AvaTrade Review 2025: A Regulated Forex Broker for Traders & CFD Professionals

AvaTrade

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 400:1

-

Spread From 0.9

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Cyprus Market Making (MM)

Cyprus Market Making (MM)

IIROC Investment Dealer

IIROC Investment Dealer

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+35315396800

(English)

+35315396800

(English)

Supported language: English, French, German, Spanish, Arabic

Social Media

Summary

AvaTrade is a globally recognized forex and CFD broker offering a wide range of assets, including forex, stocks, commodities, cryptocurrencies, and indices. The platform supports multiple trading platforms like MT4, MT5, and its proprietary WebTrader, along with TradingView integration. AvaTrade provides competitive spreads, leveraged trading, and automated trading options while ensuring negative balance protection. The broker is regulated in multiple jurisdictions, enhancing its credibility and security for traders. Additionally, AvaTrade offers educational resources, market analysis, and a user-friendly trading experience for both beginners and experienced traders.

- Strong regulatory compliance with six top-tier licenses ensuring maximum client protection

- Competitive spreads starting from 0.9 pips on major forex pairs

- Wide selection of 1,250+ tradable instruments across seven asset classes

- User-friendly platforms including MT4, MT5, and proprietary mobile solutions

- Exceptional multilingual customer support available 24/5 via multiple channels

- Comprehensive educational resources through AvaAcademy with free Trading Central access

- Low minimum deposit of $100 makes trading accessible to beginners

- Negative balance protection for all retail accounts

- Multiple local payment methods with instant deposits available

- Established 18-year track record with industry award recognition

- Limited account type selection compared to tiered VIP structures at competitors

- Inactivity fees charged after 3 months of no trading activity

- No US clients accepted due to regulatory restrictions

- Doesn't offer traditional share dealing, only CFDs on stocks

- Maximum leverage for retail accounts capped at 1:30 following ESMA regulations

- No cryptocurrency deposits or withdrawals available

- Professional account eligibility requirements may exclude some experienced traders

- Withdrawal fees apply for e-wallet methods like Skrill and Neteller

- No 24/7 support - closed on weekends

- Limited promotional offers compared to bonus-heavy competitors

Overview

AvaTrade stands as a globally recognized forex and CFD broker, established in 2006 with headquarters in Dublin, Ireland. Operating for nearly two decades, this broker has built a substantial international presence with regulated entities spanning multiple continents including Europe, Australia, Asia, Africa, and the Middle East.

The broker provides access to over 1,250 tradable instruments across diverse asset classes, supporting both beginner and professional traders through multiple award-winning platforms. AvaTrade has earned recognition including Best Forex Broker 2020 at the European Awards and Best Forex Broker 2019 from Daytrading.com, demonstrating consistent excellence in service delivery.

Overview Table

| Feature | Details |

|---|---|

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | Central Bank of Ireland, ASIC, FSA, FSCA, ADGM, BVI FSC |

| Instruments | 1,250+ (Forex, Stocks, Indices, Commodities, Crypto, Bonds, ETFs) |

| Platforms | MT4, MT5, WebTrader, AvaTradeGO, AvaOptions |

| Min. Deposit | $100 |

| Leverage | Up to 1:30 (retail), 1:400 (professional) |

| Spreads | From 0.9 pips |

| Demo Account | Yes (unlimited, $100,000 virtual funds) |

| Customer Support | 24/5 in 15+ languages |

Facts List

- Founded in 2006, establishing 18+ years of market presence

- Regulated by six top-tier financial authorities globally

- Offers 1,250+ tradable instruments across seven asset classes

- Supports five different trading platforms including MT4 and MT5

- Minimum deposit requirement of only $100

- Provides leverage up to 1:30 for retail and 1:400 for professional clients

- Extensive educational resources through AvaAcademy platform

- Premium market analysis powered by Trading Central

- Client funds segregated with negative balance protection

- Award-winning broker with multiple industry recognitions

AvaTrade Licenses and Regulatory

AvaTrade operates under exceptional regulatory oversight, maintaining licenses from six prestigious financial authorities worldwide. This multi-jurisdictional approach provides clients with enhanced security and demonstrates the broker's commitment to compliance and transparency.

Primary Regulatory Bodies

| Regulator | Jurisdiction | License Type |

| Central Bank of Ireland | European Union | MiFID II Compliant |

| ASIC | Australia | Market Maker License |

| FSA - FFAJ | Japan | Type I Financial License |

| FSCA | South Africa | FSP License |

| ADGM | Abu Dhabi | Category 3A License |

| BVI FSC | British Virgin Islands | Investment Business License |

| SFC | Colombia | Category 3A License |

| IIROC | Canada | Market Maker License |

| CySEC | Cyprus | Market Maker License |

The Central Bank of Ireland serves as AvaTrade's primary regulator, subjecting the broker to stringent European standards including regular audits, capital adequacy requirements, and mandatory client fund segregation. This comprehensive regulatory framework exceeds industry standards, as many competitors operate under single or dual licenses, often in less stringent jurisdictions.

Trading Instruments

AvaTrade's extensive instrument selection encompasses over 1,250 tradable assets, providing exceptional portfolio diversification opportunities. This comprehensive offering enables traders to access global markets from a single account, allowing them to adapt strategies to various market conditions. They also offer futures through AvaFutures, with up to 100 commission-free contracts, providing traders with a vast range of trading instruments.

| Asset Class | Number of Instruments | Key Features |

| Forex | 55+ pairs |

Majors, minors, exotics; spreads from 0.9 pips

|

| Stocks | 600+ CFDs | US, European, Asian markets |

| Indices | 20+ major |

S&P 500, FTSE 100, DAX 30, Nikkei 225

|

| Commodities | 15+ |

Oil, gold, silver, agricultural products

|

| Cryptocurrencies | 20+ |

Bitcoin, Ethereum, major altcoins

|

| Bonds | 10+ |

Government and corporate bonds

|

| ETFs | 25+ |

Sector and commodity-tracking funds

|

| Options | Vanilla FX | Multiple strikes and expiries |

| Futures | 100+ |

Available via: CQG- TradingView- MT5

|

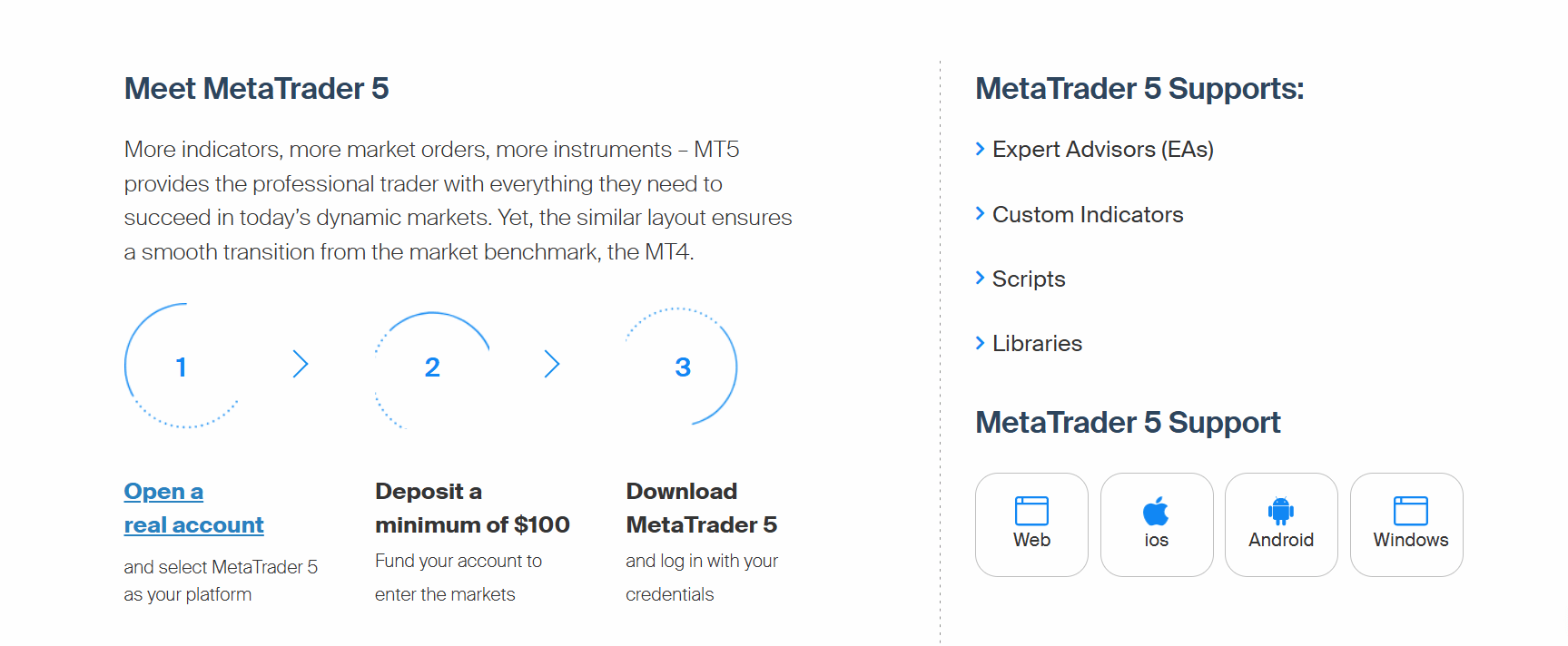

Trading Platforms

AvaTrade provides multiple platform options, each designed to meet specific trading needs and preferences. The broker successfully balances industry-standard platforms with proprietary solutions.

Platform Comparison

| Feature | MT4 | MT5 | AvaTradeGO | AvaSocial | WebTrader | AvaOptions |

| Device Support | Desktop/Mobile/Web | Desktop/Mobile/Web | Mobile Only | Mobile Only | Web Browser | Desktop/Web |

| Charting Tools | Advanced | Advanced | Basic | Advanced | Intermediate | Specialized |

| Technical Indicators | 30+ | 38+ | 20+ | 20+ | 20+ | Options-specific |

| Automated Trading | Yes (EAs) | Yes (EAs) | No | No | No | No |

| Social Trading | Via plugins | Via plugins | Integrated | Yes | No | No |

| User Level | All levels | Advanced | Beginners | All levels | All levels | Options traders |

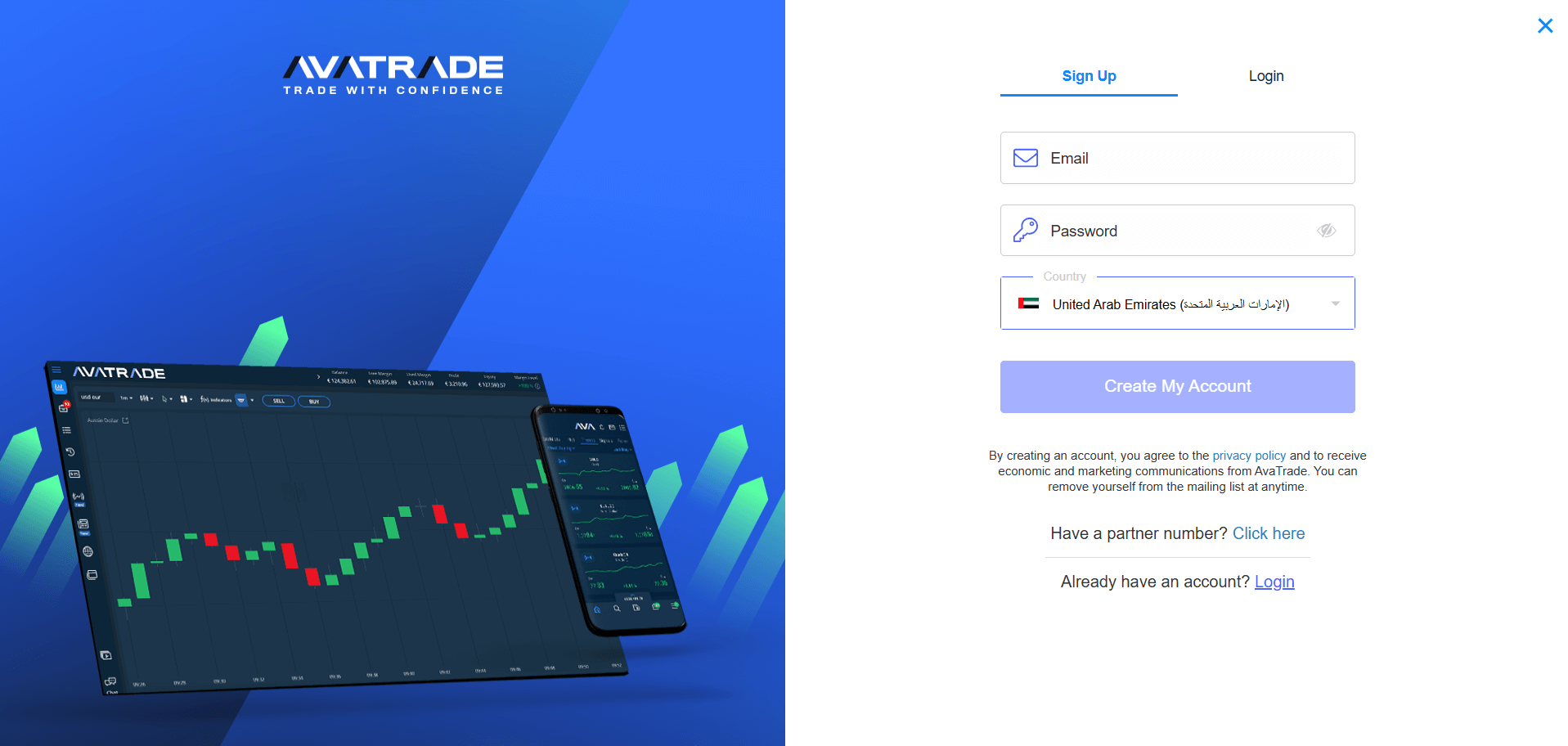

AvaTrade How to Open an Account: A Step-by-Step Guide

Opening an account with AvaTrade is a straightforward process designed to get traders up and running quickly. Here's a step-by-step guide:

Step 1: Registration Visit the AvaTrade website (www.avatrade.com) and click on the "Sign Up" button in the top right corner. You'll be asked to provide your email address and create a password for your account.

Step 2: Personal Information Fill out the registration form with your personal details, including your full name, date of birth, country of residence, and phone number. You'll also need to answer some questions about your trading experience and financial knowledge.

Step 3: Identity Verification To comply with regulatory requirements, AvaTrade needs to verify your identity. You'll be asked to upload a copy of your government-issued ID (passport, driver's license, or national ID card) and a proof of address (utility bill, bank statement, etc.). The verification process is usually completed within 1-2 business days.

Step 4: Account Funding Once your account is verified, you can make your initial deposit. AvaTrade accepts a variety of payment methods, including credit/debit cards, bank wire transfers, and e-wallets like Neteller and Skrill. The minimum deposit is $100, but this may vary depending on your account type and location.

Step 5: Start Trading With your account funded, you're ready to start trading. Download your preferred trading platform (MetaTrader 4, MetaTrader 5, AvaTradeGO, etc.) or log in to WebTrader. You can now access AvaTrade's full range of trading instruments and features.

Charts and Analysis

AvaTrade's commitment to trader education distinguishes it from many competitors. The comprehensive AvaAcademy platform provides structured learning paths suitable for all experience levels.

| Resource Type | Description | Target Audience |

|---|---|---|

| Video Tutorials | Step-by-step trading guides | Beginners |

| Webinars | Live expert sessions | Intermediate |

| E-books | Comprehensive trading guides | All levels |

| Trading Courses | Structured learning programs | Beginners to Advanced |

| Market Analysis | Daily updates and insights | Active traders |

| Economic Calendar | Major event tracking | All traders |

| Trading Central | Premium technical analysis | Serious traders |

AvaTrade Account Types

AvaTrade maintains a streamlined account structure focusing on quality over quantity. This approach ensures consistent service delivery while accommodating different trader categories.

Account Comparison

| Feature | Retail Account | Professional Account | Demo Account |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | Free |

| Maximum Leverage | 1:30 | 1:400 | 1:30 |

| Spreads | From 0.9 pips | From 0.9 pips | Variable |

| Instruments | All 1,250+ | All 1,250+ | All 1,250+ |

| Negative Balance Protection | Yes | No | N/A |

| Virtual Funds | N/A | N/A | $100,000 |

| Eligibility Requirements | Open to all | Must meet 2/3 criteria* | Open to all |

Negative Balance Protection

AvaTrade provides comprehensive negative balance protection for all retail accounts, ensuring traders cannot lose more than their deposited funds. This critical safety feature protects against extreme market volatility and gap risks. For example, if a trader maintains a $1,000 balance and market conditions cause a $1,500 loss, AvaTrade absorbs the $500 deficit, resetting the account to zero without additional liability. This protection applies automatically to all retail accounts, though professional accounts waive this protection in exchange for higher leverage access. The broker also offers a risk-management feature, "AvaProtect." It allows traders to protect their positions against losses for a chosen period of time. Overall, AvaTrade guarantees protecting its clients, and it has proven this in the past.

AvaTrade Deposits and Withdrawals

AvaTrade supports multiple payment methods ensuring global accessibility. The broker maintains transparent fee structures with most methods offering free deposits.

Payment Methods Comparison

| Method | Deposit Time | Withdrawal Time | Fees | Minimum |

|---|---|---|---|---|

| Credit/Debit Cards | Instant | 1-3 days | Free | $100 |

| Bank Wire | 1-3 days | 3-5 days | Free* | $100 |

| Skrill | Instant | 1-2 days | 1% | $100 |

| Neteller | Instant | 1-2 days | 1-2% | $100 |

| WebMoney | Instant | 1-2 days | 1-2% | $100 |

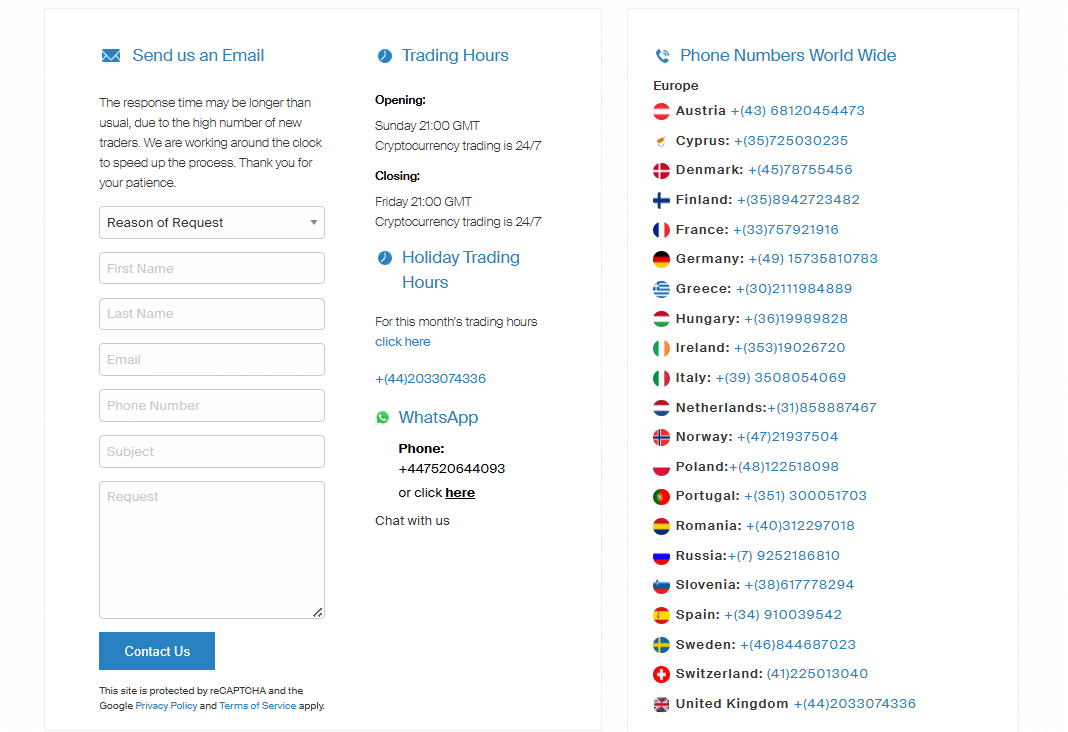

Support Service for Customer

Opening an AvaTrade account follows a straightforward five-step process designed for efficiency:

- Registration: Complete online form with email and password

- Personal Information: Provide full details including trading experience questionnaire

- Identity Verification: Upload government ID and proof of address

- Account Funding: Deposit minimum $100 via preferred payment method

- Platform Download: Access chosen trading platform and begin trading

Prohibited Countries

AvaTrade restricts clients from specific jurisdictions due to regulatory and compliance requirements. The platform does not accept traders from the USA, Belgium, Cuba, Iran, Syria, New Zealand, Russia, Belarus, Lebanon, Yemen, the Isle of Man, and Guernsey. As a result, individuals from these regions are ineligible to open accounts or engage in trading activities with AvaTrade

Countries list

-

Belgium

-

Cuba

-

Iran

-

Syria

-

USA

-

New Zealand

-

Russia

-

Belarus

-

Lebanon

-

Yemen

-

Guernsey

Special Offers for Customers

AvaTrade provides selective promotional offerings focused on long-term value:

Current Promotions

- VIP Program: Premium membership tiers offering exclusive benefits including superior trading conditions, advanced tools, and interest earnings up to 3% annually on free margin for Diamond members

- Refer-a-Friend Program: Earn cash rewards ranging from $50 to $250 based on referred friend's initial deposit amount

Conclusion

After comprehensive analysis, AvaTrade emerges as a highly reliable broker suitable for traders prioritizing security, education, and platform variety. Their exceptional regulatory profile, with six top-tier licenses, provides unmatched client protection compared to industry standards.

The broker's strengths include competitive spreads from 0.9 pips, extensive educational resources through AvaAcademy, and award-winning platform selection. The $100 minimum deposit ensures accessibility while maintaining service quality. Customer support excellence, available 24/5 in 15+ languages, demonstrates genuine commitment to client success.

However, limitations exist including inactivity fees after three months, restricted account variety, and no US client acceptance. Professional traders may find the single account structure limiting compared to brokers offering tiered VIP programs.

AvaTrade best suits traders seeking a well-regulated, education-focused broker with strong technological infrastructure. Their 18-year market presence, combined with consistent industry recognition, validates their reliability. While not the cheapest option available, AvaTrade delivers exceptional value through security, education, and comprehensive market access.

For traders prioritizing regulatory protection and educational support over lowest costs, AvaTrade represents an excellent choice. Their balanced approach to trading services, combining traditional platforms with innovative solutions, positions them strongly within the competitive forex and CFD marketplace.

Identify the safest choices via our regulation-first broker map.

Compare MENA offerings in the CFI Markets review.