Blackwell Global Review 2025: Pros and Cons & Trading Conditions

Blackwell Global

Cyprus

Cyprus

-

Minimum Deposit $500

-

Withdrawal Fee $0

-

Leverage 200:1

-

Spread From 0.3

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

US Securities License

US Securities License

Broker-Dealer License

Broker-Dealer License

Softwares & Platforms

Customer Support

+35725262000

(English)

+35725262000

(English)

Supported language: Chinese (Simplified), English, Vietnamese

Social Media

Summary

Blackwell Global is a forex and CFD broker established in 2010, offering trading on assets like currencies, commodities, indices, and cryptocurrencies. It provides access to the MT5 trading platform with competitive spreads and various account types. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring a secure trading environment. With a minimum deposit of $500, Blackwell Global caters to both retail and professional traders. The broker is known for its educational resources, market analysis, and dedicated customer support.

- Regulated by multiple respected authorities (FCA, SFC, SECC, SCB)

- Offers a range of account types to suit different trading styles

- Provides access to the popular and advanced MetaTrader 5 platform

- Solid selection of trading instruments (forex, indices, commodities, crypto)

- Implements negative balance protection and segregates client funds

- Focuses on competitive pricing and stable trading environment

- Offers swap-free Islamic accounts and demo accounts

- Provides educational resources (video tutorials, webinars, articles)

- 24/5 customer support via live chat, email, and phone

- No minimum deposit on some account types

- Mixed regulatory history with previous license revocations

- Inconsistent quality of customer support reported by some users

- Limited range of trading instruments compared to some multi-asset brokers

- No sign-up bonuses or loyalty programs offered

- Maximum leverage lower than some competitors (1:200 vs 1:500+)

- Issues locating some listed branch offices during physical checks

- Inactivity fees charged after 12 months of no trading

- Educational resources lack depth compared to larger brokers

- Withdrawal fees may apply for some methods (e.g. bank wires)

- Some account types require high minimum deposits ($500)

Overview

Blackwell Global, established in 2010, is a global forex broker headquartered in the Bahamas with a presence in over 90 countries. Regulated by authorities such as the Financial Conduct Authority (FCA) in the UK and the Securities Commission of the Bahamas (SCB), Blackwell Global offers trading in forex, indices, commodities and cryptocurrencies through the MetaTrader 5 platform.

As a multi-award-winning broker, Blackwell Global caters to traders of all experience levels. In 2016, their launch of a UK brokerage expanded their reach into European, South American and Middle Eastern markets.

While Blackwell Global is well-regulated and provides competitive trading conditions, potential clients should be aware of some mixed regulatory history, including previously revoked licenses in Germany and New Zealand. Account options include ECN, Standard, Premium and Turbo accounts, some requiring a $500 minimum deposit. Maximum leverage of 1:200 is available.

For more details on Blackwell Global's offerings, visit their official website at blackwellglobal.com. As with any broker, thoroughly researching their current regulatory status, financial health, and customer reviews is prudent before depositing funds or trading.

Blackwell Global Overview Table

| Attribute | Details |

|---|---|

| Broker Name | Blackwell Global |

| Founded | 2010 |

| Headquarters | Bahamas |

| Regulated By | FCA (UK), SFC (Hong Kong), SCB (Bahamas), SECC (Cambodia) |

| Trading Platforms | MetaTrader 5 |

| Minimum Deposit | $500 on some account types, $0 on others |

| Maximum Leverage | 1:200 |

| Tradeable Assets | Forex, Indices, Commodities, Cryptocurrencies |

Fact List

- Founded in 2010, headquartered in the Bahamas

- Regulated by FCA (UK), SFC (Hong Kong), SCB (Bahamas), SECC (Cambodia)

- Previously had licenses revoked in Germany (BaFin) and New Zealand (FSPR)

- Offers trading on MetaTrader 5 platform

- Assets include 50+ forex pairs, 10+ indices, 4 commodities, and several cryptocurrencies

- Account types: ECN, Standard, Premium, Turbo, swap-free Islamic

- ECN and Premium accounts require $500 minimum deposit

- Maximum leverage up to 1:200

- Spreads from 0 pips on ECN/Turbo, 0.2 pips on Premium, 0.8 pips on Standard

- Commissions of $4.5/lot (ECN) and $2.5/lot (Turbo) per side

- Inactivity fee of $25/month after 12 months of no trading

Blackwell Global Licenses and Regulatory

Blackwell Global operates under the oversight of several respected financial regulatory bodies worldwide. As a global forex and CFD broker, being regulated in multiple jurisdictions provides an added layer of security and trust for clients.

| Regulatory Authority | Region | Reference/License Number |

|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | Reference No. 687576 |

| Securities and Futures Commission (SFC) | Hong Kong | CE No. BJU094 |

| Securities Commission of The Bahamas (SCB) | The Bahamas | Registration No. SIA-F215 |

| Securities and Exchange Commission of Cambodia (SECC) | Cambodia | License No. 005 |

These regulatory bodies enforce strict guidelines related to capital adequacy, segregation of client funds, transparency, and fair dealing. Brokers must adhere to these standards and submit to regular audits. Multiple licenses demonstrate a commitment to compliance and willingness to operate under the purview of authorities in various jurisdictions.

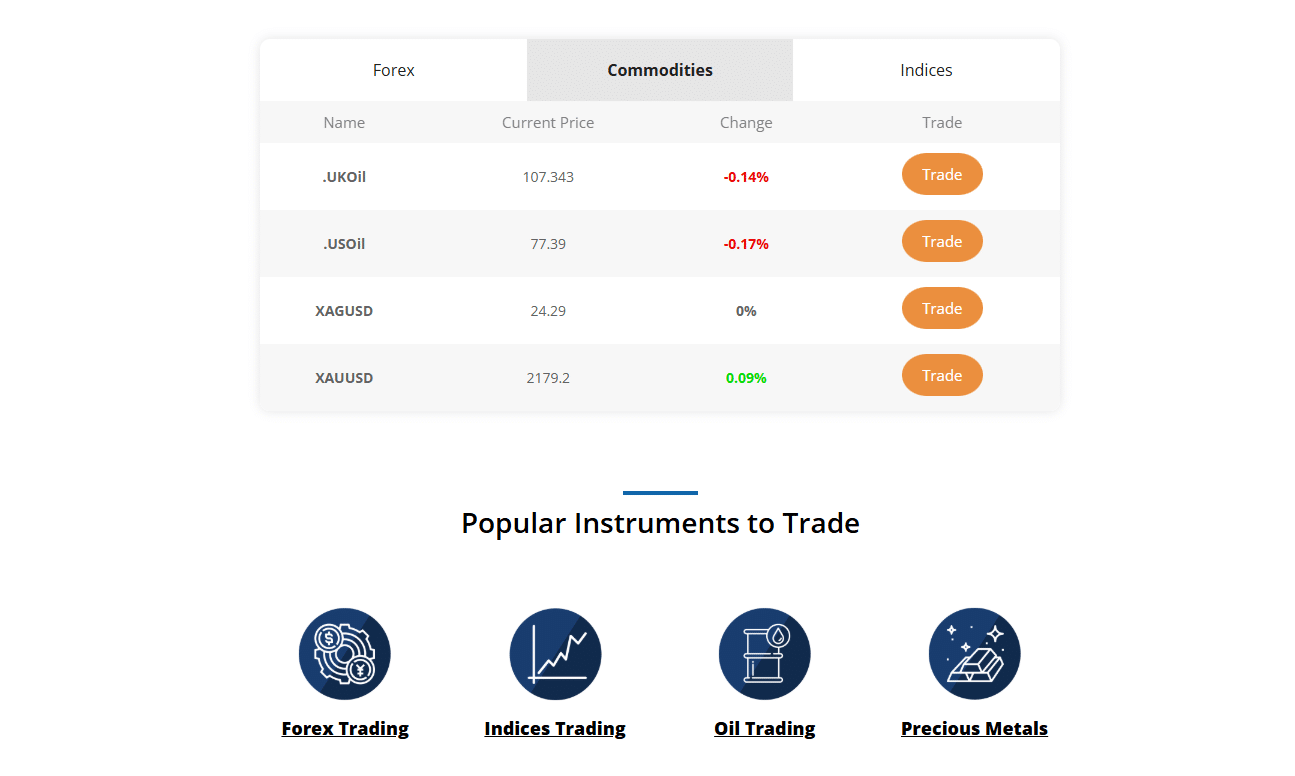

Trading Instruments

| Asset Class | Offered Instruments | Key Features & Spreads | Observations |

|---|---|---|---|

| Forex Trading | Over 50 currency pairs covering majors, minors, and exotics | Competitive spreads from 0.0 pips on ECN and Turbo accounts; leverage up to 1:200 | Offers broad diversification across global currencies; fairly standard compared to leading brokers. |

| Indices | More than 10 major global stock indices (e.g., S&P 500, FTSE 100, DAX 30, Nikkei 225) | CFD trading with competitive spreads starting from 0.3 pips | Provides exposure to entire stock markets; selection is somewhat limited compared to brokers with a wider range including lesser-known indices. |

| Commodities | Popular commodities such as gold, silver, oil, and natural gas | Tight spreads starting from 0.016 pips on precious metals | Offers portfolio diversification and hedging against inflation and geopolitical risks; number of tradable commodities is more limited than some competitors. |

| Cryptocurrencies | Major cryptocurrencies including Bitcoin, Ethereum, Litecoin, Dash, and Monero | Trading access on several top cryptocurrencies | Has gained popularity due to potential high returns, though comes with significant risk and volatility. |

While the inclusion of crypto sets Blackwell Global apart from some traditional brokers, their offering is still quite limited compared to crypto-focused exchanges and CFD platforms with dozens of coins.

Trading Platforms

MetaTrader 5 (MT5)

Blackwell Global offers the powerful MetaTrader 5 platform, the successor to the industry-standard MT4. MT5 builds upon the features that made MT4 popular, with additional enhancements and tools.

Key features of MT5 include:

- Advanced charting with 21 timeframes and 38 built-in indicators

- Support for algorithmic trading through Expert Advisors (EAs)

- Coverage of multiple asset classes, including forex, indices, commodities, and crypto

- Faster processing times and optimized resources for improved performance

MT5 is available as a desktop application for Windows and Mac, a web-based platform, and mobile apps for iOS and Android devices. This allows traders to manage their accounts and positions anytime, anywhere.

Compared to brokers offering multiple third-party platforms like cTrader and TradingView alongside MT4/5, Blackwell Global's offering may seem limited. However, for most traders, MT5 is more than sufficient and has the benefit of a large existing user community.

Overall, while Blackwell Global's sole reliance on MT5 may seem restrictive compared to multi-platform brokers, it can also be seen as a strategic choice to excel at delivering a single, robust solution. By channeling resources into optimizing MT5, Blackwell Global aims to provide a seamless trading experience that caters to the vast majority of trader needs.

As the MetaTrader suite continues to evolve with each iteration, Blackwell Global's clients can expect access to the latest tools and capabilities. However, those seeking a highly-specialized or unconventional platform may need to look elsewhere.

Trading Platform Comparison:

| Feature | Details |

|---|---|

| MetaTrader 5 (MT5) Charting | 21 timeframes, 38 indicators |

| Algorithmic Trading | Yes, through Expert Advisors (EAs) |

| Asset Classes | Forex, Indices, Commodities, Crypto |

| Order Types | Market, Limit, Stop, Trailing Stop, etc. |

| Customization | Moderate |

| Ease of Use | Moderate to High |

| Desktop App | Windows, Mac |

| Web Platform | Yes |

| Mobile Apps | iOS, Android |

Blackwell Global How to Open an Account: A Step-by-Step Guide

Account Opening Requirements To open a live trading account with Blackwell Global, you will need to meet the following requirements:

- Minimum age: 18 years old

- Valid government-issued ID (passport, national ID card, or driver's license)

- Proof of residence (utility bill, bank statement, or government-issued document)

- Minimum deposit: $500 for ECN and Premium accounts, no minimum for Standard and Turbo accounts

Account Types: Blackwell Global offers several account types to cater to different trading styles and preferences:

- ECN Account: Tight spreads from 0.0 pips, $500 minimum deposit, $4.5/lot commission per side

- Standard Account: Spreads from 0.8 pips, no minimum deposit, no commission

- Premium Account: Spreads from 0.2 pips, $500 minimum deposit, no commission

- Turbo Account: Spreads from 0.0 pips, no minimum deposit, $2.5/lot commission per side

Account Opening Steps

- Visit the Blackwell Global website and click on the "Start Trading" button.

- Fill out the registration form with your personal details, including your name, email address, phone number, and country of residence.

- Select your preferred account type and base currency (USD, EUR, or GBP).

- Verify your email address by clicking on the link sent to your registered email.

- Log in to your newly created Client Portal using your email and password.

- Complete your profile by providing additional information, such as your address, employment status, and financial knowledge and experience.

- Upload the required identification documents (proof of identity and proof of residence) for account verification. Blackwell Global uses secure SSL encryption to protect your personal information.

- Once your documents are approved, fund your account using one of the available payment methods:

- Bank Wire Transfer

- Credit/Debit Card (Visa, Mastercard)

- E-wallets (Neteller, Skrill)

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, Dash, Monero)

- Install the MetaTrader 5 (MT5) trading platform on your device (desktop, web, or mobile).

- Log in to MT5 using your Blackwell Global account credentials and start trading.

Account Verification and Funding

Blackwell Global aims to verify accounts within 24 hours of receiving the required documents. In some cases, additional information may be requested to complete the verification process.

Deposit processing times vary depending on the payment method:

- Bank Wire Transfer: 1-5 business days

- Credit/Debit Card: Instant

- E-wallets: Instant

- Cryptocurrencies: Instant

There are no deposit fees charged by Blackwell Global, but your bank or payment provider may apply their own charges.

Customer Support

If you encounter any issues during the account opening process, Blackwell Global's customer support team is available 24/5 via live chat, email, and phone. They can assist with document submission, account verification, and platform setup.

Summary Opening an account with Blackwell Global is a straightforward process that can be completed online in a matter of minutes. By providing the necessary personal information and identification documents, you can quickly gain access to the MT5 trading platform and start exploring the markets.

As with any financial decision, it's essential to carefully consider your trading goals and risk tolerance before committing funds. Be sure to familiarize yourself with Blackwell Global's terms and conditions, and only invest what you can afford to lose.

Charts and Analysis

Blackwell Global provides a range of tools and resources to help traders stay informed about market conditions and make educated trading decisions.

| Category | Description/Features | Strengths | Limitations |

|---|---|---|---|

| Economic Calendar | Displays upcoming market events (e.g., GDP reports, central bank meetings, employment figures) with filtering by currency, importance, and time period. Powered by FXStreet. | Ensures accuracy and reliability through a reputable third-party provider. | Basic customization and real-time updates compared to some competitors. |

| Market News & Insights | Provides market commentary via Experts Corner (blog), a curated Market News feed, and Company News updates covering Blackwell Global’s developments. | Offers a solid foundation for market awareness with content from reputable news sources. | May lack the depth and frequency of updates provided by brokers with dedicated research teams. |

| Educational Resources | Includes video tutorials on platform usage and trading concepts, a collection of ebooks/articles on topics like forex, CFDs, technical/fundamental analysis, risk management, and occasional live webinars with Q&A sessions. | Content is well-produced and accessible, catering to both beginners and more experienced traders. | Video library and webinar frequency are limited compared to brokers with more extensive educational programs. |

| Platform Resources | Utilizes MetaTrader 5’s robust charting package (21 timeframes, 38 technical indicators, multiple chart types, drawing tools) and supports algorithmic trading via Expert Advisors with backtesting and optimization features. | Delivers powerful chart analysis and automated trading capabilities with extensive customization options. | Some competitors may offer additional advanced backtesting and optimization features beyond MT5’s scope. |

Summary Blackwell Global provides a solid foundation of educational resources and trading tools, including market news, analysis, video tutorials, and ebooks. The MetaTrader 5 platform also offers powerful charting and algorithmic trading capabilities.

However, compared to some larger brokers, Blackwell Global's educational offerings may lack depth and variety. The frequency of webinars and updates is lower than competitors with dedicated research teams and e-learning programs.

That said, Blackwell Global's resources are well-suited for beginner to intermediate traders looking to improve their basic knowledge and skills. More advanced traders may need to supplement with additional third-party resources.

As always, traders should consider their individual learning styles and needs when evaluating a broker's educational offerings. It's also important to compare multiple brokers to find the most comprehensive and suitable resources.

Blackwell Global Account Types

Blackwell Global offers a range of account types to cater to the diverse needs of traders, from beginners to professionals. Each account type has distinct features and benefits, allowing traders to select the most suitable option based on their trading style, experience, and capital.

| Account Type | Spreads | Commission | Minimum Deposit | Maximum Leverage | Minimum Trade Size | Additional Features |

|---|---|---|---|---|---|---|

| Standard | From 0.8 pips | None | $0 | 1:200 | 0.01 lots | Designed for novice traders; commission-free and accessible for a wide range of trading strategies. |

| ECN | From 0.0 pips | $4.5 per lot per side | $500 | 1:200 | 0.01 lots | Tailored for experienced traders; offers tighter spreads, faster execution, and direct market access. |

| Premium | From 0.2 pips | None | $500 | 1:100 | 0.01 lots | Strikes a balance between Standard and ECN; favorable trading conditions without commission, with lower leverage. |

| Turbo | From 0.0 pips | $2.5 per lot per side | $0 | 1:200 | 0.01 lots | Designed for high-volume traders; ultra-fast execution and competitive pricing with reduced commission charges. |

| Demo | N/A | N/A | N/A | N/A | N/A | Free demo account with virtual funds, ideal for practicing strategies and familiarizing with the platform. |

| Islamic* | Same as live | Same as corresponding live account | Same as live | Same as live | Same as live | Swap-free accounts complying with Sharia law; available for all live account types. |

*Note: Islamic accounts are available for all live account types and adhere to Islamic principles by offering swap-free trading.

Compared to industry standards, Blackwell Global's account types offer competitive spreads and flexible deposit requirements. The choice between commission-free and ECN-style pricing caters to different trading preferences, while the demo account allows for risk-free practice.

However, some competitors may offer a wider range of account types, such as micro accounts with lower minimum deposits or VIP accounts with additional benefits and support. Blackwell Global's maximum leverage of 1:200 is also lower than some brokers who offer up to 1:500 or more.

Account Types Comparison Table

| Feature | Standard | ECN | Premium | Turbo |

|---|---|---|---|---|

| Minimum Deposit | $0 | $500 | $500 | $0 |

| Spreads (from pips) | 0.8 | 0.0 | 0.2 | 0.0 |

| Commissions (per side) | None | $4.5/lot | None | $2.5/lot |

| Maximum Leverage | 1:200 | 1:200 | 1:100 | 1:200 |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Execution Model | Instant Market | Instant Market | Instant Market | Instant Market |

| Trading Instruments | 50+ FX pairs, 10+ indices, 4 commodities, 5 crypto pairs | 50+ FX pairs, 10+ indices, 4 commodities, 5 crypto pairs | 50+ FX pairs, 10+ indices, 4 commodities, 5 crypto pairs | 50+ FX pairs, 10+ indices, 4 commodities, 5 crypto pairs |

Negative Balance Protection

Blackwell Global is committed to providing a secure and transparent trading environment for its clients. As part of this commitment, Blackwell Global offers negative balance protection to all retail clients, across all account types and trading instruments. Under Blackwell Global's negative balance protection policy, if a client's account balance falls into negative territory due to trading losses, the broker will absorb the negative balance and reset the account to zero. This means that clients will never owe money to Blackwell Global as a result of trading losses. It's important to note that negative balance protection applies to trading losses only. If a negative balance occurs due to other reasons, such as account-related fees or charges, clients remain responsible for covering these debts. To ensure negative balance protection is effective, Blackwell Global employs several risk management tools and policies, such as:

- Margin call alerts: Clients receive notifications when their account equity falls below a certain threshold, prompting them to add funds or close positions to avoid potential liquidation.

- Automatic stop-out: If a client's account equity falls below a predefined level (typically 50% of the required margin), the broker will automatically close open positions to prevent further losses.

- Monitoring and intervention: Blackwell Global's risk management team continuously monitors client accounts and market conditions, intervening when necessary to protect clients' funds and maintain orderly trading.

Blackwell Global Deposits and Withdrawals

Blackwell Global offers a range of deposit and withdrawal methods to cater to the diverse needs of its global client base. With a focus on convenience, security, and efficiency, Blackwell Global ensures that traders can easily manage their funds and focus on their trading activities.

Deposit Options

Blackwell Global accepts the following deposit methods:| Payment Method | Minimum Deposit | Maximum Deposit | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | $500 | Varies based on account type and client verification level | 1-5 business days | No fees charged by Blackwell Global, but banks may charge intermediary fees |

| Credit/Debit Cards (Visa, Mastercard) | $10 | $10,000 per transaction | Instant | No fees charged by Blackwell Global |

| E-wallets (Neteller, Skrill) | $10 | Varies based on e-wallet provider | Instant | No fees charged by Blackwell Global, but e-wallet providers may charge transaction fees |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin, Dash, Monero) | Equivalent to $10 | Varies based on account type and client verification level | 1-3 blockchain confirmations | No fees charged by Blackwell Global, but blockchain network fees apply |

Withdrawal Options

Blackwell Global supports the following withdrawal methods:| Payment Method | Minimum Withdrawal | Maximum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | $100 | Varies based on account type and client verification level | 1-5 business days | No fees charged by Blackwell Global, but banks may charge intermediary fees |

| Credit/Debit Cards (Visa, Mastercard) | $10 | $10,000 per transaction | 1-3 business days | No fees charged by Blackwell Global |

| E-wallets (Neteller, Skrill) | $10 | Varies based on e-wallet provider | 1-2 business days | No fees charged by Blackwell Global, but e-wallet providers may charge transaction fees |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin, Dash, Monero) | Equivalent to $10 | Varies based on account type and client verification level | 1-3 blockchain confirmations | No fees charged by Blackwell Global, but blockchain network fees apply |

Unique Features

Blackwell Global offers several unique features to enhance the deposit and withdrawal experience for its clients:- Multi-currency support: Traders can deposit and withdraw funds in multiple currencies, including USD, EUR, GBP, and various cryptocurrencies, without the need for currency conversion.

- Instant deposits: All deposit methods, except bank wire transfers, are processed instantly, allowing traders to access their funds and start trading without delay.

- No deposit or withdrawal fees: Blackwell Global does not charge any fees for deposits or withdrawals, regardless of the payment method used. However, traders should be aware of potential third-party fees.

- High transaction limits: Blackwell Global offers generous deposit and withdrawal limits, catering to the needs of both retail and professional traders.

- 24/7 customer support: Blackwell Global's dedicated customer support team is available 24/7 to assist clients with any deposit or withdrawal queries or issues.

Support Service for Customer

In the fast-paced world of online trading, having access to reliable and efficient customer support is crucial. Blackwell Global understands the importance of providing its clients with prompt and helpful assistance, ensuring a positive trading experience. Blackwell Global offers multiple channels for clients to reach out for assistance, catering to individual preferences and needs:

| Communication Channel | Availability | Contact/Link(s) | Average Response Time | Suitable For |

|---|---|---|---|---|

| Live Chat | 24/5 (Monday to Friday) | Accessible through the Blackwell Global website | 1-2 minutes | Quick queries and general assistance |

| 24/7 | support@blackwellglobal.com | 1-2 hours | Detailed inquiries or when a written record is preferred | |

| Phone | 24/5 (Monday to Friday) | International: +44 203 695 0898UK Toll-Free: 0800 048 9749 | 1-2 minutes | Urgent or complex issues requiring immediate assistance |

| Social Media | Varies (generally 24/7 online) | Facebook: Blackwell Global Twitter: Blackwell Global LinkedIn: Blackwell Global Instagram: Blackwell Global | 2-4 hours | General inquiries and staying updated with company news |

- Live chat: 1-2 minutes

- Phone: 1-2 minutes

- Email: 1-2 hours

- Social media: 2-4 hours

Prohibited Countries

As a global forex broker, Blackwell Global aims to provide its services to a wide range of clients across different countries and regions. However, due to various regulatory requirements, licensing restrictions, and geopolitical factors, there are certain jurisdictions where Blackwell Global is prohibited from operating or offering its services.

Reasons for Prohibited Countries: There are several reasons why a broker like Blackwell Global may be restricted from operating in certain countries:

- Local regulations: Each country has its own set of financial regulations and laws governing the provision of trading services. If a broker does not meet the required licensing or compliance standards, they may be prohibited from operating in that jurisdiction.

- Licensing requirements: Obtaining and maintaining regulatory licenses can be a complex and costly process. In some cases, a broker may choose not to pursue licensing in certain countries due to the associated costs and regulatory burdens.

- Geopolitical factors: Political tensions, economic sanctions, or international trade agreements can also impact a broker's ability to operate in specific regions. Brokers must comply with international laws and regulations to avoid potential legal consequences.

- Risk management: Brokers may also choose to restrict services in countries with high levels of financial crime, fraud, or money laundering risks. This helps maintain the integrity of the broker's operations and protect clients' funds.

List of Prohibited Countries

Blackwell Global is currently prohibited from offering its services in the following countries:

- United States

- Canada

- Japan

- New Zealand

- Belgium

It's important to note that this list is subject to change based on evolving regulations and Blackwell Global's business decisions. Traders should always refer to the most up-to-date information provided by Blackwell Global to ensure they are eligible to open an account and trade with the broker.

Consequences of Trading from Prohibited Countries

Attempting to trade with Blackwell Global from a prohibited country can result in several consequences:

- Account termination: If Blackwell Global identifies that a client is trading from a prohibited jurisdiction, the broker reserves the right to immediately terminate the client's account and close any open positions.

- Funds forfeiture: In some cases, clients from prohibited countries may forfeit their account balances and any profits earned, as the broker must comply with legal and regulatory requirements.

- Legal consequences: Depending on the jurisdiction, trading with an unlicensed broker or violating local regulations may result in legal penalties, fines, or other consequences for the individual trader.

Traders must take responsibility for ensuring they are not violating any local laws or regulations by trading with Blackwell Global. If in doubt, traders should seek legal advice or consult with their local financial authorities before opening an account.

Special Offers for Customers

At the time of this review, Blackwell Global does not offer any special offers.

Conclusion

After conducting a thorough review of Blackwell Global, I have gained valuable insights into their operations and overall standing as a forex broker. By examining various aspects of their business, from regulatory compliance to trading platforms and customer support, I can now provide a well-rounded assessment of their safety, reliability, and reputation.

One of the key factors that contribute to Blackwell Global's trustworthiness is their regulatory compliance. They are authorized and regulated by several respected financial authorities, including the FCA in the UK, the SFC in Hong Kong, the SECC in Cambodia, and the SCB in the Bahamas. These licenses demonstrate their commitment to adhering to strict financial guidelines and maintaining a secure trading environment for their clients.

However, it's important to note that Blackwell Global's regulatory history is not without blemishes. They previously had licenses revoked in Germany and New Zealand, and some of their listed branch offices could not be located during physical checks. While these incidents do not necessarily negate their current regulatory standing, they underscore the importance of regularly verifying a broker's licenses and monitoring for any changes or issues.

In terms of trading offerings, Blackwell Global provides a solid range of account types, catering to both beginner and experienced traders. Their ECN and Turbo accounts offer competitive spreads and low commissions, while the Standard account allows trading without additional costs. The inclusion of swap-free Islamic accounts and the availability of a demo account for practice further demonstrate their adaptability to different trading needs and preferences.

Blackwell Global's choice of the MetaTrader 5 platform is another point in their favor. MT5 is a widely-used and respected trading software that offers advanced charting, technical analysis tools, and algorithmic trading capabilities. The platform's user-friendly interface and customization options make it suitable for traders of all skill levels.

When it comes to trading instruments, Blackwell Global offers a respectable selection of forex pairs, indices, commodities, and cryptocurrencies. While their asset lineup may not be as extensive as some larger multi-asset brokers, it covers the most popular and actively traded markets. The inclusion of crypto trading sets them apart from some traditional brokers and caters to the growing demand for digital assets.

One area where Blackwell Global could improve is their customer support. While they offer multiple channels for reaching out, including live chat, email, and phone, the quality and consistency of their support have been called into question. Some users have reported receiving inaccurate or conflicting information from support representatives. Enhancing the training and knowledge of their support staff could help Blackwell Global deliver a more satisfactory client experience.

In terms of special offers and promotions, Blackwell Global appears to focus more on providing competitive pricing and a stable trading environment than on short-term incentives. The absence of sign-up bonuses or loyalty programs may be seen as a drawback by some traders, but it can also be interpreted as a sign of confidence in their core offerings.

Overall, Blackwell Global presents itself as a reputable and reliable broker that prioritizes regulatory compliance and the provision of a secure trading environment. Their choice of trading platform, range of account types, and asset selection cater to a broad spectrum of traders. However, their mixed regulatory history and inconsistent customer support quality may be points of concern for some potential clients.

As with any broker, it's crucial for traders to conduct their own due diligence, carefully examining factors such as regulatory status, trading conditions, and customer reviews before making a decision. While Blackwell Global has many positive attributes, individual trading needs and preferences should be the ultimate determining factors in choosing a broker.

For those considering Blackwell Global as their broker, I recommend regularly monitoring their regulatory standing, testing their platform and support, and comparing their offerings with other reputable brokers to ensure they align with your specific trading requirements and expectations.

Compare trading costs in our broker pricing index.

For education resources, read the Inveslo review.