CapTrader Review: Online Brokerage in 2025

captrader

Germany

Germany

-

Minimum Deposit $2000

-

Withdrawal Fee $varies

-

Leverage 40:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Germany Financial Services License

Germany Financial Services License

Softwares & Platforms

Customer Support

+4908008723370

(English)

+4908008723370

(English)

Supported language: English, German

Social Media

Summary

CapTrader is a Germany-based online brokerage established in 1997, offering access to over 1.2 million financial instruments across 160 markets in 36 countries. It operates as an introducing broker to Interactive Brokers and is regulated by BaFin, the FCA, and the Central Bank of Ireland. The platform supports trading in stocks, ETFs, options, futures, forex, CFDs, bonds, and mutual funds. With powerful tools like WebTrader and Trader Workstation, CapTrader caters to both individual and institutional traders. A minimum deposit of $2,000 is required to open an account.

- Well-regulated by top-tier authorities like BaFin, FCA, and Central Bank of Ireland

- Access to over 1.2 million tradable securities across 160 markets in 36 countries

- Competitive trading costs with low commissions starting at $2 for US stocks and €2 for European stocks

- User-friendly and feature-rich trading platforms, including WebTrader, Desktop Client Portal, and mobile apps

- Access to Interactive Brokers' professional-grade Trader Workstation for advanced traders

- Responsive and knowledgeable customer support via phone, email, live chat, and online contact form

- Focuses on delivering value through competitive pricing and advanced trading tools

- Offers a wide range of tradable assets for diversification

- Provides educational resources to help traders enhance their knowledge and skills

- Prioritizes security, transparency, and access to global markets

- Relatively high minimum deposit requirement of $2,000, which may be a barrier for beginner traders

- No 24/7 customer support, which could be a limitation for traders needing assistance outside specified hours

- Educational resources are not as extensive as some competitors

- Limited information available about account types and their specific features

- No guaranteed stop-loss or negative balance protection mentioned

- Lacks a wide range of base currencies for accounts

- No social trading or copy trading features offered

- Limited information about the broker's trading tools and platform features

- No clear indication of the broker's approach to sustainable and ethical investing

Overview

CapTrader is an international online broker established in 1997 and headquartered in Düsseldorf, Germany. The company provides access to over 1.2 million tradable securities across 160 markets in 36 countries. CapTrader is regulated by the Federal Financial Supervisory Authority (BaFin) in Germany and is an introducing broker to Interactive Brokers, leveraging their European licenses from regulators in Ireland (Central Bank of Ireland) and the UK (Financial Conduct Authority).

As a global broker, CapTrader offers a wide range of investment products including stocks, ETFs, options, futures, forex, CFDs, bonds, and mutual funds. The broker provides multiple trading platforms such as WebTrader, Desktop Client Portal, mobile apps, and access to Interactive Brokers' professional-grade Trader Workstation.

CapTrader has received recognition as a top online broker, with transparent and competitive pricing. Stock trades start at $2 in the US and €2 in Europe, while options and futures trades are as low as €1-2 per contract. The minimum deposit to open an account is $2,000.

While CapTrader provides broad market access and advanced trading tools, potential drawbacks include the high minimum deposit which may not suit beginner investors, and customer support is only available on weekdays rather than 24/7. Educational resources are also more limited compared to some other brokers.

For more details on CapTrader's offerings, visit their official website at captrader.com. The site provides in-depth information on account types, platforms, pricing, and the account opening process.

Overview Table

| Category | Information |

|---|---|

| Headquarter Location | Düsseldorf, Germany |

| Year Established | 1997 |

| Regulation | BaFin (Germany), FCA (UK), Central Bank of Ireland |

| Role | Introducing broker to Interactive Brokers |

| Minimum Deposit | $2,000 |

| Tradable Securities | Over 1.2 million securities across 160 markets in 36 countries |

| Products Offered | Stocks, ETFs, Options, Futures, Forex, CFDs, Bonds, Mutual Funds |

| Trading Platforms | WebTrader, Desktop Client Portal, Mobile Apps, IB Trader Workstation |

| Stock Trade Commissions | Starting at $2 (US) / €2 (Europe) |

| Option/Future Commissions | As low as €1–2 per contract |

| Account Types | Individual, Joint, Family, Company Accounts |

| Customer Support | Weekdays only |

Facts List

- CapTrader was founded in 1997 and is based in Düsseldorf, Germany.

- The broker is regulated by top-tier authorities including BaFin (Germany), FCA (UK), and the Central Bank of Ireland.

- CapTrader provides access to over 1.2 million tradable securities across 160 markets in 36 countries.

- The broker offers a broad range of investment products including stocks, ETFs, options, futures, forex, CFDs, bonds, and mutual funds.

- Multiple trading platforms are available such as WebTrader, Desktop Client Portal, mobile apps, and Interactive Brokers' professional Trader Workstation.

- CapTrader is known for its transparent and competitive pricing, with US stock trades starting at $2 and options/futures trades as low as €1-2 per contract.

- To open an account, CapTrader requires a minimum deposit of $2,000, which may be high for beginner investors.

- The broker provides individual, joint, family, and company account types to suit different investor needs.

- CapTrader's customer support is available on weekdays only, which is more limited compared to brokers offering 24/7 support.

- While providing advanced tools for experienced traders, CapTrader has comparatively fewer educational resources than some other brokers.

captrader Licenses and Regulatory

CapTrader operates under a robust regulatory framework, ensuring compliance with industry standards and providing a secure environment for clients. The broker holds licenses from top-tier financial authorities in multiple jurisdictions, demonstrating its commitment to maintaining high standards of operation and client protection.

In Germany, CapTrader is regulated by the Federal Financial Supervisory Authority (BaFin) under license number 10156708. BaFin is responsible for supervising banks, financial services providers, and insurance companies in Germany, ensuring that they operate in compliance with national and international regulations. This oversight provides an additional layer of security for CapTrader's clients.

Furthermore, CapTrader is an introducing broker to Interactive Brokers Ireland (IBIE), which is authorised and regulated by the Central Bank of Ireland. This allows CapTrader to leverage Interactive Brokers' European licenses, including authorisation from the Financial Conduct Authority (FCA) in the United Kingdom under registration number 208159. The FCA is known for its stringent regulations and oversight, further enhancing the trust and credibility of CapTrader's services.

The multiple regulatory licenses held by CapTrader are significant for several reasons. First, they demonstrate that the broker meets the strict requirements and standards set by these regulatory bodies. This includes factors such as financial stability, segregation of client funds, transparency in operations, and fair treatment of clients. By adhering to these regulations, CapTrader provides a higher level of security and protection for its clients' investments.

Moreover, being regulated by authorities in different jurisdictions allows CapTrader to offer its services to a broader client base while ensuring compliance with local regulations. This is particularly important for an international broker like CapTrader, which serves clients from various countries.

Compared to the industry standards, CapTrader's regulatory framework is robust and on par with top-tier brokers. The licenses from BaFin, the Central Bank of Ireland, and the FCA are widely recognised and respected in the financial industry. This sets CapTrader apart from less regulated or unregulated brokers that may not provide the same level of client protection and security.

In summary, CapTrader's strong regulatory compliance and multiple licenses from reputable authorities provide clients with a high level of trust and security. By adhering to strict industry standards and regulations, CapTrader demonstrates its commitment to operating transparently and fairly, prioritising the protection of its clients' interests.

Regulations List

- Federal Financial Supervisory Authority (BaFin) in Germany: License number 10156708

- Central Bank of Ireland: Authorized through Interactive Brokers Ireland (IBIE)

- Financial Conduct Authority (FCA) in the UK: Registration number 208159 through Interactive Brokers

Trading Instruments

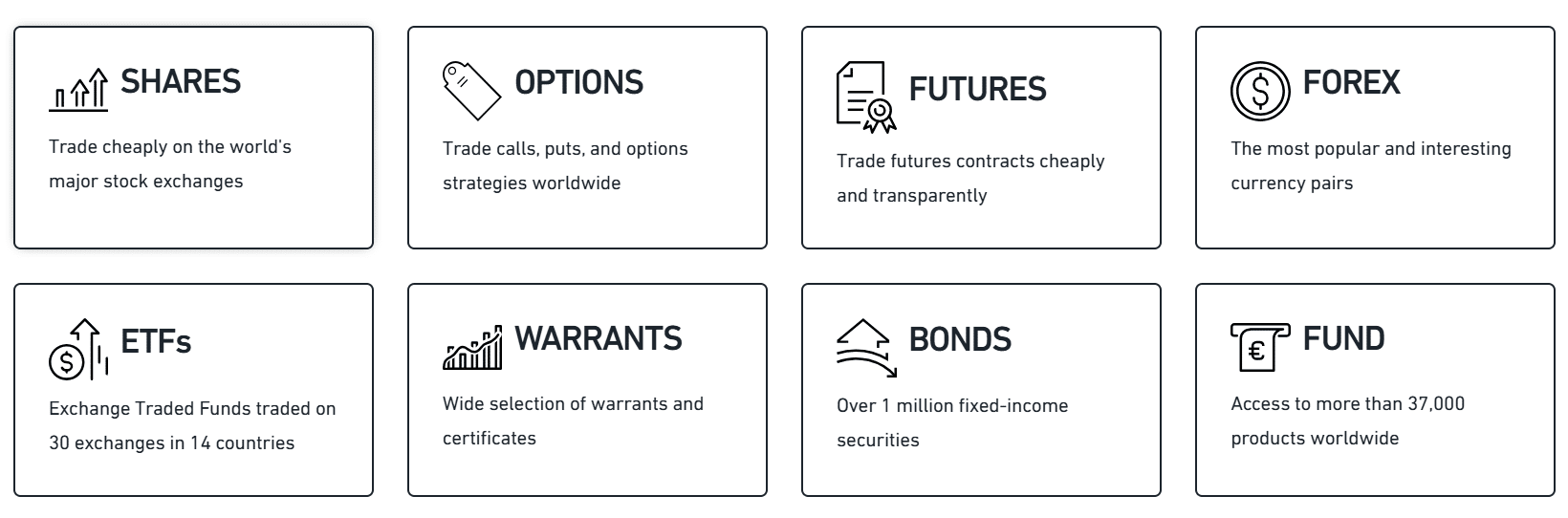

CapTrader offers a wide range of tradable assets, providing investors with diverse opportunities to build and manage their portfolios. The broker's extensive offerings span multiple asset classes, allowing clients to access global markets and take advantage of various investment strategies. For a comprehensive overview of all available assets, visit CapTrader's official website at captrader.com.

| Product Category | Details |

|---|---|

| Stocks & ETFs | - Over 7,100 stocks and 13,000 ETFs across 30 exchanges in 14 countries - Notable exchanges: NYSE, NASDAQ, LSE, TSE |

| Options & Futures | - Access to 33 options markets and 32 futures markets - Includes E-mini S&P 500, Eurodollar futures, and options on S&P 500, NASDAQ 100 |

| Forex & CFDs | - 105 currency pairs available - EUR/USD spreads from 0.3 pips - CFDs on various underlying assets including stock indices |

| Bonds & Mutual Funds | - Access to over 1 million fixed-income securities - Over 37,000 mutual funds available globally |

The breadth and depth of CapTrader's tradable assets demonstrate the broker's commitment to meeting the diverse needs of its client base. By offering such a comprehensive range of assets, CapTrader empowers investors to build flexible portfolios and adapt to changing market conditions. This extensive offering also reflects positively on CapTrader's market position, as it surpasses many competitors in terms of the sheer variety of tradable assets.

Compared to industry standards, CapTrader's asset offerings are well above average. The broker's coverage of stocks, ETFs, options, futures, forex, and fixed-income securities is extensive and caters to a wide range of investor preferences and strategies. This comprehensive offering sets CapTrader apart from brokers with more limited asset classes or market access.

Trading Platforms

CapTrader offers a range of trading platforms to cater to the diverse needs and preferences of its clients. These platforms provide access to the broker's extensive range of tradable assets, along with advanced features and tools to facilitate effective trading strategies and decision-making.

WebTrader

CapTrader's WebTrader is a user-friendly, web-based platform that allows clients to trade directly from their browser without the need for any software installation. The platform provides a seamless trading experience with real-time quotes, interactive charts, and a variety of order types. WebTrader also offers customisable layouts and a comprehensive range of technical indicators, making it suitable for both novice and experienced traders.

Desktop Client Portal

For clients seeking a more robust trading experience, CapTrader provides a downloadable Desktop Client Portal. This platform offers advanced features such as customisable workspaces, in-depth market analysis tools, and the ability to create and backtest trading strategies. The Desktop Client Portal also includes a wide range of technical indicators and drawing tools, empowering traders to make informed decisions based on their analysis.

Mobile Trading Apps

CapTrader understands the importance of mobile accessibility in today's fast-paced trading environment. The broker offers mobile trading apps for both iOS and Android devices, allowing clients to monitor their portfolios, access real-time quotes, and execute trades on the go. The mobile apps provide a streamlined interface with essential features, ensuring that clients can stay connected to the markets and manage their positions from anywhere.

Trader Workstation (TWS)

As an introducing broker to Interactive Brokers, CapTrader provides access to the professional-grade Trader Workstation (TWS) platform. TWS is a highly customisable and feature-rich platform designed for advanced traders and institutions. It offers a wide range of tools for market analysis, order management, and risk management. TWS also supports algorithmic trading and provides access to a vast array of market data and research.

CapTrader's range of trading platforms sets it apart from many competitors in the industry. By offering both user-friendly options like WebTrader and mobile apps, as well as advanced platforms like the Desktop Client Portal and TWS, CapTrader caters to the needs of traders at different skill levels and with varying trading styles.

The availability of these platforms is crucial for ensuring a satisfactory trading experience. Stable and reliable platforms are essential for executing trades efficiently, managing risk, and making informed decisions. CapTrader's platforms are designed to meet the demands of modern traders, with features like real-time quotes, advanced charting, and a wide range of order types.

In terms of meeting current market demands and client expectations, CapTrader's technological offerings are well-positioned. The broker's platforms provide the necessary tools and features for traders to implement their strategies effectively. The availability of both web-based and mobile trading options also aligns with the growing trend of mobile accessibility in the financial industry.

Trading Platforms Comparison Table

| Feature | WebTrader | Desktop Client Portal | Mobile Apps | Trader Workstation (TWS) |

|---|---|---|---|---|

| Web-based | Yes | No | No | No |

| Requires download | No | Yes | Yes (iOS/Android app) | Yes |

| Customizable layout | Yes | Yes | Limited | Highly customizable |

| Real-time quotes | Yes | Yes | Yes | Yes |

| Interactive charts | Yes | Yes | Basic | Advanced |

| Order types | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop, Algorithmic | Market, Limit, Stop | Market, Limit, Stop, Trailing Stop, Algorithmic |

| Technical indicators | Comprehensive range | Wide range | Basic | Extensive |

| Drawing tools | Yes | Yes | Limited | Advanced |

| Algorithmic trading | No | No | No | Yes |

| Market analysis tools | Basic | Advanced | Limited | Extensive |

| Risk management tools | Basic | Advanced | Limited | Advanced |

| Research and market data | Basic | Extensive | Limited | Extensive |

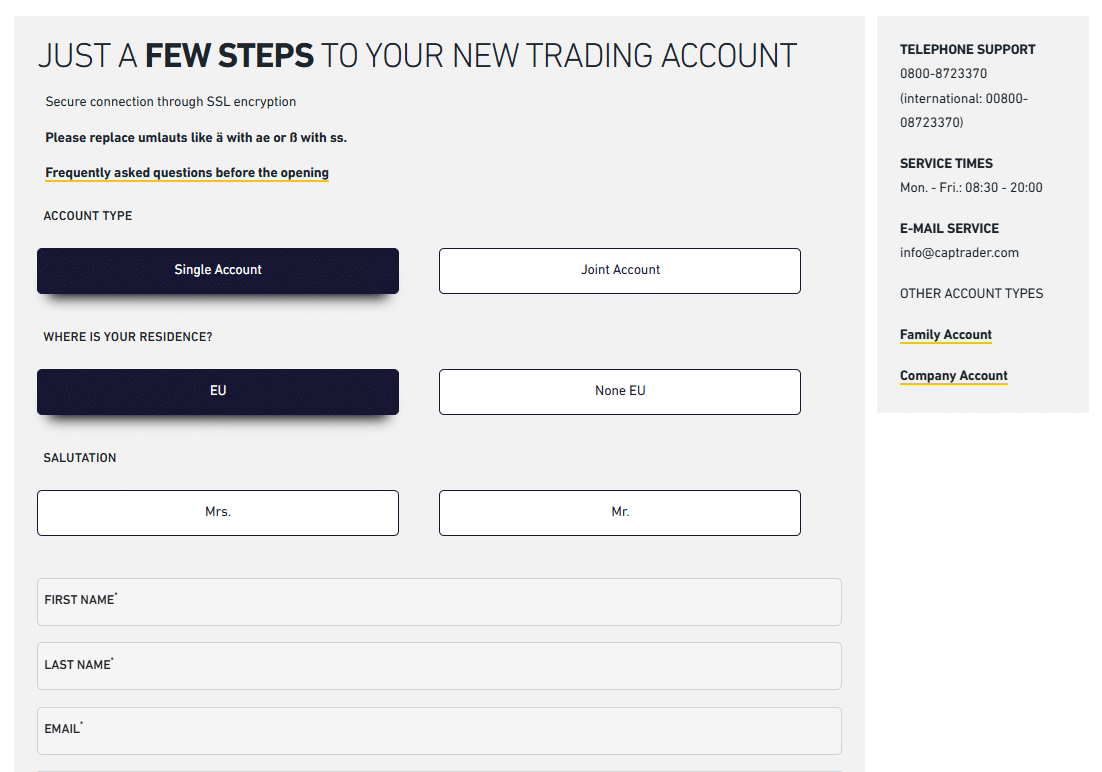

captrader How to Open an Account: A Step-by-Step Guide

Opening an account with CapTrader is a straightforward process that can be completed online. Follow these step-by-step instructions to get started:

Step 1: Visit CapTrader's website Go to www.captrader.com and click on the "Open an Account" button located at the top right corner of the homepage.

Step 2: Choose your account type Select the type of account you wish to open. CapTrader offers individual, joint, family, and company accounts. If you're an individual trader, choose the "Individual Account" option.

Step 3: Provide personal information Fill out the online application form with your personal details, including your name, date of birth, address, and contact information. Ensure that all information provided is accurate and up-to-date.

Step 4: Submit identification documents To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, CapTrader requires new clients to submit valid identification documents. This typically includes a government-issued ID, such as a passport or driver's license, and a proof of address, such as a utility bill or bank statement.

Step 5: Choose your account currency and leverage Select your preferred account currency from the available options, which include USD, EUR, GBP, CHF, and others. Also, choose your desired level of leverage, keeping in mind the risks associated with higher leverage.

Step 6: Fund your account To start trading, you'll need to fund your CapTrader account. The broker accepts various payment methods, including bank wire transfers and credit/debit cards. The minimum deposit required to open an account is $2,000 or the equivalent in your chosen account currency.

Step 7: Wait for account verification Once you've completed the application form and submitted the necessary documents, CapTrader will review your application. This process typically takes 1-2 business days. You'll receive an email notification once your account has been approved and is ready for trading.

Step 8: Log in and start trading After your account is verified, you can log in to your chosen trading platform (e.g., WebTrader, Desktop Client Portal, or mobile app) using the credentials provided by CapTrader. You're now ready to start trading the wide range of assets offered by the broker.

CapTrader's account opening process is designed to be user-friendly and efficient. The online application form is intuitive, and the broker provides clear instructions throughout the process. However, it's important to note that the minimum deposit requirement of $2,000 may be higher than some other brokers in the industry.

Charts and Analysis

CapTrader offers a range of tools and resources to help traders analyse markets, make informed decisions, and enhance their trading skills. These resources are designed to cater to traders of all levels, from beginners to advanced professionals.

| Category | Details |

|---|---|

| Charting Tools | - Available on WebTrader and Desktop Client Portal - Interactive, real-time charts with customizable timeframes and types (candlestick, bar, line) - Includes various technical indicators and drawing tools |

| Market Analysis | - Regular commentary and analysis via blog and news section - Covers forex, stocks, indices, and commodities - Conducted by experienced analysts |

| Economic Calendar | - Displays upcoming economic events and data releases - Includes event names, expected impact, and forecasted values - Useful for planning trading strategies |

| Educational Articles & Guides | - Covers technical/fundamental analysis, risk management, and trading psychology - Written clearly for all skill levels |

| Webinars & Video Tutorials | - Periodically hosted by experienced traders and analysts - In-depth insights on trading strategies and market trends - Interactive Q&A format |

While CapTrader provides a solid foundation of educational resources and tools, the broker's offerings may not be as extensive as some of its competitors. Some larger brokers in the industry offer a more comprehensive suite of resources, including structured educational courses, extensive video libraries, and regular trading seminars.

However, CapTrader's focus on quality over quantity is evident in the resources it provides. The broker's market analysis and educational content are well-researched and provide valuable insights for traders. The charting tools and technical indicators available on CapTrader's trading platforms are on par with industry standards and cater to the needs of most traders.

captrader Account Types

CapTrader offers a variety of account types to cater to the diverse needs of traders and investors. Whether you're an individual trader, a family looking to manage multiple accounts, or a company seeking to invest corporate funds, CapTrader has an account type that suits your requirements.

Individual and Joint Accounts

For individual traders, CapTrader offers single accounts that can be opened in the name of one person. These accounts provide full access to the broker's trading platforms, tools, and resources. Joint accounts are also available for two or more individuals who wish to manage their investments together. Both individual and joint accounts require a minimum deposit of $2,000 or the equivalent in other currencies.

Family Accounts

CapTrader's family account is an innovative solution for families looking to manage multiple trading accounts under one umbrella. The main account holder, known as the Family Master, can create and manage up to 15 sub-accounts for family members. This allows for efficient management of family investments while maintaining individual account ownership and control. Family accounts offer the same trading conditions and access to platforms as individual accounts.

Company Accounts

For companies and institutional investors, CapTrader offers corporate accounts designed to meet their specific needs. Company accounts can be opened in the name of the legal entity and provide access to the broker's full range of trading products and platforms. These accounts may require additional documentation and have higher minimum deposit requirements compared to individual accounts.

Managed Accounts

For investors who prefer to have their funds managed by professionals, CapTrader offers managed account services. With a managed account, clients authorise a professional money manager to trade on their behalf based on a predefined investment strategy. This option is suitable for investors who lack the time, expertise, or desire to actively manage their own investments.

Demo Account

CapTrader provides a demo account option for traders who wish to practise trading strategies and familiarise themselves with the broker's platforms without risking real money. Demo accounts offer access to live market data and all of the broker's trading tools and resources. Traders can use virtual funds to simulate real trading conditions and test their strategies before committing real capital.

CapTrader's range of account types demonstrates the broker's commitment to catering to the diverse needs of its clients. By offering accounts for individuals, families, companies, and managed funds, CapTrader ensures that traders can select an account type that aligns with their specific requirements and goals.

The minimum deposit requirement of $2,000 for individual and joint accounts is relatively high compared to some other brokers in the industry. However, this higher threshold may also be seen as a commitment to serving more serious traders and investors.

In summary, CapTrader's account types provide flexibility and choice for traders and investors with different needs and objectives. Whether you're an individual trader, a family looking to manage investments, a company, or an investor seeking professional management, CapTrader has an account type that can meet your requirements. As with any financial decision, it's essential to carefully consider your trading goals, risk tolerance, and investment horizons before selecting an account type.

Account Types Comparison Table

| Category / Feature | Individual Account | Joint Account | Family Account | Company Account | Managed Account | Demo Account |

|---|---|---|---|---|---|---|

| Minimum Deposit | $2,000 | $2,000 | $2,000 | Higher deposit may be required | Varies based on money manager | No deposit required |

| Account Ownership | Single individual | Two or more individuals | Family Master and sub-accounts | Company or institution | Individual or entity | Individual |

| Platform Access | Full access | Full access | Full access for all sub-accounts | Full access | Access granted to money manager | Full access with virtual funds |

| Available Products | All tradable assets | All tradable assets | All tradable assets | All tradable assets | Defined by investment strategy | All tradable assets |

| Managed by Professional | No | No | No | Can be managed by authorized representatives | Yes | No |

Negative Balance Protection

How CapTrader's Negative Balance Protection Works As an introducing broker to Interactive Brokers, CapTrader's clients benefit from Interactive Brokers' negative balance protection policy. According to this policy, no client can lose more than the amount deposited in their account. If a customer's account balance goes negative due to trading losses, Interactive Brokers will zero out the negative amount, effectively returning the balance to $0.00. This means that CapTrader's clients are protected from the risk of owing money to the broker due to negative balances. It's important to note that while negative balance protection provides a safety net, it should not be relied upon as a substitute for proper risk management. Traders should still employ strategies such as setting appropriate stop-loss orders and managing their position sizes to minimise potential losses. Terms and Conditions While CapTrader's clients benefit from negative balance protection through Interactive Brokers, it's crucial for traders to review and understand the specific terms and conditions related to this policy. Some key points to consider:

- Negative balance protection applies to trading losses only and does not cover other potential liabilities such as fees or charges.

- The policy may have limitations or exceptions in cases of market manipulation, fraud, or violation of the broker's terms of service.

- Negative balance protection should not be viewed as a guarantee against losses, and traders should still exercise caution and employ risk management strategies.

captrader Deposits and Withdrawals

CapTrader offers a range of convenient deposit and withdrawal options to facilitate the smooth transfer of funds for its clients. The broker understands the importance of efficient and secure transactions, ensuring that traders can quickly add funds to their accounts and withdraw their profits without unnecessary delays.

Deposit Methods

CapTrader accepts the following deposit methods:| Deposit Method | Details | Minimum Deposit | Maximum Deposit |

|---|---|---|---|

| Bank Wire Transfer | - From personal bank account - Available for all account currencies - Processing time: 1–3 business days - No deposit fees | $2,000 or equivalent | No maximum limit |

| Credit/Debit Card | - Visa or Mastercard - Available for USD, EUR, GBP accounts - Processed instantly - No CapTrader fees | $2,000 or equivalent | No maximum limit |

Withdrawal Methods

CapTrader offers the following withdrawal methods:| Withdrawal Method | Details |

|---|---|

| Bank Wire Transfer | - Withdraw funds to personal bank account - Processing time: 1–3 business days - No withdrawal fees from CapTrader - Receiving bank may charge a fee |

| Credit/Debit Card | - Withdraw funds to the same card used for deposit - Processing time: 1–3 business days - No withdrawal fees from CapTrader - Issuing bank may charge a fee |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account management, platform navigation, or technical issues, and timely support can make a significant difference in their trading journey. CapTrader recognises the importance of efficient and responsive customer support, offering multiple channels for traders to reach out for help.

Support Channels

CapTrader provides the following customer support channels:- Phone Support: Traders can contact CapTrader's customer support team via telephone. The broker offers toll-free numbers for clients in Germany and worldwide, ensuring that traders can reach out without incurring additional charges. The phone support is available Monday to Friday from 8:30 AM to 8:00 PM (CET).

- Email Support: Clients can send their enquiries or concerns to CapTrader's customer support email address. The support team aims to respond to email enquiries within 24 hours, providing detailed and helpful information to address traders' questions.

- Live Chat: CapTrader offers a live chat feature on its website, allowing traders to instantly connect with a support representative. This option is convenient for quick queries or urgent issues that require immediate attention. The live chat is available during the same hours as phone support.

- Online Contact Form: Traders can fill out an online contact form on CapTrader's website, providing their name, email address, and a detailed description of their inquiry. The support team responds to contact form submissions within 24 hours, offering personalised assistance to each trader.

Customer Support Comparison

| Feature | CapTrader Customer Support |

|---|---|

| Support Channels | Phone, Email, Live Chat, Online Contact Form |

| Phone Support | Toll-free numbers for Germany and worldwide, Monday to Friday, 8:30 AM to 8:00 PM (CET) |

| Email Support | Response within 24 hours |

| Live Chat Support | Monday to Friday, 8:30 AM to 8:00 PM (CET) |

| Online Contact Form | Response within 24 hours |

| Support Languages | English, German |

| 24/7 Support | Not available |

| Average Response Time | Phone and Live Chat: Within minutes, Email and Contact Form: Within 24 hours |

Prohibited Countries

It's important for traders to be aware of and comply with any regional restrictions to avoid potential legal consequences or issues with account verification and funding. Attempting to circumvent geographical restrictions by providing false residency information or using VPNs is generally ill-advised and against brokers' terms of service.

CapTrader does not provide services in the following regions:

-

North Korea

-

Iran

-

Syria

-

Cuba

-

Sudan

-

South Sudan

-

Afghanistan

-

Iraq

-

Yemen

-

Palestinian Territories

-

Israel

-

Lebanon

These restrictions are primarily due to international sanctions, local regulations, and licensing constraints.

Special Offers for Customers

While special offers can be attractive to traders, it's important to evaluate a broker holistically based on factors like regulation, security of funds, trading costs, market access, platform quality, and customer service. Promotional incentives should be weighed against these fundamental aspects.

CapTrader Special Offers

1. Refer-a-Customer Program

-

Details: Existing clients can earn bonuses by referring new customers to CapTrader.

-

Bonuses:

-

€75 for a new securities account opened with an initial deposit of at least €2,000.

-

€150 for a new custody account opened with an initial deposit of at least €25,000.

-

€250 for a new company custody account opened with an initial deposit of at least €25,000.

-

-

Conditions: Bonuses are credited to the referrer's CapTrader securities account after the referred client meets the deposit and account opening requirements.

2. Deposit Transfer Bonus

-

Details: Clients transferring their securities account from another bank or broker to CapTrader can receive a bonus.

-

Bonus: Up to €150 refunded as order fees within the first 3 months after opening the securities account.

-

Conditions: The bonus is credited after the transfer is completed and the account is active.

Conclusion

As I near the end of this comprehensive review of CapTrader, I want to consolidate my findings and insights to provide a cohesive summary of their safety, reliability, and overall reputation as an online broker.

Throughout this review, I have analysed various aspects of CapTrader's operations, from their regulatory compliance and geographical reach to their customer support and trading platforms. Based on the information provided, I believe that CapTrader is a trustworthy and dependable broker that prioritises the security of client funds and provides a transparent trading environment.

One of CapTrader's key strengths is its robust regulatory framework. They are licensed and supervised by top-tier authorities such as BaFin in Germany, the FCA in the UK, and the Central Bank of Ireland. This comprehensive regulatory oversight ensures that CapTrader adheres to strict financial standards and provides a high level of protection for clients' investments.

In terms of trading offerings, CapTrader provides access to an extensive range of markets and assets, with over 1.2 million tradable securities across 160 markets in 36 countries. This broad market coverage caters to the needs of diverse traders and allows for ample diversification opportunities. The broker's competitive pricing, with low commissions starting at just $2 for US stocks and €2 for European stocks, makes it an attractive choice for cost-conscious traders.

CapTrader's trading platforms are another area where they excel. The broker offers a range of user-friendly and feature-rich platforms, including WebTrader, Desktop Client Portal, and mobile apps, catering to traders of all levels. Advanced traders will appreciate the access to Interactive Brokers' professional-grade Trader Workstation. These platforms provide the necessary tools and resources for effective market analysis, order execution, and risk management.

Customer support is a crucial aspect of any brokerage, and CapTrader seems to prioritise client satisfaction in this area. They offer multiple channels for assistance, including phone, email, live chat, and an online contact form. The knowledgeable support team is available during extended hours on weekdays, providing prompt and helpful responses to clients' enquiries.

While CapTrader does not currently promote any specific bonuses or loyalty programs, they focus on delivering value through competitive pricing, advanced trading tools, and a wide range of tradable assets. The absence of promotional offers may appeal to traders who prioritise transparency and fairness over short-term incentives.

Based on my analysis, I believe that CapTrader is a reliable and reputable broker that offers a secure and user-friendly trading environment. Their strong regulatory compliance, extensive market coverage, advanced trading platforms, and responsive customer support make them a solid choice for traders seeking a trusted partner in their investment journey.

However, it's essential to note that no broker is perfect, and individual traders' needs and preferences may vary. The relatively high minimum deposit requirement of $2,000 may be a barrier for some beginners, and the lack of 24/7 customer support could be a drawback for traders who require round-the-clock assistance.

Hungry for data? Dive into the broker analytics reviews vault.

AU traders might prefer the TMGM review.