Cinda International 2025 Review: Bridging Markets with Strength

Cinda International

Hong Kong

Hong Kong

-

Withdrawal Fee $varies

-

Leverage 100:1

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: English, Chinese (Simplified), Chinese (Traditional)

Social Media

Summary

Cinda International Holdings Limited is a Hong Kong-based full-service broker established in 2000, backed by state-owned China Cinda Asset Management. With over 20 years of operation, multiple SFC licenses, and specialized access to China A-Shares through Stock Connect, they offer unmatched security and Greater China market access. While their traditional fee structure and limited modern features may not suit all traders, their no minimum deposit requirement, 24/7 futures support, and institutional-grade stability make them ideal for serious investors prioritizing security and Chinese market exposure over rock-bottom costs.

- State-owned backing through China Cinda Asset Management ensures exceptional financial stability

- No minimum deposit requirement makes it accessible to all trader levels

- Direct China A-Shares access via Stock Connect programs offers unique market opportunities

- 24/7 customer support for futures traders across all time zones

- Multiple SFC licenses through specialized subsidiaries provide strong regulatory protection

- 20+ years operational history since 2000 demonstrates proven track record

- Public company transparency with HKEX listing and regular financial reporting

- Full-service offering includes securities, futures, asset management, and corporate finance

- Multiple trading platforms cater to different trader needs and experience levels

- Strong risk management systems with automated margin controls and position monitoring

- Higher fees compared to discount brokers may impact profitability for active traders

- No demo accounts available for practice trading before risking real capital

- Limited educational resources compared to competitors focusing on trader education

- No cryptocurrency, forex, or CFDs limiting diversification opportunities

- Complex fee structure requires clarification on various charges

- Traditional broker model may not appeal to modern digital-first traders

- Inactivity fees of HK$50 apply though frequency needs confirmation

- RMB withdrawal restrictions to mainland China due to regulations

- Limited promotional offers with no bonuses or trading competitions

- Platform limitations with basic charting on mobile and no market scanner

Overview

Cinda International Holdings Limited stands as a distinguished financial services provider in Asian markets, incorporated in 2000 and renamed to its current identity in November 2008. As a publicly traded entity on the Hong Kong Stock Exchange (Stock Code: 111), the company operates under the robust backing of China Cinda Asset Management Co., Ltd., a major state-owned enterprise providing substantial credibility and financial stability.

With over two decades of operational excellence, Cinda International has built its reputation by offering comprehensive brokerage services, particularly excelling in providing access to Greater China markets. The firm serves both retail and institutional clients through multiple trading platforms, offering securities trading, futures contracts, asset management services, and corporate finance solutions.

The company's unique position as a bridge between mainland Chinese investors and international markets sets it apart, leveraging its state-owned parent company's resources while maintaining the professional standards expected of a Hong Kong-regulated broker.

For More Information, Visit Our Official Website at cinda.com.

Overview Table

| Feature | Details |

|---|---|

| Company Name | Cinda International Holdings Limited |

| Incorporated | 2000 (renamed in November 2008) |

| Headquarters | Suites 5801-04 & 08, 58/F, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong |

| Parent Company | China Cinda Asset Management Co., Ltd. |

| Stock Exchange | HKEX Stock Code: 111 |

| Regulation | Securities and Futures Commission (SFC) of Hong Kong |

| Primary Markets | Hong Kong, China A-Shares |

| Minimum Deposit | No minimum requirement |

| Customer Support | Chinese (Mandarin/Cantonese), English |

| Trading Platforms | Mobile App, Cinda SecuHub, SP-Futures NET |

Facts List

- 20+ Years of Operation: Established in 2000 with proven track record in Asian financial markets

- State-Owned Backing: Subsidiary of China Cinda Asset Management providing exceptional stability

- Dual Market Access: Specialized in Hong Kong stocks and China A-Shares through Stock Connect

- Public Company Status: Listed on HKEX ensuring transparency and regular financial reporting

- No Minimum Deposit: Accessible to traders of all levels without initial capital requirements

- Multiple SFC Licenses: Different subsidiaries hold specialized regulatory authorizations

- 24/7 Futures Support: Round-the-clock customer service for futures traders

- Full-Service Brokerage: Securities, futures, asset management, and corporate finance

- Multiple Platform Options: Consolidated mobile app plus specialized desktop platforms

- Strong Regulatory Compliance: Fully licensed by SFC with strict adherence to Hong Kong regulations

Cinda International Licenses and Regulatory

Cinda International operates under one of Asia's most stringent regulatory frameworks through multiple specialized subsidiaries. Cinda International Securities Limited (CE No. AEL202) handles securities trading operations, while Cinda International Futures Limited (CE No. ACN418) manages futures trading activities.

These licenses authorize Type 1 (Dealing in Securities) and Type 2 (Dealing in Futures Contracts) regulated activities. The significance of SFC regulation provides crucial protection for client funds through strict segregation of assets, regular financial reporting, and adherence to international conduct standards.

The dual-layered compliance structure, combining Hong Kong SFC oversight with mainland China regulatory supervision of the parent company, creates enhanced stability and accountability that benefits clients significantly.

Regulatory Licenses Held:

- Securities and Futures Commission (SFC) - Multiple CE Numbers

- Cinda International Securities Limited: CE No. AEL202

- Cinda International Futures Limited: CE No. ACN418

- Shanghai-Hong Kong Stock Connect Participant

- Shenzhen-Hong Kong Stock Connect Participant

- HKEX Member Status

Trading Instruments

Cinda International offers a focused selection of tradable assets that caters primarily to investors interested in Asian markets, particularly Greater China opportunities. The broker's asset offerings reflect its strategic positioning as a bridge between mainland China and international markets.

| Division | Products/Services | Details |

|---|---|---|

| Securities Trading | Hong Kong Stocks | Access to all HKEX-listed securities: blue-chip stocks, growth companies, REITs, ETFs. Real-time quotes, board lot & odd lot trading. |

| Securities Trading | China A-Shares | Via Shanghai-Hong Kong & Shenzhen-Hong Kong Stock Connect. Direct investment in mainland Chinese companies (Shanghai & Shenzhen). |

| Securities Trading | International Stocks | Access to US, European, and other Asian markets for portfolio diversification. Market coverage may vary. |

| Futures Contracts | Index Futures | Hang Seng Index (HSI), Mini-HSI, Hang Seng China Enterprises Index (HSCEI), and other regional index futures. Leveraged exposure & hedging opportunities. |

| Futures Contracts | Commodity Futures | Precious metals, energy, agricultural products via HKFE & global exchanges. |

| Investment Funds | Mutual Funds & Collective Investment Schemes | Curated selection of funds with professional management and diversification for hands-off investing. |

Trading Platforms

Cinda International provides multiple platforms designed to meet diverse trading needs:

Cinda International Mobile App:

The flagship platform consolidating securities and futures trading with real-time data, integrated account management, and portfolio analytics.

Cinda SecuHub:

Professional-grade desktop platform for securities trading featuring advanced charting, technical indicators, and sophisticated order types.

SP-Futures NET:

Dedicated futures trading platform with professional functionality including futures chains, options analytics, and spread trading capabilities.

Trading Platform Comparison Table

| Feature | Mobile App | Cinda SecuHub | SP-Futures NET |

|---|---|---|---|

| Platform Type | Mobile | Desktop | Desktop |

| Securities Trading | ✓ | ✓ | ✗ |

| Futures Trading | ✓ | ✗ | ✓ |

| Real-time Quotes | ✓ | ✓ | ✓ |

| Advanced Charting | Basic | Advanced | Advanced |

| Technical Indicators | Limited | Extensive | Extensive |

| Order Types | Standard | Advanced | Advanced |

| Market Scanner | ✗ | ✓ | ✓ |

| Demo Account | ✗ | ✗ | ✗ |

| Languages | CN/EN | CN/EN | CN/EN |

Cinda International How to Open an Account: A Step-by-Step Guide

Online Process:

- Download "Cinda International" mobile app

- Prepare valid ID, address proof (within 3 months), Hong Kong bank account proof

- Complete digital application form

- Upload required documents

- Initial funding (no minimum required, though forms may show HKD 10,000 as example)

- Submit deposit proof

- Await approval (1-2 business days)

Offline Process:

Visit Wan Chai headquarters with required documents for in-person account opening with immediate assistance.

Charts and Analysis

Cinda International recognises that successful trading requires more than just execution capabilities; it demands comprehensive analytical tools and educational resources. The company has developed a suite of resources designed to support traders at all experience levels.

| Feature | Description |

|---|---|

| Technical Analysis Tools | Professional charting with multiple timeframes, 50+ indicators (moving averages, oscillators, volume studies), drawing tools, custom indicators & pattern recognition. |

| Fundamental Analysis | Access to financial data, earnings reports, analyst recommendations, sector comparisons, financial ratios, and historical performance metrics. |

| Market News & Commentary | Real-time news feeds from major providers with a focus on Asian markets, especially Hong Kong and mainland China. |

| Economic Calendar | Highlights upcoming data releases, central bank meetings, and major events. Includes consensus forecasts and historical data for better preparation. |

| Educational Content | Basic trading guides, platform tutorials, and market primers to help clients understand trading mechanics. |

Cinda International Account Types

Cinda International offers a streamlined account structure with unified access to all products and services. The standard account provides full access to securities, futures, asset management products, and all trading platforms. Margin accounts are available for qualified clients with leverage ratios determined by regulatory requirements.

Account Types Comparison Table

| Feature | Standard Account | Margin Account | Corporate Account |

|---|---|---|---|

| Securities Trading | ✓ | ✓ | ✓ |

| Futures Trading | ✓ | ✓ | ✓ |

| Minimum Deposit | None | None | None |

| Leverage | ✗ | ✓ | Subject to approval |

| Platform Access | All | All | All |

| Real-time Data | ✓ | ✓ | ✓ |

| Dedicated Support | Standard | Standard | Enhanced |

| Custom Reporting | ✗ | ✗ | ✓ |

Negative Balance Protection

Cinda International implements risk management measures including automated margin calls when equity falls below maintenance requirements and automatic position closure systems when margin levels become critical. While these protections exist, traders must understand that futures trading carries inherent risks and should maintain adequate account buffers.

Cinda International Deposits and Withdrawals

Cinda International maintains a traditional approach to payment processing, reflecting its position as an established Hong Kong financial institution. The company prioritises security and regulatory compliance in all financial transactions.

Deposit Methods

| Method | Fee | Processing Time | Notes |

|---|---|---|---|

| Electronic Bank Transfer | Free | Same business day (if during HK banking hours) | Recommended |

| Bank Wire Transfer | Free | 1–3 business days (international transfers) | |

| Online Banking Transfer | Free | Same business day | |

| Cheque Deposit | Free | Varies (subject to cheque clearing times) | |

| Bank Counter Transfer | Free | Same business day | Cash deposits not accepted |

Withdrawal Methods

| Method | Fee | Processing Time | Notes |

|---|---|---|---|

| Local CHATS Transfer | HKD 200 | Same-day processing (within HK banking hours) | Only to accounts in the client’s name |

| Telegraphic Transfer (International) | HKD 300 + bank fees | 1–3 business days (depending on destination) | Additional intermediary bank charges may apply |

| Cheque Issuance | Varies | Longer processing time (subject to clearing) | Available for local clients only |

| Important Note | RMB withdrawals to mainland China are not supported due to regulations. | ||

| Security Measures | - Identity verification - Withdrawal only to client’s own accounts - Additional checks for large withdrawals - Full audit trail for compliance |

Support Service for Customer

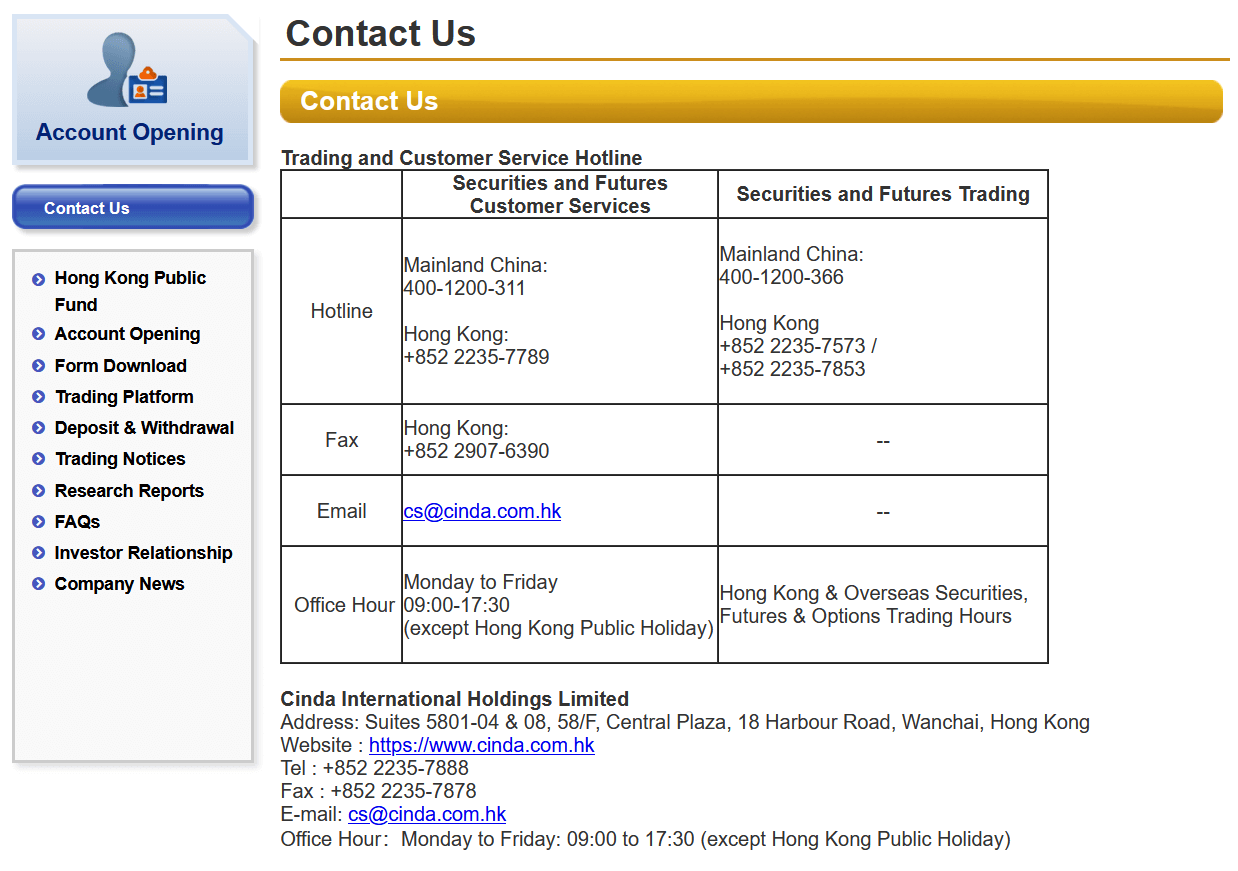

Cinda International provides comprehensive support through multiple channels:

- Mainland China: 400-120-0311

- Hong Kong: +852 2235 7789

- Email: cs@cinda.com.hk

- Physical offices in Wan Chai and Yuen Long

Customer Support Availability Table

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Phone (HK) | Extended Hours | Chinese/English | Immediate |

| Phone (China) | Extended Hours | Mandarin | Immediate |

| Futures Support | 24/7 | Chinese/English | Immediate |

| Business Hours | Chinese/English | Within 24 hours | |

| Office Visit | Business Hours | Chinese/English | Immediate |

Prohibited Countries

Cinda International cannot provide services to residents of countries under UN, US, or EU sanctions, jurisdictions where local laws prohibit foreign broker trading, or countries identified as high-risk for money laundering. The broker primarily serves Hong Kong, mainland China (through approved channels), and select Asian and international markets.

Special Offers for Customers

Cinda International takes a conservative approach to promotional offerings, focusing on delivering value through service quality rather than aggressive bonus schemes. This approach aligns with the company's positioning as a traditional, full-service broker serving serious investors.

| Category | Details |

|---|---|

| Current Promotions | No sign-up bonuses, deposit matches, cash-back promotions, or trading competitions offered. |

| Value Propositions | - No minimum deposit required to start trading. - Full access to all platforms and tools with no extra fees. - Backed by a state-owned parent company ensuring security and stability. - Professional research and analysis access, typically for institutional clients. |

| Fee Negotiations | For high-volume traders or large accounts, potential for: - Volume-based commission discounts. - Reduced platform fees. - Waived inactivity charges. - Customised service packages. |

Conclusion

Cinda International Holdings Limited represents a solid choice for investors seeking exposure to Asian markets, particularly Hong Kong and mainland Chinese securities. With over 20 years of operation and state-owned backing, they offer institutional-grade security and stability that smaller brokers cannot match.

While their traditional fee structure may be higher than discount brokers, clients receive comprehensive support, multiple platform access, and the security of dealing with an established institution. The 24/7 futures support and no minimum deposit requirement demonstrate their commitment to serving diverse trader needs.

For investors prioritizing security, regulatory compliance, and Greater China market access over rock-bottom costs, Cinda International merits strong consideration.

Check out more broker reviews to make an informed decision.

A broker regulated by the SFC? Try EBSI broker.