Axi Broker Review 2025: Comprehensive Analysis of Trading Conditions, Regulation, Deposit, and Unique Features

Axi

Australia

Australia

-

Minimum Deposit $1

-

Withdrawal Fee $0

-

Leverage 500:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Austria Financial Services License

Austria Financial Services License

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+61299655830

(English)

+61299655830

(English)

Supported language: Arabic, Chinese (Simplified), English, German, Spanish

Social Media

Summary

Axi is a globally trusted forex and CFD broker, regulated by top-tier authorities like ASIC and FCA. It offers competitive spreads, leverage up to 1:500, and access to the powerful MetaTrader 4 platform with advanced trading tools. With zero deposit fees, multiple payment methods, and 24/5 customer support, Axi caters to both beginners and experienced traders. While it lacks a proprietary platform and has limited asset variety, its strong regulation and reliable trading conditions make it a solid choice for traders in 2025.

- Multi-jurisdictional regulation by top-tier authorities ASIC, FCA, and DFSA

- Wide range of tradable assets, including forex, CFDs, and precious metals

- MetaTrader 4 platform enhanced with custom tools like Autochartist and VPS hosting

- Comprehensive educational resources such as guides, webinars, and market analysis

- Multilingual customer support is available 24/5 through various channels

- Competitive pricing with tight spreads and low commissions

- Unique Axi Select program offering additional funding and benefits for high-performing traders

- Negative balance protection ensures clients cannot lose more than their account balance

- Transparency regarding fees, policies, and regulatory status

- Suitability for various trading styles with multiple account types and a wide range of assets

- Absence of MetaTrader 5 platform

- Relatively high minimum deposit of $25,000 for Elite accounts

- Limited range of tradable instruments compared to some competitors

- No 24/7 customer support

- Inactivity fees applied after 12 months of no trading activity

- Limited number of base currencies for account funding

- No guaranteed stop-loss orders

- Withdrawal fees may apply for certain payment methods

- VPS hosting is only available for clients meeting minimum balance and trading volume requirements

- Some promotions and offers may have restrictions or limitations

Overview

Axi, formerly known as AxiTrader, is a well-established online broker specializing in forex, CFDs, and precious metals trading. Founded in 2007 in Sydney, Australia, Axi has expanded its presence to key financial hubs worldwide, including London, Dubai, and Singapore. The broker is regulated by top-tier authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Dubai Financial Services Authority (DFSA).

Axi offers a comprehensive trading environment built upon the popular MetaTrader 4 (MT4) platform, which is enhanced with custom tools and plugins like AutoChartist.Clients can access over 140 tradable instruments, including forex pairs, indices, commodities, and cryptocurrencies, with competitive spreads and flexible leverage options. The broker caters to both novice and experienced traders, providing educational resources, market analysis, and a variety of account types to suit different trading styles and strategies.

With a focus on technology and innovation, Axi has earned recognition within the industry. The broker was named the "Best MT4 Broker" at the 2020 US Forex Awards and was a finalist for "Best Forex Trading Platform" at the 2019 Fund Technology and WSL Awards. More information about Axi's services, platforms, and regulatory status can be found on their official website, axi.com.

Overview Table

| Attribute | Details |

|---|---|

| Headquarters | Sydney, Australia |

| Founded | 2007 |

| Regulation | FCA (UK), ASIC (Australia), DFSA (UAE) |

| Trading Platforms | MetaTrader 4 (MT4), MT4 NextGen |

| Instruments | Forex, CFDs, Indices, Commodities, Cryptocurrencies |

| Minimum Deposit | $0 (Standard and Pro accounts) |

| Maximum Leverage | Up to 1:500 (depending on the entity and instrument) |

| Education | Tutorials, webinars, market analysis, trading guides |

| Customer Support | 24/5 via live chat, email, and phone |

| Unique Features | Axi Select program, AutoChartist, VPS hosting |

Facts List

- Axi was founded in 2007 in Sydney, Australia, under the name AxiTrader.

- The broker is regulated by the FCA (UK), ASIC (Australia), and DFSA (UAE).

- Axi offers trading in forex, CFDs, indices, commodities, and cryptocurrencies.

- The primary trading platform is MetaTrader 4 (MT4), enhanced with custom tools like MT4 NextGen.

- Clients can access over 80 tradable instruments with competitive spreads and flexible leverage options.

- Axi caters to both novice and experienced traders, providing educational resources and market analysis.

- The broker offers various account types, including Standard, Pro, and Elite, to suit different trading styles.

- Axi has earned recognition within the industry, including "Best MT4 Broker" at the 2020 US Forex Awards.

- The broker focuses on technology and innovation, offering features like AutoChartist and VPS hosting.

- Axi provides 24/5 customer support via live chat, email, and phone in multiple languages.

Axi Licenses and Regulatory

Axi operates under a multi-jurisdictional regulatory framework, holding licenses from several respected financial authorities worldwide.

| Regulatory Authority | Entity Name | Registration/License Number | Jurisdiction |

|---|---|---|---|

| Australian Securities and Investments Commission (ASIC) | AxiCorp Financial Services Pty Ltd | ACN: 127 606 348, AFSL: 318232 | Australia |

| Financial Conduct Authority (FCA), UK | Axi Financial Services (UK) Ltd | Company No.: 6050593, FRN: 466201 | United Kingdom |

| Dubai Financial Services Authority (DFSA) | AxiCorp Financial Services Pty Ltd, Dubai Branch | Ref No.: F003742 | Dubai, UAE |

| Financial Services Authority (FSA), St. Vincent and the Grenadines | AxiTrader Ltd | Company No.: 25417 BC 2019 | St. Vincent and the Grenadines |

Compared to industry standards, Axi's regulatory profile is robust and comprehensive. Many brokers opt for a single license, often from a less stringent jurisdiction, which may not provide the same level of client protection. By maintaining licenses from ASIC, FCA, and DFSA, Axi demonstrates a willingness to adhere to the highest standards of regulatory compliance, setting itself apart from less scrupulous operators in the industry.

Trading Instruments

Axi offers an extensive range of forex trading opportunities, with over 80 currency pairs available. These include major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs. The broker provides competitive spreads, with the EUR/USD spread starting from as low as 0.1 pips on their Pro account. Axi's forex offerings cater to both novice and experienced traders, with flexible lot sizes and leverage options up to 1:500 (depending on the regulatory jurisdiction).

CFDs In addition to forex, Axi provides a diverse selection of CFDs (Contracts for Difference) across multiple asset classes. These include:

- Indices: Traders can access popular stock indices like the S&P 500, FTSE 100, DAX 30, and ASX 200, with spreads starting from 0.5 points.

- Commodities: Axi offers CFDs on a range of commodities, including gold, silver, oil, and natural gas. Spreads for gold start at 15.7 pips, while silver spreads begin at 0.7 pips.

- Cryptocurrencies: The broker provides CFD trading on major cryptocurrencies such as Bitcoin, Ethereum, and Ripple, with leverage up to 1:2 (subject to regulatory restrictions).

- Stocks: Axi offers CFDs on a selection of global stocks, allowing traders to speculate on the price movements of popular companies without owning the underlying shares.

The breadth of Axi's CFD offerings enables traders to diversify their portfolios and capitalize on opportunities across different markets. The broker's commitment to providing a wide range of tradable assets sets them apart from competitors who may focus solely on forex or a limited number of CFDs.

Precious Metals: Axi offers spot trading on precious metals, including gold and silver. These instruments are popular among traders seeking to hedge against market volatility or diversify their portfolios. The broker provides competitive spreads on precious metals, with gold spreads starting from 15.7 pips and silver spreads from 0.7 pips.

Significance of Asset Diversity: The diverse range of tradable assets offered by Axi is significant for several reasons:

- Flexibility: Traders can access multiple markets from a single platform, allowing them to adapt their strategies based on prevailing market conditions and opportunities.

- Risk Management: By diversifying across different asset classes, traders can potentially mitigate risk and smooth out their overall portfolio performance.

- Adaptability: Axi's wide range of offerings demonstrates their ability to stay attuned to market trends and cater to the evolving needs of their clients.

Compared to industry standards, Axi's tradable asset offerings are comprehensive and competitive. While some brokers may specialize in a particular asset class, Axi provides a well-rounded selection that caters to a broad spectrum of trading preferences and strategies.

Trading Platforms

MetaTrader 4 (MT4)

Axi's primary trading platform is MetaTrader 4 (MT4), a widely-used and respected software in the online trading industry. MT4 offers a user-friendly interface, advanced charting tools, and a wide range of technical indicators, making it suitable for both novice and experienced traders. Axi provides the standard MT4 platform alongside its custom-built MT4 NextGen, which includes additional features such as:

- AutoChartist: An automated pattern recognition tool that identifies potential trading opportunities.

- Trading Central: Provides expert market analysis and actionable trading ideas.

- PsyQuation: An advanced data analytics tool that helps traders analyze their performance and optimize their strategies.

MT4 is available as a desktop application for Windows and Mac, a web-based platform accessible through modern browsers, and a mobile app for iOS and Android devices.

Web Trader

For traders who prefer not to download additional software, Axi offers a web-based trading platform accessible through their website. The Web Trader provides a streamlined interface for placing trades, managing positions, and monitoring account activity. While not as feature-rich as the MT4 platform, the Web Trader is a convenient option for traders who value simplicity and accessibility.

Mobile Trading

Axi offers mobile trading apps for both iOS and Android devices, allowing traders to access their accounts and manage positions on the go. The mobile apps provide a range of features, including:

- Real-time quotes and charts

- Multiple order types (Market, Limit, Stop)

- Account management tools

- Secure login with biometric authentication

The mobile apps are well-designed and user-friendly, making it easy for traders to stay connected to the markets and react to opportunities as they arise.

Trading Platforms Comparison Table

| MT4 Desktop | MT4 Web Trader | MT4 Mobile | |

|---|---|---|---|

| Customizable workspace | Yes | Limited | Limited |

| Technical indicators | 30+ | 30+ | Basic set |

| Drawing tools | Yes | Yes | Basic set |

| Automated trading (EAs) | Yes | No | No |

| Copy trading | Yes (via MT4 NextGen) | No | No |

| Market analysis | Yes (via MT4 NextGen) | No | No |

| Mobile app support | N/A | N/A | iOS, Android |

Please note that the information provided in this comparison table is based on the general features of the MT4 platform and may vary slightly based on the specific implementation by Axi.

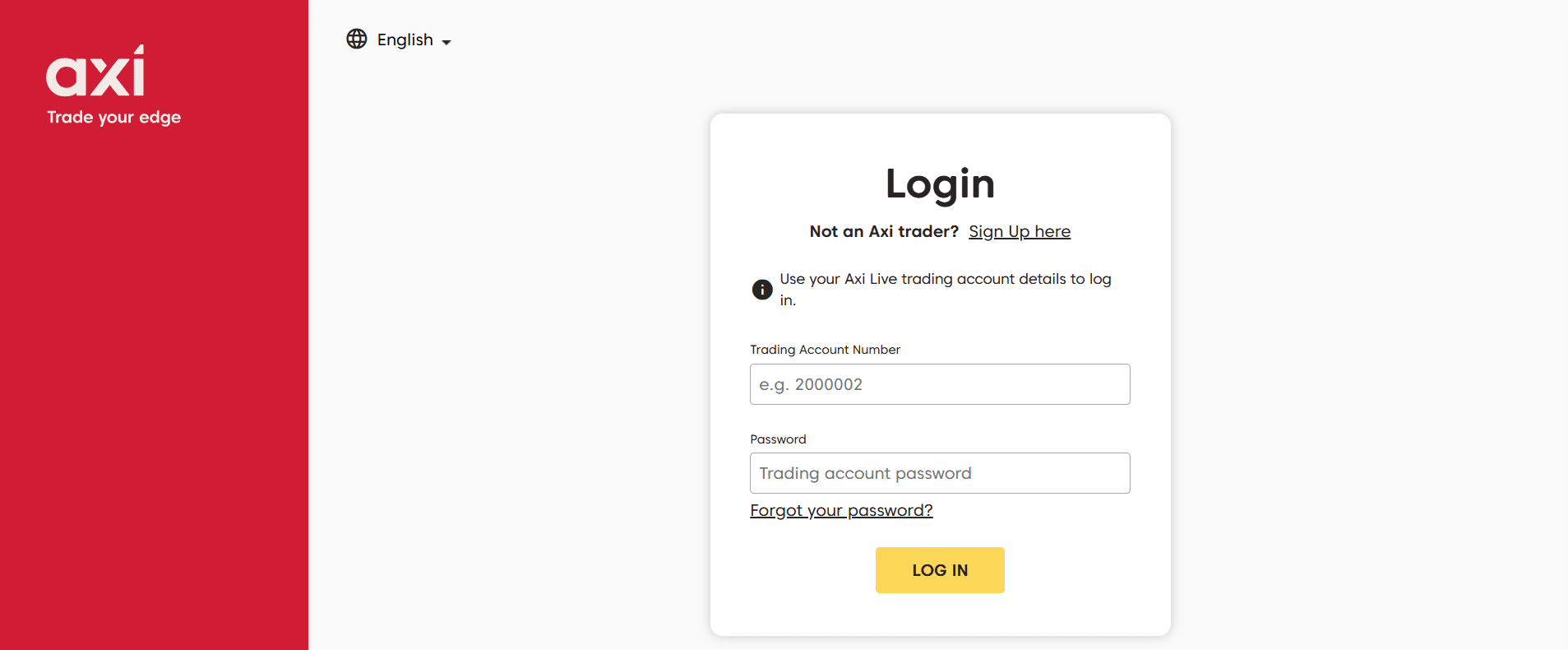

Axi How to Open an Account: A Step-by-Step Guide

Opening an account with Axi is a straightforward process that can be completed entirely online. Before getting started, it's essential to ensure that you meet the minimum requirements and have the necessary documentation ready.

Requirements

- Minimum age: 18 years old

- Valid government-issued ID (e.g., passport, driver's license)

- Proof of residence (e.g., utility bill, bank statement)

- Minimum deposit: No minimum for Standard and Pro accounts; $25,000 for Elite accounts

Step 1: Visit the Axi website and click on the "Open an Account" button.

Step 2: Select your account type (Standard, Pro, or Elite) and provide your personal information, including your name, email address, phone number, and country of residence.

Step 3: Complete the online application form, which includes questions about your trading experience, financial knowledge, and risk tolerance. This information helps Axi determine the suitability of their services for your needs and ensures compliance with regulatory requirements.

Step 4: Upload the required identification documents (proof of identity and proof of residence) to verify your account. Axi uses secure encryption to protect your personal information and typically processes verification within 1-2 business days.

Step 5: Once your account is verified, you can fund it using one of the accepted payment methods:

- Credit/debit card (instant funding)

- Bank wire transfer (1-3 business days)

- E-wallets like Neteller and Skrill (instant funding)

- Cryptocurrency (instant funding, subject to Axi's discretion)

Step 6: After your funds are credited to your account, you can download the trading platform of your choice (MT4 desktop, web, or mobile) and start trading.

Unique Features

- Axi offers a seamless and entirely digital account opening process, eliminating the need for physical paperwork.

- The broker provides a wide range of account types to suit different trading styles and experience levels.

- Axi supports multiple funding options, including cryptocurrencies, offering flexibility to traders.

By following these simple steps and providing the required information and documentation, traders can quickly and securely open an account with Axi and start exploring the world of online trading.

Charts and Analysis

Axi provides a comprehensive suite of educational resources and tools to support traders in their journey, from novice to expert. These resources are designed to enhance traders' knowledge, skills, and decision-making abilities, empowering them to navigate the complex world of online trading with greater confidence and proficiency.

| Category | Details |

|---|---|

| Trading Guides & Ebooks | Axi offers downloadable guides covering Introduction to Forex Trading, Understanding CFDs, Risk Management Strategies, Technical Analysis Basics, and Fundamental Analysis Explained. These are suitable for traders of all levels. |

| Webinars & Video Tutorials | Regular webinars and an extensive video library covering platform tutorials and advanced trading strategies, led by experienced traders and analysts. |

| Economic Calendar | A customizable tool that tracks market events and economic data releases, allowing traders to filter by currency, importance, and time frame. Essential for fundamental analysis. |

| Market Analysis & Insights | Includes daily market news, weekly outlooks, and in-depth articles on currency pairs, commodities, and other assets. Accessible via the website, email newsletters, and social media. |

| Autochartist | An automated technical analysis tool that scans markets 24/7 to identify patterns, trends, and trade opportunities, providing actionable insights for technical traders. |

Compared to industry standards, Axi's educational resources and tools are comprehensive and well-developed. The broker goes beyond the basics, offering a diverse range of materials that cater to traders of all experience levels. The integration of third-party tools like Autochartist sets Axi apart from competitors who may only provide in-house resources.

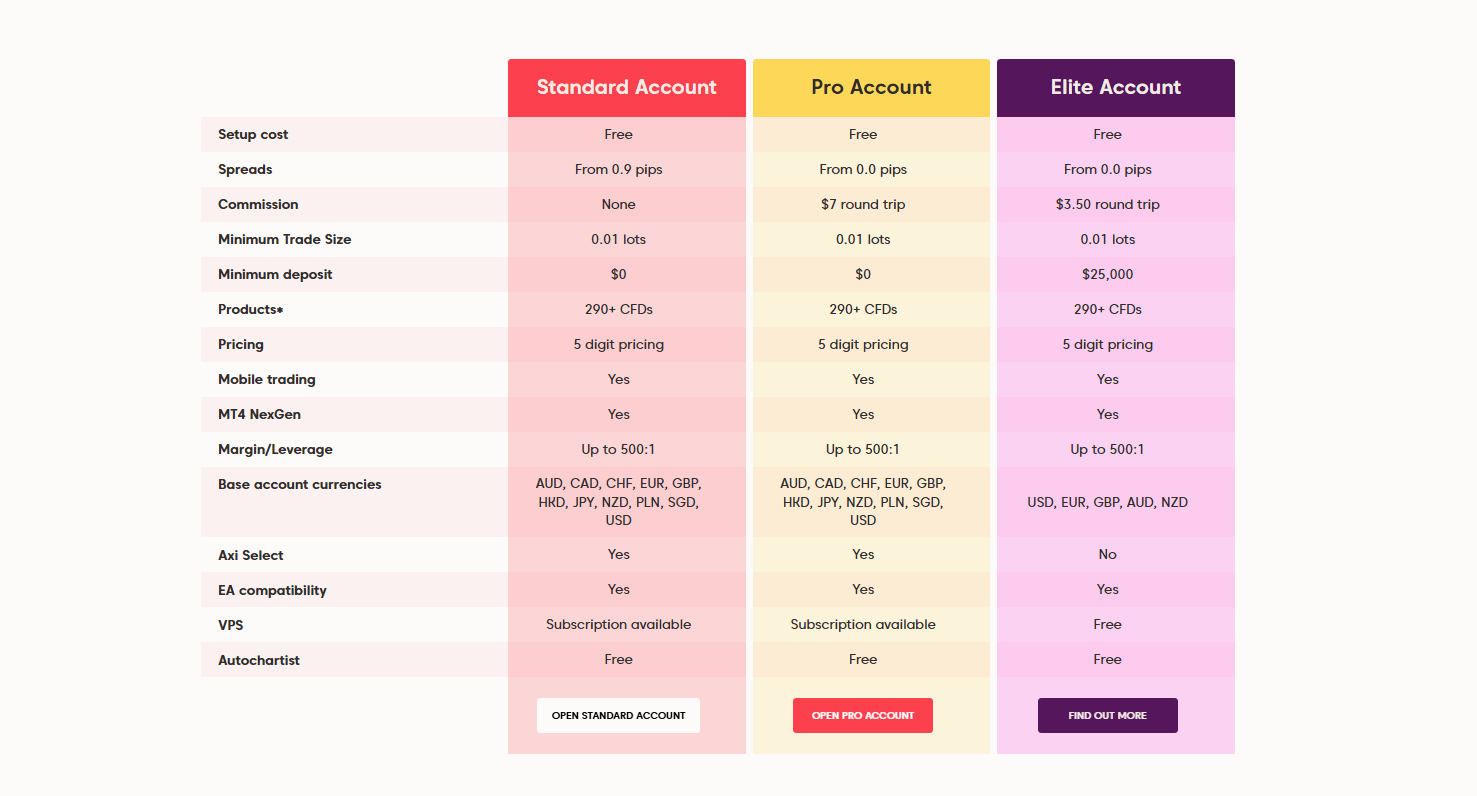

Axi Account Types

Axi provides a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading styles. By providing multiple account options, Axi ensures that traders can select the most suitable environment for their individual trading goals and strategies.

| Account Type | Minimum Deposit | Spreads | Commission | Leverage | Features |

|---|---|---|---|---|---|

| Standard Account | No minimum requirement | From 0.4 pips on major currency pairs | No commission | Up to 1:400 | Ideal for novice traders, access to all tradable instruments, lower costs, simple trading experience |

| Pro Account | No minimum requirement | Raw spreads from 0 pips on major currency pairs | $3.50 per standard lot (100,000 units) per side | Up to 1:400 | Designed for experienced traders, access to all tradable instruments, eligibility for Axi's VPS hosting service |

| Elite Account | $25,000 | Raw spreads from 0 pips on major currency pairs | $2.75 per standard lot (100,000 units) per side | Up to 1:400 | Tailored for high-volume and institutional traders, dedicated account management and support, VPS hosting eligibility |

| Demo Account | N/A (Virtual funds) | Simulated market conditions | No commission | N/A | $50,000 virtual balance, practice trading strategies, available for both Standard and Pro accounts |

Importance of Account Type Flexibility: By offering a range of account types, Axi demonstrates its commitment to serving traders with varying levels of experience, trading styles, and financial resources. This flexibility allows traders to select an account that aligns with their specific needs and goals, enhancing their overall trading experience and potential for success.

Axi's account types are competitive within the industry, offering a balance of low costs, tight spreads, and advanced features. The broker's transparency in pricing and the absence of minimum deposit requirements for Standard and Pro Accounts make it an accessible choice for a wide range of traders.

Negative Balance Protection

Axi has negative balance protection to all retail clients who trade under the AxiCorp Financial Services Pty Ltd entity, regulated by the Australian Securities and Investments Commission (ASIC). This protection ensures that clients cannot lose more than their account balance, even in the event of extreme market volatility or unexpected gaps in market prices. If a client's account balance falls below zero, Axi will absorb the negative balance and reset the account balance to zero. This policy applies to all trading products offered by Axi, including forex, CFDs, and precious metals. Terms and Conditions:

- Negative balance protection applies only to retail clients trading under the ASIC-regulated entity, AxiCorp Financial Services Pty Ltd.

- Professional and wholesale clients are not eligible for negative balance protection.

- The policy does not cover losses incurred due to client negligence, such as leaving positions open while knowingly having insufficient funds to support potential losses.

Axi Deposits and Withdrawals

Axi provides traders with a range of convenient and secure deposit and withdrawal options, ensuring a seamless experience when managing funds in their trading accounts. The broker supports various payment methods to cater to the diverse needs of their global client base.

Deposit Methods

| Payment Method | Processing Time | Minimum Deposit | Maximum Deposit per Transaction | Deposit Fees |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | $5 | $20,000 | No fees (provider/bank fees may apply) |

| Bank Wire Transfer | 1-3 business days | $1 | No limit | No fees (provider/bank fees may apply) |

| Electronic Wallets (Neteller, Skrill) | Instant | $5 | $10,000 | No fees (provider/bank fees may apply) |

| Cryptocurrencies (Bitcoin, Ethereum) | Instant (subject to blockchain confirmation) | $50 | $10,000 | No fees (provider/bank fees may apply) |

Withdrawal Methods

| Payment Method | Processing Time | Minimum Withdrawal | Maximum Withdrawal per Transaction | Withdrawal Fees |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1-3 business days | $50 | $10,000 | No fees (provider/bank fees may apply) |

| Bank Wire Transfer | 1-3 business days | $50 | No limit | No fees (provider/bank fees may apply) |

| Electronic Wallets (Neteller, Skrill) | 1-2 business days | $5 | $10,000 | No fees (provider/bank fees may apply) |

| Cryptocurrencies (Bitcoin, Ethereum) | 1-2 business days (subject to blockchain confirmation) | $50 | $10,000 | No fees (provider/bank fees may apply) |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Axi requires traders to verify their accounts before making a withdrawal. This process involves submitting proof of identity and proof of residence documents. Axi employs secure encryption technology to protect traders' personal information during the verification process.Unique Features

- Multiple base currencies: Axi supports accounts in USD, EUR, GBP, AUD, and several other currencies, allowing traders to minimize currency conversion fees.

- Cryptocurrency support: Axi is among the few brokers that accept deposits and withdrawals in cryptocurrencies, providing an additional layer of privacy and flexibility for traders.

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account management, platform troubleshooting, or general inquiries, and a responsive support team can make all the difference. Axi recognizes the importance of customer support and provides a range of channels through which traders can reach out for help.

| Support Channel | Details |

|---|---|

| Live Chat | Available on Axi's website for real-time assistance. Ideal for quick queries and troubleshooting. |

| Traders can contact support at support@axi.com for non-urgent inquiries. Response time is typically within 24 hours. | |

| Phone Support | Local phone numbers are available for traders in Australia, United Kingdom, Germany, and other countries. Support is available during regular business hours in each region. |

| Social Media | Traders can reach out via Facebook or Twitter for general inquiries and updates on news and promotions. |

Support Languages

Axi's customer support is available in multiple languages to cater to their global client base, including:- English

- Spanish

- Chinese

- Italian

- German

- Arabic

Prohibited Countries

In order to comply with international regulations and licensing requirements, Axi is unable to provide services to residents of certain countries. These restrictions are put in place to ensure that the broker operates in accordance with local laws and to protect both the company and its clients from potential legal and financial risks.

Prohibited Countries List

Axi is unable to provide services to residents of the following countries:

- United States of America

- Canada

- Japan

- New Zealand

- Brazil

- North Korea

- Iran

- Cuba

- Syria

- Sudan

- Crimea Region

Please note that this list is not exhaustive and may be subject to change based on evolving regulations and geopolitical circumstances. For the most up-to-date information on prohibited countries, visit Axi's official website or contact their customer support.

Consequences of Trading from Prohibited Countries:

Attempting to trade with Axi from a prohibited country may result in the following consequences:

- Account Closure: If Axi discovers that a client is resident in a prohibited country, the broker reserves the right to close the account immediately and return any remaining funds to the client, subject to compliance with applicable laws and regulations.

- Legal and Financial Risks: Trading with Axi from a prohibited country may expose clients to legal and financial risks, as they may be in violation of local laws and regulations. This could result in fines, penalties, or other legal consequences.

- Limited Recourse: Clients from prohibited countries may have limited recourse in the event of a dispute with the broker, as they may not be protected by the laws and regulations of Axi's licensing jurisdictions.

It is essential for traders to ensure that they are eligible to open an account with Axi before attempting to do so. By complying with the broker's prohibited countries policy, traders can protect themselves from potential legal and financial risks and ensure a safe and compliant trading experience.

Special Offers for Customers

Axi provides a range of special promotions and offers designed to enhance the trading experience and provide additional value to both new and existing clients. These offers are subject to change and may vary depending on the trader's location and account type. Some of the notable promotions currently available include:

- Axi Select Program: The Axi Select program is an exclusive offer for high-performing traders, providing them with access to additional funding and a range of benefits. Key features of the program include:

- Funding of up to $1 million for successful applicants

- Profit-sharing scheme, with traders receiving up to 90% of profits generated using Axi's funds

- Access to advanced trading tools, technical analysis, and educational resources

- Membership in a community of professional traders

To qualify for the Axi Select program, traders must meet specific criteria, such as maintaining a minimum trading volume and demonstrating consistent profitability. The program is currently only available to traders registered with Axi's St. Vincent and the Grenadines entity.

- Refer-a-Friend Program: Axi's refer-a-friend program allows existing clients to earn rewards for introducing new traders to the broker. When a referred friend opens an account and meets certain trading volume requirements, the referring client receives a cash bonus. The specific terms and conditions, including the bonus amount and trading volume thresholds, may vary depending on the client's location and account type.

- Free VPS Hosting: Axi offers free Virtual Private Server (VPS) hosting for clients who maintain a minimum account balance and trading volume. VPS hosting provides traders with a secure, reliable, and low-latency connection to Axi's trading servers, enabling them to run automated trading strategies and access the markets 24/7. To qualify for free VPS hosting, traders should check the specific requirements on Axi's website or contact their customer support.

- Autochartist and Trading Central Access: Axi has partnered with third-party service providers Autochartist and Trading Central to offer clients access to advanced technical analysis tools and market insights. Autochartist is an automated pattern recognition software that scans the markets for potential trading opportunities, while Trading Central provides expert analysis and actionable trading ideas. Access to these tools is available to Axi clients at no additional cost.

It is important for traders to carefully review the terms and conditions associated with each special offer, as they may be subject to change or have specific requirements that must be met to qualify. While these promotions can provide additional value and enhance the trading experience, traders should always prioritize sound risk management and avoid making decisions solely based on promotional offers.

Conclusion

As I approach the end of this comprehensive review of Axi, I find myself with a clear picture of their strengths, weaknesses, and overall reputation as a broker. Throughout my analysis, I have delved into various aspects of their operations, from regulatory compliance and geographical reach to customer support and special offers.

One of the most compelling aspects of Axi is their commitment to safety and reliability. They are regulated by top-tier authorities such as ASIC, FCA, and DFSA, which speaks volumes about their adherence to strict regulatory standards and their dedication to protecting clients' interests. This multi-jurisdictional regulation provides traders with an added layer of security and peace of mind.

Axi's trading environment is well-rounded and caters to a wide range of traders, from beginners to professionals. They offer a solid selection of tradable assets, including forex, CFDs, and precious metals, providing ample opportunities for portfolio diversification. The broker's primary trading platform, MetaTrader 4, is enhanced with custom tools like Autochartist and VPS hosting, elevating the trading experience.

I am particularly impressed by Axi's educational resources and customer support. Their comprehensive learning materials, including guides, webinars, and market analysis, empower traders to make informed decisions and continuously improve their skills. The broker's multilingual support team is available 24/5 through various channels, ensuring that clients receive prompt and reliable assistance whenever needed.

While Axi has some limitations, such as the absence of MetaTrader 5 and a relatively high minimum deposit for Elite accounts, these drawbacks are outweighed by the broker's numerous strengths. Their transparency, competitive pricing, and unique offerings like the Axi Select program demonstrate their commitment to providing value to their clients.

In conclusion, I believe that Axi is a trustworthy and dependable broker that prioritizes the safety and satisfaction of its clients. Their robust regulatory framework, comprehensive trading environment, and dedication to education and support make them a strong choice for traders of all levels. As with any financial decision, it is essential to conduct thorough research and consider individual trading needs before choosing a broker. However, based on my extensive review, I can confidently recommend Axi as a reliable partner in the online trading journey.

See user scores across the broker ratings index.

Explore a CFD specialist in the Alvexo review.