Alpari Review 2025: Is it Safe or Scam?

Alpari

Mauritius

Mauritius

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+442045771951

(English)

+442045771951

(English)

Supported language: Chinese (Simplified), English, French, Indonesian, Portuguese, Russian, Spanish, Vietnamese

Social Media

Summary

Alpari is a global online forex and CFD broker offering a variety of trading instruments, including currencies, commodities, and indices. Founded in 1998, the company is regulated by the Financial Services Commission (FSC) of Mauritius. Alpari provides a range of account types and trading platforms, catering to both beginners and experienced traders. With a focus on competitive spreads, advanced trading tools, and educational resources, Alpari aims to deliver a comprehensive trading experience.

- Competitive ECN trading conditions with tight spreads and low commissions

- Robust MetaTrader 4 and 5 platforms with Autochartist integration

- Wide range of tradable assets, including forex, commodities, indices, and cryptocurrencies

- Strong customer support with 24/5 availability in multiple languages

- Extensive educational resources, particularly for newer traders

- PAMM accounts and social trading options for flexible investing

- FinaCom compensation fund membership for added trader protection

- Fast account opening process and variety of payment methods

- Loyalty program and other promotions for active traders

- Long operational history dating back to 1998

- Lacks regulatory licenses from top-tier authorities like FCA or ASIC

- High number of recent client complaints noted by WikiFX

- Some restrictions on clients from certain countries

- Educational resources could benefit from more interactive elements

- Relatively high minimum deposit for Pro ECN accounts compared to some brokers

- Limited range of trading platforms beyond MT4/MT5

- Doesn't offer traditional instruments like stocks or ETFs

- Potential fees from payment providers for deposits/withdrawals

- Bonuses and promotions come with high trading volume requirements

- Alpari website lacks some key information like specific regulatory license numbers

Overview

Established in 1998, Alpari has grown into a global online trading broker, serving over 2 million clients in 150 countries. With headquarters in Mauritius and offices spanning Europe and Asia, Alpari has built a solid reputation as a trusted provider of forex, metals, commodities, indices, cryptos and stock CFD trading.

Alpari's longevity in the competitive online brokerage space is a testament to its commitment to quality service. While not without some complaints, as noted by WikiFX, Alpari has generally maintained the trust of its large client base over more than two decades.

Key strengths include tight spreads starting from 0 pips and low commissions on ECN accounts, maximum leverage up to 1:3000, a wide range of assets and account types, and a choice of powerful trading platforms, including MetaTrader 4, MetaTrader 5, and proprietary mobile apps. Alpari also offers appealing features like PAMM copy trading accounts from $100, a loyalty program for active traders, and fast client onboarding.

However, potential drawbacks to consider include Alpari's limited regulatory oversight from developing country authorities, a relative lack of educational resources for beginners, and restrictions on clients from major markets like the US, UK and Canada.

While Alpari presents an appealing option for many online traders, especially those seeking ECN trading conditions, prudent due diligence remains essential. Clients should carefully assess Alpari's offerings against their individual trading goals, experience level and risk tolerance. Visit Alpari's official website for more details on account types, platforms, fees and terms of service.

Overview Table

| Feature | Details |

|---|---|

| Broker Name | Alpari |

| Founded | 1998 |

| Headquarters | Mauritius |

| Regulation | MISA (Comoros), FSC (Mauritius) |

| Client Base | Over 2 million globally |

| Instruments | Forex, Metals, Commodities, Indices, Cryptos, Stocks |

| Platforms | MetaTrader 4, MetaTrader 5, Proprietary Mobile |

| Account Types | Pro ECN, ECN, Standard, Micro, Demo |

| Minimum Deposit | $100 - $500 (based on account type) |

| Maximum Leverage | Up to 1:3000 (1:1000 on Standard) |

| Spreads | From 0 pips on Pro ECN |

| Commissions | $25 per million on Pro ECN |

| Unique Features | PAMM accounts from $100, Trader loyalty program |

Facts List

1. Alpari was founded in 1998 and has over 20 years experience as an online forex and CFD broker.

2. Alpari serves more than 2 million clients globally across 150 countries.

3. Alpari offers a wide range of instruments, including 46 forex pairs, 28 cryptos, 5 commodities, 20 indices and 600+ global stocks.

4. Clients can choose from the popular MetaTrader 4 and MetaTrader 5 platforms as well as Alpari's proprietary mobile trading apps.

5. Alpari provides maximum leverage up to 1:3000 on forex, commodities and indices.

6. Minimum deposits range from $100-$500 based on account type, with spreads from 0 pips and commissions from $25 per million Pro ECN accounts.

7. Alpari offers PAMM copy trading accounts with a low minimum investment of just $100.

8. Active traders can qualify for Alpari's 4-tier loyalty program which provides spread discounts and other benefits.

9. Alpari has fast client onboarding and supports a wide range of payment options, including local methods in many markets.

10. Alpari is regulated by developing country authorities in Comoros and Mauritius and does not accept clients from the US, UK, Canada and some other major markets.

Alpari Licenses and Regulatory

Alpari operates under the regulatory oversight of two key authorities: the Mwali International Services Authority (MISA) in the Comoros Islands and the Financial Services Commission (FSC) in Mauritius. While these licenses allow Alpari to offer services to clients in over 150 countries, it's important to note that neither regulator is considered "top-tier" in the strictest sense.

| Regulatory Authority | License Number | Details |

|---|---|---|

| MISA (Comoros) | 002270/1121 | Licensed for "dealing in investments"; mandates segregation of client funds from company capital. |

| FSC (Mauritius) | N/A | Provides regulatory oversight and ensures basic client protections. |

| Financial Commission (FinaCom) | N/A | Voluntary membership for dispute resolution offers up to €20,000 in compensation per case. |

| Top-Tier Regulatory Comparison | N/A | Unlike FCA, ASIC and CySEC ; MISA and FSC have less stringent capital and compliance requirements but still provide basic safeguards. |

Ultimately, while Alpari's regulatory standing may not match that of the most rigorously-overseen brokers, it still provides a basic level of client protection and has a long-standing operational history. As with any broker, traders should carefully consider their individual needs and risk tolerance when assessing the sufficiency of Alpari's regulatory compliance. The inclusion of additional reputable licenses would further boost Alpari's credibility and client trust.

Trading Instruments

Alpari offers a diverse range of tradable assets, allowing clients to build well-rounded portfolios across multiple markets. With over 250 instruments spanning forex, metals, commodities, indices, cryptos, and stocks, Alpari caters to a wide spectrum of trading strategies and risk appetites.

| Asset Class | Details |

|---|---|

| Forex | Over 50+ currency pairs, including majors (EUR/USD, GBP/USD), minors (EUR/GBP, USD/CAD), and exotics (USD/RUB, USD/MXN). - Spreads from 0.1 pips in ECN accounts for cost-conscious traders. |

| Metals & Commodities | Trade popular metals (gold, silver) and key commodities (Brent crude oil, US natural gas). - Gold spreads from 10 cents per troy ounce and oil from 4 cents per barrel. |

| Stock Indices | Access to major global indices, including S&P 500, Nikkei 225, DAX 30, FTSE 100. - Leverage available, allowing traders to gain exposure to entire markets with small capital. - Spreads start from 0.2 points on some indices. |

| Individual Stocks | Trade 600+ US-listed stocks from NYSE and NASDAQ, including Apple, Amazon, Tesla, and Google. - Stock selection is more limited compared to brokers offering thousands of global equities. |

| Cryptocurrencies | Trade 28 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. - Available 24/7 with competitive spreads, though overnight swaps can be high due to volatility. |

One potential gap in Alpari's offering is the lack of ETF trading. Many brokers now offer a wide selection of these popular investment vehicles. However, Alpari's PAMM account system does provide a form of ready-made diversified investment for more passive investors.

Overall, while not the absolute broadest in the industry, Alpari's tradable asset offering covers all the key bases and allows for ample portfolio diversification. The competitive spreads on forex and metals are particularly noteworthy. As always, traders should carefully consider which markets best align with their knowledge, experience and risk tolerance.

Trading Platforms

Alpari offers a robust suite of trading platforms catering to a wide spectrum of trader preferences and needs. Whether you're a desktop diehard, a web-based warrior, or a mobile market maven, Alpari has you covered.

MetaTrader

Masterclass For the vast majority of Alpari traders, the venerable MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are the tools of choice. These industry-standard platforms offer a potent blend of user-friendly interfaces, advanced charting capabilities, and extensive customization options via expert advisors (EAs) and custom indicators.

MT4, the long-time staple, is particularly renowned for its algorithmic trading capabilities, with a vast library of EAs available to automate trading strategies. MT5, the newer iteration, builds on MT4's strengths while adding more advanced features like a built-in economic calendar, depth of market (DOM) information, and a multi-threaded strategy tester for optimizing EAs.

Both platforms are available via desktop clients for Windows and MacOS, web-based versions for browser-based trading, and mobile apps for iOS and Android devices. This multi-platform approach ensures traders can access their accounts and monitor markets anytime, anywhere.

Proprietary Prowess

In addition to the MT4/5 suite, Alpari also offers its own proprietary mobile trading apps for iOS and Android. These streamlined apps focus on ease of use and quick trade execution, making them ideal for traders who prioritize simplicity and speed. That said, they lack some of the more advanced features and customizability of the MT platforms.

Autochartist Advantage: One notable advantage of Alpari's MT4/5 offering is the integration of Autochartist, a powerful automated market analysis tool. Autochartist constantly scans markets in real-time, identifying key chart patterns, Fibonacci levels, and other technical indicators. This can be a significant time-saver for technical traders, alerting them to potential trade opportunities across multiple markets.

Social Trading

Savvy For traders interested in learning from or copying the trades of successful traders, Alpari offers the Alpari CopyTrade system. This social trading platform allows users to browse and follow a wide range of strategy providers, automatically copying their trades in real-time. It's an interesting option for newer traders still developing their own strategies, or experienced traders looking to diversify their approach.

Alpari Trading Platform Comparison

| Feature | MT4 | MT5 | Alpari App |

|---|---|---|---|

| Customizable layout | ✓ | ✓ | ✗ |

| Technical indicators | 30+ | 38+ | ✗ |

| Timeframes | 9 | 21 | ✗ |

| Charting tools | 24 | 44 | Basic |

| Automated trading (EAs) | ✓ | ✓ | ✗ |

| Strategy tester | Mono-thread | Multi-thread | N/A |

| Depth of Market (DOM) | ✗ | ✓ | ✗ |

| Economic calendar | ✗ | ✓ | ✗ |

| Autochartist | Add-on | Add-on | ✗ |

Alpari How to Open an Account: A Step-by-Step Guide

Opening an account with Alpari is a straightforward process that can be completed entirely online in just a few steps. Here's what you need to know:

Regardless of account type, all applicants must be at least 18 years old and provide proof of identity and residency as part of the account verification process.

Registration Process

1. Visit the Alpari website and click on the "Open an Account" button.

2. Select your preferred account type and click "Open an Account".

3. Fill in your personal details, including full name, date of birth, country of residence, and contact information.

4. Choose your account base currency (USD, EUR, GBP, NGN, INR, IDR, MYR, VND) and leverage.

5. Agree to the terms and conditions and click "Open an Account.".

6. You will receive a confirmation email with your login details. Use these to log into your Alpari dashboard.

Verification & Funding

Before you can start trading, you'll need to verify your identity and fund your account.

1. In your Alpari dashboard, go to the "Profile" section and upload proof of identity (passport, national ID card, or driver's license) and proof of residency (utility bill or bank statement less than 3 months old).

2. Once your documents are approved (usually within 24 hours), go to the "Deposit" section to fund your account.

3. Choose your preferred payment method (credit/debit card, bank wire, e-wallet, Bitcoin, etc.) and follow the instructions to complete your deposit.

4. Once your funds are credited, you can download your chosen trading platform (MT4 or MT5) and start trading.

The whole process is designed to be quick and user-friendly. Most accounts are approved and ready to trade within 24 hours.

As a fully digital onboarding process, opening an account with Alpari is possible 24/7. However, if you encounter any issues or have questions, multilingual support is available via live chat, email, and phone.

In terms of accepted payment methods, Alpari offers a wide range including major credit/debit cards, bank wires, various e-wallets like Skrill and Neteller, and even Bitcoin. Processing times vary by method, with cards and e-wallets usually instant while bank wires can take several business days.

One thing to note: while Alpari accepts clients from many countries, there are some notable exceptions including the USA, Canada, Japan, Brazil, Israel, and EU countries. Be sure to check the full list of restricted countries before applying.

Overall, Alpari's account opening process is streamlined and user-friendly. The wide range of account types and payment methods cater to a broad spectrum of traders, while the quick digital onboarding ensures you can start trading with minimal delay.

Charts and Analysis

Alpari provides a range of educational resources and tools to support its clients in making informed trading decisions. While the offering is not the most extensive in the industry, it covers key areas and caters to traders of different experience levels.

| Feature | Details |

|---|---|

| Market Analysis | Alpari’s in-house analysts provide daily insights on forex, commodities, indices, and more. Articles include technical and fundamental analysis with key levels and potential trading opportunities. |

| Forex Economic Calendar | A comprehensive calendar covering key global economic releases. - Filterable by date & currency for customized tracking. - Events are categorized by importance (low, medium, high). - Displays actual, forecast, and previous figures to help traders understand market expectations. |

| Educational Articles | Covers trading basics, strategies, and psychology, categorized by beginner, intermediate, and advanced levels. - Limited interactivity: No courses, quizzes, or videos. - Content not frequently updated, which may be a drawback for evolving market conditions. |

| Webinars & Seminars | Occasional webinars & in-person seminars led by Alpari analysts or industry experts. - Less frequent than other brokers; topics focus mainly on introductory concepts rather than advanced strategies. |

| Trading Tools | Standard tools are included in MetaTrader 4 & 5, featuring built-in technical indicators and charting tools for analysis. |

However, Alpari does not offer many proprietary tools or add-ons. Some brokers provide sentiment indicators, volatility meters, or correlation matrices to give traders additional market insights. The lack of these tools may be a drawback for more advanced traders.

Overall, while Alpari's educational and tool offering covers the basics well, it lacks the depth and breadth of some industry leaders. The market analysis is a standout, providing accessible and actionable insights. However, the static nature of much of the educational content and the limited range of advanced tools may not satisfy more experienced traders.

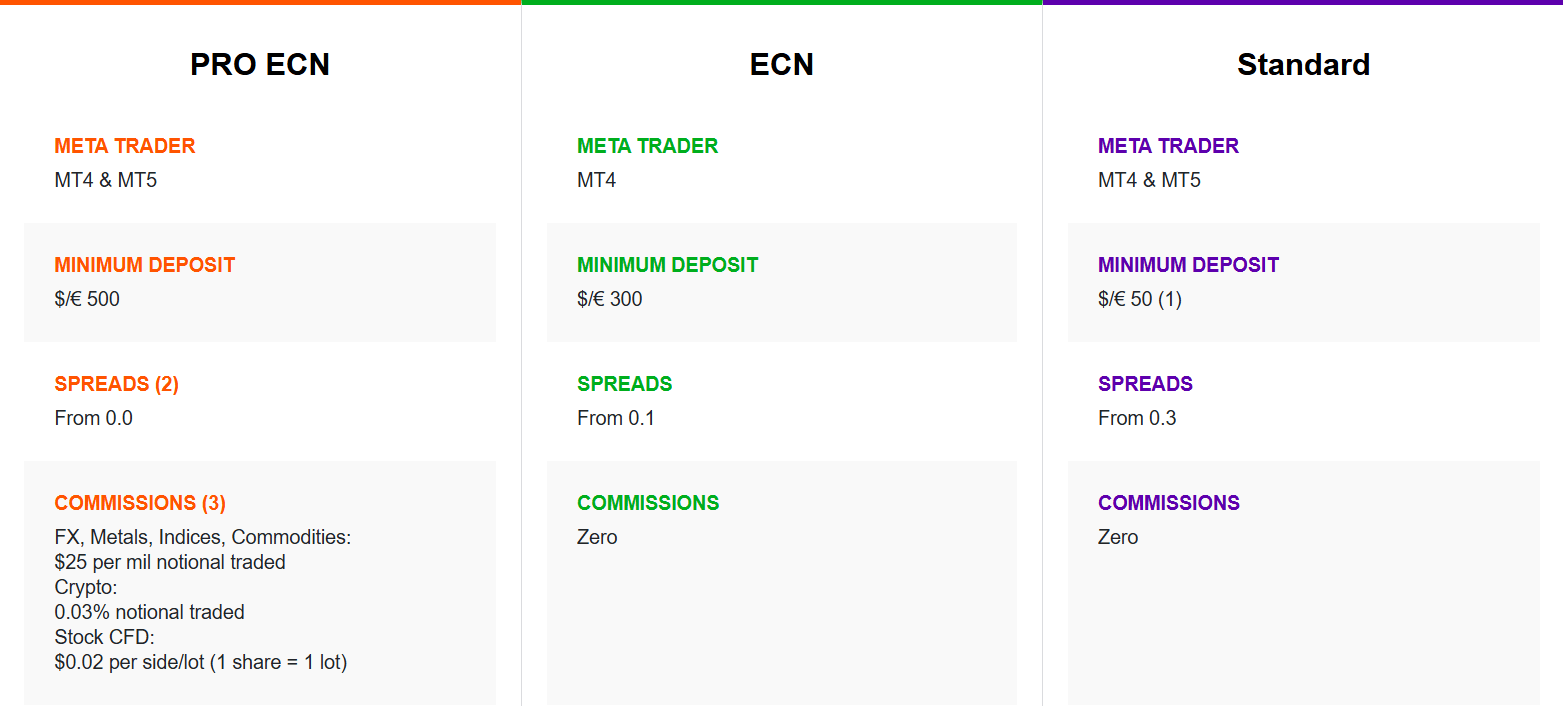

Alpari Account Types

Alpari offers a range of account types designed to cater to traders with different needs, experience levels, and trading styles. Whether you're a novice trader learning the ropes or a seasoned pro looking for the most competitive trading conditions, Alpari has an account to suit you.

| Feature | Standard Account | ECN Account | Pro ECN Account | Demo Account | Islamic Account |

|---|---|---|---|---|---|

| Minimum Deposit | $100 | $300 | $500 | None | Matches live account type |

| Leverage | Up to 1:1000 | Up to 1:3000 | Up to 1:3000 | Customizable | Matches live account type |

| Spreads | From 0.3 pips | From 0.1 pips | From 0.0 pips | From 0.3 pips | Matches live account type |

| Commission | None | None | $2.5 per $100k traded | None | None |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.1 lots | 0.01 lots | Matches live account type |

| Account Currencies | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP | Matches live account type |

| Best For | Traders of all levels | Active traders needing tight spreads & deep liquidity | High-volume professional traders | Strategy testing & practice | Traders requiring swap-free accounts under Sharia law |

The diversity of Alpari's account types is a significant strength. By catering to a wide spectrum of traders, from complete beginners to seasoned professionals, Alpari ensures that almost any trader can find an account that meets their needs.

The inclusion of demo and Islamic accounts further broadens the appeal. The demo account is a particularly valuable resource, allowing traders to gain familiarity with the platform and test strategies without risk.

While the specific conditions of each account type are competitive, they are not necessarily market-leading. Some other brokers offer even tighter spreads or lower commissions. However, Alpari's offering is well-rounded, with a good balance of competitive pricing and accessible minimum deposits.

Overall, Alpari's range of account types is a compelling offering that caters well to a diverse client base. While it is always important to compare with other brokers, most traders should be able to find an Alpari account that suits their trading style and requirements.

Negative Balance Protection

In the fast-paced world of online trading, where leverage can amplify both gains and losses, negative balance protection (NBP) has emerged as a crucial safeguard for traders. This risk management mechanism, offered by some brokers like Alpari, ensures that a trader's losses can never exceed their account balance. Alpari offers negative balance protection to all its clients, regardless of the account type or trading platform used. If a trader's account balance falls into negative territory, Alpari will absorb the loss and reset the account balance to zero. For example, imagine a trader has $1,000 in their Alpari trading account. They open a large position in EUR/USD ahead of a major news event, not anticipating the seismic market reaction. The trade goes against them rapidly, and before they can close the position, their loss exceeds $1,000. Without NBP, their account balance would go negative and they would owe money to Alpari. However, with Alpari's NBP policy, the loss is limited to the $1,000 in their account, which is reset to zero. It's important to note that NBP does not excuse traders from responsible risk management practices. It should be seen as a last line of defense, not a license for reckless trading. Traders should still employ appropriate risk management tools and maintain a level of margin well above the minimum requirement.

Terms and Conditions

Alpari's NBP policy is automatic and unconditional for all clients. There are no extra fees or additional terms and conditions. It's part of Alpari's commitment to fair and responsible trading practices. However, it's worth noting that NBP does not protect against poor trading decisions. If a trader's account balance is eroded due to a series of losing trades, NBP does not restore those lost funds. It only covers situations where a single trade or series of trades causes the account to go into negative balance.Alpari Deposits and Withdrawals

Efficient and secure deposit and withdrawal processes are critical aspects of the online trading experience. Alpari understands this and provides a range of convenient payment methods to cater to its diverse global clientele.

Deposit Options

Alpari offers a variety of deposit methods, including:| Payment Method | Processing Time | Minimum Deposit | Maximum Deposit | Fees | Additional Notes |

|---|---|---|---|---|---|

| Bank Wire Transfer | 1-3 business days | $100 | No maximum limit | No fees (bank charges may apply) | Direct deposit from bank accounts |

| Credit/Debit Cards | Instant | $100 | $10,000 per transaction, $100,000 daily | No fees | Supports Visa, Mastercard |

| E-wallets | Instant | $100 | No maximum limit | No fees | Supports Skrill, Neteller, FasaPay |

| Cryptocurrencies | After 1 blockchain confirmation | 0.01 BTC | No maximum limit | No fees | Supports Bitcoin (BTC) |

| Local Payment Methods | Varies by provider | Varies | Varies | No fees (provider fees may apply) | Includes UnionPay (China), India Net Banking (India), and others |

Withdrawal Options

Alpari offers the same range of methods for withdrawals as for deposits. The minimum withdrawal amount is $1 or equivalent, with no maximum limit.| Payment Method | Processing Time | Fees | Additional Notes |

|---|---|---|---|

| Bank Wire Transfer | 1-3 business days | No fees (provider fees may apply) | Processing times depend on the receiving bank. |

| Credit/Debit Cards | 1 business day | No fees (provider fees may apply) | Supports Visa, Mastercard. Funds are returned to the same card used for deposits. |

| E-wallets | Instant | No fees (provider fees may apply) | Supports Skrill, Neteller, FasaPay. |

| Cryptocurrencies | Instant after 1 blockchain confirmation | No fees (network fees may apply) | Supports Bitcoin (BTC). Funds were credited to the trader’s crypto wallet. |

Verification Requirements

To comply with anti-money laundering regulations, Alpari requires all clients to verify their identity before making a withdrawal. This involves submitting proof of identity and proof of address documents. The verification process is straightforward and can be completed online by uploading the necessary documents in the Alpari client portal. It's important to note that the name on the trading account must match the name on the payment method used for deposits and withdrawals. Third-party payments are not allowed.Convenience and Security

One of the standout features of Alpari's payment system is the variety of methods available. With support for everything from traditional bank transfers to modern cryptocurrencies, Alpari caters to a wide range of preferences. The instant processing for many methods is also a significant plus, allowing traders to fund their accounts and access their profits without delay. The lack of deposit and withdrawal fees from Alpari's side is another welcome feature, although traders should always be aware of potential charges from their payment providers. In terms of security, Alpari uses industry-standard encryption to protect clients' sensitive data. The identity verification process, while necessary, ensures that funds are only withdrawn to the account holder, providing an additional layer of security.Support Service for Customer

In the fast-paced world of online trading, reliable customer support can make all the difference. Traders need to know that help is available when they need it, whether they're dealing with a technical issue, a question about their account, or a problem with a trade. Alpari understands this and provides a robust customer support system to assist its clients.

Support Channels

Alpari offers several ways for traders to get in touch with their support team:| Support Channel | Availability | Details |

|---|---|---|

| Live Chat | 24/5 | Available on the Alpari website within the trader’s personal area for immediate assistance. |

| 24/5 | Traders can email support@alpari.org for non-urgent inquiries. Alpari aims to respond within 24 hours. | |

| Phone Support | 24/5 | Direct support via +44 20 3769 9686. Traders can also request a callback from their personal area. |

| Feedback Form | 24/5 | Traders can submit feedback, suggestions, or complaints via the online form on the Alpari website. |

| Social Media | Business hours | Alpari is active on Facebook, Twitter, Instagram, and Telegram, engaging with the community and posting updates. |

| Support Languages | 24/5 | Multilingual support covering English, Russian, Spanish, Chinese, Arabic, and other major languages. |

Support Quality and Response Times

Alpari prides itself on the quality of its customer support. The support team is made up of knowledgeable professionals who understand the platform and the markets. They aim to provide clear, helpful responses to all queries. In terms of response times, Alpari sets a high standard. Live chat queries are typically responded to within a few minutes. Email responses are provided within 24 hours, although often much faster. Phone support waiting times may vary depending on call volumes, but callbacks can be scheduled to avoid waiting on hold.Self-Help Resources

In addition to its direct support channels, Alpari also provides a range of self-help resources. These include a detailed FAQ section on the website, educational articles and videos, and user guides for the trading platforms. These resources can often provide quick answers to common questions, allowing traders to resolve issues independently. However, the support team is always ready to assist if needed.Alpari Customer Support Comparison

| Feature | Alpari |

|---|---|

| Support Channels | Live chat, email, phone, callback, feedback form, social media |

| Support Hours | 24/5 for live chat and callback, business hours for email and social media |

| Support Languages | English, Indonesian, Chinese, Russian, Spanish, French, Portuguese, Vietnamese, Thai |

| Response Times | Live chat: few minutes Email: within 24 hours Phone: varies (callback available) |

| Self-Help Resources | Detailed FAQ, educational articles & videos, platform user guides |

Prohibited Countries

In the globally interconnected world of online trading, it's crucial for brokers and traders alike to navigate the complex web of international regulations. Each country has its own laws governing financial services, and failure to comply can result in serious consequences. As a responsible broker, Alpari is committed to adhering to these regulations, even if it means restricting services in certain jurisdictions.

List of Prohibited Countries

Alpari does not offer its services to residents of the following countries:

North America

- United States

- Canada

Asia-Pacific

- Japan

- North Korea

- Iran

- Singapore

Europe

- Belgium

- United Kingdom

- Italy

- Luxembourg

- Netherlands

Africa

- Sudan

- Libya

This list is subject to change based on evolving regulations and Alpari's business decisions. It's always best to check with Alpari directly for the most up-to-date information.

Consequences of Trading from a Prohibited Country

Attempting to trade with Alpari from a prohibited country can have serious consequences. If Alpari detects that a client is from a prohibited jurisdiction, it may:

- Refuse to open the account

- Close any existing accounts

- Withhold any funds in the account

- Report the activity to relevant authorities

Traders should never attempt to circumvent these restrictions by providing false information or using a VPN. Not only is this illegal, but it also puts the trader at risk of losing their funds with no recourse.

Special Offers for Customers

In the competitive world of online trading, brokers often use special offers and promotions to attract new clients and reward existing ones. These offers can provide extra value to traders, but it's important to understand the terms and conditions before participating. Here's a rundown of Alpari's current promotions.

| Promotion | Details |

|---|---|

| 100% Deposit Bonus | New clients receive a 100% deposit bonus on deposits of at least $500, up to a $1,000 bonus. - Bonus is non-withdrawable until trading volume requirements are met. - Trading requirement: 10,000 lots for Standard accounts, 250,000 lots for ECN accounts within 3 months. - If the requirement isn't met, the bonus is removed. |

| Loyalty Cashback Program | Active traders earn points per trade, based on account type and trading volume. - Points accumulate over 3-month quarters. - Points convert to cashback at $1 per 100 points. - Four loyalty levels: Silver, Gold, Platinum, VIP, each with better point earning rates. - Cashback is withdrawable or can be used for trading. |

| Refer-a-Friend Program | Earn $50 for referring a friend who opens an account and trades at least 3 standard lots. - Both the referrer and the friend receive $50. - No limit to the number of referrals. |

Conclusion

As I come to the end of this comprehensive review of Alpari, it's time to distill the wealth of information into a clear assessment of their strengths, weaknesses, and overall position in the online trading landscape.

Throughout this review, I've delved into the various aspects of Alpari's operations, from their regulatory status and geographical reach to their trading platforms, account types, and customer support. What emerges is a picture of a broker that, while not without some limitations, offers a solid and reliable service.

On the regulation front, Alpari's status is a bit of a mixed bag. While they are regulated by bodies in Belize and Mauritius, they don't have the heavyweight oversight of major regulators like the FCA or ASIC. However, their membership in the FinaCom compensation fund does provide an extra layer of protection for traders.

In terms of trading conditions, Alpari offers a competitive package. Their ECN accounts feature tight spreads and low commissions, making them attractive for active traders. The range of tradable assets is broad, covering forex, commodities, indices, and even cryptocurrencies. The MetaTrader 4 and 5 platforms are industry standards, and the addition of the Autochartist tool is a nice bonus.

One area where Alpari really shines is in their customer support. The 24/5 availability across multiple languages is impressive, and the commitment to fast response times is reassuring. The extensive educational resources, including the detailed market analysis, are also a big plus, particularly for newer traders.

However, there are a few areas where Alpari could improve. The educational resources, while extensive, could benefit from more interactive elements like webinars and quizzes. The lack of any official regulatory license on the company's main website may be a red flag for some traders. And while the PAMM account offering is interesting, the lack of ETFs does limit the investment options somewhat.

Perhaps the biggest question mark over Alpari is the concerning number of recent complaints noted by WikiFX. While it's hard to verify the legitimacy of these complaints, the sheer volume is a potential warning sign that traders should heed.

In conclusion, Alpari presents as a solid, if not quite top-tier, broker. Their competitive trading conditions, strong customer support, and extensive educational resources make them an attractive choice for many traders. The social trading options and PAMM accounts add an extra dimension of flexibility.

However, traders should be aware of the regulatory limitations and the potential warning signs in the complaint history. As always, thorough due diligence is essential before committing funds to any broker.

For traders who prioritize low-cost ECN trading, robust platforms, and good customer support, Alpari is definitely worth considering. But as with any financial decision, it's crucial to weigh the pros and cons in light of your individual trading needs and risk tolerance. Trade wisely!

View raw-spread specialists in the low-cost broker reviews set.

See multi-platform support in the Admirals review.