BlackBull Markets Review 2025: Pros, Cons, and Key Features

Blackbull Markets

New Zealand

New Zealand

-

Withdrawal Fee $5

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Japan Forex Trading License

Japan Forex Trading License

Austria Financial Services License

Austria Financial Services License

Softwares & Platforms

Customer Support

+6495585142

(English)

+6495585142

(English)

Supported language: Chinese (Simplified), English, French, Greek, Spanish

Social Media

Summary

BlackBull Markets is a New Zealand-based, FMA-regulated broker offering over 26,000 tradable instruments, including forex, commodities, stocks, indices, and cryptocurrencies. It provides advanced trading platforms like MetaTrader 4, MetaTrader 5, cTrader, and TradingView, catering to both retail and institutional traders. With competitive ECN pricing, low spreads, and support for copy trading and algorithmic strategies, BlackBull Markets delivers a professional trading experience. The broker also offers in-depth market research and educational resources, though it has limited regulatory coverage and high share CFD fees on cTrader.

- Exceptional asset variety with 26,000+ instruments

- Multiple platform options including MT4, MT5, cTrader, and TradingView

- Competitive ECN pricing with spreads from 0.0 pips

- No minimum deposit for Standard accounts

- Negative balance protection

- Strong research capabilities via ATM Strategy acquisition

- Free VPS for qualifying accounts

- 24/5 multilingual support

- Limited regulatory coverage compared to top-tier brokers

- No investor compensation scheme

- High bank wire withdrawal fees ($25)

- Restricted access to major markets (US, EU, UK)

- $20,000 minimum for best trading conditions

- Inactivity fees on dormant accounts

- Complex platforms may overwhelm beginners

- High share CFD fees on cTrader platform

Overview

BlackBull Markets has established itself as a noteworthy player in the online trading landscape since its founding in 2014. Headquartered in Auckland, New Zealand, this broker has built a reputation for offering an exceptionally diverse range of tradable instruments while maintaining competitive pricing structures. Operating under the regulatory oversight of the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles, BlackBull Markets serves traders across multiple jurisdictions, though notably excluding major markets like the United States and European Union.

The broker's most distinctive feature is its impressive catalog of over 26,000 tradable instruments, far exceeding the industry average of 1,000-5,000 assets typically offered by competitors. This extensive selection spans forex pairs, commodities, indices, cryptocurrencies, and notably, a vast array of global stocks. The 2022 acquisition of ATM Strategy Research demonstrates BlackBull Markets' commitment to enhancing its analytical capabilities and providing clients with institutional-grade market insights.

For more information about BlackBull Markets' services, regulation, and trading conditions, visit their official website at blackbullmarkets.com

Overview Table

| Aspect | Details |

|---|---|

| Founded | 2014 |

| Headquarters | Auckland, New Zealand |

| Regulation | FMA (New Zealand), FSA (Seychelles) |

| Tradable Instruments | 26,000+ |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $0 (ECN Standard) |

| Spreads From | 0.0 pips (Institutional) |

| Leverage | Up to 1:500 |

| Demo Account | Available |

| Customer Support | 24/5 Live Chat, Email, Phone |

Facts List

- Founded in 2014 with headquarters in Auckland, New Zealand, giving the broker over 10 years of operational experience in the forex and CFD trading industry.

- Regulated by two authorities: The Financial Markets Authority (FMA) in New Zealand (Tier-1) and the Financial Services Authority (FSA) in Seychelles (Tier-3).

- Offers 26,000+ tradable instruments, making it one of the most diverse brokers in terms of asset selection, far exceeding the industry average of 1,000-5,000 instruments.

- Acquired ATM Strategy Research in 2022, significantly enhancing its in-house research capabilities for NZX, ASX, and US market analysis.

- Provides four major trading platforms: MetaTrader 4, MetaTrader 5, cTrader, and TradingView, more than most competitors who typically offer 2-3 platforms.

- Three account tiers available: ECN Standard ($0 minimum), ECN Prime ($2,000 minimum), and ECN Institutional ($20,000 minimum) with progressively better trading conditions.

- Leverage up to 1:500 available across all account types, competitive with industry standards for retail traders.

- Spreads start from 0.0 pips on the ECN Institutional account with commissions as low as $4 per round turn.

- Cannot serve residents of major markets including the United States, European Union, United Kingdom, Australia, and Japan due to regulatory restrictions.

- Offers free VPS hosting for clients maintaining a $2,000 account balance and trading 20+ lots monthly, beneficial for algorithmic traders.

Blackbull Markets Licenses and Regulatory

The regulatory structure of BlackBull Markets reflects a middle-tier approach to compliance and client protection. The Financial Markets Authority of New Zealand provides Tier-1 regulation through Black Bull Group Limited, offering a reasonable level of oversight and operational standards. However, the secondary regulation through Seychelles' FSA represents a Tier-3 regulatory environment, which provides less stringent oversight compared to jurisdictions like the UK's FCA or Australia's ASIC.

| Regulatory Authority | Jurisdiction | License Type | Client Protection Level |

|---|---|---|---|

| FMA | New Zealand | Full License | High (Tier-1) |

| FSA | Seychelles | International License | Basic (Tier-3) |

Trading Instruments

BlackBull Markets' extensive asset selection represents its primary competitive advantage, offering institutional-level market access to retail traders.

| Asset Class | Number of Instruments | Typical Spreads | Trading Hours | Leverage | Key Markets/Examples |

|---|---|---|---|---|---|

| Forex Majors | 7 pairs | 0.0-0.8 pips | 24/5 | Up to 1:500 | EUR/USD, GBP/USD, USD/JPY |

| Forex Minors | 35+ pairs | 0.1-2.0 pips | 24/5 | Up to 1:500 | EUR/GBP, AUD/NZD, GBP/JPY |

| Exotic Currencies | 50+ pairs | 2.0-5.0 pips | 24/5 | Up to 1:100 | USD/ZAR, EUR/TRY, USD/MXN |

| Global Stocks | 26,000+ | Variable | Exchange hours | Up to 1:20 | NYSE, NASDAQ, LSE, ASX, NZX |

| Stock Indices | 20+ | 0.4-2.0 points | Near 24/5 | Up to 1:100 | S&P 500, FTSE 100, DAX 30 |

| Commodities - Metals | 6 | 0.01-0.30 | 23/5 | Up to 1:100 | Gold, Silver, Platinum, Palladium |

| Commodities - Energy | 5 | 0.02-0.05 | 23/5 | Up to 1:100 | WTI Crude, Brent, Natural Gas |

| Agricultural | 8 | Variable | Exchange hours | Up to 1:50 | Wheat, Corn, Soybeans, Coffee |

| Cryptocurrencies | 15+ | 0.3-1.5% | 24/7 | Up to 1:5 | Bitcoin, Ethereum, Litecoin, XRP |

| Bonds | 10+ | Variable | Exchange hours | Up to 1:50 | US T-Notes, German Bunds |

| ETFs | 100+ | Variable | Exchange hours | Up to 1:20 | SPY, QQQ, GLD, VXX |

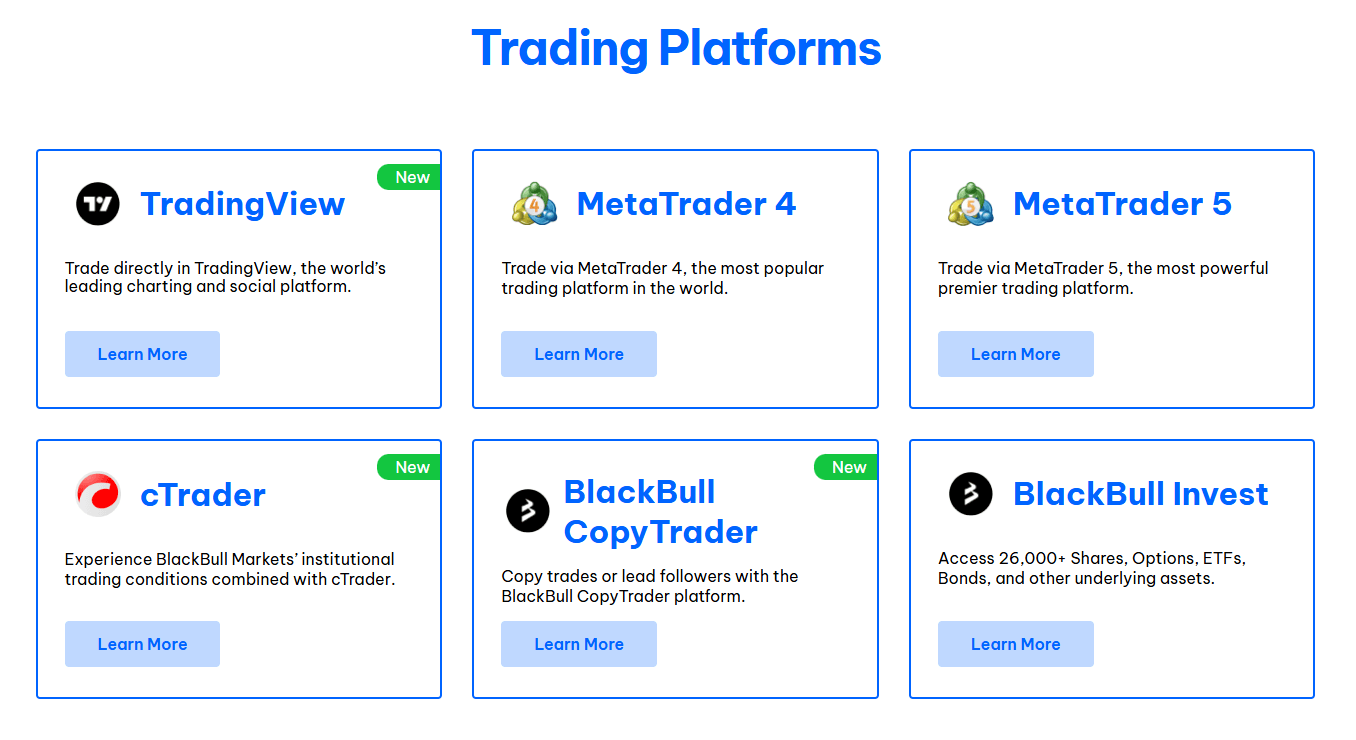

Trading Platforms

BlackBull Markets distinguishes itself through platform diversity, offering four major trading platforms to accommodate different trading styles and technical requirements. Each platform serves specific trader needs, from algorithmic trading to social trading features.

| Platform | Best For | Mobile App | Automated Trading | Social Features |

|---|---|---|---|---|

| MetaTrader 4 | Traditional forex trading | Yes | Yes (EAs) | Limited |

| MetaTrader 5 | Multi-asset trading | Yes | Yes (EAs) | Limited |

| cTrader | ECN trading | Yes | Yes (cAlgo) | Limited |

| TradingView | Chart analysis | No | No | Yes |

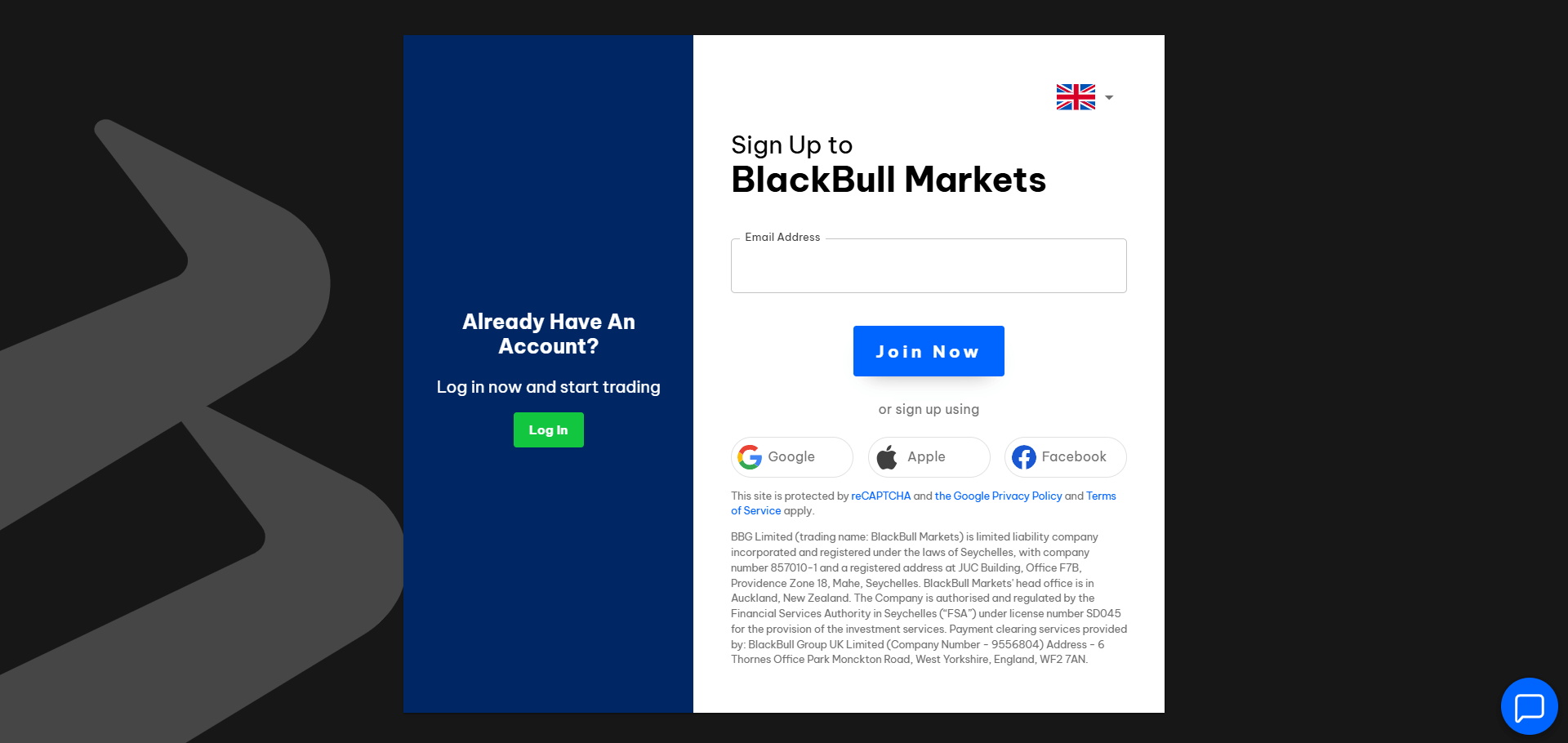

Blackbull Markets How to Open an Account: A Step-by-Step Guide

Opening an account with BlackBull Markets is a straightforward process that can be completed online in a few simple steps. This guide will walk you through the requirements, registration process, and account verification to help you get started with trading on the BlackBull Markets platform.

Requirements for Opening an Account

To open an account with BlackBull Markets, you must meet the following requirements:

- Be at least 18 years old

- Provide a valid government-issued identification document (e.g., passport, driver's license, or national ID card)

- Provide proof of residence (e.g., utility bill, bank statement, or credit card statement)

- Have a valid email address and phone number

Account Registration Process

1. Visit the BlackBull Markets website and click on the "Open an Account" button.

2. Fill out the registration form with your personal information, including your name, email address, phone number, and country of residence.

3. Select your preferred account type (ECN Standard, ECN Prime, or ECN Institutional) and base currency.

4. Agree to the broker's terms and conditions and privacy policy.

5. Submit your registration form.

After submitting the registration form, you will receive an email with a verification link. Click on the link to verify your email address.

Charts and Analysis

BlackBull Markets provides a comprehensive suite of educational resources and trading tools to support clients in enhancing their knowledge and skills. These resources cater to traders of all experience levels, from beginners to advanced market participants. By offering a diverse range of educational materials, BlackBull Markets empowers its clients to make informed trading decisions and develop effective strategies.

| Feature | Details |

|---|---|

| Trading Platforms & Charts | Supports MT4, MT5, cTrader, and TradingView. - Advanced charting tools with customizable timeframes, chart types, and drawing tools. - Technical indicators for in-depth market analysis. |

| Market Analysis & Insights | Provides daily market reviews, technical reports, and fundamental analysis. - Covers forex, indices, commodities, and other tradable assets. - Acquired ATM Strategy (2022) for enhanced research on NZX, ASX, and US shares. |

| Educational Articles & Guides | Offers structured articles and guides categorized by skill level. - Covers trading basics, technical & fundamental analysis, risk management, and trading psychology. - Step-by-step platform guides on trade execution and market analysis. |

| Webinars & Video Tutorials | Live webinars by experienced analysts on market trends, strategies, and platform usage. - Interactive sessions with Q&A opportunities. - Video tutorials covering technical indicators, order execution, and risk management. |

| Economic Calendar | Displays upcoming economic events such as interest rate decisions, GDP reports, inflation data, and employment figures. - Helps traders prepare for potential market-moving events. |

| Trading Calculators | Includes margin calculator, pip calculator, and risk management calculator. - Assists in position sizing, profit/loss estimation, and risk assessment. |

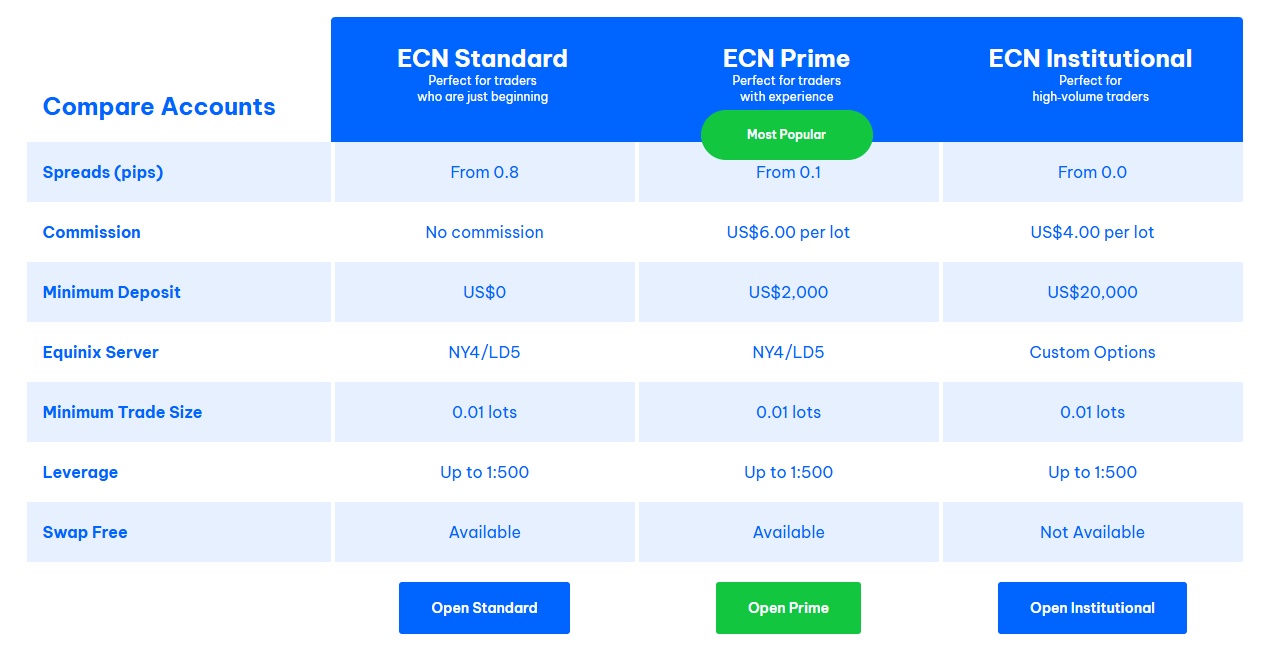

Blackbull Markets Account Types

BlackBull Markets offers a range of trading account types to cater to the diverse needs and preferences of its clients. By providing multiple account options, the broker ensures that traders can select the most suitable account based on their trading style, experience level, and capital.

| Feature | ECN Standard | ECN Prime | ECN Institutional | Demo Account |

|---|---|---|---|---|

| Minimum Deposit | No minimum | $2,000 | $20,000 | No deposit required |

| Spreads | From 0.8 pips | From 0.1 pips | From 0.0 pips | Simulated spreads |

| Commission | None | $6 per round turn (per standard lot) | $4 per round turn (per standard lot) | No commissions |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 | Customizable |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 | Simulated trading sizes |

| Trading Instruments | Forex, Commodities, Indices, Cryptocurrencies | Forex, Commodities, Indices, Cryptocurrencies | Forex, Commodities, Indices, Cryptocurrencies | All available markets in a risk-free environment |

| Best For | Traders preferring commission-free trading | Traders seeking tight spreads with commissions | High-volume traders & institutional clients | Practice & strategy testing before live trading |

Negative Balance Protection

Under BlackBull Markets' negative balance protection policy, if a client's account balance falls below zero due to trading losses, the broker will absorb the negative balance and reset the account to zero. This means that clients will not owe any money to the broker, even if their losses exceed their account balance. It is essential to note that negative balance protection does not eliminate the risk of losing money in trading. Traders are still responsible for managing their risk effectively and making informed trading decisions. BlackBull Markets encourages clients to use appropriate risk management tools, such as stop-loss orders, and to maintain a suitable level of leverage based on their trading experience and risk tolerance. To ensure transparency and clarity, BlackBull Markets outlines its negative balance protection policy in its terms and conditions. Clients should familiarize themselves with these terms and any specific requirements or limitations related to the policy.

Blackbull Markets Deposits and Withdrawals

BlackBull Markets supports various payment methods to facilitate global client transactions, though the fee structure presents some concerns for cost-conscious traders.

| Payment Method | Deposit Fee | Withdrawal Fee | Processing Time |

|---|---|---|---|

| Bank Wire | None | $25 | 1-3 days |

| Credit/Debit Card | None | None | Instant/1-3 days |

| E-wallets | None | $5 | Instant/24 hours |

| Cryptocurrency | None | 0.5% | 1-3 hours |

Support Service for Customer

The support structure at BlackBull Markets reflects professional standards with multichannel accessibility and multilingual capabilities.

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/5 | 5 languages | Instant |

| 24/5 | 5 languages | Within 24 hours | |

| Phone | Business hours | 5 languages | Immediate |

| Social Media | Business hours | Multiple | Variable |

Prohibited Countries

BlackBull Markets is prohibited from offering its services to residents of the following countries and regions:

- United States of America

- Canada

- European Union (including the United Kingdom)

- Australia

- Japan

- North Korea

- Iran

- Cuba

- Syria

- Sudan

- South Sudan

- Crimea

Special Offers for Customers

BlackBull Markets offers a range of special promotions and incentives to both new and existing clients, providing additional value and support for their trading activities. These offers are designed to enhance the trading experience, reward client loyalty, and attract new traders to the broker's platform.

Current special offers and promotions available at BlackBull Markets include:

| Promotion | Details |

|---|---|

| Loyalty Program | Tiered rewards program based on trading volume and account balance. - Benefits include reduced spreads, cashback rewards, personalized trading support, and VIP event invitations. |

| Trading Competition | Periodic competitions where traders compete for cash prizes, trading bonuses, and other rewards. - Typically includes specific trading volume or profit percentage requirements. |

| VPS Hosting | Clients maintaining a $2,000 account balance and trading 20+ lots per month qualify for free VPS hosting. - Ideal for automated traders who need a stable, uninterrupted connection. |

| Educational Resources | Webinars, trading guides, and market analysis are provided to help traders improve their skills. - Some content is free, while premium resources require a minimum balance or trading volume. |

Conclusion

After conducting a thorough review of BlackBull Markets, I have found them to be a reliable and trustworthy broker that offers a comprehensive trading experience for clients worldwide. Their commitment to regulatory compliance, with licenses from the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles, demonstrates their dedication to providing a safe and transparent trading environment.

One of the standout features of BlackBull Markets is their wide range of tradable assets, which includes over 26,000 instruments across forex, commodities, indices, shares, and cryptocurrencies. This extensive offering allows traders to diversify their portfolios and take advantage of opportunities in various markets. The broker's competitive spreads and low commissions across their account types cater to both beginner and experienced traders, making them an attractive choice for a wide range of clients.

BlackBull Markets' trading platforms, which include MetaTrader 4, MetaTrader 5, cTrader, and TradingView, provide users with advanced charting tools, technical indicators, and automated trading capabilities. The broker's commitment to offering a diverse range of platforms ensures that traders can choose the tools that best suit their needs and preferences.

The broker's educational resources, including articles, webinars, and video tutorials, are designed to support traders at every stage of their journey. The acquisition of ATM Strategy Research in 2022 further bolsters BlackBull Markets' research capabilities, providing clients with in-depth market insights and analysis.

Customer support is another area where BlackBull Markets excels, offering multiple channels for clients to get assistance, including live chat, email, phone, and social media. The support team is knowledgeable and responsive, ensuring that clients can resolve any issues or concerns promptly.

While BlackBull Markets has a lot to offer, it's important to note that they do have some limitations. The broker's regulatory licenses, while reputable, may not provide the same level of protection as those from higher-tier regulators. Additionally, some of the trading platforms and tools may be complex for beginners, requiring a learning curve to fully utilize their capabilities.

Overall, I believe that BlackBull Markets is a solid choice for traders seeking a reliable and well-rounded broker. Their extensive range of tradable assets, competitive pricing, advanced trading platforms, and commitment to education and customer support make them a strong contender in the online trading industry. As with any broker, it's essential to carefully consider your individual trading needs and risk tolerance before making a decision.