CFI markets Review 2025: Is This Global Forex Broker Legit or a Scam?

CFI markets

United Arab Emirates

United Arab Emirates

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Broker-Dealer License

Broker-Dealer License

Forex Trading License

Forex Trading License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

Supported language: Arabic, English

Social Media

Summary

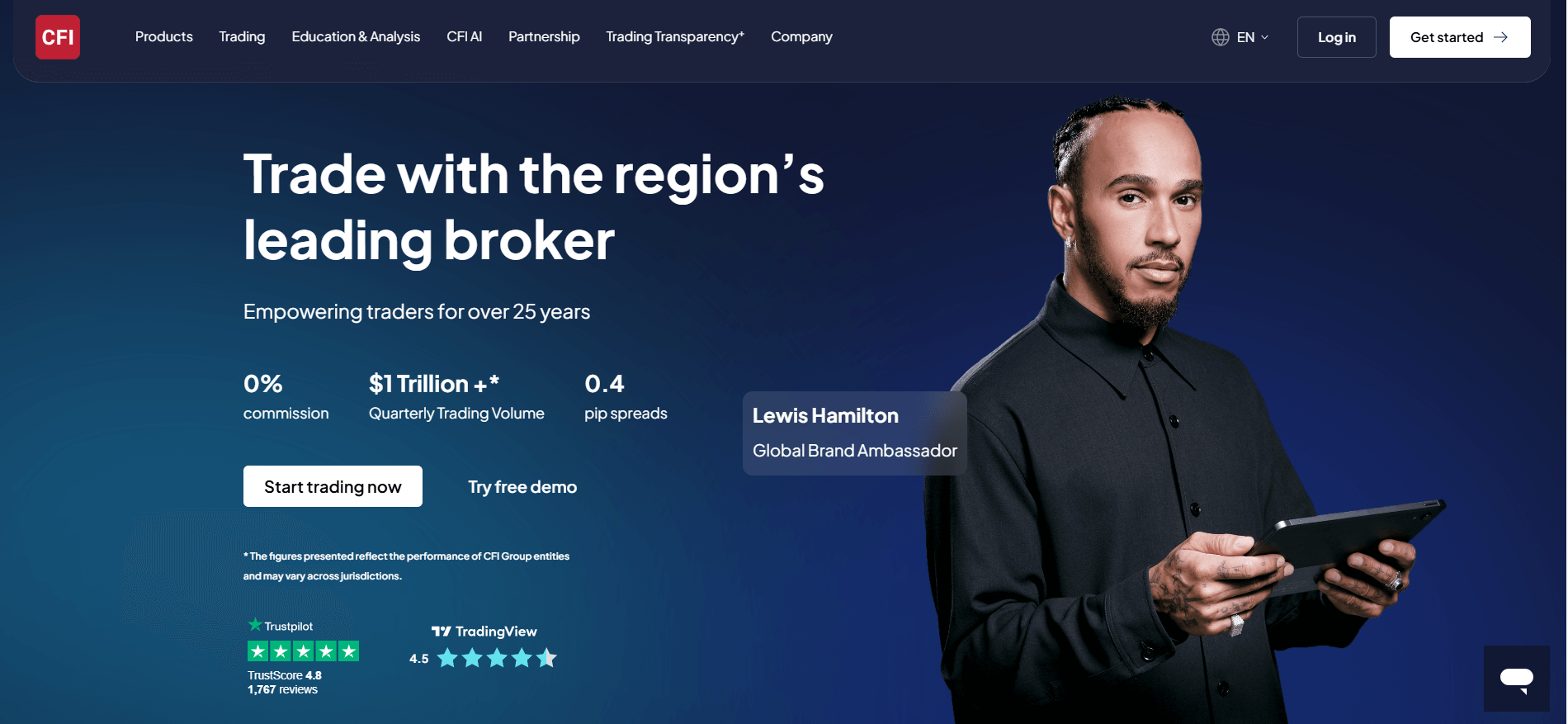

Credit Financier Invest (CFI) is a global forex and CFD broker established in 1998, with offices in key locations such as London, Dubai, and Beirut. It offers access to over 15,000 instruments, including forex, stocks, indices, commodities, and cryptocurrencies. CFI supports platforms like MT4, MT5, cTrader, and TradingView, along with 24/7 customer support and educational resources. Regulated by authorities like the FCA and CySEC, CFI serves both retail and institutional clients. However, services are not available to clients in the US and some other regions.

- Well-regulated by top-tier authorities like FCA and CySEC

- Wide range of 15,000+ tradable instruments

- Supports popular trading platforms (MT4, MT5, cTrader, TradingView)

- Competitive spreads and flexible leverage options

- No minimum deposit requirements

- Negative balance protection and segregation of client funds

- Extensive educational resources and market analysis tools

- 24/7 customer support through multiple channels

- Suitable for both beginner and experienced traders

- Long-standing reputation with over 25 years of experience

- Trading conditions may vary depending on the specific entity and jurisdiction

- Not available to residents of certain countries, including the US

- Limited information on the average spreads for specific instruments

- The variety of funding options may be limited compared to some competitors

- Some promotional offers may have restrictive terms and conditions

Overview

Credit Financier Invest (CFI) is a global forex and CFD broker established in 1998. With a presence in London, Larnaca, Beirut, Amman, Dubai, and other regions, CFI serves retail and institutional clients through multiple regulated entities. The broker has received recognition for its competitive trading conditions and advanced platforms.

CFI offers a wide range of over 15,000 tradable instruments, including forex, stocks, commodities, indices, cryptocurrencies, ETFs, bonds, and futures. Clients can choose from popular platforms like MT4, MT5, cTrader, and TradingView. CFI provides extensive research, educational resources, and 24/7 customer support.

While CFI is well-regulated by authorities such as the FCA (UK) and CySEC (Cyprus), trading conditions may vary based on the entity. The broker does not accept clients from the US and a few other countries. Visit CFI's official website for more details on their offerings.

Overview Table

| Criteria | Information |

|---|---|

| Headquarters | Dubai, UAE |

| Founded | 1998 |

| Regulated by | FCA (UK), CySEC (Cyprus), DFSA (UAE), FSC (Mauritius), VFSC (Vanuatu), FSA (Seychelles), JSC (Jordan), BDL (Lebanon) |

| Clients Accepted | Global (with some restrictions) |

| Minimum Deposit | No minimum |

| Instruments | 15,000+ (forex, stocks, commodities, indices, cryptocurrencies, ETFs, bonds, futures) |

| Trading Platforms | MT4, MT5, cTrader, TradingView, CFI Multi-Asset |

| Education | Articles, webinars, seminars, videos |

| Customer Support | 24/7 via live chat, email, phone |

Facts List

- CFI has over 25 years of experience in the forex and CFD trading industry.

- The broker is headquartered in Dubai, UAE, with a presence in multiple global locations.

- CFI is regulated by top-tier authorities such as the FCA (UK) and CySEC (Cyprus).

- Clients can access over 15,000 trading instruments across various asset classes.

- CFI supports popular platforms like MT4, MT5, cTrader, and TradingView.

- The broker offers competitive spreads starting from 0.0 pips and flexible account types.

- CFI provides negative balance protection and segregates client funds.

- Extensive educational resources are available, including webinars, seminars, and articles.

- Customers can reach support 24/7 through live chat, email, and phone.

- CFI has received industry recognition for its advanced trading solutions.

CFI markets Licenses and Regulatory

CFI operates through multiple regulated entities, ensuring compliance with the rules and guidelines set by various financial authorities worldwide. The broker's primary licenses include:

FCA (Financial Conduct Authority) – CFI's UK entity, Credit Financier Invest Limited, is authorised and regulated by the FCA under registration number 828955. The FCA is known for its strict regulatory standards, providing a high level of client protection.

CySEC (Cyprus Securities and Exchange Commission) – Credit Financier Invest (CFI) Ltd, the broker's Cyprus entity, is regulated by CySEC under license number 179/12. CySEC is a well-respected regulator in Europe, ensuring transparency and fair trading practices.

CFI holds additional licenses from DFSA (UAE), FSC (Mauritius), VFSC (Vanuatu), FSA (Seychelles), JSC (Jordan), and BDL (Lebanon), allowing the broker to serve clients in various regions while adhering to local regulations.

Multiple licenses demonstrate CFI's commitment to operating transparently and providing a secure trading environment. However, traders should be aware that the level of protection may vary depending on the entity they choose to trade with.

Regulations List

- FCA (UK): Credit Financier Invest Limited - license no. 828955 CySEC (Cyprus): Credit Financier Invest (CFI) Ltd - license no. 179/12

- DFSA (UAE): Credit Financier Invest (DIFC) Limited - license no. F00393333

- FSC (Mauritius): CFI International Ltd - registration no. C161178

- VFSC (Vanuatu): Credit Financier Invest (International) Limited - registration no. 700479

- FSA (Seychelles): Credit Financier Invest International Limited - license no. SD107

- JSC (Jordan): Credit Financial Invest for Financial Brokerage LTD - license no. 49631

- BDL (Lebanon): Credit Financier Invest SAL - license no. 40

Trading Instruments

CFI offers an extensive selection of over 15,000 trading instruments, catering to the diverse needs of both retail and institutional clients. The broker's wide range of tradable assets includes:

| Asset Class | Details | Examples |

|---|---|---|

| Forex | 80+ currency pairs including majors, minors, and exotics | EUR/USD, GBP/JPY, USD/CAD |

| Stocks | 3,000+ global stocks from major exchanges like NYSE, NASDAQ, LSE | Apple, Amazon, Tesla |

| Indices | 20+ global indices covering US, Europe, Asia | S&P 500, FTSE 100, DAX 30 |

| Commodities | Includes energies, precious metals, and soft commodities | Brent Crude, WTI Crude, Gold, Silver |

| Cryptocurrencies | 100+ crypto pairs with major and minor coins | BTC/USD, ETH/USD, XRP/USD |

| ETFs | 600+ ETFs across sectors and asset classes | SPDR S&P 500, iShares MSCI Emerging Markets |

| Bonds | Government and corporate bonds from the UK, EU, and Canada | Euro Bund, UK Gilt, Canada 10 Year Bond |

| Futures | Contracts on agriculture, energies, and indices | Cotton, Coffee, Crude Oil Future, E-mini S&P 500 |

Visit CFI's website for a comprehensive list of tradable instruments and their specifications, such as contract sizes, margin requirements, and trading hours.

Trading Platforms

CFI provides clients with a choice of advanced trading platforms to suit their preferences and needs:

MetaTrader 4 (MT4)

The industry-standard platform is known for its user-friendly interface, comprehensive charting tools, and automated trading capabilities. MT4 is available for desktop, web, and mobile.

MetaTrader 5 (MT5)

An upgraded version of MT4, offering additional features such as an expanded set of technical indicators, depth of market, and built-in economic calendar. MT5 supports desktop, web, and mobile trading.

cTrader

A powerful platform with advanced charting, fast order execution, and algorithmic trading tools. cTrader is accessible via desktop, web, and mobile apps.

TradingView

A web-based platform with a strong focus on social trading, offering advanced charting tools and access to a large community of traders.

CFI Multi-Asset Platform: CFI's proprietary platform for trading financial markets and accessing investment services under a single system. All platforms provide a range of order types, including market, limit, stop, and trailing stop orders, along with risk management tools like stop-loss and take-profit orders.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | cTrader | TradingView |

|---|---|---|---|---|

| Type | Desktop, Web, Mobile | Desktop, Web, Mobile | Desktop, Web, Mobile | Web |

| Language Support | 38 | 23 | 18 | 20+ |

| Automated Trading | Yes (EAs) | Yes (EAs) | Yes (cBots) | No |

| Algorithmic Trading | Limited | Yes | Yes | No |

| Social Trading | No | No | Yes | Yes |

| Indicators | 38 | 80+ | 105+ | 100+ |

| Drawing Tools | 31 | 44 | 84+ | 50+ |

| Timeframes | 9 | 21 | 14 | 12 |

| Chart Types | 3 | 21 | 8 | 12 |

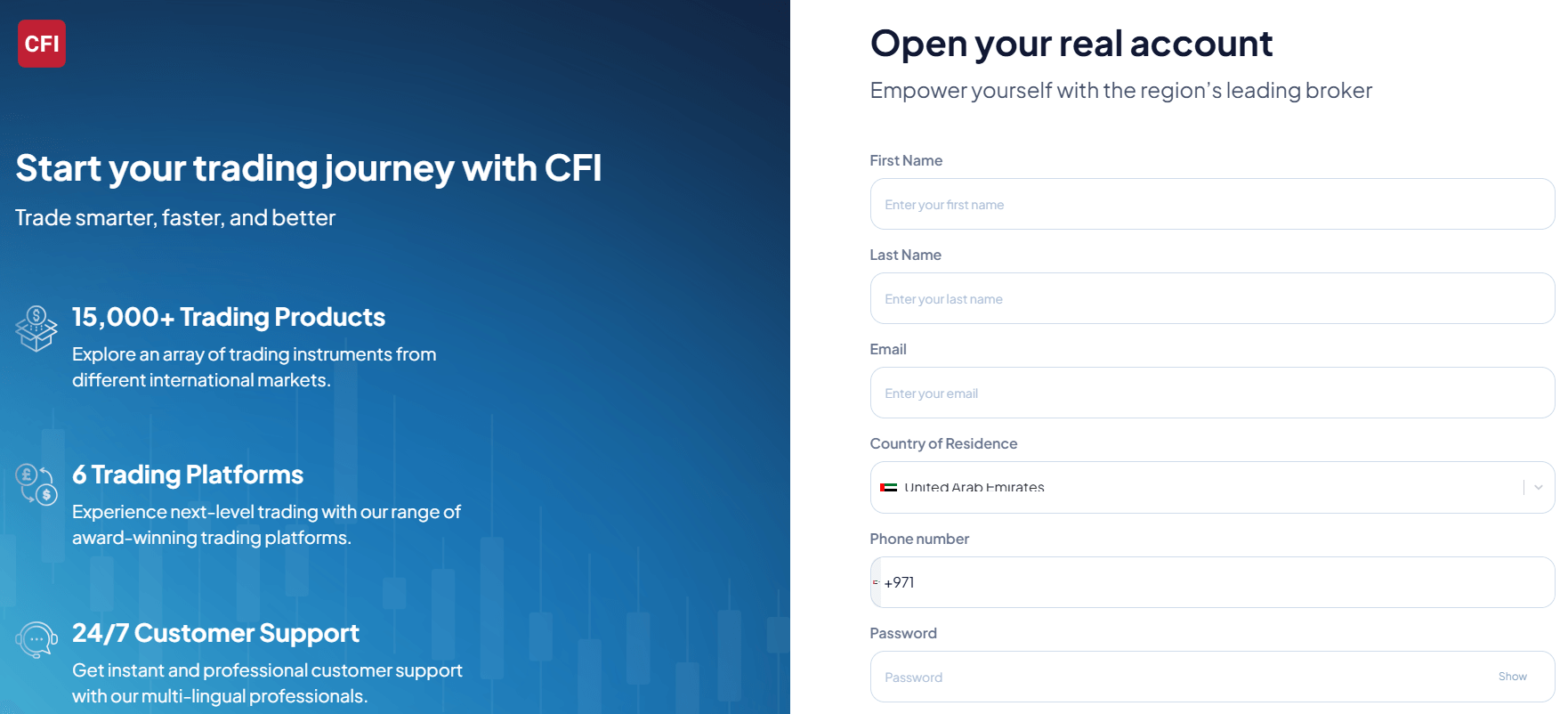

CFI markets How to Open an Account: A Step-by-Step Guide

To open an account with CFI, follow these steps:

- Visit CFI's official website and click on the "Open an Account" button.

- Select your preferred account type (Zero Commission or Dynamic Trader).

- Fill out the registration form with your personal information, including your full name, email address, phone number, and country of residence.

- Choose your base currency and leverage.

- Agree to CFI's terms and conditions and privacy policy.

- Verify your email address by clicking on the link sent to your registered email.

- Log in to your newly created account and complete the profile verification process by uploading the required documents (proof of identity and proof of residence).

- Fund your account using one of the available deposit methods.

- Once your account is verified and funded, you can start trading.

Charts and Analysis

CFI offers a range of tools and resources to help traders analyze the markets and make informed trading decisions

| Feature | Details |

|---|---|

| Real-time Charts | Available on MT4, MT5, cTrader, and TradingView with advanced charting tools, custom indicators, drawing tools, and multiple timeframes. |

| Technical Analysis | Includes a wide range of indicators such as moving averages, oscillators, and volatility tools for analysing price action and identifying trade opportunities. |

| Fundamental Analysis | Economic calendar, market news, and updates to track events that impact market conditions. |

| Trading Central | Partnership with Trading Central offers professional market insights, technical analysis, and actionable trade ideas. |

| Market Sentiment | Tools like Market Buzz analyse social media and headlines to show trader sentiment around specific assets. |

| CFI's Blog | Regular blog updates with market news, trading tips, and educational content to support trader development. |

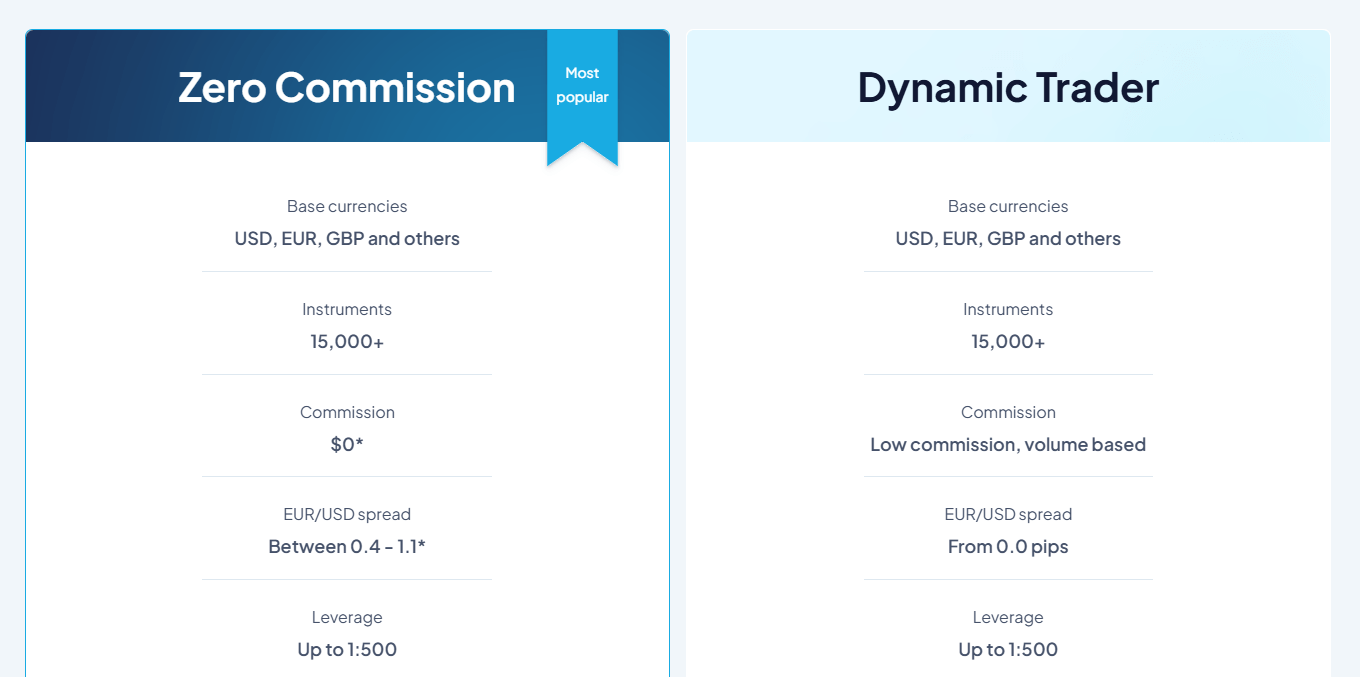

CFI markets Account Types

CFI offers two main account types designed to cater to different trading styles and preferences:

Zero Commission Account

Spread from 0.4 pips No commissions Suitable for traders who prefer a simple, all-inclusive fee structure Access to all trading platforms (MT4, MT5, cTrader, TradingView, CFI Multi-Asset) Ideal for beginners and casual traders

Dynamic Trader Account

Raw spreads from 0.0 pips Commission-based pricing (commission varies based on trading volume) Designed for active and high-volume traders Access to MT4, MT5, and cTrader platforms Suitable for experienced traders seeking the most competitive pricing Both account types offer flexible leverage options, no minimum deposit requirements, and the ability to trade in various base currencies.

CFI also provides swap-free (Islamic) accounts for traders who cannot receive or pay interest due to religious reasons. These accounts are subject to certain terms and conditions.

Account Types Comparison Table

| Feature | Zero Commission | Dynamic Trader |

|---|---|---|

| Minimum Deposit | No minimum | No minimum |

| Spread | From 0.4 pips | From 0.0 pips |

| Commission | No | Yes (based on volume) |

| Maximum Leverage | Up to 1:500 | Up to 1:500 |

| Trading Platforms | MT4, MT5, cTrader, TradingView, CFI Multi-Asset | MT4, MT5, cTrader |

| Base Currencies | EUR, USD, GBP, and others | EUR, USD, GBP, and others |

| Swap-free (Islamic) | Available | Available |

Negative Balance Protection

CFI offers negative balance protection to its clients, ensuring that they will not lose more than the funds available in their trading account. This means that if a trader's account balance reaches zero due to trading losses, CFI will absorb any additional losses, and the trader will not be required to pay back any negative balance. It is essential for traders to understand that negative balance protection does not negate the risks associated with trading and should not be relied upon as a substitute for proper risk management. Traders should always employ sound risk management techniques, such as setting appropriate stop-loss orders and managing their position sizes, to minimise potential losses.

CFI markets Deposits and Withdrawals

CFI offers several convenient deposit and withdrawal methods to cater to clients' preferences:

Deposits

| deposit Method | Type | Fees (by CFI) | Processing Time |

|---|---|---|---|

| Bank Wire Transfer | Deposit | No | 1–5 business days |

| Credit/Debit Card | Deposit | No | Instant |

| CFI Card by G2P | Deposit | No | Instant |

Withdrawals

| Withdrawal Method | Fees (by CFI) | Processing Time | Notes |

|---|---|---|---|

| Bank Wire Transfer | No | 1–5 business days | Bank charges may apply |

| Credit/Debit Cards | No | Up to 24 hours | Visa and Mastercard supported |

| CFI Card by G2P | No | Up to 24 hours | Available for eligible clients |

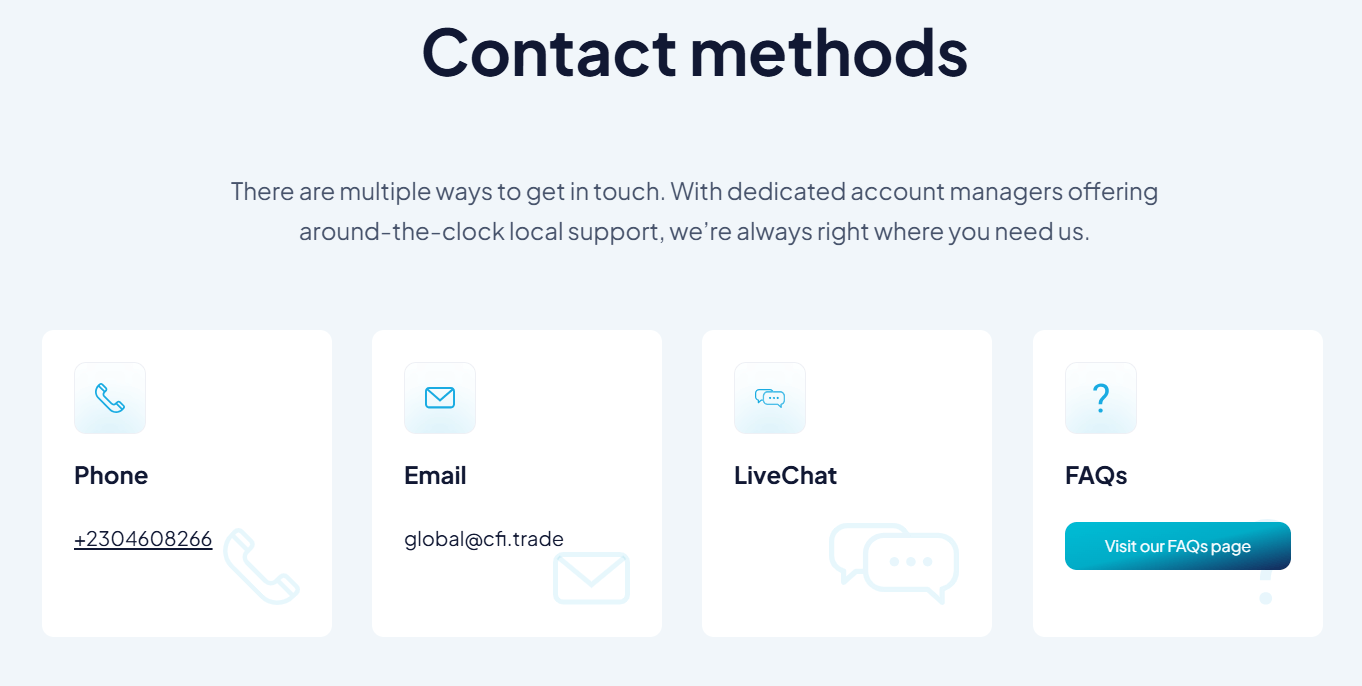

Support Service for Customer

CFI recognises the importance of reliable customer support in providing a positive trading experience. The broker offers several channels for clients to reach out for assistance:

- Live Chat: Available 24/7 through the CFI website, allowing clients to get instant help from a support representative.

- Email: Clients can send their enquiries to global@cfi.trade and expect a response within 24 hours.

- Phone: CFI provides a global phone number (+2304608266) for clients to speak directly with a support representative.

- Request a Callback: Clients can fill out a form on the CFI website to request a callback from a support team member.

- FAQ: The broker's website features a comprehensive FAQ section addressing common questions related to account opening, trading platforms, deposit/withdrawal, and more.

CFI's customer support is available in multiple languages, including English and Arabic, ensuring that clients from different regions can communicate effectively with the support team.

CFI's customer support is available in multiple languages, including English and Arabic, ensuring that clients from different regions can communicate effectively with the support team.

Customer Support Comparison Table

| Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | Instant | English, Arabic |

| 24/7 | Within 24 hours | English, Arabic | |

| Phone | 24/7 | Instant | English, Arabic |

| Request a Callback | 24/7 | Within 24 hours | English, Arabic |

| FAQ | 24/7 | Instant | English, Arabic |

Prohibited Countries

Due to regulatory restrictions and legal requirements, CFI does not accept clients from certain countries. These restrictions may vary depending on the specific CFI entity and the applicable laws and regulations in each jurisdiction.

Some of the countries where CFI does not offer its services include:

- United States

- Sudan

- Syria

- North Korea

- Iran

- Myanmar

Residents of prohibited countries cannot open an account or trade with CFI. Attempting to do so may result in the closure of the account and the forfeiture of any funds deposited.

It is essential for potential clients to check the specific restrictions applicable to their country of residence before attempting to open an account with CFI. The broker's website provides information on prohibited countries, and clients can contact customer support for further clarification.

Special Offers for Customers

CFI occasionally provides special offers and promotions to both new and existing clients.

These offers may include:

Welcome Bonus

New clients may be eligible for a welcome bonus upon making their first deposit. The bonus amount and terms may vary depending on the promotion.

Loyalty Program

CFI may offer a loyalty program that rewards clients with various perks based on their trading activity, such as reduced spreads, cashback, or exclusive event invitations.

Trading Competitions

The broker may host trading competitions where participants can compete for prizes based on their trading performance over a specified period.

Educational Resources

CFI may provide free access to premium educational content, such as webinars, e-books, or trading courses, as part of a promotional offer.

Third-Party Partnerships

The broker may collaborate with third-party service providers to offer exclusive discounts or benefits to CFI clients, such as reduced fees on trading tools or access to market research.

It is essential for clients to carefully review the terms and conditions of any special offer or promotion before participating. Some offers may have specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations.

Conclusion

After conducting a thorough review of CFI, I can confidently say that they are a reliable and trustworthy broker. With over 25 years of experience and regulation from top-tier authorities like the FCA and CySEC, CFI demonstrates a strong commitment to providing a secure trading environment for its clients.

One of CFI's standout features is its wide range of tradable assets, with over 15,000 instruments across forex, stocks, indices, commodities, cryptocurrencies, ETFs, bonds, and futures. This extensive offering caters to the diverse needs of both retail and institutional traders.

The broker's choice of trading platforms is another notable aspect, with popular options like MT4, MT5, cTrader, and TradingView available. These platforms provide advanced charting tools, automated trading capabilities, and a user-friendly interface for traders of all levels.

CFI's educational resources and market analysis tools, including Trading Central insights and market sentiment indicators, are valuable aids for traders looking to make informed decisions. The broker's commitment to customer support, with 24/7 availability through multiple channels, ensures that clients can access assistance whenever needed.

While CFI's trading conditions may vary depending on the specific entity and jurisdiction, the broker generally offers competitive spreads, flexible leverage options, and no minimum deposit requirements. The negative balance protection and segregation of client funds further enhance the safety of trading with CFI.

This platform’s ranking lives in our master broker review list.

High leverage offshore? Check the LQDFX review.