ATC Brokers Review 2025 : Trusted FCA Broker for Forex Trading?

ATC Brokers

United States

United States

-

Minimum Deposit $5000

-

Withdrawal Fee $40

-

Leverage 200:1

-

Spread From 0.3

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Unavailable

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Softwares & Platforms

Customer Support

+17029485000

(English)

+17029485000

(English)

Supported language: Chinese (Simplified), English, Spanish

Social Media

Summary

ATC Brokers is a forex and CFD broker regulated by the Financial Conduct Authority (FCA) in the UK under registration number 591361, ensuring a secure and transparent trading environment. The broker requires a minimum deposit of $2,000, making it suitable for dedicated traders. It offers competitive spreads, fast trade execution, and access to popular trading platforms like MT4. ATC Brokers focuses on providing a reliable and professional trading experience with strong regulatory oversight.

- Regulated by the FCA (UK) providing strong oversight

- A long operating history since 2005 suggests stability

- Competitive forex spreads from 0.1 pips

- Supports high leverage up to 1:200

- Allows scalping, hedging and EAs

- Offers MetaTrader 4 platform on all devices

- Provides negative balance protection

- Segregates client funds for safety

- Processes withdrawals quickly within 1-2 days

- VPS hosting rebate for high-volume traders

- High minimum deposit of $5000

- Limited range of markets beyond forex

- Only offers the MT4 platform, no other options

- Charges fees for deposits and withdrawals

- Educational resources are fairly basic

- Research and analysis tools are limited

- Customer support is not 24/7

- Promotions and bonuses are underwhelming

- Concerning number of user complaints about withdrawals

- Unregulated in some areas with only Cayman Islands license

Overview

ATC Brokers is a well-established forex broker that has been providing online trading services since its founding in 2005. With over 20 years of experience as of 2025, ATC Brokers has built a solid reputation as a reliable and competitive player in the forex industry. The broker is headquartered in the United States and maintains a global presence, catering to traders worldwide.

One of the standout features of ATC Brokers is its regulation by top-tier financial authorities. The broker is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under registration number 591361. Additionally, ATC Brokers operates under the oversight of the Cayman Islands Monetary Authority (CIMA) with license number 1448274. This dual regulation by respected authorities in major financial hubs underscores ATC Brokers' commitment to maintaining high standards of security, transparency, and ethical practices.

ATC Brokers specializes in providing access to the forex market, offering competitive trading conditions designed to appeal to both beginner and experienced traders. The broker supports a wide range of currency pairs, including majors, minors, and exotics, enabling traders to diversify their portfolios and capitalize on various market opportunities. With spreads starting from as low as 0.1 pips on popular pairs like EUR/USD, ATC Brokers strives to keep trading costs low for its clients.

In terms of trading platforms, ATC Brokers offers the widely popular MetaTrader 4 (MT4) platform. MT4 is known for its user-friendly interface, advanced charting tools, and extensive customization options, making it a preferred choice among forex traders worldwide. ATC Brokers provides the MT4 platform for desktop, web, and mobile devices, allowing traders to access their accounts and trade on the go.For more Information, visit their official website at atcbrokers.com.

Overview Table

| Category | Details |

|---|---|

| Broker Name | ATC Brokers |

| Founded | 2005 |

| Regulation | FCA (UK), CIMA (Cayman Islands) |

| Headquarters | United States |

| Minimum Deposit | $2000 |

| Trading Platforms | MetaTrader 4 (MT4) |

| Instruments | Forex, Metals |

| Spreads | From 0.1 pips on EUR/USD |

| Leverage | Up to 1:200 |

| Deposit/Withdrawal Fees | Yes |

| Inactivity Fee | Yes |

Facts List

- ATC Brokers was established in 2005 and has over 20 years of experience in the forex industry as of 2025.

- The broker is regulated by the Financial Conduct Authority (FCA) in the UK and the Cayman Islands Monetary Authority (CIMA), ensuring a high level of security and regulatory oversight.

- ATC Brokers specializes in providing access to the forex market, offering competitive spreads starting from 0.1 pips on major currency pairs like EUR/USD.

- Traders can access the popular MetaTrader 4 (MT4) platform for desktop, web, and mobile devices, enabling flexible trading options.

- The broker supports a wide range of currency pairs, including majors, minors, and exotics, allowing for portfolio diversification.

- ATC Brokers offers passive investment opportunities through trade copying services and PAMM accounts, catering to investors who prefer hands-off approaches.

- The minimum deposit requirement at ATC Brokers is relatively high, ranging from $5000, which may not be suitable for all beginner traders.

- While ATC Brokers focuses primarily on forex trading, it also offers a limited selection of metals for trading.

- Traders should be aware of the fees associated with deposits, withdrawals, and account inactivity when considering ATC Brokers as their broker of choice.

- ATC Brokers maintains a global presence and caters to traders worldwide, providing customer support and educational resources to assist clients in their trading journey.

ATC Brokers Licenses and Regulatory

ATC Brokers operates under a robust regulatory framework, holding licenses from top-tier financial authorities. The broker's primary regulation comes from the Financial Conduct Authority (FCA) in the United Kingdom, where it is registered under license number 591361. The FCA is widely regarded as one of the most stringent and respected regulatory bodies in the world, known for its comprehensive oversight and strict enforcement of financial regulations.

| Regulatory Authority | License/Registration Number | Key Requirements & Benefits |

|---|---|---|

| Financial Conduct Authority (FCA) | 591361 | Strict oversight, segregation of client funds, capital adequacy, robust risk management, and FSCS compensation protection. |

| Cayman Islands Monetary Authority (CIMA) | 1448274 | Enhanced regulatory standards, strict AML/CTF compliance, and a reputable framework for offshore financial services. |

This dual regulation highlights ATC Brokers' commitment to high standards of client protection and compliance, providing an added layer of trust and security compared to brokers regulated solely by offshore authorities.

In conclusion, ATC Brokers' regulatory framework, with licenses from the FCA and CIMA, provides a strong foundation for client trust and security. The broker's adherence to strict regulatory standards and multi-jurisdictional oversight sets it apart from many competitors and demonstrates a commitment to maintaining a safe and compliant trading environment. As always, traders should carefully consider their individual needs and risk tolerance when choosing a broker, but ATC Brokers' regulatory status is a positive factor to consider.

Trading Instruments

ATC Brokers offers a focused selection of tradable assets, specializing primarily in the foreign exchange (forex) market. While the broker's offerings may not be as extensive as some of its competitors, it provides a solid range of instruments within its core asset classes.

| Asset Class | Available Instruments | Key Features |

|---|---|---|

| Forex | 38 currency pairs (major, minor, exotic) | Competitive spreads, as low as 0.1 pips on EUR/USD |

| Metals | Gold and Silver (spot contracts) | Traded against the US dollar; diversification and hedging opportunities |

While ATC Brokers specializes primarily in forex and metals trading, it offers a solid selection of instruments within these categories. The broker's focus allows it to provide competitive trading conditions, including tight spreads and leverage trading. However, traders seeking a broader range of assets like stocks, indices, or cryptocurrencies may need to consider other brokers to meet their specific needs.

Trading Platforms

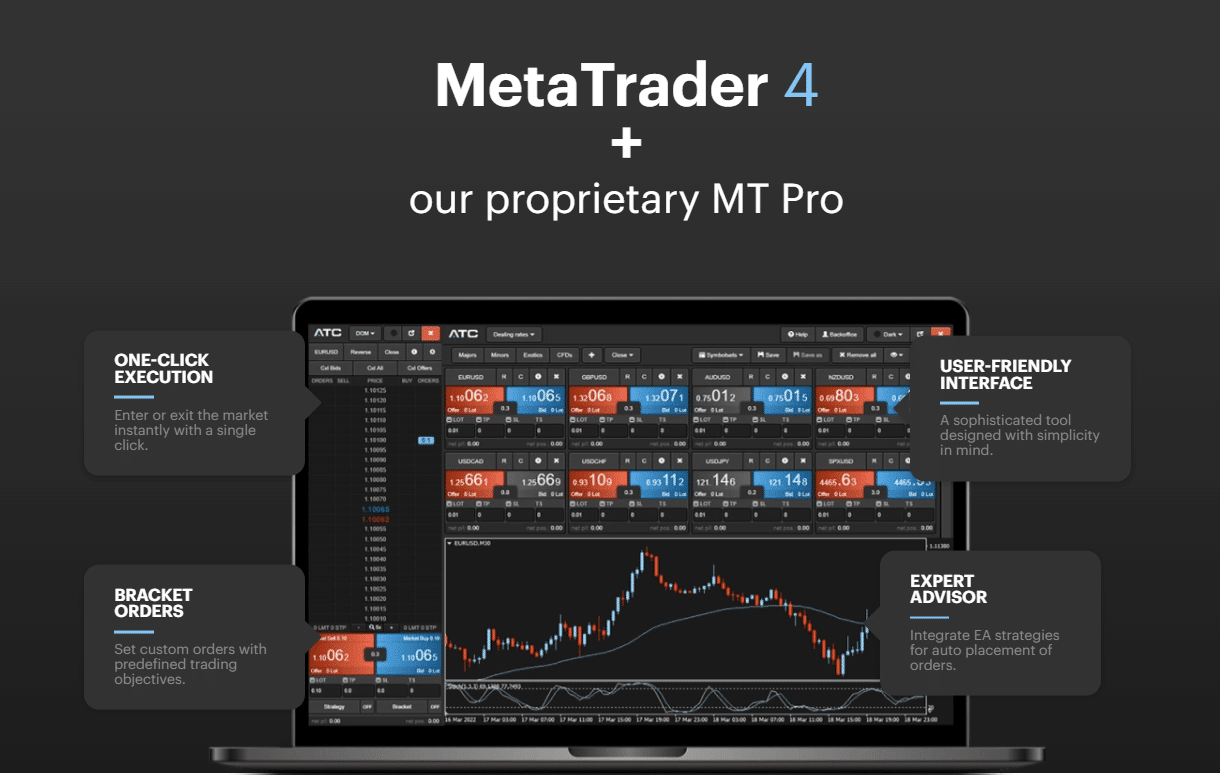

MetaTrader 4 (MT4)

MT4 serves as the primary trading platform for ATC Brokers' clients. The platform is available in multiple formats to cater to different trading preferences and needs:

- Desktop: The MT4 desktop application can be downloaded and installed on Windows and macOS computers, providing a comprehensive trading experience with full functionality.

- Web: For traders who prefer not to download software, ATC Brokers offers a web-based version of MT4. This option allows users to access their trading accounts and execute trades directly through a web browser, providing flexibility and convenience.

- Mobile: ATC Brokers' MT4 mobile app, available for iOS and Android devices, enables traders to monitor their accounts, analyze markets, and place trades on the go. The mobile app offers a streamlined version of the desktop platform, ensuring that traders can stay connected to the markets even when away from their computers.

Key Features of MT4

ATC Brokers' MT4 platform comes equipped with a range of features designed to enhance the trading experience:

- Advanced Charting: MT4 provides a comprehensive set of charting tools, including multiple chart types, timeframes, and a wide selection of technical indicators. These tools enable traders to analyze market trends, identify potential entry and exit points, and make informed trading decisions.

- Automated Trading: MT4 supports the use of Expert Advisors (EAs), which are automated trading programs that can be developed using the platform's built-in programming language, MQL4. EAs allow traders to automate their trading strategies, executing trades based on predefined rules and algorithms.

- Customization: MT4 offers a high degree of customization, allowing traders to personalize their trading environment. This includes the ability to create custom indicators, modify chart layouts, and set up personalized alert notifications.

- Backtesting: The platform includes a built-in strategy tester, enabling traders to backtest their trading strategies using historical data. This feature helps traders evaluate the performance of their strategies and make necessary adjustments before implementing them in live trading.

MT Pro

In addition to the standard MT4 platform, ATC Brokers offers an enhanced version called MT Pro. MT Pro is a proprietary add-on that provides additional features and tools to complement the MT4 trading experience. Some of the notable features of MT Pro include:

- Advanced Risk Management: MT Pro offers advanced risk management tools, such as the ability to set custom stop-loss and take-profit levels, as well as trailing stops. These tools help traders manage their risk more effectively and protect their positions.

- Advanced Order Types: The add-on provides access to advanced order types, such as one-cancels-the-other (OCO) orders and order templates. These features allow traders to implement more sophisticated trading strategies and streamline their order placement process.

- Advanced Reporting: MT Pro generates detailed trading reports, providing traders with insights into their trading performance, including profit and loss analysis, trade statistics, and more. These reports can be used to evaluate trading strategies and make data-driven decisions.

By offering the MT4 platform, along with the enhanced MT Pro add-on, ATC Brokers provides its clients with a robust and reliable trading environment. The platform's popularity, combined with its advanced features and accessibility, ensures that traders can execute their strategies efficiently and effectively.ATC Brokers Trading Platforms Comparison

| Feature | MT4 Desktop | MT4 Web | MT4 Mobile | MT Pro |

|---|---|---|---|---|

| Advanced Charting | ✓ | ✓ | ✓ | ✓ |

| Automated Trading (EAs) | ✓ | ✓ | ✗ | ✓ |

| Customization Options | ✓ | ✓ | Limited | ✓ |

| Backtesting | ✓ | ✗ | ✗ | ✓ |

| Advanced Risk Management | ✗ | ✗ | ✗ | ✓ |

| Advanced Order Types | ✗ | ✗ | ✗ | ✓ |

| Detailed Reporting | Limited | Limited | Limited | ✓ |

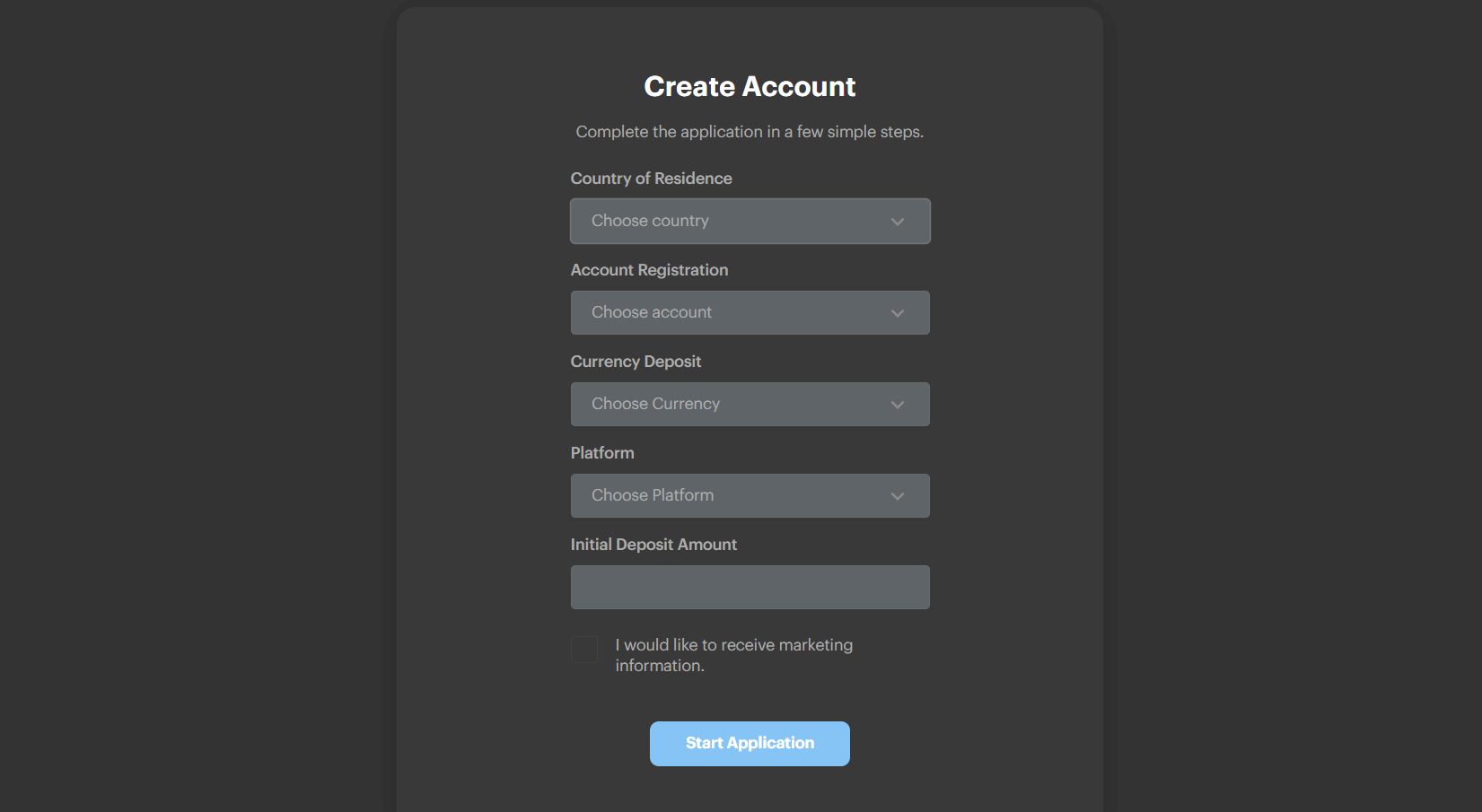

Opening an account with ATC Brokers is a straightforward process that can be completed online in a few simple steps. Before getting started, it's essential to ensure that you meet the broker's requirements and have the necessary documents ready.Account Opening Requirements To open an account with ATC Brokers, you must:

- Be at least 18 years old

- Provide a valid government-issued ID (e.g., passport or driver's license)

- Provide proof of residence (e.g., utility bill or bank statement)

- Meet the minimum deposit requirement of $5000, depending on your account type

ATC Brokers How to Open an Account: A Step-by-Step Guide

Step-by-Step Account Opening Process

- Visit the ATC Brokers website at atcbrokers.com and click on the "Open an Account" or "Register" button.

- Select your preferred account type (Individual, Joint, or Corporate) and fill in the required personal information, including your name, date of birth, address, and contact details.

- Choose your base currency (USD, EUR, or GBP) and select your preferred trading platform (MT4 or MT Pro).

- Answer the questionnaire regarding your trading experience, financial knowledge, and risk tolerance. This helps ATC Brokers assess the suitability of their services for your needs.

- Upload the required documents (proof of identity and proof of residence) for verification. ATC Brokers uses secure encryption to protect your personal information.

- Review and accept the broker's terms and conditions, privacy policy, and risk disclosure statement.

- Once your application is submitted, ATC Brokers will review your information and documents. The verification process typically takes 1-2 business days for individual accounts and 3-5 business days for corporate accounts.

- Upon successful verification, you will receive an email notification confirming the approval of your account.

- Log in to your newly created account and follow the instructions to fund your account using one of the available payment methods (bank wire transfer, credit/debit card, or e-wallet).

- Once your funds are deposited and available in your trading account, you can start trading with ATC Brokers.

Funding Your Account

ATC Brokers supports the following payment methods for account funding:

- Bank Wire Transfer: No fees, processing time of 3-5 business days

- Credit/Debit Card (Visa, Mastercard): Instant funding, 2.9% fee

- E-wallet (Skrill): Instant funding, 2.9% fee

It's important to note that ATC Brokers does not charge any fees for deposits. However, withdrawals may be subject to fees, which vary depending on the payment method used.

Demo Account

For those who wish to practice trading or test ATC Brokers' platforms risk-free, the broker offers a demo account option. Simply follow the steps to open an account and select the "Demo Account" option when prompted. You will receive virtual funds to use for practice trading.

By following these steps and providing the necessary information and documents, you can quickly and easily open an account with ATC Brokers. As always, it's crucial to carefully review the broker's terms, conditions, and policies before starting to trade.

Charts and Analysis

ATC Brokers provides a range of educational resources and tools to support its clients in their trading journey. While the broker's offerings may not be as extensive as some of its competitors, it does provide a solid foundation for traders to enhance their knowledge and skills.

| Category | Features |

|---|---|

| Trading Charts & Tools | Multiple chart types (line, bar, candlestick); Customizable timeframes (1 min to 1 month); 50+ technical indicators; Drawing tools (trendlines, Fibonacci, shapes); Customizable templates and profiles |

| Market Analysis & Insights | Daily market commentary; Weekly market outlook; Quarterly market forecasts |

| Educational Content | Video tutorials; Live and recorded webinars; Downloadable e-books and guides; Trading glossary |

| Research & Analysis Tools | Economic calendar; Forex calculators (margin, pip value, risk/reward); Market sentiment indicator |

While ATC Brokers offers a range of useful resources for traders to enhance their knowledge and skills, the depth and variety of these offerings could be expanded to cater to a wider range of trading experience levels and needs. Nonetheless, the broker provides a solid foundation for traders to learn and grow, with room for future enhancements.

ATC Brokers Account Types

Individual Account

-

- Minimum Deposit: $2000

- Leverage: Up to 1:30 (retail) / 1:200 (professional)

- Platforms: MT4, MT Pro

- Ideal for retail traders managing their own funds with access to forex, metals, and CFDs

Joint Account

-

- Similar conditions as Individual Accounts

- Designed for two or more individuals trading together with shared funds

Corporate Account

-

- Minimum Deposit: Negotiable

- Leverage: Up to 1:200

- Platforms: MT4, MT Pro

- Tailored for businesses and institutional clients with dedicated support and advanced trading tools

Demo Account

-

- Uses virtual funds for a risk-free practice environment

- Available on MT4 for both Individual and Corporate account types

Professional Account

-

- Minimum Deposit: Varies (criteria apply)

- Leverage: Up to 1:200

- Platforms: MT4, MT Pro

- For qualified clients under ESMA regulations with access to additional instruments and tools

ATC Brokers Account Types Comparison Table

| Feature | Individual | Joint | Corporate | Demo | Professional |

|---|---|---|---|---|---|

| Minimum Deposit | $2000 | $2000 | Negotiable | N/A | $2000 |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:200 | Up to 1:30 | Up to 1:200 |

| Spread (EUR/USD) | From 0.3 | From 0.3 | Competitive | From 0.3 | From 0.3 |

| Commission | No | No | Negotiable | No | No |

| Trading Platform | MT4, MT Pro | MT4, MT Pro | MT4, MT Pro | MT4 | MT4, MT Pro |

| Real Trading | Yes | Yes | Yes | No | Yes |

| Account Holders | Individual | Multiple | Corporate | N/A | Individual |

| Dedicated Support | No | No | Yes | No | No |

| Advanced Tools | No | No | Yes | No | Yes |

| Qualification Criteria | None | None | Corporate | None | ESMA rules |

Negative Balance Protection

ATC Brokers offers negative balance protection to all clients, ensuring that traders cannot lose more than their account balance. If a trader's account balance falls into negative territory due to trading losses, ATC Brokers will absorb the negative balance and reset the account balance to zero. This policy applies to all trading accounts, including Individual, Joint, and Corporate Accounts, and covers all trading instruments offered by ATC Brokers, such as forex, metals, and CFDs. It's important to note that negative balance protection does not absolve traders of their responsibility to manage risk effectively. Traders should still employ proper risk management techniques, such as setting appropriate stop-loss orders and maintaining sufficient margin in their accounts.

Terms and Conditions

To be eligible for negative balance protection, traders must adhere to ATC Brokers' terms and conditions, which include:- Trading in accordance with the broker's policies and procedures

- Not engaging in any form of market manipulation or abuse

- Maintaining sufficient margin in their account to cover potential losses

ATC Brokers Deposits and Withdrawals

ATC Brokers offers a range of convenient deposit and withdrawal options to cater to the needs of its diverse client base. The broker aims to provide a seamless funding experience while adhering to strict security and regulatory standards.

Deposit Methods

Traders can fund their accounts using the following methods:| Payment Method | Minimum Deposit | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | $2000 | 3-5 business days | None from ATC Brokers (banks may charge fees) |

| Credit/Debit Card (Visa, Mastercard) | $2000 | Instant | 2.9% of the deposit amount |

| E-wallets (Skrill) | $2000 | Instant | 2.9% of the deposit amount |

Withdrawal Methods

Traders can withdraw funds from their accounts using the following methods:| Payment Method | Minimum Withdrawal | Maximum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | $100 | No limit | 3-5 business days | $40 per withdrawal |

| Credit/Debit Card (Visa, Mastercard) | $50 | $5,000 per transaction; $20,000 per month | 1-3 business days | 2.9% of the withdrawal amount |

| E-wallets (Skrill) | $50 | $10,000 per transaction; $50,000 per month | 1-2 business days | 1.0% of the withdrawal amount |

Verification Requirements

To ensure the security of clients' funds and comply with regulatory obligations, ATC Brokers requires traders to verify their accounts before processing withdrawals. This verification process involves submitting proof of identity (e.g., government-issued ID) and proof of residence (e.g., utility bill or bank statement). Once a trader's account is fully verified, subsequent withdrawals can be processed without additional verification, provided there are no significant changes to the trader's personal or financial information.Unique Features

One notable aspect of ATC Brokers' deposit and withdrawal process is the ability for traders to use the same payment method for both funding and withdrawing. This simplifies the process and ensures that traders can easily manage their funds using their preferred payment option. Additionally, ATC Brokers offers a "Rapid Withdrawal" feature for verified clients, which allows for faster processing of withdrawal requests, typically within 24 hours. This feature is subject to certain conditions and may not be available to all clients.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly and easily reach out for assistance whenever they encounter issues or have questions about their accounts or the trading platform. ATC Brokers recognizes the importance of providing excellent customer support and offers several channels through which traders can get in touch with their support team.

Customer Support Channels

| Support Channel | Description | Response Time |

|---|---|---|

| Live Chat | Access directly from the ATC Brokers website for real-time communication with a support representative | 1-2 minutes |

| Send inquiries to support@atcbrokers.com | 12-24 hours | |

| Phone | Dedicated support line at +44 20 3318 1399 (available during market hours) | Immediate |

| Contact Form | Fill out the form on the website for non-urgent inquiries; response via email | 12-24 hours |

Support Languages and Availability

ATC Brokers offers customer support in the following languages:- English

- Spanish

- Mandarin

Prohibited Countries

ATC Brokers is a global forex and CFD broker, but it does not offer services universally. The company is restricted from operating or accepting clients in certain jurisdictions due to regulatory constraints, licensing limitations, and geopolitical considerations.

Countries where ATC Brokers does not provide services include:

United States: ATC Brokers is not registered with the Commodity Futures Trading Commission (CFTC) or National Futures Association (NFA) and therefore cannot accept U.S. clients. The strict regulatory environment and high capital requirements make it challenging for many foreign brokers to operate in the American market.

Canada: ATC Brokers is not licensed by the Investment Industry Regulatory Organization of Canada (IIROC) or any provincial securities commissions. Canada has stringent rules governing forex and CFD trading, requiring brokers to obtain proper authorization before servicing Canadian residents.

European Union (EU): Although ATC Brokers is regulated by the UK Financial Conduct Authority (FCA), this license does not automatically permit the company to operate throughout the EU. Many European countries have their own specific licensing requirements that brokers must meet.

Japan: The Financial Services Agency (FSA) of Japan maintains a tightly controlled forex market. Brokers must acquire a Type I Financial Instruments Business License to offer trading services, which ATC Brokers currently lacks.

Brazil: The Securities and Exchange Commission of Brazil (CVM) requires forex brokers to obtain specific licenses to operate legally. As ATC Brokers does not hold these licenses, it cannot serve Brazilian clients.

Iran, North Korea, Cuba, Sudan, Syria: These countries are subject to international sanctions and trade embargoes, making it illegal for ATC Brokers to provide services to residents of these nations.

It is crucial for prospective clients to verify whether they reside in a permitted jurisdiction before attempting to open an account with ATC Brokers. Trading from a prohibited country could result in legal consequences and the freezing or confiscation of funds. Always check with local regulators and ATC Brokers directly for the most up-to-date information on restricted regions.

Allowed Regions

ATC Brokers is allowed to operate and provide services in the following regions:

- Asia (excluding Japan and sanctioned countries)

- Africa

- Australia

- New Zealand

- Latin America (excluding Brazil)

- Middle East (excluding sanctioned countries)

Special Offers for Customers

ATC Brokers provides a few special offers and promotions to attract new clients and reward existing traders. However, the range of bonuses is quite limited compared to many other brokers.

| Program | Requirements | Bonus / Rebate | Conditions / Notes |

|---|---|---|---|

| 20% Deposit Bonus | Minimum deposit: $5000 | 20% bonus on first deposit, up to $5,000 | Bonus funds are non-withdrawable and require 20× trading volume before profit withdrawal |

| Refer-a-Friend Program | Friend must deposit at least $2000 | $100 per referred friend | No limit on referrals; bonus capped at $1,000 per client |

| VPS Hosting Rebate | Minimum trading volume: 20 lots per month | 25% rebate on VPS fees at 20 lots, up to 100% rebate at 60 lots or more | Rebate scales with trading volume |

It's important to note that ATC Brokers does not offer any no-deposit bonuses, which may disappoint traders looking to test the broker's services without risking their own capital. Additionally, there are no loyalty programs or exclusive perks for high-value clients.

The deposit bonus and refer-a-friend promotions are fairly standard and come with typical restrictions such as trading volume requirements and limited withdrawal of bonus funds. Traders should carefully review the terms and conditions before participating.

The VPS hosting rebate is a nice offer for active traders, but the volume requirements may be too high for many retail clients to benefit from.

Conclusion

After thoroughly analyzing ATC Brokers across multiple aspects of their business, I have formed a mixed opinion about their overall reputation and suitability as a forex broker.

On the positive side, ATC Brokers is regulated by the well-respected Financial Conduct Authority (FCA) in the UK, which provides a good level of oversight and client protection. They also segregate client funds and offer negative balance protection, further enhancing the safety of trading with them. The broker's long operating history dating back to 2005 is another point in their favor, suggesting a level of stability and reliability.

However, I do have some concerns about ATC Brokers that prevent me from giving them a full endorsement. Firstly, their regulatory status outside of the UK is less robust, with only a license from the Cayman Islands Monetary Authority, which is considered a lower-tier regulator. This means clients in many regions may not have the same level of protection as UK traders.

Secondly, there are a worrying number of negative customer reviews and complaints about ATC Brokers online, particularly regarding withdrawal issues and suspected scams. While not all of these may be legitimate, the volume and consistency of complaints do raise red flags. The broker's limited popularity and small client base are also potential concerns.

In terms of trading, ATC Brokers offers very competitive conditions for forex, with raw ECN spreads, high leverage, and good execution. Their support for EAs, hedging and scalping will appeal to many strategies. However, the range of markets is quite narrow, with a focus on forex and only a few CFDs. This lack of variety may deter some traders.

The high minimum deposit requirement of $2000 is likely to exclude many beginner traders and those with smaller budgets. Combined with the lack of extensive educational resources, ATC Brokers seems better suited to more experienced traders.

While the MetaTrader 4 platform is a popular choice, the absence of any alternative options like MT5 or cTrader is a drawback compared to brokers with more diverse offerings. Mobile trading is supported but the research and analysis tools are also limited.

Customer service is adequate but not outstanding, with some mixed user experiences reported. Support is available 24/5 but not 24/7 which is a disadvantage.

Lastly, the promotions and bonuses from ATC Brokers are fairly underwhelming, with a small 20% deposit bonus and no demo account contests or loyalty rewards. Active traders may benefit from the VPS rebate, but otherwise there is little to get excited about here.

Overall, I believe ATC Brokers is a legitimate broker that can provide a solid trading experience for the right type of client, primarily those focused on forex. The FCA regulation and length of operation provide some reassurance.

However, the concerns over negative reviews, limited market range, average platforms, and lack of standout features mean I would not place ATC Brokers among the top tier of brokers. Traders should exercise caution, start with a small deposit, and withdraw profits regularly to minimize risk.

Beginners and those seeking to trade a wide variety of assets will likely find ATC Brokers' offering too restrictive. The high minimum deposit and lack of learning resources are also barriers. For these traders, I would recommend exploring other brokers with stronger educational support and more diverse market access.

In conclusion, ATC Brokers is a legitimate option for experienced forex traders comfortable with MetaTrader 4 and seeking raw spreads. But they fall short of being a full-service broker suitable for everyone. As with any broker, thorough due diligence is essential before depositing significant funds.