BDSwiss Review 2025: A Comprehensive Look at the Forex & CFD Broker

BDSwiss

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.3

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Securities Brokerage License

Securities Brokerage License

Japan Forex Trading License

Japan Forex Trading License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+35725262513

(English)

+35725262513

(English)

Supported language: English, German, French, Italian, Spanish, Portuguese, Arabic, Chinese (Simplified)

Social Media

- Wide range of tradable assets (250+ CFDs)

- Multiple advanced trading platforms (MT4, MT5, WebTrader, mobile apps)

- Competitive spreads and flexible leverage

- Negative balance protection

- Extensive educational resources

- Excellent customer support (24/5)

- No deposit or withdrawal fees

- Multiple account types catering to different needs

- Regular promotional offers and bonuses

- Multi-lingual support

- Not available to residents of certain countries (USA, Canada, EU, Australia, Japan)

- Past regulatory issues with the FCA

- Limited range of tradable instruments compared to some larger brokers

- Higher minimum deposits for Pro and Prime accounts

- No managed or copy trading services

- Potential fees from payment providers for deposits and withdrawals

- Inactivity fees for dormant accounts

- Overnight financing fees for holding positions open overnight

- Not listed on a public stock exchange

Overview

Established in 2012, BDSwiss is a leading online forex and CFD broker that has made a name for itself in the competitive world of online trading. With a strong presence in over 180 countries, BDSwiss has earned a reputation for providing a reliable, user-friendly, and feature-rich trading environment to its clients worldwide.

BDSwiss's commitment to excellence has been recognised through numerous industry awards, including "Best Trading Conditions" and "Best Trade Execution" from the World Finance Forex Awards in 2020 and 2021, respectively. These accolades are a testament to the broker's dedication to offering competitive spreads, fast execution speeds, and a wide range of tradable assets.

One of the key strengths of BDSwiss is its diverse offering of over 1,000 financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies. This extensive range of markets allows traders to diversify their portfolios and take advantage of various trading opportunities, all from a single platform.

BDSwiss prides itself on providing cutting-edge technology and powerful trading tools to its clients. The broker offers the popular MetaTrader 4 and MetaTrader 5 platforms, as well as its proprietary BDSwiss WebTrader and mobile apps, catering to the needs of both beginner and advanced traders.

To further support its clients, BDSwiss offers a comprehensive suite of educational resources, including webinars, video tutorials, and in-depth market analysis. These materials are designed to help traders of all skill levels improve their knowledge and make informed trading decisions.

While BDSwiss has many positive attributes, it's essential for potential clients to be aware of the broker's regulatory status. BDSwiss is regulated by the Financial Services Commission (FSC) in Mauritius and the Financial Services Authority (FSA) in Seychelles, which are considered tier-3 and tier-4 regulators, respectively. The broker also holds a license from the Securities and Commodities Authority (SCA) in the United Arab Emirates.

It's worth noting that BDSwiss previously held a license from the Cyprus Securities and Exchange Commission (CySEC) but voluntarily surrendered it in 2021. Additionally, the broker was cited by the Financial Conduct Authority (FCA) in the UK for issues related to its affiliate marketing practices and can no longer operate in the country.

Despite these regulatory challenges, BDSwiss remains committed to providing a safe and transparent trading environment for its clients. The broker implements strict security measures, segregates client funds from its own operating capital, and offers negative balance protection to help mitigate potential losses.

For more in-depth information about BDSwiss's offerings, services, and regulatory status, visit their official website at www.bdswiss.com.

Overview Table

| Feature | BDSwiss |

|---|---|

| Year Founded | 2012 |

| Headquarters | Cyprus |

| Regulation | FSC (Mauritius), FSA (Seychelles), SCA (UAE) |

| Tradable Assets | 1,000+ (Forex, Stocks, Indices, Commodities, Cryptocurrencies) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, BDSwiss WebTrader, Mobile Apps |

| Customer Support | 24/5 Live Chat, Email, Phone |

| Education | Webinars, Tutorials, Market Analysis |

| Minimum Deposit | $100 |

| Payment Methods | Credit/Debit Cards, Bank Transfer, E-wallets |

| Account Types | Classic, Pro, Prime |

Facts List

- Established in 2012 with a strong global presence

- Offers over 250 CFDs on forex, shares, indices, commodities, and cryptocurrencies

- Regulated by the FSA in Seychelles and FSC in Mauritius

- Provides MetaTrader 4, MetaTrader 5, and proprietary trading platforms

- Offers competitive spreads starting from 0 pips

- Supports a wide range of payment methods for deposits and withdrawals

- Provides negative balance protection to mitigate risk

- Offers extensive educational resources and trading tools

- Multiple account types catering to different trader needs and budgets

- Award-winning broker recognized for excellence in the industry

BDSwiss Licenses and Regulatory

BDSwiss operates under a robust regulatory framework, holding licenses from multiple jurisdictions to ensure the highest standards of security and transparency for its clients. The broker is regulated by the Financial Services Authority (FSA) in Seychelles and the Financial Services Commission (FSC) in Mauritius.

BDSwiss also holds licenses from the Mauritian Independent Commission Against Corruption (MISA) and the Securities and Commodities Authority (SCA) in the United Arab Emirates (UAE). Additionally, the company operates as a Tied Agent in Germany.

It's worth noting that BDSwiss previously held a license from the Cyprus Securities and Exchange Commission (CySEC) but no longer accepts European Union (EU) clients as of 2024. The broker was also regulated by the Financial Conduct Authority (FCA) in the United Kingdom but was cited in 2021 for prohibited marketing practices by its affiliates and can no longer operate in the UK.

BDSwiss' multi-jurisdictional regulatory approach demonstrates its commitment to adhering to strict industry standards and providing a secure trading environment for its clients.

The broker's licenses from FSA, FSC, MISA, and SCA showcase its compliance with the regulations set forth by these respected authorities.

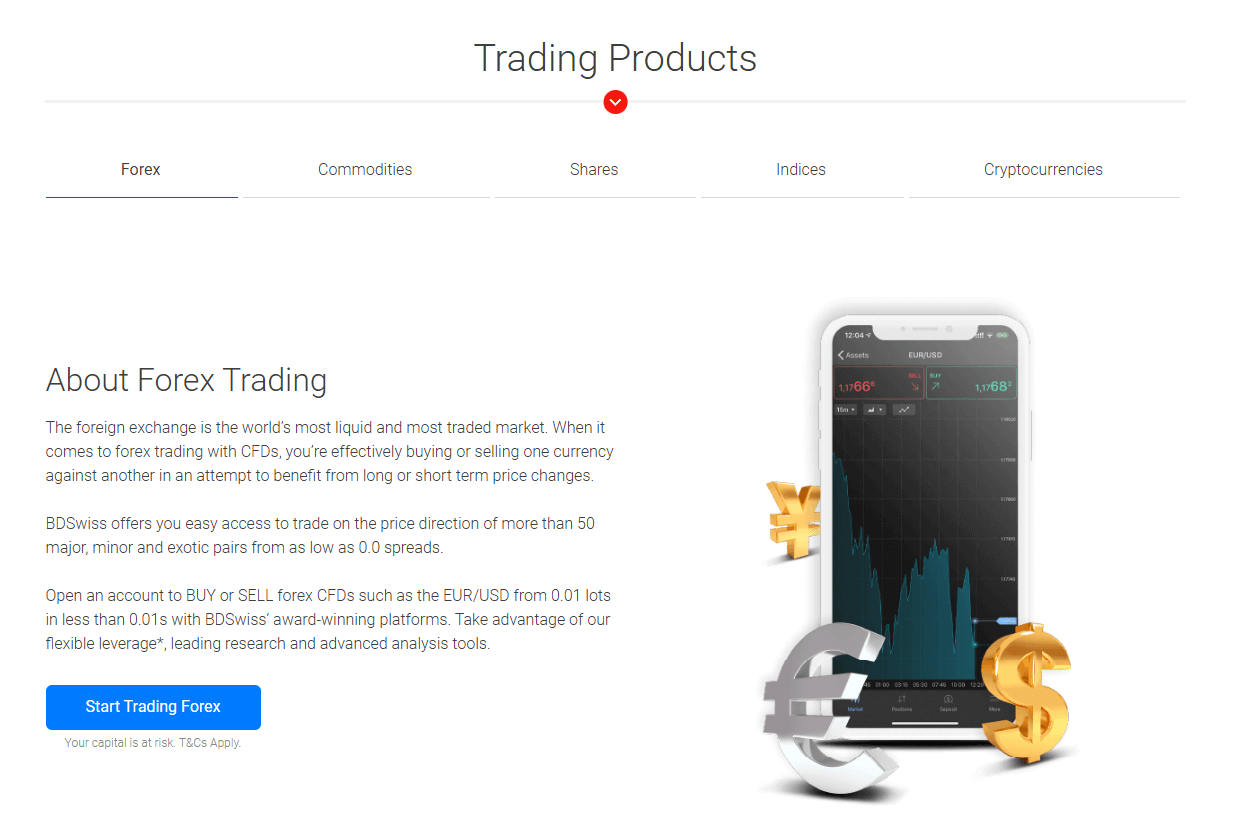

Trading Instruments

BDSwiss offers a comprehensive range of tradable assets, providing traders with ample opportunities to diversify their portfolios and capitalise on various market conditions. The broker's extensive offering includes over 250 CFDs on forex, shares, indices, commodities, and cryptocurrencies, making it an attractive choice for traders with different preferences and strategies.

| Asset Class | Description |

|---|---|

| Forex | Access to a wide range of major, minor, and exotic currency pairs with competitive spreads and flexible leverage options. |

| Shares | Trade CFDs on global shares of top companies, allowing speculation on price movements without owning the actual stocks. |

| Indices | CFDs on major stock indices like the S&P 500, FTSE 100, and DAX 30, enabling exposure to broader market segments. |

| Commodities | CFDs on commodities including precious metals (gold, silver) and energy products (oil, natural gas). |

| Cryptocurrencies | Trade CFDs on leading cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple, capitalising on the volatility of digital assets. |

Trading Platforms

BDSwiss provides a user-friendly and feature-rich trading experience through its multiple trading platforms:

MetaTrader 4 (MT4)

The industry-standard MT4 platform, known for its stability, advanced charting tools, and extensive customisation options. MT4 supports automated trading through Expert Advisors (EAs) and is available for desktop, web, and mobile devices.

MetaTrader 5 (MT5)

The next-generation trading platform, offering enhanced functionality, such as depth of market (DOM), a built-in economic calendar, and advanced risk management tools. MT5 also supports algorithmic trading and is accessible via desktop, web, and mobile apps.

BDSwiss WebTrader

A proprietary web-based trading platform that allows traders to access their accounts and trade directly through their web browsers without the need for any software installation. The WebTrader offers a user-friendly interface, real-time quotes, and advanced charting tools.

BDSwiss Mobile App

A powerful mobile trading application, available for both iOS and Android devices, enabling traders to manage their accounts, execute trades, and monitor the markets on the go. The mobile app provides a seamless trading experience with real-time quotes, interactive charts, and push notifications.

Trading Platforms Comparison Table

| Platform | MT4 | MT5 | WebTrader | Mobile App |

|---|---|---|---|---|

| Availability | Yes | Yes | Yes | Yes |

| Operating Systems | Windows, Mac, iOS, Android | Windows, Mac, iOS, Android | Web-based | iOS, Android |

| Automated Trading | Yes (EAs) | Yes (EAs, APIs) | No | No |

| Charting Tools | Yes (Advanced) | Yes (Advanced) | Yes (Basic) | Yes (Basic) |

| Indicators | 50+ | 80+ | 30+ | 30+ |

| Trading Signals | Yes | Yes | No | No |

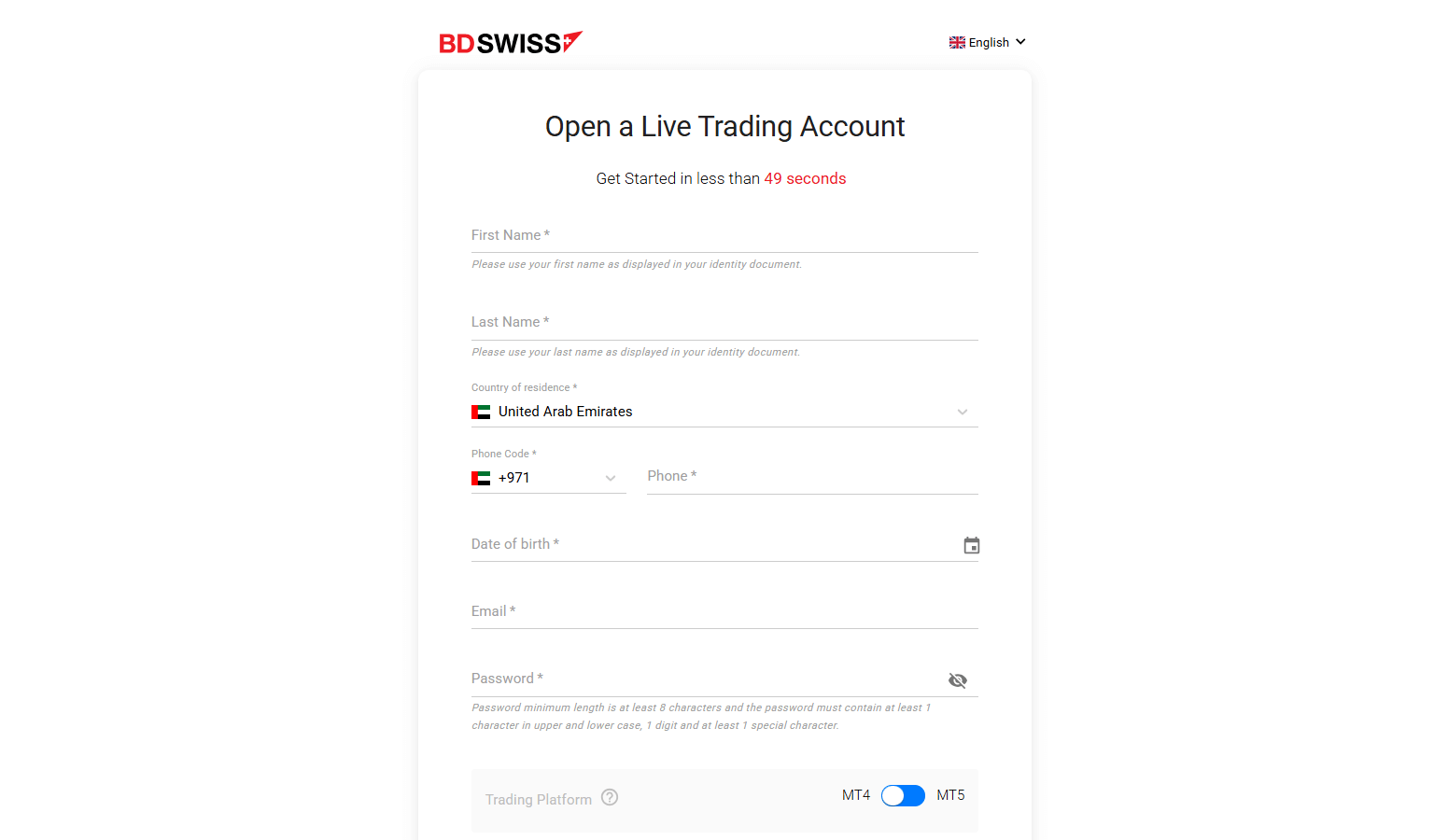

BDSwiss How to Open an Account: A Step-by-Step Guide

Opening an account with BDSwiss is a straightforward process that can be completed in a few simple steps:

- Visit the BDSwiss website and click on the "Open Account" button.

- Fill in the required personal information, including your name, email address, phone number, and country of residence.

- Choose your preferred account type (e.g., Classic, Pro, or Prime) and base currency.

- Provide the necessary identification documents, such as a valid passport or government-issued ID, and proof of address (e.g., utility bill or bank statement) for account verification.

- Make your initial deposit using one of the available payment methods, such as credit/debit cards, bank wire transfers, or e-wallets like Skrill and Neteller.

Charts and Analysis

BDSwiss offers a wealth of educational resources and trading tools to support traders in their market analysis and decision-making process:

| Feature | Description |

|---|---|

| Charts | Advanced charting tools with customisable indicators, drawing tools, and various timeframes are available on all BDSwiss trading platforms. |

| Analysis Tools | Includes technical tools such as pattern recognition, Fibonacci retracements, and pivot points for identifying trading opportunities. |

| Economic Calendar | Integrated calendar showing upcoming market-moving events like central bank decisions, GDP data, and employment reports. |

| Webinars | Regular live webinars led by expert analysts, covering market trends, strategies, and risk management techniques. |

| Educational Resources | Wide range of learning materials, including e-books, video tutorials, and articles suitable for all levels of traders. |

| Market News & Analysis | Provides daily market updates, news articles, and in-depth reports to keep traders informed and assist with strategic decision-making. |

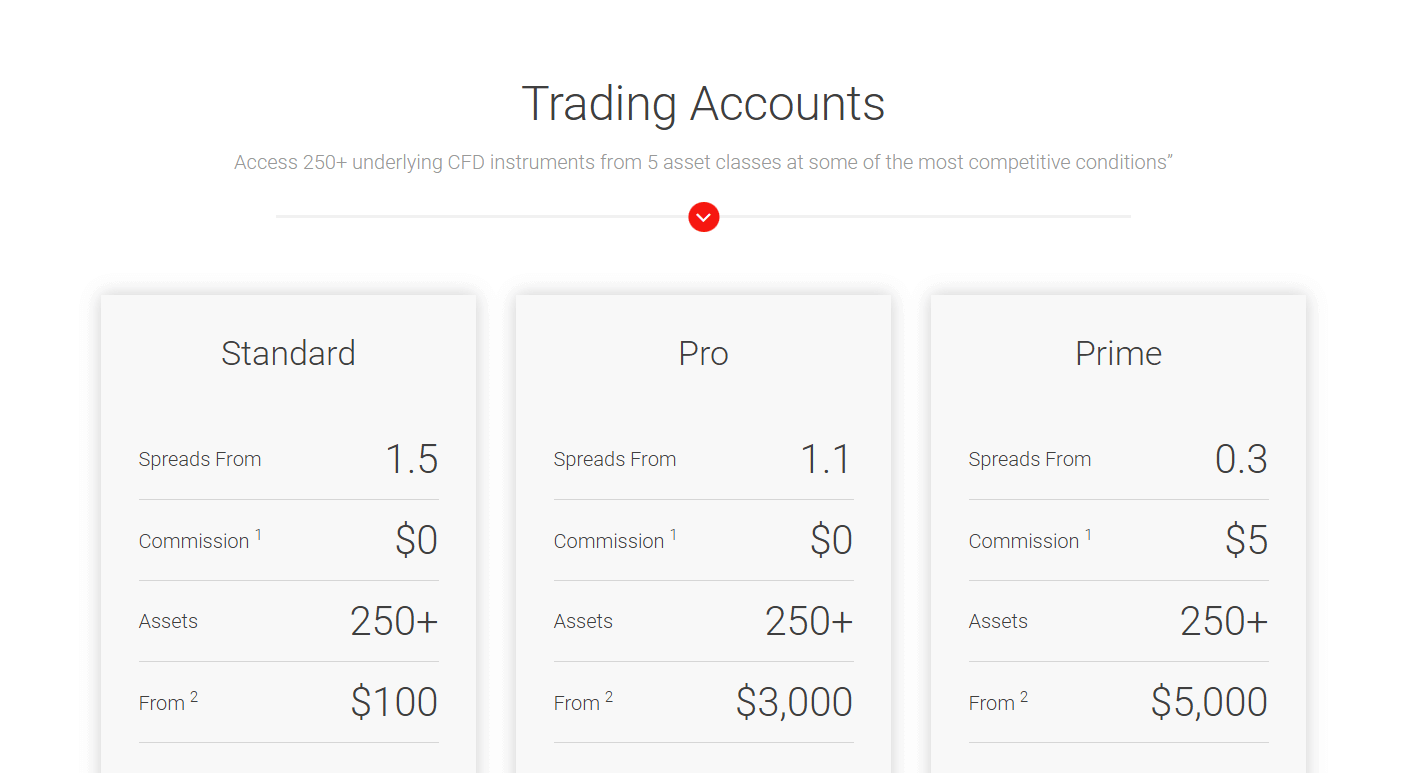

BDSwiss Account Types

BDSwiss offers three main account types, catering to the diverse needs and preferences of traders:

Classic Account

- Minimum deposit: $100

- Spreads from 1.5 pips

- No commission

- Up to 1:500 leverage

- Access to all trading instruments

Pro Account

- Minimum deposit: $3,000

- Spreads from 1.1 pips

- No commission

- Up to 1:200 leverage

- Access to all trading instruments

- Dedicated account manager

- VIP webinars and analysis

Prime Account

- Minimum deposit: $5,000

- Spreads from 0.3 pips

- $5 commission per lot

- Up to 1:100 leverage

- Access to all trading instruments

- Dedicated account manager

- Exclusive market analysis and trading signals

All account types offer access to BDSwiss' advanced trading platforms, educational resources, and customer support. The higher-tier accounts provide additional benefits such as tighter spreads, lower commissions, and personalised service from a dedicated account manager.

Account Types Comparison Table

| Feature | Classic Account | Pro Account | Prime Account |

|---|---|---|---|

| Minimum Deposit | $100 | $3,000 | $5,000 |

| Spreads | From 1.5 pips | From 1.1 pips | From 0.3 pips |

| Commission | $0 | $0 | $5 per lot |

| Leverage | Up to 1:500 | Up to 1:200 | Up to 1:100 |

| Instruments | 250+ | 250+ | 250+ |

| Account Manager | No | Yes | Yes |

| VIP Webinars | No | Yes | Yes |

| Exclusive Analysis | No | No | Yes |

Negative Balance Protection

BDSwiss offers negative balance protection to all its clients, ensuring that traders cannot lose more than their account balance. This feature is crucial in managing risk, particularly during volatile market conditions or unexpected events that may lead to significant price gaps. With negative balance protection, if a trader's account balance falls below zero due to trading losses, BDSwiss will absorb the negative balance and reset the account to zero. This protection provides traders with peace of mind, knowing that their losses are limited to the funds available in their trading account. It's essential for traders to understand that negative balance protection does not eliminate the risk of losing money in trading; it only prevents the account from going into a negative balance. Traders should still employ proper risk management techniques, such as setting appropriate stop-loss orders and managing their position sizes, to minimise potential losses.

BDSwiss Deposits and Withdrawals

BDSwiss offers a wide range of deposit and withdrawal options to cater to the needs of its global client base. The broker supports various payment methods, including:

Deposit Methods

| Feature | Details |

|---|---|

| Payment Methods | Credit/Debit Cards (Visa, Mastercard), Bank Transfers, Skrill, Neteller, MPESA, GCash, and more |

| Processing Time | Instant for most methods |

| Deposit Fees | None (BDSwiss does not charge deposit fees) |

| Minimum Deposit | $100 |

Withdrawal Methods

| Feature | Details |

|---|---|

| Withdrawal Methods | Same as deposit methods (Card, Bank Transfer, E-wallets, Local options) |

| Processing Time | Typically within 24 hours (after verification) |

| Withdrawal Fees | None (provider fees or currency conversion charges may apply) |

| Verification | Proof of identity and address required to comply with AML and KYC policies |

| Security Measures | Strict verification for fund protection |

Support Service for Customer

BDSwiss places a strong emphasis on providing exceptional customer support to ensure a seamless trading experience for its clients. The broker offers multiple channels through which traders can reach out for assistance:

- Live Chat: Available 24/5, BDSwiss' live chat service allows traders to connect with a support representative in real-time for quick answers to their queries.

- Email: Traders can send their questions or concerns to the dedicated support email address, with most enquiries being responded to within 24 hours.

- Phone Support: BDSwiss provides local phone numbers for several countries, allowing traders to speak directly with a support representative during business hours.

- Social Media: The broker maintains an active presence on popular social media platforms, such as Facebook, Twitter, and Instagram, providing an additional channel for traders to reach out for support or stay informed about the latest news and promotions.

Languages: BDSwiss offers support in multiple languages, including English, German, French, Italian, Spanish, Portuguese, Arabic, and Chinese, catering to its diverse global client base.

The BDSwiss customer support team comprises experienced professionals who are well-versed in the broker's products, services, and trading platforms. They strive to provide prompt, accurate, and helpful responses to ensure that traders have a positive experience and can focus on their trading activities.

Languages: BDSwiss offers support in multiple languages, including English, German, French, Italian, Spanish, Portuguese, Arabic, and Chinese, catering to its diverse global client base.

The BDSwiss customer support team comprises experienced professionals who are well-versed in the broker's products, services, and trading platforms. They strive to provide prompt, accurate, and helpful responses to ensure that traders have a positive experience and can focus on their trading activities.

Customer Support Comparison Table

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/5 | English, German, French, Italian, Spanish, Portuguese, Arabic, Chinese | Instant |

| 24/5 | English, German, French, Italian, Spanish, Portuguese, Arabic, Chinese | Within 24 hours | |

| Phone | Business hours | English, German, French, Italian, Spanish, Portuguese, Arabic, Chinese | Instant |

| Social Media | 24/5 | English, German, French, Italian, Spanish, Portuguese, Arabic, Chinese | Within 24 hours |

Prohibited Countries

BDSwiss adheres to strict regulatory guidelines and does not provide services to residents of certain countries due to legal restrictions, licensing requirements, or geopolitical factors.

As of 2025, the following regions are prohibited from opening an account with BDSwiss:

- United States

- Canada

- European Union (as of 2024)

- Australia

- Japan

- North Korea

- Iran

- Syria

- Sudan

- Cuba

Traders from prohibited countries who attempt to open an account with BDSwiss may face legal consequences and will have their accounts closed and funds returned, subject to the broker's terms and conditions.

It's crucial for traders to ensure that they are eligible to trade with BDSwiss based on their country of residence and to comply with their local laws and regulations regarding online trading.

Regions where BDSwiss is allowed to operate:

- Africa, Asia (excluding Japan, North Korea, Iran, Syria), Latin America, Middle East (excluding Sudan, Cuba), Europe (excluding European Union as of 2025)

Special Offers for Customers

BDSwiss occasionally offers special promotions and bonuses to attract new clients and reward existing ones. Some of the notable offers include:

Welcome Bonus: New clients may be eligible for a welcome bonus upon making their first deposit, subject to certain trading volume requirements.

Loyalty Program: BDSwiss runs a loyalty program that rewards clients with points for their trading activity, which can be redeemed for cash bonuses or other prizes.

Trading Competitions: The broker hosts regular trading competitions, giving traders the opportunity to win cash prizes and other rewards based on their trading performance.

Educational Offers: BDSwiss may provide free access to premium educational resources, such as webinars, e-books, or trading courses, as part of their promotional offers.

It's important for traders to carefully review the terms and conditions of any special offers or promotions, as they may be subject to specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations.

Conclusion

Throughout this comprehensive review, I have thoroughly examined BDSwiss' offerings, services, and reputation as an online forex and CFD broker. Based on my analysis, I can confidently conclude that BDSwiss is a reliable and trustworthy broker that prioritises the safety and satisfaction of its clients.

BDSwiss' multi-jurisdictional regulatory approach, with licenses from the FSA, FSC, MISA, and SCA, demonstrates their commitment to operating transparently and adhering to strict industry standards. While the broker faced some regulatory challenges with the FCA in the past, they have taken steps to address these issues and maintain a compliant and secure trading environment.

One of BDSwiss' key strengths is its extensive range of tradable assets, which includes over 250 CFDs on forex, shares, indices, commodities, and cryptocurrencies. This diverse offering allows traders to access multiple markets and implement various trading strategies based on their preferences and risk appetite.

The broker's advanced trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, and mobile apps, cater to the needs of both novice and experienced traders. These platforms provide a user-friendly interface, powerful charting tools, and automated trading capabilities, enhancing the overall trading experience.

BDSwiss' commitment to education is evident through its extensive collection of resources, including webinars, e-books, video tutorials, and daily market analysis. These materials are designed to help traders improve their skills, stay informed about market developments, and make well-educated trading decisions.

The broker's customer support is another notable aspect, with a knowledgeable and responsive team available 24/5 through various channels, including live chat, email, phone, and social media. This level of support ensures that traders can quickly resolve any issues or queries they may encounter.

In terms of account types, BDSwiss offers a range of options to suit different trading styles and budgets. The Classic, Pro, and Prime accounts provide competitive spreads, flexible leverage, and access to all trading instruments, with higher-tier accounts offering additional benefits such as dedicated account managers and exclusive market analysis.

BDSwiss' negative balance protection is a crucial risk management feature that ensures traders cannot lose more than their account balance, providing peace of mind during volatile market conditions.

The broker's wide range of deposit and withdrawal methods, including credit/debit cards, bank wire transfers, e-wallets, and local payment options, makes it easy for traders to manage their funds. The absence of deposit and withdrawal fees is another advantage, although traders should be aware of any potential charges from their payment providers.

While BDSwiss has many positive aspects, it's important to note that the broker does not accept clients from certain regions, such as the United States, Canada, the European Union (as of 2024), Australia, and Japan, due to regulatory restrictions. Traders from these countries will need to find alternative brokers that cater to their specific needs.

Overall, I believe that BDSwiss is a solid choice for traders seeking a reliable, well-regulated, and feature-rich broker. The company's extensive range of trading instruments, advanced platforms, educational resources, and customer support make it an attractive option for both beginners and experienced traders alike. As with any broker, it's crucial for traders to carefully review the terms and conditions, understand the risks involved, and ensure that BDSwiss meets their individual trading requirements before opening an account.

Browse CFD-heavy brands on our CFD broker reviews panel.

App-first traders might like the Skilling review.