CGSI Review Review 2025: Is This Broker Legit and Safe?

CGSI

Hong Kong

Hong Kong

-

Withdrawal Fee $varies

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: Chinese (Simplified), English, Malay, Chinese (Traditional)

Social Media

Summary

China Galaxy Securities, established in 2000 through the merger of securities departments from five major Chinese state-owned banks, is a leading state-backed financial institution. With its international arm, CGS International Holdings Limited, the firm operates across key Asian markets including China, Hong Kong, Singapore, and Malaysia. Listed on the Hong Kong Stock Exchange (06881.HK), it offers a broad range of services such as securities trading, futures, investment banking, and asset management. The company features no minimum deposit requirements, supports multiple trading platforms, and provides multilingual customer support, making it a comprehensive and accessible choice for investors seeking exposure to both domestic and international markets.

- State-backed stability with prestigious banking heritage

- Comprehensive SFC licensing ensuring regulatory compliance

- No minimum deposit requirements across all accounts

- Direct access to Chinese and Hong Kong markets

- 140+ futures and options products

- Multiple proprietary trading platforms

- Segregated client funds protection

- Commission negotiations for volume traders

- Priority IPO allocations available

- Strong physical presence in Hong Kong

- No MetaTrader 4/5 support

- Limited educational resources for beginners

- No 24/7 customer support

- Absence of forex and crypto trading

- Platform learning curve for new users

- Geographic restrictions on Western clients

- No promotional bonuses or incentives

- Business hours only operation

- Limited English language resources

- No demo accounts available

Overview

China Galaxy Securities stands as one of China's premier state-backed financial institutions, established in 2000 through the strategic merger of securities departments from five major Chinese state-owned banks. With over two decades of operation and a robust international presence through CGS International Holdings Limited (established 2011), the company has evolved into a comprehensive investment banking powerhouse serving both domestic Chinese and international markets.

The firm's impressive pedigree stems from its formation by the Industrial and Commercial Bank of China, China Agricultural Bank, Bank of China, China Construction Bank, and China Life Insurance—representing the backbone of China's financial infrastructure. Listed on the Hong Kong Stock Exchange under stock code 06881.HK, China Galaxy Securities has expanded its footprint across 9 overseas business networks, positioning itself as a crucial bridge between Chinese capital markets and global investment opportunities.

Overview Table

| Feature | Details |

|---|---|

| Company Name | China Galaxy Securities Co., Ltd. |

| Founded | August 22, 2000 |

| International Division | CGS International Holdings Limited (2011) |

| Headquarters | China (Parent), Hong Kong (International) |

| Stock Code | 06881.HK |

| Initial Capital | RMB 4.5 billion |

| Regulatory Status | SFC Licensed (Hong Kong) |

| Global Presence | 9 overseas business networks |

| Key Markets | China, Hong Kong, Singapore, Malaysia |

| Core Services | Securities, Futures, Investment Banking, Asset Management |

| Trading Platforms | 4 proprietary platforms |

| Account Types | 5 different account options |

| Minimum Deposit | No minimum requirement |

| Demo Account | Not available |

| Customer Support Languages | Chinese (Mandarin/Cantonese), English |

Facts List

- State-Backed Heritage: Formed from the securities departments of five major Chinese state-owned banks, providing unparalleled financial stability and government support

- Dual Market Specialist: Serves as the primary gateway for Chinese investors accessing international markets and foreign investors entering Chinese markets

- Comprehensive Licensing: Holds five critical Hong Kong SFC licenses (Types 1, 2, 4, 6, and 9) covering the full spectrum of financial services

- Regional Dominance: Maintains subsidiaries in Hong Kong, Singapore, and Malaysia, creating a robust pan-Asian financial network

- No Minimum Deposit: Offers accessible entry for all investor levels with no initial deposit requirements across all account types

- 140+ Futures Products: Provides extensive futures and options trading opportunities, focusing on Asian market derivatives

- Four Trading Platforms: Offers SPTrader Pro, Galaxy Global Trading Terminals, Soft Token, and AAStocks for comprehensive market access

- Full-Service Investment Bank: Beyond brokerage, provides investment banking, corporate finance advisory, and asset management services

- Public Company Transparency: Listed on Hong Kong Stock Exchange ensures regular financial reporting and corporate governance standards

- Multilingual Support: Offers customer service in Chinese (Mandarin/Cantonese) and English through multiple communication channels

CGSI Licenses and Regulatory

China Galaxy Securities operates under a robust regulatory framework that exemplifies the highest standards of financial oversight in Asia. The company's international arm, CGS International Holdings Limited, maintains comprehensive licensing through the Securities and Futures Commission (SFC) of Hong Kong, one of Asia's most stringent financial regulators.

The significance of SFC regulation cannot be overstated. Hong Kong's regulatory environment ranks among the world's most sophisticated, with requirements that match or exceed those of major Western financial centers. The SFC enforces strict capital adequacy requirements, segregated client fund policies, and regular compliance audits that ensure broker solvency and operational integrity.

China Galaxy's regulatory compliance demonstrates exceptional breadth through its five distinct SFC licenses. The Type 1 license for dealing in securities provides the foundation for equity trading operations. The Type 2 license for futures contracts enables derivative trading across multiple exchanges. Type 4 and Type 6 licenses for advising on securities and corporate finance respectively position the firm as a full-service investment bank. Finally, the Type 9 asset management license allows for discretionary portfolio management services.

This multi-license approach reflects China Galaxy's commitment to comprehensive service provision while maintaining the highest compliance standards. Each license requires separate capital requirements, compliance procedures, and regulatory reporting, demonstrating the firm's substantial investment in regulatory infrastructure.

Regulatory Licenses

- Type 1 License: Dealing in Securities (SFC Hong Kong)

- Type 2 License: Dealing in Futures Contracts (SFC Hong Kong)—License Number: AYH772

- Type 4 License: Advising on Securities (SFC Hong Kong)

- Type 6 License: Advising on Corporate Finance (SFC Hong Kong)

- Type 9 License: Asset Management (SFC Hong Kong)

- Entity Name: China Galaxy International Futures (Hong Kong) Co., Limited

- Regulatory Status: Fully Regulated and Compliant

- Segregated Client Funds: Required under SFC regulations

- Investor Compensation: Covered under Hong Kong investor protection schemes

Trading Instruments

China Galaxy Securities offers a focused yet comprehensive selection of tradable assets, strategically positioned to serve investors interested in Asian markets. The firm's asset offerings reflect its core strength in Chinese and regional securities while providing access to international markets through futures and options trading.

| Product Category | Key Offerings | Highlights |

|---|---|---|

| Securities Trading | - Hong Kong Stock Exchange- China A-shares via Stock Connect- Selected international equities | Strong access to Greater China markets, IPOs, and secondary offerings |

| Futures & Options | - 140+ products including: • Index futures on Asian benchmarks • Commodity futures (agriculture, energy) • Stock and index options | Robust derivatives offering for complex trading and hedging strategies |

| Fixed Income | - China & Hong Kong government bonds- Investment-grade corporate bonds- Dim sum bonds (RMB-denominated offshore bonds) | Specialized access to Chinese fixed income opportunities |

| Mutual Funds | - Equity funds (Greater China & emerging markets)- Money market funds- Bond funds- Balanced & multi-asset funds- Sector-specific strategies | Broad range of strategies for diversification and strategic allocation |

| Structured Products | - Equity-linked notes - Capital-protected products - Yield enhancement structures | Tailored investment solutions focused on Asian underlying assets |

Trading Platforms

China Galaxy Securities provides traders with four distinct trading platforms, each designed to cater to different trading styles and technical requirements. While the firm does not offer popular Western platforms like MetaTrader 4 or 5, its proprietary systems are specifically optimized for Asian market trading.

SPTrader Pro

The mobile-focused SPTrader Pro serves as the primary platform for on-the-go trading. This application provides real-time quotes for Hong Kong and Chinese markets, advanced charting with technical indicators, and quick order execution capabilities. The platform's strength lies in its optimization for Asian market data feeds and local language support.

Galaxy Global Trading Terminals

As the flagship desktop platform, Galaxy Global Trading Terminals offers institutional-grade functionality, including multi-market access across securities and derivatives, advanced order types including algorithmic trading, comprehensive market depth information, and integrated research and analysis tools. This platform targets professional traders requiring sophisticated functionality.

Soft Token

The Soft Token mobile application provides secure two-factor authentication for trading activities while also offering basic trading functionality. This dual-purpose app enhances security while maintaining trading accessibility.

AAStocks

Primarily serving as a market information platform, AAStocks provides comprehensive financial data, real-time news feeds, fundamental analysis tools, and community features for trader interaction. While not a primary execution platform, it serves as a valuable research companion.

Trading Platforms Comparison Table

| Feature | SPTrader Pro | Galaxy Terminals | Soft Token | AAStocks |

|---|---|---|---|---|

| Device Type | Mobile | Desktop | Mobile | Desktop |

| Real-time Quotes | Yes | Yes | Yes | Yes |

| Order Execution | Yes | Yes | Limited | View Only |

| Technical Analysis | Basic | Advanced | None | Basic |

| Fundamental Data | Limited | Comprehensive | None | Comprehensive |

| Multi-Market Access | HK/China | Global | HK/China | HK/China |

| Algorithmic Trading | No | Yes | No | No |

| Two-Factor Auth | Yes | Yes | Primary Function | Yes |

| Language Support | Chinese/English | Chinese/English | Chinese/English | Chinese |

| Learning Curve | Low | High | Low | Low |

| Best For | Retail Traders | Professionals | Security-Conscious | Researchers |

CGSI How to Open an Account: A Step-by-Step Guide

Opening an account with China Galaxy Securities follows a straightforward process designed to comply with regulatory requirements while maintaining accessibility. The firm offers both online and mobile application methods, with no minimum deposit requirements across all account types.

Requirements

Prospective clients must provide valid government-issued identification (passport or national ID), proof of residential address dated within three months, and bank account information for funding purposes. Additional documentation may be required for margin or professional trading accounts.

Application Process

- Choose Application Method: Select between online application through the company website or mobile app submission

- Select Account Type: Choose from securities cash, securities margin, futures, stock options, or electronic trading accounts based on your needs

- Complete Application Form: Provide personal information, financial background, investment experience, and trading objectives

- Submit Documentation: Upload required identity and address verification documents through the secure portal

- Risk Assessment: Complete mandatory risk profiling questionnaire to ensure suitable product access

- Account Verification: CGS compliance team reviews application within 1-3 business days

- Account Approval: Receive account credentials and trading platform access upon approval

- Fund Your Account: Transfer initial funds through approved payment methods (no minimum required)

Payment Methods

China Galaxy accepts bank wire transfers (domestic and international), FPS (Faster Payment System) for Hong Kong banks, check deposits through designated machines or bank counters, and electronic fund transfers from linked bank accounts.

Account Opening Process List

- Visit official website at chinastock.com.hk

- Choose between online or mobile application methods

- Select appropriate account type for your trading needs

- Complete comprehensive application form with personal details

- Upload identity verification documents (passport/ID)

- Provide proof of address (within 3 months)

- Complete risk assessment questionnaire

- Await account verification (1-3 business days)

- Receive login credentials upon approval

- Fund account through preferred payment method

Charts and Analysis

China Galaxy Securities provides a comprehensive suite of analytical tools and educational resources designed to support informed trading decisions. While the offerings may not match the extensive educational libraries of some Western brokers, they effectively serve the needs of traders focused on Asian markets.

| Category | Key Features | Highlights |

|---|---|---|

| Technical Analysis Tools | - Standard indicators: moving averages, oscillators, trend tools - Advanced charting on Galaxy Global Trading Terminals - Custom indicators - Market depth & order flow | Suitable for both basic and advanced technical traders with multi-timeframe and real-time analysis |

| Fundamental Research | - Equity research (China & Hong Kong) - Financial modeling & industry comparison - Macro reports on Chinese economy and policy | In-depth local market insight backed by proprietary research |

| Market Data Services | - Real-time data: HKEX, Shanghai, Shenzhen, major futures markets - Historical data access - Corporate actions & dividend calendars | Broad coverage with support for backtesting and informed investment decisions |

| Educational Resources | - Market commentary & daily insights (CN/EN) - Webinars on China opportunities - Platform usage guides | Focused on intermediate and advanced users; less beginner-oriented compared to Western platforms |

CGSI Account Types

China Galaxy Securities offers five distinct account types, each tailored to specific trading needs and regulatory requirements. The absence of minimum deposit requirements across all account types demonstrates the firm's commitment to accessibility while maintaining professional service standards.

Securities Cash Account

The standard brokerage account enables cash-based trading in stocks, bonds, and mutual funds. This account type suits conservative investors who prefer to trade without leverage. Features include access to Hong Kong and China A-shares markets, real-time market data and research, and dividend collection and corporate action processing.

Securities Margin Account

Designed for experienced traders, margin accounts provide leveraged trading capabilities with competitive margin rates. Additional features include short selling capabilities for eligible securities, portfolio margining for efficient capital usage, and enhanced buying power for larger positions. Margin requirements vary by security type and market conditions.

Futures Account

Specialized for derivatives trading, futures accounts provide access to 140+ futures and options contracts. Key features encompass commodity, index, and currency futures trading, options on futures for advanced strategies, and professional-grade risk management tools. Initial margin requirements vary by contract specifications.

Stock Options Account

Dedicated to equity options strategies, this account type enables covered and naked options writing (subject to approval), multi-leg option strategies, and portfolio hedging capabilities. Options approval levels depend on experience and financial capacity.

Electronic Trading Account

An enhanced version of standard accounts, electronic trading provides direct market access for faster execution, algorithmic trading capabilities, and API connectivity for automated strategies. This account type targets active traders and institutions.

Account Types Comparison Table

| Feature | Cash Account | Margin Account | Futures | Options | Electronic |

|---|---|---|---|---|---|

| Minimum Deposit | None | None | None | None | None |

| Leverage Available | No | Yes | Yes | Yes | Yes |

| Stock Trading | Yes | Yes | No | Yes | Yes |

| Futures Trading | No | No | Yes | No | Yes |

| Options Trading | No | Limited | Yes | Yes | Yes |

| Short Selling | No | Yes | N/A | Yes | Yes |

| Interest on Balance | Standard | Standard | Standard | Standard | Premium |

| Platform Access | All | All | Specialized | All | Enhanced |

| API Access | No | No | Limited | No | Yes |

| Best For | Investors | Active Traders | Derivatives | Options Traders | Professionals |

Negative Balance Protection

China Galaxy Securities implements robust risk management protocols that effectively prevent negative account balances under normal market conditions. While not explicitly marketed as "negative balance protection" in the European regulatory sense, the firm's margin call and position liquidation procedures protect both clients and the firm from excessive losses. The firm's risk management framework includes real-time position monitoring across all leveraged accounts, automated margin calls when equity falls below maintenance requirements, and forced liquidation procedures to prevent account deficits. For futures trading, daily mark-to-market settlements and variation margin calls ensure positions remain adequately funded. During extreme market volatility, such as the 2015 China stock market turbulence, China Galaxy's risk systems performed effectively, preventing significant client defaults. The firm's conservative margin requirements, typically higher than Western brokers, provide additional buffer against market gaps. Clients should understand that while systematic protections exist, trading leveraged products always carries risk. The firm's terms clearly outline client responsibilities for margin maintenance and potential liability in extraordinary circumstances. Professional traders may negotiate enhanced risk parameters based on their experience and financial capacity.

CGSI Deposits and Withdrawals

China Galaxy Securities provides multiple funding options designed to accommodate both local and international clients. The firm's payment processing integrates seamlessly with Asian banking systems while maintaining compatibility with international transfers.

Deposit Methods

| Deposit Method | Description | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | Domestic HK transfers and international SWIFT transfers for large funding needs | Same-day (HK) / 1–3 days (SWIFT) | No fees from broker; sending bank may charge |

| FPS (Faster Payment System) | Instant HKD transfers for Hong Kong bank account holders via 24/7 access | Instant | No fees |

| Check Deposit | USD and HKD checks deposited via ATMs or bank counters | Same-day (ATM) / 1–2 days (counter) | No broker fee |

| Electronic Fund Transfer | Linked bank accounts for recurring and automated transfers; initial verification required | Varies (based on schedule) | No fees |

Withdrawal Methods

| Withdrawal Method | Description | Processing Time | Fees |

|---|---|---|---|

| Bank Transfer (HKD) | Standard withdrawals to registered Hong Kong bank accounts | 1–2 business days | No standard fee |

| Bank Transfer (Foreign Currencies) | Withdrawals in foreign currencies (e.g., USD) | 2–3 business days | No standard fee |

| Third-Party Withdrawals | Allowed with documentation and compliance approval | Subject to review | May vary |

| Request Methods | - Online platform (with 2FA) - Written instructions for large sums - Standard forms for irregular payees | Depends on method used | No standard fee; expedited options may incur charges |

| Minimum Balance Requirement | Clients must maintain sufficient funds to support open positions | Ongoing requirement | N/A |

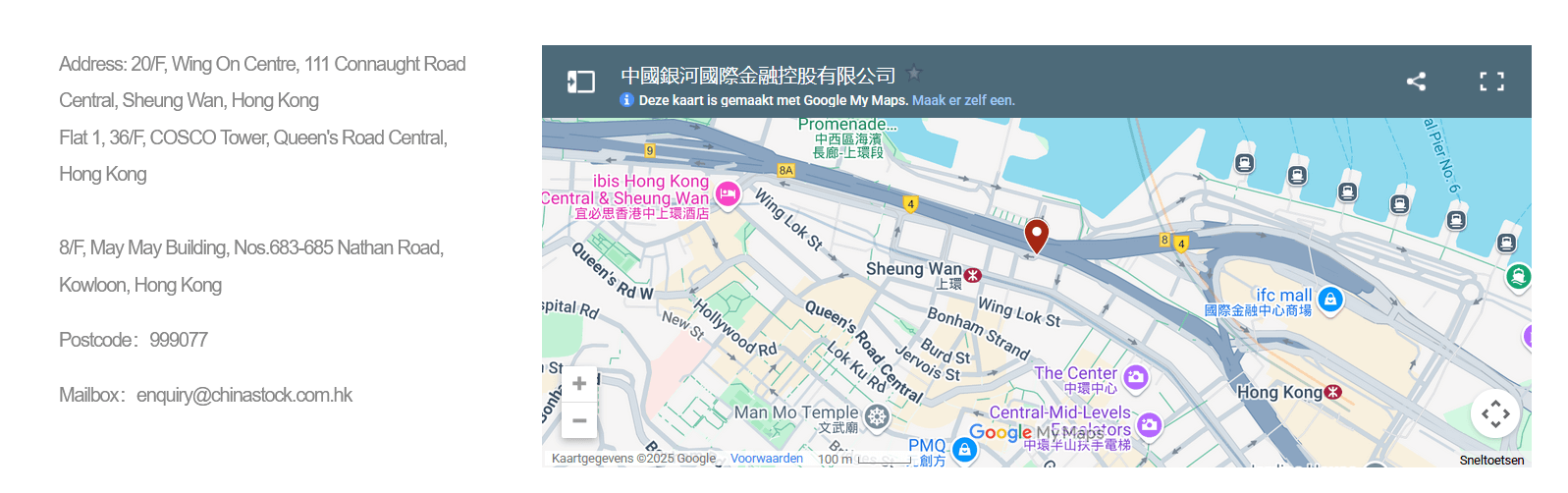

Support Service for Customer

China Galaxy Securities provides multilingual customer support primarily optimized for Chinese-speaking clients, with English support available for international customers. The support infrastructure reflects the firm's institutional focus, emphasizing dedicated relationship management over 24/7 retail support.

Support Channels

- Phone Support: Primary support lines include Hong Kong: (852) 3698 6750 for international clients and Mainland China: 400 866 8833 for domestic clients. Phone support operates during extended Asian business hours (8:30 AM - 6:00 PM HKT weekdays).

- Email Support: Professional email support at cs@chinastock.com.hk typically responds within 24 hours for general inquiries. Complex technical or account-specific issues may require 48-72 hours for comprehensive resolution.

- WeChat Integration: Recognizing the prevalence of WeChat in Chinese business communication, China Galaxy maintains official WeChat channels for client support, market updates, and account notifications.

- Physical Offices: Three Hong Kong locations provide in-person support:

- 20/F, Wing On Centre, 111 Connaught Road Central, Sheung Wan

- Unit 1, 36/F, Cosco Building, Queen's Road

- 8/F, Mei Mei Building, 683-685 Nathan Road, Kowloon

Service Quality

Response times average 2-5 minutes for phone support during business hours and 24 hours for email inquiries. Support quality excels for Chinese-language assistance, with highly knowledgeable staff familiar with local market nuances. English support, while professional, may occasionally require escalation for complex technical issues. The firm assigns dedicated account executives to high-value clients, providing personalized service and direct contact numbers. This relationship-based approach suits institutional and professional traders but may feel less accessible to retail clients accustomed to 24/7 chat support.Customer Support Comparison Table

| Support Feature | Details |

|---|---|

| Phone Availability | Business Hours (8:30 AM - 6:00 PM HKT) |

| Email Response Time | 24-48 hours |

| Live Chat | Not Available |

| 24/7 Support | No |

| Languages | Chinese (Mandarin/Cantonese), English |

| Dedicated Manager | For High-Value Clients |

| WeChat Support | Yes |

| Physical Locations | 3 Hong Kong Offices |

| FAQ Section | Limited |

| Video Tutorials | Platform Guides Only |

Prohibited Countries

China Galaxy Securities maintains specific geographic restrictions based on regulatory requirements and business considerations. The firm's operational framework primarily serves Asian markets, with limitations reflecting both regulatory compliance and strategic focus.

Operational Regions

China Galaxy actively operates in:

- Hong Kong (Primary international hub)

- Mainland China (Through parent company)

- Singapore (Via CGS International Securities Pte. Ltd)

- Malaysia (Through CGS International Securities Group Malaysia)

The firm does not actively solicit or accept clients from:

- United States (FATCA compliance restrictions)

- European Union countries (MiFID II considerations)

- Sanctioned countries under UN/Hong Kong regulations

- Japan (Regulatory restrictions)

- Countries without tax information exchange agreements

These restrictions stem from complex regulatory requirements, including tax reporting obligations, anti-money laundering compliance, and cost-benefit analysis of maintaining multi-jurisdictional licenses. Hong Kong's implementation of FATCA creates particular challenges for U.S. person accounts, leading most Hong Kong brokers to exclude American clients.

Potential clients should verify their eligibility during the application process, as restrictions may change based on evolving regulations. The firm's focus remains on serving Greater China markets and Asian regional investors.

Regions Where China Galaxy Operates

- Hong Kong, Mainland China, Singapore, Malaysia, Taiwan (limited services), Thailand (institutional only), Indonesia (partnership basis), Philippines (select services), Vietnam (institutional clients)

Special Offers for Customers

China Galaxy Securities takes a conservative approach to promotional offerings, reflecting its institutional heritage and focus on professional services rather than retail marketing. Unlike aggressive retail brokers, the firm eschews flashy bonuses in favor of value-added services and relationship-based benefits.

| Category | Key Features | Notes |

|---|---|---|

| Relationship Benefits | - Negotiated commission rates (based on trading volume) - Priority IPO access for eligible accounts - Exclusive analyst research | Personalized; not publicly advertised; based on client relationship |

| Professional Services | - Portfolio reviews for high-balance accounts - Invitations to investment seminars and outlook events - Corporate finance introductions | Designed for serious investors; no cash bonuses |

| New Client Considerations | - Waived account opening fees - Free platform training with support - Trial access to premium research | Focus on education and value rather than short-term incentives |

| Positioning | - No aggressive promotions - Emphasis on professionalism and long-term value | Appeals to experienced, investment-focused clients |

Conclusion

As I conclude this comprehensive review of China Galaxy Securities, I find myself impressed by the firm's institutional pedigree and strategic positioning while acknowledging its limitations for certain trader segments. They've successfully carved out a unique niche as the bridge between Chinese capital markets and international investors, leveraging their state-backed heritage and comprehensive regulatory compliance.

Their strengths lie unmistakably in their deep Chinese market access and expertise. With roots tracing back to five major state-owned banks, they offer unparalleled insights into China's financial landscape. The five SFC licenses they hold demonstrate serious regulatory commitment, far exceeding what many retail-focused brokers maintain. Their no-minimum-deposit policy across all account types shows admirable accessibility, though their platform offerings clearly target more experienced traders.

However, I must note that they're not ideal for everyone. The absence of MetaTrader platforms will disappoint traders accustomed to these industry standards. Their educational resources, while adequate, won't hand-hold beginners through their trading journey. Western traders seeking 24/7 support and extensive forex offerings should look elsewhere.

What strikes me most is their authenticity—they don't pretend to be everything to everyone. Instead, they excel at serving traders interested in Asian markets, particularly those seeking genuine access to Chinese securities and derivatives. Their commission-based model without promotional gimmicks reflects a professional approach that values long-term relationships over quick customer acquisition.

For the right trader—one focused on Asian markets, comfortable with proprietary platforms, and valuing regulatory security over bells and whistles—China Galaxy Securities presents a compelling option. They're particularly suited for institutional clients, high-net-worth individuals, and experienced traders who appreciate direct Chinese market access.

If you are looking for more brokers, visit our broker review page.

A broker with more regulations? check out eToro .