic trading, making it a powerful choice for experienced traders. |

| AMarkets App | A proprietary mobile trading application designed for on-the-go access. Features a user-friendly interface, real-time quotes, and the ability to place trades directly from charts. Also offers market analysis, educational resources, and account management functions. Available on both iOS and Android devices. |

| Web Trading | A web-based trading platform accessible via modern browsers. Offers a streamlined trading experience with essential features such as real-time quotes, interactive charts, and one-click trading—ideal for traders who prefer not to download additional software. |

| Copy Trading | Enables users to automatically mirror the trades of successful traders. Particularly useful for novice traders seeking to learn from professionals or those preferring a more passive approach to trading. |

The availability of multiple trading platforms demonstrates AMarkets' commitment to providing clients with flexibility and choice. By offering both industry-standard and proprietary platforms, the broker ensures that traders can select the tools that best suit their needs and preferences.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | AMarkets App | Web Platform |

|---|---|---|---|---|

| Customizable interface | ✓ | ✓ | ✓ | ✓ |

| Real-time quotes | ✓ | ✓ | ✓ | ✓ |

| Interactive charts | ✓ | ✓ | ✓ | ✓ |

| Technical indicators | 30 | 38 | ✓ | ✓ |

| Expert Advisors (EAs) | ✓ | ✓ | - | - |

| Automated trading | ✓ | ✓ | - | - |

| Mobile trading | ✓ | ✓ | ✓ | - |

| Web trading | ✓ | ✓ | - | ✓ |

| Algorithmic trading | - | ✓ | - | - |

| Built-in economic calendar | - | ✓ | - | - |

| Multiple order types | ✓ | ✓ | ✓ | - |

| One-click trading | ✓ | ✓ | ✓ | ✓ |

| Copy trading | - | ✓ | - | - |

| Market analysis | - | - | ✓ | - |

| Educational resources | - | - | ✓ | - |

| Account management | ✓ | ✓ | ✓ | ✓ |

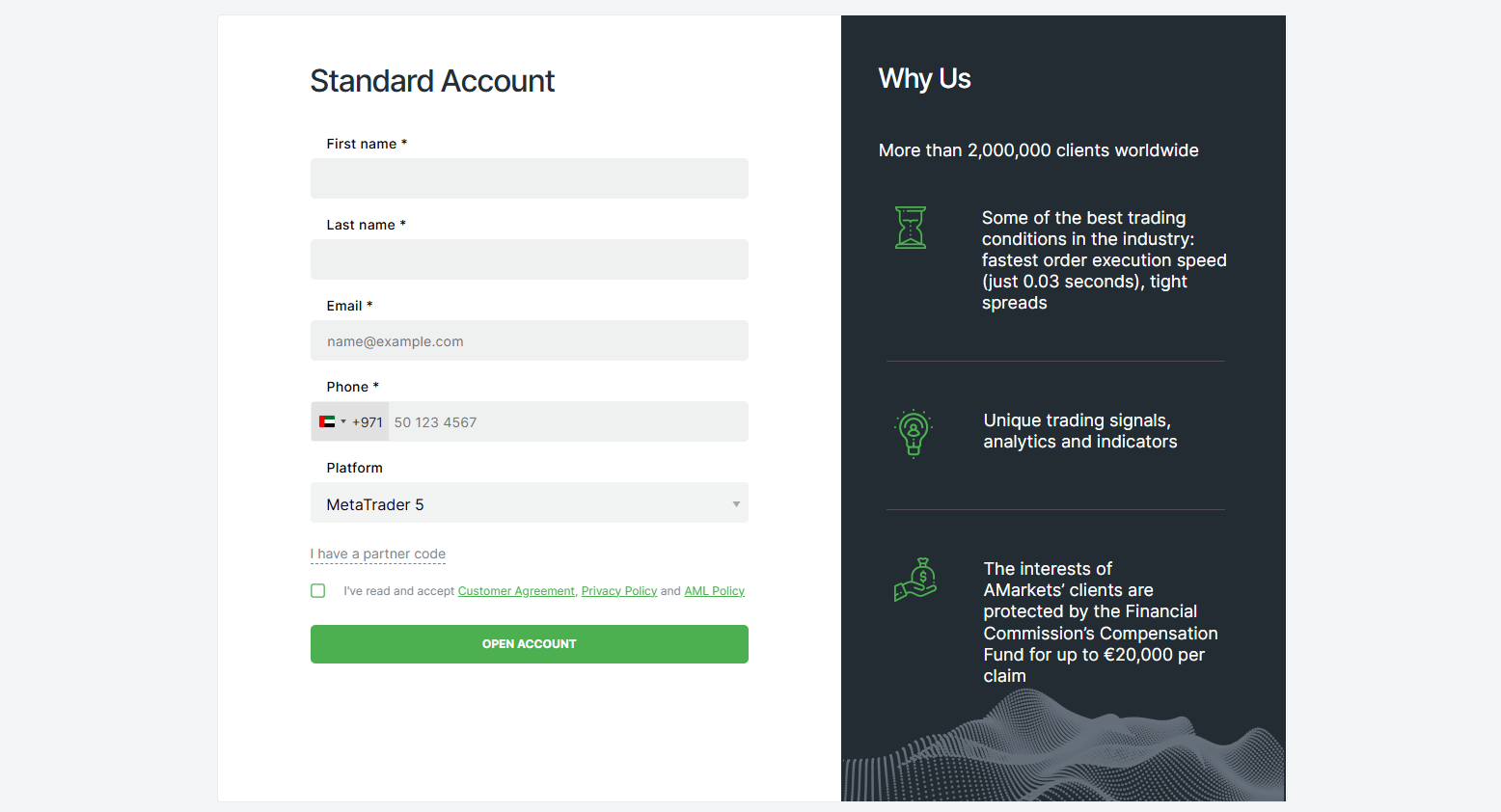

AMarkets How to Open an Account: A Step-by-Step Guide

Opening an account with AMarkets is a straightforward and user-friendly process designed to help traders start their journey in the financial markets quickly and efficiently. This step-by-step guide will walk you through the account opening process, outlining the requirements, accepted payment methods, and unique features offered by AMarkets.

Account Types and Minimum Deposit

AMarkets offers four main account types to cater to the needs of different traders:

- Standard Account: Minimum deposit of $100

- ECN Account: Minimum deposit of $200

- Fixed Account: Minimum deposit of $100

- Crypto Account: Minimum deposit of $10 (in Bitcoin)

Requirements for Opening an Account

To open an account with AMarkets, you will need to provide the following information and documents:

- Personal details: Full name, date of birth, country of residence, and contact information

- Proof of identity: A valid government-issued ID, such as a passport or driver's license

- Proof of address: A utility bill, bank statement, or any other official document confirming your residential address (issued within the last three months)

Account Registration Process

- Visit the AMarkets website at amarkets.com and click on the "Open an Account" button.

- Select your preferred account type (Standard, ECN, Fixed, or Crypto) and fill in the required personal information.

- Choose your base currency and provide the necessary identification documents (proof of identity and address).

- Read and accept the terms and conditions, privacy policy, and risk disclosure statement.

- Submit your application and wait for the account verification process to be completed (usually within 24 hours).

Unique Features

AMarkets offers several unique features and benefits to streamline the account opening process:

- Quick and easy online registration

- Multiple account types to suit different trading styles and preferences

- Low minimum deposit requirements, starting from just $10 (for Crypto accounts)

- Wide range of payment methods, including credit/debit cards, e-wallets, and cryptocurrencies

- Fast account verification, typically completed within 24 hours

Payment Methods and Processing Times

AMarkets accepts the following payment methods for account funding:

- Credit/debit cards (Visa, Mastercard): Instant processing

- E-wallets (Skrill, Neteller, WebMoney): Instant processing

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin): 1-3 hours processing time

- Bank wire transfer: 3-5 business days processing time

Once your account is funded, you can start trading on AMarkets' platforms immediately. The broker's wide range of payment options and quick processing times ensure that traders can begin their trading journey without delay.

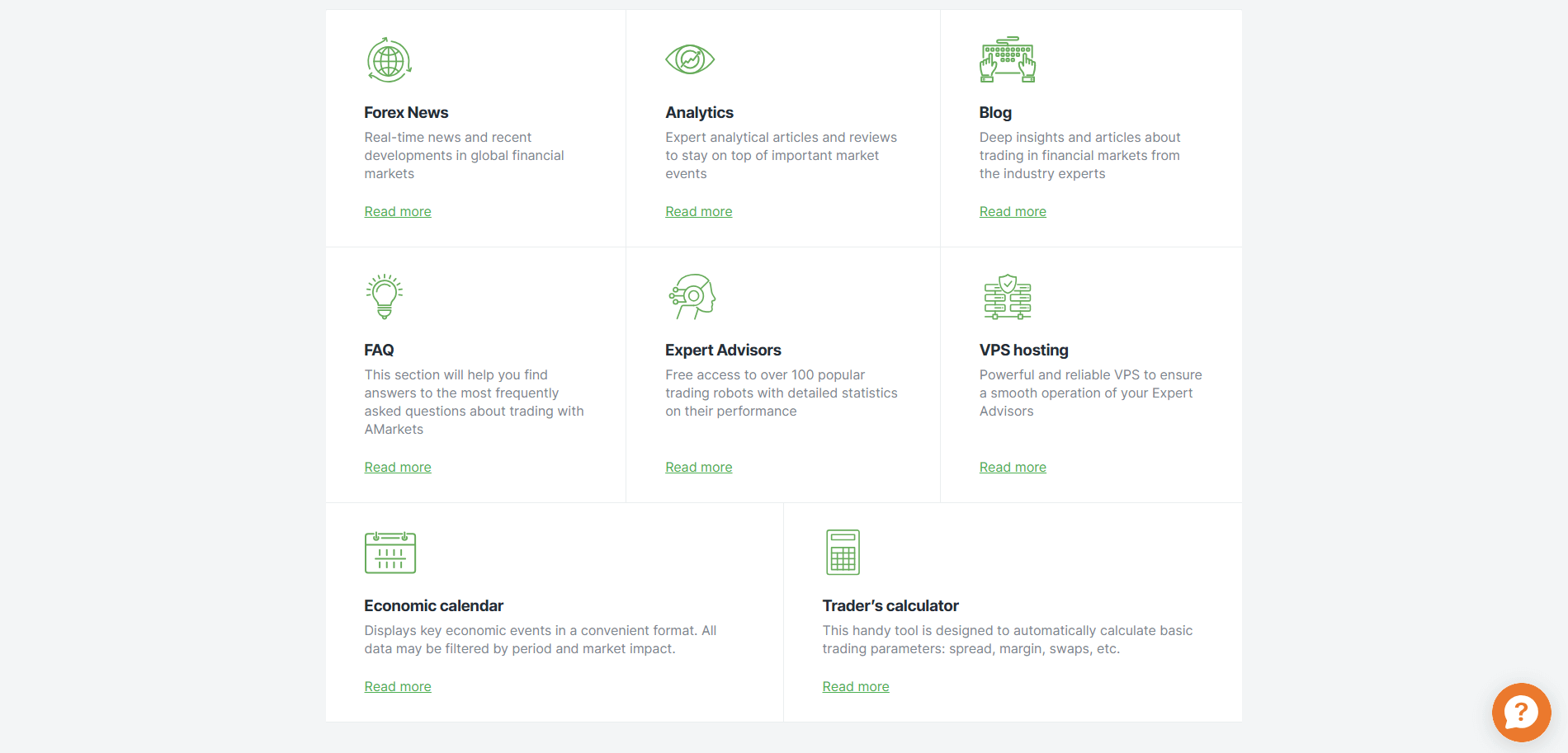

Charts and Analysis

AMarkets provides a comprehensive suite of educational trading resources and tools designed to support traders in making informed decisions and enhancing their trading skills. The broker offers a diverse range of materials, including charts, analysis tools, economic calendars, webinars, downloadable PDFs, market news updates, and blog articles.

| Feature | Description | Key Elements |

|---|---|---|

| Charts & Technical Analysis Tools | Advanced charting capabilities are available on MetaTrader 4 and MetaTrader 5 platforms that enable in-depth market analysis. | Multiple chart types (candlestick, bar, line), over 50 built-in technical indicators, drawing tools |

| Economic Calendar | A detailed economic calendar is provided on the AMarkets website that informs traders about upcoming economic events and data releases that may impact financial markets. | Important events, expected impact, previous and forecasted values |

| Webinars & Educational Videos | A range of webinars and educational videos covering various trading topics, catering to both beginners and experienced traders. | Topics include market analysis, trading psychology, risk management; regular sessions |

| Downloadable PDFs & Guides | A collection of downloadable PDFs and guides is available on the website, offering detailed tutorials and strategies for trading. | Platform tutorials, trading strategies, market analysis, step-by-step instructions |

| Market News & Analysis | Regular market news updates and analysis are provided through the AMarkets blog and news section, offering insights on current market trends and trading opportunities. | Expert insights, current market trends, economic events, trading opportunities |

AMarkets' commitment to providing a diverse range of educational resources demonstrates the broker's dedication to supporting its clients in their trading journey. By offering a mix of interactive tools, such as webinars and videos, alongside self-paced learning materials like PDFs and guides, AMarkets caters to the varied learning preferences of its clientele.

In comparison to industry standards, AMarkets' educational offerings are competitive and comprehensive. The broker's focus on providing a well-rounded selection of resources positions it as a strong choice for traders seeking to enhance their knowledge and skills.

AMarkets Account Types

AMarkets offers a diverse range of trading account options designed to cater to the needs of various types of traders, from beginners to experienced professionals. The broker provides four main account types: Standard, Fixed, ECN, and Crypto, each with unique features and benefits.

Standard Account

- Minimum Deposit: $100

- Spreads: Floating, from 1.3 pips

- Leverage: Up to 1:3000

- Commission: None

- Execution Type: Instant & Market

- Trading Instruments: Currencies, stock & commodity assets, cryptocurrencies

- Additional Features: Suitable for both beginners and experienced traders

Fixed Account

- Minimum Deposit: $100

- Spreads: Fixed, from 3 pips

- Leverage: Not specified

- Commission: None

- Execution Type: Instant & Market*

- Trading Instruments: Currencies, stock & commodity assets, cryptocurrencies

- Additional Features: Ideal for position traders valuing consistent trading costs

ECN Account

- Minimum Deposit: $200

- Spreads: From 0 pips

- Leverage: Not specified

- Commission: $2.5 per lot per side

- Execution Type: Fast and efficient

- Trading Instruments: Full range of trading instruments

- Additional Features: Designed for professional and high-frequency traders

Crypto Account

- Minimum Deposit: $10 (in Bitcoin)

- Spreads: Floating, from 1.3 pips

- Leverage: Not specified

- Commission: None

- Execution Type: Instant & Market*

- Trading Instruments: Same as other accounts

- Additional Features: Caters to traders preferring cryptocurrency deposits and trades

Demo Account

- Minimum Deposit: N/A

- Spreads: N/A

- Leverage: N/A

- Commission: N/A

- Execution Type: Simulated trading

- Trading Instruments: Virtual access to full range of instruments (demo mode only)

- Additional Features: Ideal for practicing strategies without risking real funds

AMarkets' diverse account types demonstrate the broker's commitment to accommodating the varied needs of its clientele. By offering competitive spreads, flexible leverage options, and a choice between floating and fixed spreads, AMarkets ensures that traders can select an account type that aligns with their trading style and risk tolerance.

The availability of a Crypto account sets AMarkets apart from many competitors, as it provides a convenient entry point for traders looking to capitalize on the growing cryptocurrency market. Furthermore, the demo account option allows traders to practice and refine their strategies without risk, enhancing the overall trading experience.

Account Types Comparison Table

| Feature | Standard | Fixed | ECN | Crypto |

|---|---|---|---|---|

| Minimum Deposit | $100 | $100 | $200 | $10 (in BTC) |

| Spread | Floating from 1.3 pips | Fixed from 3 pips | Floating from 0 pips | Floating from 1.3 pips |

| Commission | No | No | $2.5 per lot per side | No |

| Leverage | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 | Up to 1:500 |

| Execution Type | Instant & Market | Instant & Market | Market | Market |

| Instruments | Currencies, Stocks, Commodities, Crypto | Currencies, Stocks, Commodities, Crypto | Currencies, Stocks, Commodities, Crypto | Currencies, Stocks, Commodities, Crypto |

| Stop Out Level | 20% | 20% | 40% | 20% |

| Account Currency | USD, EUR | USD, EUR | USD, EUR | BTC, USD |

Negative Balance Protection

AMarkets applies negative balance protection to all trading accounts, regardless of the account type or trading platform used. If a trader's account balance falls below zero due to trading losses, AMarkets will absorb the negative balance, effectively resetting the account balance to zero. It is important to note that negative balance protection does not waive any obligations related to margin requirements or margin calls. Traders are still responsible for maintaining sufficient margin in their accounts and may face margin calls or position closures if they fail to do so.

Terms and Conditions

While AMarkets offers negative balance protection, traders should be aware of the following terms and conditions:- Negative balance protection applies only to trading losses and does not cover other account-related fees or charges.

- In the event of a negative balance, AMarkets reserves the right to investigate the circumstances leading to the negative balance and may take appropriate action if any abuse or manipulation is suspected.

- Negative balance protection does not excuse traders from their responsibility to manage risk and maintain sufficient margin in their accounts.

AMarkets Deposits and Withdrawals

AMarkets offers a wide range of deposit and withdrawal options to facilitate convenient and secure transactions for its clients. The broker supports various payment methods, ensuring that traders can easily fund their accounts and withdraw their profits.

Deposit Options

AMarkets accepts the following deposit methods:| Payment Method | Processing Time | Minimum Deposit | Fees | Additional Notes |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | $10 | No fees | Immediate funding for trading |

| E-wallets (Skrill, Neteller, WebMoney) | Instant | $10 | No fees | Quick access to funds |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin) | 1-3 hours | $10 worth of the respective cryptocurrency | No fees | Convenient for traders using digital assets |

| Bank Wire Transfer | 3-5 business days | $100 | No fees charged by AMarkets; bank fees may apply | Outgoing wire transfer fees may be charged by the trader’s bank |

Withdrawal Options

AMarkets offers the following withdrawal methods:| Payment Method | Processing Time | Minimum Withdrawal | Fee | Additional Notes |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1-5 business days | $50 | 1.8% | |

| E-wallets (Skrill, Neteller, WebMoney) | 1-2 business days | $20 | 0.5% | |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin) | 1-3 hours | $20 worth of the respective cryptocurrency | 0.5% to 1% | |

| Bank Wire Transfer | 3-5 business days | $500 | No fees (AMarkets); bank fees may apply | Incoming wire transfer fees may be charged by the trader’s bank |

Verification Requirements and Processing Times

To ensure the security of clients' funds and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, AMarkets requires traders to complete a verification process before withdrawing funds. This process typically involves submitting proof of identity and proof of address. The verification process usually takes 1-2 business days to complete. Once a trader's account is verified, subsequent withdrawals will be processed according to the timeframes mentioned above.Unique Features

One of the standout features of AMarkets' deposit and withdrawal process is the support for a wide range of cryptocurrencies. This sets the broker apart from many competitors and provides a convenient option for traders who prefer to use digital assets. Additionally, AMarkets' instant processing for credit/debit card and e-wallet deposits allows traders to quickly fund their accounts and start trading without delay.Support Service for Customer

Reliable customer support is a crucial aspect of the trading industry, as it directly impacts a trader's experience and confidence in their chosen broker. AMarkets recognizes the importance of providing excellent customer support and offers several channels through which traders can reach out for assistance.

Support Channels

AMarkets provides the following customer support channels:

| Payment Method | Processing Time | Minimum Withdrawal | Fee | Additional Notes |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1-5 business days | $50 | 1.8% | |

| E-wallets (Skrill, Neteller, WebMoney) | 1-2 business days | $20 | 0.5% | |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin) | 1-3 hours | $20 worth of the respective cryptocurrency | 0.5% to 1% | |

| Bank Wire Transfer | 3-5 business days | $500 | No fees (AMarkets); bank fees may apply | Incoming wire transfer fees may be charged by the trader’s bank |

Support Languages

AMarkets offers customer support in multiple languages, ensuring that traders from various regions can communicate effectively with the support team. The available support languages include:

- English

- Russian

- Arabic

- Chinese

- Spanish

24/7 Support and Response Times

One of the standout features of AMarkets' customer support is the availability of 24/7 assistance through live chat and phone. This commitment to round-the-clock support demonstrates the broker's dedication to serving traders in different time zones and ensuring that help is always available when needed.

AMarkets strives to provide prompt responses to all customer inquiries. The average response times for each support channel are as follows:

- Live Chat: Instant response

- Email: Within 24 hours

- Phone: Immediate response

- Social Media: Within 24 hours

While these response times are not guaranteed, AMarkets has a strong track record of providing timely and efficient support to its clients.

In comparison to industry standards, AMarkets' customer support offering is competitive and comprehensive. The availability of 24/7 support through multiple channels sets the broker apart from many competitors who may have limited support hours or fewer communication options.

The multi-lingual support is another advantage, as it caters to a diverse international client base and ensures that language barriers do not hinder traders from receiving the assistance they need.

Customer Support Comparison Table

| Feature | Details |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media |

| Support Languages | English, Russian, Arabic, Chinese, Spanish |

| 24/7 Support | Yes (Live Chat and Phone) |

| Average Response Time - Live Chat | Instant |

| Average Response Time - Email | Within 24 hours |

| Average Response Time - Phone | Immediate |

| Average Response Time - Social Media | Within 24 hours |

Prohibited Countries

AMarkets operates in accordance with international regulations and licensing requirements. As a result, there are certain countries and regions where the broker is not permitted to offer its services. It is essential for traders to be aware of these restrictions to avoid any potential legal issues or risks associated with attempting to trade from a prohibited jurisdiction.

Reasons for Restrictions

The primary reasons behind country-specific restrictions include:

- Local Regulations: Some countries have strict regulations governing the operation of online trading platforms. These regulations may require brokers to obtain specific licenses or adhere to particular guidelines, which can be challenging or impractical for international brokers like AMarkets.

- Licensing Requirements: Each jurisdiction has its own set of licensing requirements for financial service providers. Obtaining and maintaining these licenses can be a complex and costly process, leading some brokers to focus on specific regions where they have already secured the necessary licenses.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors can also influence a broker's decision to restrict services in certain countries. These factors can create additional risks for both the broker and its clients.

Consequences of Trading from Prohibited Countries

Attempting to trade with AMarkets from a prohibited country can result in several consequences:

- Account Closure: If AMarkets detects that a trader is accessing its platform from a prohibited country, the broker may immediately close the account and terminate the trading relationship.

- Funds Forfeiture: In some cases, traders may face the risk of having their funds frozen or forfeited if they are found to be trading from a prohibited jurisdiction.

- Legal Ramifications: Trading from a prohibited country may violate local laws and regulations, potentially exposing traders to legal consequences in their home jurisdiction.

It is crucial for traders to comply with the restrictions imposed by AMarkets and to only access the broker's services from permitted regions.

List of Prohibited Countries

AMarkets does not offer services to clients from the following countries and regions:

- United States of America

- Canada

- Japan

- Australia

- New Zealand

- Belgium

- Israel

- Palestine

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- The United Kingdom (UK)

- All countries in the European Union (EU)

- All countries in the European Economic Area (EEA)

- All countries in the European Free Trade Association (EFTA)

Special Offers for Customers

AMarkets offers a range of enticing promotional offers and bonuses to both new and existing clients, aimed at enhancing their trading experience and providing additional value. These special offers include welcome bonuses, loyalty programs, trading competitions, and partnerships with third-party service providers.

| Feature | Description | Key Details |

|---|---|---|

| Welcome Bonus | New traders receive a bonus on their first deposit. | Up to 100% bonus depending on account type and deposit amount (e.g., 20% bonus for a $500 deposit in Standard, 50% bonus for a $2,000 deposit in ECN). Trading volume requirement: 10,000 USD per 1 USD bonus within 30 days. |

| Loyalty Program | Rewards loyal clients based on their trading activity. | Earn loyalty points per trade based on volume, instrument, and account type. Benefits include reduced spreads, cashback rewards, priority support, VIP event invitations, and premium educational resources. |

| Trading Competitions | Regular contests allow traders to showcase their skills and compete for prizes. | Competitions often follow a leaderboard format with metrics like trading volume or profitability. Prizes include cash rewards, trading bonuses, luxury items, or all-expenses-paid trips. |

| Autochartist Partnership | Exclusive access to advanced market insights through a partnership with Autochartist. | Provides automated chart pattern recognition, volatility analysis, and key level identification, enhancing traders' technical analysis capabilities. |

The integration of Autochartist within the AMarkets trading platform allows traders to make informed decisions based on real-time market analysis and actionable trading opportunities. This value-added service sets AMarkets apart from competitors and demonstrates the broker's commitment to empowering its clients with cutting-edge trading tools.

Conclusion

Throughout this comprehensive review of AMarkets, I have conducted an in-depth analysis of their operations, focusing on crucial aspects such as regulatory compliance, trading conditions, platform offerings, customer support, and special promotions. By consolidating the findings and insights gathered, I aim to provide a cohesive summary that addresses AMarkets' safety, reliability, and overall reputation as a broker.

One of the primary considerations when evaluating a broker is their regulatory compliance. AMarkets operates under the oversight of several financial authorities, including the Financial Services Commission (FSC) in the Cook Islands, the Financial Services Authority (FSA) in Saint Vincent and the Grenadines, and the Mwali International Services Authority (MISA) in Comoros. While these regulatory bodies may not be considered top-tier, AMarkets has demonstrated a commitment to transparency and adherence to international standards. Their segregation of client funds and negative balance protection further bolster client security.

In terms of trading conditions, AMarkets offers a competitive environment with a wide range of tradable assets, flexible account types, and attractive spreads. The broker's ECN account, with spreads starting from 0 pips and low commissions, is particularly well-suited for active traders seeking cost-effective trading. The availability of high leverage, up to 1:3000, can be advantageous for experienced traders but also underscores the importance of responsible risk management.

AMarkets' platform offerings, including the industry-standard MetaTrader 4 and MetaTrader 5, along with their proprietary AMarkets App, cater to the diverse needs and preferences of traders. The platforms' advanced charting tools, automated trading capabilities, and user-friendly interfaces provide a seamless trading experience. The broker's copy trading platform is an attractive feature for novice traders looking to learn from experienced professionals.

Customer support is another area where AMarkets shines, with their 24/7 availability, multiple communication channels, and multilingual assistance. The broker's commitment to providing prompt and reliable support instills confidence in their clients and demonstrates a client-centric approach.

AMarkets' range of special offers and promotions, including welcome bonuses, loyalty programs, and trading competitions, adds an extra layer of value for both new and existing clients. However, it is essential for traders to carefully review the terms and conditions associated with these offers to ensure they align with their trading style and expectations.

While AMarkets has numerous strengths, it is crucial to consider the potential drawbacks of their offshore regulatory status. Traders should assess their risk tolerance and conduct thorough due diligence before choosing any broker. Additionally, while AMarkets' educational resources are comprehensive, there is always room for improvement in terms of depth and variety.

In conclusion, AMarkets presents itself as a reliable and reputable broker, offering a well-rounded trading experience with competitive conditions, advanced platforms, and responsive customer support. Their commitment to client satisfaction, combined with their range of account types and tradable assets, makes them a strong contender in the online brokerage space. However, as with any financial decision, traders should carefully evaluate their individual needs and risk tolerance before selecting a broker.

Discover micro-lot brokers in the micro-account list.

See social-trading tools in the GVD Markets review.