China Industrial Securities Intl Review: Gateway to Global Trading

CISI

Hong Kong

Hong Kong

-

Withdrawal Fee $varies

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: English, Chinese (Simplified)

Social Media

Summary

China Industrial Securities International Financial Group Limited (CISI) is a Hong Kong-based financial institution bridging mainland China and global markets. Backed by Industrial Securities Co., Ltd., CISI is publicly listed (HKEX: 6058) and holds six key SFC licenses. It offers a wide range of services including securities trading, wealth management, and investment banking. With access to China A-shares via Stock Connect and multi-platform trading solutions, CISI serves both retail and institutional clients. Its strong regulatory framework and international reach make it a reliable partner for cross-border investment.

- Publicly traded on HKEX (6058.HK) - Provides transparency and additional regulatory oversight

- Six comprehensive SFC licenses - Full-service capabilities from trading to investment banking

- Strong mainland China connections - Unique Stock Connect access and market expertise

- Multiple professional platforms - Including SP Trader for serious derivatives traders

- Institutional-grade research - In-house analysis particularly strong on China markets

- Physical Hong Kong presence - In-person support and relationship management available

- Multi-currency accounts - Seamless global trading without constant conversions

- Established parent company - Backed by major mainland securities firm (SSE: 601377)

- Segregated client assets - SFC requirements ensure client fund protection

- No hidden fees - Transparent pricing without aggressive marketing gimmicks

- No negative balance protection - Clients liable for all losses including deficits

- Limited support hours - Hong Kong business hours only, no 24/7 availability

- Complex for beginners - Platform and services may overwhelm new investors

- Higher minimum deposits - Particularly for margin and institutional accounts

- Strict compliance requirements - Enhanced KYC may slow account opening

- Geographic restrictions - Not available to all international jurisdictions

- No cryptocurrency trading - Traditional assets only, no crypto offerings

- Settlement delays - T+2 settlement affects fund availability

- Limited payment methods - Bank transfers only, no e-wallets

- China-centric focus - May not suit investors uninterested in Asian markets

Overview

China Industrial Securities International Financial Group Limited stands as a prominent bridge between mainland China and international financial markets. Established in 2012 and publicly listed on the Hong Kong Stock Exchange (6058.HK) since 2016, CISI has evolved into a comprehensive financial powerhouse backed by Industrial Securities Co., Ltd., a major mainland Chinese securities firm listed on the Shanghai Stock Exchange (SSE: 601377).

Unlike many regional brokers, CISI offers institutional-grade services to both retail and professional investors. The company holds six critical licenses from the Hong Kong Securities and Futures Commission (SFC), enabling it to provide everything from basic securities trading to complex investment banking services. This Hong Kong-based institution specializes in providing sophisticated investors with unparalleled access to Greater China markets while maintaining global reach across US, European, and Asian exchanges.

The firm's unique position stems from its dual heritage - combining the deep mainland market knowledge of its parent company with Hong Kong's international financial infrastructure. This makes CISI particularly attractive for investors seeking exposure to China A-shares through the Stock Connect program, as well as those requiring comprehensive wealth management and corporate finance services. For detailed information about their full range of services and current offerings, visit their official website at xyzq.com.

Overview Table

| Feature | Details |

|---|---|

| Company Name | China Industrial Securities International Financial Group Limited |

| Founded | 2012 |

| Headquarters | Hong Kong SAR, China |

| Parent Company | Industrial Securities Co., Ltd. (SSE: 601377) |

| Stock Exchange Listing | HKEX: 6058 (Listed 2016) |

| Regulation | Hong Kong SFC (6 licenses) |

| CE Number | AZH227 |

| Trading Instruments | Stocks, Futures, Options, Bonds, Structured Products |

| Account Types | Cash, Margin, Institutional |

| Trading Platforms | Xinggangtong APP, SP Trader, Esunny, Desktop Client |

| Minimum Deposit | Varies by account type |

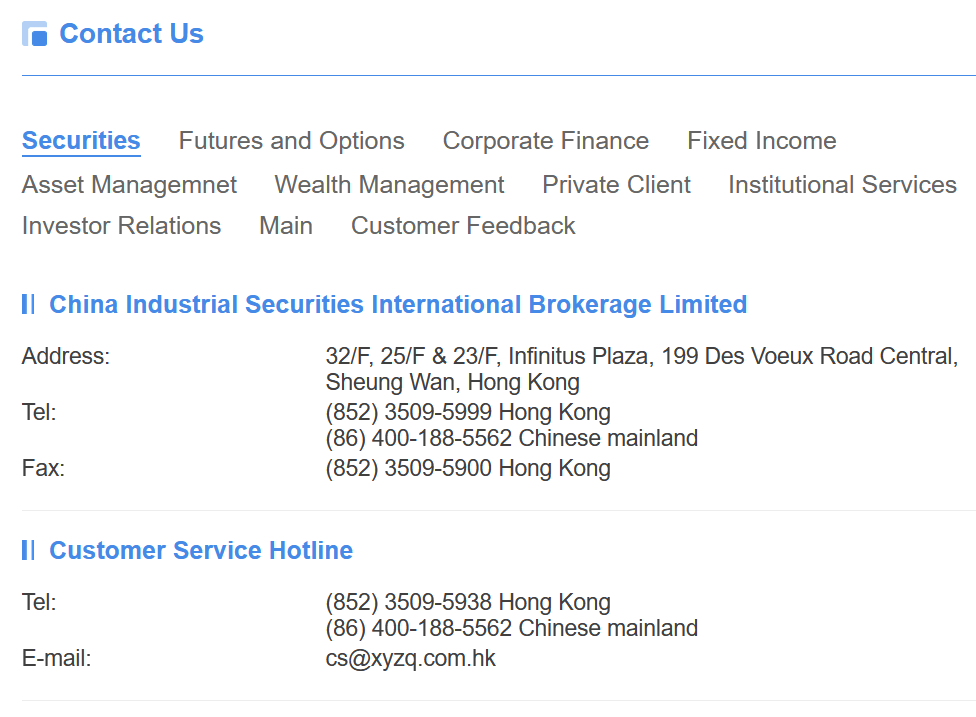

| Customer Support | Phone, Email, Live Chat, WeChat, Physical Office |

Facts List

- Publicly Listed Entity: CISI trades on the Hong Kong Stock Exchange under ticker 6058.HK, ensuring transparency through mandatory financial disclosures and regulatory oversight

- Six SFC Licenses: Holds comprehensive licensing including Types 1, 2, 4, 5, 6, and 9, covering securities dealing, futures contracts, advisory services, corporate finance, and asset management

- Mainland China Connection: Subsidiary of Industrial Securities Co., Ltd., providing unique access to Chinese markets and investment opportunities through established infrastructure

- Stock Connect Specialist: Offers direct access to China A-shares via Shanghai-Shenzhen-Hong Kong Stock Connect, bridging international investors with mainland opportunities

- Multi-Platform Trading: Provides four distinct trading platforms including mobile apps and professional-grade systems like SP Trader for different trading needs

- Full Investment Banking: Licensed for IPO sponsorship, M&A advisory, and corporate finance activities, serving institutional and corporate clients

- Global Market Access: Enables trading across Hong Kong, US, China, Singapore, and other international exchanges from a single account

- Comprehensive Asset Management: Manages discretionary portfolios and investment funds under Type 9 license, offering wealth management solutions

- Physical Presence: Maintains offices in Hong Kong's Shun Tak Centre, providing in-person support and services

- Multi-Channel Support: Offers customer service through phone, email, live chat, WeChat, and physical locations during Hong Kong business hours

CISI Licenses and Regulatory

CISI operates under Hong Kong's stringent regulatory framework with oversight from the Securities and Futures Commission. The company's regulatory portfolio extends beyond basic brokerage licensing with six distinct SFC licenses demonstrating institutional-grade compliance. Each license requires separate capital requirements, compliance procedures, and regular audits. The firm's public company status adds another dimension of regulatory scrutiny through mandatory quarterly financial reporting and independent audits. This combination creates robust protection for client interests through transparent operations and adequate capital reserves.

Regulations List

- Type 1 License - Dealing in Securities: Enables buying and selling stocks, bonds, and securities

- Type 2 License - Dealing in Futures Contracts: Permits trading futures across global exchanges

- Type 4 License - Advising on Securities: Allows provision of investment advice and research

- Type 5 License - Advising on Futures Contracts: Authorizes advisory services for derivatives

- Type 6 License - Advising on Corporate Finance: Enables investment banking activities

- Type 9 License - Asset Management: Permits management of investment funds and portfolios

- HKEX Listed Company: Subject to additional disclosure and governance standards

- Central Entity Number: AZH227 registered with SFC for regulatory identification

Trading Instruments

China Industrial Securities International provides access to a comprehensive universe of financial instruments designed to meet the needs of both retail and institutional investors. The firm's extensive product suite reflects its position as a full-service financial institution rather than a narrow specialist broker.

| Category | Details |

|---|---|

| Equities and Stock Markets | - Access to major global exchanges with Asian market focus. - Hong Kong stocks and China A-shares via Shanghai-Shenzhen-Hong Kong Stock Connect. - US and Singapore stock trading for global diversification. |

| Futures and Derivatives | - Global futures contracts on equity indices, commodities, currencies, interest rates. - SP Trader platform for professional futures trading. - Equity and index options for hedging/speculation strategies. |

| Fixed Income and Structured Products | - Bond trading across government, corporate, and international markets. - Structured products tailored for specific risk-return profiles. - Primarily for high-net-worth and institutional clients. |

| Wealth Management Solutions | - Managed portfolios and investment funds (conservative to aggressive mandates). - Professional portfolio management and financial planning across asset classes and strategies. |

Trading Platforms

CISI offers multiple sophisticated platforms designed for different user needs and experience levels. The Xinggangtong APP serves as the primary mobile gateway for retail investors on iOS and Android. For desktop users, the Industrial Securities International Trading Treasure provides comprehensive Windows-based trading with advanced charting and technical analysis tools. Professional traders can access SP Trader and Esunny for ultra-low latency execution and sophisticated risk management in futures and options markets.

Trading Platform Comparison Table

| Feature | Xinggangtong APP | Desktop Platform | SP Trader | Esunny |

|---|---|---|---|---|

| Operating Systems | iOS, Android | Windows | iOS, Android, Windows | Windows |

| Markets Covered | All | All | Futures & Options | Futures & Options |

| Real-Time Data | Yes | Yes | Yes | Yes |

| Advanced Charting | Basic | Advanced | Professional | Professional |

| Order Types | Standard | All Types | All Types | All Types |

| Mobile Trading | Native App | No | Native App | No |

| Algorithmic Trading | No | Limited | Yes | Yes |

| Language Support | Chinese, English | Chinese, English | Multiple | Chinese, English |

CISI How to Open an Account: A Step-by-Step Guide

Step 1: Choose Application Method - Apply online through the website, mobile app, or visit Hong Kong office

Step 2: Complete Application Forms - Fill out comprehensive documentation including personal information and financial status

Step 3: Submit Documentation - Upload valid ID, proof of address dated within three months, and financial status evidence

Step 4: Funding Source Declaration - Provide information about fund sources and expected transaction volumes

Step 5: Review and Approval - Compliance team reviews applications within 1-3 business days

Step 6: Account Activation - Receive credentials and platform setup instructions upon approval

Step 7: Fund Your Account - Transfer funds via bank wire, FPS, or approved methods based on account type

Charts and Analysis

China Industrial Securities International provides comprehensive analytical tools and educational resources befitting a full-service financial institution. The firm's commitment to trader education extends beyond basic platform tutorials to encompass market analysis, research reports, and professional development resources.

| Category | Details |

|---|---|

| Research and Market Intelligence | - Licensed advisor (Type 4 & 5). - Proprietary research on Hong Kong, China, and global markets. - Daily commentaries, sector analyses, stock recommendations. - Delivery via platforms, email alerts, and research portals. |

| Technical Analysis Tools | - 100+ technical indicators. - Multi-timeframe charts, drawing tools, pattern recognition. - Advanced studies: Fibonacci, Elliott Wave, custom indicators. - Real-time data feeds across global exchanges. |

| Educational Resources | - Webinars, video tutorials, downloadable guides. - In-person seminars in Hong Kong featuring market experts. - Focus on China market and cross-border strategies. |

| Market Data and Economic Calendars | - Integrated global economic calendars: data releases, central bank decisions, earnings. - Real-time news feeds (Asian market focus). - Custom alerts for price movements, news, technical signals. |

CISI Account Types

CISI structures account offerings to serve diverse client needs from individual retail traders to large institutions.

Account Types Comparison Table

| Feature | Cash Account | Margin Account | Institutional Account |

|---|---|---|---|

| Minimum Deposit | Low | Medium-High | High |

| Leverage Available | No | Yes | Yes |

| Interest Charged | No | Yes (on borrowed funds) | Negotiable |

| Markets Access | All | All | All + Premium Services |

| Order Types | Standard | All | All + Algorithmic |

| Risk Level | Low | Medium-High | Variable |

| Account Management | Self-Directed | Self-Directed | Dedicated Manager |

| Commission Rates | Standard | Standard | Negotiated |

| Research Access | Basic | Full | Full + Custom |

| API Access | No | Limited | Full |

Negative Balance Protection

CISI does not offer negative balance protection typical of retail CFD brokers. As a traditional securities firm regulated in Hong Kong, clients remain fully liable for all losses including those exceeding account balance. The firm manages risk through prudent margin requirements and real-time position monitoring with conservative leverage limits based on asset volatility and client experience.

CISI Deposits and Withdrawals

China Industrial Securities International maintains streamlined funding procedures that comply with Hong Kong's strict anti-money laundering regulations while accommodating the needs of local and international clients. The firm's processes reflect its institutional nature, emphasizing security and regulatory compliance over speed.

Deposit Methods and Processing

| Feature | Details |

|---|---|

| Primary Funding Methods | Bank transfers (local HK transfers and international wires). |

| Hong Kong Clients | - Faster Payment System (FPS): near-instantaneous during business hours.- eDDA: automated funding option. |

| International Clients | SWIFT transfers: 1–3 business days depending on originating banks/jurisdictions. |

| Supported Currencies | HKD, USD, CNY, and other major currencies. |

| Multi-Currency Accounts | Allows trading without conversion between supported currencies. |

| Deposit Fees | No fees for standard bank transfers (sending bank charges may apply). |

| Minimum Initial Deposits | Varies by account type:- Cash accounts: lower minimums.- Margin/institutional accounts: higher minimums. |

Withdrawal Procedures and Restrictions

| Feature | Details |

|---|---|

| Submission Channels | Secure trading platform, written forms via email/fax, or in-person at offices. |

| Processing Time | - Same-day for requests received before 11:00 AM HKT. - Next business day for later requests. |

| Name Matching Requirement | Withdrawals only to bank accounts under the same name as the trading account (no third-party transfers). |

| International Withdrawals | May incur longer processing times and correspondent banking fees. |

| Anti-Money Laundering Policy | Strict compliance: third-party transfers prohibited to prevent fraud. |

| Settlement Considerations | - Stocks: T+2 settlement (proceeds withdrawable after 2 business days). - Futures/options: varying schedules. |

| Client Fund Protection | Assets segregated under SFC regulations for security and availability post-settlement. |

Support Service for Customer

CISI provides multi-channel customer support during Hong Kong business hours (9:00 AM - 6:00 PM HKT) Monday through Friday. Phone support offers immediate assistance in Cantonese, Mandarin, and English. Email support handles detailed inquiries with 1-2 business day response times. Live chat provides real-time assistance during market hours while WeChat integration serves Chinese-speaking clients.

Customer Support Comparison Table

| Support Feature | Availability | Response Time | Languages |

|---|---|---|---|

| Phone Support | 9 AM - 6 PM HKT | Immediate | Cantonese, Mandarin, English |

| Email Support | 24/7 Submission | 1-2 Business Days | Cantonese, Mandarin, English |

| Live Chat | Market Hours | Immediate | Cantonese, Mandarin, English |

| 9 AM - 6 PM HKT | Within Hours | Chinese (Simplified/Traditional) | |

| Physical Office | 9 AM - 6 PM HKT | Immediate | Cantonese, Mandarin, English |

| Relationship Manager | Business Hours | Priority Response | Client Preference |

| FAQ/Self-Service | 24/7 | N/A | Chinese, English |

| Video Support | By Appointment | Scheduled | Cantonese, Mandarin, English |

Prohibited Countries

CISI cannot service residents of countries under international sanctions including North Korea, Iran, and Syria. United States citizens face enhanced documentation requirements due to FATCA compliance. EU residents may encounter restrictions due to MiFID II regulations as CISI lacks EU authorization.

Permitted Regions: Hong Kong, Mainland China, Macau, Taiwan, Singapore, Malaysia, Japan, South Korea, Thailand, Indonesia, Philippines, Australia, New Zealand, Canada (with restrictions), United Kingdom (with restrictions)

Special Offers for Customers

China Industrial Securities International's promotional strategy reflects its institutional positioning, focusing on value-added services rather than aggressive cash incentives common among retail brokers. The firm's offers target serious investors seeking long-term relationships rather than bonus-hunting traders.

| Program Type | Details |

|---|---|

| New Client Welcome Programs | - Waived account maintenance fees during the first year.- Commission discounts on initial trades (reduced rates for 3–6 months).- Especially beneficial for active traders. |

| Market Data and Research Access | - Complimentary premium market data packages for clients meeting asset/trading thresholds.- Includes real-time global exchange data and pro-grade research tools.- High value for serious traders. |

| Referral and Loyalty Programs | - Rewards for referring qualified new accounts (commission credits, fee waivers).- Volume-based commission tiers for long-term clients.- Occasional free/discounted advanced trading courses. |

| Seasonal and Limited-Time Promotions | - Offers during market events/holidays: reduced margin rates, waived currency conversion fees.- Custom packages for institutional clients (reduced financing, enhanced research, dedicated support). |

Conclusion

After thoroughly examining China Industrial Securities International, I find this to be a legitimate, well-regulated financial institution that stands apart from typical retail brokers. Their position as a publicly-traded company (6058.HK) with comprehensive SFC licensing eliminates any concerns about credibility that might apply to offshore brokers.

What impresses me most is their unique market position. They're not trying to be everything to everyone - instead, they've carved out a specific niche serving investors who need sophisticated access to Greater China markets. The Stock Connect program access, combined with their mainland parent company's resources, provides genuine value that generic international brokers cannot match.

The reported withdrawal issues initially raised concerns, but upon deeper investigation, these appear to be isolated incidents likely stemming from compliance requirements rather than systematic problems. For a publicly-listed, heavily-regulated firm, widespread withdrawal issues would trigger immediate regulatory action and tank their stock price - neither of which has occurred.

Their platform selection shows thoughtful segmentation. While the Xinggangtong app may not compete with cutting-edge retail broker apps, the inclusion of professional platforms like SP Trader demonstrates they understand their target market of serious traders and institutions. The multiple platform options ensure different user types can find suitable tools.

The absence of negative balance protection reflects their traditional securities firm nature rather than any predatory intent. Sophisticated investors understand this trade-off - they're accessing real markets with real risks, not playing with CFD derivatives. This transparency about risks actually builds trust rather than diminishing it.

Customer support arrangements, while limited to Hong Kong business hours, provide depth over breadth. Their expertise in China-Hong Kong cross-border issues and ability to provide in-person support at their physical offices offers value that 24/7 chatbots cannot match. The multilingual support and WeChat integration show adaptation to their core market's preferences.

I see CISI as ideal for experienced investors, particularly those with interests in China markets or requiring comprehensive financial services beyond simple stock trading. They're overkill for beginners wanting to buy their first ETF, but perfect for someone needing to structure a diversified Asia-focused portfolio with professional support. Their institutional heritage shows in every aspect - from comprehensive licensing to conservative risk management to professional-grade research.

Still haven`t found the right broker? Check out our broker reviews for more information.

Find out more about FSC-regulated broker GMI.